"Chain finance" or complete decentralization? This article discusses the development path of DeFi after USDC is unanchored

Original title: "The USDC Depeg Implications on DeFi: Two Paths Forward"

Author: Igans

Original compilation: Frank, Foresight News

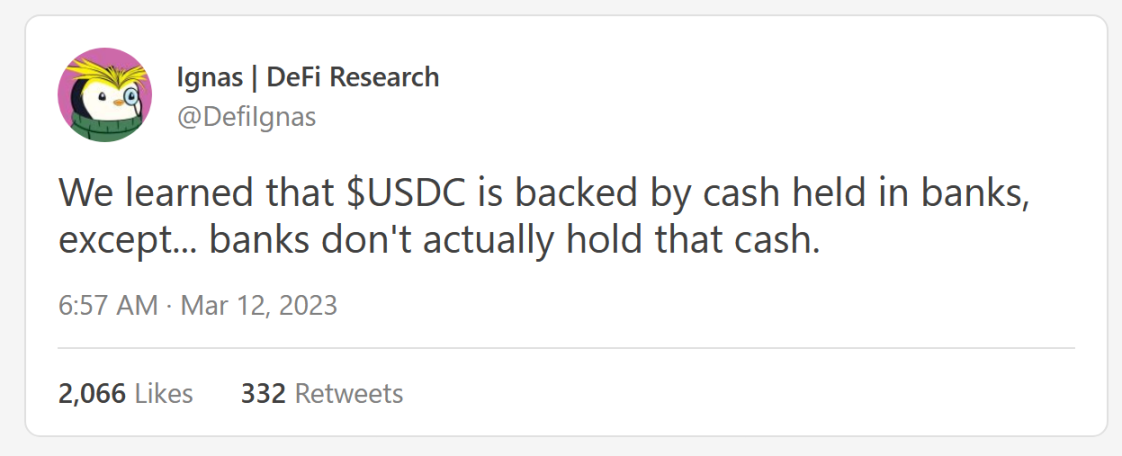

The unanchoring of USDC has aroused major concerns and doubts in the market about the future development of DeFi. As the DeFi ecosystem relies heavily on USDC, it is critical to evaluate potential future solutions.

I think we have two paths for the DeFi community to choose:Redefine DeFi as "on-chain finance",orFully Embrace Decentralization。

1: Rename DeFi as “On-Chain Finance”

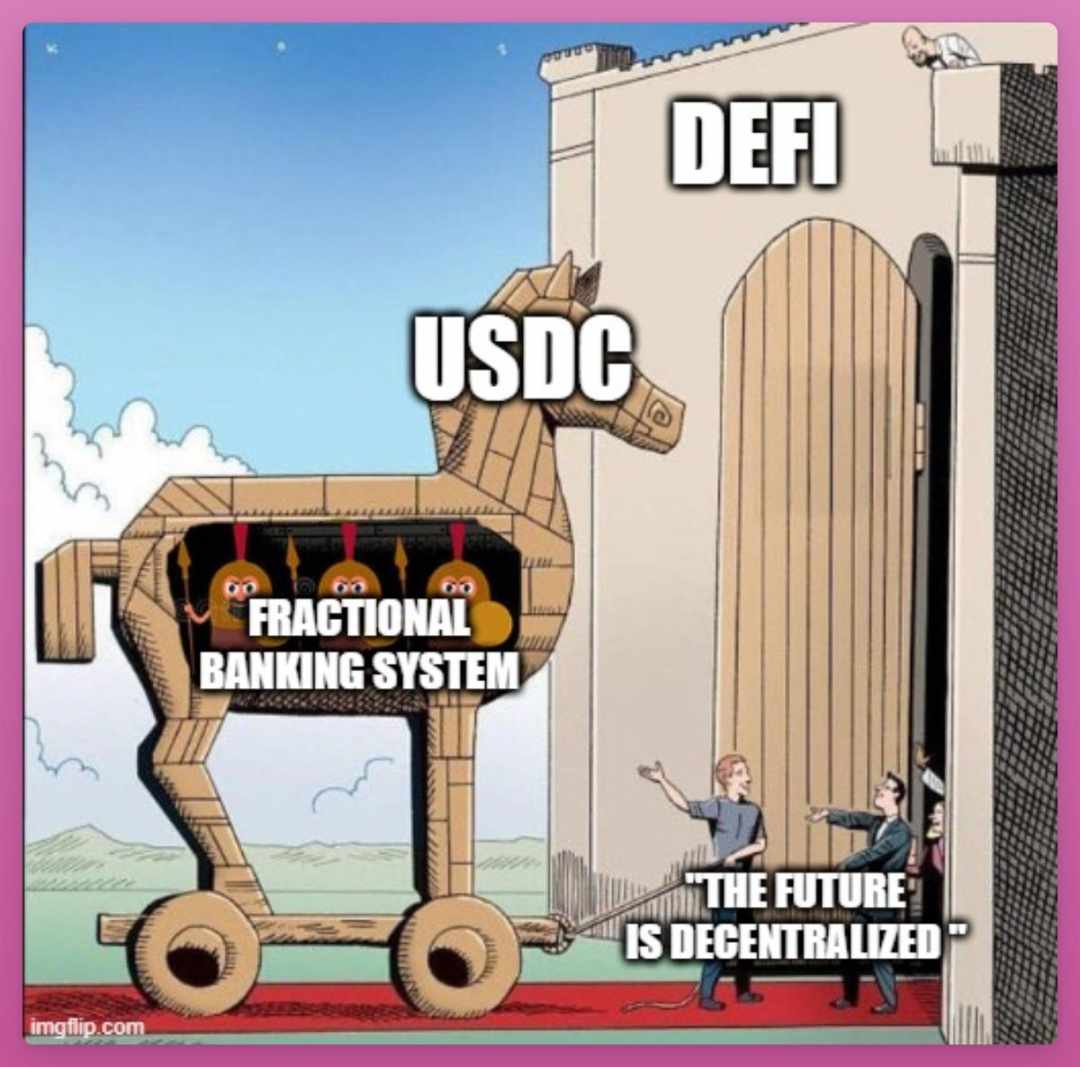

DeFi relies on centralized components like stablecoins, oracles, and Web2 infrastructure, making it vulnerable to potential government crackdowns.

USDC itself is considered the safest collateral, so that Compound v2 directly locks the value of USDC at $1.

Now we realize thatTrust in USDC ultimately depends on trust in traditional financial banking systems and governments.If governments really want to shut down (most of) DeFi, they can.

Right now, DeFi is meant to be decentralized and trustworthy at every level, soEven one centralized component can affect the security of the entire protocol.

So by renaming DeFi as “on-chain finance,” the industry can acknowledge centralization while maintaining key advantages such as self-regulation, increased liquidity, composability, and a single source of data (irreversible transactions).

The benefits of "chain finance" will become more and more obvious:

Increased liquidity (expansion of the buyer's market);

Enhanced composability (new financial products);

Single source of data (lower reconciliation costs);

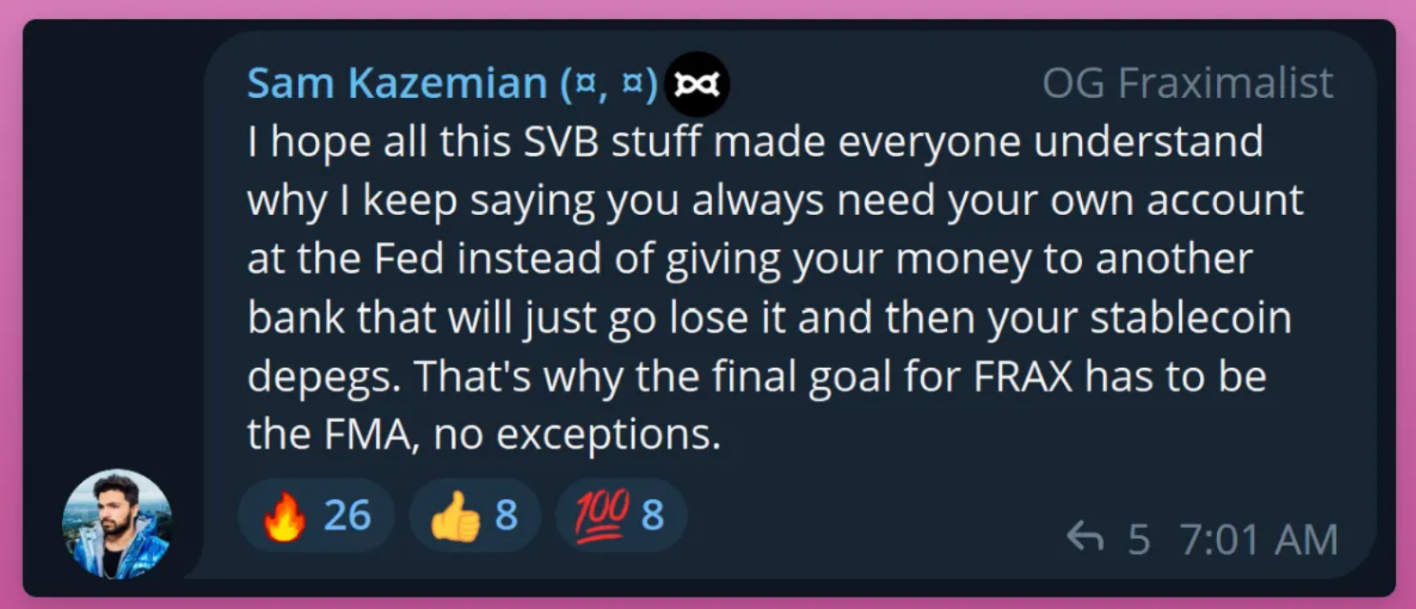

Examples like FRAX show that projects can move in the direction of "on-chain finance" without fully embracing decentralization:

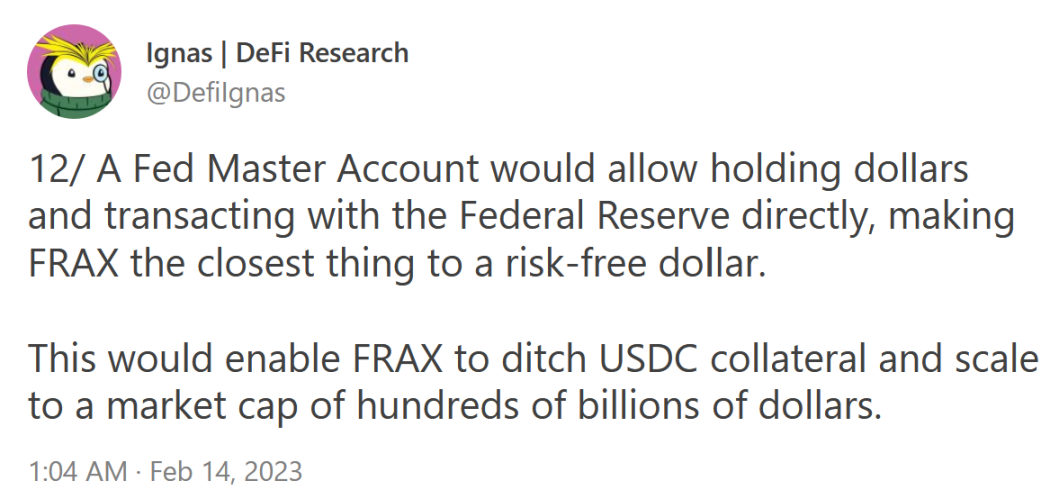

Frax Finance aims to be as close to the Fed as possible by applying for the Federal Reserve Master Account (FMA)(Foresight News note, the Fed’s master account allows holding dollars and trading directly with the Fed), thus getting rid of the limitations of using USDC as collateral and the risk of bank failure, and expanding the market value to hundreds of billions of dollars, making FRAX the closest Risk-free dollar stuff.

this meansEven with some centralized components, projects like FRAX can still benefit from DeFi infrastructure.

This is because the DeFi ecosystem can maximize a trustless environment, thereby minimizing the need for human intervention.

Take Uniswap as an example: its code is designed to be immutable, which allows assets like FRAX to be traded on-chain without any censorship.

It’s worth noting, however, that Uniswap’s user interface is still centralized and therefore vulnerable to regulatory pressure.

this highlightstherefore,

therefore,All elements and protocols of DeFi may never be fully decentralized or censorship-resistant,Therefore, viewing tokens like USDC as risky assets and DeFi as "on-chain finance" can help resolve this confusion and moral dilemma.

Two: Embrace complete decentralization

The second option is for the DeFi community to remove the centralization elements and become as decentralized as Bitcoin.

This would involve replacing USDC with censorship-resistant collateral like Bitcoin or Ethereum, with projects such as Liquity's LUSD, Maker's DAI, and Tornado Cash being prime examples of efforts in this direction.

Liquidity's LUSD

Liquity's LUSD is a typical project taking a more decentralized approach.

During the USDC crash, LUSD demonstrated its value as a safe-haven asset, providing stability amid market turmoil, much like the Swiss franc in the current traditional financial system.

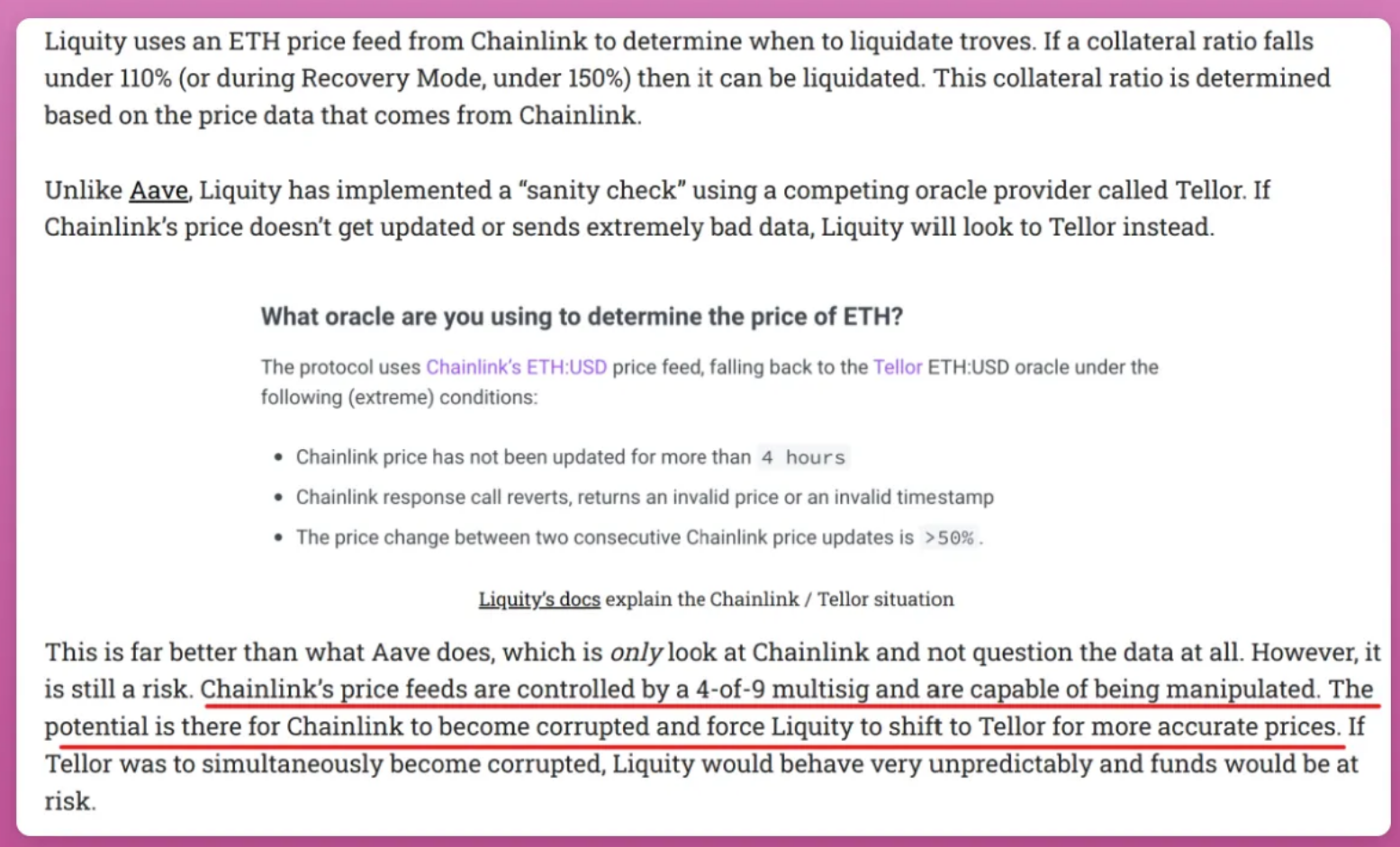

However, we must realize thatEven LUSD, with its decentralized nature, relies on price oracles that can be manipulated in extreme cases.

This highlights the ongoing challenges and complexities facing DeFi projects in their pursuit of full decentralization while ensuring security and reliability for their users.

Maker's DAI

MakerDAO's vision for DAI is to build it into a fully decentralized and fair global currency.

To achieve this, Maker intends to phase out the use of easily seized collateral such as USDC to ensure greater resilience and a safer foundation for the currency,This requires it to abandon the exchange rate system anchored to the US dollar when necessary.

The recent alarm bells have sounded in the DeFi ecosystem due to its heavy reliance on USDC, prompting MakerDAO to accelerate the realization of this mission.

Tornado Cash

Tornado Cash proves that achieving full decentralization is possible, albeit at a high cost.

A successful privacy tool, Tornado Cash obfuscates transaction data for senders and receivers, and its Total Value Locked (TVL) has reached $247 million.

Unfortunately, this level of decentralization was costly for the project’s developer, who ended up facing jail time for alleged money laundering.

The High Cost of Decentralization

The case of Tornado Cash raises key questions for the DeFi ecosystem:

Are the founders willing to take the risks that come with complete decentralization?

Would users be willing to interact with a fully decentralized application if complete decentralization would put their wallets at risk of being blacklisted?

While not every DeFi DApp will be viewed as a threat by regulators, the possibility of regulator intervention remains a perpetual problem facing the industry. In fact, the recent crackdown on stablecoins is pushing DeFi toward decentralization.

With the continuous development of the DeFi field,Striking a balance between decentralization and compliance is critical to the long-term success and sustainability of these projects.

The "D" in DAO

For example, imagine if the US government demanded that DAI be blacklisted.

So how will Decentralized Autonomous Organizations (DAOs) such as Curve, which allows the creation of permissionless liquidity pools, respond to this request, and Aave?

Faced with this dilemma, will Curve DAO choose to block DAI at the smart contract level or risk being blacklisted?

Finding a balance in the fully decentralized DeFi space is no easy task, and projects must carefully balance their commitment to decentralization with the need to address potential regulatory challenges and maintain a sustainable ecosystem.

The Two-Way Future of DeFi

In fact, there is a third option for the entire DeFi ecosystem.

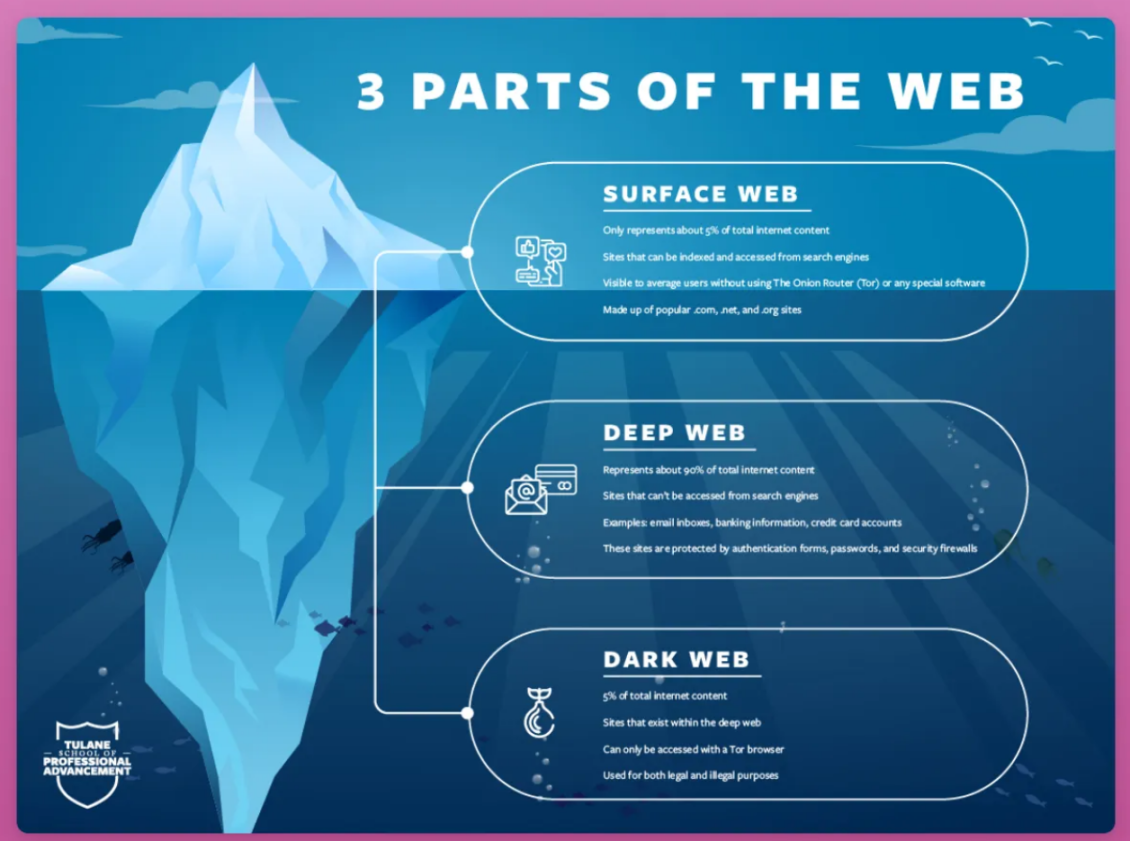

DeFi may develop in two directions at the same time like the current Internet:While most users access the internet through regulated services, privacy-seeking individuals can use the dark web for increased anonymity.

DeFi protocols may have varying degrees of decentralization and regulatory compliance.

For example, the Uniswap interface may be censored, blocking access to specific tokens, but the community can create its own user interface because the code is immutable and non-discriminatory.

the future of finance

The recent USDC crash sounded the alarm for the DeFi community, because the risks originate from traditional financial banks. This incident made people clearly realize that,DeFi is not as decentralized as we once imagined.

But the term "DeFi" is already deeply rooted in the hearts of the people, and it is unlikely to be easily replaced.

despite this,DAOs must stop perpetuating the illusion of complete decentralization,And start acknowledging the reality of the situation.

In fact, although we continue to use the term "DeFi", we should realize that it more accurately represents the concept of "on-chain finance", which includes both elements of decentralization and centralization.

Original link

![Axe Compute [NASDAQ: AGPU] completes corporate restructuring (formerly POAI), and Aethir, an enterprise-grade decentralized GPU computing power, officially enters the mainstream market.](https://oss.odaily.top/image/2025/12/12/ff08e068a361495da15f80b89405441e.jpeg)