The U.S. regulation strikes hard, can D5 Exchange find a new way out for encrypted natives?

Gemini, Kraken, Coinbase, and Paxos, all once-familiar leading encryption companies that flaunt compliance, are being ruthlessly suppressed by U.S. regulations. But this is not the end, just the beginning of the US SEC's regulatory enforcement actions under the leadership of Gary Gensler.

More and more centralized platforms will come under greater scrutiny over time. For crypto users, turning to decentralized exchanges (DEXs) is a general trend. However, DEX has long had many problems such as insufficient depth, poor liquidity, impermanent losses, high Gas fees, and poor trading experience, which have greatly hindered the migration of encrypted users.

D5 Exchange The emergence of , may be able to find a new way out for encrypted users under the general trend of supervision. D5 Exchange

first level title

1. New trends in 2023: CEX declines, DEX rises again

What is the biggest trend in the encryption industry in 2023? A basic consensus is:With the decline of the centralized financial platform (CeFi), decentralized finance (DeFi) once again ushered in new development opportunities, and the core of DeFi is DEX——DEX is also known as the cornerstone of DeFi, and it is bound to become the most popular in 2023. Hot track.

The decline of CeFi (especially CEX) and the rise of DeFi (DEX) are not aimless, but just the general trend. CEX's own transparency issues and tightened supervision are the fundamental driving forces behind the development of DEX.

In November last year, the encrypted trading platform FTX was finally hit by a storm due to misappropriation of user assets. Hundreds of thousands of users (creditors) were forced to enter the bankruptcy court, looking forward to the early completion of FTX's bankruptcy liquidation. The FTX incident has reduced the trust of centralized trading platforms to a freezing point, and DEX has become the best solution for crypto users in times of low transparency in the industry by virtue of its features such as permissionless trust and self-custodial assets. According to The Block data, the total transaction volume of DEX in November last year reached 65 billion US dollars, a month-on-month increase of 93%.

After FTX, Gemini, an American compliance platform, was also sued because of the EARN income product storm, and nearly 340,000 users had difficulty recovering their investment funds, which once again reduced the trust of CEX. After this year, US regulation hit the CeFi platform again, and many CEXs became targets again, making the situation worse.

On January 13, the U.S. SEC sued Genesis and Gemini, alleging that a $900 million encrypted asset loan program of the two companies violated investor protection laws; Kraken paid USD 30 million to reach a settlement; on February 12, the SEC took action against Paxos, claiming that the stablecoin BUSD issued by it was an unregistered security, and eventually BUSD stopped issuing additional tokens and started redemption.Reuters reported that Coinbase and Binance will be the targets of the SEC's next crackdown.

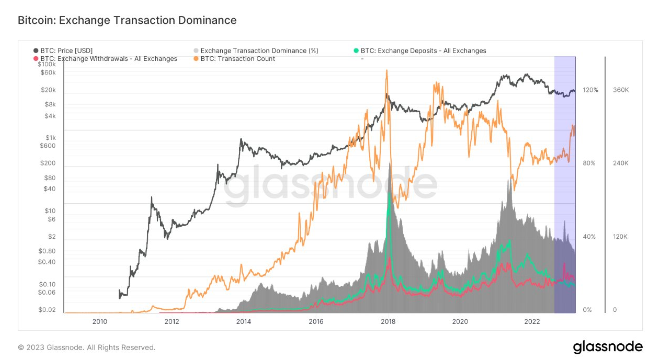

In fact, with the SEC's frequent attacks, the development of centralized platforms, especially CEX business, has encountered obstacles. In order to avoid regulatory risks, crypto users started to move crypto assets from CEX to the chain. According to Glasnode data, Bitcoin withdrawals on centralized exchanges have been higher than deposits since November last year, indicating that more users prefer self-custody assets.

first level title

2. D5 Exchange's three tricks: hybrid trading model + aggregated liquidity + ultimate user experience

Although the future of DEX is bright, judging from the current transaction volume, it is still difficult for DEX to compete with CEX. According to a recent report from crypto data firm Kaiko, Coinbase has traded more than $185 billion so far this year, nearly double Uniswap's $93 billion.

Why can't DEX surpass CEX? Poor liquidity, insufficient depth, low matching efficiency, high gas fees, impermanent losses, etc. are all important barriers that hinder users from migrating from CEX to DEX.secondary title

(1) D5 Exchange Hybrid Trading Model: AMM+Order Book Model

As a DEX, the first problem to be solved is liquidity. At present, the two most common DEX transaction execution models are the order book model and the automatic market maker (AMM), both of which have their own advantages and disadvantages.

The advantage of AMM is that it can facilitate transactions in illiquid markets, quotes are always available, traders can close (complete) orders without waiting to match with any counterparty, and save Gas, transactions can be completed in one transaction; the disadvantage is that if There is insufficient liquidity in the pool, large traders will suffer from significant slippage, LPs may suffer impermanent losses, and capital utilization is inefficient, and most transactions can only be executed within a certain range. Most of the early DEX products such as Uniswap and Balancer adopted the AMM model.

The advantage of the order book model is that a trader can place a limit order and wait for it to be filled at the desired price; Traditional finance and CEX are widely used and are more acceptable to individual and institutional investors. The disadvantage is that large orders must be executed multiple times to fully complete the transaction, and the gas cost is higher. Representative order book models are dYdX and Injective.

It can be said that both AMM and order book have their own characteristics and application scenarios. The best way is to combine the two to achieve complementary advantages.D5 Exchange is the first aggregator to combine order book and AMM functionality. In the vision of D5 Exchange, AMM is more suitable for stable currency transactions, without problems such as slippage and impermanent loss, while the order book is suitable for other volatile encrypted asset transactions.

While achieving internal liquidity, the D5 Exchange automatic router can also aggregate the liquidity of other external DEXs such as Uniswap (V2+V3), Curve, and provide the best exchange rate, and eventually become the king of the most liquid DEX in the Ethereum ecosystem .

secondary title

(2) Innovative order book dual model algorithm: GMOB+GPLM

The order book technology behind D5 Exchange comes from Gridex Protocol, which is the first decentralized trading platform built on Gridex Protocol, and Gridex Protocol is currently the only one that supports running order book protocols on the Ethereum chain.

It is worth noting that Gridex abandoned the central limit order book (CLOB) commonly used by centralized platforms, but created a new order book model called Grid Maker Order Book (GMOB). The fundamental reason is that when CLOB is deployed on the chain, it needs to consume a lot of resources. In order to solve this problem, dYdX and other currently used CLOB platforms are all semi-centralized, that is, matching transactions off-chain and synchronizing results on-chain, but this method has certain systemic risks and is also contrary to the essence of DeFi .

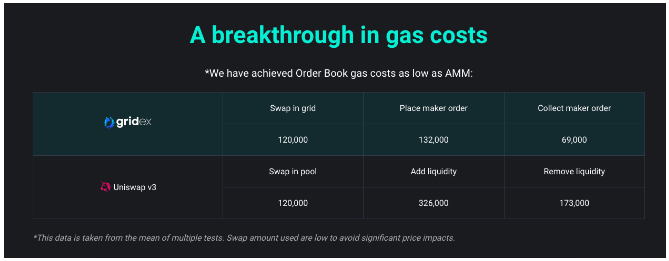

In order to realize the prospect of decentralization, Gridex invested a lot of energy to overcome difficulties, and finally launched GMOB, and used the "Grid Price Linear Movement" algorithm (Grid Price Linear Movement, GPLM). The GMOB model is based on L1 chain transactions, which is a huge improvement compared to many DEXs that are L2 or even off-chain matching. In addition, after using the GPLM algorithm, even if all transactions are on-chain, the Gas consumption of Gridex Protocol is at the same level as that of Constant Function Market Maker (CFMM), which will not impose higher cost burdens on users, and will not affect transaction settlement efficiency . According to calculations, the Gas level of Gridex Protocol is basically the same as or even lower than that of Uniswap, which uses the AMM mechanism, whether it is a pending order, a taker, or a transaction.

secondary title

(3) Ultimate user experience

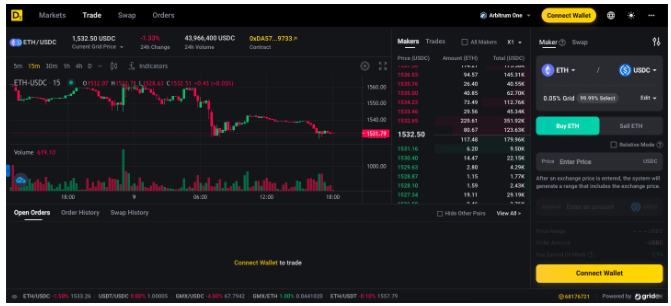

The founder of Ethereum, V God, stated in a recent journal article that user experience is the key reason why many Ethereum users often choose centralized solutions instead of decentralized alternatives. "A simple and powerful UI is better than a fancy and sleek UI. Also, most users don't even know what a gas limit is, so we really just need better presets."

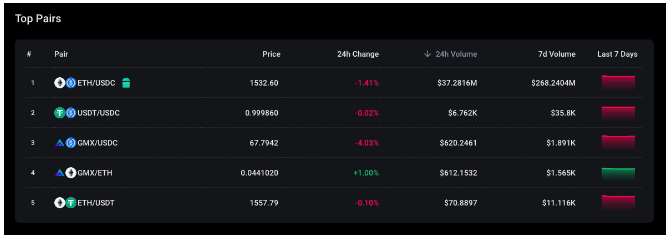

From the perspective of user experience, the product design of D5 Exchange is not much different from that of the centralized platform. The page is simple, and users can directly trade after connecting the wallet. The entire operation experience is very smooth, and there is no slippage during the transaction.

3. Conclusion

3. Conclusion

D5 Exchange adopts the combination of AMM and order book mode, which has forward-looking significance for promoting the development of the entire DEX track. Of course, D5 Exchange is not a panacea. There are still many problems to be solved in the entire DEX track, which requires the joint efforts of industry builders. As pioneers, D5 Exchange and Gridex Protocol are contributing to the development of DeFi.