ETH Weekly | Lido upgrade to V2 will activate Ethereum withdrawals; Optimism mainnet will undergo Bedrock upgrade on June 7 (5.15-5.21)

1. Overall overview

1. Overall overview

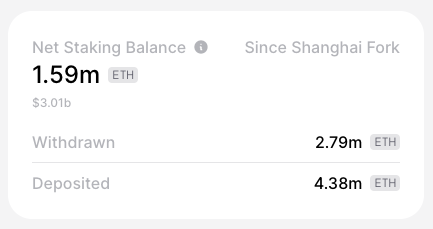

The Lido V2 upgrade was voted in and will allow users to withdraw staked ETH. Due to multiple security audits, Lido takes an additional month to process withdrawals. According to Dune data, Lido has withdrawn a total of 450,000 pledged ETH, accounting for 7% of its total pledged amount, and there are still 6.49 million ETHs in the pledged state.Additionally, the Lido community publishesnew proposal

, plans to introduce an LDO staking module and a repurchase program to support token holders to pledge LDO in exchange for a portion of Lido DAO revenue (through the LDO repurchase and distribution plan), which includes 20-50% of future Lido DAO revenue (based on Governance decision specific parameters) distributed to LDO pledged users every week through the repurchase and distribution mechanism.

Second, the secondary market

Second, the secondary market

1. Spot market

image description

ETH daily chart via OKX

The daily chart shows that the price is currently consolidating around $1,800 and may continue to test $1,800 in the short term. If the support is valid, it is expected to rebound to $1,850 and $1,900.

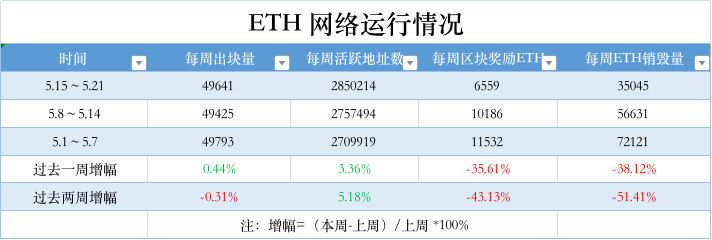

2. Network operation

Etherscan 3. Large transaction

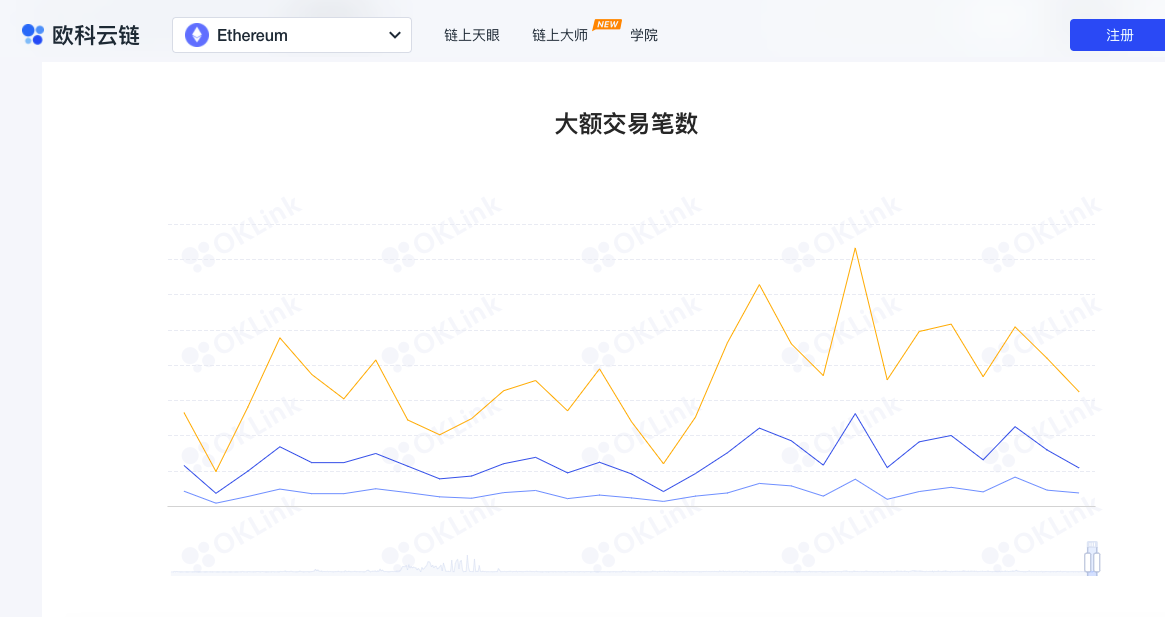

3. Large transaction

OKlink data4. Rich list address

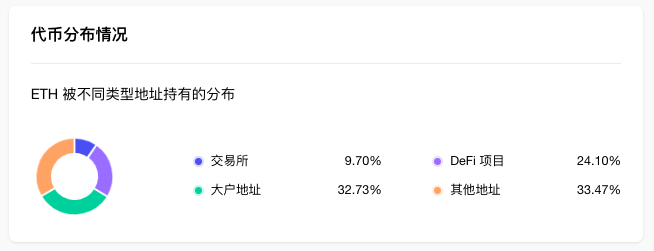

4. Rich list address

OKLink dataOKLink data

token.unlocks3. Ecology and technology

3. Ecology and technology

1. Technological progress

107th Ethereum ACDC meeting: Core devs plan to launch new testnet next week

It's official, the Ethereum client Prysm has released version v 4.0.4, which includes many optimizations since the previous version. This is the first full release following the recent ethereum mainnet issues and it is highly recommended to upgrade to this release immediately.

2. Voice of the Community

Former Ethereum Foundation developer skeptical of crypto project Worldcoin

Worldcoin, the encryption project founded by OpenAI CEO Sam Altman, is in advanced talks to raise about $100 million and is preparing to launch in the next few weeks, three people familiar with the matter said, according to previous reports. The project, which has been in beta testing, is now preparing to launch its blockchain protocol and start recording transactions within the next six weeks.

3. Project trends

(1) The Lido V2 upgrade has been voted through and Ethereum withdrawal will be activated

The Lido V2 upgrade has been voted and has been upgraded to the V2 version, which will allow users to withdraw the pledged ETH. Due to multiple security audits, Lido takes an additional month to process withdrawals. According to Dune data, Lido has withdrawn a total of 450,000 pledged ETH, accounting for 7% of its total pledged amount, and there are still 6.49 million ETHs in the pledged state.Additionally, the Lido community publishesnew proposal

(2) Loopring launched the "Block Trade" function to build a P2P trading system

(3) The Bedrock upgrade of the Optimism mainnet will take place on June 7, and the mainnet will be shut down for 2 to 4 hours at that time

(4) Ronin Network launched the NFT market Mavis Market

The Ethereum sidechain Ronin Network launched the NFT market Mavis Market to support the transaction of NFT on Ronin. Users can purchase NFTs with AXS, WETH, USDC, and RON. NFT authors can set their own royalties, and Mavis Market will charge a fixed fee of 2.5%, of which 2% will be allocated to Sky Mavis and 0.5% will be allocated to the Ronin treasury.

(5) The proposal to deploy Uniswap V3 to Moonbeam is being voted on the chain

(6) CyberConnect releases Litepaper, including three core components including CyberProfile and CyberWallet

According to the Litepaper released by CyberConnect, the Web3 social graph protocol, the three core components of CyberConnect are CyberProfile, CyberConnect Social Graph, and the smart contract wallet CyberWallet under development. The utility of CyberConnect’s native token CYBER includes governance, CyberProfile minting payment, and Gas payment in CyberWallet. Cyberwallet is under development and will be deployed on Ethereum, Optimism, Arbitrum, BNB Chain, Base and Polygon.

(7) The Uniswap community voted to approve the proposal on "deploying Uniswap V3 to Moonbeam"

The Tally voting page shows that the Uniswap community passed the proposal of "deploying Uniswap V3 to Moonbeam" almost unanimously (99.99%). It is reported that discussions on the proposal have already begun in 2022. At that time, the proposal chose Nomad as the designated cross-chain messaging solution, and the proposal was forced to be suspended due to the attack on Nomad.

According to the proposal, GFX labs will be responsible for the technical deployment of contracts on the target chain, and the cross-chain bridge will be provided by Wormhole. Approval of the proposal by Uniswap governance will result in said Uniswap v3 contract being considered a canonical deployment on Moonbeam. Like all canonical v3 deployments, this one will be governed and controlled by the Ethereum Layer 1 Uniswap protocol.

(8) Coinbase launched the educational platform Base Camp for Web3 developers

(9) BitDAO and Ethereum's second-layer solution Mantle Network will be merged

The latest update of Aave V2 makes it impossible to withdraw, borrow and repay about 110 million US dollars of WETH, USDT, WBTC, and WMATIC in Aave V2 on Polygon. At present, Aave has submitted a patch to fix this problem, which will be deployed after voting. The reason for the problem is that the Polygon implementation of Aave V2 uses a slightly different function definition list for its interest rate strategy contract, which makes a bug after the update.

4. Borrowing

DeFiLlamaThe data shows that the value of locked collateral on the chain fell from $27.23 billion to $26.95 billion last week, a 1% month-on-month drop. Specifically, the number of ETH mortgages dropped from 15.13 million to 14.93 million last week, a drop of 1.3%. From the perspective of individual projects, the top three lock-up values are: Lido $11.83 billion; MakerDAO $6.84 billion; Aave $4.43 billion.

4. News

(1) Data: The market share of NFT trading volume on the Ethereum chain reached 96% in April

According to Footprint Analytics data, Ethereum accounted for the largest share of NFT transaction volume last month, with a market share as high as 96%. However, in terms of active users of NFT on the chain, Ethereum only accounts for 44%, followed by Polygon with 37%. While Ethereum remains the platform of choice for most mainstream NFT projects, its network congestion and high transaction fees may drive some users to alternative platforms.

(2) Encryption asset management company Bitwise has requested to withdraw its application to the US SEC for Ethereum futures ETF

(3) Visa deploys two sets of Paymaster contracts on the Ethereum Goerli test network to study account abstraction use cases

Payment giant Visa recently published "Rethinking Digital Transactions with Account Abstraction". According to the article, in order to better understand the Ethereum account abstraction proposal ERC-4337, the Visa team has deployed two sets of experimental Visa Paymaster contracts on the Ethereum Goerli test network, showing how to redesign the gas fee on the blockchain to improve User convenience.

Both sets of tests used the startup code provided by the Ethereum Foundation and the ERC-4337 core team. With the first set of Visa Paymaster contracts, Visa is exploring whether users can pay transaction fees with other tokens, such as U.S. dollar stablecoins or even central bank digital currencies. In this case, the payer pays transaction fees in ETH by receiving an equivalent amount of generic ERC-20 tokens paid by the user. The test setup includes deploying a smart contract wallet and sending user actions.

![Axe Compute [NASDAQ: AGPU] completes corporate restructuring (formerly POAI), and Aethir, an enterprise-grade decentralized GPU computing power, officially enters the mainstream market.](https://oss.odaily.top/image/2025/12/12/ff08e068a361495da15f80b89405441e.jpeg)