Token Terminal: In-depth analysis of the economic principles, operating data and market performance of L1 and L2

Compilation of the original text: Deep Tide TechFlow

Compilation of the original text: Deep Tide TechFlow

We often intuitively feel the costs and benefits of using different blockchains, namely gas fees and incentives.

But do you really understand their complete economic models thoroughly? Where do gas and incentives come from and where will they flow? What is the market performance under different economic model designs?

Token Terminal explores the main L1 and L2 blockchain economic models based on PoW and PoS, as well as emerging models of protocols such as liquidity staking. And the economic model principles of each blockchain are disassembled and given examples in a very easy-to-understand manner.

introduce

introduce

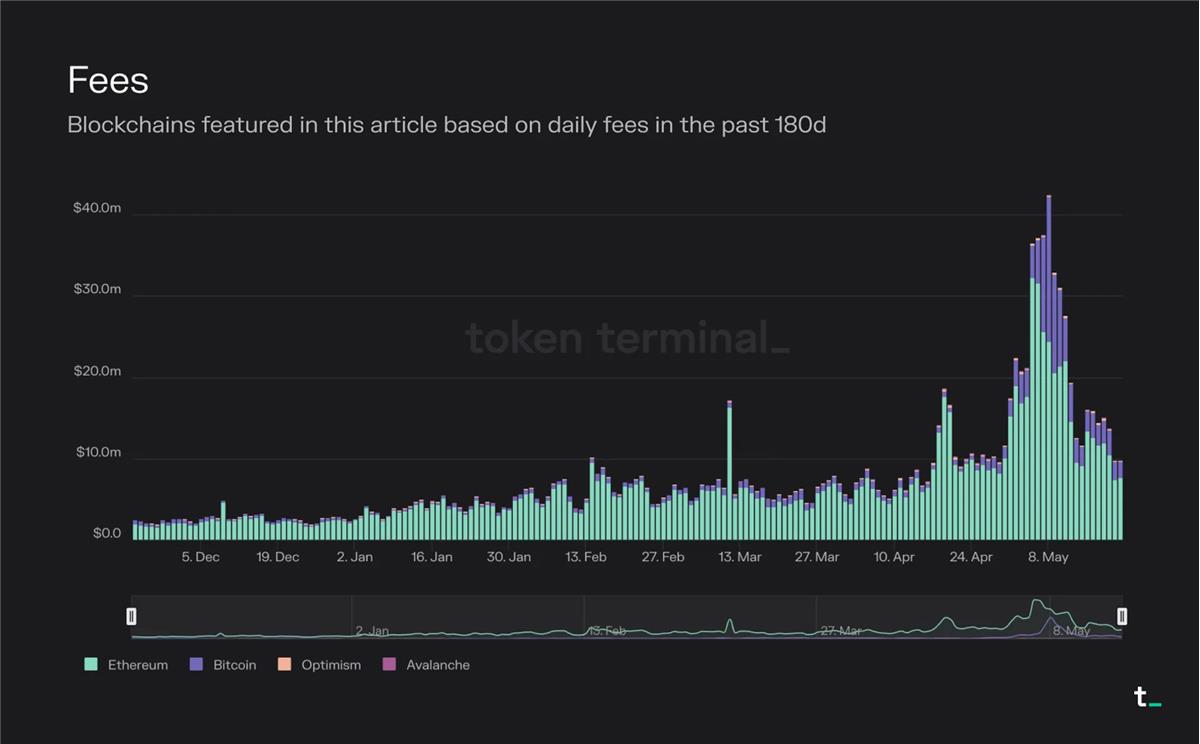

The chart below visualizes daily fees over the past 180 days for the blockchains mentioned in this article.

Deep Wave Note: It can be seen that the total transaction fees of Ethereum and Bitcoin are still far ahead.

The key components that usually make up the economic structure of a blockchain are transaction fees, inflationary block rewards (incentives), and fee burns.

Transaction fees represent the market price of block space.

Incentives are economic rewards that encourage people to take actions such as validating transactions.

Fee burning is a mechanism that removes a portion of each transaction fee from circulation.

Given the limited capacity of a single blockchain, we will see a world of multiple different blockchains - each optimized for a different use case - interoperating with each other.The blockchain market was originally created by BitcoinDominance, an extremely simple and limited contract execution environment.With EthereumWith the launch of , it is (theoretically) possible to deploy arbitrarily complex contracts or programs on the blockchain. Now, with scaling solutions, application-specific blockchains and cross-chainbridgefirst level title

PoW-based L1

Principle Explanation:

Users pay a transaction fee of 1 BTC for a block

Miner receives all fees (1 BTC)

Miners get 1 BTC from the block reward (newly issued BTC)

Final Results:

Main points:

Main points:

in bitcoinThe demand to submit transactions online creates a market for block space. Users pay miners for block space. Miners are further incentivized by the block subsidy, which is newly minted bitcoins that increase the total supply of the currency. Currently, all fees and block subsidies in Bitcoin go to miners.

Bitcoin provides security through CPU power. The value proposition of Bitcoin is to create a secure, transparent and immutable global ledger that allows trustless and irreversible transfer of value. These values are maintained by a security derived from CPU usage. Each block consumes a lot of CPU power to be verified on the network. Essentially, 1 CPU corresponds to 1 vote on the network. Therefore, as long as a majority of CPUs are in the hands of honest miners, the network is secure.

first level title

PoS-based L1

Principle Explanation:

Users pay a transaction fee of 1 ETH for a block (including MEV)

0.8 ETH is destroyed —> “share buyback” benefits all ETH holders equally

Validators earn 0.2 ETH from fees

Validators get 1 ETH from block rewards (newly issued ETH)

Since validators already receive half of their stake from delegators, validators must share 50% of their income with these ETH holders

Final Results:

0.8 ETH is destroyed

Validator receives 0.6 ETH

Ethereum

Main points:

existEthereumIn practice, roughly 85% of total transaction fees are burned, effectively serving as a "share buyback" that benefits all ETH holders equally. Meanwhile, validators earn remaining fees and additional staking rewards, newly minted ETH. Ethereum has averaged about $15 million in fees per day over the past 30 days.

EIP-1559 passed in August 2021The implemented fee burning mechanism turns ETH into a productive asset. Additionally, the transition from PoW to PoS has reduced the new issuance rate of ETH. Since the September 2022 Merge, Ethereum no longer distributes block rewards to miners. This change caused the issuance of new ETH to drop by about 90% (block rewards of about 14 k ETH/day were replaced by staking rewards of about 1.7 k ETH/day). This results in a deflationary ETH supply during periods of high usage.

Ethereum's economic structure consists of three key components: total transaction fees, the portion of transaction fees that are burned, and staking rewards. Transaction fees are determined based on the supply and demand of network block space. Staking rewards are inflationary rewards that increase the total supply of ETH. The burning of transaction fees causes deflationary pressure on ETH, while the reduction in circulating supply may increase the value of the token over time.

Post-merger, ETH supply has been deflationary during periods of high usage. For example, in May of this year, the amount of ETH burned (revenue) was consistently greater than the amount of ETH minted as staking rewards (token incentives).

Liquidity pledge projectAllows users to stake their assets and maintain liquidity through a liquid staking derivative (LSD) representing the underlying asset.

Principle Explanation:

Users pay a transaction fee of 1 ETH for a block (including MEV)

0.8 ETH is destroyed —> “share buyback” benefits all ETH holders equally

Validators earn 0.2 ETH from fees

Validator receives 1 ETH from block rewards (newly issued ETH)

The validator has received full equity from users who deposited ETH via Lido, the liquidity collateral protocol, so it shares 100% of the revenue with these ETH holders

Lido takes 10% (0.12 ETH) of the total staking rewards for providing services and distributes the remaining 90% (1.08 ETH) to ETH holders who staked through Lido

Final Results:

0.8 ETH is destroyed

Validator receives 0 ETH

Lido receives 0.12 ETH (50% of which is used to pay node operating costs)

Main points:

Main points:

The Liquid staking protocol enhances the user experience. Staking, which is inherently a technical and high-maintenance process, has been adopted asLidoSuch a protocol is simplified. By allowing users to lock their ETH and receive transferable utility tokens (stETH), Lido facilitates seamless staking, while enabling users to earn rewards associated with validating activity. To provide this service, Lido takes a 10% fee from gross proceeds. This fee is split equally between node operators and Lido DAO.

The technicalities and high capital requirements of staking open up business opportunities for liquid staking protocols.Traditional EthereumStaking requires users to maintain a node, invest a lot of money (32 ETH), and sacrifice token liquidity. In contrast, Lido distributes users’ tokens to validators in batches, removing the 32 ETH barrier. By simplifying the user experience, providing liquidity, and democratizing staking, Lido and similar protocols are unlocking a rapidly growing market segment.

The democratization of staking allows for a wider range of investor participation. Apart fromBlockchain (L2)Shapella UpgradeShapella Upgrade(April 12) Arguably reducing the risks associated with ETH as an investment, and the risks associated with ETH as a yielding asset. Therefore, it is expected that the ETH pledge ratio (staked assets/market capitalization in circulation) will grow and be on par with other PoS chains. at present,The collateral ratio of ETH is about 15%, which is relatively low compared to other PoS chains. For example, Solana and Avalanche currently have collateralization ratios of over 60%. Given ETH's high market cap, around $220 billion at the time of writing, we could see pledged assets growing by the billions in the coming quarters.

Lido has become the current market leader in the liquid staking market space with $12 billion in total assets pledged. This number is up 38% year-over-year and 105% over the past 180 days.

Over the past 30 days, Lido generated $60.4 million in fees and received 10% of that, or $6.04 million in revenue. This revenue is split 50/50 between node operators and Lido DAO.

Avalancheis a blockchain (L1) that competes with Ethereum by prioritizing scalability and faster transaction speeds. It uses a novel consensus algorithm that provides strong security, fast transaction finality, and high throughput while remaining decentralized.

Principle Explanation:

Users pay a transaction fee of 1 AVAX for a block

1 AVAX is destroyed —> “Share Buyback” benefits all AVAX holders equally

Validators earn 0 AVAX from fees

Validators receive 2 AVAX (newly issued AVAX) from block rewards

Since validators already receive a portion of their stake from delegators, validators must share their income with those AVAX holders

Final Results:

1 AVAX destroyed

The validator receives 1 AVAX

exist

Main points:

existAvalancheOn , all transaction fees are burned, and the only source of income for validators is staking rewards. The burning mechanism, as a kind of "share repurchase", is equally beneficial to all AVAX holders. Over the past 30 days, Avalanche has averaged about $64,000 per day.

A relatively newcomer to the blockchain space, Avalanche is issuing a large number of AVAX tokens to reward its validators. This approach is often used as a way to bootstrap growth in the early stages of a platform. These rewards attract validators and stimulate growth and activity within the Avalanche ecosystem.

Avalanche's economic model may change in the future. Fee and reward structures are not set in stone and can be adjusted based on future governance decisions. Currently, 50% of the total AVAX token supply is allocated as staking rewards for validators. This allocation is planned to take place over a ten-year period, from 2020 to 2030. In the future we may see a portion of transaction fees being redirected to validators as the staking reward distribution finally ends.

first level title

PoS-based L2

Optimismis a scaling solution (optimistic rollup) designed to makeEthereum just got better.Optimism executes transactions on L2 and submits them in batches to L1 for finalization. Depending on the transaction type, this results in a roughly 5-20x gas reduction.

Principle Explanation:

Users pay a transaction fee of 1 ETH for a block

All transaction fees (1 ETH) go into a sequencer run by the Optimism Foundation

Sequencer pays a transaction fee of 0.8 ETH to submit the transaction to L1 (Ethereum)

Sequencer (in this case Optimism Foundation) reserves 0.2 ETH as profit

Final Results:

0 ETH burned (excluding burns on Ethereum)

Sequencer receives 0.2 ETH

Main points:

Main points:

Layer 2 BlockchainExtend the application. L2 blockchains allow for widespread use of L1 applications such asUniswap、Blur、OpenSeaetc., move their transaction activity from L1 to a separate chain that periodically settles its transactions back to L1.Currently, UniswapMore than 30% came from L2.

Layer 2 blockchains enable a more optimized user experience. As an L2, the application can optimize the user experience (transaction fees/MEV collection and rebates, on-chain privacy, etc.) for its use case (e.g. transactions). This optimization can be implemented while still maintaining transaction records on the more secure L1.

The economics of layer 2 blockchains are driven by two variables: the fees charged by L2 and the cost of settling transactions to L1. The main business model of the L2 blockchain is to generate revenue by cutting transaction fees paid by users. The profit margin is determined by the cost of settling transactions to L1. For example,Users on OptimismA total of $38.2 million in transaction fees have been paid since launch. Of those fees, $28.5 million was spent on gas fees for submitting transactions to Ethereum. Therefore, Optimism captures the difference, or $9.7 million, as revenue. Profit margins for L2 blockchains are expected to decline as competition intensifies. L2 blockchains that are able to optimize their gas spending on Ethereum through data compression and other techniques, further reducing L2 fees, may gain market share in the future.

in conclusion

in conclusion

Blockchain is redefining the infrastructure of economic activity by providing a decentralized, secure and transparent transaction processing architecture. In a fast-moving industry like crypto, we see constant innovation in the economic models of these computing platforms. Despite the differences, investors can use the above framework to compare their economic performance, potential and sustainability.