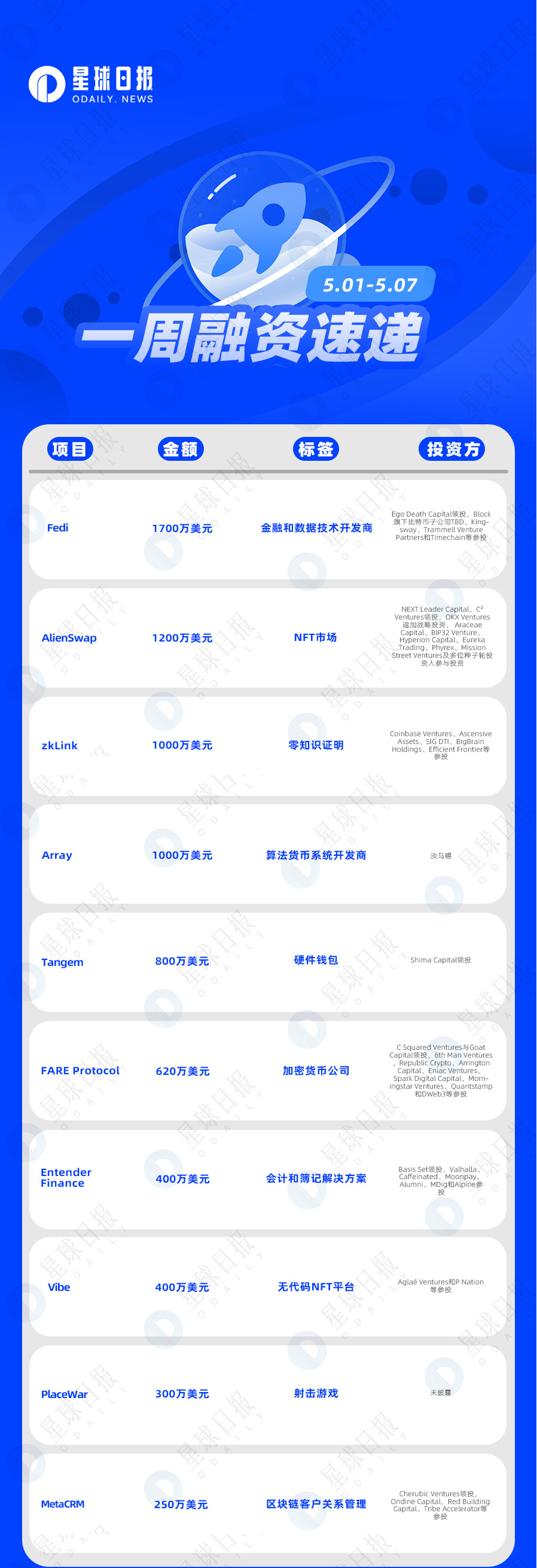

One-week financing express | 20 projects have been invested; the total disclosed financing is about 87.9 million US dollars (5.1-5.7)

According to Odaily’s incomplete statistics, there were 20 domestic and overseas blockchain financing incidents announced from May 1st to May 7th, a significant decrease from last week’s data. There is a significant decline.

The following are specific financing events (Note: 1. Ranked according to the announced amount; 2. Excluding fundraising and mergers and acquisitions; 3. * is a "traditional" company whose business involves blockchain):

The following are specific financing events (Note: 1. Ranked according to the announced amount; 2. Excluding fundraising and mergers and acquisitions; 3. * is a "traditional" company whose business involves blockchain):

Finance and data tech developer Fedi closes $17M Series A round led by Ego Death Capital

On May 4th, according to official news, Fedi, a financial and data technology developer, completed a US$17 million Series A financing led by Ego Death Capital and participated by Block’s Bitcoin subsidiary TBD, Kingsway, Trammell Venture Partners and Timechain. The funding brings Fedi's total funding to $21.21 million.

It is reported that Fedi uses Bitcoin to host the open source protocol Fedimints, allowing developers to easily build other applications and modules. Fedi's community or "second-party" hosting model provides third-party cryptocurrency exchanges, cloud backup services, and encrypted messaging applications. Provides a safe alternative. The company will pre-release an alpha version of its joint operating system for the builder community later this month.

On May 4th, AlienSwap, an NFT market and aggregation trading platform, completed a strategic financing of US$12 million. NEXT Leader Capital and C² Ventures led the investment, OKX Ventures added strategic investment, Araceae Capital, BIP 32 Venture, Hyperion Capital, Eureka Trading, Phyrex, Mission Street Ventures and several seed round investors participated in the investment.

It is reported that AlienSwap will release AlienSwap Pro and launch NFT space race airdrops in the next week. The space race airdrop rewards will be 2-5 times that of the first round of airdrops.

The new financing will be used to expand AlienSwap's engineering team, develop innovative NFT liquidity tools and trading products, and increase investment in NFT infrastructure to create a leading NFT trading infrastructure.

On May 4, zkLink, a multi-chain unified transaction infrastructure based on zero-knowledge proofs, announced the completion of a $10 million financing, with participation from Coinbase Ventures, Ascensive Assets, SIG DTI, BigBrain Holdings, and Efficient Frontier.

zkLink is a cross-chain infrastructure layer that makes it easier for users to trade assets across blockchains, and this round of funding will help propel zkLink to launch its mainnet in the third quarter. (CoinDesk)

Temasek invests $10 million in AI-based algorithmic currency system developer Array

On May 1, Array, a developer of an algorithmic currency system based on smart contracts and AI, received a $10 million investment from Temasek at a valuation of over $100 million.

It is reported that Array’s smart contract platform ArrayFi aims to implement decentralized applications based on its network and powered by its proprietary AI algorithm ArrayGo. The system is expected to have various use cases including payments, remittances as well as investments. (Cointelegraph)

Hardware Wallet Maker Tangem Closes $8M Funding Led by Shima Capital

On May 3, Tangem, a provider of hardware wallet solutions, completed $8 million in financing, led by Shima Capital. Funds from this round of financing will be used to expand its product range. (PRNewswire)

According to previous reports, encrypted currency smart card manufacturer Tangem completed a US$15 million seed round of financing in January 2019, and the investor was SBI Crypto Investment, a digital asset venture capital institution wholly owned by SBI Holdings.

FARE Protocol Closes $6.2M Funding Led by C Squared Ventures and Goat Capital

On May 1, the cryptocurrency company FARE Protocol completed a US$6.2 million seed round of financing, led by C Squared Ventures and Goat Capital, 6th Man Ventures, Republic Crypto, Arrington Capital, Eniac Ventures, Spark Digital Capital, Morningstar Ventures, Quantstamp and D Web3 and others participated in the investment. (CoinDesk)

On May 2, New York-based Entender Finance, a provider of Web3 automated end-to-end accounting and bookkeeping solutions, announced the completion of a $4 million seed round of financing, led by Basis Set, with participation from Valhalla, Caffeinated, Moonpay, Alumni, MDig and Alpine .

The Entender Finance platform supports multiple blockchains, and can be integrated and customized with different accounting platforms and Web3 applications. It is suitable for any enterprise that intends to introduce blockchain transactions into its ecosystem. Its customers include Hedgey, Lava, Anima wait. (Finsmes)

No-Code NFT Platform Vibe Raises $4M With Alchemy Ventures Participating

On May 4, code-free NFT platform Vibe announced the completion of $4 million in financing, with participation from Alchemy’s venture capital arm Aglaé Ventures and K-Pop artist Psy’s music label P Nation. Vibe aims to increase the value of NFTs beyond their scarcity and implement or increase the utility of NFTs. The no-code platform lets creatives turn NFTs into apps and products, allowing NFTs to evolve and deliver real-world and digital utility, with embeddable features including loyalty points, ticketing, and physical redemption opportunities. Vibe NFTs can be deployed on any chain and bridged to any other chain. (CoinDesk)

On May 7, PlaceWar, an artillery shooting game based on BNB Chain, announced the completion of a strategic investment of US$3 million. This round of financing will be used to develop the game's ecology, market operations, establish a new brand effect, and start the brand remodeling plan.

According to previous reports, in October 2021, the metaverse game project PlaceWar announced the completion of private equity financing of US$1.8 million. AC Capital, AU 21, Woodson Game, Exnetwork Capital, Icetea Labs, IoTex, Kyros Ventures, LD Capital, Lucid Blue Ventures, Megala Ventures, Metrix Capital, ReBlock, RoseOn, X 21, etc. participated in the investment.

MetaCRM Closes $2.5M Seed Funding Round Led by Cherubic Ventures

On May 1, MetaCRM, a blockchain customer relationship management (CRM) solution provider, completed a $2.5 million seed round of financing led by Cherubic Ventures, with participation from Ondine Capital, Red Building Capital, and Tribe Accelerator. MetaCRM stated that the new round of funds will be used to launch new products, accelerate customer expansion and user growth, and better integrate multi-chain data for products to create an enhanced blockchain experience for brands and users.

It is reported that MetaCRM connects on-chain and off-chain data to create blockchain-native solutions and analysis tools, including MetaForm, MetaDesk and MetaPanel. (The Block)

Cosmos DEX protocol Nolus completes $2.5 million seed round financing

On May 2, Nolus, an interoperable protocol on Cosmo, has received $2.5 million in pre-seed and seed rounds of financing, with participation from Dorahacks, Everstake, Cogitent Ventures, Token Metrics Ventures, and Autonomy Capital. (cryptodaily)

On May 6, Playcraft, an NFT commercial application chain game platform, completed its first round of financing of US$2 million in August 2022. Animoca and Shima Capital led the investment, and Big Brain holdings, Klaytn, Orgin Ventures, Waterdrip Capital and others participated in the investment. This round of financing is mainly used for platform game development.

The founder Andrew said that Playcraft will start the second round of financing in May 2023, which will be mainly used for continuous game research and development, product operation and marketing promotion. The test network (Alpha version) will be launched at that time, and the main network Beta version will be launched in August. .

Mobaverse is the first MOBA chain game self-developed by PlayCraft, which allows players to use their own NFT as heroes. The first batch of NFT partners signed by the platform include BAYC, Azuki and other well-known blue-chip communities. (The Block)

VEGA Completes USD 2 Million Seed Round Financing, Super Web3 Serves as Financial Advisor

On May 3, VEGA, a Web3 entertainment technology platform, announced the completion of a US$2 million seed round of financing. This round of financing was led by Arcane Group, and New Wheel Capital, well-known investors in the industry, etc. participated in the investment. This round of financing will be used to expand the operation and development team, expand the global market, promote technological innovation, and establish partnerships.

It is reported that the core team of VEGA comes from the founding team of TikTok and JD Finance, and is composed of senior encryption native engineers, iQiyi, top Asian producers, and a media marketing team.

Spencer Fan, founder of Super Web3, said: "The overall investment focus of the Web 3.0 industry is gradually shifting from the infrastructure layer to the application layer. A first-class entrepreneurial team can choose the appropriate product form, successfully build the necessary business relationship, and let the block Chain technology can play its due value and empower application scenarios. The VEGA team has rich practical experience in both first-line Internet companies and the Web 3.0 industry, and has the strength to promote its entertainment platform products and services to a large number of users who are not yet familiar with blockchain technology. , becoming a star enterprise in the entertainment technology field. We are very honored to support VEGA for a long time and look forward to growing together.”

DeFi platform Portals completed a $2 million seed round, led by Lightshift Capital

On May 4, DeFi platform Portals announced the completion of a $2 million seed round of financing, led by Lightshift Capital, Poolside, Basement Labs, LongHash Ventures, Daedalus Angels, Mechanism Capital, and Mathieu Baril, David Dias, Rudy Kadoch, and 0x Maki of angel investors participated.

Portals aims to simplify loads of DeFi transaction operations, from staking to Swap, and also provides application programming interface (API) services to support Web3 data access. (Alexa Blockchain)

On May 4, OpenTrade, an encrypted structured financial product, announced the completion of $1.5 million in financing, led by Sino Global Capital, with participation from Circle Ventures, Kronos Research, Kyber Ventures, Polygon Ventures, and Outlier Ventures. The funding will help OpenTrade expand its operations ahead of its launch in the second half of this year, with initial products to include liquidity pools in U.S. Treasury bills, investment-grade commercial paper and investment-grade supply chain financing. (CoinDesk)

Web3 role-playing game Swords of Blood raises $1.2 million

On May 2, the Polygon blockchain-based Web3 role-playing game Swords of Blood announced the completion of a new round of financing of 1.2 million US dollars, as an expansion of the Web2 game "Blade Bound" in the Web3 field. With a financing of US$1.6 million, investors include Gate.io, Fundamental Labs, etc. The new funds raised this time will support its launch of the minimum viable product (MVP) version of the game in May this year. (business 2c community)

On May 2, according to official news, DEX and liquidity protocol Cetus based on the public chain Sui and Aptos announced the completion of seed round financing, led by OKX Ventures and KuCoin Ventures, Comma 3 Ventures, NGC Ventures, Jump Crypto, Animoca Ventures, IDG Capital, Leland Ventures, AC Capital, Adaverse, Coin 98 Ventures and others participated in the investment. The specific financing amount has not been disclosed yet.

The new financing will be used to support the initial development and growth of the platform and expand its market presence and customer base. Cetus hopes to further develop its centralized DeFi-based liquidity infrastructure and act as a strong liquidity layer within the growing Move ecosystem.

OKX Ventures Strategically Invests in NFT Marketplace AlienSwap

On May 4, according to official news, OKX Ventures announced a strategic investment in the NFT market AlienSwap. The new financing will be used to expand its engineering team and develop innovative NFT liquidity tools and trading products. AlienSwap is a community-based NFT market and aggregator, with a cumulative transaction volume exceeding $50 million.

Dora, founder of OKX Ventures, said, "The total NFT transaction volume in 2021 will reach about 20 billion US dollars. OKX Ventures is optimistic about the long-term development of the NFT track, and has already deployed a number of NFT projects. It is expected that this investment will help AlienSwap become a more efficient platform." The NFT market will reshape the competitive landscape of the industry."

Sui Ecological Decentralized Exchange MovEX Receives Investment from Mysten Labs

Odaily News Sui ecological decentralized exchange MovEX announced on Twitter that it has received investment from Sui development company Mysten Labs. MovEX stated that it will continue to build on-chain finance on Sui.

Metaverse project Mars 4.me receives long-term financial support from DWF Labs

On May 5th, the metaverse project Mars 4.me has established a strategic partnership with DWF Labs and received a large amount of investment. The investment and long-term financial support of DWF Labs will accelerate the launch of innovative additions to the Mars 4 ecosystem, including the launch of multiplayer features in Mars 4's 3D survival game. Mars 4 is a 3D metaverse and innovative game project based on blockchain technology, the main products include its immersive 3D multiplayer survival game built on Unreal Engine 5.1, and the accompanying AI and machine learning powered In-game asset management system Mars Control Center. (Cointelegraph)