Digital Hong Kong dollar ≠ Hong Kong dollar stable currency, why is it still regarded as the "backbone" and pillar between legal currency and virtual assets?

Original source: Okey Cloud Chain Research Institute

Original Author: Jason Jiang

Original source: Okey Cloud Chain Research Institute

As June approaches, Hong Kong becomes more active in the field of virtual assets and Web3. According to Bloomberg, Hong Kong will announce that retail investors can trade cryptocurrencies under its new industry rules, and individual investors are expected to be able to trade tokens such as BTC and ETH from June with appropriate safeguards. This move will mark an important step for the Hong Kong government to open up cryptocurrency transactions and embrace Web3 innovation. In addition, the Hong Kong Monetary Authority's announcement on May 18 to launch the "Cyber Hong Kong Dollar" pilot program has also attracted attention.

In the digital age, we urgently need all kinds of new financial infrastructures that match digital innovation, among which currency digitization is one of the inevitable trends. Although the underlying technology of virtual assets can solve the problem of automatic transaction execution without trusted authorization, its own risks cannot be ignored, and it cannot be widely used as a payment tool or expand financial inclusion. As a result, currency innovations such as the digital Hong Kong dollar with strong endorsements have entered the public eye. The digital Hong Kong dollar is not only the "backbone" and pillar connecting legal currency and virtual assets, but also a new digital financial infrastructure necessary for the development of Hong Kong's Web3 ecology and digital economy.

Digital Hong Kong dollar = Hong Kong dollar stable currency? No, there are at least 7 differences between the two

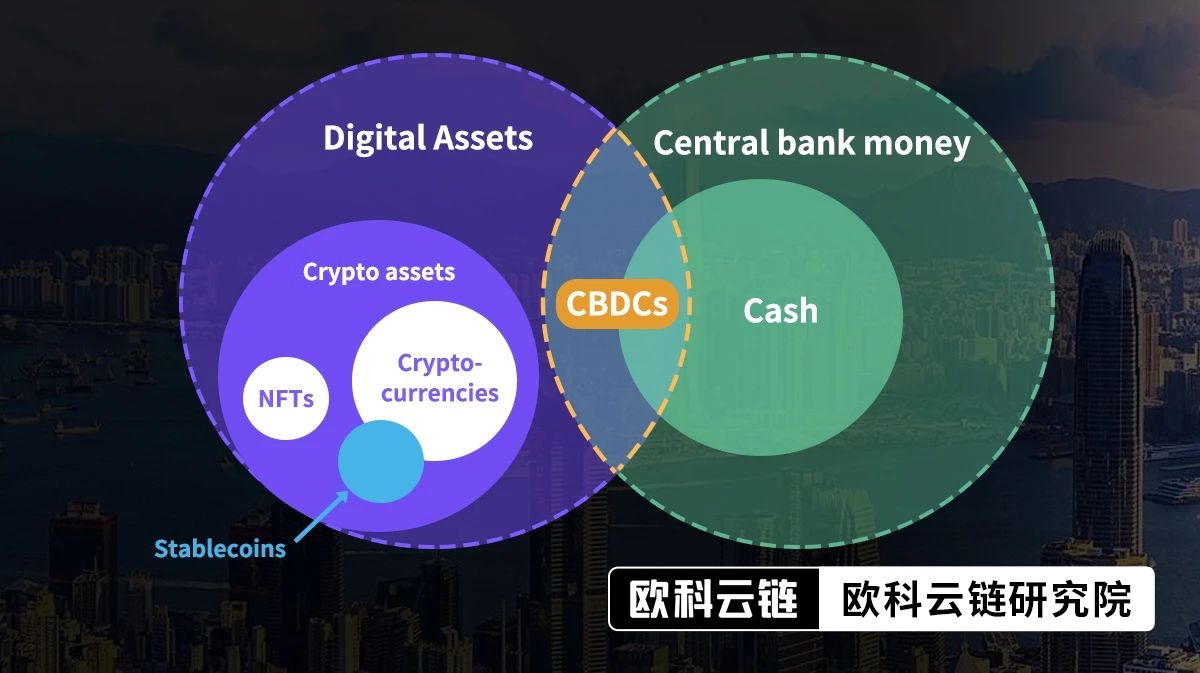

Before the development of CBDC by central banks, stablecoins were the type of digital currency that received the most attention from traditional financial markets. Since CBDC and stablecoins have certain commonalities in some aspects, such as stable asset types and almost no price fluctuations, they have obvious advantages compared with other virtual assets; they can also be used as a new type of payment tool, affecting or even changing the current payment structure. So the two are often confused in the early days. This situation is now "playing" again on the digital Hong Kong dollar and the Hong Kong dollar stable currency.

image description

Figure: The position of stablecoin and CBDC in the current currency system (source: Okey Cloud Chain Research Institute)

As the Hong Kong Monetary Authority accelerates the development of the digital Hong Kong dollar, many people are actively or passively confusing the two concepts of the digital Hong Kong dollar and the Hong Kong dollar stable currency. But in essence, the digital Hong Kong dollar and the Hong Kong dollar stable currency are two completely different forms of digital currency.

From the perspective of issuance mechanism, operating model and technical characteristics, there are at least seven differences between the digital Hong Kong dollar and the Hong Kong dollar stable currency:

(1) Issuer. This is also the most important difference between the digital Hong Kong dollar and the Hong Kong dollar stable currency. The digital Hong Kong dollar will be issued by the Hong Kong Monetary Authority, and the Hong Kong dollar stable currency can theoretically be issued by various private institutions or commercial banking organizations. The Hong Kong Monetary Authority previously issued a stablecoin regulatory document that stated that banking institutions can issue their own stablecoins as long as they meet the corresponding regulatory requirements.

(2) Purpose of issuance. The Hong Kong Monetary Authority first launched the research and development of CBDC at the wholesale level. Later, due to the increasing attention of the international community on how CBDC can improve cross-border payments and remittances, it began to study the digital Hong Kong dollar at the retail level. Its purpose is mainly to discuss how to use the latest technology to effectively respond to the current and future evolving payment needs. The main function of issuing Hong Kong dollar stable currency at this stage should be to accelerate the development of Hong Kong's Web3 industry and strengthen Hong Kong's right to speak in the field of virtual assets.

(4) Legal status. The digital Hong Kong dollar is essentially a digital version of Hong Kong dollar cash and will have the same legal tender status as the existing Hong Kong dollar. The HKMA will push for legislative amendments at an appropriate point in time to ensure that all forms of Hong Kong currency are issued on a consistent legal basis. However, the Hong Kong dollar stable currency issued by private institutions obviously cannot obtain the legal currency status of the digital Hong Kong dollar, and it will still exist as a payment tool or a type of digital asset in the short term.

(5) Technical framework. The Hong Kong Monetary Authority is open to the adoption of blockchain technology for the digital Hong Kong dollar, and has proposed a DLT-based technical architecture and design options. From the analysis of potential use cases revealed by the pilot plan, blockchain technology may play an important role in the issuance and settlement of the digital Hong Kong dollar in the future, but it is still uncertain whether the digital Hong Kong dollar will eventually adopt public chain or alliance chain technology. However, considering that the digital Hong Kong dollar is mainly for retail scenarios, and the current block chain technology has limited ability to handle high concurrency, combined with the Hong Kong Monetary Authority’s previously revealed that it may adopt a two-tier operating structure, the author guesses that the digital Hong Kong dollar may be more secure and controllable in the early stage of issuance. Consortium chain technology, and adopt a similar Layer 2 idea to solve the usability problem of digital Hong Kong dollar: that is, to build a digital Hong Kong dollar alliance with the Hong Kong Monetary Authority and digital Hong Kong dollar-related issuance and operation agencies as the main body, responsible for the chain issuance and on-chain settlement of digital Hong Kong dollar, and with Transactions and payment-related business links may be carried out outside the chain. With reference to the issuance and operation models of mainstream USD stablecoins such as USDT and USDC in the market, Hong Kong dollar stablecoins may still be issued and circulated on the chain based on public chain technology and networks in the future.

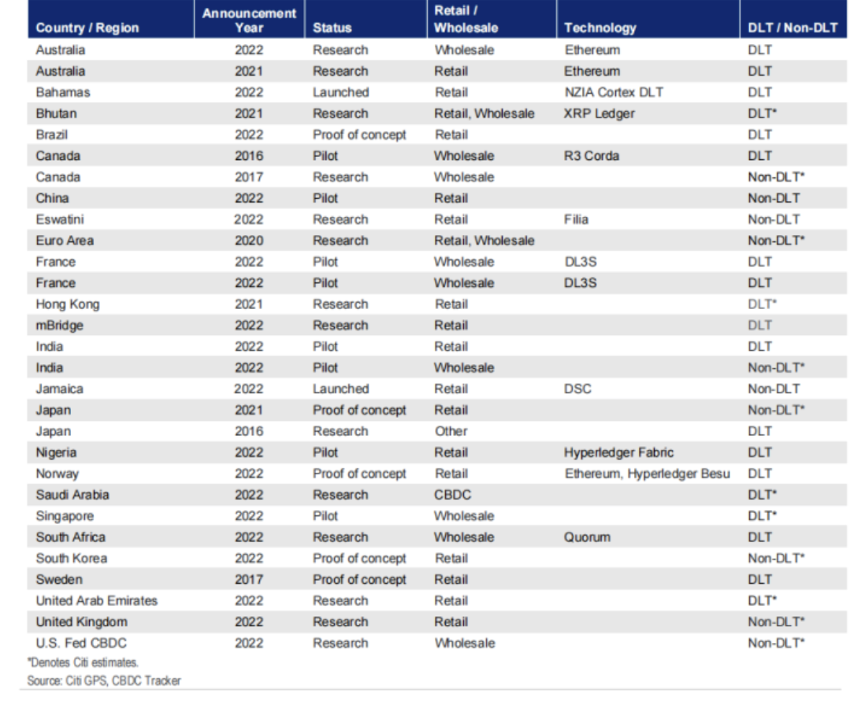

Image: Global CBDC Project Progress (Source: Citibank)

text

image description

secondary title

Can digital Hong Kong dollars and Hong Kong dollar stablecoins coexist?

text

However, even if the Hong Kong dollar stable currency is launched earlier than the digital Hong Kong dollar, it will not affect the original thinking and plan of the Hong Kong Monetary Authority to launch the digital Hong Kong dollar. After the launch of the digital Hong Kong dollar, the digital Hong Kong dollar and the Hong Kong dollar stable currency can also maintain synergy and cooperation in the competition. Possible ways of cooperation include but are not limited to:

(1) The digital Hong Kong dollar is integrated with the issued Hong Kong dollar stable currency. The integrated digital Hong Kong dollar will become a synthetic central bank digital currency (sCBDC), issued by and under the responsibility of private institutions, but backed by full reserves at the Hong Kong Monetary Authority. Previously, the IMF has mentioned sCBDC in its reports many times, and believes that this public-private partnership model allows the central bank to focus more on its core functions, which is better than a CBDC completely controlled by the central bank.

image description

(2) Digital Hong Kong dollar and Hong Kong dollar stable currency share resources and complement each other. After the launch of the digital Hong Kong dollar, you can choose to use the established Hong Kong dollar stable currency system for pilot and promotion to accelerate its own popularization speed and application scope. The previous Libra Association pointed out in the second edition of the Diem white paper that after the launch of CDBC, the central banks of various countries have directly integrated with the Libra network to replace other stable coins in the Libra network with a more compliant and secure CBDC.

These existing forms of cooperation will create an imaginary space for the coexistence of digital Hong Kong dollars and Hong Kong dollar stablecoins in the future. More importantly, the cooperation and coexistence with the Hong Kong dollar stable currency will also help the digital Hong Kong dollar to better adapt to the development of Web3, making it better to become the "backbone" and pillar between the fiat currency and the virtual asset market.

Viewing the relationship between the digital Hong Kong dollar and the virtual asset market from the perspective of the pilot plan

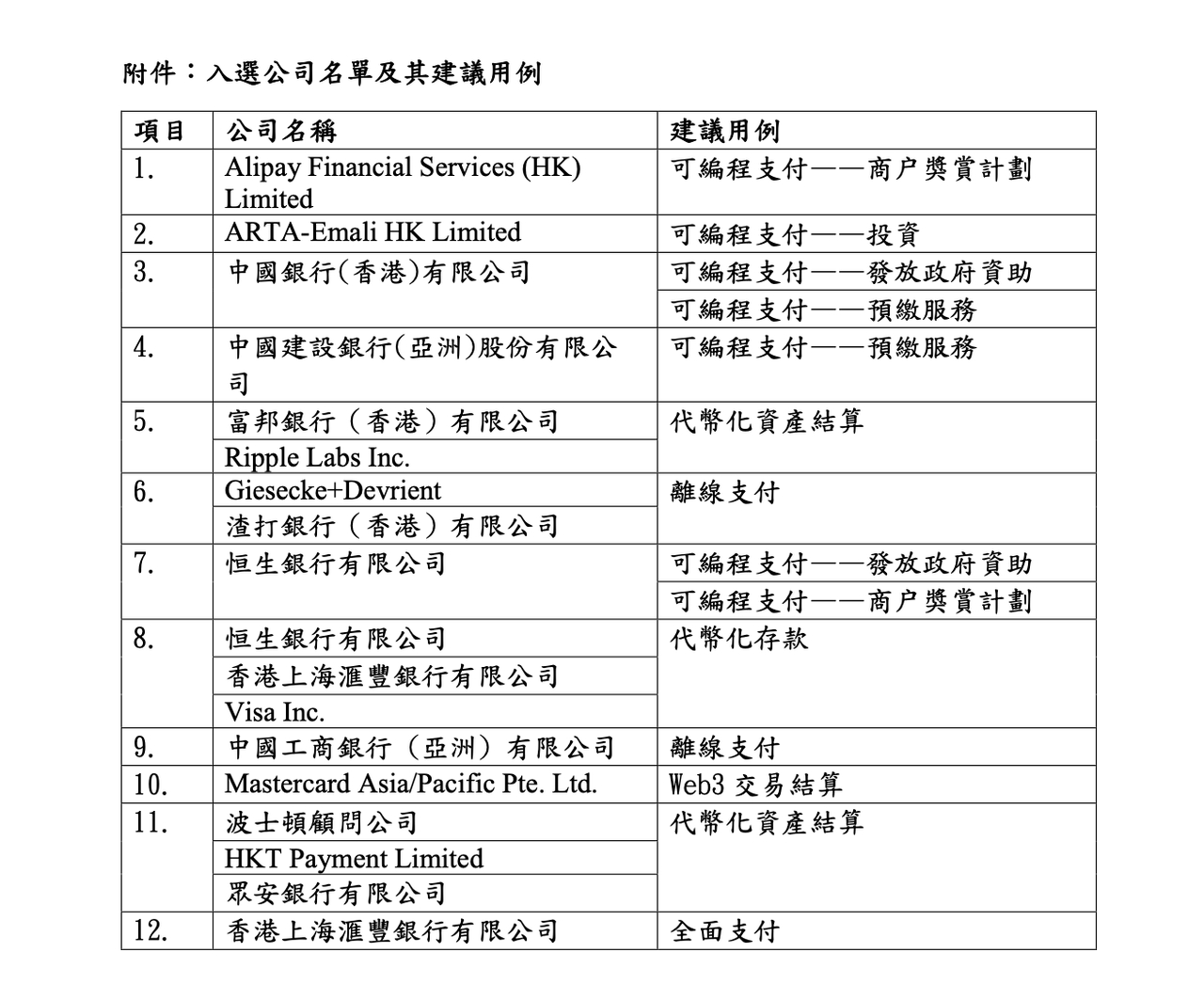

A few days ago, the Hong Kong Monetary Authority announced the launch of the Digital Hong Kong Dollar Pilot Program. The 16 selected companies will study the digital Hong Kong dollar in six aspects including comprehensive payment, programmable payment, offline payment, tokenized deposit, Web3 transaction settlement and tokenized asset settlement within this year. A wide range of potential use cases.

image description

Figure: List of companies selected for the Digital Hong Kong Dollar Pilot Scheme and suggested use cases

After the pilot plan was put forward, it attracted widespread attention. Fu Rao, a senior researcher at the Hong Kong International New Economic Research Institute, believes that the launch of the pilot plan is a sign that the digital Hong Kong dollar has clearly entered the experimental stage. After carefully studying the participating institutions of the pilot program and the direction of potential use cases, Okey Cloud Research Institute believes that the following three points deserve attention:

Secondly, from the perspective of the distribution of cases selected into the pilot program, potential use cases related to payment are the main direction of this exploration. This is mainly related to the basic positioning and future applications of the digital Hong Kong dollar, but considering the diversification of payment methods in Hong Kong, even if the digital Hong Kong dollar is officially launched, it will not have a major impact on Hong Kong’s payment industry and user consumption habits in the short term. Or the scenario where the current digital payment method is not covered may be the opportunity for the digital Hong Kong dollar.

secondary title

epilogue

epilogue

text

Since ancient times, currency has been the core of all economic and social activities, and it is also a financial infrastructure with social benefits. From the development of currency, we can see the path of change in financial infrastructure in different periods. Today, the virtual asset industry is gaining momentum, and emerging technologies such as artificial intelligence, blockchain, cloud computing, and big data are in the ascendant. Web3 innovation is at the right time, and the development of the digital economy is ushering in a new stage. The digital financial infrastructure also needs to continue to change. iterate.

secondary title

About Okey Cloud Chain Research Institute

About Okey Cloud Chain Research Institute