Foresight Ventures Weekly Brief: Market rebounds mid-term, starts year strong

Market View:

first level title

Currency liquidity is loosening. U.S. PPI inflation accelerated in December, the largest drop since the outbreak. With the growing risk of a U.S. recession, the U.S. dollar is gradually falling into an adjustment cycle. The market raised expectations of the Fed's dovish turn, U.S. stocks rebounded on a weekly basis, and the encryption market was strong. We're only halfway through the first month of 2023, and we already feel like this year will be very different from previous years.

2. The whole market

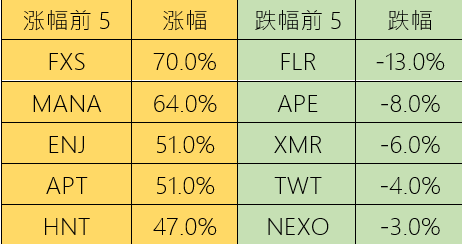

The top 100 gainers by market capitalization:

secondary title

2. The whole market

The top 100 gainers by market capitalization:

3) AGIX: Binance launched the contracts of AGIX and FET in the artificial intelligence sector. After the ChatGPT fire, Microsoft’s large investment in artificial intelligence can be compared to Facebook’s previous investment in Metaverse. This blockchain + artificial intelligence project is just a concept, characterized by a small market value in circulation and highly concentrated chips. However, the long duration and large range have indeed formed the profit-making effect of the sector, and the funds may be repeatedly hyped in the future.

3. BTC market

1) Data on the chain

secondary title

3. BTC market

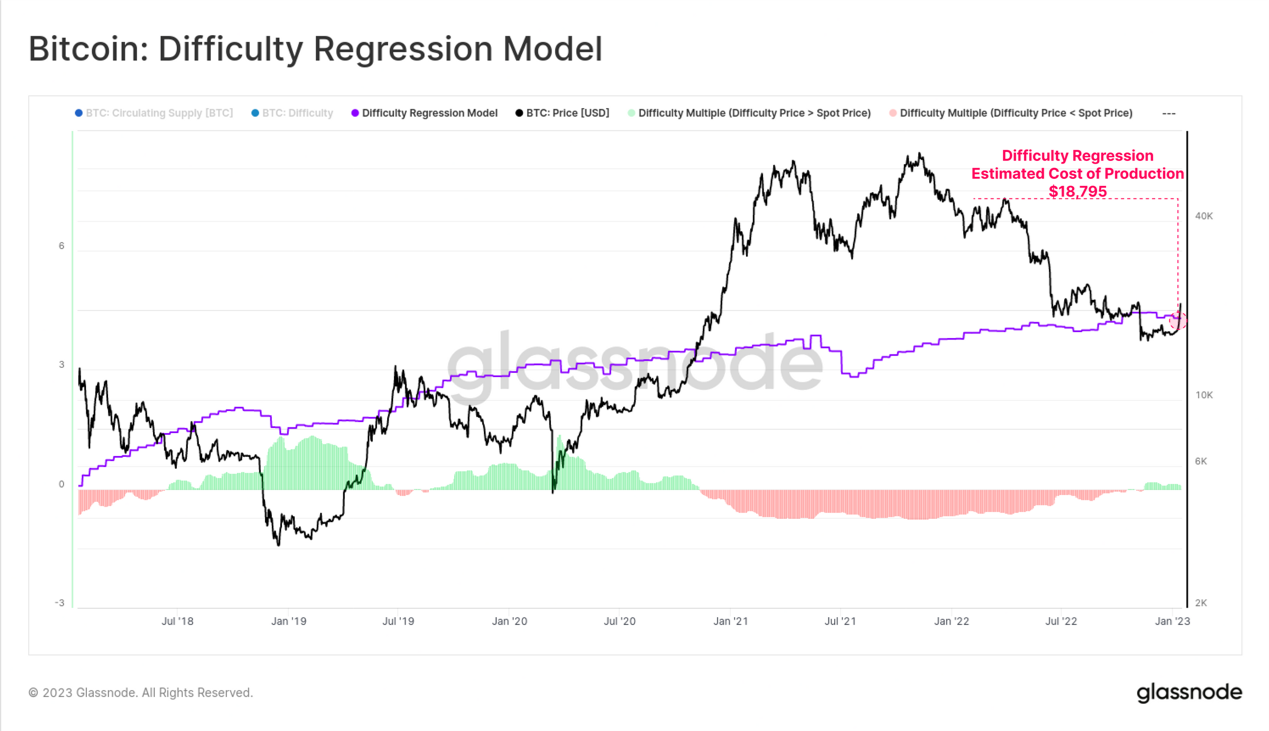

BTC miners are profitable again. BTC miners have been the hardest hit over the past year, and this cycle has been especially pronounced, as public companies’ share prices have taken a major hit. The current average production cost of BTC is about $17,000-18,800, which is lower than the BTC price of $21,000.

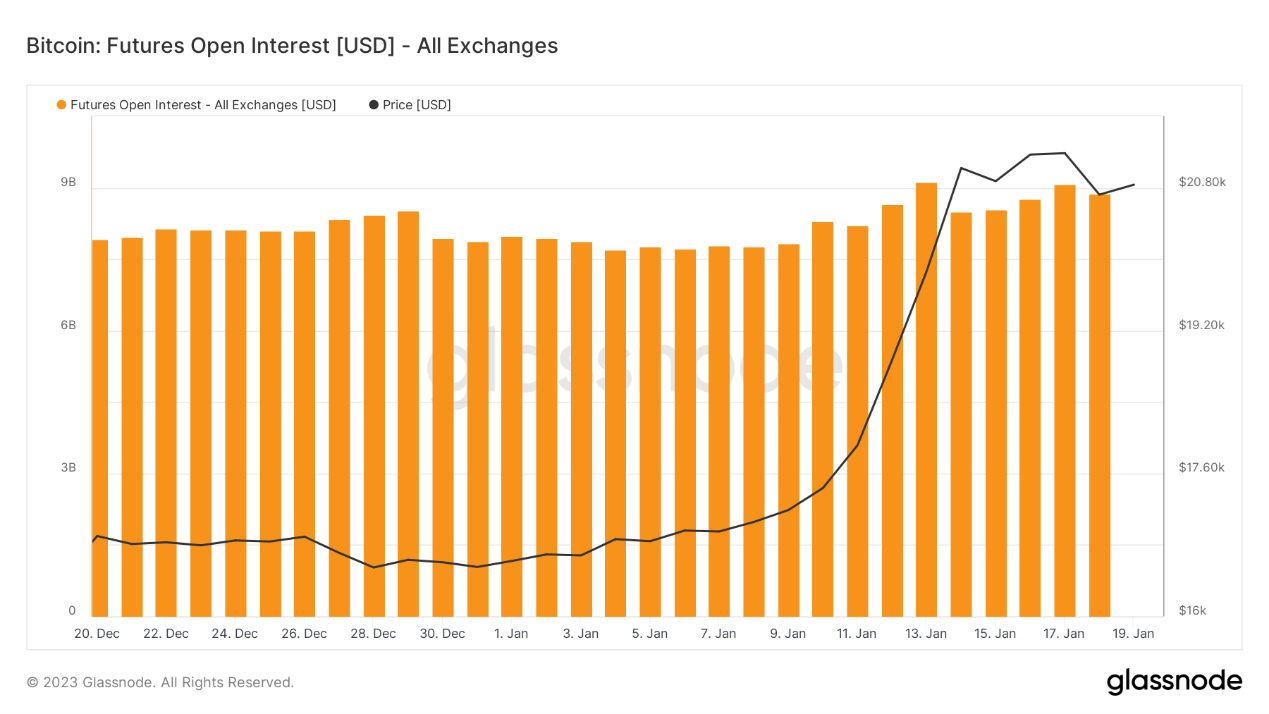

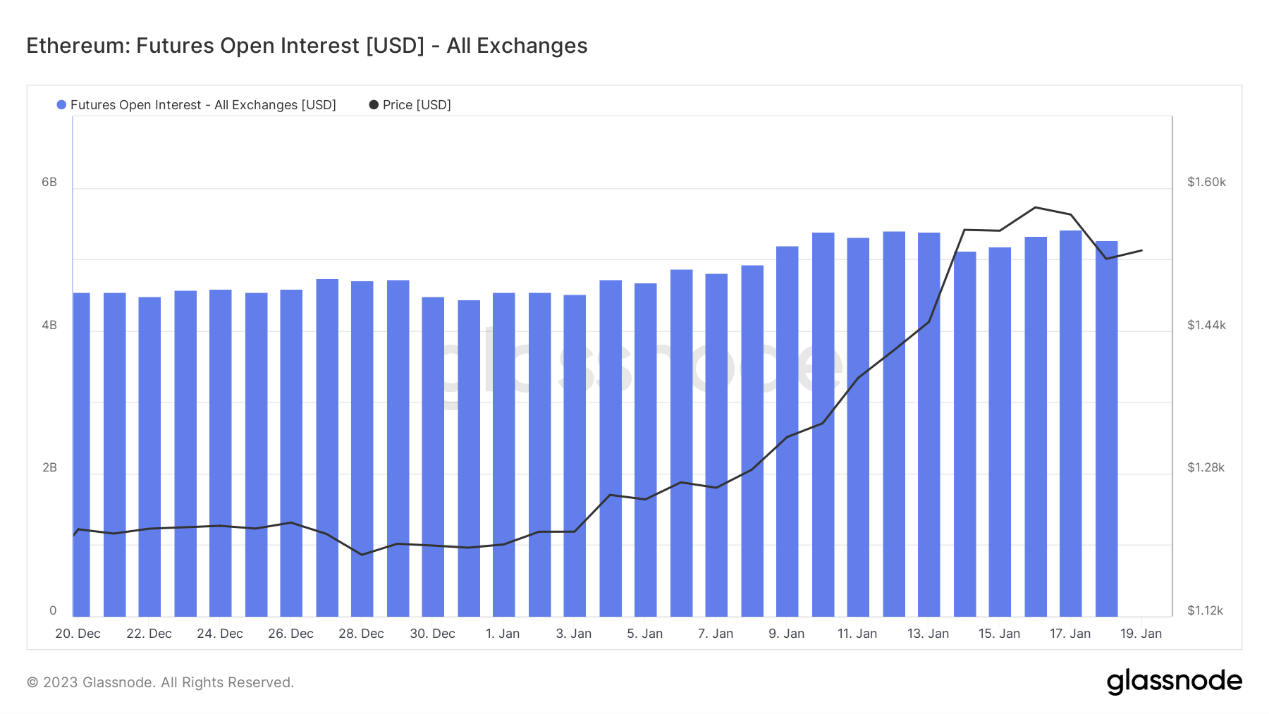

2) Futures market

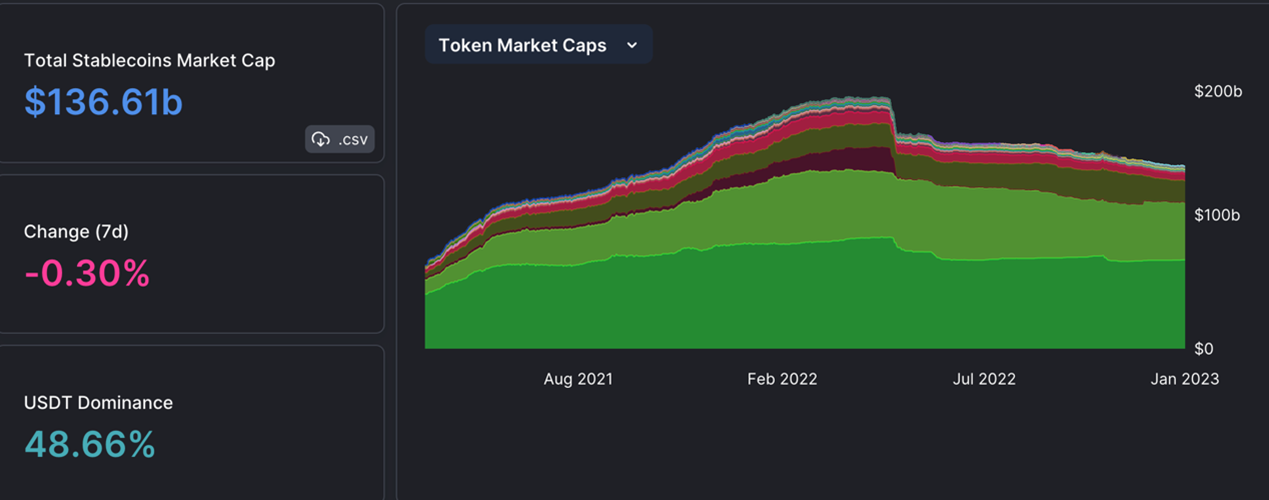

Market funds were flat. In the context of the market surge, the overall market value of stablecoins has not changed, indicating that the game of stock funds in the market is the main game, because the rise also prevents the trend of capital outflows.

The long-term trend indicator MVRV-ZScore is based on the total market cost and reflects the overall profitability of the market. When the index is greater than 6, it is the top interval; when the index is less than 2, it is the bottom interval. MVRV fell below the key level 1, and holders are generally in the red. The current indicator is 0.07, out of the green bottom-buying range.

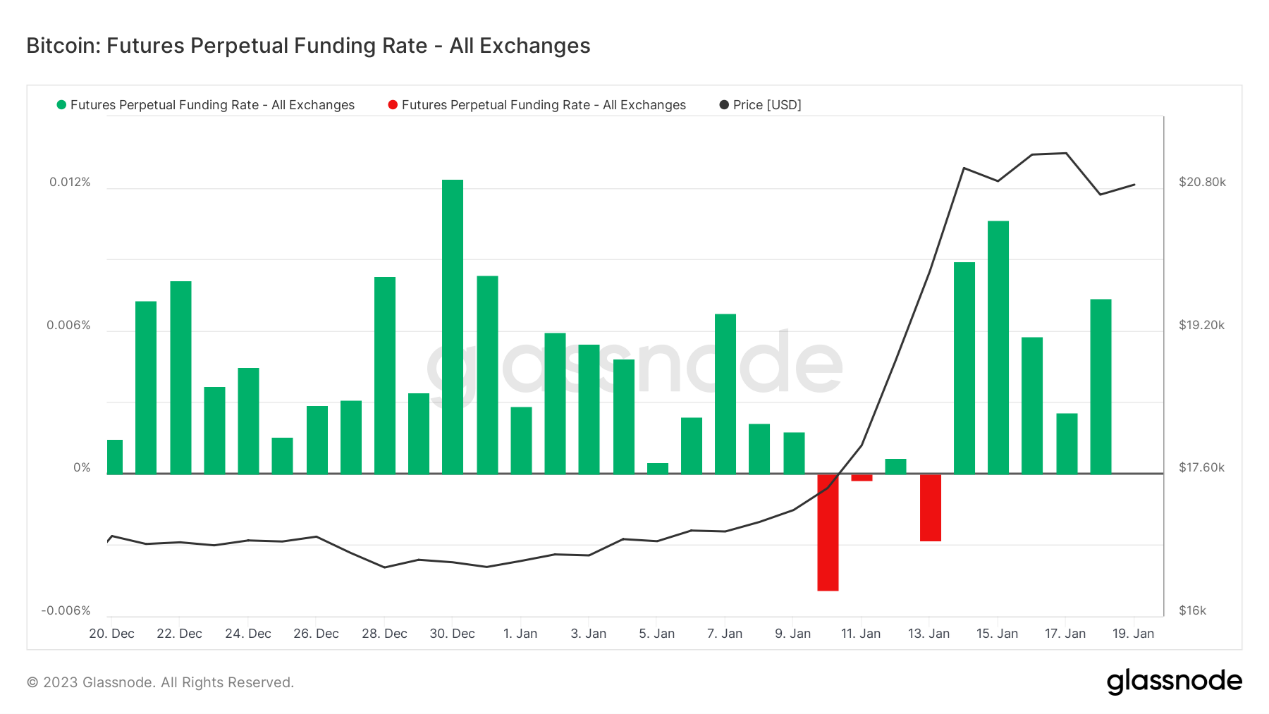

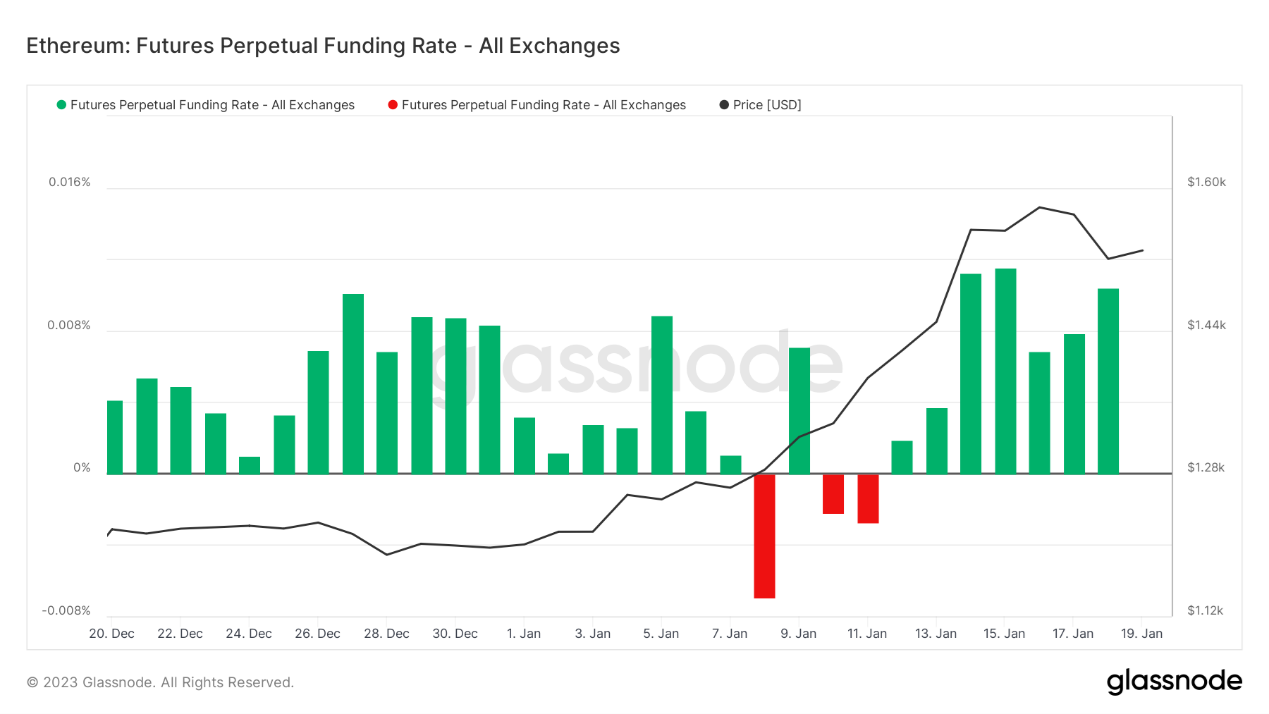

Futures funding rate: This week's rate is positive, and the main force in the market is bullish. The fee rate is 0.05-0.1%, and the long leverage is more, which is the short-term top of the market; the fee rate is -0.1-0%, and the short leverage is more, which is the short-term bottom of the market.

3) Spot market

The market broke out strongly this week. BTC stands firmly at the bull-bear boundary line of 18,500. This round of weekly level rebound is the strongest since July last year and is expected to last for 1-2 months. In order to digest the profits brought about by the rapid rise in the market, the market may enter a period of shocks in the future. BTC around 21000 is a strong resistance level for the starting point of the previous decline. It has recovered the decline caused by the FTX thunderstorm incident. You can pay attention to the strong counterfeit varieties that rebound the fastest during the adjustment period, which shows that the consensus on funds is strong, and they are more likely to become the core leader leading the rebound.

market data:

market data:

secondary title

secondary title

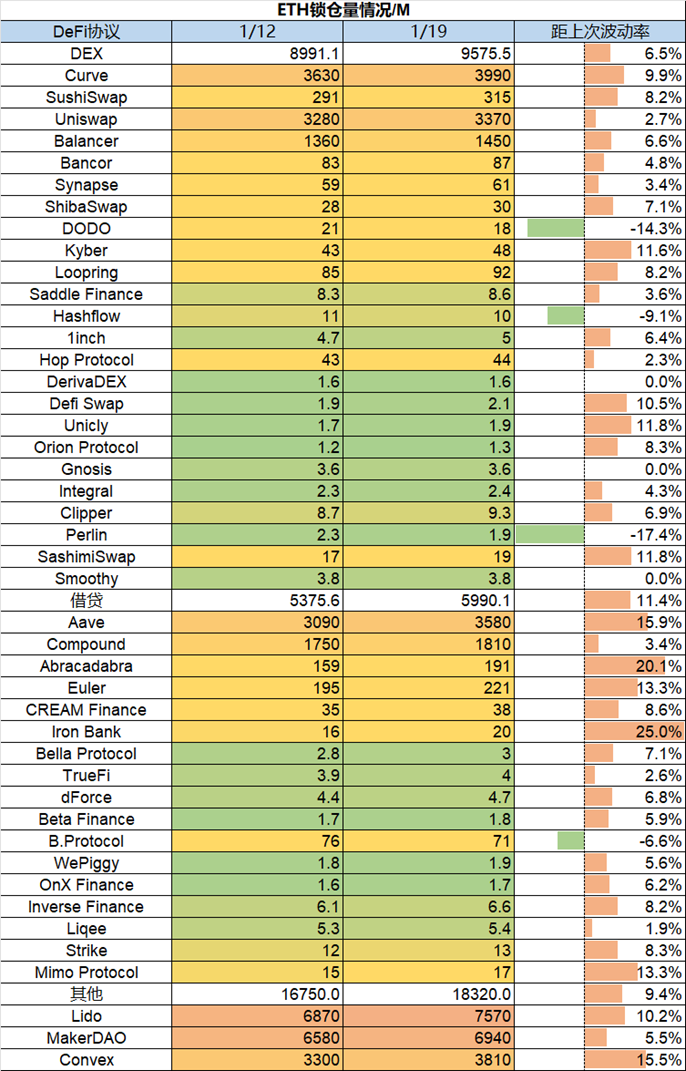

1) ETH locked position situation

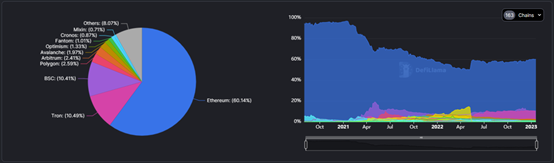

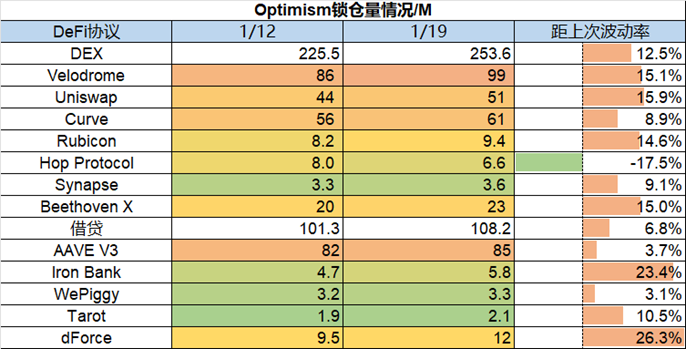

There has been an increase in TVL for three consecutive weeks. This week, the TVL increased by 2.26 B, an increase of 5.3%. Compared with the market, the increase is still low, and the proportion of each chain has not changed significantly. Looking at the agreement, the mainstream agreement has a large increase in the short term. Small agreements have a small increase, and funds continue to concentrate on top agreements. In this round of rebound, agreements with lower increases will gradually lose control.

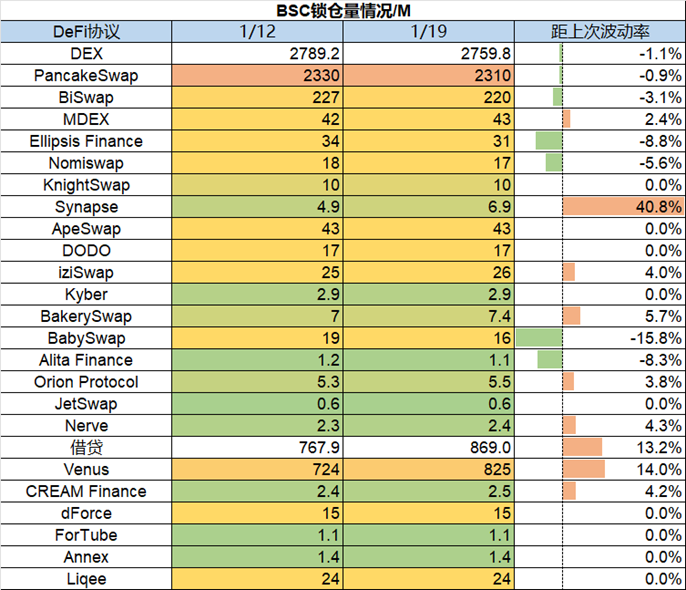

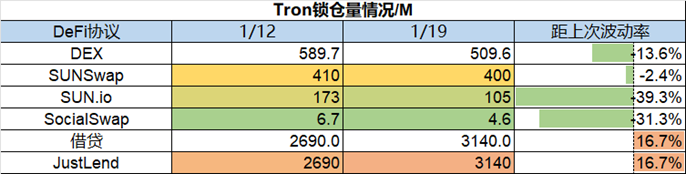

3) Tron lock-up volume

3) Tron lock-up volume

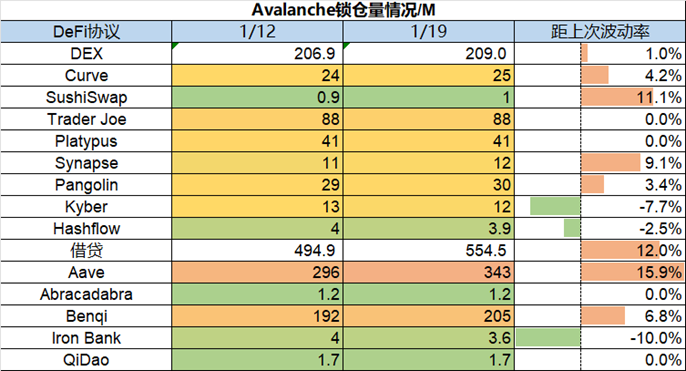

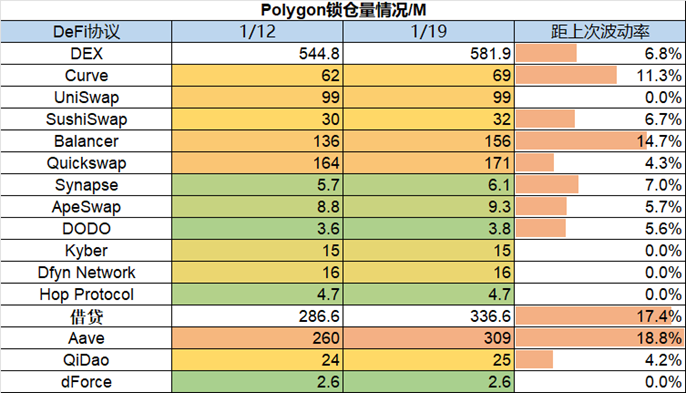

5) Polygon lock-up volume

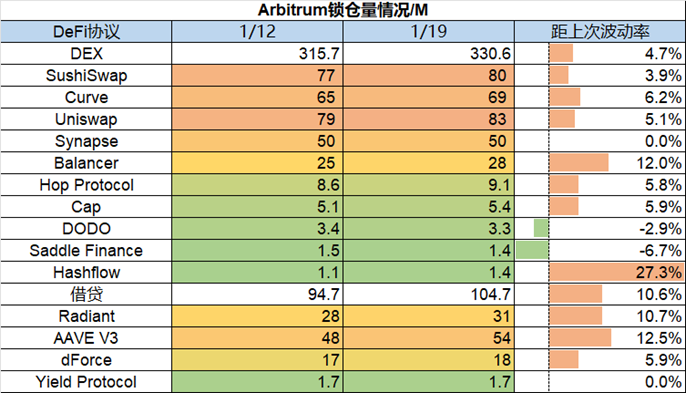

6) Arbitrum lock-up volume

6) Arbitrum lock-up volume

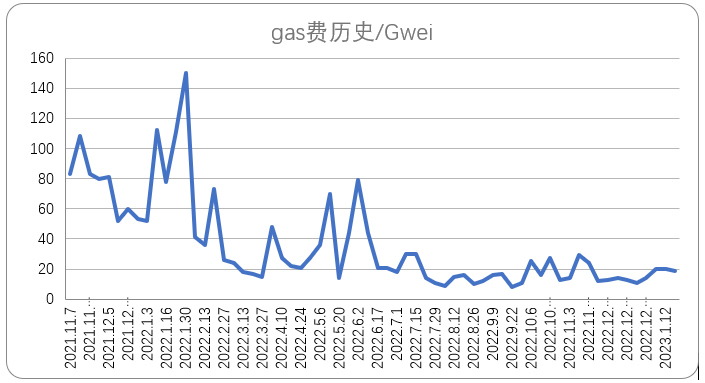

4. History of ETH Gas fee

This week, Gas continued to show an upward trend overall. The current average transfer fee on the chain is about $1.57, the average transaction fee on Uniswap is about $5.35, and the average transaction fee on Opensea is about $2.08. From the perspective of Gas consumption, the transaction popularity of NFT has increased. Decrease, the consumption of NFT-related agreements has decreased, corresponding to the strong fluctuations in the market in recent days, coupled with the market correction on the 18th, the gas consumption of trading-related agreements such as Uniswap has increased significantly, and the short-term market may further fluctuate.

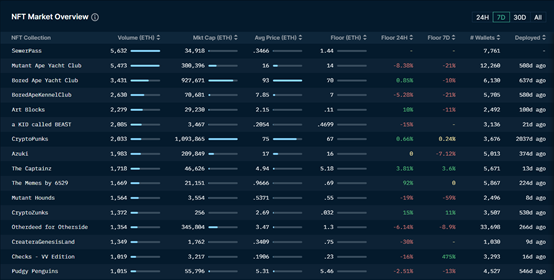

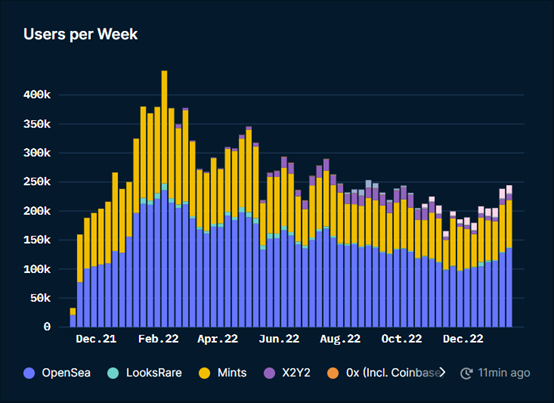

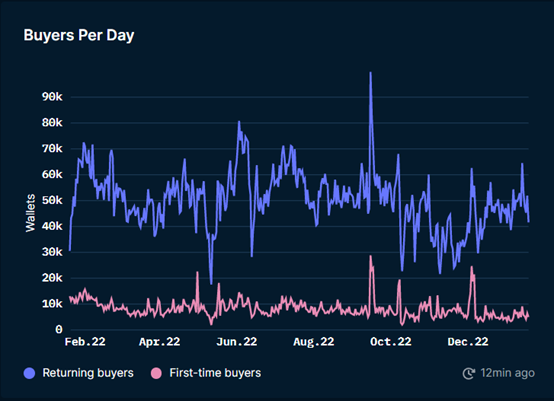

5. Changes in NFT market data

NFT-500 Market Cap:

secondary title

5. Changes in NFT market data

NFT-500 Market Cap:

secondary title

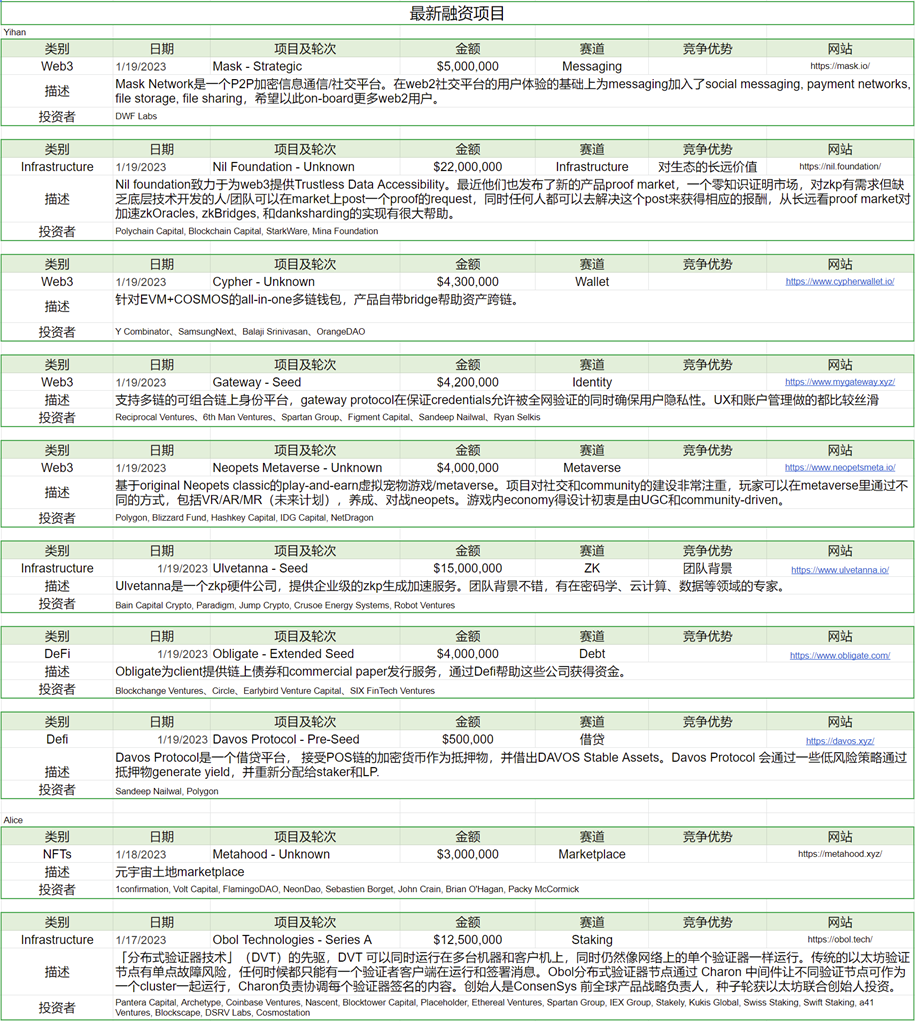

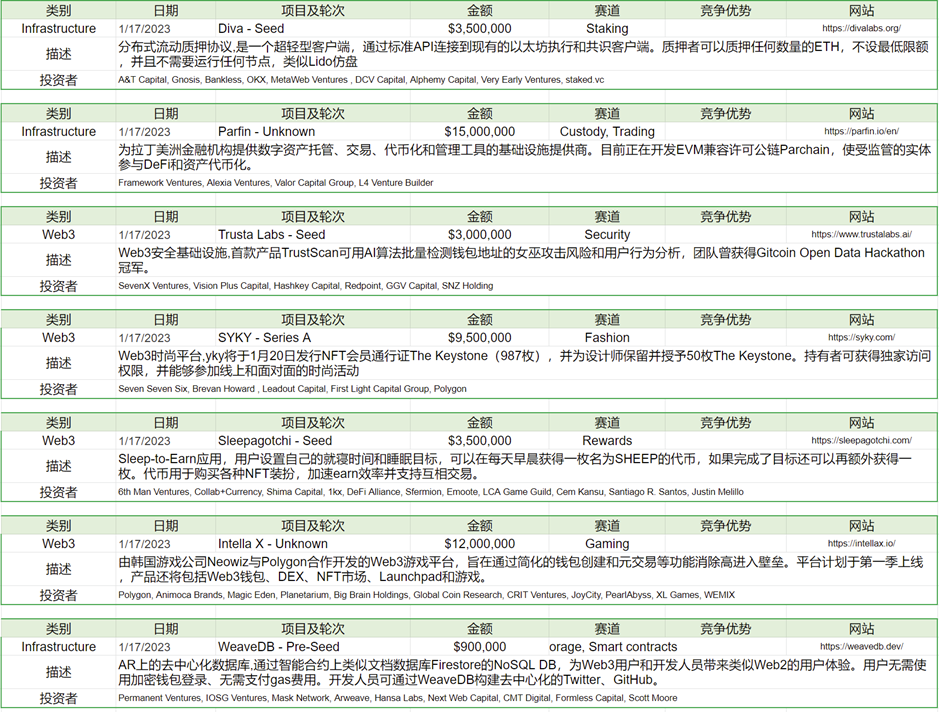

The latest financing of the project

Disclaimer: All Foresight Ventures articles are not intended as investment advice. Investment is risky, please assess your personal risk tolerance and make investment decisions prudently.

Foresight Ventures backs innovative and disruptive Web 3 projects. We believe that the future of innovation will be defined by crypto. As early investors, we want to participate in the growth of the project and provide extensive support from our ecosystem.

The latest financing of the project

Disclaimer: All Foresight Ventures articles are not intended as investment advice. Investment is risky, please assess your personal risk tolerance and make investment decisions prudently.

Twitter: twitter.com/ForesightVen

Medium: foresightventures.medium.com