Multi-dimensional analysis of the cross-chain pattern of Aptos: Wormhole and LayerZero, who has the greater development potential?

Aptos is an Alt Layer 1 public chain that has attracted much attention from the market. The new public chain is one of the important growth points of the cross-chain bridge. The scale of chain funds can reflect the development potential of cross-chain bridges. During the more than three months since the Aptos mainnet went live, PANews counted the data of each cross-chain bridge on Aptos as of February 3, and found the following results:

The cross-chain funds on Aptos are mainly distributed in three DEXs: PancakeSwap, AUX Exchange, and LiquidSwap. After PancakeSwap launched liquidity mining on Aptos, AUX Exchange lost its dominant position. PancakeSwap and LiquidSwap support LayerZero more, and Wormhole is more used on AUX Exchange.

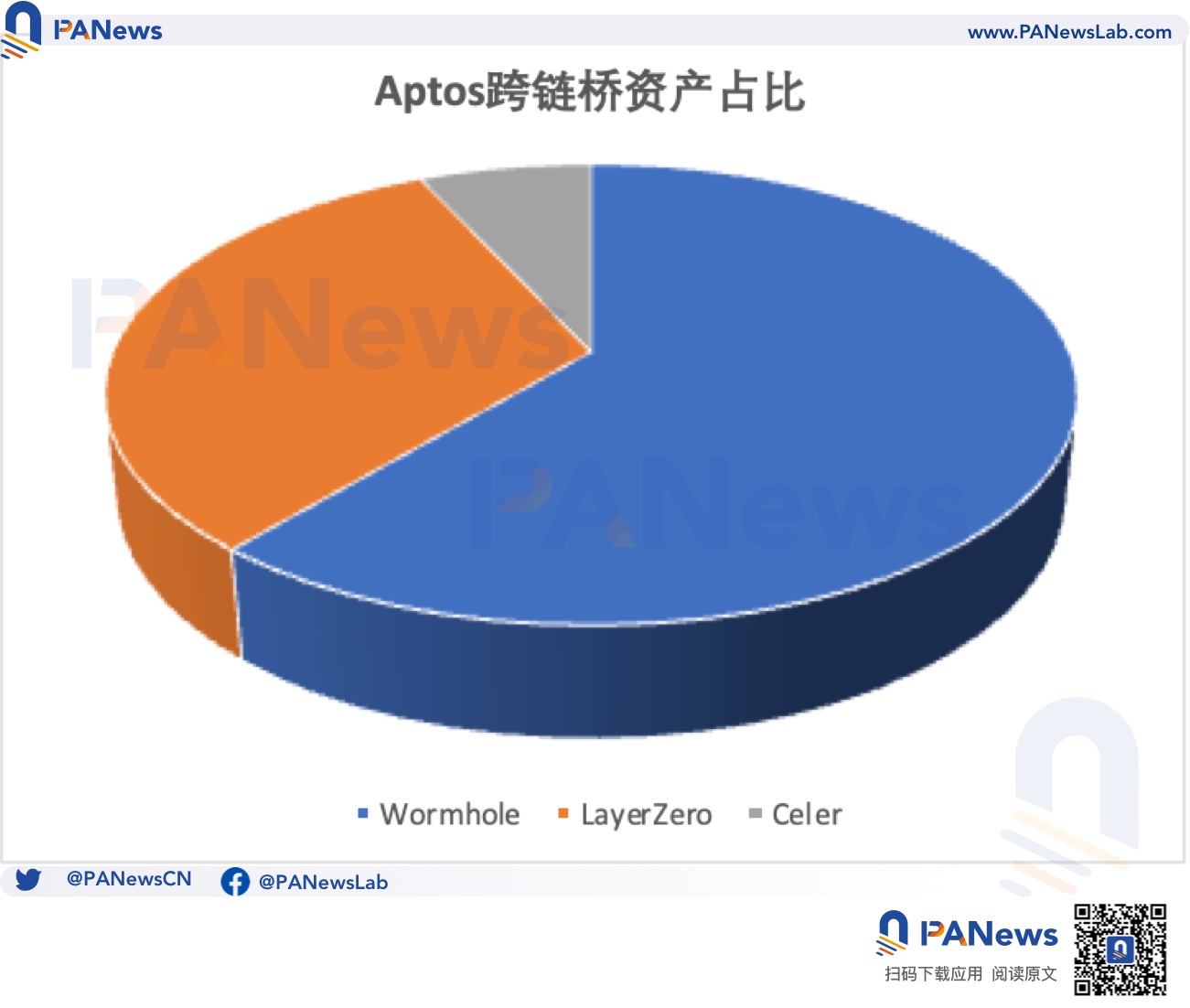

The main cross-chain bridges and their cross-chain assets account for 61.2% of Wormhole Portal, 32% of LayerZero, and 6.9% of Celer cBridge. Although Multichain, which is widely used on other chains, also supports Aptos, it has not been used yet.

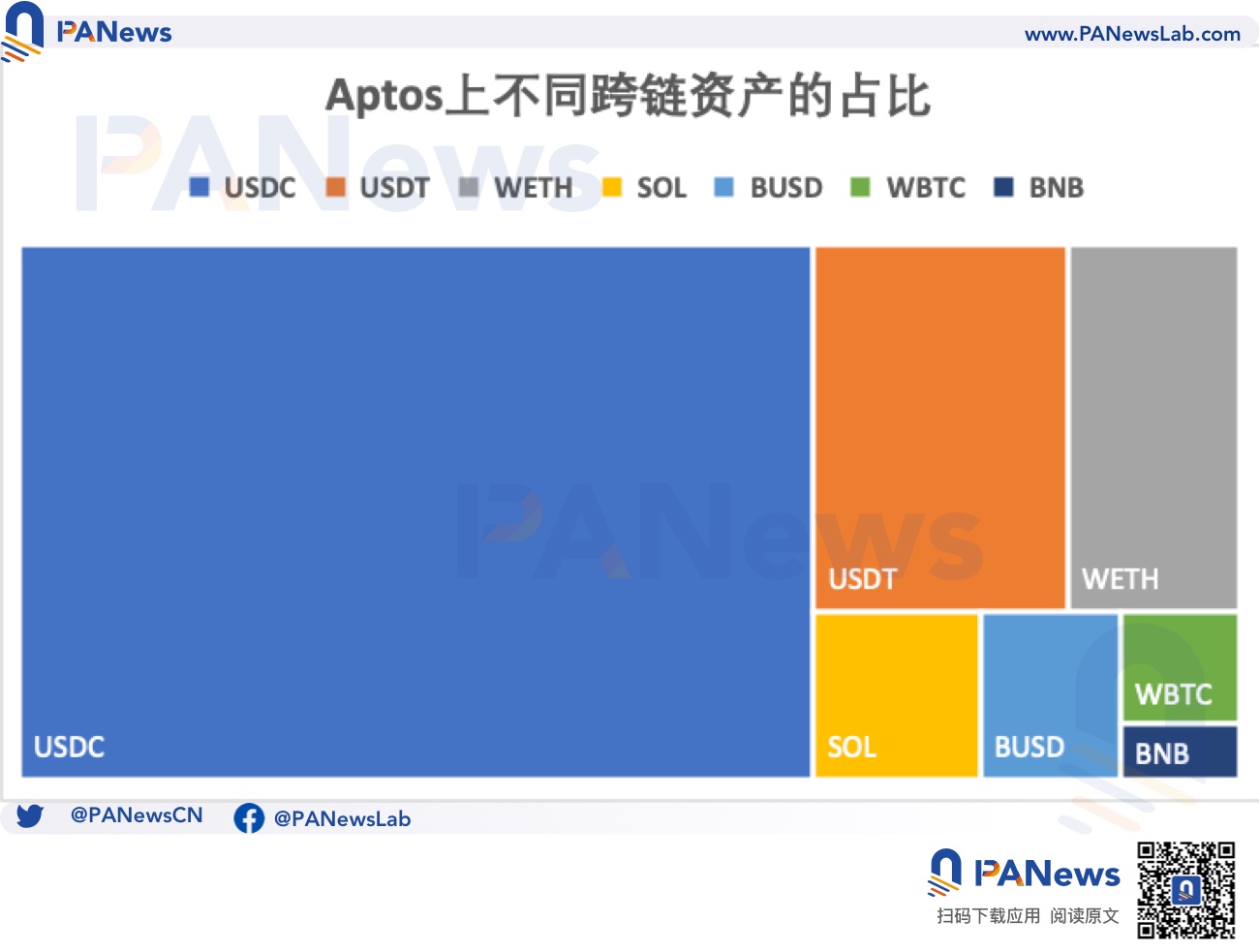

The value of cross-chain assets on Aptos is about 88.17 million US dollars. The main cross-chain assets and their values are USDC 26.32 million USD in Wormhole, USD 16.39 million USDC in LayerZero, and USD 11.37 million USDC in Wormhole (SOL).

If classified by asset class, USDC has an absolute advantage. The value of cross-chain USDC on Aptos is 57.49 million US dollars, accounting for 65.2%. It shows that the cross-chain bridge is heavily dependent on USDC, and Circle's CCTP may have a serious impact on the cross-chain bridge. According to the development potential of Aptos, Circle may also launch native USDC on Aptos.

There are 10 cross-chain assets that can be mined on PancakeSwap alone, which makes Aptos also encounter the liquidity fragmentation problem encountered by other public chains without official cross-chain bridges.

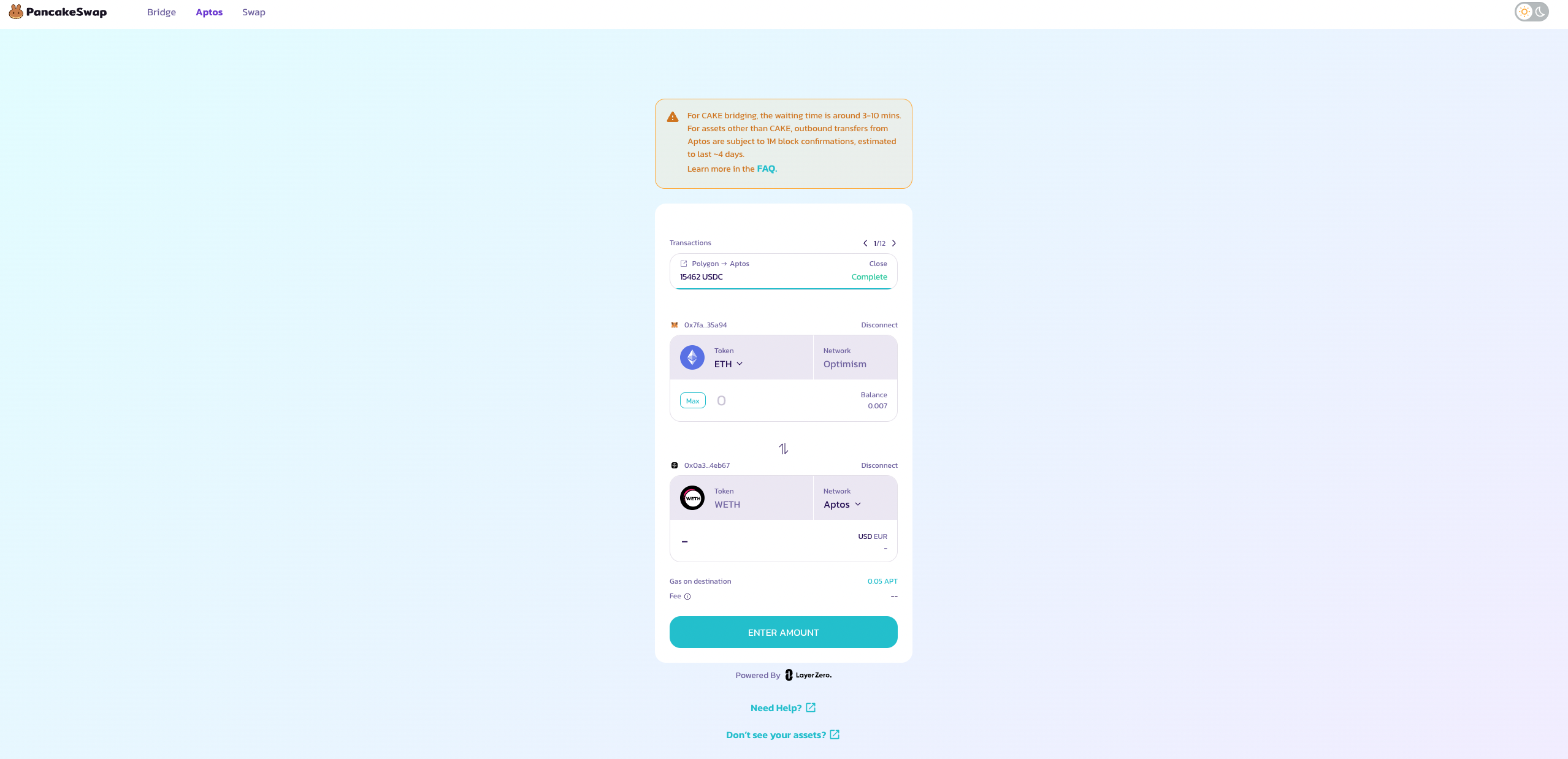

Using LayerZero to cross-chain from Aptos back to other networks needs to wait for 1 million block confirmations on Aptos (about 4 days), which may be based on security considerations, but it greatly reduces the cross-chain efficiency; the cross-chain of Wormhole and Celer can be done in time to the account.

Cross-chain fund distribution on Aptos: PancakeSwap catches up

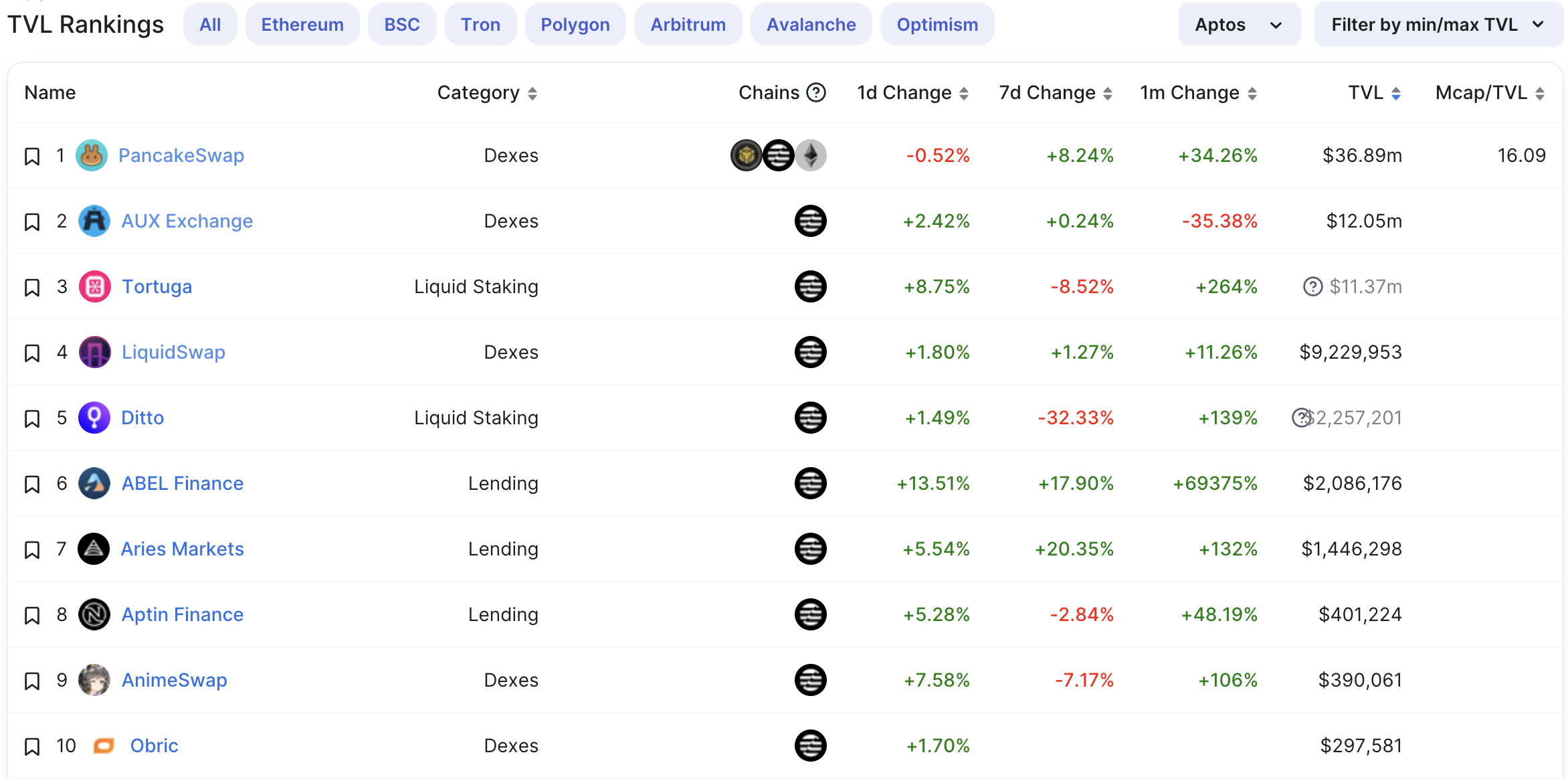

DEX and mortgage lending projects are the applications that attract the most cross-chain funds. According to the data of Defi Llama on February 2, the TVL on Aptos totaled 63.34 million US dollars, which is relatively low compared to the total market value or circulation market value of Aptos. The data at this stage can only reflect which projects have seized the opportunity during the three months since the mainnet went live, and cannot represent the final result.

Among these applications of Aptos, projects with funds exceeding USD 3 million include PancakeSwap, AUX Exchange, Tortuga, LiquidSwap, and Ditto, among which Tortuga and Ditto are liquid pledge projects, and the funds in the contract only include APT tokens and will not be used to the cross-chain bridge. The analysis below only includes PancakeSwap, AUX Exchange, and LiquidSwap, and projects with smaller capital amounts are also ignored.

Defi Llama Aptos TVL Ranking

On-chain application support for cross-chain bridges

In the absence of an official public chain cross-chain bridge, the support between the cross-chain bridge and on-chain applications is mutual. First of all, the cross-chain bridge needs to support the cross-chain of the corresponding public chain. Although theoretically DEXs do not need permission to create liquidity pools, some DEXs will provide liquidity mining rewards for assets minted through specific cross-chain bridges, which makes official support from DEXs particularly important for cross-chain bridges.

PancakeSwap currently has a TVL of $36.89 million on Aptos. Because of its strong background and incentives for multiple trading pairs on Aptos, PancakeSwap took the first place in TVL on Aptos shortly after liquidity mining started. The cross-chain bridges and assets it supports include LayerZero’s USDC, USDT, WETH; Celer cBridge’s USDC, USDT, WETH, BNB; Wormhole Portal’s USDC, BUSD, WETH.

Although these assets can be mined in trading pairs to obtain CAKE rewards, PancakeSwap has more official support for LayerZero. On the Trade-Bridge page of Pancakeswap official website (bridge.pancakeswap.finance/aptos), which shows LayerZero’s cross-chain bridge. Assets minted by LayerZero have relatively higher reward multiples for liquidity and mining. For example, for stablecoin trading pairs, the reward multiple of LayerZero’s USDC-USDT trading pair is 15 times, with a liquidity of $7.06 million; Wormhole’s USDC-BUSD trading pair is 10 times, with a liquidity of $5.38 million; cBridge’s USDC- The USDT trading pair is 6 times, and the liquidity is 2.09 million US dollars.

AUX Exchange used to be the project with the highest TVL on Aptos. Because it has not issued coins for a long time, after PancakeSwap started liquidity mining, its liquidity dropped sharply. At present, there are relatively few community updates for this project. Since there are no tokens, AUX Exchange cannot set rewards for liquidity mining, and the official website does not show the entrance of the cross-chain bridge. The liquidity in AUX Exchange should be provided by users voluntarily. The cross-chain bridge used is mainly Wormhole, including USDC, WETH, WBTC, USDT from Ethereum to Aptos, and USDC and SOL from Solana to Aptos. The liquidity of trading pairs corresponding to USDC, USDT and other assets using LayerZero cross-chain is less than $3,000, which is negligible.

Liquidswap also prominently displays the cross-chain entry on the official website, and the cross-chain bridge is provided by LayerZero. Liquidswap only opened a small amount of liquidity mining rewards for USDC-WETH and USDC-APT trading pairs, and the cross-chain assets of USDC and WETH also use LayerZero’s cross-chain bridge. Similarly, although assets minted by cross-chain bridges such as Wormhole can also be used in it, due to the lack of official cooperation, these assets have relatively low liquidity.

To sum up, among the three projects PancakeSwap, AUX Exchange, and Liquidswap that have the most cross-chain assets on Aptos, PancakeSwap and Liquidswap support LayerZero more, and both have displayed the entrance of the LayerZero cross-chain bridge on the official website; although AUX Exchange uses more Wormhole , but the official website does not display any cross-chain bridge links and cooperation news. PancakeSwap also supports Wormhole and cBridge, but LayerZero cross-chain assets have the best liquidity.

Distribution of cross-chain funds: USDC accounted for as high as 61.2%

According to PANews statistics, as of February 3, the total value of cross-chain assets issued on Aptos is about 88.17 million US dollars, and the specific distribution is as follows. The main cross-chain assets on Aptos and their value are Wornhole’s USDC $26.32 million, LayerZero’s USDC $16.39 million, Wormhole’s USDC (SOL) $11.37 million, LayerZero’s USDT $8.09 million, and Wormhole’s WETH $4.06 million. The value of cross-chain assets even exceeds the sum of the TVL of major projects, indicating that there are still a large number of cross-chain assets that have not been applied in projects.

The prefix of cross-chain assets minted by Wormhole is represented as wh, the prefix of LayerZero is represented as lz, and the prefix of Celer is represented as ce. Wormhole's WBTC, WETH, USDT, and USDC cross-chain from Ethereum, USDC (SOL) and SOL cross-chain from Solana, and BUSD cross-chain from BNB chain. LayerZero's WETH, USDT, and USDC may have borrowed Stargate's liquidity, and can be cross-chained and redeemed from Stargate's liquid chain. Celer's WETH, USDT, and USDC cross-chain from Ethereum, and BNB cross-chain from the BNB chain.

If divided according to cross-chain bridges, Wormhole’s cross-chain assets are worth $53.92 million, accounting for 61.2%; LayerZero’s cross-chain assets are worth $28.19 million, accounting for 32%; Celer’s cross-chain assets are worth $6.06 million, accounting for 61.2%. 6.9%. Wormhole's cross-chain assets are more in terms of variety and value. However, some cross-chain assets of Wormhole have not been well applied, such as whUSDC (SOL), although the circulation on Aptos is 11.37 million, but there is only more than 1 million dollars in liquidity in AUX Exchange. AUX Exchange is the DEX that supports Wormhole the best. If AUX Exchange can maintain its leading position, these cross-chain assets of Wormhole can also be well supported. But currently AUX Exchange has been surpassed by PancakeSwap, and PancakeSwap is more inclined to LayerZero.

If classified by cross-chain assets, USDC has an absolute advantage. The value of cross-chain USDC on Aptos is 57.49 million US dollars, accounting for 65.2%; USDT is worth 12.57 million US dollars, accounting for 14.3%; WETH is worth 8.47 million US dollars, accounting for 65.2%. 9.6%; SOL is worth $3.76 million, accounting for 4.3%; BUSD is worth $3.19 million, accounting for 3.6%; WBTC is worth $1.78 million, accounting for 2%; BNB is worth $860,000, accounting for 1%.

Circle, the issuer of USDC, said that it will soon launch the official cross-chain transfer protocol CCTP. Since USDC is currently the most used cross-chain asset on Aptos (there is a similar situation on other Alt Layer 1), the launch of CCTP is likely to unify all chains on each chain. USDC cross-chain assets are bound to have a huge impact on the existing cross-chain pattern. Relying on Stargate's liquidity pool, LayerZero may still be useful, depending on whether it can compete with CCTP in terms of cross-chain speed and cost, while Wormhole does not have the liquidity of native assets on each chain, and may be more affected big.

Experience: It takes 4 days for LayerZero to cross-chain from Aptos to other networks

In terms of user experience, there are obvious differences between LayerZero, Wormhole and Celer.

First of all, due to the liquidity of native assets on multiple chains on Stargate, LayerZero can cross-chain from all supported chains, and can also redeem assets from Aptos to multiple chains. However, Wormhole and Celer do not have this advantage. Assets such as USDT and USDC must be cross-chained from the Ethereum mainnet, and can only be redeemed back to the Ethereum mainnet.

The main assets used in LayerZero are native assets, and PancakeSwap’s cross-chain bridge page will only display supported cross-chain assets. Wormhole will not identify this process and supports the cross-chain of any asset. When using Wormhole, you need to pay attention to check the address on the target chain to confirm whether you get the assets you want after crossing the chain. For example, some users mistakenly use Wormhole to cross-chain lzUSDC issued by LayerZero on Aptos to Ethereum, and what they get is also whUSDC minted on the Ethereum mainnet after Wormhole locks lzUSDC, instead of the original USDC issued by Circle, resulting in inappropriate Necessary Gas waste.

Another important difference is that when using LayerZero to cross-chain assets from Aptos back to other chains (except CAKE), it takes about four days to wait for 1 million block confirmations on Aptos. The entire cross-chain process of Wormhole and Celer can be credited in time. Fraxferry, the cross-chain bridge designed by Frax before, also has a similar waiting mechanism, with a one-day wait in between. The four-day waiting period set by LayerZero may be based on security considerations, but at the same time it also greatly sacrifices cross-chain efficiency, which may be the slowest cross-chain bridge.