Who is DWF Labs who frequently shoots? "VC+Market Maker", 5 projects are scheduled to be invested every month

Original author: 0x22D, Cookie, BlockBeats

Recently, an organization called DWF Labs has frequently thrown large sums of investment, attracting market attention. In fact, they are not crypto newcomers, but have already entered the market, but only recently began to invest in high-profile projects.

DWF Labs positions itself as a "global encrypted asset market maker and multi-stage Web3 investment company", a subsidiary of Digital Wave Finance (DWF), with offices in Singapore, Switzerland, British Virgin Islands, UAE, South Korea and Hong Kong, China office. DWF is a global cryptocurrency high-frequency trading company. Since 2018, it has conducted spot and derivatives transactions on more than 40 top trading platforms, ranking among the top 5 global cryptocurrency trading volumes.

Andrei Grachev, managing partner of DWF Labs, said in an interview that the current volatile market is the best time to enter the investment field, and they have accumulated enough funds from profits to invest in projects. In most cases, DWF Labs invests in projects by directly purchasing Tokens. It currently has 104 projects in its portfolio, covering almost all verticals of Web3.

Invest in at least 5 projects per month, DWF Labs' investment philosophy

DWF Labs stated on its official website, “No matter what the market conditions are, DWF Labs invests in an average of 5 projects per month.” As a company whose main business is market making and high-frequency trading, how did they choose so many projects?

At present, there are more than 100 projects in DWF Labs' investment portfolio, and they are quite diverse, ranging from blockchain infrastructure, DeFi, NFT, chain games to DAO, decentralized social networking, data analysis, privacy, entertainment, etc. It is difficult to find a very large investment focus. This is not just the implementation of diversification investment thinking. For DWF Labs, portfolio diversification is also a way to get involved in all vertical fields, maintain a leading position and adapt to market demand.

In the introduction on the official website, DWF Labs stated that it is seeking investment and support for bold founders who want to build the future of Web3. It can provide consulting, liquidity supply, network security, smart contract auditing, debt financing, and fund management. Network with its many partners in different verticals.

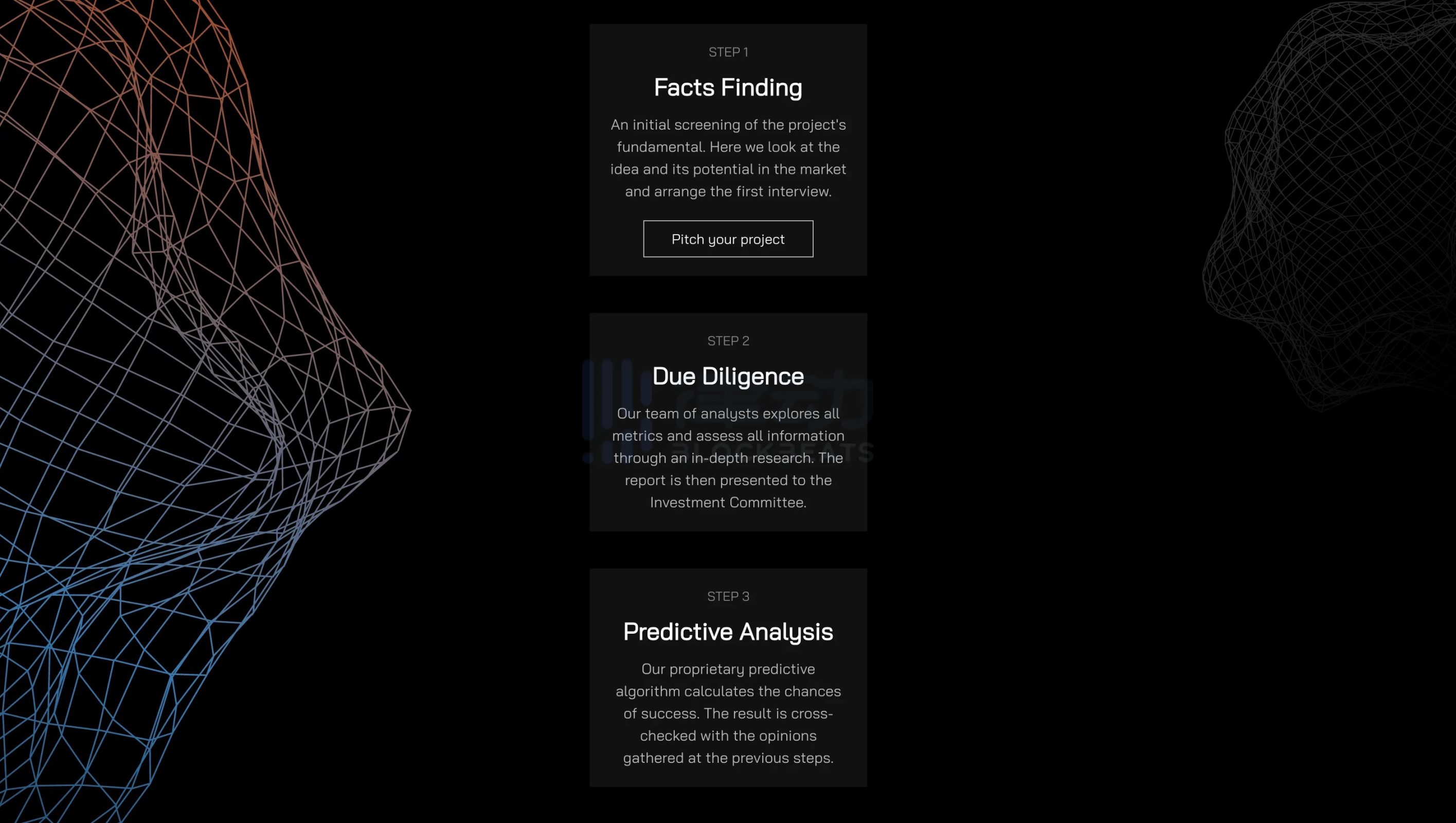

Before confirming an investment, DWF Labs will first conduct a fact check on the basic information of the project, and then the analyst will conduct a more in-depth due diligence. Finally, the predictive algorithm designed by it will calculate the chance of success of the project, and the results will be compared with the previous results. The opinions collected in the step are comprehensively evaluated.

DWF Labs strives to lead collaborations on projects across its portfolio, sparking new chemistry. For example, Orbs Protocol has launched a large-scale cooperation with TON in 2022 and developed multiple Layer 3 Apps for TON, such as TON-Access, TON Minter and TON Verifier. This year, Orbs Protocol became the main sponsor of two TON hackathons.

team background

Andrei Grachev, managing partner of DWF Labs, worked at Ulmart, an e-commerce platform known as "Russian Jingdong" in his early years. He joined the encryption market in 2017 and established an organization called Crypsis Blockchain Holding in Moscow. He joined the Russian encryption network in May 2018. The Association of Economics, Artificial Intelligence and Blockchain (RACIB) served as the deputy director of transactions. He became the CEO of Huobi Russia in September 2018 and joined DWF Labs in December of the same year.

Andrei Grachev said in an interview that the encryption market can be divided into the US market and markets outside the US. They mainly focus on the Asian market, and many Asian faces can also be seen on their official website.

Partner Heng Yu Lee used to work at JPMorgan Chase, and after leaving JPMorgan Chase established a cyber security and intelligence company called GROUP 8 in Singapore, supported by well-known AI, information security and defense industry veterans, May 2022 Join DWF Labs.

Partner Zac Zou used to work in China Harbor Engineering Co., Ltd., joined OKEx in August 2018 as a regional business manager, focusing on Vietnam, India, and Russia markets, and joined DWF Labs in June 2022.

DWF Labs Highlights at a Glance

Fetch.ai

On March 29, 2023, Fetch.ai announced that it has received a $40 million investment from DWF Labs, which will be used to support the development and cooperation of autonomous agents, network infrastructure, and decentralized machine learning on the Fetch.ai platform. deploy.

Founded in 2017, Fetch.ai is a public chain focusing on AI applications. In 2019, Fetch.ai's token FET was listed on Binance Launchpad, selling about 69.2 million FETs in 22 seconds, raising about $6 million.

Applications within the Fetch.ai ecosystem include CoLearn, a data and AI model market, Axim, an enterprise-level privacy-preserving AI data analysis application, Atomix, a DeFi protocol that introduces real-world collateral, Mobix, a low-carbon travel to Earn application, and Catena, a data sharing network for the automotive industry -X, decentralized social network Resonate and Cosmos wallet Leap Wallet, etc.

Synthetix

On March 17, 2023, the Synthetix Treasury Committee announced via email that DWF Labs had purchased $15 million of Synthetix's native token, SNX, on March 16, with a further purchase of $5 million to follow. On the same day, according to the information released by DWF Labs official push, DWF Labs reached an agreement with the Synthetix Finance Committee to provide SNX with liquidity and market maker services on centralized and decentralized trading platforms. DWF Labs promises to become a member of the Synthetix protocol in a variety of ways, including: integrating and trading Synthetix perpetual contracts, participating in SNX governance during the Epoch election, participating in community and product exchanges.

Synthetix is a decentralized liquidity layer, built on Ethereum and Optimism, powering some of the most exciting protocols in DeFi with liquidity backends. Stakers provide liquidity to back a range of synthetic assets and earn rewards and market returns as a result. This liquidity provides oracle price guarantees for trading synthetic assets and perpetual futures, eliminating the need for traditional order books and counterparties. As a result, liquidity becomes composable and fungible between markets, and traditional slippage is eliminated.

Synthetix V3 will be rolled out in phases over the next few months, with users slowly transitioning from existing V2 X systems to V3.

Flare Network

On March 2, 2023, DWF Labs announced that it has invested in Flare, an EVM-based Layer 1 blockchain. The specific amount of investment was not disclosed.

Flare has two core protocols, State Connector and Flare Time Series Oracle. State Connector obtains information from other blockchains through a set of independent certification providers and transfers it to Flare Network. The smart contract of State Connector will check the consistency of the response to determine the validity of the obtained information. The Flare Time Series Oracle relies on a set of independent data providers to retrieve information on price pairs from external data sources. An external data source can be weighted by staking FLR, and the most effective external data provider will share rewards with the FLR stakers who provide it with weighting. Through the State Connector and the Flare Time Series Oracle, the Flare Network allows information from other chains and Web2 APIs to be used securely and trustlessly on Flare, and provides dApps with highly decentralized pricing and data series.

Coin 98

DWF Labs announced its investment in Coin 98 on December 30, 2022, for an undisclosed amount. Earlier, on January 5 last year, Binance Labs announced a strategic investment in Coin 98.

Coin 98 is a leading DeFi one-stop platform, which includes Coin 98 wallet, Coin 98 trading platform, Space Gate cross-chain bridging service, etc. By the end of 2022, the number of Coin 98 users will exceed 5 million, and the total transaction volume will exceed 750 million US dollars. In 2022, Coin 98 will also issue its own stablecoin CUSD.

Yield Guild Games (YGG)

On February 17, 2023, according to Tech in Asia, Yield Guild Games (YGG), a chain game association, has raised US$13.8 million through the sale of tokens, led by DWF Labs and a16z. YGG co-founder Gabby Dizon revealed that YGG will use the new funds to further develop its soul-bound reputation token.

On November 17, 2022, DWF Labs announced a $10 million commitment to support the TON ecosystem. In the next 12 months, DWF Labs also plans to make a total of 50 seed round investments aimed at accelerating the growth of TON and its projects.

TON

On November 17, 2022, DWF Labs announced a $10 million commitment to support the TON ecosystem. In the next 12 months, DWF Labs also plans to make a total of 50 seed round investments aimed at accelerating the growth of TON and its projects.

TON is a Layer 1 blockchain solution developed by the Telegram Messenger team in 2018. TON is the native token of the chain and is mainly used to pay transaction fees and serve as a deposit for validators to ensure network security.

Conflux

On September 16, 2022, Conflux received a strategic investment from DWF Labs, a Web3 venture capital institution. The specific financing amount was not disclosed.

Conflux is the only compliant, public, permission-free blockchain in China.

Mask Network

On January 19, 2023, DWF Labs, a Web3 investment company, announced a strategic investment and cooperation with Mask Network by purchasing MASK Token worth 5 million US dollars, which will be used to support decentralized social networks and the entire Mask Network The continuous construction of the ecosystem makes Web3 more accessible.

Mask is committed to protecting data privacy and building the best bridge between Web 2.0 and Web 3.0. Through a browser extension, Mask introduces an ecosystem of 30+ popular Web 3.0 dApps/functions that can run seamlessly on existing Web 2.0 sites such as Twitter and Facebook.

Radix

On March 23, 2023, Radix, a Layer 1 public chain, announced the completion of financing of US$10 million. This round of financing was fully supported by DWF Labs, with a post-investment valuation of US$400 million. Radix chief executive Piers Ridyard said DWF has provided $8 million in funding, with the remaining $2 million to be provided in the near future. Previously, Radix completed a financing of US$12.7 million in 2021, and issued XRD Token to the community in the same year.

Radix started as a blockchain research project in 2013, and the project was corporatized in 2017, and has continued to develop until now. From 2013 to 2017, the project raised 3,000 bitcoins from the community. Piers Ridyard, CEO of Radix, said that not wanting to repeat existing technologies is the reason why the project’s research cycle lasts nearly 10 years. Radix will have its own unique consensus system, execution environment and programming language, and Radix’s programming language "Scrypto" Will be "easier to use" than Solidity.

Radix expects to launch its mainnet called Babylon in the second quarter of this year. Piers Ridyard said that more than 50 projects have been committed to building applications on Radix, ranging from DeFi to NFT markets. Radix launched the Olympia mainnet in July 2021, but the Olympia mainnet only supports users to create wallets and transfer/stake XRD on the network. The Babylon mainnet will be released as the final version of the Radix technology stack, and users will be able to obtain the complete experience brought by many dApps.

Tomi

On March 22, 2023, according to Cointelegraph, alternative (non-traditional) Internet developer tomi completed $40 million in financing, led by DWF Labs, Ticker Capital, Piha Equities, and Japanese encryption investor Hirokado Kohji. It is reported that tomi was launched as a decentralized cloud computing network in 2022, aiming to create a version of the Internet managed by a decentralized autonomous organization (DAO) (decentralized digital assets and cloud services / anti-censorship). tomiDAO's mission is network governance, including voting on code change proposals and reaching consensus on managing content that violates community guidelines.

Orbs

On March 14, 2023, encryption infrastructure developer Orbs plans to raise $10 million from venture capital firm DWF Labs. Orbs said that DWF Labs will purchase Orbs Token worth up to $10 million. Orbs CEO Nadav Shemesh said the first tranche of the total investment was settled today. He added that the rest of the investment would be "at an average price". Orbs was established in 2017, and its product positioning is "an independent execution layer between Layer 1 / Layer 2 solutions and application layers". Orbs plans to use the financing to continue developing its infrastructure to increase adoption of Orbs on the EVM chain and TON.

Beldex

Original link