AC: Why is it a good thing that DeFi has "no new narrative"?

This article comes from MediumThis article comes from

, the original author: Andre Cronje, compiled by Odaily translator Katie Koo.

A reporter asked me the following question:

This article is my answer to that question.

DeFi is dead?

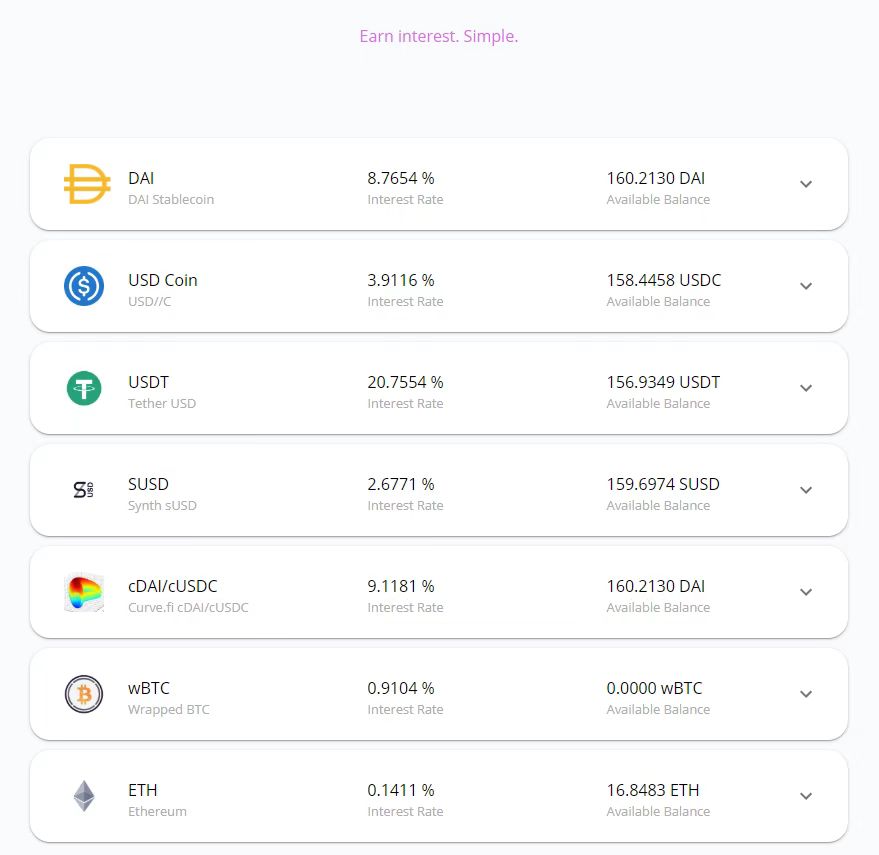

Yearn dashboard data as of February 5, 2020.

Above is Yearn's raw dashboard data. At that time, DAI had a DAI Savings Rate (DSR), which provided a subsidy of about 7% through high interest rates, and the actual DAI yield was between 1% and 2%. USDC is about 4%. USDT is at the peak of its FUD, people are shorting, but usually USDT will be around 2%-4%. 2% for SUSD. 0.9% for BTC and 0.14% for ETH.

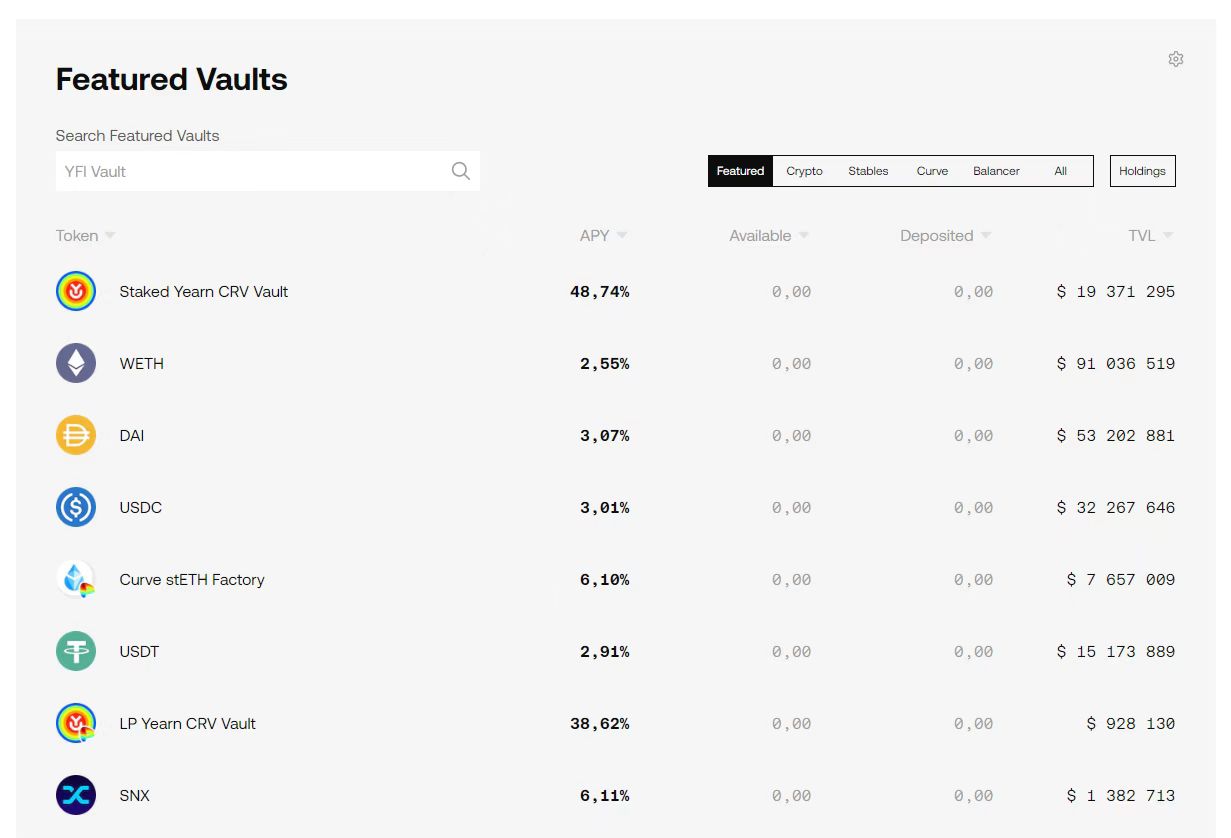

Now let's look at the Yearn dashboard data again, as shown in the figure below.

ETH is 2.5%, DAI is 3%, USDC is 3%, and USDT is 3%.

And all of this is happening in an inactive market. All real gains come from lending markets and transaction fees. The lending market is driven by long/short activity.

In a bear market, people enter short positions, they use stablecoins to collateralize their positions (increasing stablecoin supply, depressing stablecoin real yields), borrowing crypto and selling (increasing crypto yield, which increases from ETH/BTC’s This can be clearly seen in the increase in the real yield), and the stablecoin obtained in the sale is used as further collateral (further reducing the real yield of the stablecoin).

In a bull market, people enter long positions, they use their cryptocurrencies to collateralize their positions (decreasing the real return on cryptocurrencies), borrowing stablecoins to buy more cryptocurrencies from the market (increasing real returns on stablecoins rate), and use the purchased cryptocurrency as further collateral (further reducing the real rate of return of the cryptocurrency).

Right now, we are in a low-volatility phase of deep bearishness. At this point (based on the past two bull markets) we are seeing very little trading activity, everyone who tried to short is short, but they are not yet confident enough to close their positions (resulting in buybacks and longs) . So, it's a "real yield low." With that in mind, real yields are still higher than they were when Yearn was first created.

Therefore, I disagree with the statement that "high yields have long since disappeared, and DeFi has almost zero growth". This claim is based on comparing the current market to an unsustainable, highly delusional market peak, not on how it has evolved.

The dot-com bubble didn’t destroy the internet, and there was no need for a next narrative, and it was the projects that were born during those crazy times that became the anchor products we use today.

secondary title

DeFi cannot be defeated"DeFi is the next narrative of DeFi. It doesn't need a 'new narrative' or a 'new eye-catching tool', DeFi just works."

secondary title

Real World Assets (RWA)

Now coming to Real World Assets (RWA), the three most important crypto innovations are:

Zero Trust Finance (0 Trust Finance: trust is not required or assumed), examples here are Bitcoin, Ethereum, Fantom, Uniswap or Yearn V1;

Verifiable Finance (Verifiable Finance: there is assumed trust, but you can verify), the examples here are Aave, Compound, Yearn V2, you can verify the execution of time lock through multisig (multisig);

Trusted Finance (Trusted Finance: requires absolute trust), centralized exchanges and institutional brokers, such as Binance, Wintermute, etc.The next focus will be regulation.Regulated CryptocurrenciesThe issuer of must be a fully legal, compliant and regulated entity.encryption regulation

is the concept of trying to add supervision to a decentralized protocol. The latter is not feasible and will only create friction for all parties involved.RWA needs to exist in "trust finance" or "verifiable finance" and requires a regulated cryptocurrency.

As the reporter's question pointed out, the RWA discussion has been going on for a long time. Back in 2018, I had my first conversations with traditional custodians, regulators and governments on this topic. Regulated cryptocurrencies didn’t exist back then, and now they are, and the success of any RWA project depends on it. Notable examples of regulated crypto legislation include South Korea’s Financial Services Commission allowing the issuance of security tokens, and the Swiss parliament passing a federal bill on the DLT Act.

Regulation is one part of this, the second part is equipping traditional auditors with the ability to verify and understand on-chain RWA and provide those reports, without which, again, would fail. Therefore, as the technology continues to develop, we will see more real-world assets tokenized on-chain.

But it needs to be pointed out that none of these are new narratives, nor will they revolutionize DeFi in any way. DeFi is still just DeFi, it’s just another tokenized asset added as collateral or a trading pair.soI don't think DeFi needs to be the next trend, I think DeFi is a trend.

The focus of the Fantom Foundation is to:

regulatory framework;

audit tools;

Layer 1 transaction volume and scalability;

DeFi and other blockchain verticals (social media, gaming, art, news, etc.) still exist, but they are limited by their current state and access to the underlying technology (just like the early web was limited by the underlying technology and access). There's no "new narrative" or "new trend" here, it's just that "cookie-cutter" is a good thing.