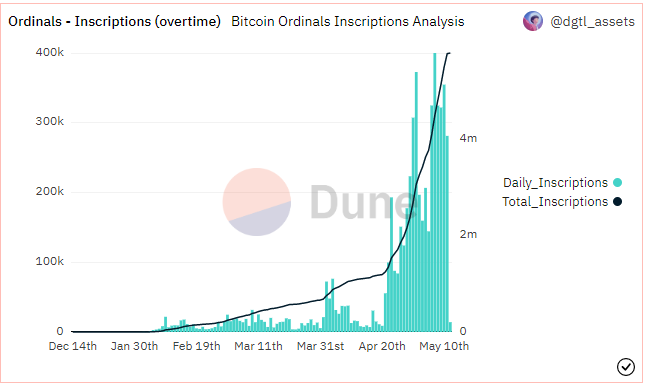

Behind the explosion of BRC-20, what happened to the blockchain network?

Fees on the bitcoin blockchain have soared to two-year highs as the growing popularity of BRC-20 tokens and the Ordinals protocol has fueled demand for bitcoin block space.

image description

Source dune. Ordinals-Inscriptions Quantity

bitcoin

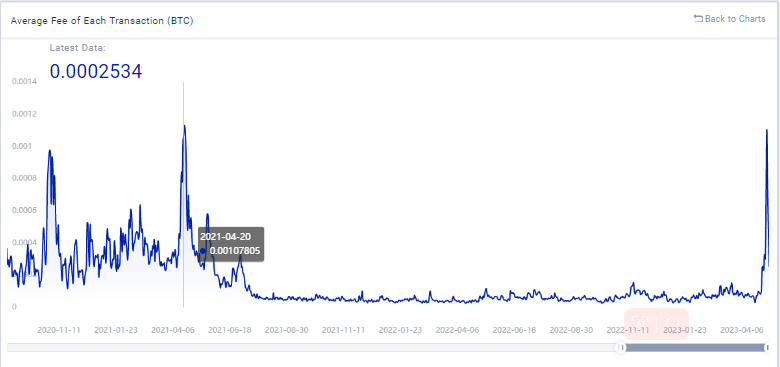

image description

Source Tokenview.io. Bitcoin daily average transaction fee

The surge in transaction fees has also sent shockwaves through the entire Bitcoin ecosystem. On May 7, the Binance exchange temporarily shut down BTC withdrawals as 400,000 pending transactions clogged the mempool.

In addition, influenced by BRC-20 tokens, meme coins on Ethereum have also become active. On May 5, the Ethereum network Gas fee soared to 136.39 gwei, a new high in more than a year.

Ordi’s token in the Ordinals marketplace is by far the most valuable BRC-20 token with a market capitalization of around $400 million. ordi is also the first BRC-20 token deployed on Bitcoin.

Unlike pepe tokens issued on Ethereum, Pepe tokens on Bitcoin are the second largest BRC-20 issuance despite a relatively small market cap of around $24 million.

The rapid popularity of these new coins has made the bitcoin network congested and expensive to operate. It also challenges how Bitcoin can handle the demands of rapid scaling.

As fees for sending tokens soar and transactions wait longer in queue, some users and exchanges have begun to consider alternatives, such as the Lightning Network. The Bitcoin Lightning Network is a so-called "Layer 2" scaling solution designed to make Bitcoin transactions faster and cheaper. It is reported that during the week from May 3rd to 10th, the Bitcoin Lightning Network added more than 2,500 nodes a week, a record high.

Bitfinex Chief Technology Officer Paolo Ardoino said: "Lightning Network is very suitable to alleviate the congestion problem of the Bitcoin network. At Bitfinex, we have seen 11000 transactions in the past 30 days, and I expect this number will only grow. We need more Exchanges and more exchange users to promote the development of Lightning Network in order to benefit from faster speed and lower cost."

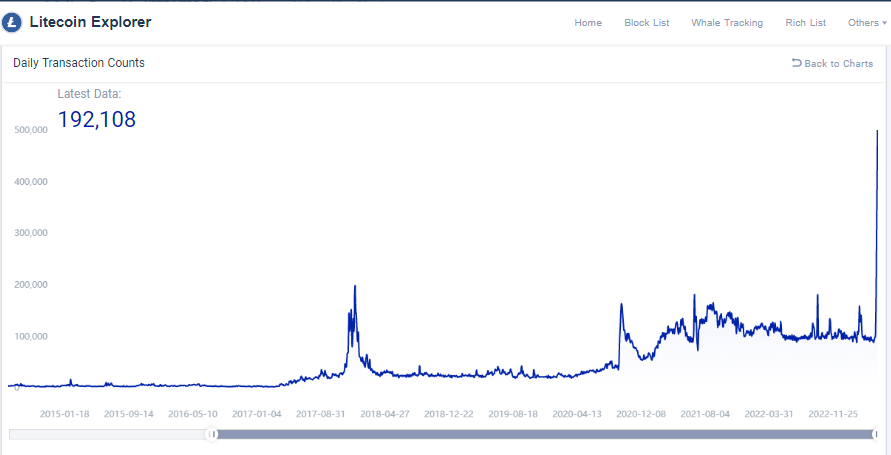

Litecoin

As Bitcoin fees soar amidst the BRC-20 frenzy, Litecoin is also riding a fresh wave. Transaction volumes on the Litecoin blockchain have surged to new all-time highs. Cryptocurrency users scrambled to find alternatives as the memcoin's growing popularity and subsequent high fees on the bitcoin network.

image description

Source Tokenview.io. Litecoin daily trading volume

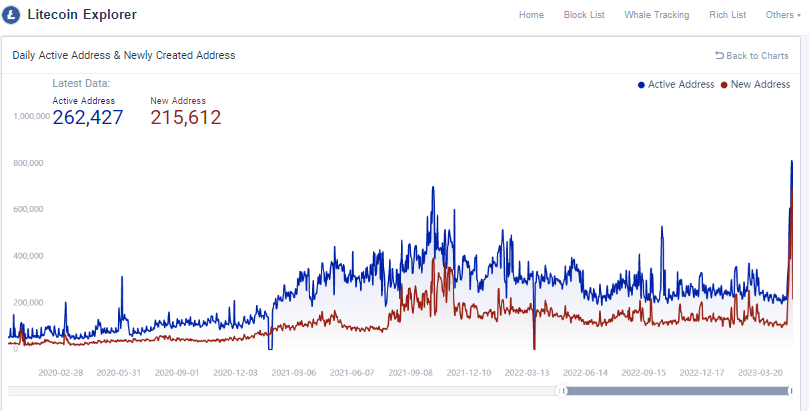

image description

Source Tokenview.io. Litecoin daily active addresses and new addresses

Another driving force for the doubling of Litecoin’s daily active addresses in May may have come from the introduction of the NFT experimental standard LTC-20 on Litecoin. On May 2, the Litecoin community launched the LTC-20 experimental standard by emulating the BRC-20 standard. Therefore, anyone can now write NFTs (LTC-20 standard tokens) to the Litecoin blockchain using the Litecoin Ordinals protocol.

Rising demand for LTC is highlighted by more network activity, which has also influenced Litecoin's recent price gains. Additionally, optimism surrounding Litecoin’s imminent halving in August has also boosted LTC’s upside outlook.

For or against?

With the BRC-20 token frenzy, the Bitcoin blockchain is undoubtedly experiencing extreme congestion and high fees. This has also sparked a lot of controversy in the Bitcoin community. Proponents claim that Ordinals will help the Bitcoin network unlock greater value and provide it with a wider range of financial use cases; while opponents believe that Ordinals deviates from Satoshi Nakamoto's original vision of Bitcoin as a peer-to-peer cash system. The impact of Ordinals on the capacity and scalability of the Bitcoin network is also one of the biggest debates among Bitcoin purists.

Despite conflicting views between Ordinals proponents and opponents, it's important to note that most of the arguments for or against Ordinals depend heavily on individual perceptions. So perspective is very important. For example, it is natural for a Layer-2 technology builder to object to Bitcoin's underlying development like Ordinals. In contrast, miners may not object to things that increase revenue.

Whether Ordinals will continue to exist, the community has yet to see the full potential of this technology and its real consequences.