Decentralized stablecoin protocol TiTi Protocol plans to land on the Ethereum mainnet in the next few weeks

On May 9, the decentralized stablecoin protocol TiTi Protocol officially announced that it will officially launch the Ethereum mainnet in the next few weeks, and plans to start IDO and the second round of airdrops. TiTi Protocol plans to launch IDO on May 10, users can go tohttps://ido.titi.financeParticipate in IDOs.

first level title

What is TiTi Protocol?

TiTi ProtocolIt is a stable coin protocol that is completely decentralized, supported by multi-asset reserves, has "Use-to-Earn" (earn as you use it), and naturally prevents bank runs. It aims to provide encrypted native stable currency systems and Independent monetary policy, bringing more diversified DeFi services to global users. The new paradigm of decentralized stablecoin protocol TiTi Protocol is the first stablecoin that uses "Use-to-Earn" and has the function of preventing bank runs. TiUSD is a stablecoin issued by TiTi Protocol, and $TiTi is the governance token of the protocol.

Previously, TiTi Protocol announced in April 2022 that it had completed a financing of US$3.5 million at a valuation of US$30 million. Spartan Group led the investment, and participating investors included SevenX Ventures, Incuba Alpha, DeFi Alliance, Agnostic Fund, Fourth Revolution Capital ( 4 R Capital ), Solidity Venture and other investment institutions, as well as independent investors such as 0x b 1 (Fold Finance), Tascha and Nipun (Alpha Venture DAO), Michael (Fantom).

first level title

About TiTi Protocol Mainnet, Airdrop, IDO Airdrop

TiTi Protocol is the first decentralized stablecoin to use "Use-to-Earn". It is officially announced that TiTi Protocol will be officially launched on the Ethereum mainnet in the next few weeks. Users can use and trade TiUSD to passively or actively earn protocol fees.

After the TiTi mainnet goes live, TiTi Protocol will inject a large amount of TiTi into the mainnet as a reward. Users can earn TiTi through yield farming, especially the unique unilateral liquidity MMF function of TiTi Protocol. Users only need to provide unilateral liquidity to earn TiTi. Early TiTi rewards are generous.

It is reported that TiTi Protocol has just completed the first round of airdrops a few weeks ago, and both new and old users in the community have the opportunity to receive airdrops. After the mainnet goes live, TiTi Protocol will plan to start the second round of airdrops.

In addition, TiTi Protocol officially announced that it will launch IDO on May 10, and users can go tohttps://ido.titi.financefirst level title

Unique features of TiTi's stablecoin (TiUSD) design

As a new star of decentralized stablecoins, the most unique feature of TiTi Protocol is that it can improve the liquidity and user acceptance of decentralized stablecoins under the premise of ensuring stability, and bring new innovations in stablecoin solutions through five core modules. Paradigm:

TiTi-AMM (M-AMM): Primary market for TiTi minting and redemption

TiTi-AMM is the core mechanism to adjust the circulation of TiUSD, and maintain the stability of the primary TiUSD market through specific trading strategies. Users can exchange their assets for another asset they need at an agreed price. TiTi-AMM always provides users with $1 TiUSD buy and sell bilateral orders. TiTi-AMM greatly improves the on-chain liquidity and capital efficiency of stablecoins, avoiding impermanent losses. Liquidity providers want to participate in liquidity mining, they only need to provide unilateral liquidity for TiTi-AMM to make a market.

Multi-asset reserve: including ETH, USDC, WBTC, DAI, etc.

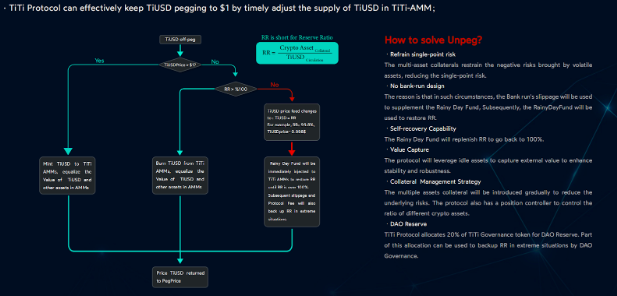

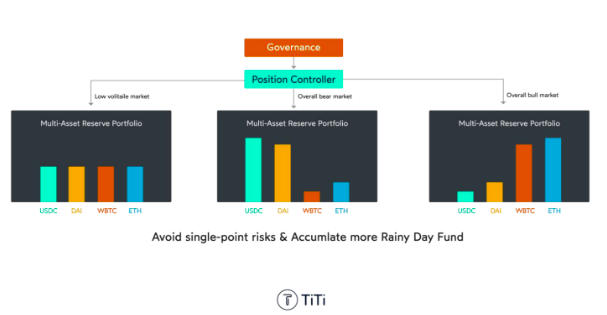

First of all, TiTi is a protocol that supports multiple assets to issue stable coins. TiUSD is a stable currency issued by ETH, USDC, WBTC, DAI, etc. In addition, TiTi has designed a position controller to actively control the ratio of mortgage assets. This design can avoid single point risk. At the same time, using a variety of mainstream encrypted assets as collateral will help break the ceiling of stablecoin issuance.

TiUSD is a fully on-chain, decentralized stablecoin backed by multiple cryptoassets. TiUSD is supported by sufficient encrypted assets (WBTC, ETH, USDC) in reserves, and is provided with continuous income by the Rainy Day Fund. Multi-asset reserves effectively avoid single-point risks, making TiUSD more stable, and at the same time solve the two most important issues in the competition of decentralized stablecoins: stability and liquidity.

Reorders: Efficient Hooking Mechanism

The peg system in TiTi Protocol is called ReOrders. ReOrders has two core functions:

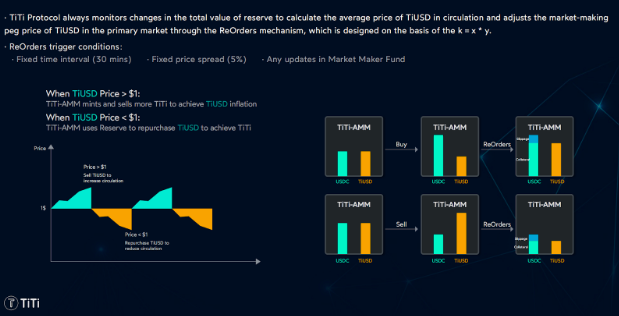

a) By adjusting the amount of TiUSD in TiTi AMM, Reorders can rebalance TiUSD and another token is AMM, so that the price of TiUSD always stays at 1 USD in due time;

b) By adjusting the number of Reserve Tokens in TiTi AMM, the premise is that the total reserve value (mortgage assets) of the agreement is equal to the circulation of TiUSD. Reordering can collect slippage during the market making cycle. (Essentially, ReOrders are similar to market maker strategies running on TiTi AMM)

TiTi Protocol uses the Reorders supply and demand algorithm to adjust liquidity to ensure that the value of TiUSD is always anchored at $1. Reorders actively collect slippage and distribute the resulting revenue to the Rain Day Fund and protocol fees, freeing protocol users from profiting through speculation. Compared with Rebase and Reweight, the trigger conditions of Reorders are more precise. According to the settings of TiTi Protocol, the Reorders algorithm can be triggered when the anchor price fluctuates by 5%, or every 30 minutes, to quickly restore the price anchor and stabilize user confidence.

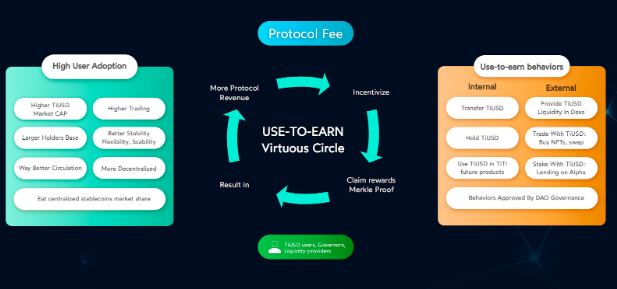

Use-to-Earn: A New Concept of Stablecoin Earnings

As the market demand for decentralized stablecoins continues to increase, TiTi Protocol invented the Use-to-Earn mechanism to drive the organic adoption of decentralized stablecoins. Use-to-Earn is a brand-new concept of stable currency income, which is actually to use stable currency to passively or actively earn protocol fees.

Use-to-Earn's technical solution is based on "Merkle Proof" to verify the user's reward distribution on the chain. The off-chain part will calculate rewards based on the user's use of TiUSD, and the algorithm and distribution model used to earn rewards It is mainly judged according to the way users use TiUSD.

TiTi hopes to stimulate the use value of TiUSD as a trading medium, and the incentive method for TiUSD users will not adopt Olympus's stake mechanism. On the contrary, TiTi adopts the incentive distribution method of Merkle Distribution, and TiUSD users will be able to obtain benefits while using TiUSD. TiTi will design incentive behaviors based on goals. At this stage, the Use-to-Earn algorithm and distribution model are designed and adopted based on the early organic growth of the protocol, and this right will be determined by the DAO Governance in the future.

DAO governance:

TiTi Protocol will over-govern for DAO after the project matures, which can incentivize the long-term healthy development of stablecoins for decades and beyond, rather than short-term profits, auction governance tokens, or future reserve yields. Many protocol core parameters and mechanism adjustment rights in TiTi Protocol will be transferred to community members to ensure the fairness of the protocol. In order to meet the governance needs of the protocol, TiTi Protocol will issue a governance token, TiTi, which is similar to Compound's governance mechanism, and TiTi is mainly used for proposals and voting.

Community adjustable parameters and mechanisms in TiTi Protocol include but are not limited to:

1) The time period and price difference threshold triggered by the ReOrders mechanism;

2) New M-AMM opening and upper thresholds for various assets;

3) The proportion of system revenue allocated to Rainy Day Fund;

Summarize

Summarize

TiTi ProtocolAims to bring a new elastic supply decentralized stablecoin solution to DeFi and Web3. Compared with existing stablecoins such as USDT, DAI, FEI, etc., TiTi Protocol has six major advantages: decentralization, high capital utilization, more stable and efficient anti-risk reserves and multi-asset reserve guarantees, and anti-volatile risks. Stablecoin TiUSD will become a new medium of exchange in the cryptocurrency world while meeting the investment needs of different investors.

and

For more information on project progress and other information, see the officialtelegraph、Discord/Twitter、MeidumandDocs。