Euro assets are frozen, and US dollar assets are counterfeited. Will Crypto.com explode in 2023?

Crypto.com, a compliant encryption trading platform that focuses on the European and American markets, has been in constant trouble in the past few months. One is that Crypto.com was revealed to have transferred about US$1 billion to the defunct FTX. Although the founder Kris refuted the rumors, it still failed to dispel market doubts; the other is that in last year’s transparency asset disclosure, Crypto.com was suspected of borrowing from other platforms The funds are publicized, and the reliability of the audit is greatly reduced.

first level title

The original text comes from Cryptadamus, author Michel de, compiled by Odaily, there are deletions, please be sure to indicate the source when reprinting.

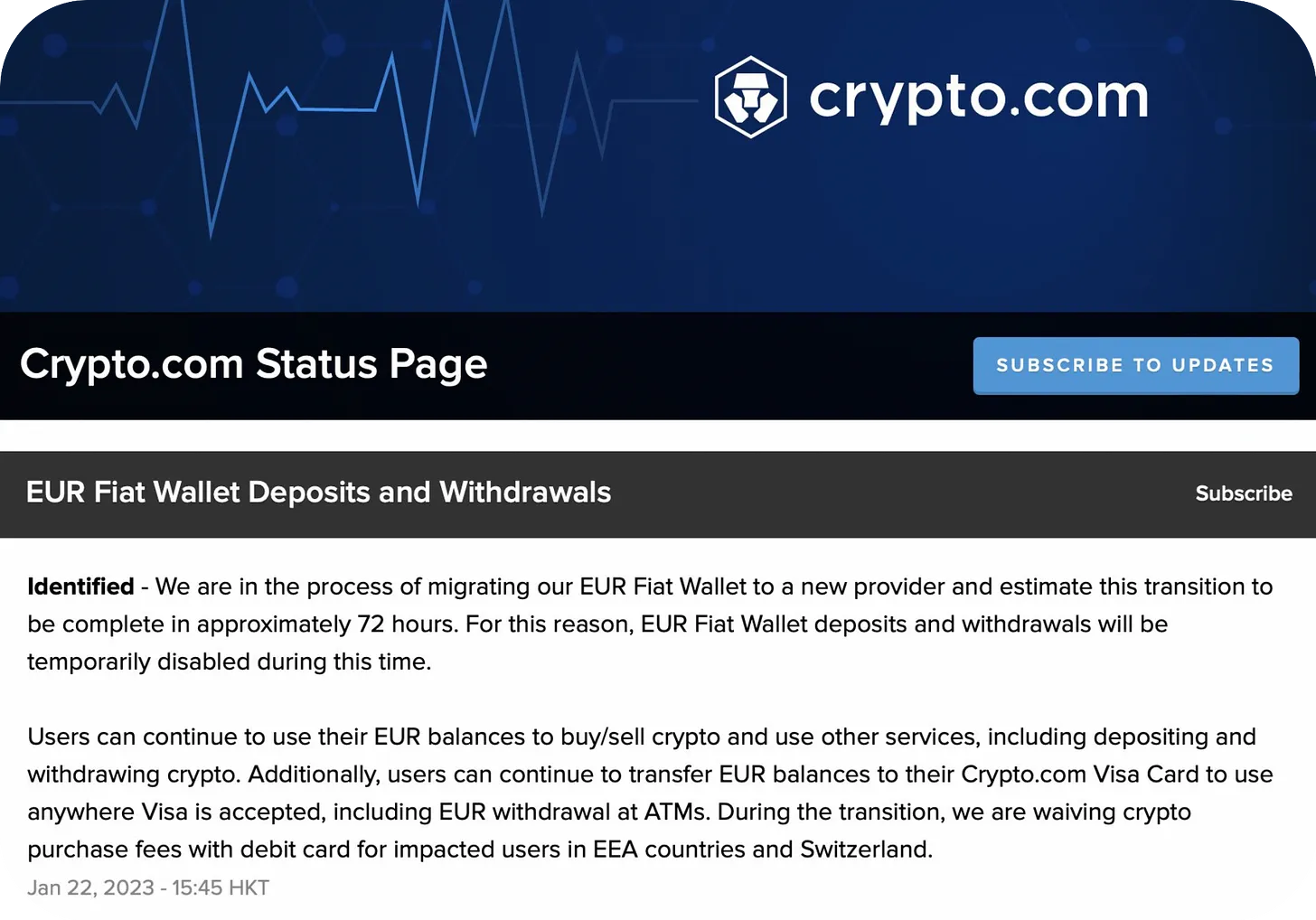

image description

(Crypto.com notification email)

As a person who has participated in the migration of payment systems in several technology companies, I just want to say that there are many red flags behind this incident, and it can even be said to "sound the air defense alarm". You can't speak without investigating, so I decided to dig deeper into the matter to find out what's going on behind the scenes.

The findings were, very, very bad. Available evidence suggests that the Lithuanian government has seized user deposits currently denominated in euros on Crypto.com as part of an anti-money laundering enforcement action; com quickly filed for bankruptcy. However, like all corporate executives in deep abyss, Crypto.com's management has been silent about this and has not been honest with users about the real situation.

1. System loopholes or human negligence, where did the funds go?

Usually, if a large company is going to perform some unexpected actions that may have a serious impact on user services, it should try to give sufficient notice in advance, especially if it involves user funds. Just like Crypto.com's interruption of deposit and withdrawal services this time, it should have been notified several months in advance, and the frequency of notifications should be increased even before the deadline.

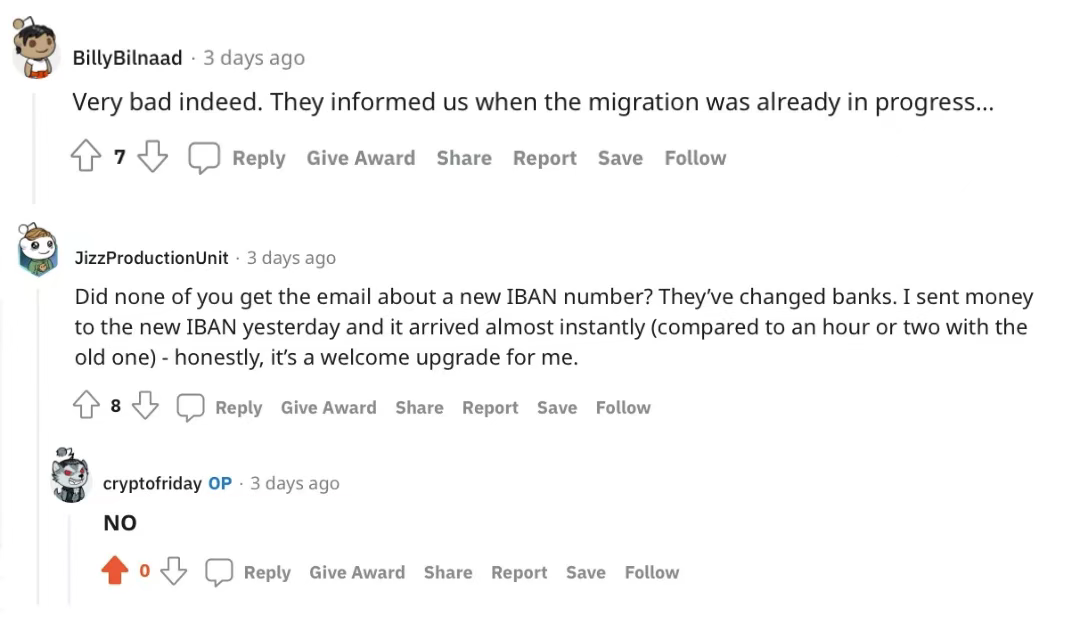

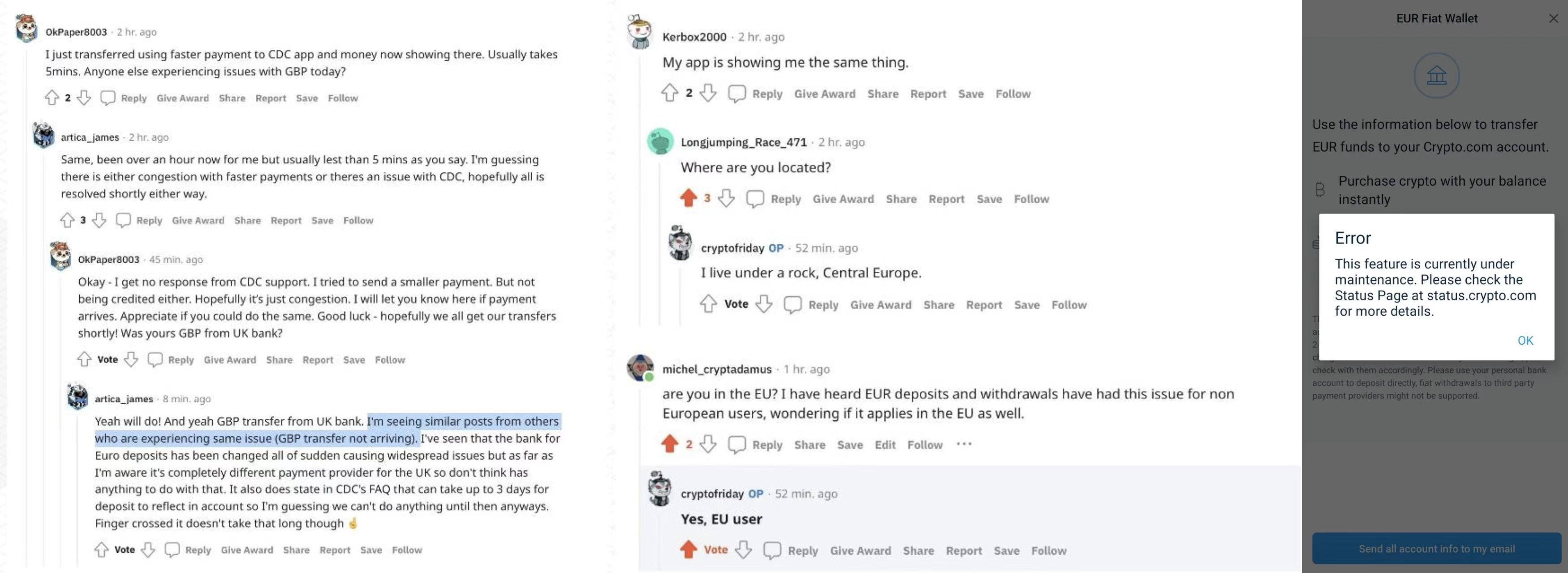

image description

(The user reported that he did not receive the email at all)

More importantly, there are no pop-up announcements in the app, nor does Crypto.com mark the service as inoperable on the platform's "status page". Additionally, the Crypto.com mobile app still showed some users the old deposit instructions after sending them a user "migration notice" on Jan. 22 -- which also led some to wire money to their old bank accounts. All this is really puzzling, either the staff of Crypto.com are fishing for laziness every day, or they deliberately only tell a small number of active deposit and withdrawal users as much as possible (to avoid expanding the impact of the situation).

The question now is, where does the money that users transfer to Crypto.com go?

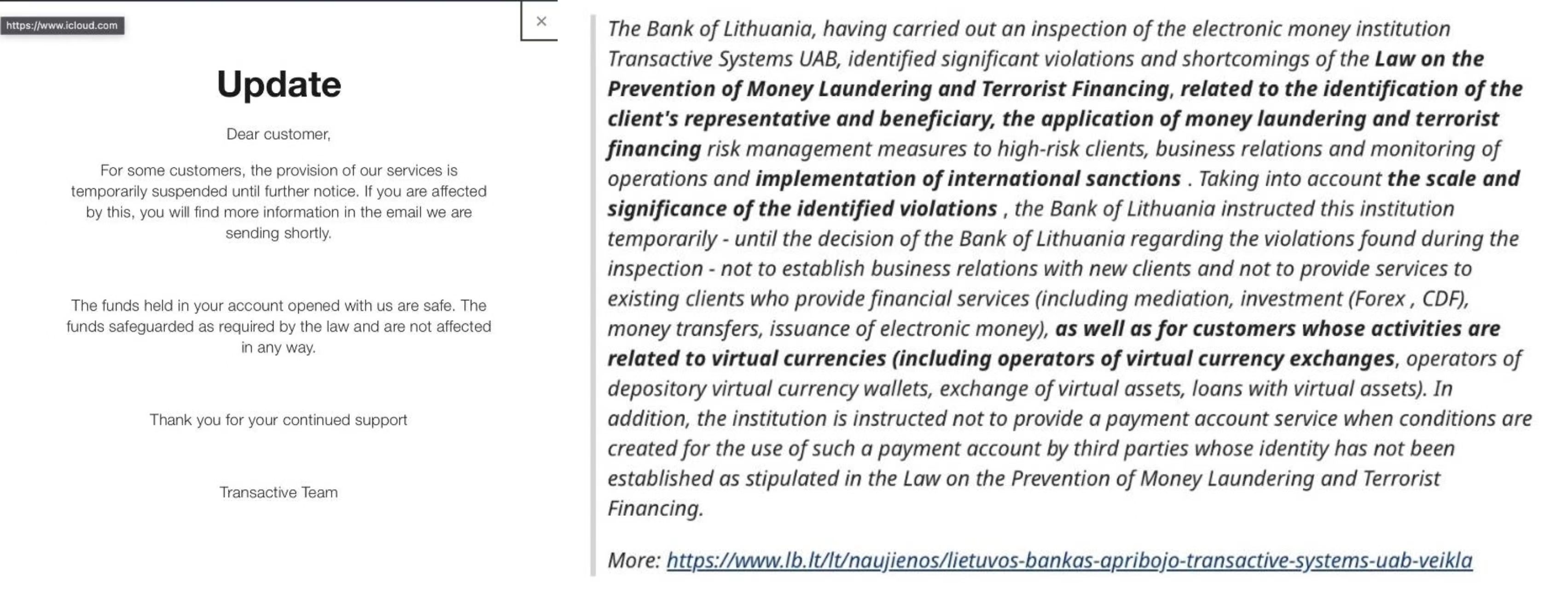

A simple investigation will find that before the old SEPA transfer expires, the funds and deposits that users recharge to the Crypto.com "fiat currency wallet" will be sent to a Lithuanian bank called "Transactive Systems UAB". Lithuania is indisputable in itself that Lithuania is the place where all legitimate companies look for high-quality banking providers.

When I visited the Transactive Systems UAB website, a pop-up window indicated that the bank is currently out of service: "Update: For some customers, our service is temporarily suspended until further notice. Funds in your account with us are safe Yes, these funds will be guaranteed in accordance with the law and will not be affected."

image description

(Left image is Transactive Systems UAB announcement, right image is Bank of Lithuania announcement)

Now the question is: where did all the euro-denominated funds on Crypto.com go? Because it sounds like it has been confiscated by the Lithuanian government and can never be taken back. And what about users who transfer Euros to Transactive Systems UAB accounts?

The latest news is that those users who sent funds to the bank account after the announcement on January 21 have already received refunds - bank account blocked, wire transfer returned. But this is bad news for those who sent Euros to Crypto.com before January 21, as bank accounts have been confirmed to be blocked, at least "temporarily" without getting their money back.

2. Crypto.com’s new payment provider, working closely with Tether

After closing the Transactive Systems UAB bank account in Lithuania, Crypto.com quickly found a new banking partner and was able to regain SEPA euro-denominated deposits and withdrawals. Now, Crypto.com users need to send deposits to a bank account owned by a company called "Foris DAX MT Limited," which is based in Malta and is the local holding company for Crypto.com.

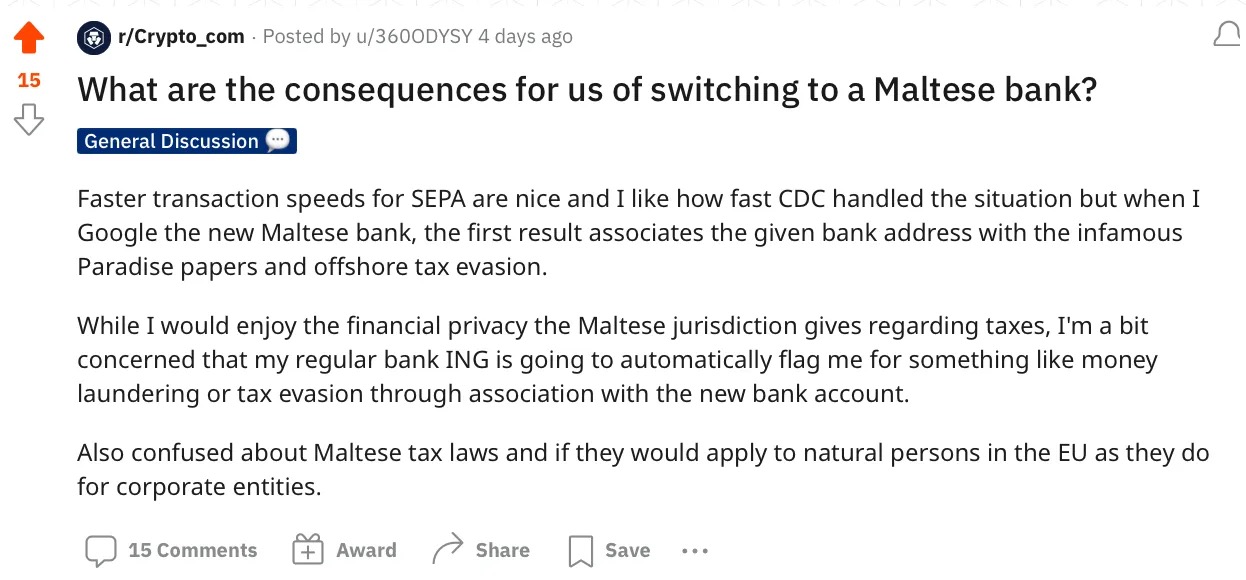

image description

(Crypto.com users are worried about using Malta banking services, which will lead to entanglements with money laundering, tax evasion, etc.)

Back to the topic, after the resumption of deposits and withdrawals, can customers who hold euro assets in Crypto.com's platform fiat currency account be able to withdraw these euros? In my opinion, the intensive withdrawal pressure may expose Crypto.com's shortcomings.

Because if Crypto.com's euros were seized before being transferred to the new Malta bank, that would mean that Crypto.com was effectively starting from scratch, and the new Malta bank account might have had 0 euros 7 days ago. This means that even a small withdrawal pressure will force Crypto.com to stop withdrawals (Note: Crypto.com has not responded positively to this issue).

Also, according to my research, this new payment provider that accepts deposits from Crypto.com is a company called "OpenPayd". Guess what other customers the company has? OpenPayd is the favorite payment processor of the encryption exchange Bitfinex, and the founder of Bitfinex also owns a company Tether-its transparency issues have also been criticized in the encryption market.

image description

(User Feedback Questions)

For Crypto.com users in the European Union, it is now back to the original "maintenance mode" again, and the official has not responded to this.

3. Crypto.com and his shell company

When I was investigating Crypto.com, I also found some shell companies and some "violations" created by it.

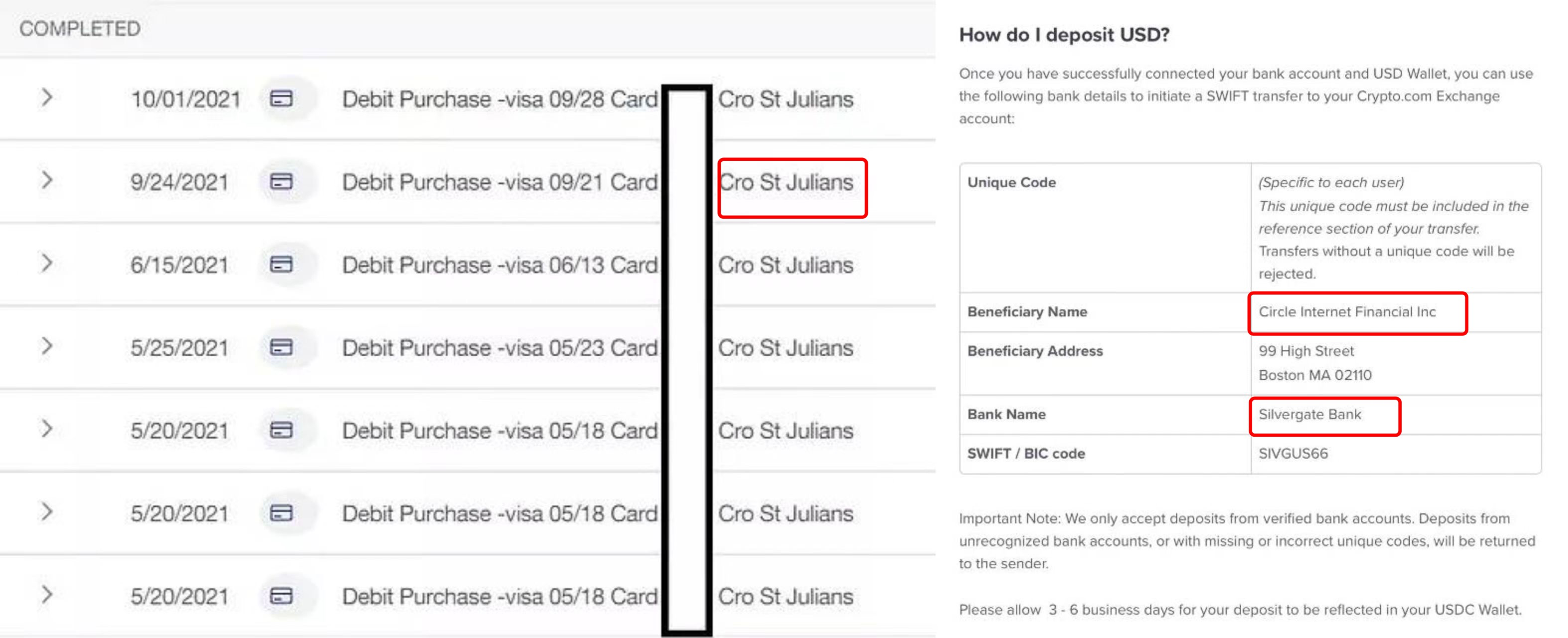

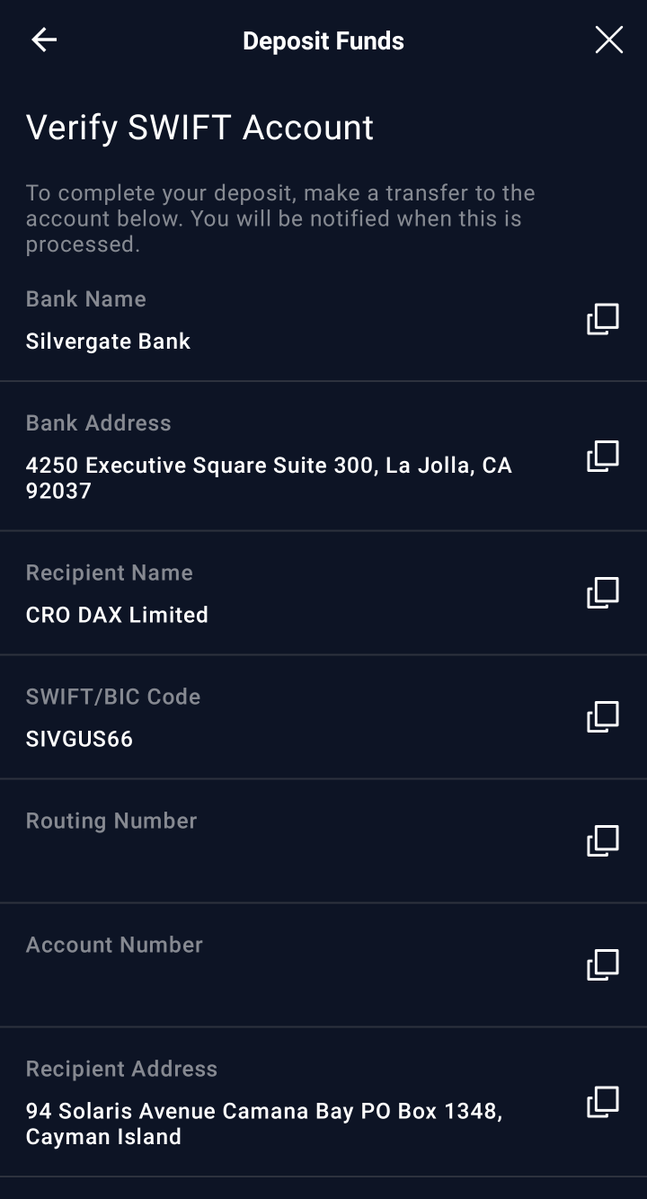

According to Twitter users@Ryan McClintockimage description

(The left picture is the Crypto.com deposit record posted by the user; the right picture is the deposit statement issued by Crypto.com)

However, Crypto.com tells users in the deposit instructions on the official website that all deposits are deposited in a company account called "Circle Internet Financial" - the company is the issuer of the stable currency USDC, and is managed by a crypto-friendly bank Silvergate for hosting.

Therefore, we can make an inference, either that Crypto.com used a false name and did not cooperate with Circle and Silvergate Bank; or that Circle & Silvergate knew the inside story and deliberately helped Crypto.com to conceal - The consequences are more serious, and even shake the stability of USDC.

write at the end

write at the end

There are still many issues worth exploring about Crypto.com, such as transparency audits, such as the terms of service that do not specify that users want to have "ownership" of platform assets... But the most important thing is to clarify where the euro and dollar reserves go Where, in the end can not achieve rigid redemption. I also hope that the Crypto.com official can stand up and respond to doubts as soon as possible, so that users can feel more at ease.

Finally, a reminder to all crypto investors, it is best to self-custody crypto assets, after all, the lessons of FTX are in sight.