Has the Stablecoin “Landscape” on DEXs Changed Before and After Regulatory Raids?

This article comes from21Shares, the original author: Tom, compiled by Odaily translator Katie Koo.

first level title

Data conclusion preposition

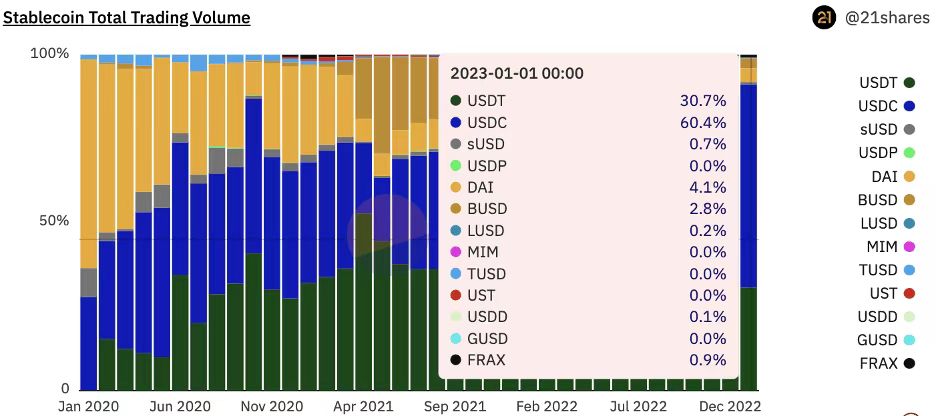

Stablecoin pairs account for 79% of trading volume on decentralized exchanges (DEXs).

USDC is the most traded stablecoin on DEX with a 60% dominance.

Stablecoins MIM and UST once accounted for a combined 63% of volume on Curve, but since Terra’s crash, those feats have been lost forever.

first level title

background

background

USD stablecoins are the killer use case for digital assets driving mainstream adoption. In 2022, Tether processed $18.2 trillion in settlements. That’s 136% more than Mastercard’s ($7.7 trillion) and more than 30% of Visa’s ($14.1 trillion). USD stablecoins also play an important role in DeFi (for investors) as the primary means of exchange on DEXs and several smart contract platforms such as Ethereum and Solana. Last year, 70% to 80% of trading volume came from stablecoin pairs.

Analyzing the trading volume of each stablecoin is crucial for investors:

Characteristics of each stablecoin.

Sources of trading volume for each DEX by trading pair type.

secondary title

Analysis coverage:

Chains: Ethereum, BNB Chain, Avalanche, Polygon, Optimism, Arbitrum.

DEX:Uniswap、 Curve、 Sushiswap、 GMX、 Trader Joe、 Pancakeswap、 Apeswap、 DODO、 Biswap、 Velodrome、 Shibaswap、 Hashflow、 Platypus Finance。

Five Key Points

secondary title

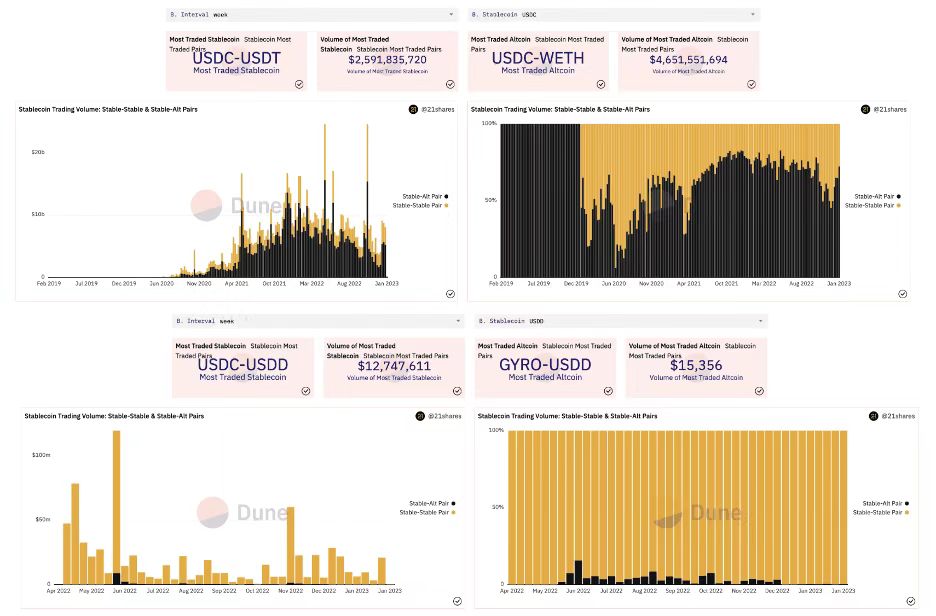

image description

Source: Dune Analytics

Source: Dune Analytics

On CEX, USDT and BUSD are the leading stablecoins by trading volume, accounting for 64% and 36% dominance, while USDC only accounts for about 0.3% as of January 2023. However, USDC is the stablecoin of choice, with 60% dominance of stablecoin trading volume on DEXs, rather than USDT and BUSD. Additionally, USDC is the leading stablecoin on Ethereum, Avalanche, Polygon, Arbitrum, and Optimism.In 2023, AAVE and Curve may launch their own decentralized stablecoins GHO and crvUSD, which are both over-collateralized crypto assets. These new stablecoins with different mechanisms could also be potential challengers to USDC, BUSD and USDT.

secondary title

image description

Source: Dune Analytics

Source: Dune Analytics

However, the algorithmic model built by Terra proved to be unsustainable. As a result, UST fell sharply below the $1 peg and has never recovered. The market capitalization of MIM, which is closely related to UST, has also dropped significantly, indicating that holders are exiting their MIM shares. A month after the UST crash, UST and MIM’s trading volume on Curve has dropped to just 2.2%.

secondary title

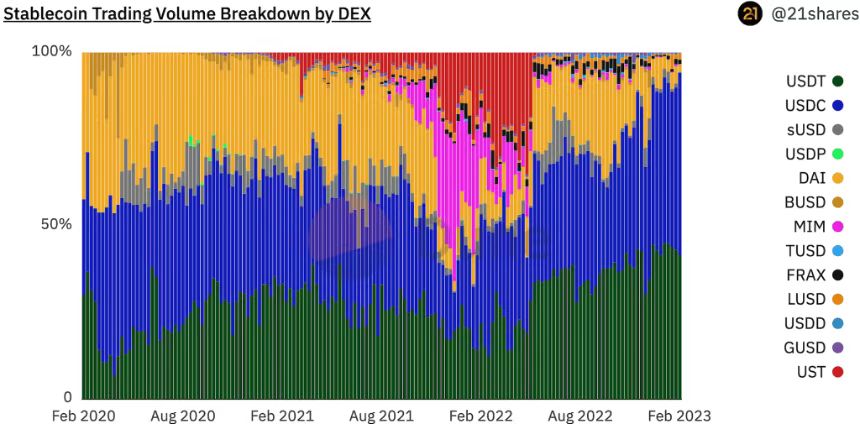

image description

Source: Dune Analytics

Source: Dune Analytics

From 2020 to early 2021, Curve V1 dominates with 70%-90% of the "stablecoin pair volume", thanks to their low fees and the low volatility provided by the stablecoin pair trading (Stableswap) mechanism. Compared to Uniswap V2's constant formula, where liquidity is evenly distributed across the price curve, Curve's stablecoin pair trading can make better use of liquidity. Therefore, traders tend to use Curve for stablecoin transactions.

Uniswap V3, launched in May 2021, solved the problem of inefficiency in liquidity provision by introducing centralized liquidity. Liquidity Providers (LPs) can now deploy capital within a specific price range. In the case of stablecoins, whose prices typically remain between $0.99 and $1.01, centralized liquidity can help traders access higher liquidity and trade at lower spreads. Thanks to Uniswap V3 improvements, their dominance of “stablecoin pairs” volume rose from 6.2% to 34% in a month.

In response to the aggressive pricing of Uniswap V3, Curve is also reducing 3 Pool fees from 3 basis points to 1 basis point in May 2022. As a result, their dominance of "stable pair" volume rebounded from 11.8% to 46.5%.

secondary title

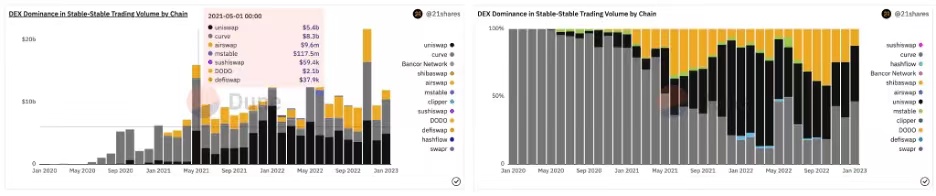

image description

Source: Dune Analytics

Source: Dune Analytics

This metric compares the trading volume between stablecoin pairs and between "stablecoin-altcoins". Stablecoins have a higher share of "stable-altcoin" (Stable-altcoin) trading volume, which means that it has more practical utility in DEX trading, because it provides traders on DEX. medium. On the other hand, the trading volume of "stablecoin pairs" mainly comes from traders entering or exiting stablecoin positions. Therefore, having a high volume of "stablecoin pairs" does not demonstrate the actual utility of trading on a DEX.first level title

Summarize

SummarizeStablecoins will continue to be an integral part of DeFi. While most of the trading volume is dominated by USDC, the ultimate winner has yet to be determined.