Talking about whether MEV is a good investment opportunity?

Original Author: Zixi

MEV originally refers to the miners extractable value (Miners extractable value), applied to POW, is to measure the profit that miners can obtain by arbitrarily adding, excluding or reordering transactions in the blocks they produce. MEV is not limited to miners in proof-of-work (PoW) based blockchains, but also applies to validators in proof-of-stake (PoS) networks. The maximum extractable value (Maximal extractable value MEV) refers to under POS, the verifier can extract more than the standard block reward and gas fee in block production by adding, deleting and changing the order of transactions in the block maximum value. Now MEV generally refers to the maximum extractable value.

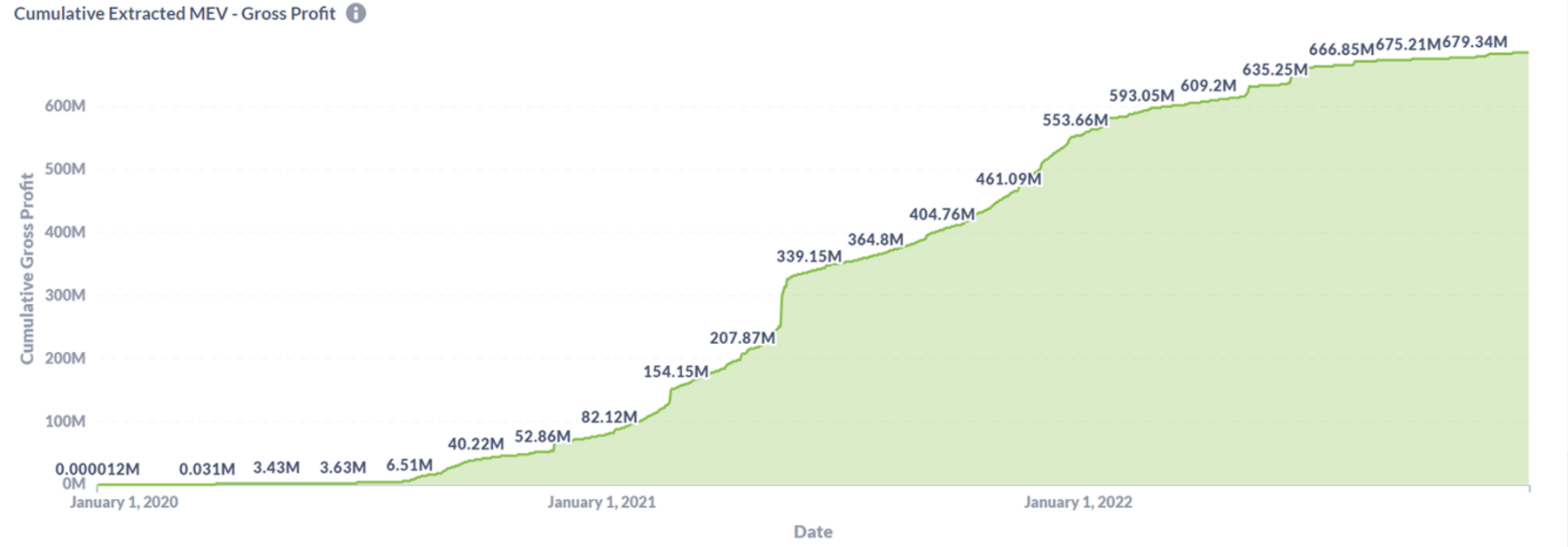

image description

MEVs have pros and cons. The advantage is that it can improve the efficiency of DeFi, and rely on Searcher to quickly equalize the price difference. The disadvantage is that some MEVs greatly affect the user experience. For example, the attacked users will face higher slippage and extremely poor user experience, and due to the existence of gas priority fee, the searcher will sometimes greatly increase the gas fee, resulting in network congestion and Poor user experience.

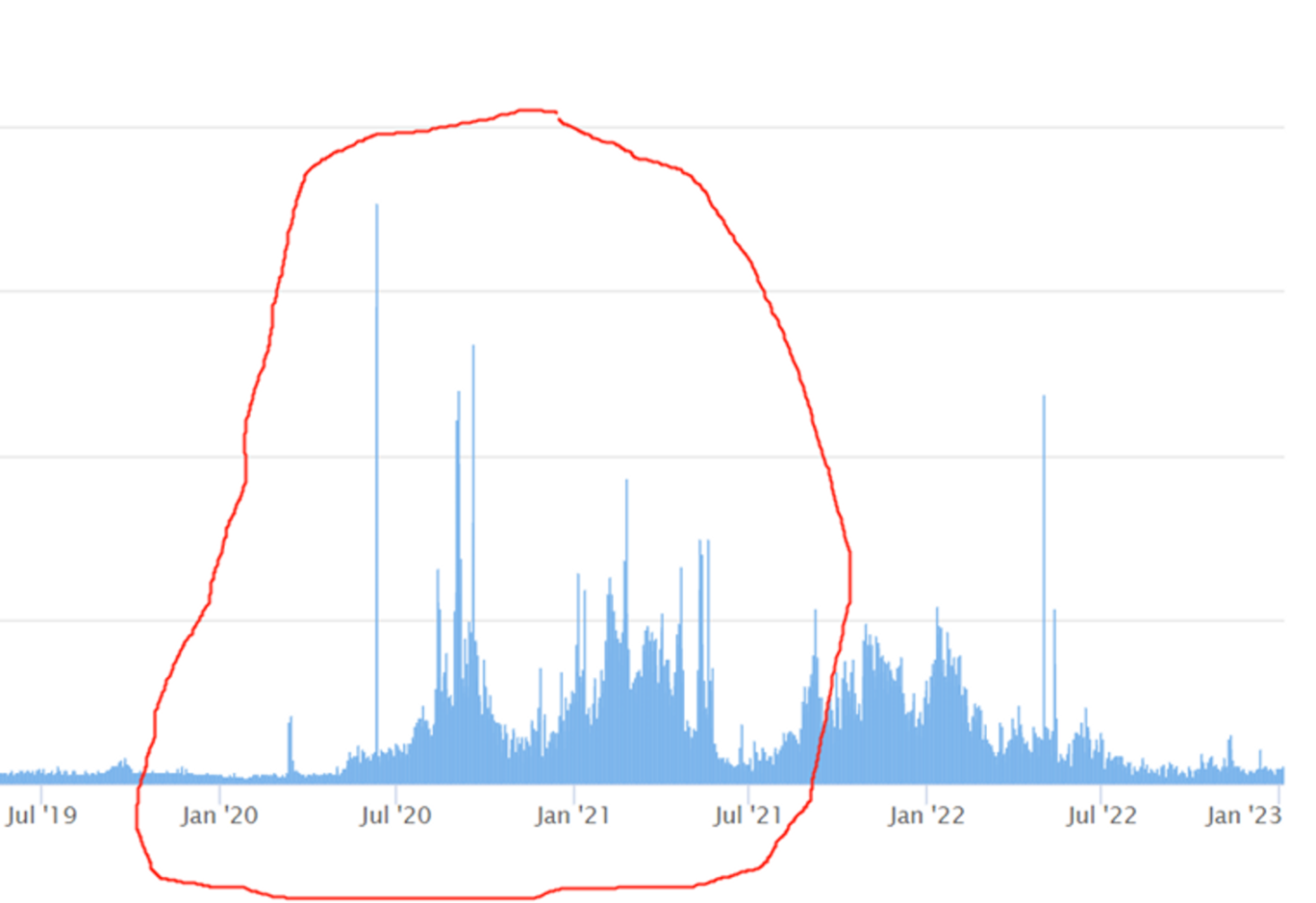

Figure 1: The MEV situation of the top 10 DeFi in Ethereum over the years

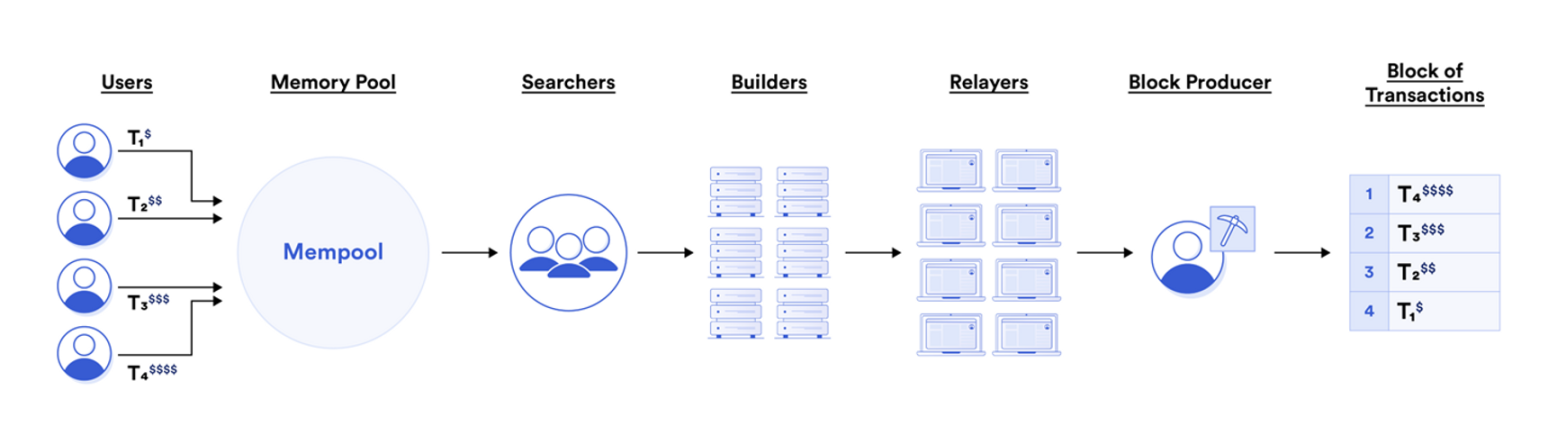

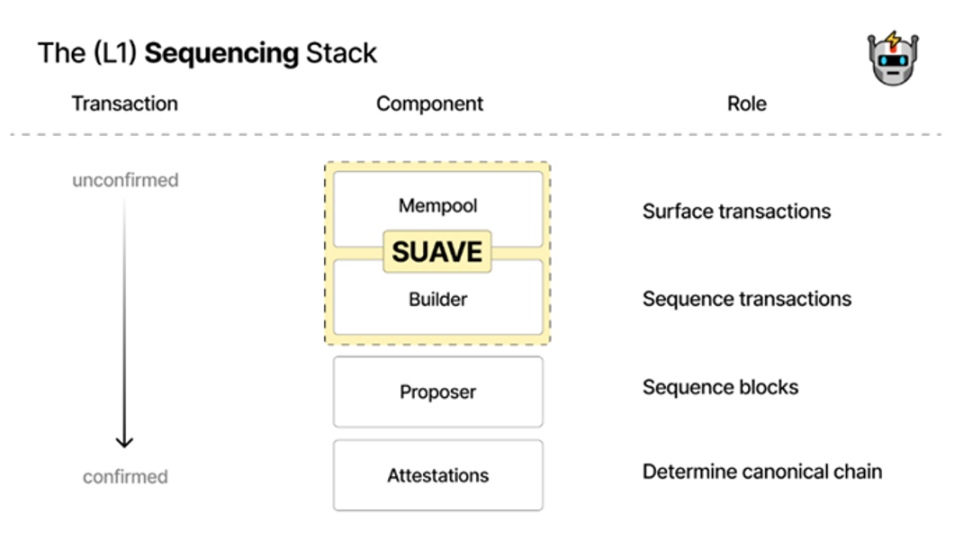

The following briefly describes the division of labor of each role in MEV on Ethereum.

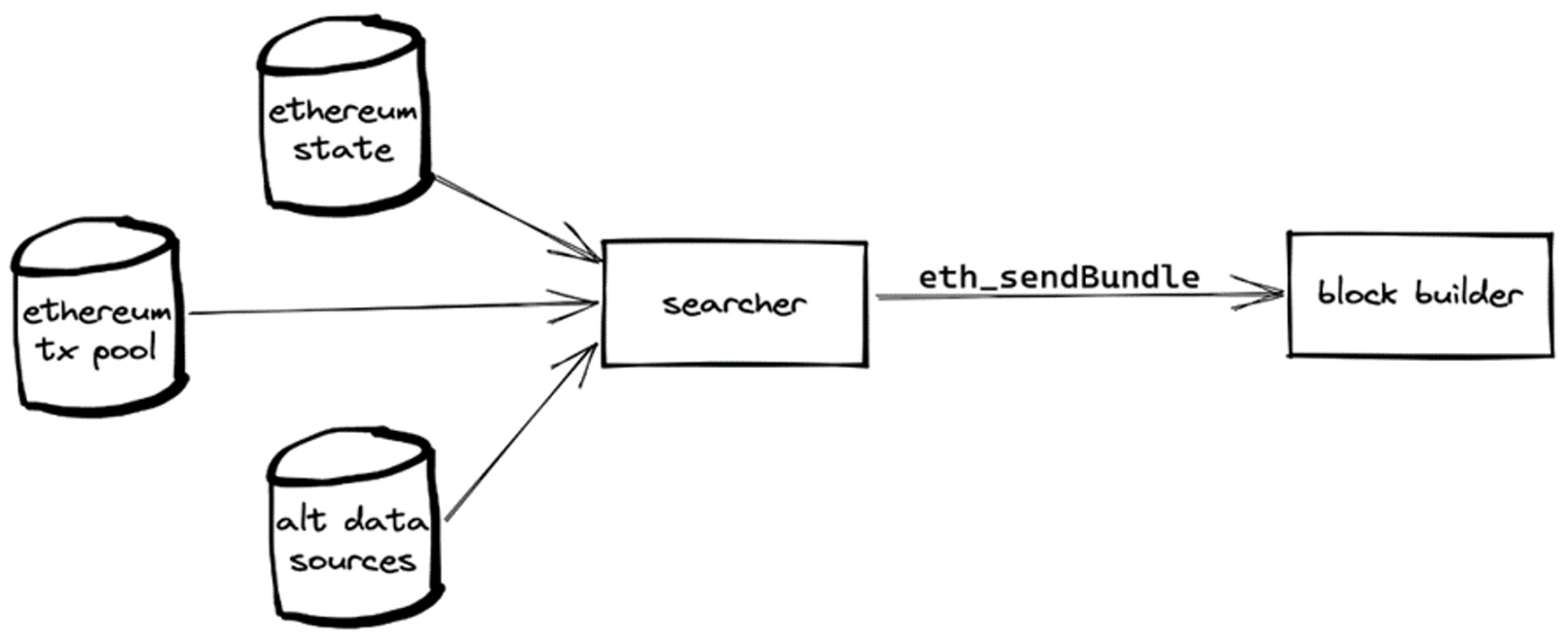

image description

Figure 2: Searcher listens to public trading pools and private trading pools to use algorithms to quote

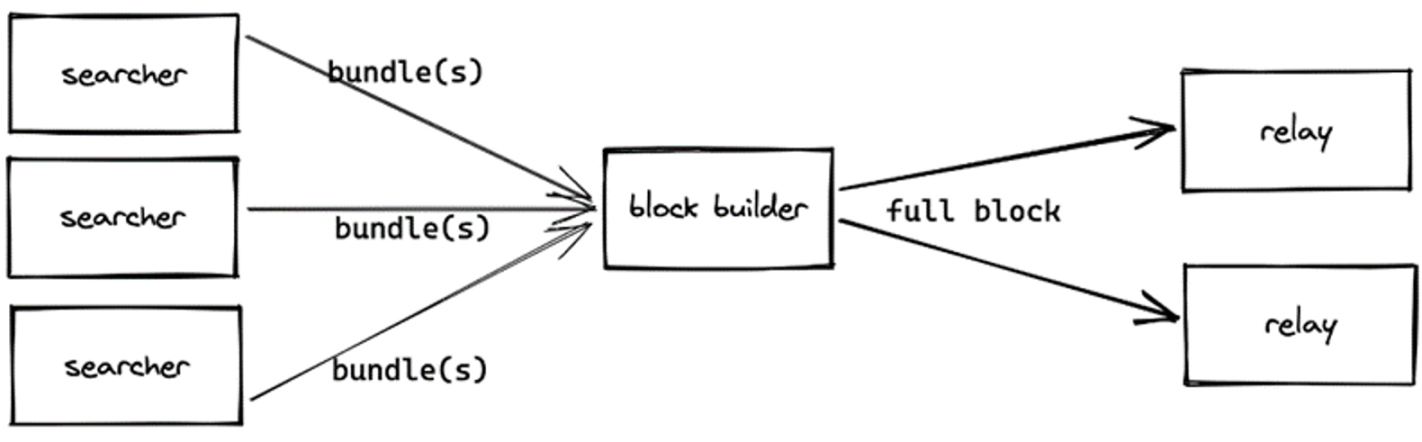

image description

Figure 3: The builder collects quotes from different searchers

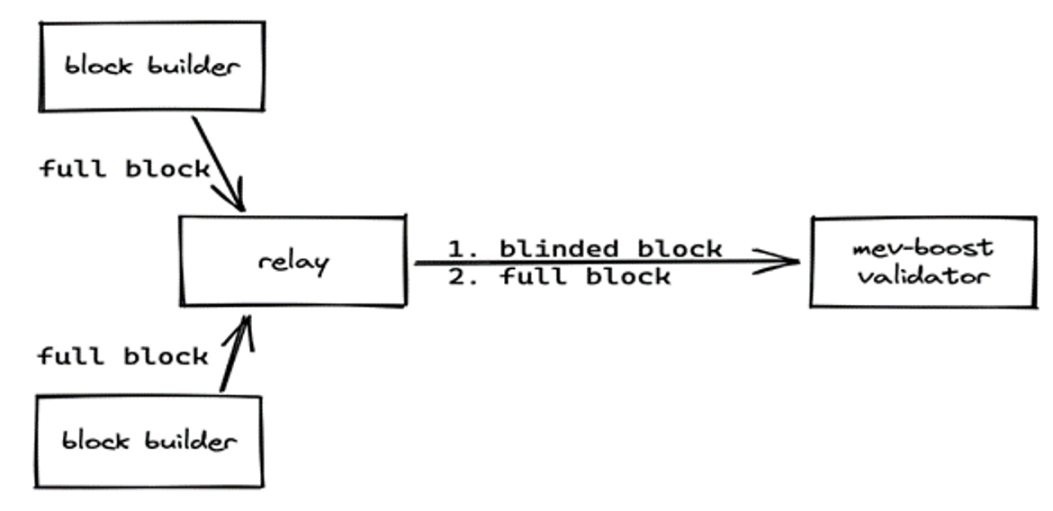

image description

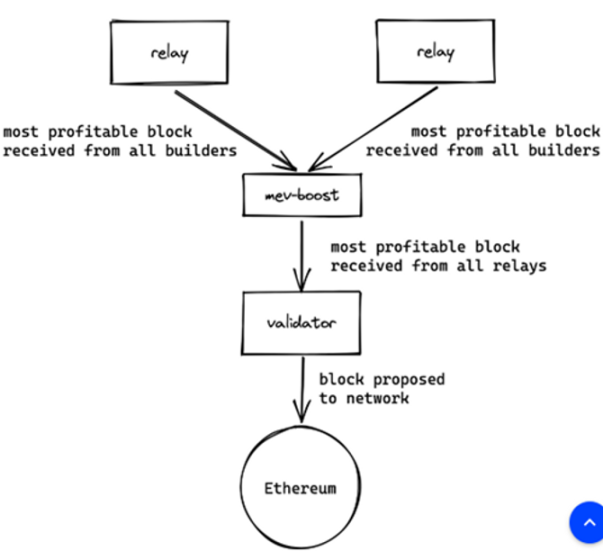

Figure 4: The relayer collects blocks from different builders

image description

image description

Figure 6: The entire MEV industry chain

image description

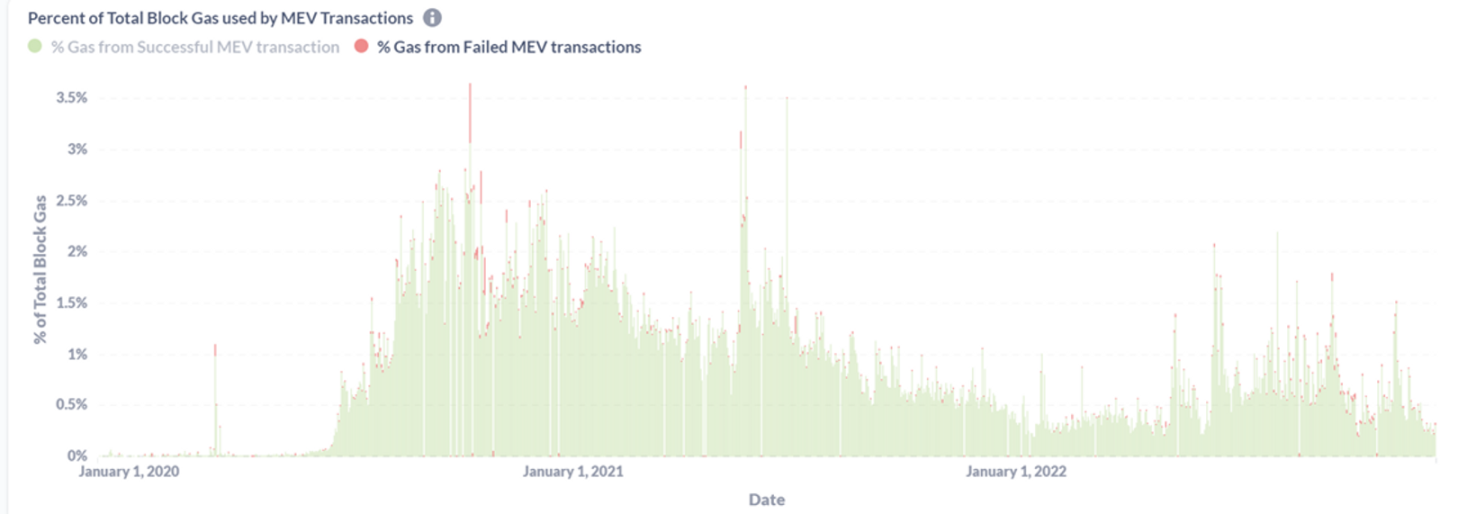

Figure 7: Among MEVs, the cost of failed MEVs is small

Flashbots is a research and development company aimed at mitigating negative externalities (such as on-chain congestion) caused by MEV. Flashbots has launched several products such as Flashbots Auction (with the Flashbots Relay), the Flashbots Protect RPC, MEV-Inspect, MEV-Explore and MEV-Boost etc. Here we will focus on two products, Auction (MEV-GETH) and MEV-Boost.

Before Flashbots Auction, such as in the DeFi Summer in early 2020-2021, the surge in the usage of Ethereum brought a lot of negative externalities, such as high gas and Ethereum congestion. This is due to the fact that in conventional transaction pools in the past, users broadcast the gas bid fee p2p to all nodes, and then miners (now validators) calculate the most profitable blocks. This open bidding method will lead to high gas, and all ordinary retail investors will also have to bear high gas, resulting in poor user experience. In addition, transactions due to auction failure (that is, less gas payment) will also be restored on the chain, occupying a certain block space, which will eventually lead to waste of block space and reduced revenue for miners (validators), a lose-lose situation. So Flashbots created Auction to alleviate the above problems. Auction provides a private transaction pool + private bidding block auction mechanism, allowing validators to trustlessly outsource the most profitable block building work. In this private private transaction pool, searchers can communicate privately without paying for failure.

image description

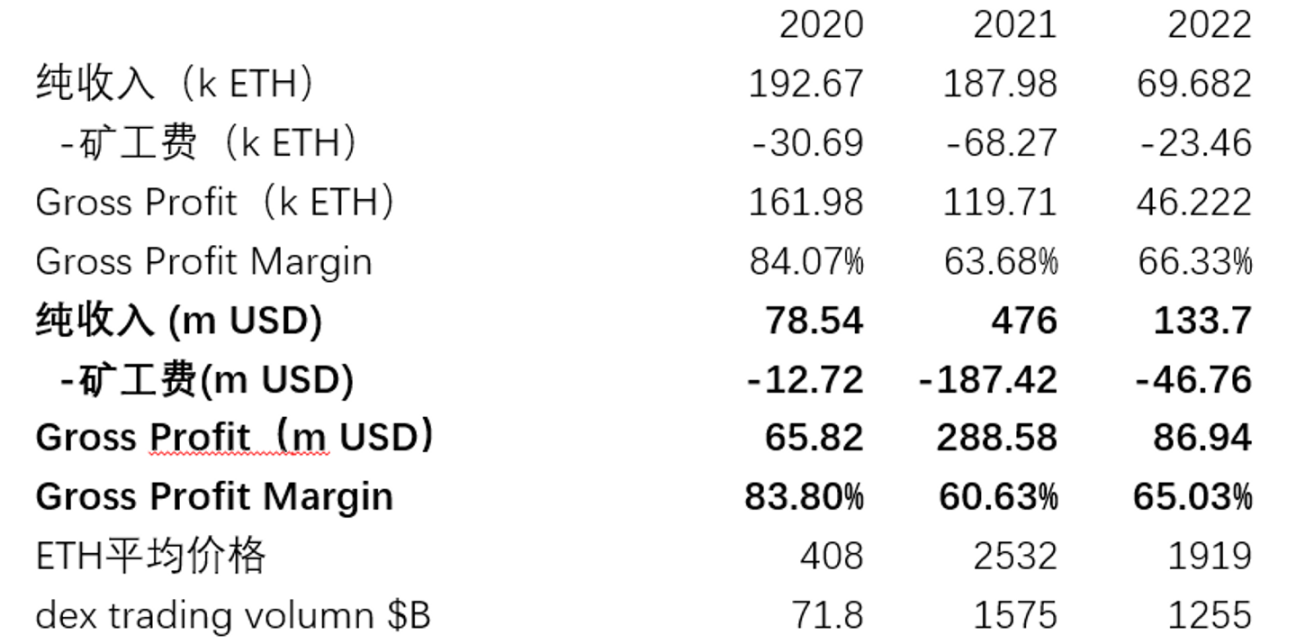

Figure 8: Searcher's revenue gross profit is around 64%

image description

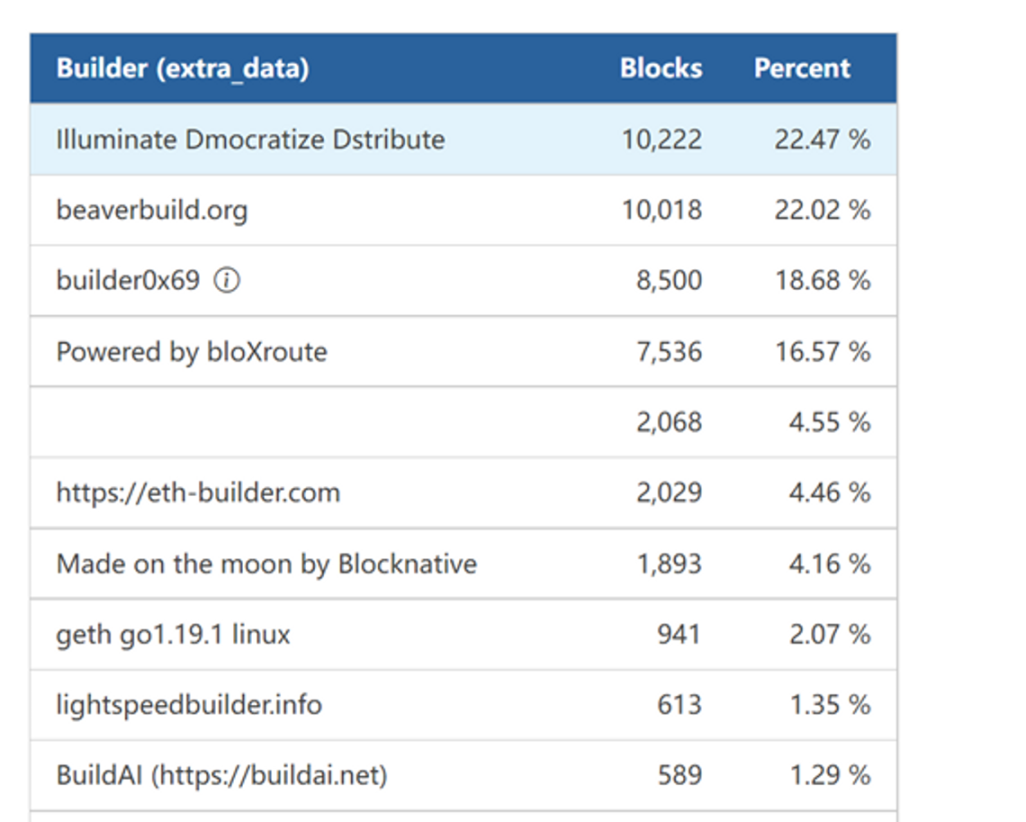

Figure 9: Builder is becoming more and more centralized

image description

image description

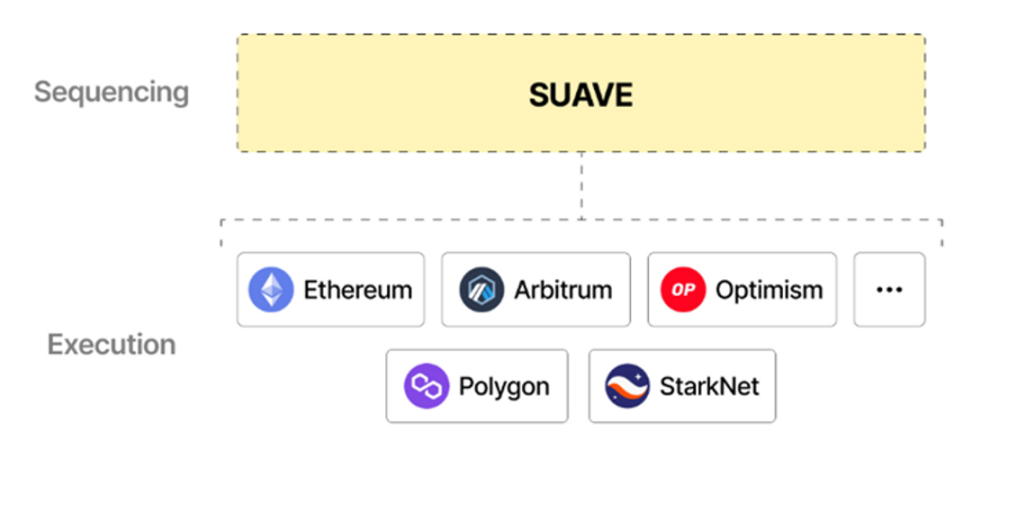

Figure 11: SUAVE can realize cross-chain MEV

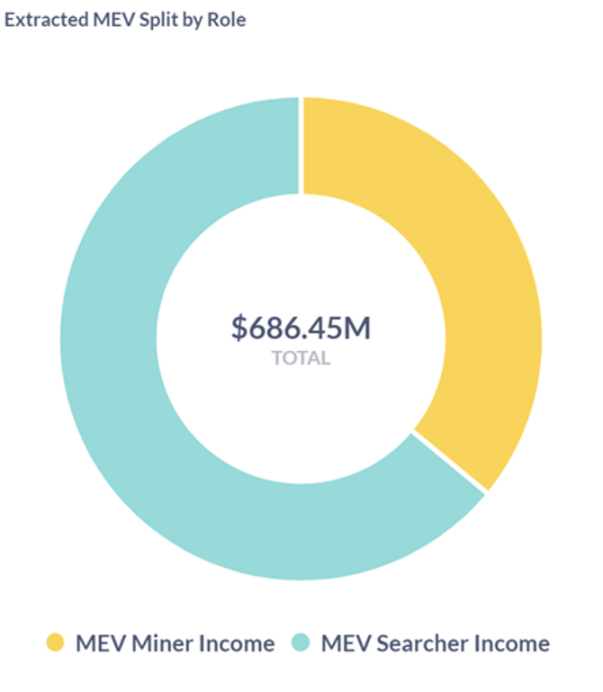

According to the statistics of Flashbots, ME V2 will accumulatively earn 70 K ETH in the 10 top DeFi projects on Ethereum in 2022, or 133 million US dollars in revenue, compared to the cumulative income of 188 K ETH in the bull market in 2021, the revenue of 475 million US dollars is significantly higher. The decline is due to the bearishness of on-chain transactions (full-chain dex transaction volume will drop from $1575 B in 2021 to $1255 B in 2022), and the decrease in leverage on the chain (liquidation chain liquidation is also one of the sources of MEV profits. However, due to the excessive decline, the leverage ratio on the chain has been reduced), etc.; but the overall gross profit margin has increased, from 61% in 2021 to 65% in 2022, because the promotion of Flashbots has increased the gross profit margin of searchers. MEV is highly dependent on the activity/transaction volume on the chain, and the activity/transaction volume on the chain is greatly affected by the market. For example, in the bull market in 2021, the overall revenue ceiling is 476 million US dollars.

image description

image description

Figure 13: The bullish chain is full of opportunities, the MEV market is large, but the Gas fee is high and the profit margin is low

Low trading volume in bear market, small MEV market, but no more expensive Gas War, high profit margin

image description

image description

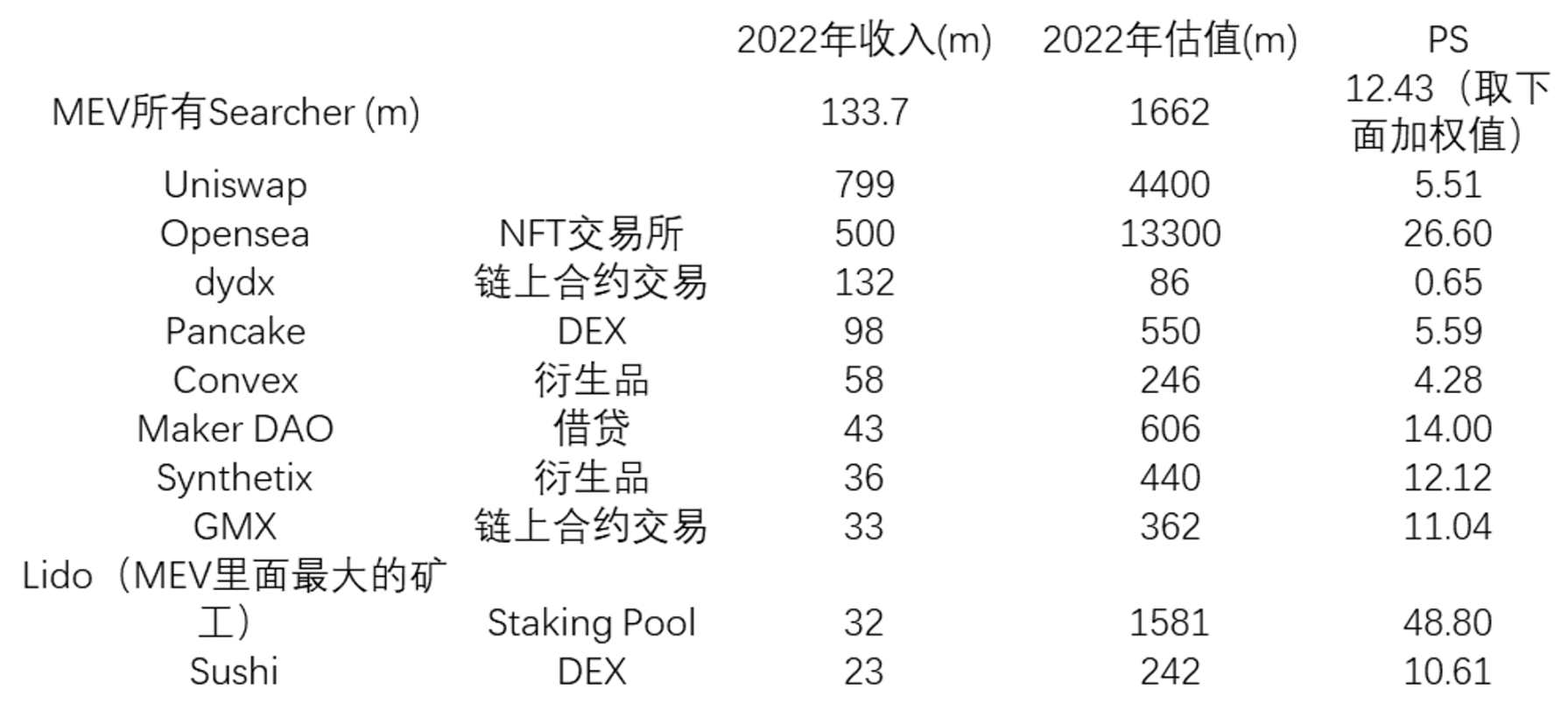

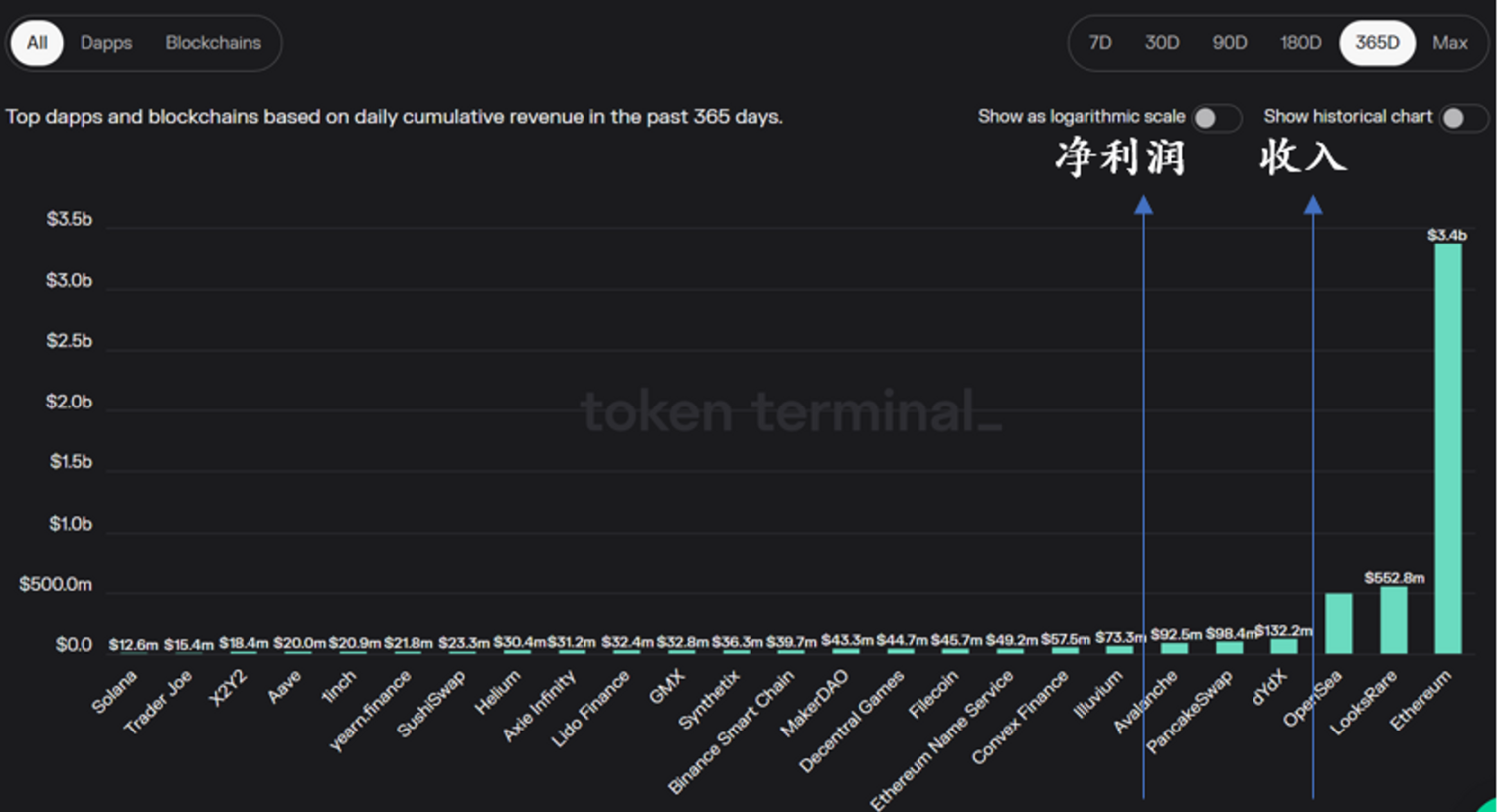

Figure 15: In 2022, MEV Searcher's revenue is second to opensea, better than dydx, and ranks high among all blockchain projects

In summary, MEV is a rare underlying track in the blockchain with strong cash flow, strong transaction correlation, high income but relatively low risk. MEV will be similar to quant and market makers in some strategies, but because it does not bear any counterparty risk, MEV is more stable than quant and market makers (at least it will not be as big as some market makers) The position will be liquidated when it changes). The strategy of MEV is more rigid, but the risk is also lower. The most typical manifestation is to do arbitrage in DEX. Judging from the performance of Searcher in 2022, the MEV income brought by the top 10 top dapps on Ethereum is 133.7 million US dollars, minus about 1/3 of the miners' gas fees, and the income is about 87 million US dollars, plus other Layer 1 and Layer 2, the overall MEV income of the blockchain is quite high. However, according to the recent feedback from some Searchers on Ethereum, more and more newcomers have begun to enter the MEV track as searchers, which has led to the original oligopoly competition of Searchers gradually becoming a complete competition, and the excess returns have been greatly reduced. The income originally belonged to the searcher was finally attributed to the Validator, which also explains the reason for the increase in Lido's income in the past year and a half. In addition, for other L1s represented by BSC, although the overall scale of BSC's MEV will be smaller than Ethereum's MEV, but due to the lack of a unified bidding system and less intense competition, the overall net profit rate of Searcher will be high. In addition, we have seen MEV projects similar to Flashbots who want to dominate the market on Cosmos.

From the perspective of investors, MEV (Searhcer) is a typical equity structure project, which is similar to the investment of market makers as a whole, but there is no counterparty risk, so the overall risk is smaller. Since such companies are less likely to issue coins, the exit path may only be mergers and acquisitions, dividends, etc. The core of judging the MEV (Searhcer) project is still 1. Whether the search algorithm is reliable 2. Whether it can quote to the node immediately 3. Control the cost of gas 4. Expand other chains, etc. Therefore, the overall technical requirements for the team are relatively high, typically not BD-oriented industries may be suitable for Chinese people. Therefore, when investing in companies similar to MEV (Searhcer), if the valuation in the first and second rounds is low and the team level is high, you can consider the layout. If you consider MEV bidding system companies, if the chain is dynamic enough and there is no unified bidding system, then you may be able to produce products like flashbots, which may be suitable for foreigner teams to build Infra and then do BD .

Original link