Galaxy: 4D details MEV supply chain and decentralization path

Originally Posted by Christine Kim, Vice President of Research, Galaxy

main points

main points

The MEV supply chain has become more complex since the creation of MEV-Boost, the standardized software used by PoS validators on Ethereum to earn MEV;

New stakeholders, called block builders, are responsible for building a complete block, and they optimize the transactions contained in the block to maximize the return of tips and MEV;

Block builders develop proprietary models to simulate blocks and efficiently propagate them through an off-chain MEV marketplace called relays;

There are concerns that the builder landscape will become centralized in the long run due to the specialized skills required to become a builder;

Introduction

Introduction

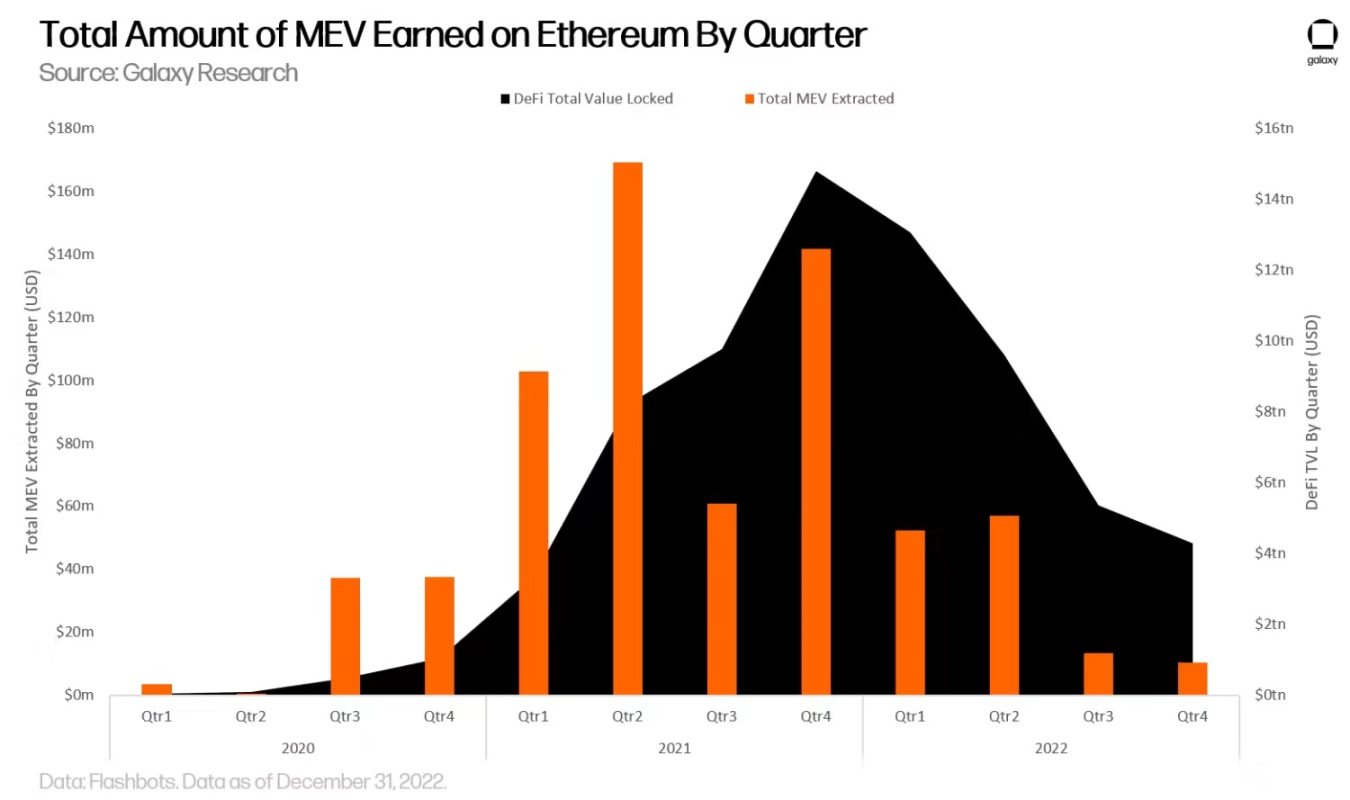

Between January 1, 2022 and December 31, 2022, Ethereum achieved a maximum extractable value (MEV) of $133 million. (The data in the table below contains data obtained by Flashbots based on a new method of identifying MEVs on Ethereum, numbers may differ fromIn Galaxy Research's MEV report last yeardifferent data).

Compared with the same period last year, the total MEV revenue in 2022 is significantly lower than in 2021, one of the reasons is that the bear market has caused a sharp decline in DeFi activity on Ethereum. In addition, increased competition among MEV searchers has also increased the efficiency of the DeFi market, thereby reducing MEV profit margins. Until the end of Q3, the majority of MEV revenue went to Ethereum miners. However, after the merge activates, most of the MEV revenue starts to go to validators, as validators replace miners as the main security providers and block proposers of the network.

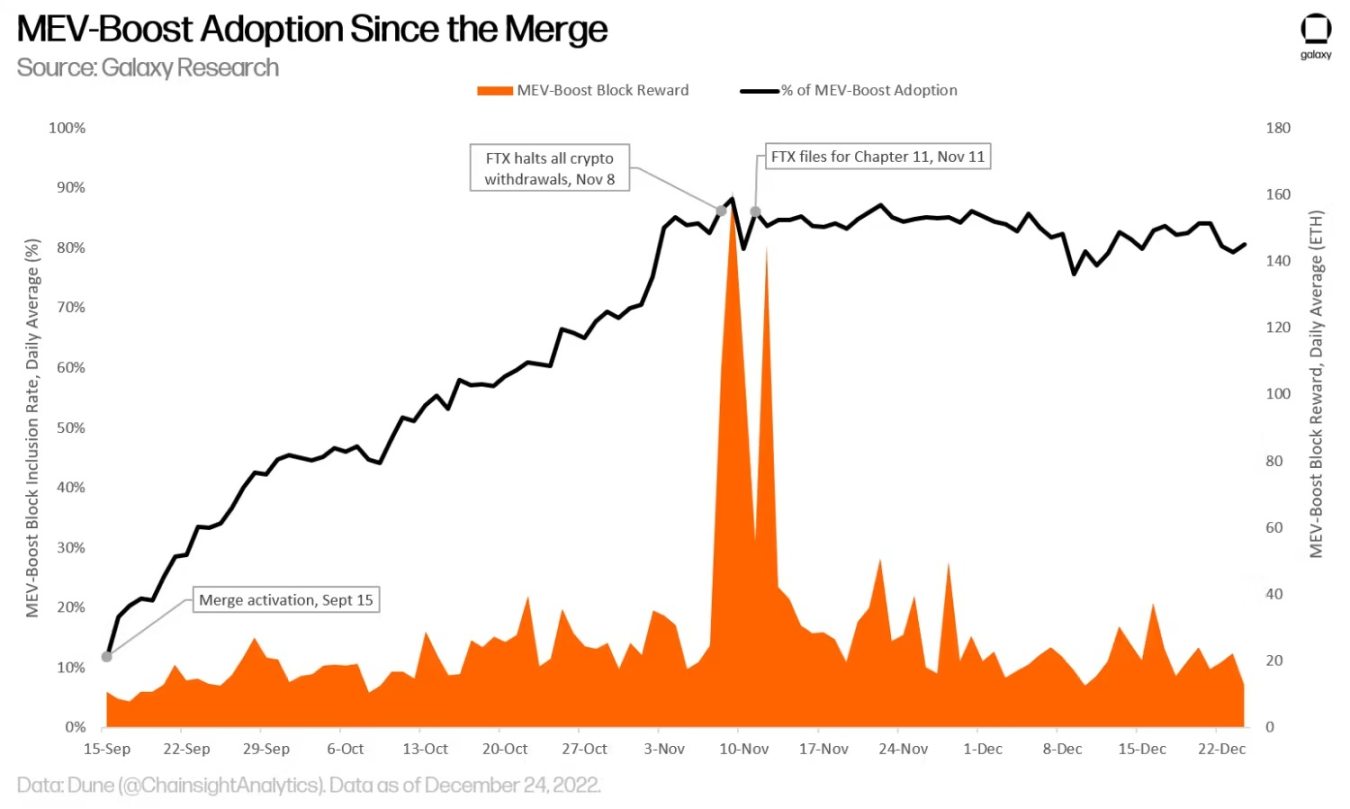

As of December 2022, approximately 80% of Ethereum validators are earning MEV earnings through third-party neutral software called MEV-Boost. Designed by Flashbots in collaboration with Ethereum core developers, MEV-Boost is software that enables validators to connect to multiple off-chain markets to auction off block space (also known as relayers). Through relayers, validators receive a block containing a tip and a block containing MEV built by a third-party block builder.

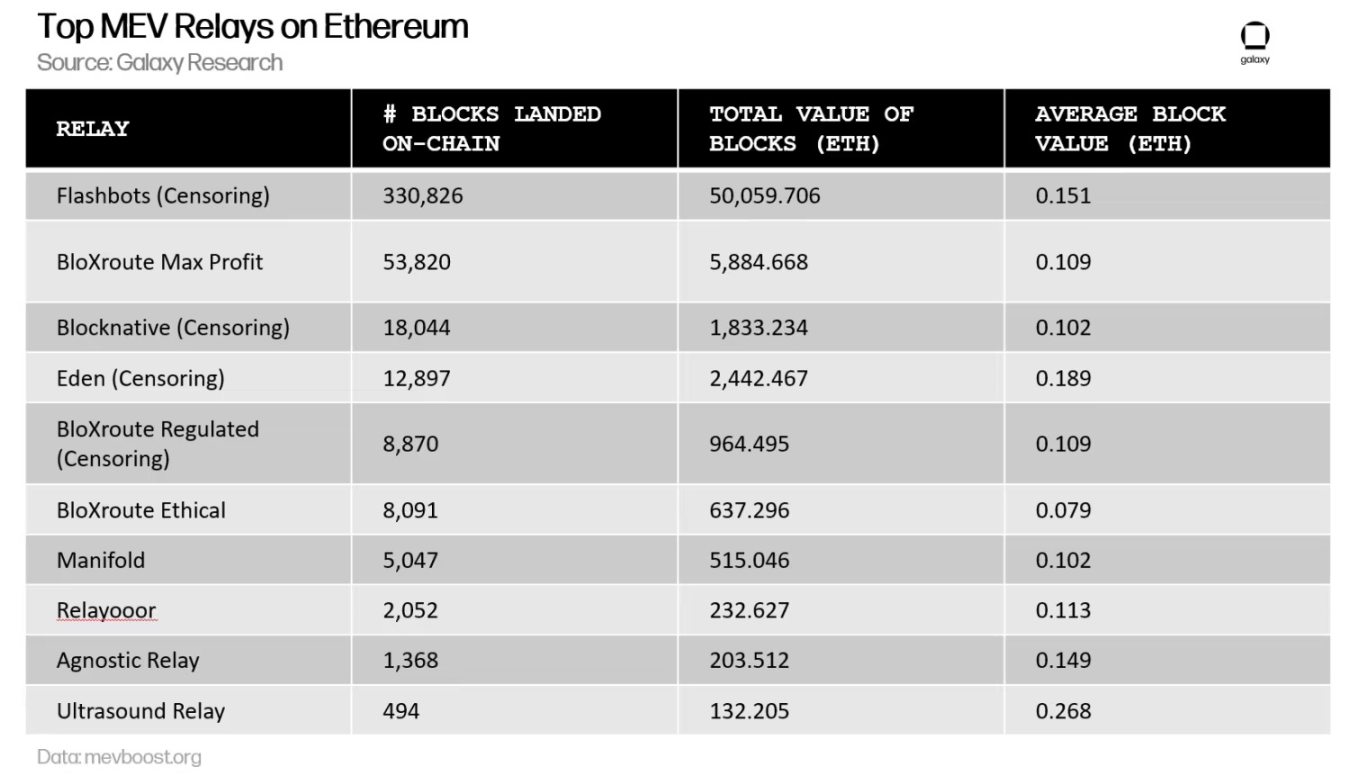

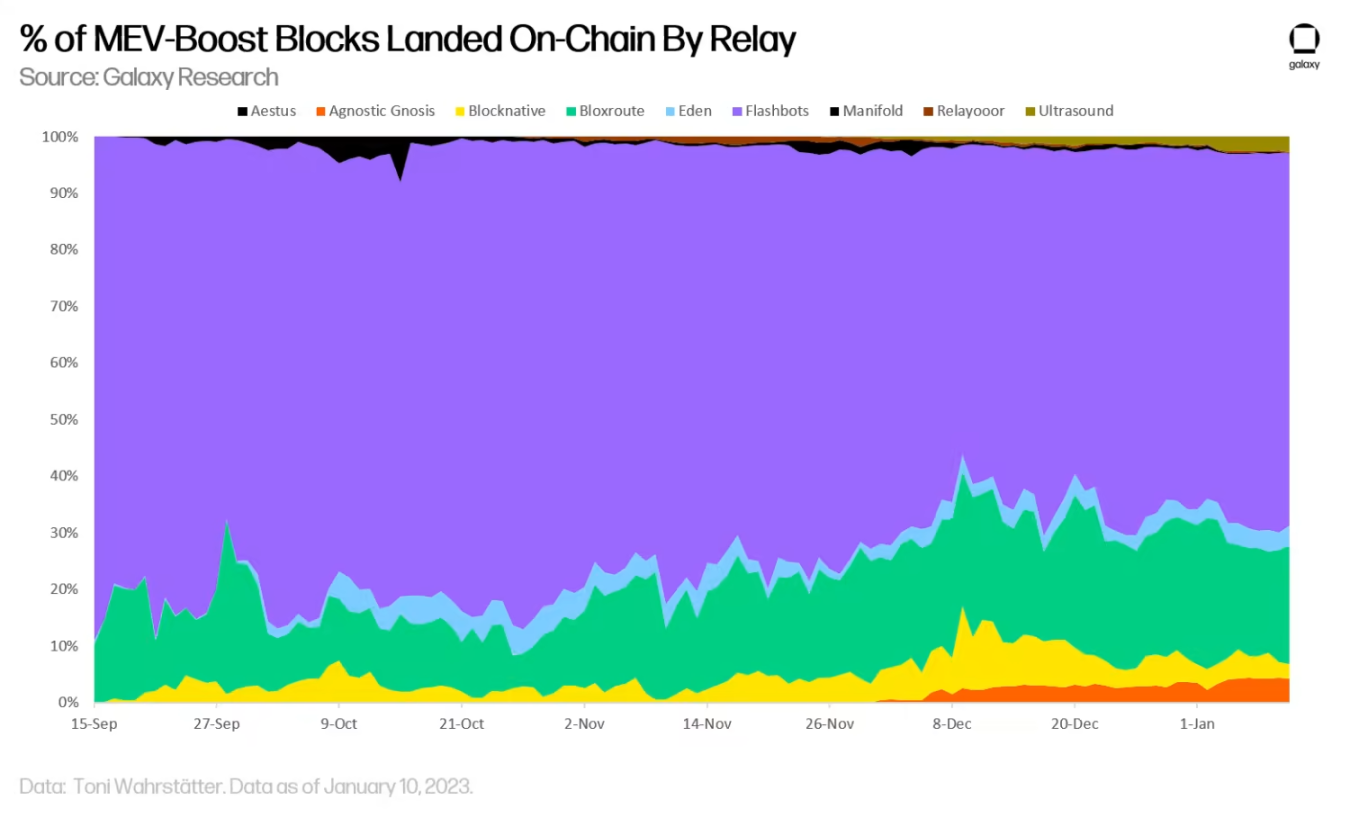

Thanks to the advent of the MEV-Boost software and the open source code of block builders and relayers, third-party block builders and relayers are new entities in the Ethereum MEV space. Historically, Flashbots has been the only relay operator, with mining pools connecting to Flashbots relays to earn MEV. However, due to MEV-Boost andOpen Source of Repeater Technology, other MEV relayers, such as the Dreamboat relay operated by Blocknative, began to compete with the Flashbots MEV relay and help decentralize the MEV infrastructure. The Flashbots MEV relayer remains by far the most utilized, generating 81% of MEV-Boost blocks.

The long-term motivation for the persistence of multiple relayers on Ethereum remains unclear. Additionally, there is concern that the specialization of block builders and the rise of payment-for-flow (PFOF) activity could lead to a single builder monopoly over time. Since MEV-Boost is designed to only support full block auctions, there is another concern that transaction censorship by dominant MEV infrastructure operators such as Flashbots will lead to a decrease in the neutrality of the network. As of January 20, 2023, about 67% of the blocks produced every day on Ethereum are actively censored by relayers.

This report will provide an overview of the post-merger MEV landscape. First, we will outline the MEV-Boost architecture and its main stakeholders, including searchers, block builders, relayers, and validators. We will then discuss concerns about relayer censorship and builder centralization due to MEV-Boost and the long-term solutions being developed by the Ethereum core developers and the Flashbots team to address these issues. For an in-depth look at the basics of MEV on Ethereum, including what it is, how it was created, and how it is similar to traditional finance, readThis Galaxy Research reportas the basis for this report.

MEV-Boost overview

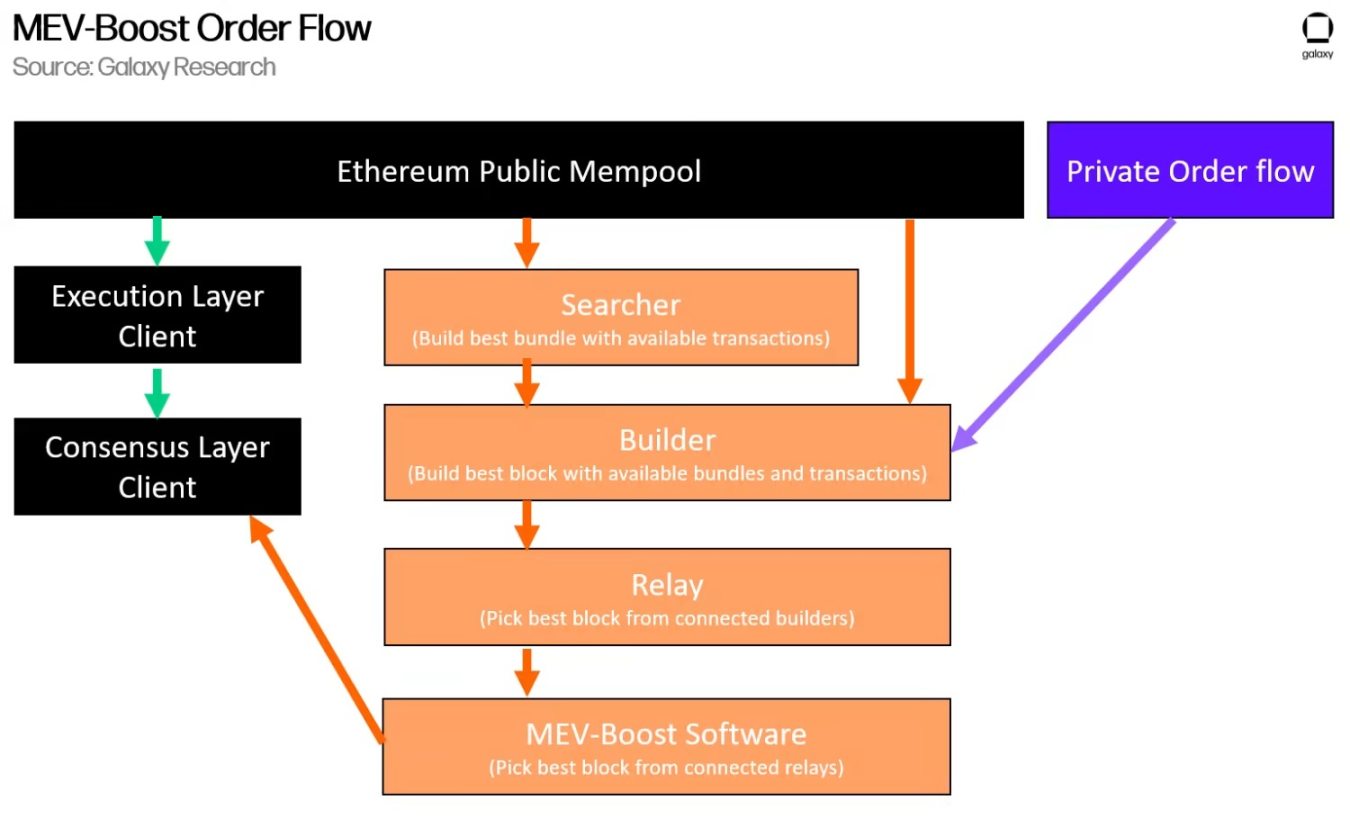

MEV-Boost is an early implementation of Proposer Builder Separation (PBS) on Ethereum. PBS refers to the separation of responsibilities for building blocks and block proposals. Traditionally, public blockchain security providers, either miners or validators (or pools of both), are responsible for building blocks containing user transactions and submitting those blocks to the network for validation. Under PBS, the role of the security provider is limited to submitting blocks, while the responsibility for block construction falls to a third party. The motivation for splitting these responsibilities is to reduce the amount of expertise and hardware required to run an Ethereum validator. By ensuring that competition among validators does not depend on specialized skills or equipment, the barrier to entry for new entrants into the validator pool remains low. Encouraging as many participants as possible to contribute to the security and decentralization of Ethereum is the main goal of PBS.

MEV-Boost is the first step towards realizing the full vision of PBS, as the MEV-Boost software relies on off-chain marketplaces, also known as relayers. The role of relayers is to ensure honesty between builders and validators by checking block reward payments, monitoring activity among participants, and ensuring that validators do not get ahead of builders by "stealing" block information Behavior. The complete vision of PBS is to not need to trust third-party relayers, and to write the rules of honest participation between builders and validators into the protocol layer of Ethereum. Due to the complexity of the merger, the ethereum core developers agreed to delay porting the coding of PBS to the ethereum protocol layer. At the same time, in order to solve the direct impact of MEV dynamics on validators, Ethereum core developers and the Flashbots R&D team created MEV-Boost.

MEV-Boost is a "side-by-side" software that runs alongside the core software of Ethereum validators (i.e. the execution layer and consensus layer client packages). By running the MEV-Boost software, validator node operators can connect to multiple relayers and start accepting pre-built blocks from block builders that include MEV. Validators only receive block rewards and block headers from relayers. They cannot see the contents of a block until it is included on the chain. This level of privacy ensures that validators cannot front-run blocks by copying and recreating blocks built by third-party builders. according toestimateBlocks produced through Flashbots MEV relayers are twice as profitable as other blocks. Locally constructed blocks are blocks that a validator constructs itself from its local view of the Ethereum mempool. Blocks from the relay are constructed by builders who package transactions from seekers, private order streams (meaning directly from individuals and entities), and local mempools.

Searchers

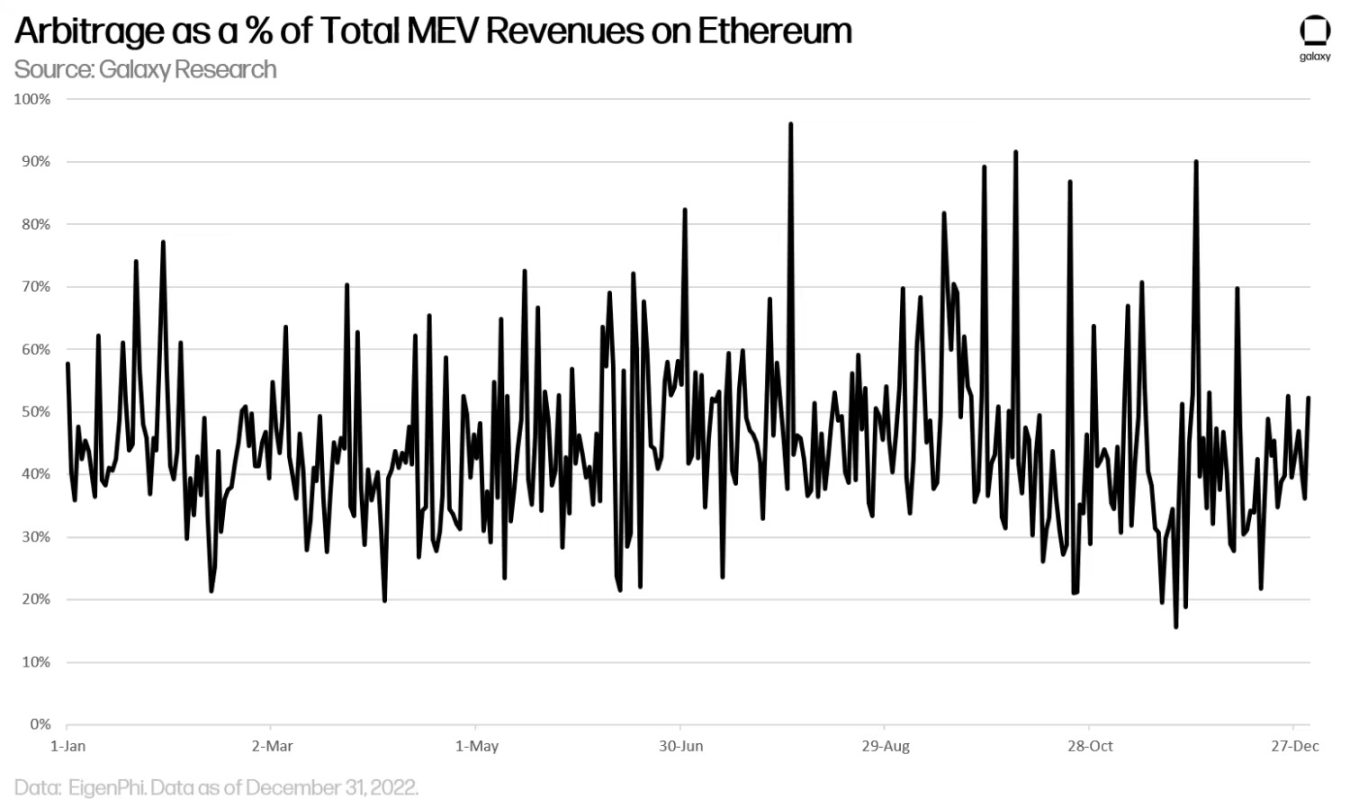

Seekers look for opportunities to extract MEV by sorting user transactions within blocks. Seekers actively monitor public mempools and identify profit-maximizing options, sometimes causing DEXs to experience increased slippage or non-executability. For more information on MEV types and strategies, readThis Galaxy Research report. MEV's strategies often mimic those found in traditional stock markets, such as front-running, "sandwich attacks," stop losses, and arbitrage. In 2022, the most profitable MEV strategy is arbitrage. According to EigenPhi, arbitrage accounts for about half of all MEV revenue generated in 2022. The graph below illustrates how searchers earn arbitrage revenue per day as a percentage of total MEV revenue:

While some types of MEV are beneficial to end users, such as arbitrage and follower trading, others are not. Certain DEXs, such as CowSwap, aim to reduce harmful MEV on-chain by making order execution more profitable for end users. On CowSwap, professional searchers called solvers have the right to bid to execute user transactions on the chain. Solvers that can provide the best order execution will be able to offer the most competitive prices for user trades, either by establishing exclusive relationships with builders so that user trades are executed first, or by combining multiple user trades together to minimize With transaction slippage, solvers can gain a competitive advantage. Although it cannot be preempted by regular searchers or "sandwiched" when executing user transactions. But in these cases, the solvers are the ones paying for poor order execution, because solvers pay transaction fees to users before any transactions are executed on-chain.

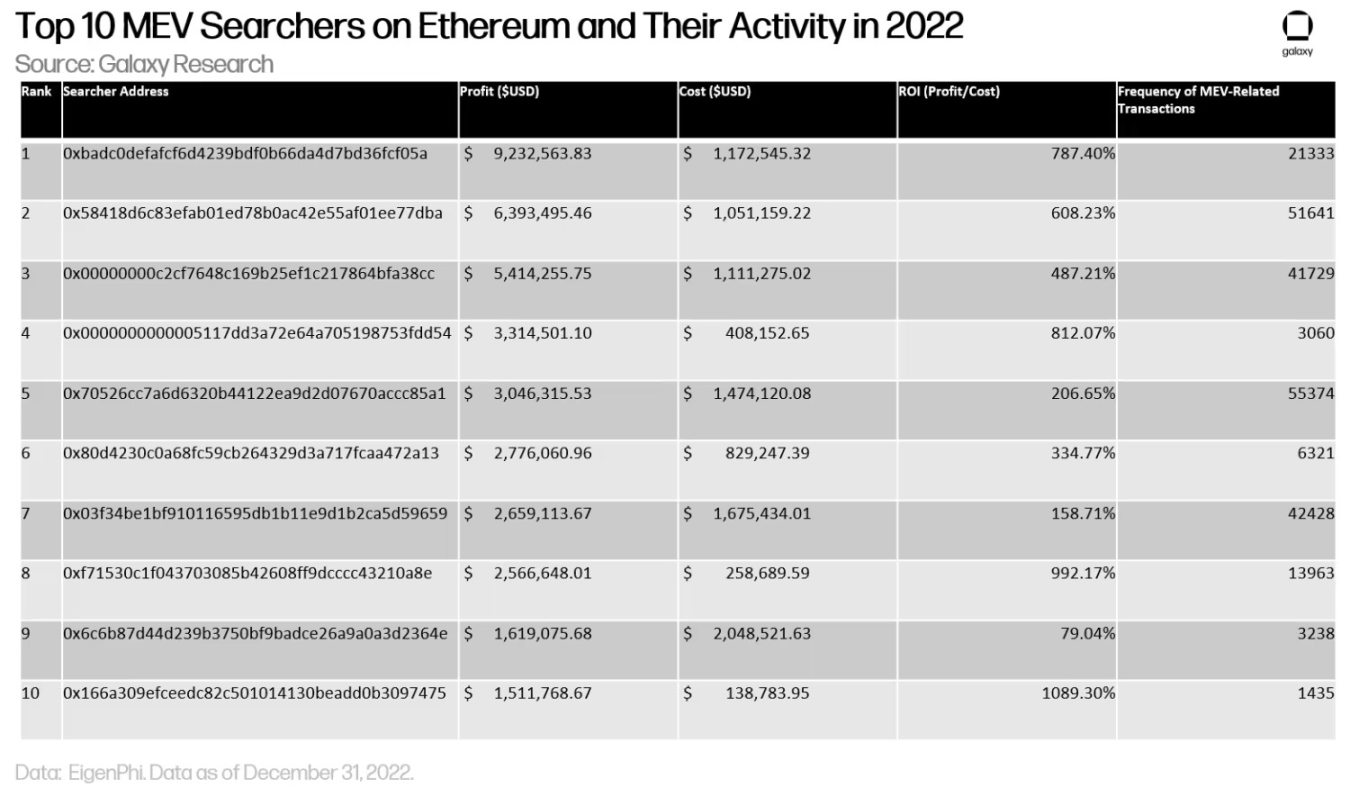

There are more than 10 solvers competing for user transactions on CowSwap. However, CowSwap is just one of many DEXs on Ethereum, where monitoring user transactions and bundling them can be a lucrative activity. On other DEXs like Uniswap and Curve, users execute their own transactions directly on-chain, with general Seekers bidding for the right to reorder transaction execution order on relayers, which is discussed in more detail later in this report. The most profitable and skilled searchers on Ethereum are those experts who are good at monitoring and analyzing on-chain activity, especially DeFi transactions. Search also requires a solid understanding of financial markets and transactions, as these skills are critical to identifying and exploiting market inefficiencies that create MEV. The chart below shows the top ten most competitive searchers on Ethereum in 2022.

MEV is a zero-sum game. There are limited opportunities to extract value from re-ranking transactions, and the searchers who identify the MEV opportunities fastest are usually the ones who earn the most MEV. To maximize revenue, competitive searchers will write scripts to automate tasks to capture easily identifiable MEV opportunities. Additionally, Seekers can run dedicated hardware or subscribe to a paid service that provides a low-latency visualizer of the Ethereum mempool to gain faster insight into pending user transactions. To outwit other searchers, experienced searchers may deploy complex strategies including multiple token trades, bots, and manual searches through on-chain activity for higher profits. For a detailed view of searchers' arbitrage strategies on Ethereum and later Avalanche, read Google Product Manager Daniel McKinnon'sthis blog posttweetstweets。

Block Builders (Builders)

Builders are new stakeholders in the MEV supply chain responsible for packaging transactions from Seekers, as well as transactions from public memory and private transaction order streams, into blocks. Builders themselves are somewhat of a searcher, as the task of building a profit-maximizing block does not depend solely on reordering the searcher's bundled transactions, but also on how to use beneficial resources from the mempool and other sources. Graphable transactions to fill block space outside of bundled transactions. The latter activity requires some knowledge of basic search strategies. While Seekers may specialize in the task of extracting MEV from a specific DeFi protocol, Builders typically have a broader view of the eligible transactions included in a block and specialize in full block simulations from multiple sources. Task.

high performance hardware

The task of simulating multiple transactions in a block, calculating and evaluating their value is computationally intensive and requires complex hardware like a full node. Block builders, like searchers, need to have their own unique techniques for efficiently simulating full blocks based on incoming transaction data. Builders typically wait until the last minute to submit a full block to maximize the potential MEV value contained in a block, which requires extremely low latency to propose blocks and look into the Ethereum mempool.

Before the merger, the task of packaging Seekers' transaction bundles into blocks used to be the responsibility of miners and mining pools.Based on the user's anonymous Twitter profile, it’s no surprise that Builder 0x69, one of the top block builders on Ethereum, is himself a former mining pool operator.

Before the merger, miners spent most of the electricity calculating the hashrate. The first miner to find an acceptable hash will have the right to produce the next block. Miners also spend electricity ordering bundles of transactions from Seekers to maximize their reward from a block. Fast forward to January 2023, validators who now replace miners consume almost no electricity to submit blocks on Ethereum, since they are randomly selected by the protocol. Additionally, if they are not earning MEV rewards and building blocks from the local mempool, validators will order transactions within the block by highest to lowest priority fee, without complex block simulation.

searcher collaboration

In addition to complex hardware, block builders rely on close collaboration with professional searchers who identify MEVs from more complex and profitable strategies than their own. From the Seekers perspective, builders may preemptively run the Seeker transaction package and steal their MEV, which is why some Seekers choose to build blocks themselves when they have enough funds and resources, and why as An honest builder's reputation is key to fostering close collaboration between professional builders and independent searchers. In addition to working closely with Seekers, Block Builders also compete through private order streams. Blocknative, a blockchain infrastructure company that operates block builders and relayers, estimates that 1% of blocks built by third-party buildersAbout 3.8% of transactionsFrom a private source outside of the public memory pool.

block subsidy

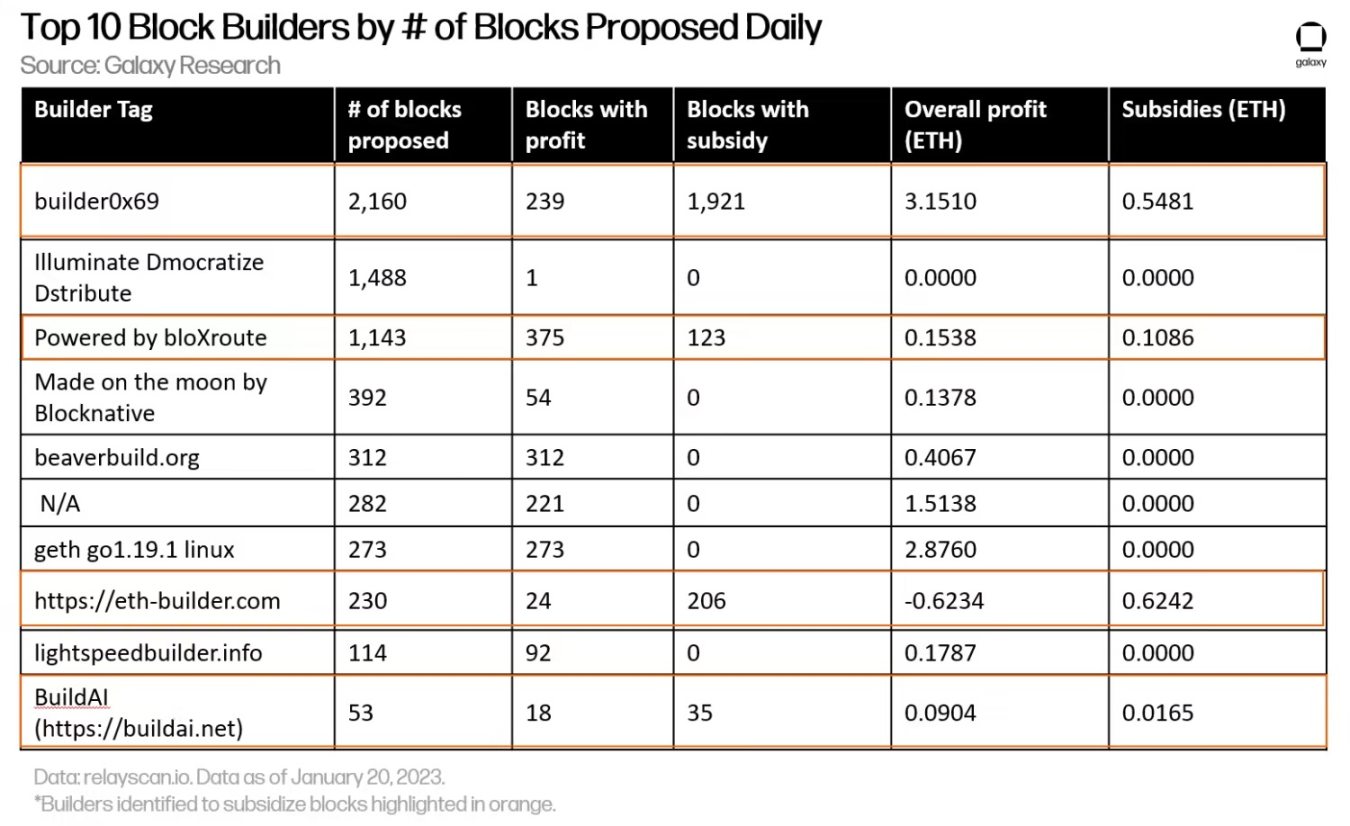

Once builders identify a profitable block, they calculate a bid to include in that block, either as a bidding fee for priority inclusion of the block or as a fee paid directly by block builders to validators . The higher the bid, the more likely the builder will have their block included on the chain. The final field of competition among builders is subsidies.There are at least five builders on EthereumIt appears to be submitting blocks with bids higher than the value of the block reward, suggesting that these builders are somehow subsidizing their blocks. Four of the top 10 block builders by number of blocks submitted per day are subsidizing their blocks.

According to BloXroute founder Uri Klarman, BloXroute builders can use revenue from other businesses to subsidize their blocks on an ongoing basis. Builder 0x69seemIs to use the subsidy as a temporary means to encourage more traffic from searchers and build trust with searchers. Another explanation could be that some of the block subsidy is achieved through direct payments from seekers to builders for transaction bundles that are not captured on-chain.

The prevalence of subsidies has helped certain builders, such as Builder 0x 69 and BloXroute, get ahead of others. Ultimately, however, it is a combination of factors that determine its profitability. Over the past week, the two most profitable block builders on Ethereum, Flashbots and beaver.build, combined without using any subsidiesrepeater。

repeater

Digging deeper into the competitive dynamics of block builders needs to consider the fact that block builders like Flashbots also operate their own MEV relayers. Although there is little financial incentive for businesses to run their own relayers, the number of relayer operators has only grown since the switch to PoS. Most operators do not earn revenue from their repeater operations, in part because the first entity to build an open-source, permissionless, high-performance relay provides the service for free as a public good.

Flashbotsis a venture-backed venture that has been building and operating MEV-related infrastructure on Ethereum for several years. Given that today's most popular repeaters are still operated by Flashbots, it's not cost-effective to operate a high-performance and competitive repeater for a fee for most relays. However, BloXroute, a blockchain infrastructure company that also operates and subsidizes its own block builders, is one of the fewCharge for its repeater serviceone of the companies. Most others, including Blocknative, Relayooor, Agnostic, and Ultrasoundno charge。

Incentives for Entities to Operate Relays

The motivation of entities launching relayers may be to increase their brand awareness and help MEV on Ethereum become more decentralized. Builder 0x 69 inA post on Discordindicated that they startrelayooor repeaterThe goal is to have "at least 1 fully open-source, non-censorship-free, permissionless relayer" running on Ethereum. But with two more relayers on the horizon, Builder 0x69 added, relayooor could be phased out in the next ethereum network upgrade. An increase in the number of relayers is good for the health of Ethereum, and the diversity ensures that a potential bug in any one relayer's software does not prevent validators from earning MEV at scale, as they can easily switch to using other relayers and other relayers. . This is the same rationale for promoting client diversity on Ethereum.

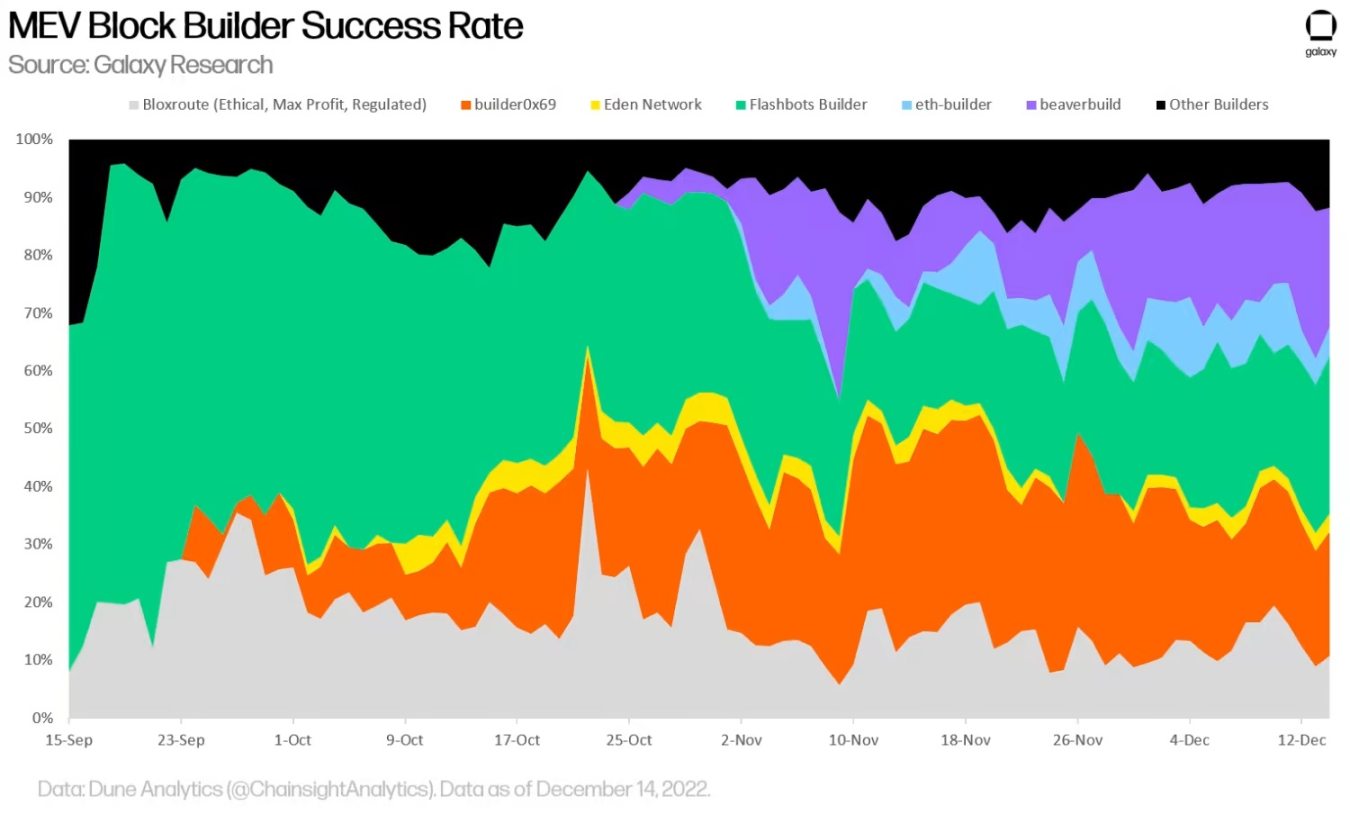

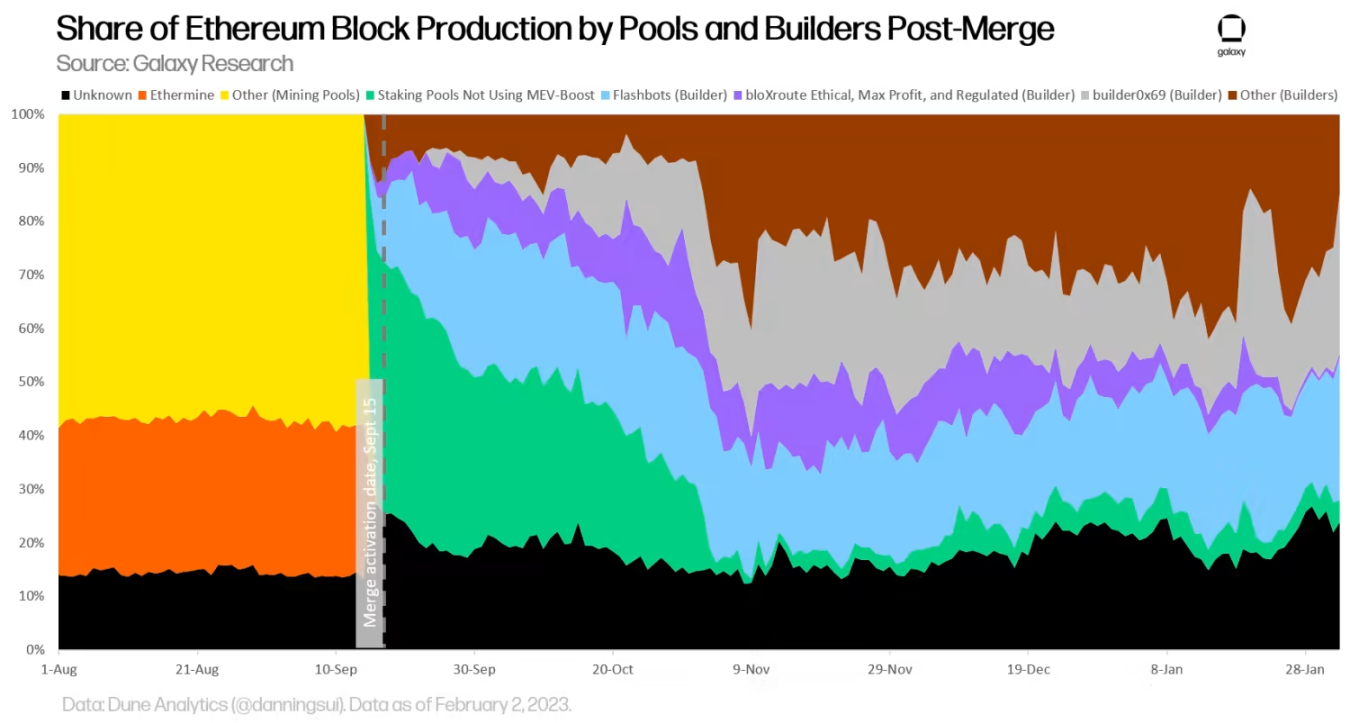

Central to the MEV-Boost software implementation is the ability for validators to connect to multiple relayers, thereby avoiding over-reliance on one MEV infrastructure provider. The optionality of relayers is a particularly important feature from a validator perspective, since prior to the merger, the only relays miners used to earn MEV by operating the MEV-Geth software were the Flashbots relays. Flashbots relay review transactions to comply with US sanctions. As of December 2022, there are 10 relays on Ethereum, 6 of which do not censor user transactions. Of the six non-censored relays including Agnostic, Ultrasound, Relayoor, Bloxroute Ethical, Bloxroute Max Profit, and Manifold, five are permissionless, meaning any builder can submit blocks to the relayer. The only non-censorship relay that requires permission and requires block builders to be whitelisted before submitting blocks is Bloxroute Ethical. Bloxroute Ethical intentionally rejects blocks from block builders detected to be from private order streams, with the goal of providing users with a more "ethical" relaying option. The Flashbots relay, a censored but permissionless relay, dominated the market as the most popular relay and also won the most blocks. However, its dominance is gradually fading, as the chart below shows:

Besides altruistic reasons, builders may choose to run their own high-performance relays so that their blocks can reach validators faster than they would otherwise. A permissionless relay that accepts blocks from any builder must simulate every block proposed by the builder to ensure that the submitted block is valid. This introduces some delay in blind auctions hosted on unlicensed relayers. Trusted relay builders who are whitelisted and whose blocks do not require inspection can be fast-tracked through the block bidding process, which is why some builders may choose to vertically integrate their MEV operations and run their own middle continue.

The cost of running a relay

Depending on the performance of the repeater, the cost of operating a repeater can vary widely. For example, permissionless relayers open up to more builders and thus potentially more profitable MEV blocks, requiring protections to prevent denial of service attacks and spam. Additionally, high-performance relays that attempt to minimize the amount of latency when sending blocks to validators on Ethereum must set up multiple servers to handle variable load conditions and maintain a high-bandwidth network. This is especially important considering that relayers must impersonate blocks submitted by third-party or non-whitelisted block builders to ensure they are valid, and redisplay all validators connected to their relayer every epoch. The cost of these to run a high performance and competitive repeater can be thousands of dollars per month. However, not all relayers are optimized for performance, especially those funded as public goods.

In addition to differences in the technical capabilities and capacity of each repeater, there are also differences in reliability. The biggest competitive advantage of relayers is uptime, reliability, and a proven track record of fair processing of blocks between block builders and validators. Relays are in a unique position in the MEV supply chain on Ethereum. As infrastructure, relayers can learn about blocks and their contents before validators commit them on-chain. Therefore, block builders and validators must trust that relay operators will not do evil. Malicious relay operators may modify the original version of the relay specification published by Flashbots, allowing them to pre-bid other block builders. To increase trust in relayers, most relayer operators open-sourced their software and created public endpoints for anyone to monitor their relay activity in real time.

BloXroute's MEV repeater had problems a few days after the merge activation, causing validators to miss about88 blocks. BloXroute compensates validators for funds lost due to temporary relay failures. Compensating validators is a controversial decision, seen by other relay operators such as Blocknative as creating a "negative economic benefit". Based on the cost of running a high-performance repeater that competes with the Flashbots repeater, which is zero-cost to users to operate, coupled with the expectation of compensating users for repeater failures, relay operators do not appear to have a strong incentive to Build high-performance relays. In fact, while most of the major staking pools on Ethereum are connected to multiple relayers, the Flashbots relayer wasThe largest number of blocksVerifier

Verifier

Validators on Ethereum earn passive income. Beyond their initial deposit of 32 ETH and software configuration, validators have little room to materially increase their rewards for further optimization, which is by design. If consuming more electricity or using expensive specialized hardware does affect validator rewards, then competition among validators will lead to specialization and potential centralization. As Ethereum founder Vitalik Buterin put it, the goal is for validators to maintain "as stupid as possible」。

One of the criticisms of MEV-Boost is that in order to reduce the risk of specialization and centralization among validators, the network transfers this risk to third-party builders. Flashbots and the Ethereum core developers believe that entities that do not directly interact with the Ethereum protocol involve less risk than validators. However, the trend toward centralization among block builders still leads to the same concern that MEV rewards will be concentrated to a small group of experienced participants who can then exert influence over Ethereum by accumulating more ETH. In the next section of this report, solutions to the problem of centralization of block builders will be discussed in detail.

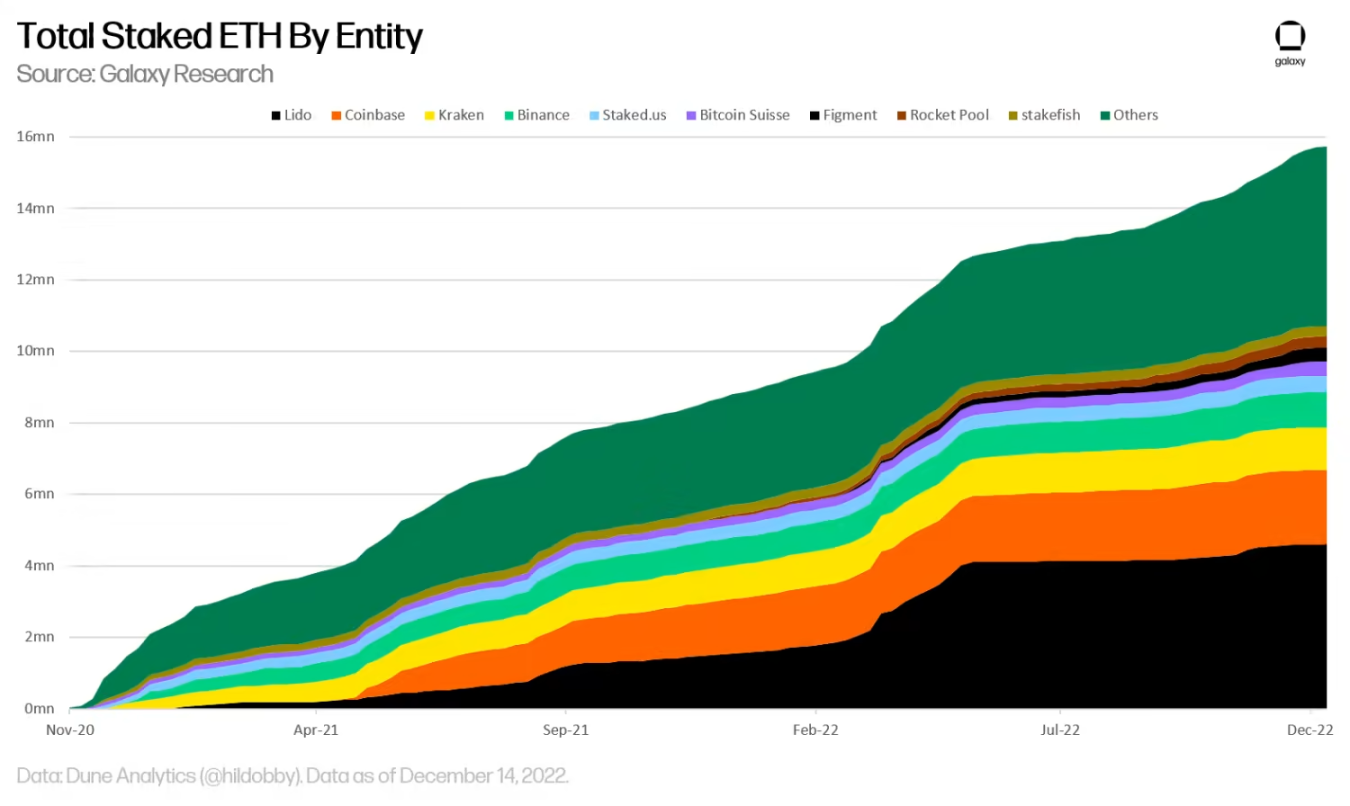

While there is little opportunity for specialization when operating a validator, there is such a problem when it comes to staking pools. Staking pools are entities that operate validators on behalf of individuals. There are several advantages to staking through a pool rather than setting up independent validators. For more details on validator pools on Ethereum, please readThis Galaxy Research report. The entities most capable of offering staking services are typically cryptocurrency exchanges, as they already hold and deploy capital on behalf of individuals.

From an exchange's perspective, offering staking services is an easy way to incentivize users to hold assets on their platform for longer by providing them with a deposit yield. Most staking pools also offer users the ability to stake less than 32 ETH, with some degree of insurance against a validator’s technical setup failing. The second and third largest staking entities on Ethereum are exchanges.

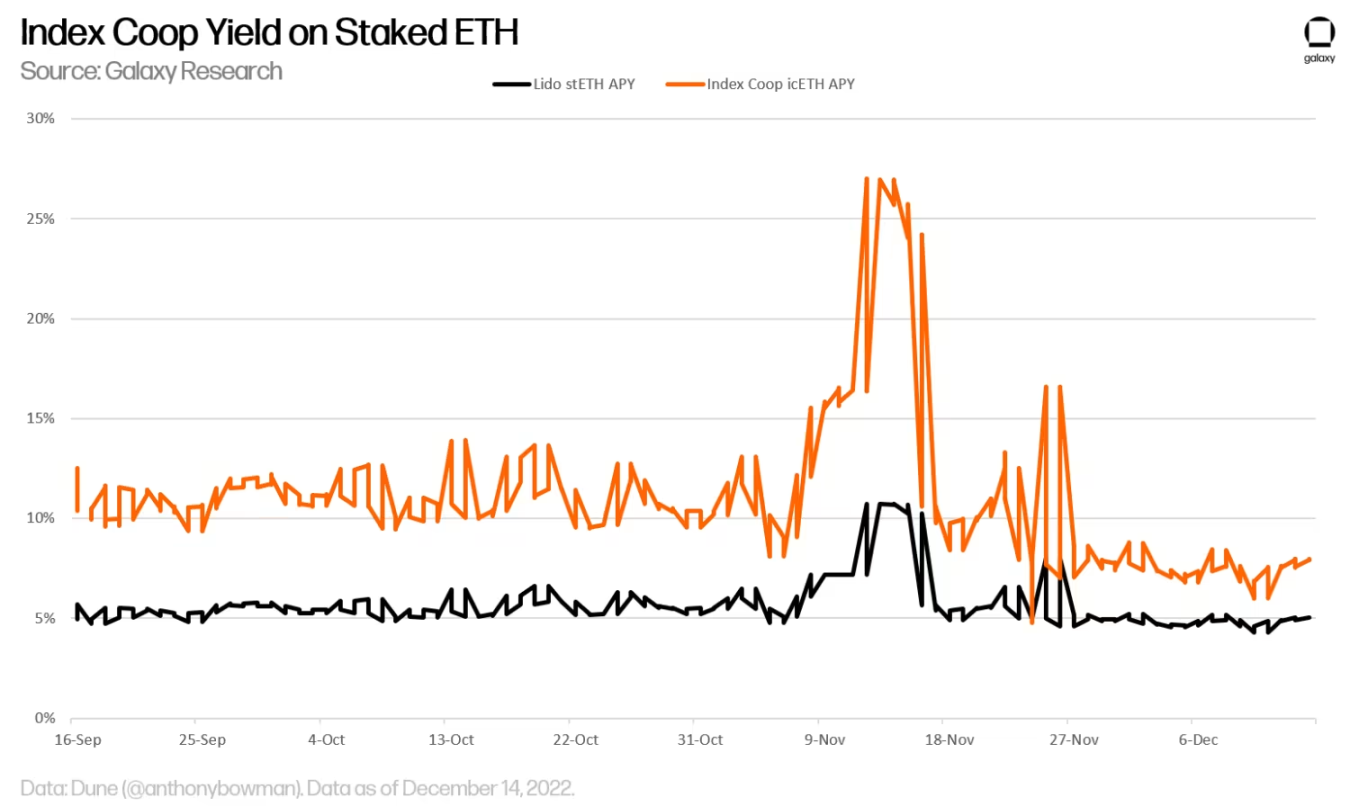

The largest staking entity is Lido, a liquidity staking service provider. Liquid Staking Derivatives (LSD) are assets representing pledged ETH that can be freely traded and transferred on Ethereum. Users often re-mortgage their LSD to DeFi applications (such as Aave) for additional yield. The Index Coop protocol provides users with a derivative asset called icETH, which automatically mortgages the LSD tokens obtained by staking ETH to Aave to obtain income, and then uses it to purchase more staking Ethereum. At times, Index Coop yields are almost double that of normal collateralized ETH.

The lucrative yield from re-staking ETH gives liquid staking service providers a competitive advantage in adoption over individual stakers and regular staking pools. However, among liquidity staking providers, the competitive landscape is characterized by a “winner takes all”. While there are other liquidity staking providers, none are as popular as Lido, whose stETH token has amassed the highest liquidity in the DeFi market. The deep liquidity of stETH is due in part to theKey integrations for major DeFi protocols like Curve and Yearn Finance. Alternatives to stETH typically trade at a greater discount to ETH due to greater technical or regulatory risk and do not offer as high a return as stETH. Contrary to past trends, new staking protocols like Frax Finance deploy a dual-token model, allowing users to earnabove average earnings. Outside of centralized exchanges, the only entity best suited to compete as a staking pool is a service that provides LSD to users, and in these services, the LSD protocol with the highest market depth is usually the first choice.

Repeater Review Questions

The MEV supply chain on merged Ethereum remains vulnerable to regulation due to over-reliance on Flashbots products such as Flashbots relayers. Over 60% of all blocks published on Ethereum are built via the Flashbots relay, thus enforcing censorship of user transactions. Percentage of blocks that censor user transactions in addition to other censored relays such as Bloxroute's "supervised" relayabout 70%。

Since the merger and activation of the MEV-Boost software, the number of non-censorship relayers running on Ethereum has gradually increased. In November 2022, three new operators, Gnosis, Ultrasound Money, and Builder 0x69 launched their own relay infrastructure to improve Ethereum’s censorship resistance. However, the dominance of the Flashbots repeater has not materially declined with the advent of other new repeaters, as the Flashbots repeater has maintained a near-perfect uptime record since its launch and has a free, license-free , which means that validators and block builders do not need to pay or be whitelisted to connect to the relay. As mentioned earlier, reliability is one of the most important competencies for a relay, which is why the longer a Flashbots relay can remain up and running without interruption, the more it will become the one that all validators trust and connect using MEV-Boost One of the repeaters.

Ethereum core developers and the Flashbots team view relay review as a short-term issue, as there are plans to remove relays from the MEV supply chain entirely, even if relay diversification does not improve. The full vision of PBS that inspired MEV-Boost incorporates the role of relays into the Ethereum protocol.

Protocol Built-in PBS

The separation of block proposal and construction, sometimes referred to as a protocol-built PBS, was the original motivation for building MEV-Boost as an interim solution to mitigate the centralizing effects of MEV following the Ethereum merger. The implementation of PBS is an active area of research for Ethereum core developers, in addition to other important protocol-level changes in progress, focusing on scalability and state growth, such asDanksharding and state expiry. One of the core challenges of PBS is to devise a way to facilitate block auctions in a decentralized manner. The protocol built-in PBS will require the Ethereum protocol to create and record a canonical list of block bids from block builders, and ensure that validators receive payments from builders after execution builders submit blocks.

By Vitalik Buterin, June 2021 onOriginal Proposal from PBSTwo different implementation ideas are provided. The first line of thought proposes that block builders publish on-chain a portion of the block they created first, along with the amount they paid the validators and a cryptographic signature verifying that the block was the one they submitted. Validators who choose to submit the next block on Ethereum will review the payout list, choose the highest one, and then the "winning" block builder will publish the full contents of the block for validator submission.

The second method is similar, but instead of the validator picking from a partial list of blocks, the validator signs a statement promising to pick from a different transaction package, providing a higher level of reliability for the validator's on-chain execution. Choice and flexibility. The second method requires a new constraint that penalizes them if they don't propose one of the transaction bundles in their list. Since Vitalik Buterin's original proposal, there has been new discussion in the community around alternative paradigms for PBS, such as redesigning the core mechanism so that the bidding process takes place insingle slotinstead oftwo(A slot is a unit of time on the beacon chain that lasts 12 seconds, during which a validator can submit a block).

Flashbots founder Phil Daian also proposed a "light" version of PBSidea, where validators and builders do not participate in block auctions at all. Instead, validators choose the most profitable payment from builders by creating new transaction types. A new transaction type transfers rights to block data availability to chosen builders.

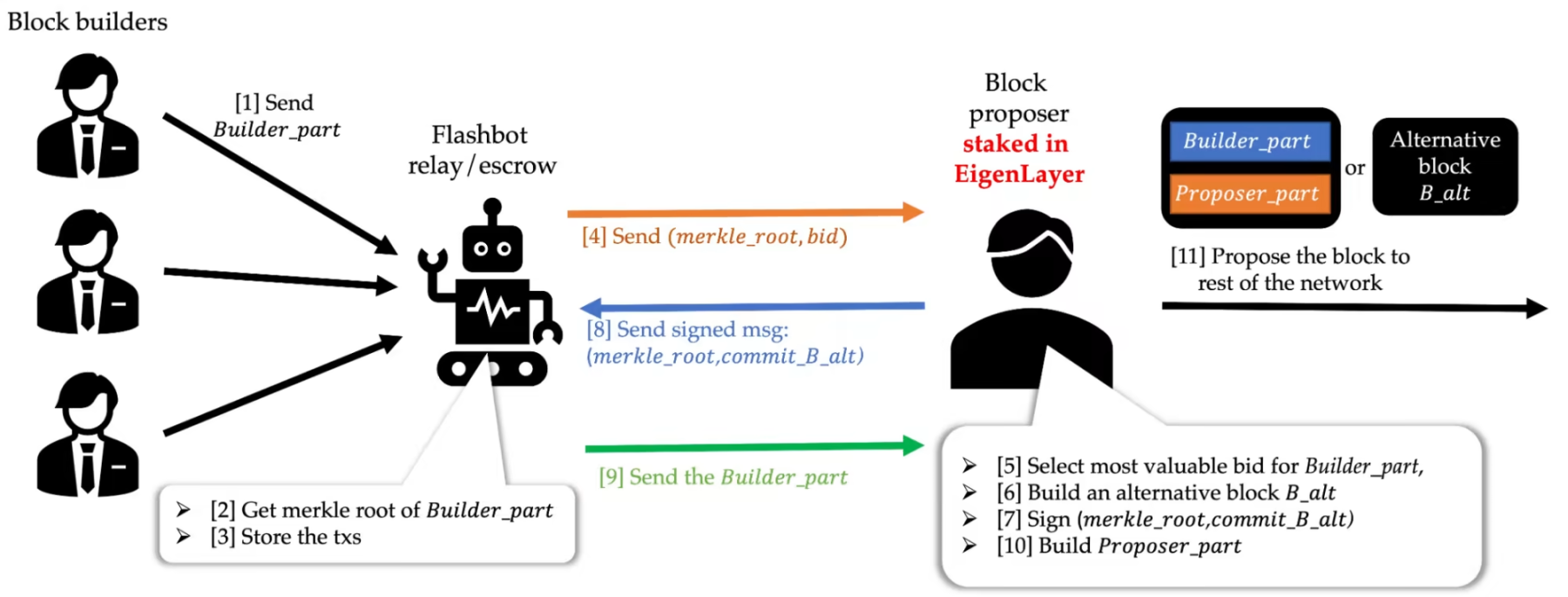

Protocol Enforced Validator Commitment (PEPC)

In addition to the protocol’s built-in PBS, ethereum developers are considering another possible framework for enabling block auctions in the protocol. known asProtocol Enforced Validator Commitment (PEPC), a framework that attempts to enforce block reward distribution by having validators enforce more complex rules around how blocks are created, such as enforcing limits on gas usage, limiting block space usage, communicating state access lists, and specifying transaction flow compatibility. EigenLayer is a smart contract protocol currently under development that can serve as a testing ground for PEPC and other experiments related to applying additional slashing conditions to validators.

The EigenLayer protocol enables validators to earn additional yield by restaking their staked ETH into Ethereum, other applications, and alternative blockchain protocols. Two re-staking models are envisioned on EigenLayer: local restaking by updating validator withdrawal credentials, and liquidity restaking by depositing liquidity staking derivative tokens into the EigenLayer smart contract. Restaking of EigenLayer is made possible by imposing additional slashing conditions on validators. According to the middleware and rules that validators opt-in through the EigenLayer protocol, there are additional penalties for misbehavior, which can minimize the harm of re-staking to Ethereum security.

EigenLayer expects to launch its restaking service within 2023. In the first phase of its rollout, EigenLayer will only allow validators to choose from a select set of restaking middleware. For example, validators will be able to restake toEigen Data Availability Layer, which is designed to serve Layer 2 Rollups such as Arbitrum and Optimism with highly customizable and highly scalable data availability services. However, over time, EigenLayer's vision is to enable permissionless innovation and enable users to create and launch their own restaking middleware. One type of restaking middleware that could theoretically be developed on future EigenLayer is the fractional block auction component.

Due to the use of MEV-Boost and relayers, validators cannot insert their own transactions into blocks built by third-party builders, because they cannot see the content of the block before committing it to the chain. Relayers only show block headers and rewards to validators. Only after a validator commits a particular block by signing the block header, the relay sends back the full content of the block for the validator to commit on-chain. This is to ensure that validators cannot simply look at the block content and reconstruct it themselves. However, if additional penalty rules are imposed on the verifier to rebuild the block through EigenLayer, it can be more powerful to ensure that the block originally constructed by the block builder is correctly retained, otherwise the re-staking verifier will be severely punished.

The EigenLayer protocol will act as middleware software to facilitate the bidding process for portions of block space between block builders and validators. This is an important feature that removes concerns about censorship by relayers and ensures that Ethereum’s censorship resistance is strengthened by giving back to validators the ability to propose transactions for inclusion in blocks. In addition, EigenLayer's long-term vision is to support a complete set of re-staking middleware and penalty schemes, which is the basis of PEPC research. Many components of PEPC will be tested with the development of EigenLayer, such as how the core principles behind PBS are currently tested with MEV-Boost before PBS is built into the protocol.

Protocol built-in PBS and PEPC are likely to be years away from implementation. Further research is needed on the complexity of in-protocol solutions and the impact on validator behavior. In addition to further research, there are other protocol-level upgrades aimed at improving Ethereum's virtual machine and scalability, and these upgrades are likely to be prioritized now that the merger is closed. However, until an in-protocol solution for MEV block auctions is ready, there will still be a risk of front-running by relayers to block builders. To mitigate this risk, relay diversity is important in the short term, as are other interim solutions, such as through new smart contract protocols such as EigenLayer or alternative network-level solutions such asClosed Beacon Chain Concept). As background, the closed beacon chain concept, proposed by Gnosis CEO Martin Köppelmann, proposes selectively encrypting user transactions through distributed key generation so that the content of transactions cannot be revealed before being included on-chain. A proof of concept for the closed beacon chain is expected to be implemented on Gnosis Chain later this year.

Block Builder Centralization Issues

Outside of relayer censorship, there are concerns that block builders will be concentrated in a small number of specialized entities. Building profitable blocks is a resource-intensive activity because block builders have only a short amount of time (approximately 12 seconds) to run multiple different block simulations to determine the block that maximizes revenue. Leaving the resource-intensive and highly-optimizable block builder activity to the merged validators naturally provides large, complex staking pools with an advantage over independent validators, as the former can invest in the best block builds solution, while the latter cannot. Therefore, to prevent MEV from becoming a centralized force on Ethereum, MEV-Boost separates block building activities from validators. Under the PBS model, validators, whether run by large staking pools or independent node operators, can outsource the responsibility for building profitable blocks containing MEV rewards to third-party block builders, and in this way avoid Centralization of MEV rewards to large staking entities.

However, outsourcing block building activities to third-party block builders means that the market for block builders still has the potential to become centralized. While this is better than validators becoming centralized due to MEV, it is still suboptimal and creates regulatory risk at the beginning of the MEV supply chain. To mitigate the negative externalities of builder centralization, Flashbots has made small tweaks to the MEV-Boost software in recent months, most notably allowing validators to setminimum bid, by setting the minimum bid higher than zero, validator node operators can automatically build blocks locally from the Ethereum mempool if the rewards for blocks built by third-party builders do not exceed a certain threshold. In addition to minimum bids, ethereum core developers are making tweaks to the ethereum engine API to help validatorscompare more easilyRewards for locally built blocks and third-party built blocks.

As of December 31, 2022,75% of MEV-Boost blocksBuilt by Flashbots. Through competition, the dominance of Flashbots block builders is gradually waning. By the end of December 2022, the proportion of blocks built by anonymous builders has increased from less than 10% in September 2022 to nearly 50%.

In addition to the growing competition, Ethereum core developers and the Flashbots team are discussing a number of other solutions to the negative externality of block builder centralization.

Review boycott list

The first and easiest solution is review resistance lists (crLists). This is something Ethereum core developers have been discussing since as early as January 2022idea. It proposes a list of transactions that third-party block builders must include when building a block. This ensures that even if the block building market does become centralized, builders do not have the authority to censor transactions and thereby reduce Ethereum's trusted neutrality by building regulatory-compliant blocks. By using crLists, validators will be able to force the list of transactions from the common mempool that block builders must accept into their blocks. In terms of implementation, crLists is not difficult.Robert Miller, Product Owner at Flashbots, said in a podcast, crLists could be implemented in as little as 2 to 3 months if there is enough consensus among Ethereum core developers to make a code update. However, there is little consensus among developers on enforcing crLists at the protocol level, as some believe that crLists cannot solve builder centralization in the short term. Some developers felt that it would be a more efficient solution to address the root of the problem by decentralizing the role of builders rather than implementing crLists.

Collaborative Building Blocks

Currently the Ethereum community is studying how to redesign the core responsibilities of block builders so that multiple builders can collaborate to create a block. Builders rely on highly specialized algorithms to combine transactions from searchers and local mempools. Multiple builders can run their algorithms to collaboratively build a block, and combinations of different aggregation techniques may produce blocks with higher yields than one. Creating blocks independently without cooperating with others is only possible if builders can run their algorithm independently and hide parts of the block's content to prevent other builders from stealing their MEV. Through the development of decentralized computing and hardware, several independent builders can pool resources together to build blocks without revealing sensitive information. Discussions around breaking the responsibility of block builders often rely on the use of advanced cryptography, such as zero-knowledge and polynomial commitments. Compared to crLists, the approach of decentralized block builders several independent builders may pool their resources together for block building without revealing sensitive information. Discussions around breaking the responsibility of block builders often rely on the use of advanced cryptography, such as zero-knowledge and polynomial commitments. Approach to decentralized block builders compared to crListsis a less well-defined and well-developed field of study。

SUAVE

Flashbots is actively working on a solution to decentralize the role of building blocks by collaboratively building blocks. The project is called Single Unifying Auction for Value Expression (SUAVE). SUAVE was presented on October 14, 2022 by Phil Daian, co-founder of Flashbots, during Devcon, the annual Ethereum developer conference. Daian described it as a MEV-aware encrypted memory pool for returning MEV profits to end users. In late November, Flashbots published a blog post titled "The future of MEV is SUAVE, revealing more details about the project. The blog describes SUAVE as an independent blockchain network that can be used to extract cross-chain MEV. “Importantly, SUAVE goes beyond the ordering of individual blockchains. We design SUAVE as a mempool and block generator for all blockchains,” the article said.

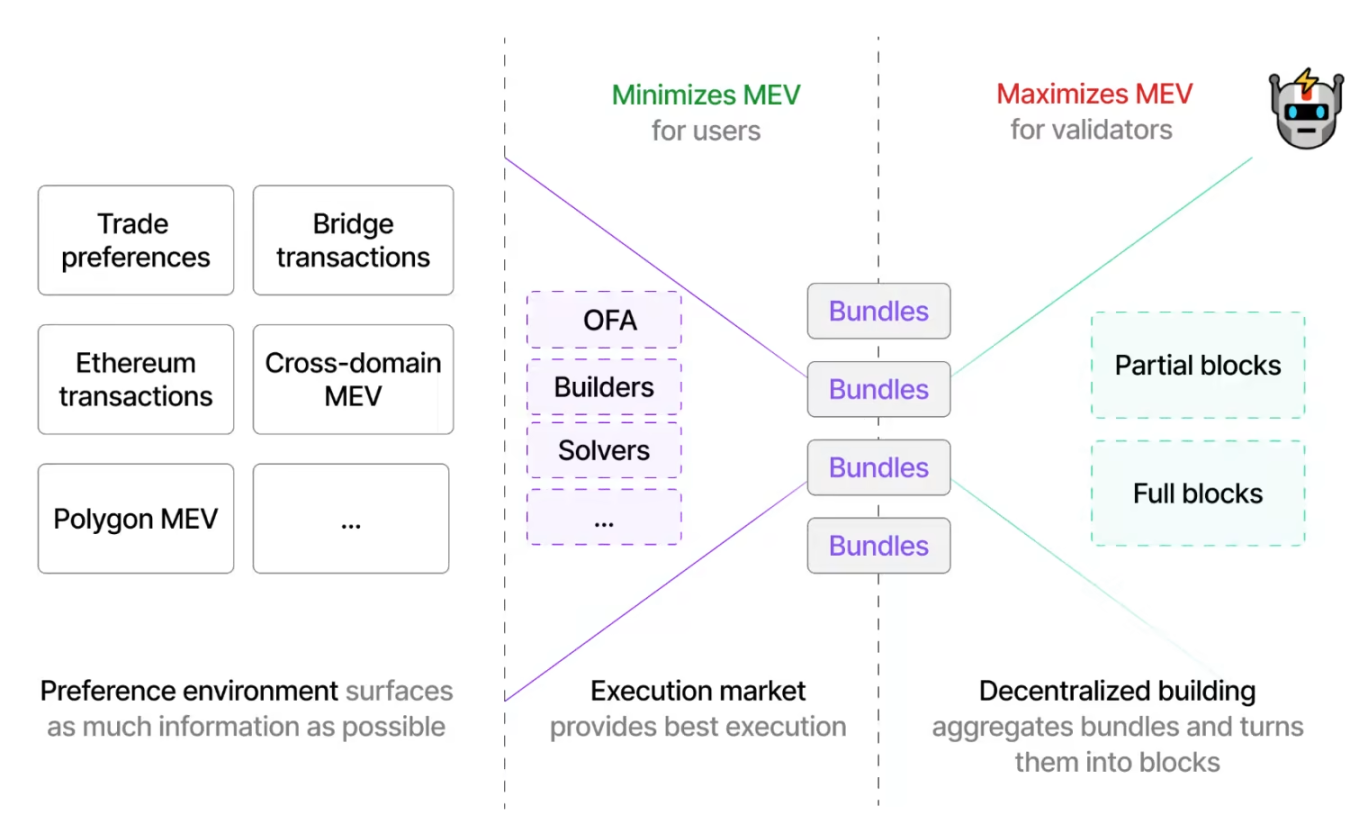

Today, there are few technical details about how SUAVE works. The currently available information about SUAVE illustrates the frame of mind that inspired the product architecture, rather than detailing the architecture of SUAVE itself. In theory, SUAVE would be a blockchain capable of accepting expressions of user preferences from multiple blockchains, and then assisting a decentralized network of block builders to propose blocks to each network in a trustless manner. The SUAVE chain will consist of three main components: a general preference environment, an optimal execution market, and a decentralized block building network.

The preference environment is envisioned to be as flexible as possible, meaning that users should be able to express their preferences not only for MEV, but for any type of ordering or placement of transactions within a block. This preference will be associated with a bidding contract, where users will lock a certain amount of ETH to incentivize the execution of their preferences, which may be as complicated as the state representation of the block, or it may be as simple as packaging a certain transaction into the next blocks.

Afterwards, the preference will be passed to the execution market. In an execution market, participants called enforcers compete to provide the best possible execution of user preferences. Today, block builders can be thought of as enforcers of searcher bids. On the SUAVE chain, executors will process various transaction preferences in exchange for ETH locked by users in the preference market. The final piece of the SUAVE chain is the decentralized builders marketplace. Details about that market are the sparsest of the three. At its best, the SUAVE chain will enable blocks to be built collaboratively among builders, using secure enclaves to protect block content privacy.

Executors will scan the preference market and run algorithms to combine different user preference and searcher transaction bundles within one block. These blocks will be iterated, improved and propagated among executors so that the final block will be enriched with contributions from multiple executors. In this way, while SUAVE's decentralized block building network may introduce more delays in the block building process, it may also produce more valuable blocks because the blocks produced by these blocks benefit from many building blocks. device and block building algorithm.

To ensure that user preferences are not leaked during block construction, builders will be required to run their transaction ordering algorithms within a secure enclave, which refers to an isolated computing environment where code and data are processed on a computer. Historically, there have beenHardware-Related Vulnerabilities Using Secure Enclaves, which is why their use in SUAVE may pose a security risk.Flashbots mentionedThey are exploring alternatives to secure enclaves, including trusted execution environments, fully homomorphic encryption, threshold encryption, and multi-party computation. However,According to Flashbots, based on the maturity of the technology available today, secure enclaves are the best short-term solution to facilitate decentralized block building over the next 3 to 6 months. A full vision of SUAVE supporting all three components above may take many years to implement.

Flashbots has talked a lot about SUAVE, but few details have been released today. Some notable aspects of SUAVE's design remain unclear, including:

proposalproposalIt is recommended to build SUAVE as a Layer 2 Rollup on Ethereum instead of a Layer 1 blockchain, which will reduce the risk of bridging.

to reportto reportThis will be the first part of the SUAVE implementation.

Use safe enclaves. It is unclear how SUAVE will use secure enclaves to decentralize the role of block builders, as SUAVE may allow executors to host their own enclaves on their own devices, or may require executors to use trusted cloud-hosted solutions. plan.

Closely related to the research on mitigating builder centralization highlighted above, Flashbots and Ethereum Foundation developers are discussing solutions in several other areas of MEV, such as:

Improve user transaction privacy. sometimes calledProgrammable Privacy, developers are actively researching ways to lower the barriers to cooperation among builders by enhancing the privacy guarantees of user transactions.

MEVs are returned to end users. The current MEV supply chain on Ethereum ensures that most of the value growth of MEV goes to block proposers, the validators on Ethereum, which may incentivize validators to collude.MEV smoothingis another area of research by Ethereum core developers, trying to minimize MEV's block reward variance and prevent validator collusion.

Cross-chain MEV. People are also interested in other Layer 1 blockchains such asCosmosin conclusion

in conclusion

MEV-Boost enables the start of a more decentralized MEV supply chain, where several different entities can participate as block seekers, builders, validators, or relayers. The dominance of Flashbots should be seen as a description of the state of Ethereum before the merger, which will take time to shake off. Despite initial concerns about network censorship and builder centralization, early data on MEV on Ethereum since the merger suggests that competition among builders is increasing and various censorship-resistant relays are slowly undercutting the Flashbots relay dominant position. However, in the absence of strong incentives to encourage competition among searchers, block builders, and relayers, there are concerns that the MEV supply chain will be dominated by a small number of knowledgeable stakeholders.

Flashbots as an organization continues to work towards the democratization of MEV, by subsidizing other relayers and open sourcing their strategy to be a powerful builder on Ethereum. Ethereum developers and researchers are working on ways to remove the trusted relay setup needed to connect builders to validators. However, there are several unresolved issues related to implementing PBS, and Ethereum core developers may prioritize other major upgrades to the Ethereum protocol, such as proto-danksharding, before PBS is implemented. As such, the Flashbots team and other new entities in the MEV supply chain are working to further optimize block building and relay technology to make it more resilient and efficient.

Original link