What exactly does Huawei's "milk" "Defactor" do?

This afternoon, a screenshot was widely circulated in the encryption community. At the same time, it was also circulated-"Huawei's official Twitter recommended a DeFi project named "Defactor"". As soon as the news came out, the Defactor governance token FACTR rose sharply. At present, it is temporarily reported at US$0.214, with a maximum increase of about 800%.

Odaily confirmed the reliability of the news after verification. The tweet was posted on February 21 byHuawei official twitterimage description

according to

according toVideo (click to jump)Introduction, Huawei and Dogpatch Labs held the "Huawei International Scale-Up Program" in Ireland,Defactor participated in this support plan as a local Web3 startup in Ireland.Odaily also found that the program was held as early as October last year. Except for Defactor, the other nine participating companies are not Crypto companies, namely:

Empeal: AI-driven multilateral digital health SaaS solution;

Tracworx: digital product suite for managing returnable packaging;

Little Red: focus on children's English;

Helgen Industrial Machine Robotics;

Graphite: All-in-one no-code ML and data analytics platform;

HaloSOS: Wearable device security protection company;

Energy Elephant: an integrated energy and sustainability management platform;

Xpanse AI: a data predictive analysis company that applies AI;

Sensipass: An interactive identity authentication system.

What kind of platform is Defactor? According to the official website (https://defactor.com/) introduction, its core concept is Real World Asset Tokenization (RWA), and similar competing products on this track include Centrifuge, MakerDAO, etc. "The 'real world' is becoming digital. Ownership, no longer evidenced by documents. We want to remove friction and open up opportunities for people, businesses and their assets. Build a communication bridge between traditional (TradFi) and decentralized (DeFi) finance. "

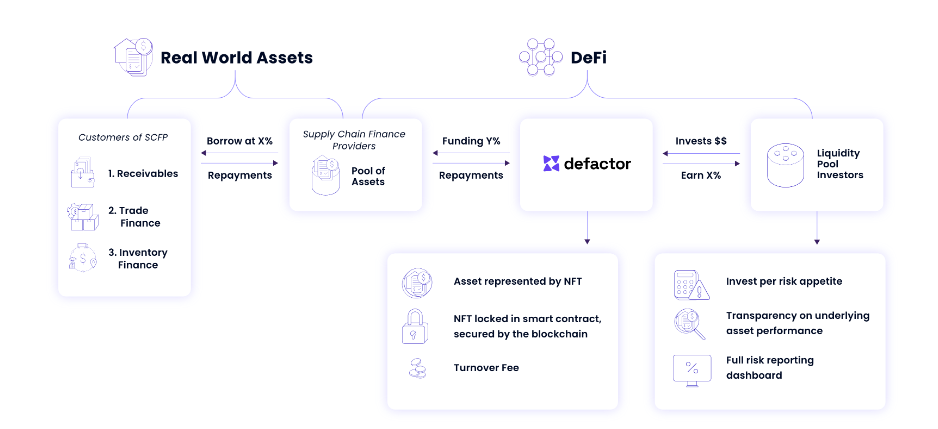

To put it simply, Defactor connects asset promoters (AO) at one end and liquidity provider (LP) at the other end, creating a DeFi investment platform through blockchain tools, and its business model charges AO and LP fees.

Specifically, the asset promoter (AO) needs to apply on Defactor and submit relevant legal documents to prove the reliability of the asset; Defactor evaluates the asset through the risk control system and the audit committee, and gives four ratings: Prime+, Prime , Prime-, SubPrime.

Users who intend to become investors providing liquidity funds will also need to pass the KYC and AML requirements of the platform; they will then be assigned a dashboard where LPs can allocate funds to selected liquidity pools (multiple pools with different risk profiles) pools), supports encrypted payments.

Currently, Defactor only supports the tokenization of three real-world assets, namely:

Accounts receivable/factoring business(Note: Factoring, Factoring, the full name is the guarantee agency, also known as the acquisition of accounts receivable, the collection guarantee);

trade finance;

Inventory financing.

In terms of tokens, FACTR is the native token of the Defactor ecosystem, and its application scenarios are as follows:

Network Access: FACTR tokens are required by asset originators to access the Defactor platform and services. AO's tokens will be locked in smart contracts throughout the funding period, reducing circulation. AO may be required to pay a fee for each funding term.

Governance: In the medium term, FACTR will introduce a governance model to manage and optimize the network, which will allow token holders to participate in community decision-making.

Staking: Token holders who stake FACTR will be rewarded.

Buyback model: Defactor will allocate a portion of its revenue to buy back FACTR tokens regularly.

At present, the development of Defactor is still in the early stage, and no business data has been released. Odaily reminds users to participate cautiously and avoid FOMO.