How can tokenized RWA bring new revenue opportunities to DeFi?

This article comes from Forbes, the original author: Leeor Shimron, compiled by Odaily translator Katie Koo.

secondary title

What about real-world assets recently on-chain?

Over the past few months, traditional funds and asset issuers have launched plans to tokenize other assets via public crypto networks. This not only boosts interest in bringing real-world assets (RWA) on-chain, but also creates new opportunities for DeFi earnings.

Likewise, the Monetary Authority of Singapore (MAS) announced Project Guardian, a pilot program to tokenize bonds and deposits that can be used in various DeFi strategies. Banks participating in the project will be able to tokenize bonds and deposits that can be used in permissioned liquidity pools. These funds can be lent out to earn interest on DeFi apps like Aave and Compound, or used as collateral to access credit. The pilot project has already enlisted JP Morgan, DBS Bank and Marketnode as partners.

secondary title

DeFi's native income bear market is cold, turning to tokenized RWA

Since the first DeFi protocols started gaining traction in 2020, they have been a driving force in attracting users and traders to the cryptocurrency space. Experiments in DeFi offer innovative financial applications such as decentralized automated market makers (AMAs), stablecoins, loans, insurance, cross-chain bridges, synthetic assets, and derivatives.

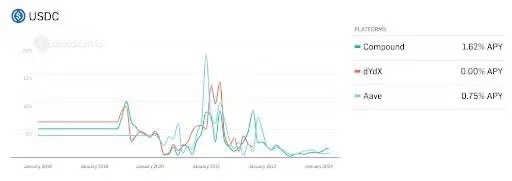

During the 2022 bear market, returns are discontinuous as general user interest in cryptocurrencies wanes as token prices fall. Historical lending rates for the stablecoin USDC peaked in December 2020 at 18% for Aave and 8% for Compound. Currently, the yields on the two bonds are down to 0.75% and 1.62%, respectively.

image description

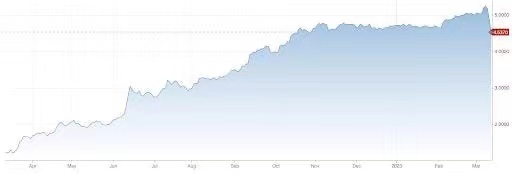

With one-year U.S. Treasury yields around 5%, investors flocked to the safety of government bonds. Treasury yields have exploded as the Federal Reserve (Fed) abandons its zero-interest-rate policy and one-year Treasury yields rise from 0.3% in December 2021.

image description

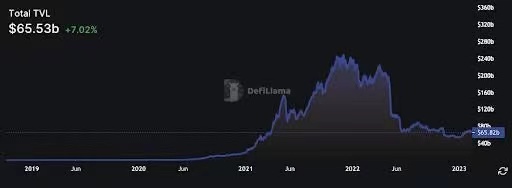

With traditional finance’s risk-free rates rising and DeFi yields falling, investor participation in DeFi has shrunk significantly in recent months, with TVL down 73% from its December 2021 high to the current $66 billion .

image description

DeFi’s TVL has been declining since peaking in 2021. (Source: DEFELLAMA)

In order to attract new capital, DeFi protocols began to use RWA as collateral or a source of new investment opportunities, providing investors with more consistent returns.Since 2018, the tokenization of real-world assets such as real estate, commodities, private equity and credit, bonds and art has been creeping into our lives. Formerly known as “security tokens” or “tokenized securities,” tokenized RWAs leverage blockchain technology to bring traditional assets on-chain.Tokenized RWA offers tangible benefits including lower investment minimums and increased access through fractional ownership, increased trading of previously illiquid assets, enhanced transparency and security.

Because there is an immutable transaction history on the blockchain, as well as automated ownership management.

Sidney Powell, CEO and co-founder of Maple Finance, noted: “Tokenized RWA benefits DeFi because it can serve non-crypto-native businesses and customers. As long as we only accept Bitcoin or Ethereum as collateral, DeFi lending is capped. Being able to accept tokenized real estate or corporate property as collateral reduces risk for crypto lenders and investors, making DeFi accessible to real-world businesses.”

DeFi lending is also down. (Source: RWA.XYZ)

secondary title

How can DeFi go further on the road of tokenized RWA?DeFi must offer higher yields than traditional investments in order to remain competitive and attract capital.

DeFi applications such as Maple Finance, Goldfinch, and Centrifuge raise funds from cryptocurrency holders and lend them out through various strategies to generate yield.

Maple Finance is a platform for institutional borrowers to take advantage of the DeFi ecosystem to obtain undercollateralized loans. Pool representatives are the credit professionals on the platform responsible for insurance underwriting and managing pools, who source institutional borrowers and set the terms for each loan pool. Lenders can then deposit crypto funds into pools they wish to back, lending assets in exchange for yield. To date, Maple has provided nearly $1.8 billion in loans.

Goldfinch focuses on lending to real-world businesses in emerging markets. Borrowers must be audited to determine if they qualify for a loan. Once approved, they can create pools and determine loan terms such as interest rates, loan amounts, terms, and late fees.

Lenders can choose to fund higher returns by funding the first pool of individuals who suffer capital losses on impaired loans. Alternatively, liquidity providers can provide capital that is distributed across a pool of all borrowers, resulting in lower yields while mitigating the risk of capital loss.

(Note: Impaired payment provision is a reserve drawn by commercial banks to offset loan risks that cannot be recovered by the bank. It is a provision for bad debts that cannot be recovered after the bank releases goods to customers.)

Tokenizing real-world assets could give DeFi access to some of the largest financial markets. Global real estate is worth $327 trillion in 2020, and non-financial corporate debt exceeds $87 trillion in 2022. These are huge markets for which tokenization can bring higher liquidity and new investors.

secondary title

How can investors grasp the income opportunities of tokenized RWA on DeFi?When evaluating yield-generating opportunities, investors should look at the track record of existing DeFi applications leveraging real-world assets. Find out if they have ever experienced a default, learn about their insurance coverage, due diligence process and how they manage risk.

As development continues, those insurance underwriters that require borrowers to overcollateralize (overcollateralization) and have access to insurance or support mechanisms in the event of default are likely to perform best.

Notably, Maple Finance has $36 million in defaulted loans in a pool for December 2022. Borrower Orthogonal Trading suffered losses from the collapse of FTX. In response, Maple has launched version 2.0, which introduces a more immediate default and liquidation process for non-performing loans. This shows that for low-collateralized DeFi lending platforms like Maple, borrowers need better risk parameters and industry diversification options.