Why is it urgent for NFT trading platforms to curb dishwashing behavior

first level title

We analyze the current state of NFT wash trading (especially trade mining), and dig into the strategies behind the main wash traders and their profits and losses. At the same time, we also shared a model in this article that can increase the probability of gain and reduce the risk of loss, thus showing how the current transaction mining reward mechanism can be easily manipulated for arbitrage. Finally, we make several points that highlight how wash trading is seriously affecting the survival of these NFT trading platforms themselves.

But for those who have long profited from the industry's lack of regulation, the outlook is less rosy.

image description

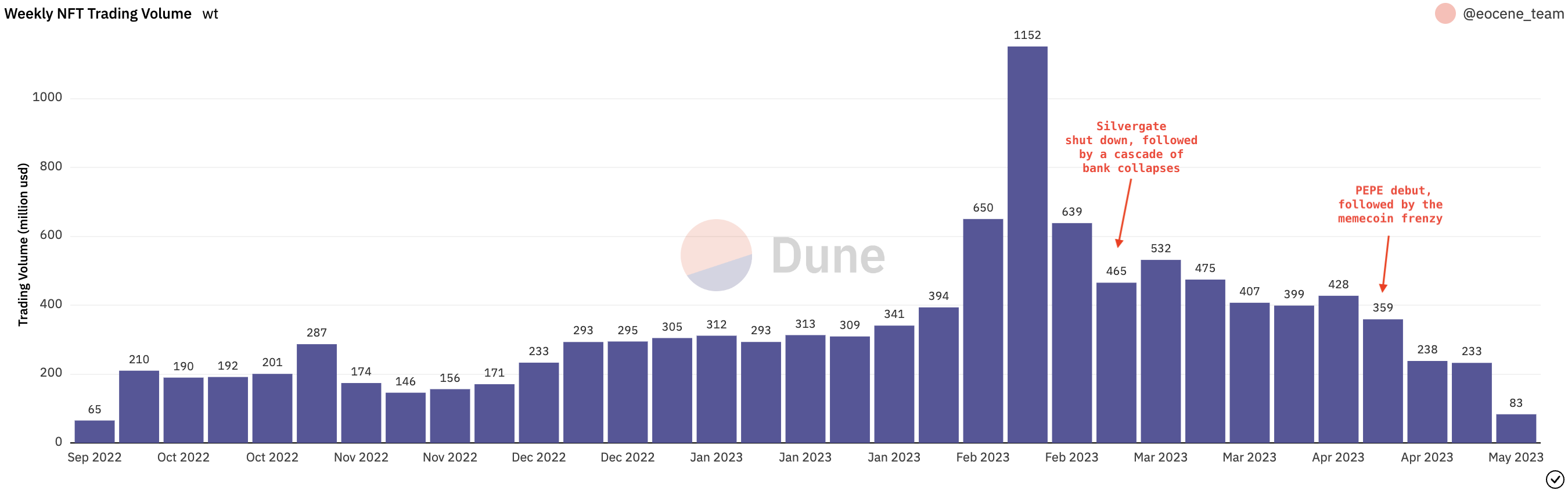

NFT Weekly Trading Volume

Compared with attempts to manipulate the market, using dishwashing transactions to obtain token rewards sounds more "harmless", but this behavior is actually unreasonable and even more illegal. In traditional finance, dishwashing is a strictly defined illegal behavior, but it has been growing wildly in the NFT world. However, as the crypto industry becomes more important globally, governments and regulators are bound to step in. We have all witnessed the rapid increase in regulation of the industry since 2022, so the NFT market will inevitably be subject to stricter regulation before long, and wash trading, as one of the most obvious problems, will bear the brunt of it.

first level title

Who is the biggest wash trader?

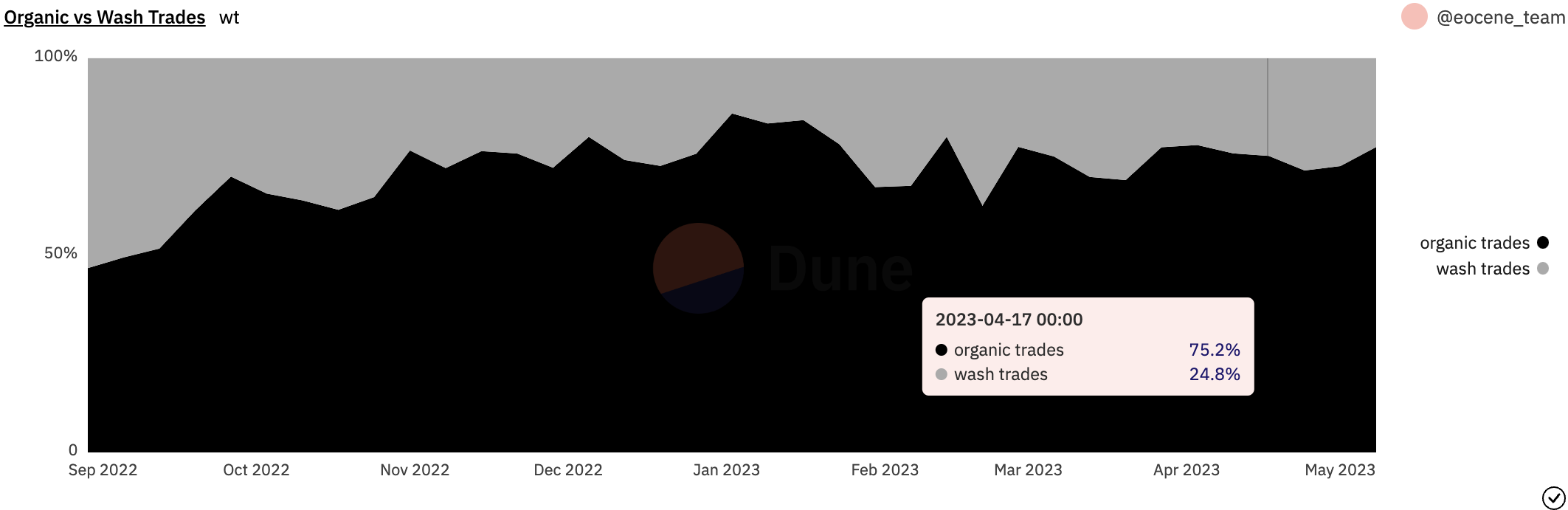

On average, daily wash trades account for roughly a quarter of all NFT trades on that day. Almost all wash trades happen on X2Y2 and LooksRare¹.[1] Since the launch of the BLUR token and the debut of Rewards Season 3 in March 2023, there has been a surge in wash trading volume on Blur. Although this is also related to transaction mining, Blur's reward mechanism is significantly different from X2Y2 and LooksRare; wash trading on Blur is more an "unfortunate" result of user risky behavior than intentional behavior. As to whether such transactions should be considered wash tradingIt's been going on. In this article, we will focus on intentional wash trades, the type dominated by X2Y2 and LooksRare.

image description

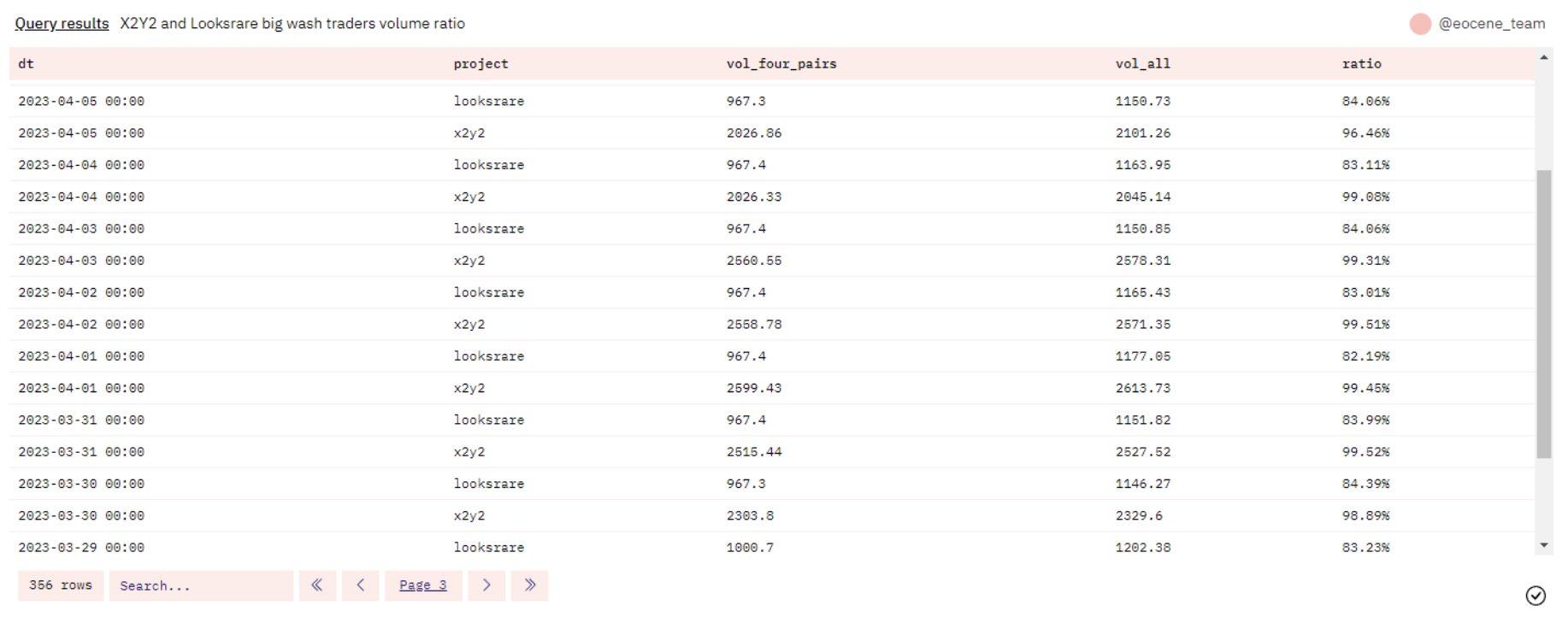

The respective proportions of real transactions and washing transactionswhat is interesting is,4 pairs of addresses (8 in total) accounted for almost 80% of the wash volume in the market

[ 2 ] There are two sources of rewards on X2Y2: transaction mining and pledge mining. Pledge mining will distribute the transaction fees obtained by the platform to users who pledge tokens. Some users have been staking to compensate for some of the costs consumed by wash trading. However, in general, if a wash trade produces a negative PnL, the user's best option is to stop the wash trade altogether. From this perspective, transaction mining and pledge mining are relatively independent.

image description

Addresses involved in the most wash transactions

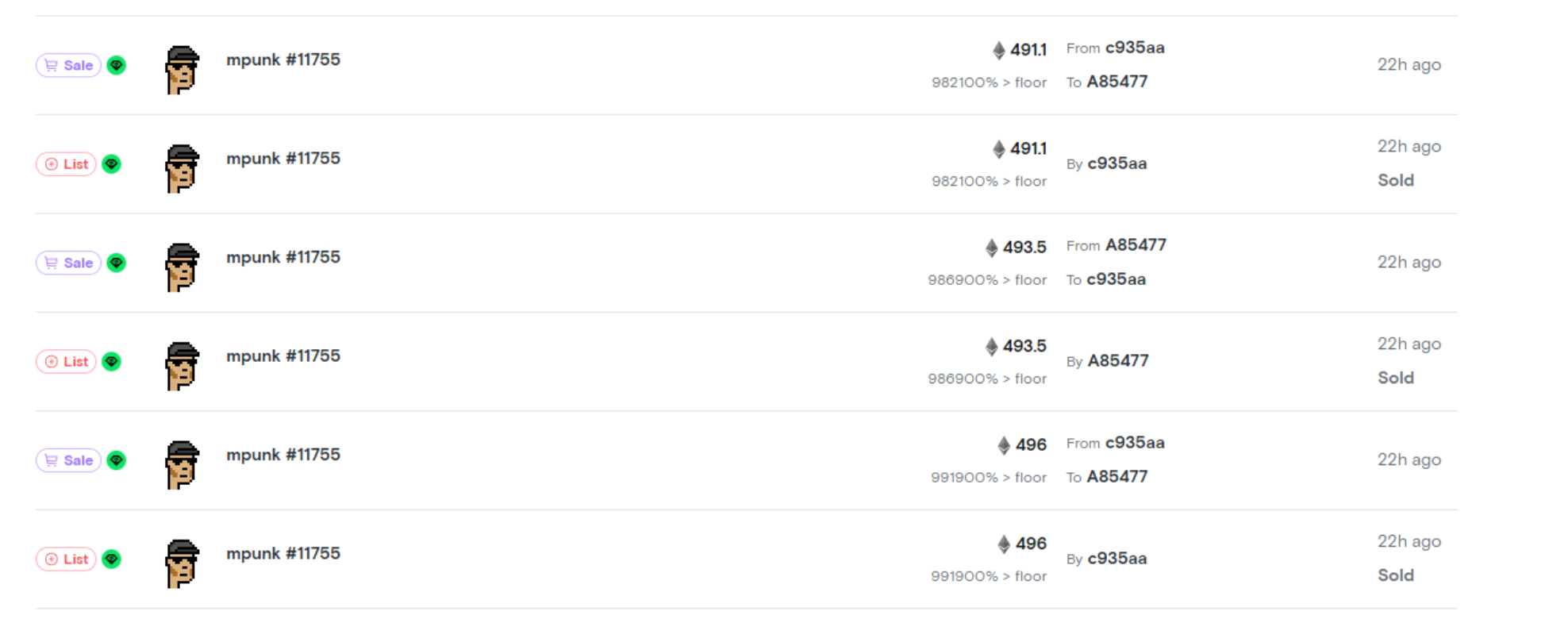

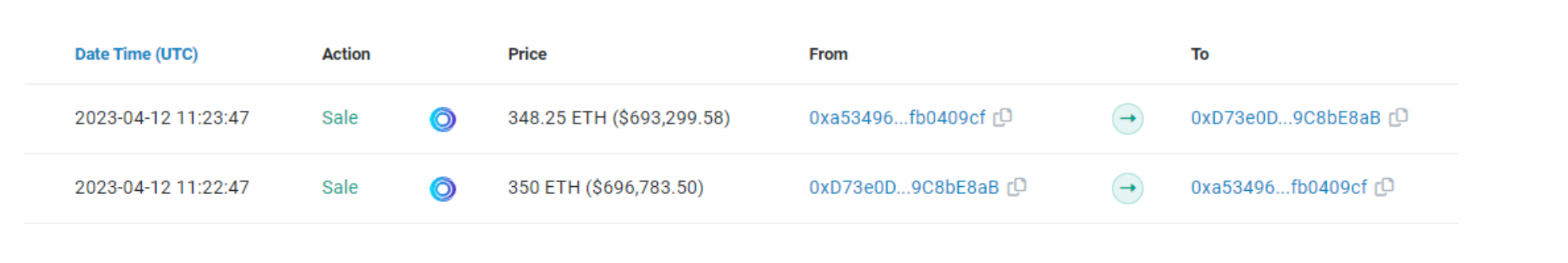

All four pairs of wallets employ the same strategy — repeatedly trading the same NFT between the two wallets, each for hundreds of ETH (well above the floor):

Address pair A trades on X2Y2 More Loot #666688;

Address pair B trades mpunk on LooksRare #11755;

Address pair C trades on X2Y2 Dreadfulz #164;

Around 90% of all transactions via X2Y2 and LooksRare come from these four pairs of wallets (excluding private transactions):

image description

Transactions from these eight addresses account for approximately 90% of transaction volume on X2Y2 and LooksRare

Some interesting findings:

Address pair A and address pair B are actually controlled by the same entity, which shows that this group of wash traders who seriously affects the market is very concentrated.The importance of royalties, royalties can not only fairly distribute value to creators, but also prevent bad trading behaviors, thereby maintaining the healthy development of NFT.

secondary title

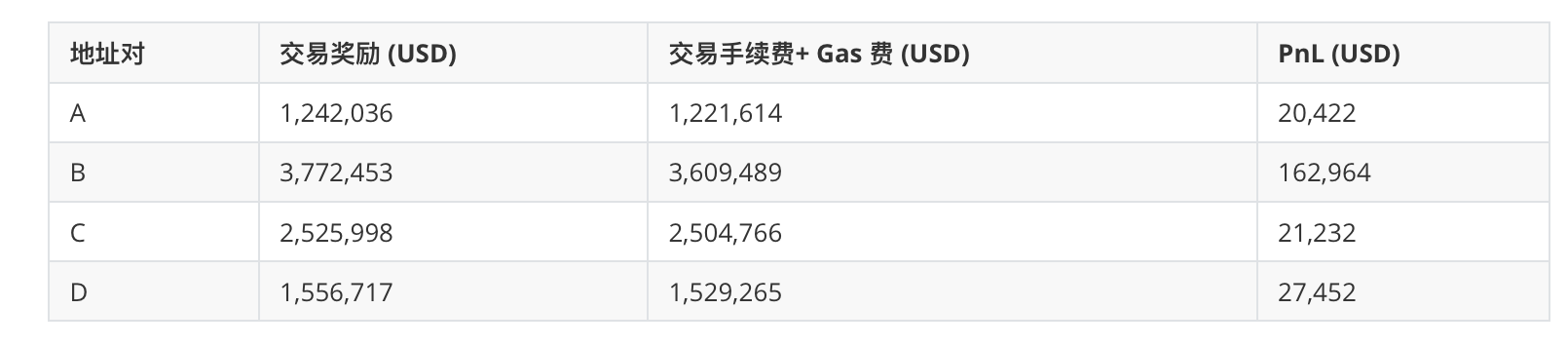

How much profit do wash traders make?

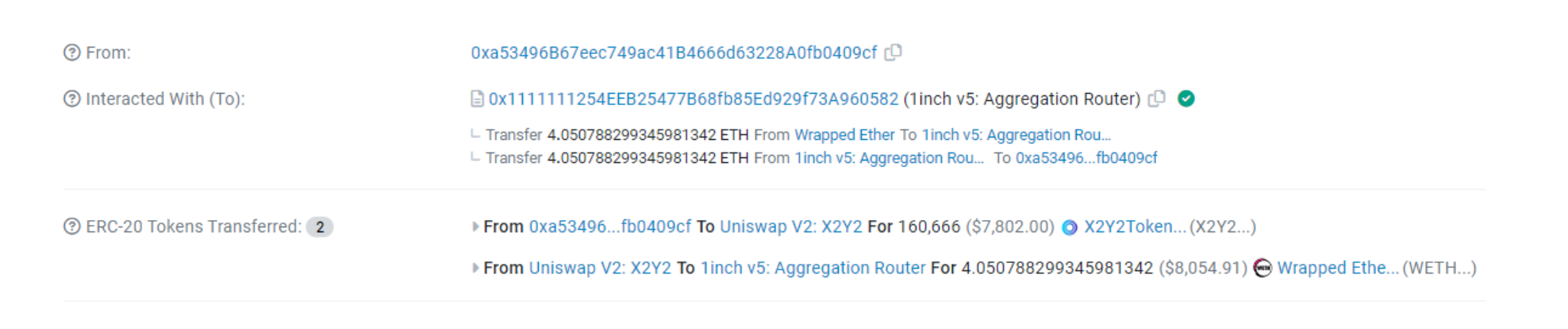

We calculated the income of these four pairs of addresses from wash trading between November 1, 2022 and April 6, 2023, using X2Y2 or LOOKS token rewards as income (the rewards of both platforms are mainly allocated to seller), the platform fee and gas fee are used as the cost.

PnL = Transaction Reward - Platform Fee - Gas Fee

transaction reward

X2Y2: From October 5, 2022, 400,000 X2Y2 tokens will be rewarded daily, 95% of which will be allocated to sellers according to the proportion of transaction fees, and the remaining 5% will be allocated to buyers

LooksRare: 437,458 LOOKS tokens will be awarded every day between May 12, 2022 and January 3, 2023, and 236,650 LOOKS tokens will be awarded every day after January 3, 2023. From October 28, 2022, 95% of the rewards will be distributed to sellers and 5% to buyers (evenly before then)

handling fee

X2Y2: fixed at 0.5%

In general, all 4 pairs of addresses have gained positive returns from wash trading, with address pair B earning a particularly substantial profit.

Traders' profits through dishwashing

secondary title

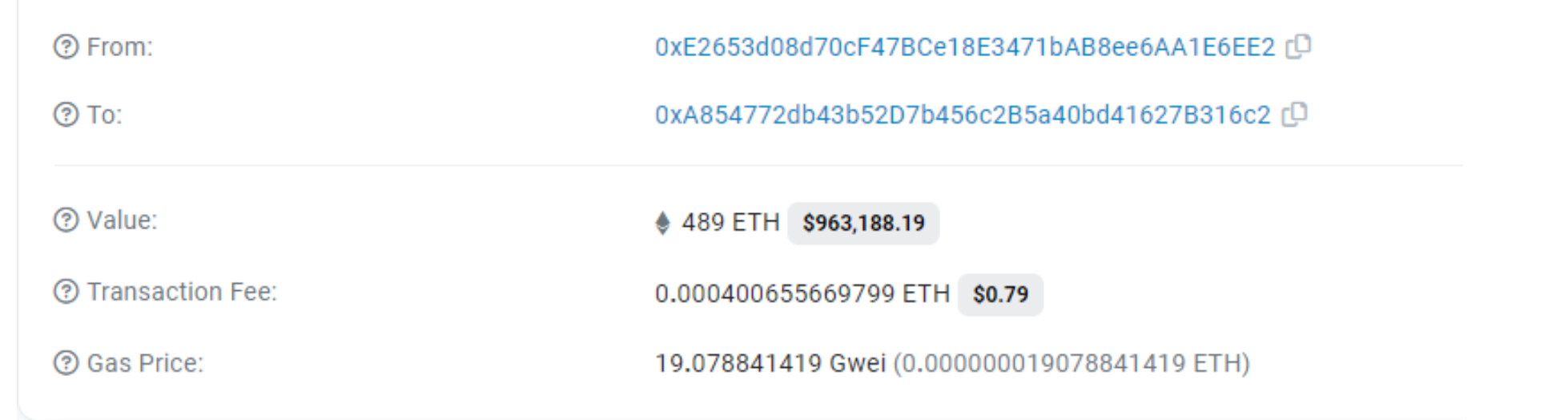

A specific example of wash trading operation

Below is a step-by-step demonstration of how address pair A and address pair B perform a wash trade, both of which are funded from 0xE2653d08d70cF47BCe18E3471bAB8ee6AA1E6EE2

0xE265 First borrow ETH from Aave

0xE265 First borrow ETH from Aave

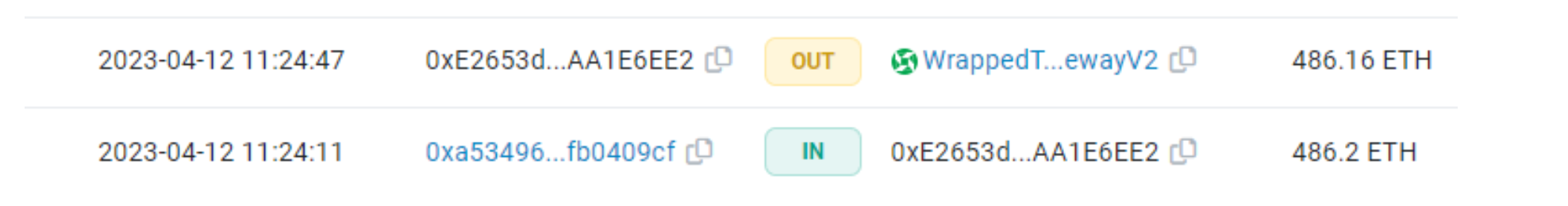

2. Then 0xE265 will send the borrowed ETH to any one of the four addresses

3. After obtaining funds, these addresses will start to trade with left-handed and right-handed at extremely high prices on X2Y2 and LooksRare

4. After the transaction is completed, these addresses will send ETH back to 0xE265, and then 0xE265 will repay Aave's loan

5. The two trading markets will settle the trading rewards at the end of each day. After receiving the reward, these addresses will exchange the reward tokens for ETH,

This process seems reasonable at first glance, but there are many confusing places in it. First of all, how do these wash traders determine the transaction price? Why trade for 400 ETH instead of 200 or 1000, even though the higher the transaction price, the more rewards you may receive? Second, the timing of these trade executions is also confusing, why not choose to trade when the rewards are settled each day to better estimate the level of volume at which you can earn more?

first level title

Trading strategy, and the game between dishwashing peopleReal profit is not as simple as it seems. More transaction volume does not always lead to higher rewards; in fact,After the market's total daily volume exceeds a certain threshold, every trader loses money for the day. Given such a threshold, it is actually more advantageous to enter the market earlier in the day, as it deters other traders who also want to profit from the trading bonus

(assuming others are similarly experienced).

1) Calculate the profit threshold

For example, the profit threshold on X2Y2 on March 9, 2023 is: ( 380,000 * 0.0617) / ( 1,438 * 0.5% ) = 3,262 ETH

This threshold changes daily as reward tokens and ETH prices fluctuate. But the key point here is: as long as the total trading volume of the trading market is below this threshold (excluding private transactions), every trader can earn income through transaction mining on that day. That is, the revenue from transaction rewards will exceed the cost of transaction fees.

It's no surprise, then, why traders want to enter the market earlier in the day rather than towards the end - whoever gets in first has more leeway to manipulate trade sizes and rewards. Conversely, traders who enter the market near the end of the day are left with very little room to trade to earn reward tokens, as they cannot push their total volume beyond the profit threshold. Of course, many traders may not be that savvy and understand this mechanism. There are also some traders who really focus on actual NFT transactions rather than token reward earnings. These are factors beyond the control of whip traders, but being first to the market can still give them an advantage.

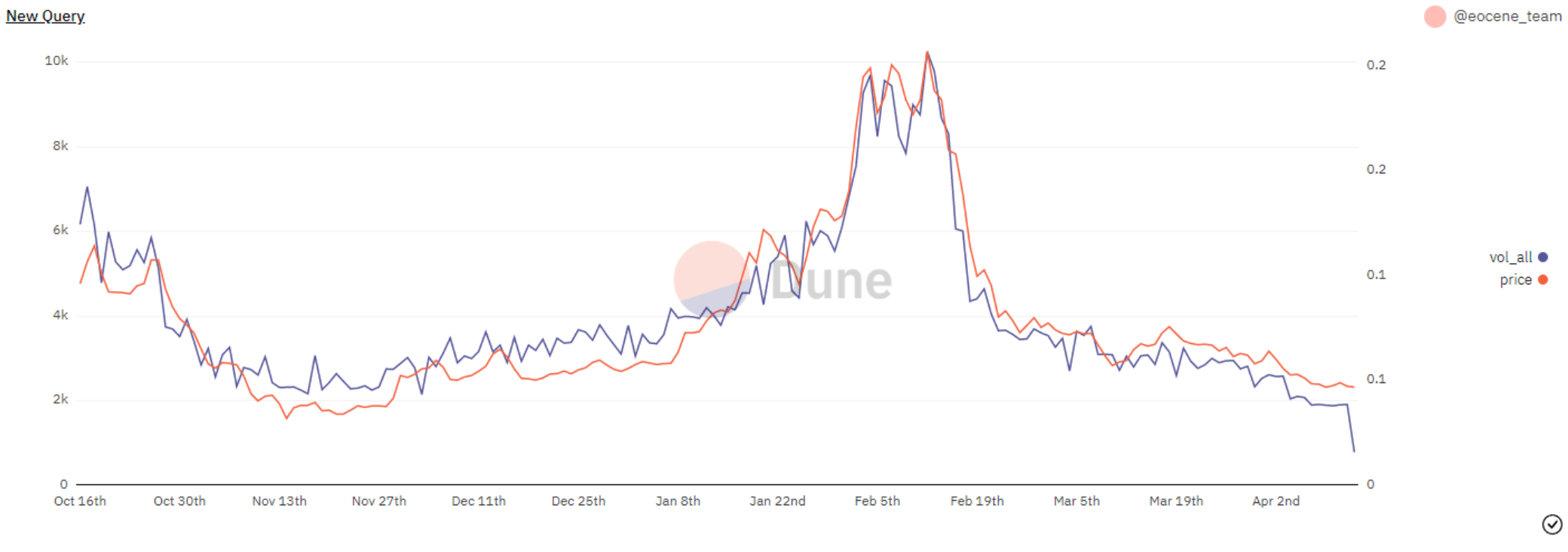

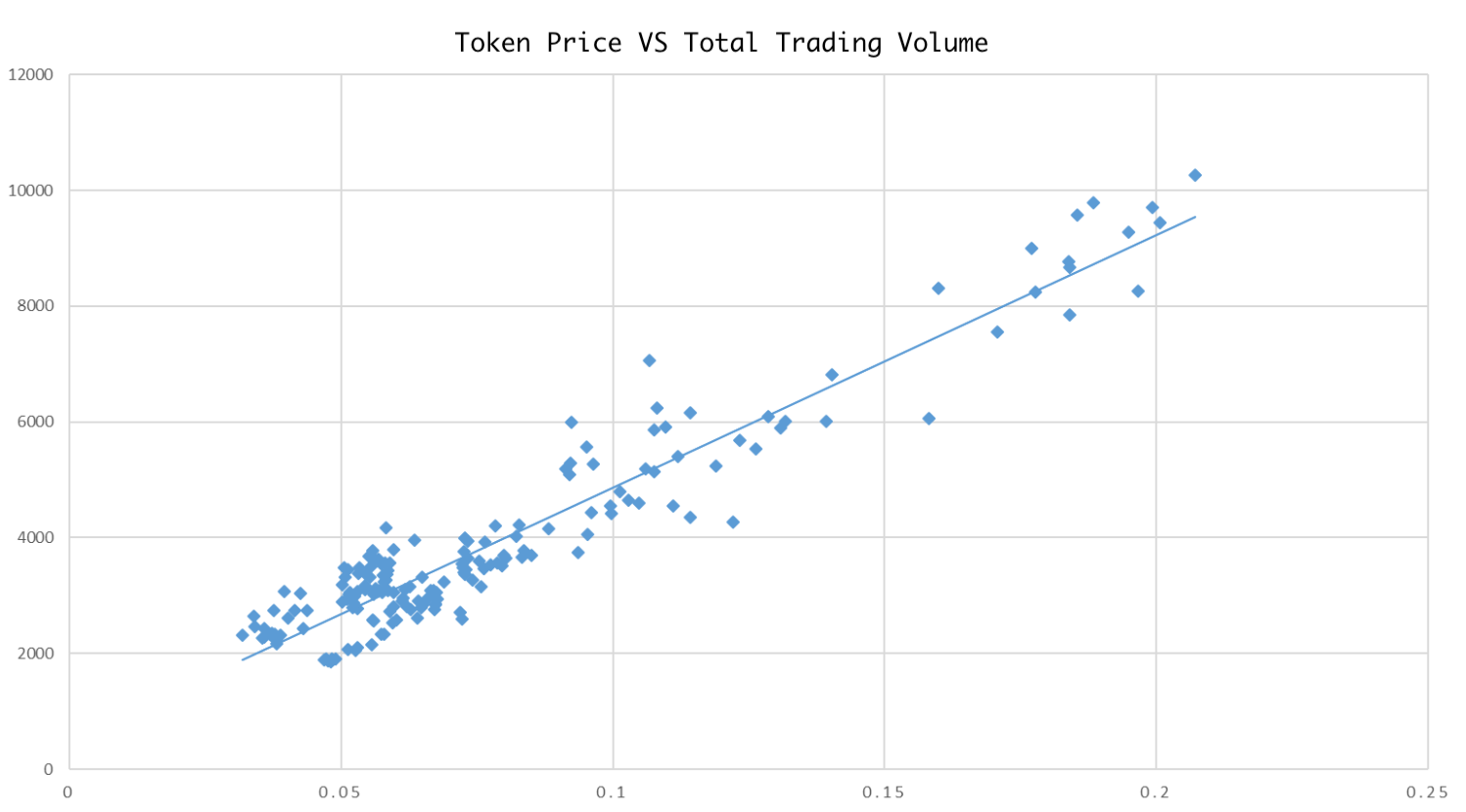

Next, it is necessary to estimate the probability that the total trading volume of the market (excluding private transactions) on that day is below the profit threshold. Taking X2Y2 as an example, we found a strong linear correlation between total transaction volume and reward token price.

Platform transaction volume vs. reward token price trend

image description

There is a strong linear correlation between transaction volume and reward token price

The trading volume for the day can be estimated based on the current token price:

For example, on March 9, 2023, the estimated total transaction volume is: 43,617 * 0.0617 + 499.63 = 3,191 ETH

If this number is smaller than the profit threshold, the trader can confidently participate in the day's trade and make a positive profit.

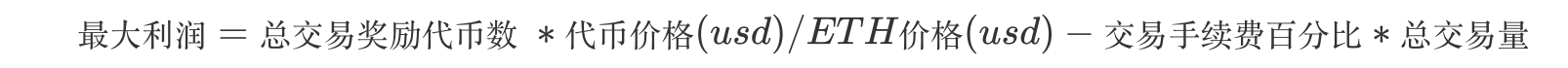

3) Determine the transaction amount according to the target profit

The maximum profit can be calculated as:

For example, on March 9, 2023, the maximum profit would be: 380,000 * 0.0617 / 1,438 – 0.5% * 3,191 = 0.35 ETH

If a trader wants to make a profit of 0.1 ETH, which is 29% of the maximum profit, his transaction price should be set at:

For example, 29% * 3, 191 = 925 ETH

Traders can complete this goal in one transaction, or in multiple transactions, but multiple transactions also mean that more gas fees need to be paid.

Despite this, there are very few transactions by real users on X2Y2 and LooksRare (we will explain why these two platforms lack real transactions below). Even less savvy whip traders realize after losing money consistently that their strategy isn't working. The above analysis is enough to prove that through some simple mathematical calculations, the trading and mining reward systems of these two platforms can be easily manipulated for arbitrage.

first level title

The NFT trading market is getting itself into trouble by indulging a flood of wash trading

In discussions about NFT wash trading, X2Y2 and LooksRare often become the focus of topics, but they have not taken any strong actions to solve this problem. One obvious reason is that wash trading brings them real benefits, which on the face of it seem to outweigh the cost of the negative reputation of the flood of wash trading.

However, we firmly believe that the negative impact of wash trading on these platforms is not only in reputation, but also poses a serious threat to the development and even survival of these trading platforms:

Unable to attract professional traders

Professional traders who want to make large trades on X2Y2 and LooksRare do not benefit from token rewards, as the fake volume brought in by wash traders can easily push the total volume beyond the profit threshold. In contrast, these traders can trade on other NFT marketplaces, such as Blur, without paying any transaction fees, while still being rewarded with points.

Transaction volume stagnated

On the one hand, real traders have no motivation to trade on these platforms, and on the other hand, there is a game in the reward system (once the transaction volume exceeds a certain threshold, the reward is meaningless compared with the transaction fee), these two factors are combined, It has become a huge resistance to the rise of the platform's trading volume.

first level title

epilogue

epilogue

first level title

about the author

about the authorEocene ResearchCo-authored by Helena L. and Sun L. of .existTwitterexist