Analysis of gtcETH: Perhaps the most "politically correct" LSD product

In the early hours of March 8, the decentralized donation platform Gitcoin officially announced the details of its liquid collateralized index token Gitcoin Staked ETH Index (gtcETH) jointly launched with the index protocol Index Coop on its official website, and in the accompanying official website article gtcETH transactions and minting on Index Coop are disclosed infront end。

secondary title

The most "politically correct" LSD product

gtcETH is an LSD index token jointly launched by Gitcoin and Index Coop. The main purpose of the two parties issuing this token is to explore a new, effective and sustainable public goods donation mechanism.

As an ERC-20 standard token, gtcETH has many similarities with well-known LSD tokens such as stETH and rETH, such as:

Holding gtcETH means owning the redemption rights to the corresponding amount of ETH;

The circulation of gtcETH is not restricted, which can unlock the liquidity of ETH in the pledged state;

Holding gtcETH can also obtain the pledge income of participating in PoS.

However, gtcETH also has certain differences from such tokens, such as:

Gitcoin and Index Coop themselves do not directly provide pledge services, and the value of gtcETH will be supported by a package of LSD tokens issued by decentralized liquid pledge projects such as stETH;

gtcETH will automatically strip part of the pledged income for public goods donation. This is the biggest difference between gtcETH and all LSD tokens.

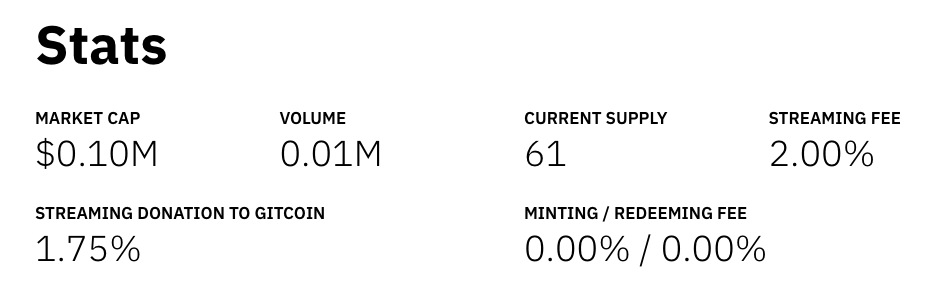

In the design of gtcETH, how much revenue should be stripped depends on the parameter of streaming fee.Currently, the streaming fee parameter is 2% (direct subtraction based on the percentage of revenue), which consists of 1.75% flowing to Gitcoin Grants and 0.25% flowing to Index Coop.

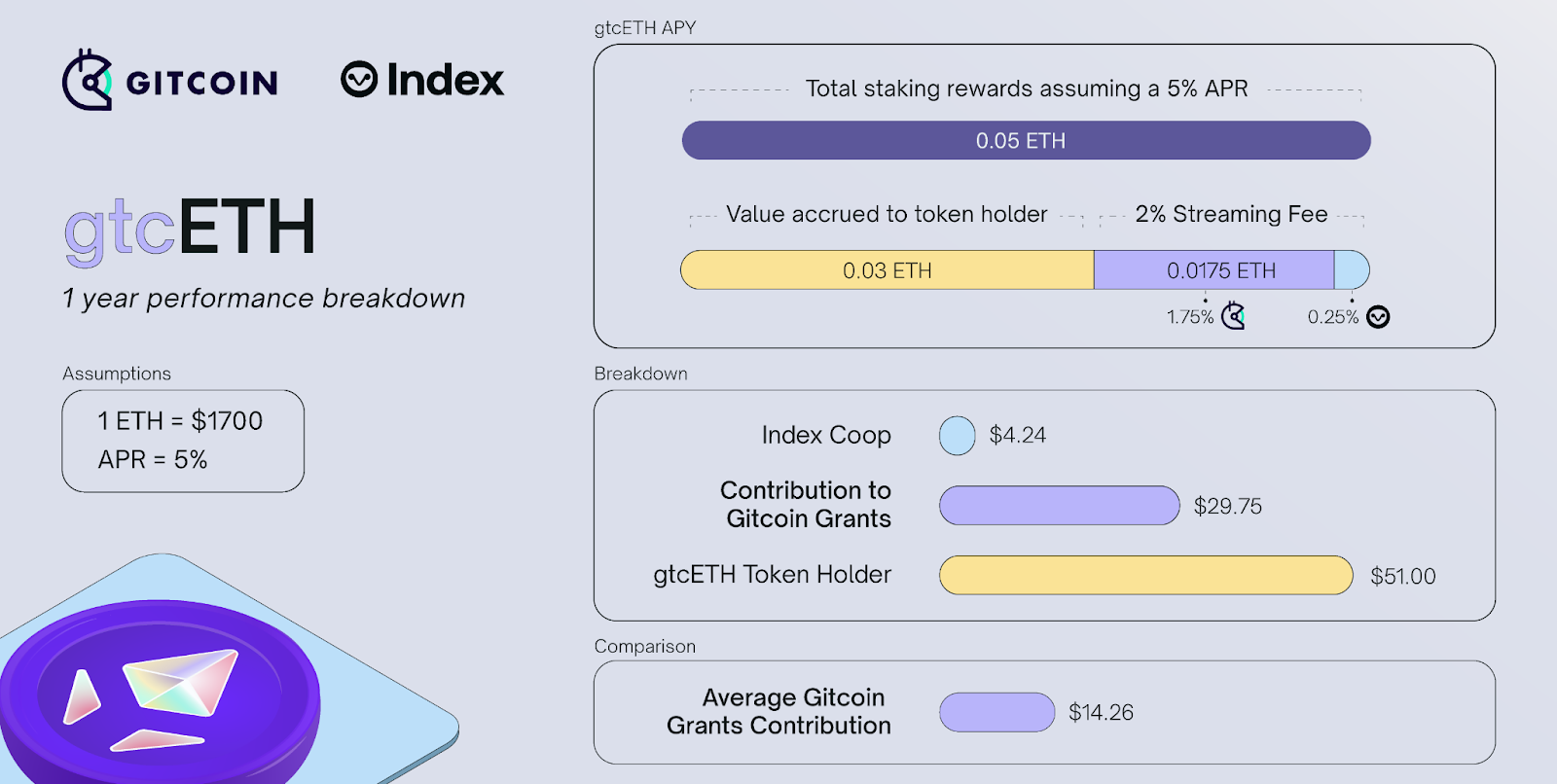

Gitcoin officials gave an example, assuming that ETH is stable at $1,700 and the pledge income is stable at around 5%, then one unit of ETH will be able to obtain a pledge income of 0.05 ETH in one year. If the user chooses to hold gtcETH, 0.03 ETH out of the 0.05 ETH will belong to the user, and the remaining 0.02% will be stripped, of which 0.0175 will flow to Gitcoin Grants for donations, and the remaining 0.0025 will flow to Index Coop as a fee.

secondary title

Can the road of going against the market be passed?

It is not difficult to see from the design of gtcETH that due to the need to peel off a small half of the pledge income, the passive yield of holding gtcETH will always be lower than that of ordinary LSD tokens, not to mention other derivative tokens with additional incentives added.

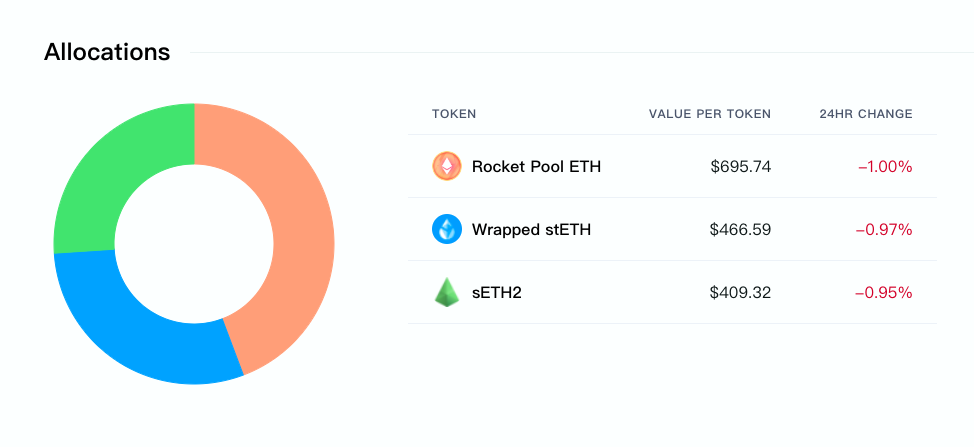

According to the information given by Index Coop, the initial supporting assets of gtcETH will be composed of three LSD tokens: wstETH (Lido), rETH (Rocket Pool), and sETH 2 (StakeWise), and the proportions of the three are about 30% and 44% respectively , 26%.

After weighting the real-time yields, fees and combination ratios of the three tokens, the real-time yield of gtcETH will only be about 2.53% after deducting the 2% streaming fee. "Start up" LSD track is not enough to see. Pursuing profit is the nature of funds, so it is not difficult to understand why the supply data of gtcETH is so "bleak".

Odaily Note: For the yield war on the LSD track, you can refer to it"LSD Hidden Sevenfold Benefits, APR-War Finale Is TVL 1 0X Growth? "。

However, gtcETH, which goes against the market, is not without its own unique advantages.

Due to the natural "political correctness" of gtcETH, individuals, projects, and institutions that need to publicize their brands and images may consider giving up part of their income and using gtcETH to support the development of public goods in exchange for a certain community reputation.

In addition, another possibility that is somewhat brain-filled is that the attributes of gtcETH determine that its holders will continue to contribute to public utilities (the income is stripped), so some users on Twitter believe that gtcETH has the potential to become an industry A future airdrop standard. Although this approach is too speculative, it would be a good thing if it can stimulate the supply of gtcETH and expand donations to public utilities.

On the whole, gtcETH, which continues the Gitcoin gene, is completely different from regular LSD tokens in terms of positioning, and it is not reasonable to force it into the LSD war. With the Shanghai upgrade approaching, LSD is gradually becoming the mainstream narrative of the entire cryptocurrency industry. While other projects are trying to increase incentives and seize the market, we are very happy to see gtcETH making innovations in completely different directions around LSD , and even expect to see more projects follow a similar path.

It may not bring any wealth effect, but it is expected to benefit the entire industry.