Researched 61 projects with more than 100 times, I found that they have these characteristics

Original source:

Original source:@Rocky_Bitcoin

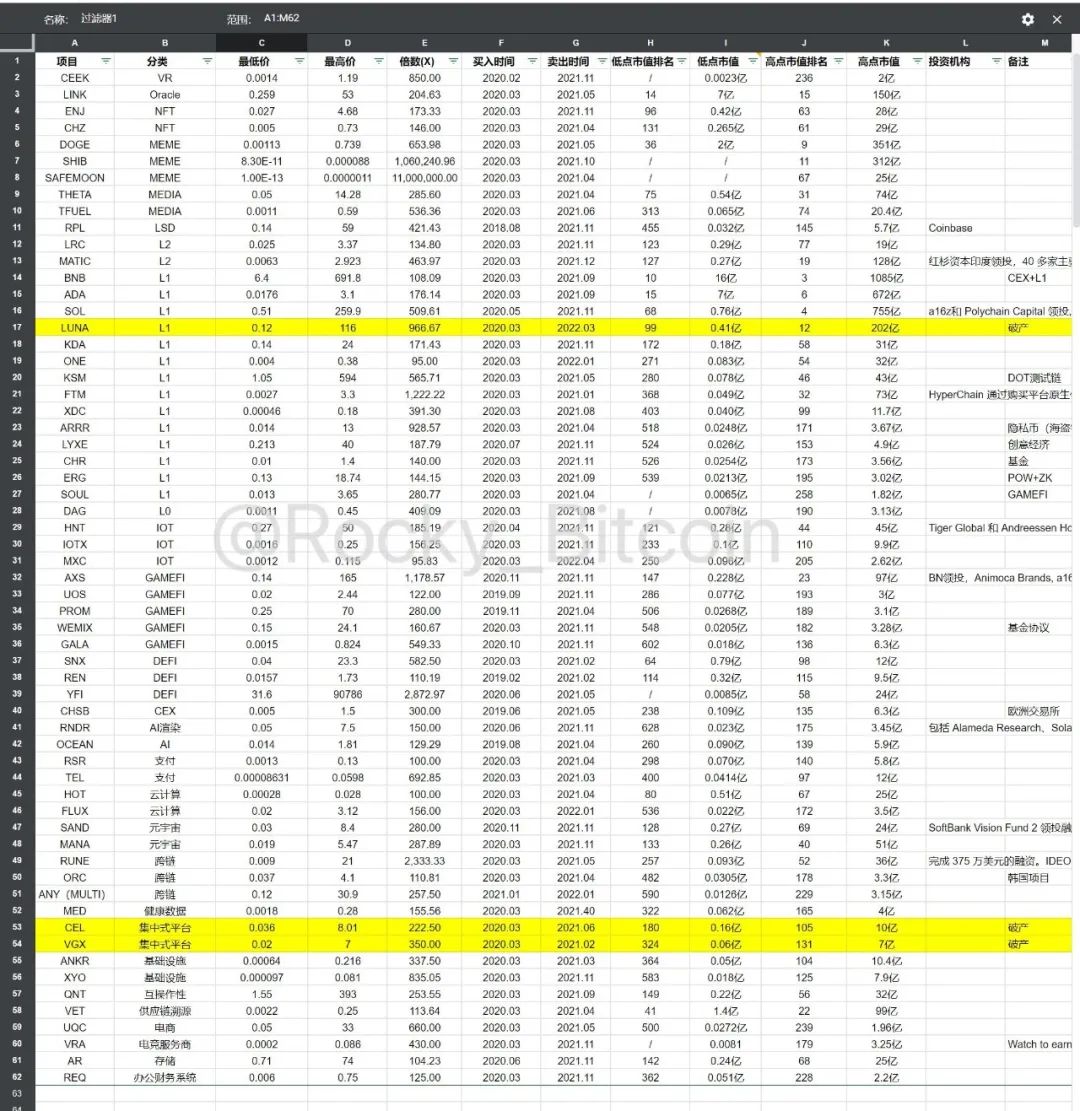

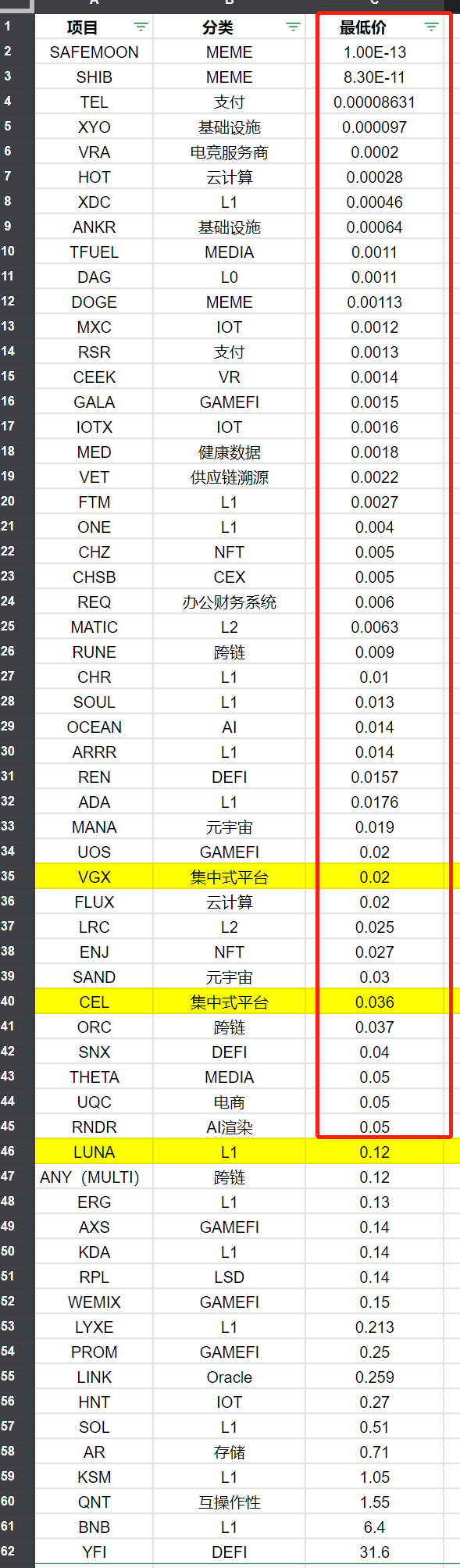

During the entire bull market cycle from 2020 (individually 2019) to 2021, among the top 600 cryptocurrencies by market capitalization, 61 projects with more than 100 times of value were born.

Today we take a look at what characteristics, attributes, and implications they have for our upcoming new cycle 2023-2025! (Due to the source of the data, there may be some discrepancies in individual data, please understand, select the species that can be purchased in the secondary market, except for the first-level)

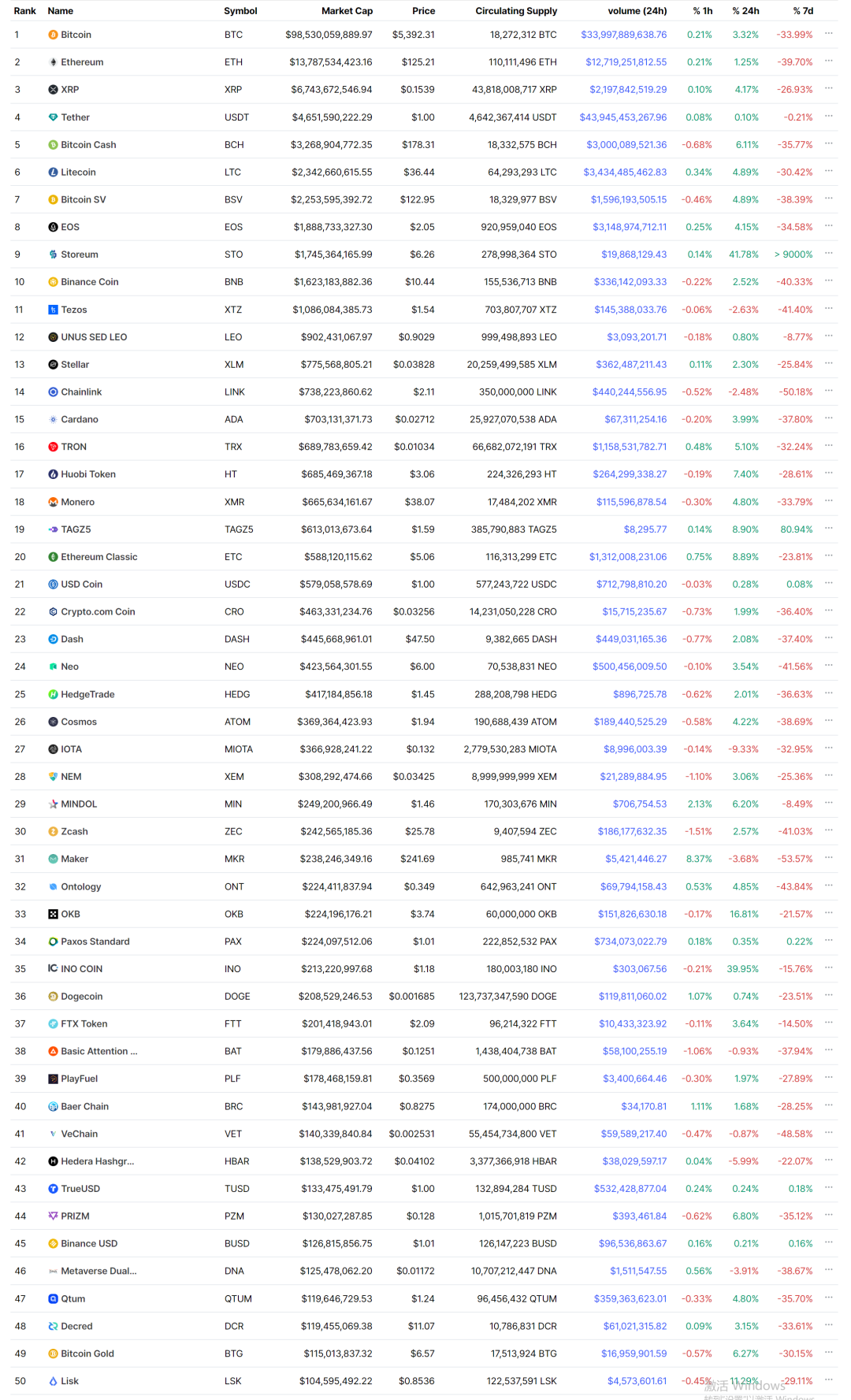

image description

Chart of the top 100 projects in cryptocurrencies, March 15, 2020

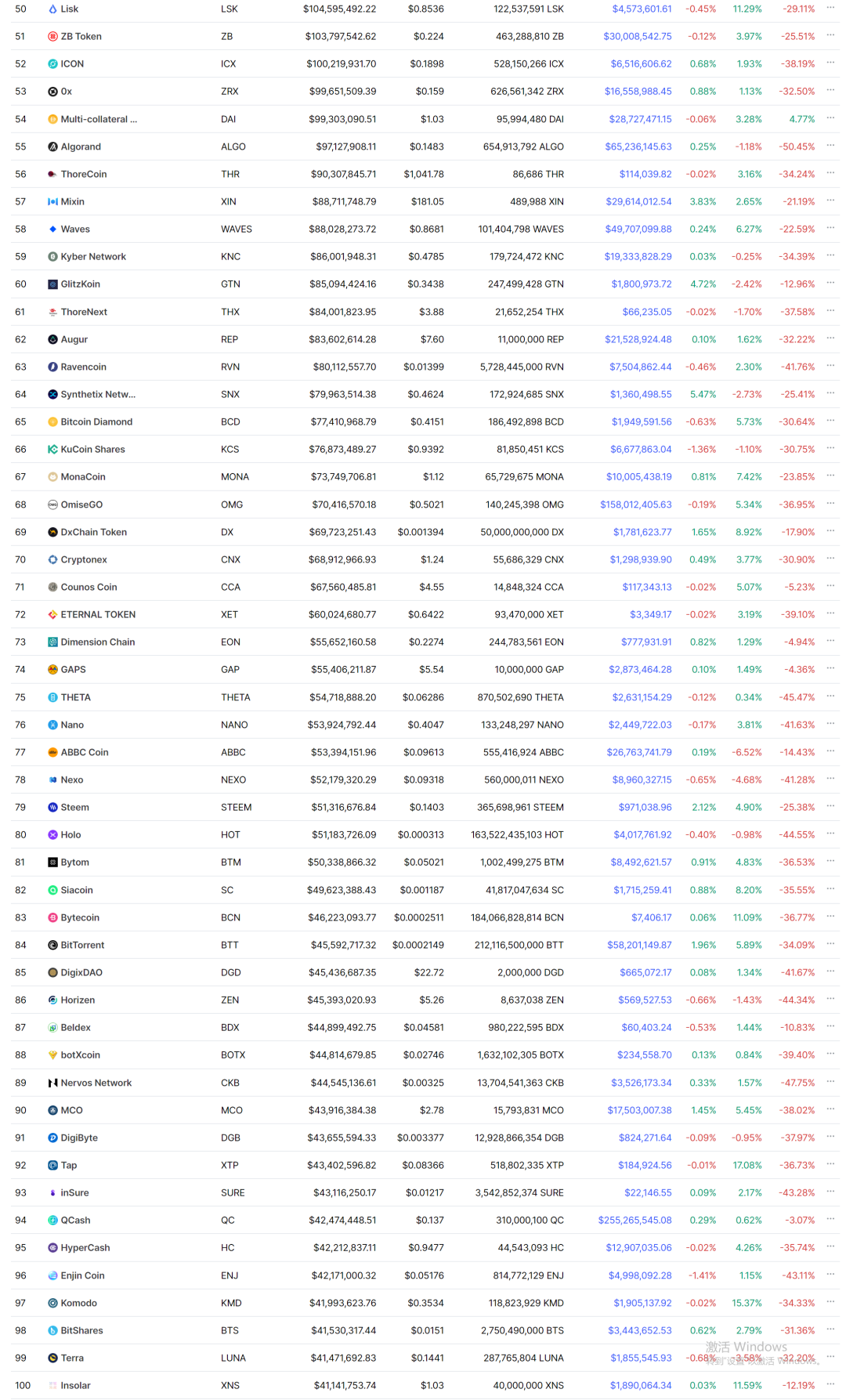

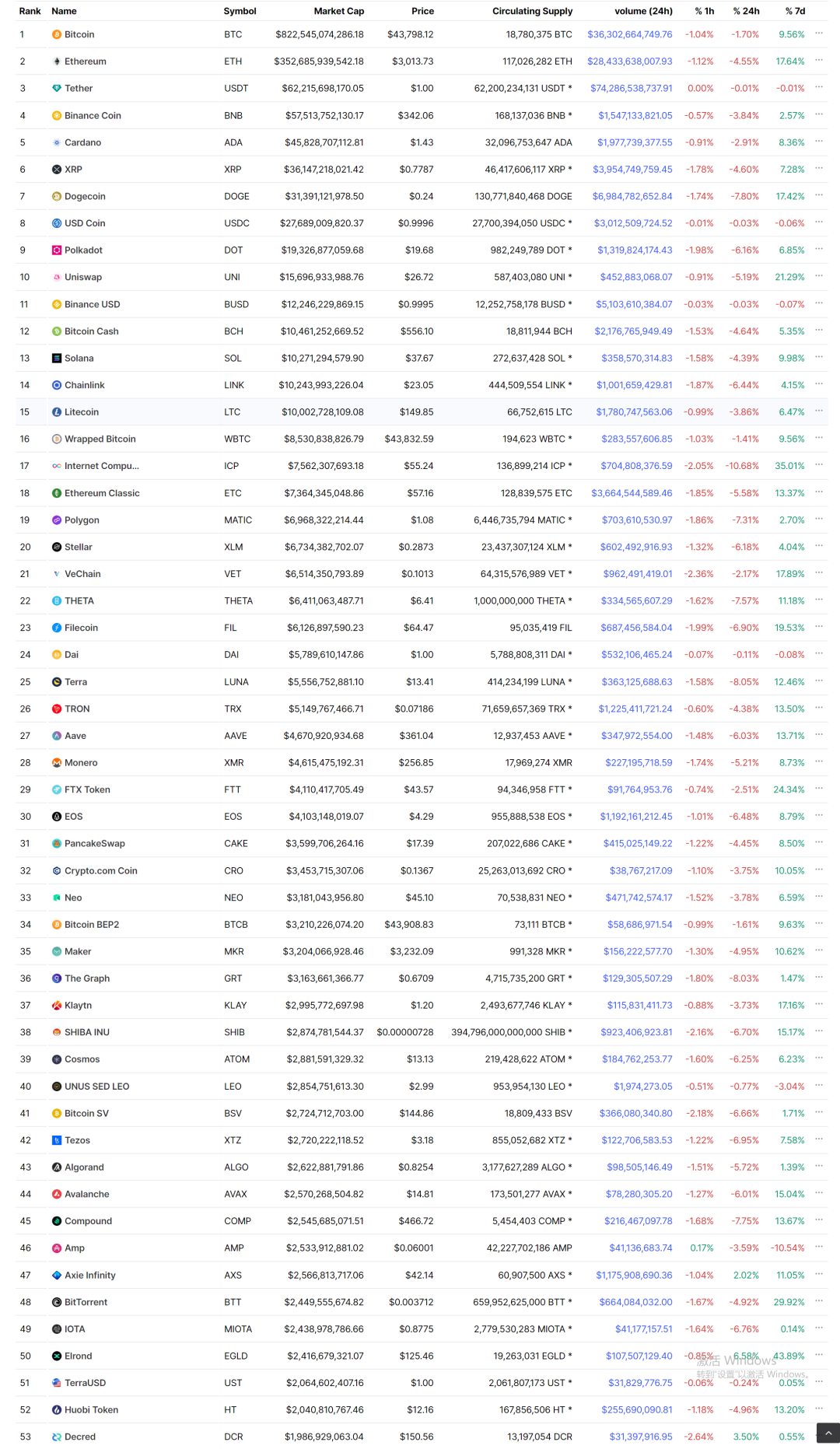

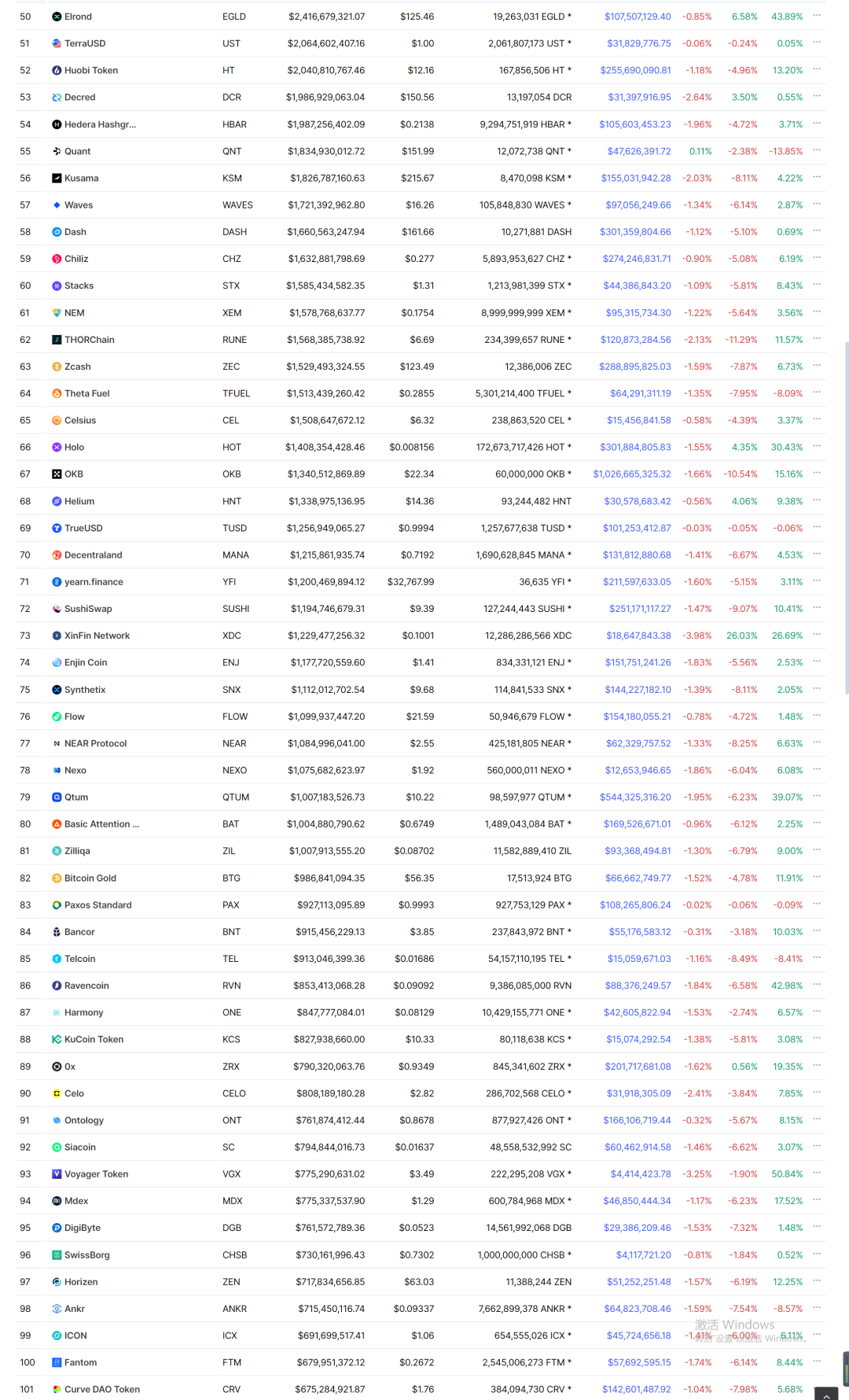

image description

Top 100 Cryptocurrency Project Charts November 8, 2021

When I was at the Securities Research Institute, Master often told us that when investing, we must have imagination, make bold assumptions, and carefully verify. In the currency circle, I think it is even more necessary to be unconstrained, often dozens or hundreds of times, and it is none other than an advanced idealist who is unconstrained.

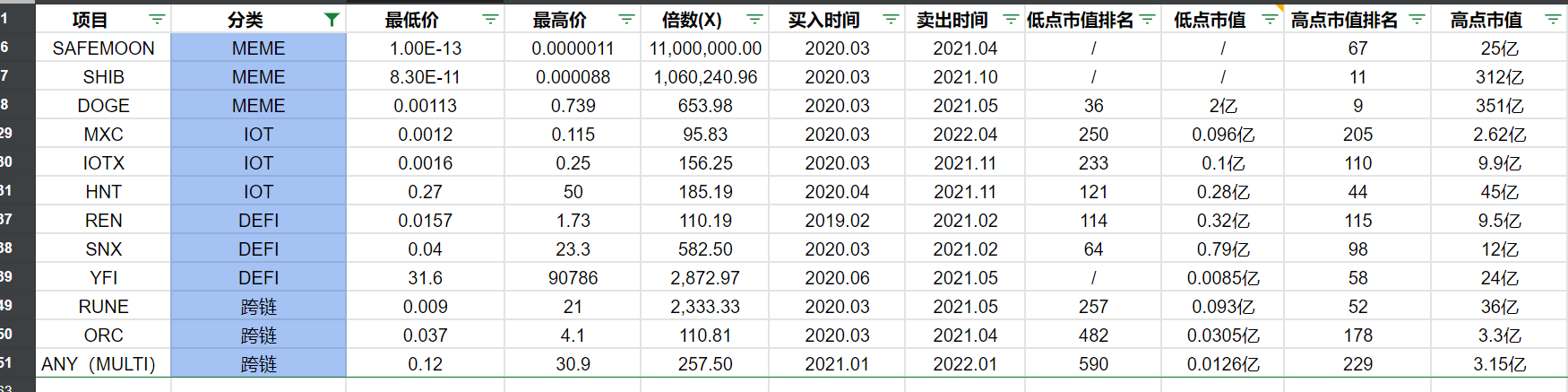

2. From the perspective of market value ranking, in March 2020, among the top 600 coins by market value, 61 100-fold coins (secondary market) were born. Among the top 100 coins by market capitalization, Baibicoin was born. There are 11 in total, accounting for 18%, namely #BNB, #LINK, #ADA, #DOGE, #VET, #SNX, #SOL, #THETA, #HOT ,#ENJ,#LUNA, the old currency has a new narrative, and it is also a new growth point. For example, BNB and BSC chains are separated from a single exchange token attribute

Among the top 100-300 coins by market capitalization, 21 hundred times coins were born, accounting for 34.4%. Among the top 300-600 coins by market capitalization, 22 were born, accounting for 36%. There are 7 more, the market cap is too low to scrape the data. So on the whole, among the top 300 by market value, a total of 32 hundred times coins were born, accounting for 10.6% of the total, one out of ten.

3. From the perspective of investment institutions, there are only 9 institutional investments that can be checked. The proportion is low. According to the main analysis, the fundraising method of cryptocurrency at that time still applied the traditional ICO logic of 17 years, and there were few institutional players. In addition, due to the limited screening logic of the secondary market, many projects had not issued coins at that time. At that time, institutions such as: #Multicoin #Polychain #Alameda #BN #A16Z also became the top capital of cryptocurrency in the later period!

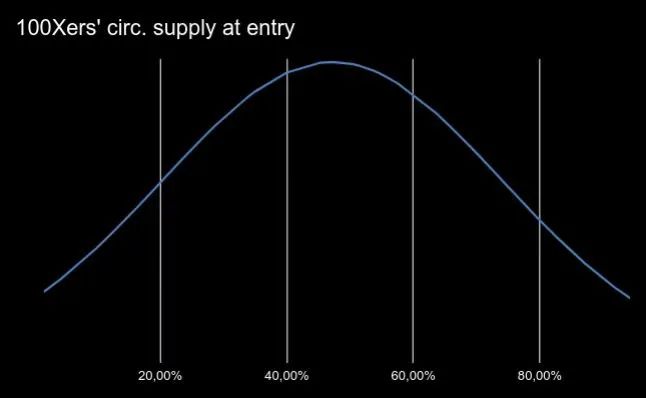

4. Judging from the unlocking circulation situation. MC is concentrated in the range of 40% -60%. It does not mean that full circulation is good, nor is it good that there is little circulation. This is a strange phenomenon that cannot be falsified. I don't have a good reason to convince myself yet (discussion welcome). The high probability is related to the time of birth, most of them were born in 18, 19, and 20 years.

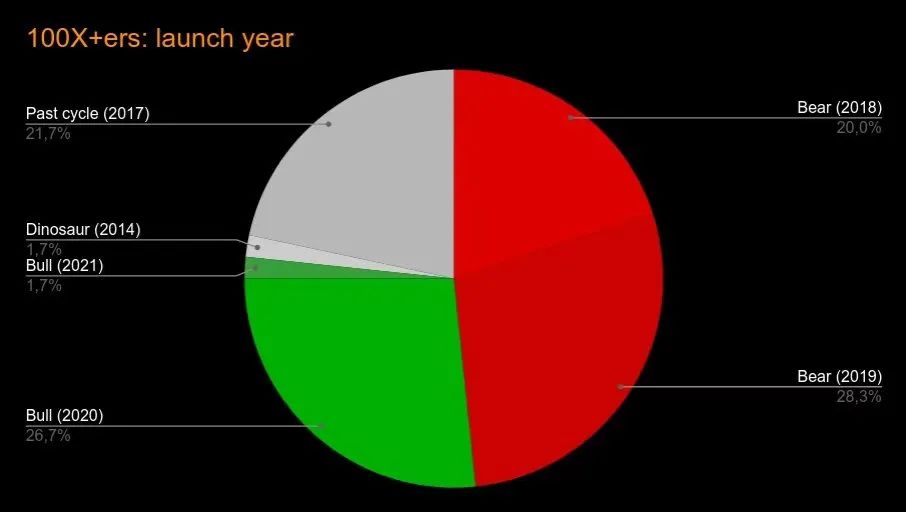

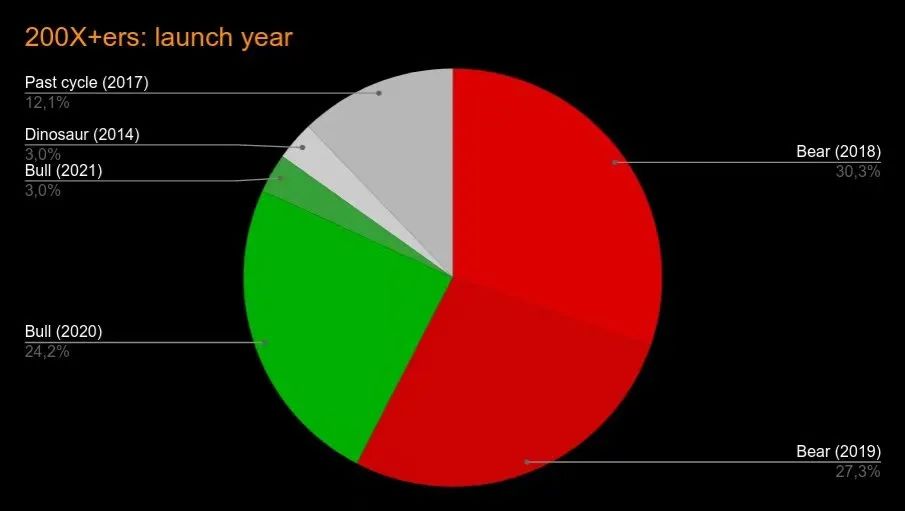

5. Judging from the establishment time of the project. Of the 100x projects, 76% were established during the 18-20 year bear market cycle, while only 24% were established before 2017 (the previous cycle). 200+ projects: 85% were created in 2018, 2019, 2020. And only 1.7% of the 100x projects were created in the late bull market (2021). So judging from this logic, more attention should be paid to projects in 22 and 23 years.

6. Judging from the unit price of tokens, people generally prefer varieties with cheap unit prices. The lower the unit price, the subjectively giving people the same unit of USDT, which can be exchanged for more project tokens, which makes people feel more fulfilled or happy . This is a strange phenomenon, but the fact is here. Might be handy for CX...

7. The best allocation time, the low point of 100 times currency is basically synchronized with the low point of BTC, and the high point of 100 times currency is basically synchronized with the high point of BTC. Judging from the current situation, the second dip, 15,000 or below 15,000, is likely to be the best time to buy Shanzhai. I expect the pie to be in the U.S. financial crisis, and the forecast low may be at 9800, but who knows. Make a good strategy and build positions in batches.

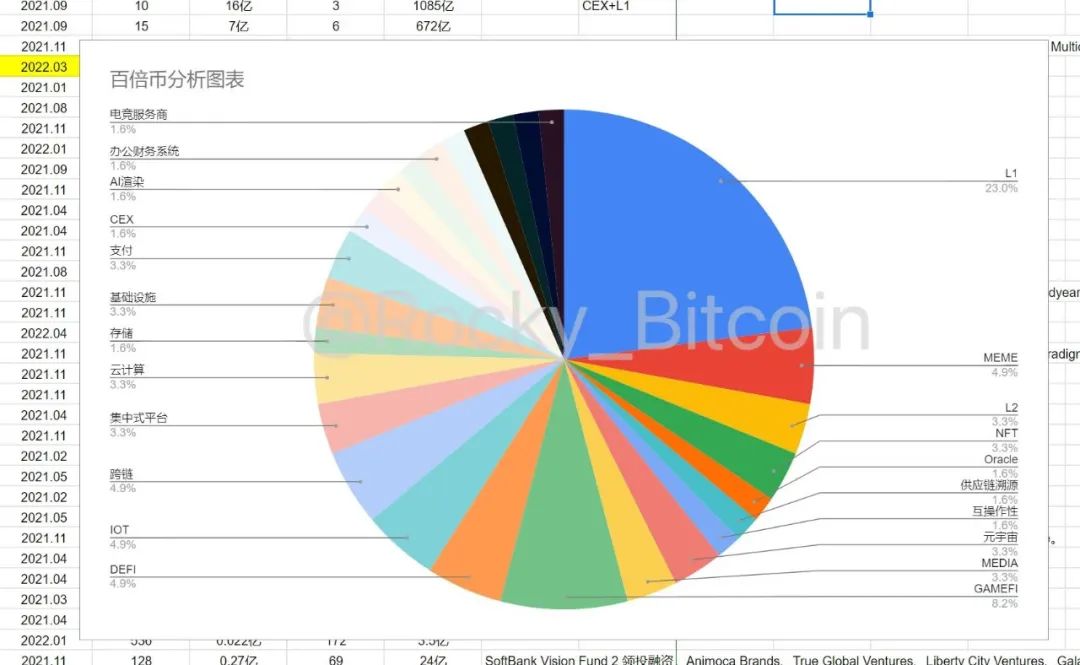

8. Track classification, the largest number of 100 times coins belongs to the public chain, a total of 17, accounting for 27.8%. Among them, there are 14 in L1, 2 in L2, and 1 in L0. Comments: In the last cycle, in order to solve pain points such as ETH expansion, TPS, and GAS fees, similar to the bull market in 2017, there was a phenomenon of contention among public chains, and many high-performance public chains such as #SOL, #MATIC, and #BNB were born. Bring prosperity to our cryptocurrency market!

From an investment point of view, investing in the public chain is the choice with the highest fault tolerance rate. There are so many ecological applications, survival and withering, but as long as the public chain grows a few super applications, it can survive for a long time, so investors flock to it. From this point of view, the probability of birth of a hundred times public chain in the future will be L2, L0, privacy public chain. It doesn't make much sense to do L1 again. Whether L2 is the current OP, ARB, or future ZK, they are all good choices

L0 solves the underlying interoperability. ATOM and Layerzero belong to this category. I used to have great expectations for DOT, mainly trusting Gavin Wood. Unfortunately, the slot has discouraged many projects and is slowly closing.

The privacy public chain has always been the direction I am very optimistic about. I have been discussing the vision of the next DEFI SUMMER, which is the prosperity of credit + derivatives. Our modern finance is based on credit. The birth of blockchain credit will amplify encryption 1000 times the size of the money market. The privacy public chain is indispensable, available but not visible.

Judging from the current financing of hundreds of millions of private public chains, it can be seen.

At present, I am more optimistic about two, one is #ALEO (unissued currency), ZK technology, and a well-established infrastructure, including its own development tools. The other is #ROSE, TEE technology, Professor Song's project, in fact, the essence is to invest in people.

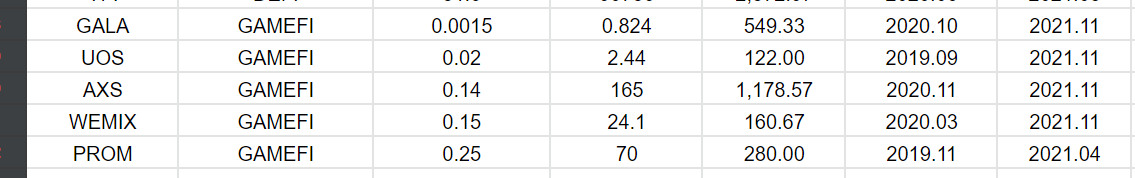

9. The second largest number of 100-fold coins belongs to GAMEFI, with a total of 5, accounting for 8.2%. GAME has always been a battleground for traditional WEB2 military strategists, with Tencent and NetEase before it and Mihayou later. This track is the most profitable, but also the most traffic. At the same time, it is also the best educational tool for cultivating users outside the circle to enter WEB3. Only when there are many people with strong consensus and the market value of cryptocurrency continues to reach new highs, can institutions cash out at a better price and leave the market. Therefore, institutions are also willing to invest, which is naturally a hot spot among hot spots.

For the game track, there are super applications, such as #AXS, #GMT, and game public chains, such as #IMX, #RON. There are those who do the entire game ecology, such as #GALA, #MAGIC. There are many paths to choose from. This track is likely to be the field with the most 100-fold coins in the next cycle. Here are a few high-probability 100-fold currency game varieties in the next cycle, you can private message me.

research reportIt's worth a look.

10. The third in the number of 100 times coins belongs to cross-chain, IOT (Internet of Things), DEFI, MEME coins. There are 3 respectively, accounting for 4.9% respectively. In terms of these directions, there is a high probability that the Internet of Things will have nothing to do in the next cycle. Cross-chain is just needed. There will definitely be one or two kings. The correlation between addresses, the ability to capture giant whales. This can be expanded later, combined with tools

DEFI should also be the top three track for generating 100 times coins in the next cycle. Among them, I focus on: the direction of derivatives in DEFI, the direction of algorithmic stable coins, the direction of credit, NFT lending, NFT liquidity, and CRV ecology. Fortunately, these projects have emerged and are growing, so it is worth looking forward to.

11. Due to space reasons, more detailed data analysis and charts will not be repeated here. Thanks to our team, thanks to the encryption partners and communities online, let’s discuss together.