From 0 to $1.3 billion within 100 days of going online, where does frxETH’s high returns come from?

Author: Frank, Foresight News

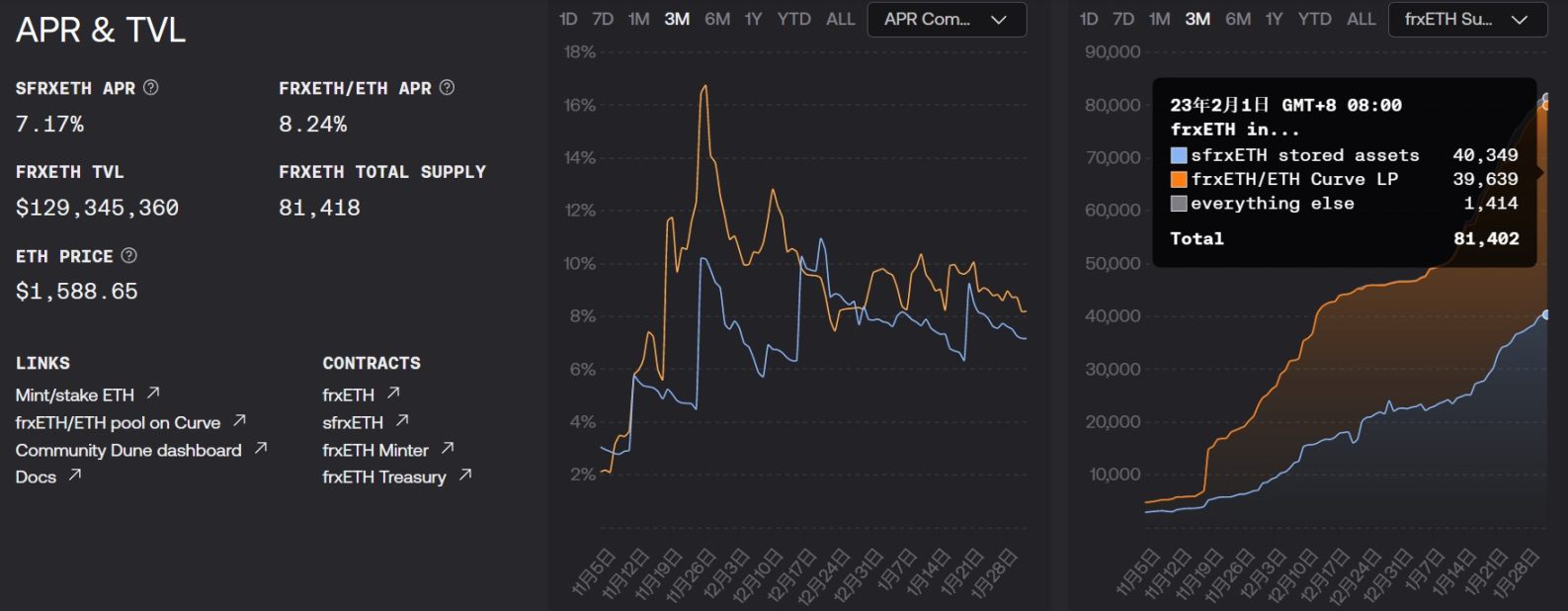

On October 21, 2022, the Ethereum liquid pledge product frxETH launched by Frax Finance, a mixed-algorithm stablecoin protocol, was launched. As of today, exactly 100 days have passed, and frxETH has grown from 0 to over 81,400 pieces, worth about $1.3 billion .

first level title

The "sameness and difference" of frxETH

Similar to Lido's stETH, frxETH is a liquid pledge token provided by Frax Finance for users who pledge Ethereum.

However, unlike stETH that directly distributes staking rewards to stETH users through rebase, frxETH users cannot directly obtain staking rewards—if frxETH users want to obtain Ethereum staking income, they need to pledge frxETH to sfrxETH again.

It’s just that the accumulation method of pledge rewards is still frxETH, but since not all users choose to pledge frxETH to sfrxETH again, as time goes by, sfrxETH will accumulate more frxETH,

This means that when sfrxETH users quit, they can participate in the division of the entire frxETH reward pool, so as to obtain a higher rate of return than similar products. To give a simple example:

Assuming that a total of 100 ETHs in the Frax contract are pledged as frxETH, and only 30 of them are minted as sfrxETH through the second pledge, then these 30 sfrxETHs will share the pledge rewards (in the form of frxETH) of the 100 ETHs in proportion.

In short, users who did not choose to re-stake frxETH to sfrxETH transferred their pledge rewards to sfrxETH users.

Arbitrage balance between frxETH and sfrxETH

So here comes the question, why some frxETH users don’t choose the second pledge, and are willing to transfer their income to sfrxETH users?

Because Frax Finance provides another income option for frxETH users - deposit frxETH into Curve's frxETH/ETH liquidity pool and reap LP income.

From the perspective of users, Frax Finance actually provides two income paths for frxETH:

First pledge ETH as frxETH, then deposit it in the frxETH/ETH liquidity pool to eat Curve income, and at the same time transfer your own frxETH pledge income;

First pledge ETH to frxETH, and then pledge to sfrxETH again, so that while obtaining your own pledge income, you can also obtain the frxETH pledge income transferred by the first part of users;

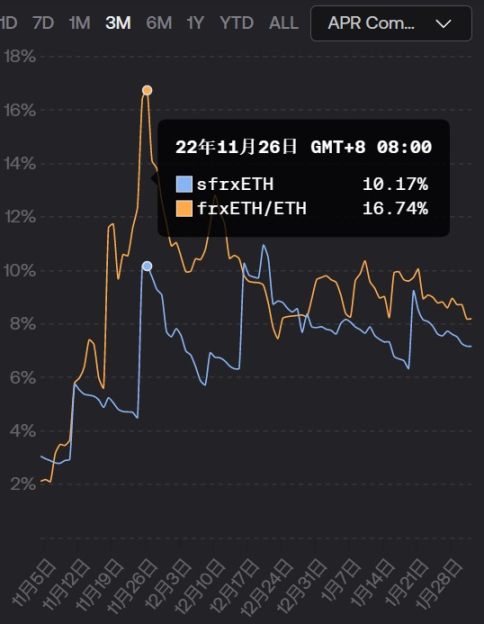

Theoretically speaking, choosing Curve's frxETH/ETH liquidity pool (frxETH) and choosing secondary pledge (sfrxETH) will gradually form a dynamic arbitrage balance due to the difference in yield, so that the yield of the two different options will always be maintained. in the same interval.

According to Frax Finance official website data, as of February 1, the yields of the two are indeed relatively close: Curve's frxETH/ETH liquidity pool (frxETH) is 8.24%, and the second pledge (sfrxETH) is 7.17%. The ratio is almost the same.

The continuation of the Curve War behind 4 pool's broken dreams

So here comes the question again, why can Frax Finance have the confidence to add the differentiated design of Curve pool income to its liquid pledge products? How can we maintain the high returns of the frxETH/ETH liquidity pool?

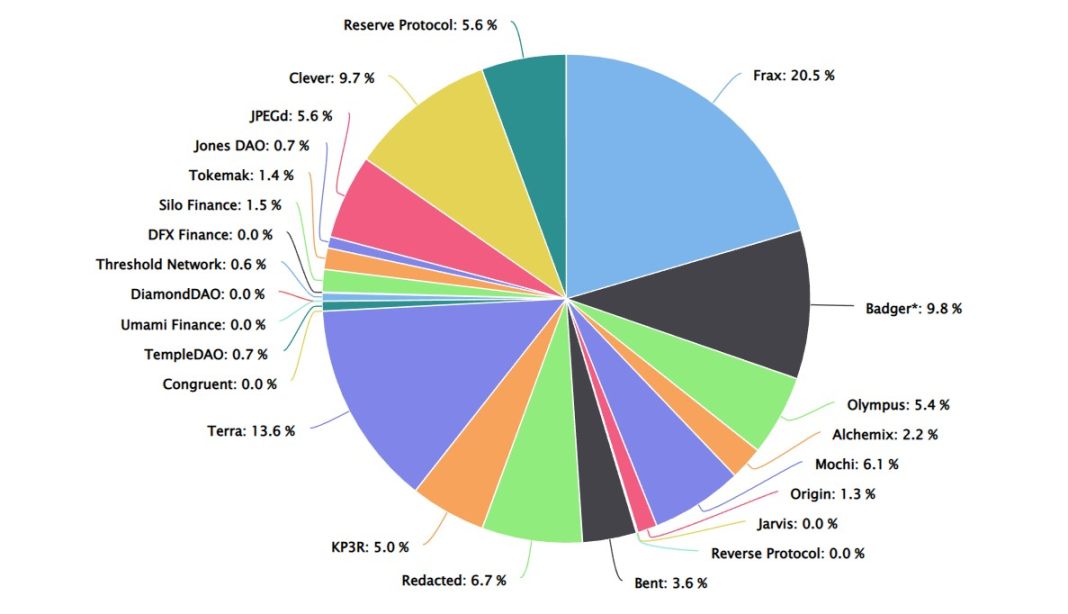

In a nutshell, because Frax Finance holds the most Convex governance token CVX (20.5%), and Convex controls more than half of Curve voting rights (veCRV), this gives Frax the incentive to use the huge exchange rate to influence Curve emissions , thus creating the possibility of higher returns (extended reading "Understand the increasingly fierce "CRV battle", how does Convex "hold Curve to make stablecoin princes"?》)。

At this time, we may look back at a piece of history.

In April 2022, Terraform Labs released a new proposal, planning to launch 4 pools of UST, FRAX, USDC, and USDT on Curve, directly targeting the 3 pools (USDT, USDC, and DAI) that were at the core of the stablecoin market at that time.

In part, DAI's success in maintaining its peg is due to the deployment of 3 pools on Curve.

Therefore, in the original idea of Terraform Labs, Terra and Frax Finance, as the two largest agreement holders of CVX, can influence Curve's incentive policy through the huge bribe of vlCVX, so as to maintain the deep liquidity in the 4 pool pool, making 4 pool Become the most liquid and frequently used cross-chain stablecoin pool.

This not only means the subversion of 4 pools to 3 pools, that is, the market replacement of DAI by UST and FRAX, but can even further change the track pattern of the stablecoin track.

However, the collapse of UST/Terra in May 2022 brought this idea to an abrupt end, and the plan of Frax Finance also collapsed.

But half a year later, Frax Finance finally realized its influence on Cureve with the launch of frxETH again.

In general, through its influence on Curve, Frax Finance has found a differentiated competitive advantage for frxETH that is different from similar products such as stETH - a higher-yielding option under the arbitrage balance between frxETH and sfrxETH, and frxETH/ETH is hidden behind it Complex product logic such as anchor adjustment.

100 days, from 0 to 1.3 billion US dollars, with the approach of the Shanghai upgrade node in March, it remains to be seen whether frxETH can become an outlier in the Ethereum liquidity staking track.