In the past year, the encryption industry has experienced turmoil and reshuffle, and black swans are frequent. In the tense market sentiment, people have endless FUD about Tether and USDT, but in fact, in the more than 8 years since Tether came out, from No redemption request has been rejected.

text

1. In October, Tether celebrated its eighth anniversary. During these eight years, Tether has grown into the stable currency with the largest market value, serving hundreds of millions of users. What do you think makes Tether so popular?

Eight years ago, Tether invented the concept of stablecoins. In less than a decade, stablecoins have grown from a concept that has been proven over time to an issued asset class worth more than $100 billion, which is widely used and circulated.

Tether is the first stablecoin in the crypto industry and is used by tens of thousands of traders every day. It is essentially the dollar on the blockchain and circulates on nearly every crypto platform and exchange in the world. Tether's success is inseparable from its innovative community, word of mouth and recognition from users.

Traders also choose Tether because it is the largest and most liquid stablecoin and has been open to redemption since its inception, and Tether has never refused redemption in its history. Tether is used to open/close positions quickly and efficiently, which is why Tether's utility is growing in popularity as the cryptocurrency industry continues to grow.

2. A major event that happened recently is the collapse of FTX. From the perspective of Tether, how do you view this matter? How does this affect financial freedom? How does Tether view these major crashes in the industry in 2022? (FTX, LUNA/UST, 3AC)

In the midst of the bankruptcy of cryptocurrency exchange FTX and concerns about Alameda Research's financial situation, we first and foremost want to act as a voice for the entire cryptocurrency ecosystem and reiterate to the public that one crisis does not determine the fate of an industry.

Regardless of the turmoil this event may cause, cryptocurrencies and blockchain technology are facilitating a revolution in financial inclusion, changing traditional financial models that do not work in many parts of the modern world.

Second, we would like to state that Tether does not have any credit risk from FTX or Alameda Research. Tether has never suffered losses from Alameda Research or FTX.

Tether tokens are 100% backed by our reserves, and the assets backing the reserves exceed our liabilities. Tether has a strong, conservative, and liquid portfolio that includes cash, cash equivalents, and U.S. Treasuries. Tether will continue to focus on securing these reserves, as it has done for many years.

While their situation comes as a surprise to many, given FTX’s reputation and size, it does not represent the practices of all important players in the industry. Tether has worked and delivered on its promise to strengthen its balance sheet wherever possible and improve the quality and liquidity of its collateral.

As market conditions have changed, Tether has adapted and grown with them. We can proudly say that the vast majority of Tether's reserves are now in U.S. Treasuries. This puts Tether in a strong position to weather any market volatility that may arise.

Trust is built over years and can be lost in an instant. We'd love to know who else would go on to fail if large, trusted businesses suddenly collapsed. Tether will continue to dispel fear and address community concerns, and we will continue to stand by your side in the fight for the potential inherent in a decentralized monetary system.

Tether continues to lead the industry in transparency and security, and has never wavered from its mission to provide a safe haven for all.

3. As the stable currency with the largest market share, how does Tether expand the influence of the US dollar through the solution of stable currency and keep the US dollar strong?

Stablecoins are one of the most significant innovations in how fiat currencies (especially the U.S. dollar) are used and provide use cases to the world. It is well known that the U.S. dollar is the most popular fiat currency in the world, but despite this, it is still very difficult for individuals to hold or acquire U.S. dollars in many countries outside the United States.

In fact, there is a black market for dollars in some countries. Due to the high inflation of the country's national fiat currency, the dollar circulates on the black market at a premium to the prevailing foreign exchange rate. In these countries and regions, only the rich have reliable access to dollars.

This problem is further complicated in an environment where the dollar is appreciating against other currencies. The strength of the dollar has wreaked economic havoc in many emerging markets, where limited access to dollars means ordinary people are forced to bear the burden of high inflation with little recourse for compensation.

While the attention and priority given to the cryptocurrency industry usually comes after the fiat financial order, it ignores the fact that billions of people around the world want easy access to dollars.

Tether not only created a way for people to acquire dollars as a tool for financial freedom, it also created a system to strengthen the dollar. Previously, the global demand for dollars could only be met with actual dollars.

Additionally, Tether has become a buyer of U.S. Treasuries based on Tether’s conservative management of its reserves. In fact, in May, stablecoins accounted for more than 2% of the total U.S. Treasury market, more than Berkshire Hathaway owns. Even today, Tether remains a significant buyer in the U.S. Treasury market.

This means that, theoretically, all dollar needs that could not be met before can now be met using USD₮.

Tether is an important and powerful tool for the United States to maintain the status of the US dollar as the most stable, most used and most popular currency in the world. In the 1970s, the United States secured the dollar's future through the petrodollar system, and oil producing countries sold oil only in dollars. Large creditor countries (Japan, Europe, etc.) that cannot acquire sufficient energy reserves have to pay for oil in dollars. This strengthens the demand for the dollar during currency transitions and puts both the dollar and the US in a strong position. The trade surplus then flowed back into U.S. Treasuries.

The invention of Tether, the digital dollar, is a monetary policy tool for the digital age. We hope that the United States will encourage this practice.

4. Judging from the collapse of FTX, the misappropriation of user assets is the main reason for the failure of FTX. This is also the importance of transparent reserves, and is this one of the reasons why Tether chose to eliminate commercial paper to further reduce the risk value of reserves?

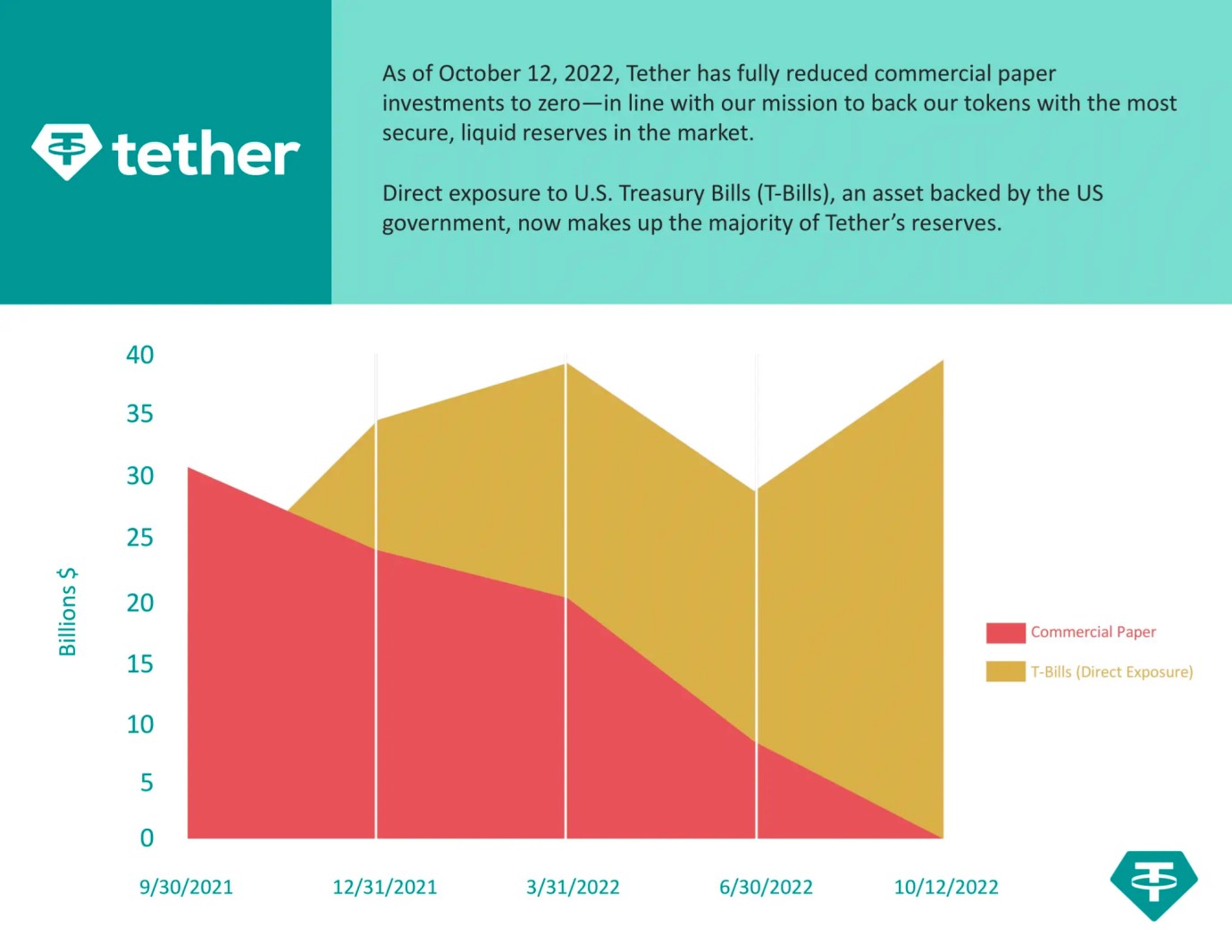

Over the past six months, our exposure to commercial paper has been gradually reduced until completely eliminated, while our reserves in U.S. Treasuries have increased. To ensure that its exposure is diversified, Tether imposes limits on individual issuer and regional exposures to commercial paper.

Speculation that Tether uses commercial paper issued by cryptocurrency exchanges as reserves is irresponsible and absolutely false; Tether does not hold such commercial paper (even if they exist). Any commercial paper purchased by Tethe was not issued by any of its affiliated entities.

Tether has a strong, conservative and liquid investment portfolio, which includes cash, cash equivalents and U.S. Treasury bonds, and Tether is focused on protecting these reserves. Tether has developed a set of risk indicators and risk measurement processes that enable Tether investment and finance teams to assess the risk of the investment portfolio at any point in time.

The latest reserves report can be read here:https://assets.ctfassets.net/vyse 88 cgwfbl/1 Xfu 4398 CIoMiuKjPhvnHM/6 d 1608 c 90 bb 775 d 2d 43 2b 7 b 24264 da 28/ESO.02 _Std_ISAE_ 3000 R_Opinion_ 30-9-2022 _RC 1324 BD 05482.pdf

The report also showed a marked decrease in the percentage of commercial paper investments. The reduction in commercial paper exposure is in response to our community feedback and is consistent with Tether's investment policy and risk framework.

Any media hype and suggestion that Tether may pose a risk to the broader economy is misleading the public. Based on our latest assurance report, we believe unbiased analysts would agree that Tether has extremely limited exposure to commercial paper. The latest Fitch Rating "Stablecoin Dashboard: 4 Q2 1" independently noted that Tether has the most detailed reserve reporting and also affirmed the liquidity of Tether's portfolio, which increased with the reduction of commercial paper.

5. In terms of promoting future financial freedom, what plans does Tether have in the future? What position will Tether occupy in the financially free Web3 world in the future?

Tether has set its sights on the future of retail and stores. We believe that Tether tokens will surpass traditional credit and debit card solutions as they are cheaper, faster and more transparent.

We have been working with the city of Lugano in Switzerland to demonstrate real-world applications of blockchain technology by actually applying it to local communities in the region. To date, most blockchain projects have focused on basic work, paying little attention to local communities, and providing real-world applications. Through this partnership, we hope to expand the city's blockchain capabilities and promote Lugano as a major hub for blockchain adoption in Europe.

We remain hopeful that stablecoin regulation will provide much-needed transparency to large corporations, institutions and fintech companies looking to enter the cryptocurrency market.

To date, stablecoins have become a necessary fiat in and out channel, used by traders to quickly open/close positions and provide a stable unit for settling cryptocurrency payments.

As this fact takes hold, we expect it will open the door for more products to come to market and better (and more compliant) ways to do business.

Since we invented cryptocurrencies in 2014, the topic of stablecoins has entered the upper echelons of lawmakers and regulators, which excites Tether as it further validates the utility of stablecoins in the global financial system.

6. Currently, the three mainstream stablecoins are USDT, USDC and BUSD. How do you see the other two competitors? How will USDT respond to the competition from the other two?

Tether is able to stand out from competitors because it has a strong, conservative and liquid portfolio and emphasizes the importance of protecting its reserves. Tether continues to lead the industry in a quarterly reserve certification from an independent accountant, certifying that all Tether tokens are fully backed by reserves. These reserves have also been stress tested. Most importantly, Tether has never rejected a customer's redemption request. Unlike our competitors, our core target remains individuals rather than banks, and as a result, we are able to have a popular, liquid, trusted and transparent stablecoin.

7. In what ways does Tether advance the idea of real-world adoption of cryptocurrencies and financial freedom?

Tether is the first stable currency in the encryption industry and the pioneer of stable currency technology. Of all the stablecoins, Tether has the highest trading volume and liquidity.

Tether's original intention was to improve the efficiency of the encrypted economy by putting dollars on the blockchain. It is used to reshape the rules of everything from digital payments to e-commerce, and even facilitate transactions within the decentralized financial ecosystem. Currently, Tether is the most used stablecoin in the cryptocurrency trader ecosystem, with at least $60 billion and as much as $120 billion in transaction volume done every day.

In addition to the cryptocurrency market, Tether is also being used to facilitate cross-border trade and remittances to emerging markets. Tether provides a stable and efficient way to transfer value and is widely used by tens of thousands of traders in Asia, Latin America and Europe every day because it makes activities such as trading and arbitrage more efficient.

8. How does Tether deal with the massive run in the black swan event?

Tether has nearly $70 billion in collateral and can back USD₮ to redeem those collaterals. Currently, no exchange has a comparable reserve of sufficient liquidity. Due to Tether’s USD redemption mechanism and the collateral behind it, USD₮ is able to remain pegged to the USD, rather than simply because the price of USD₮ is usually traded at $1 on exchanges. In fact, USD₮ does usually trade at $1 on exchanges because investors know that Tether's redemption mechanism is reliable.

Tether has never rejected the USD₮ redemption application. We should remember that during numerous black swan events, Tether not only maintained its peg to the USD exchange rate, but honored every redemption request.

This year alone, Tether was able to redeem 10% of its outstanding debt within 48 hours, which is of practical significance - no bank in the world can process a withdrawal of 10% of its outstanding debt in a single day. payment requirements. Additionally, Tether processed $20 billion in redemptions in 30 days, accounting for 25% of reserves. Some of the largest bank runs in history have amounted to far less than that, but Tether has been able to do it without a hitch.

Since Tether's inception, it has made serious and continuous efforts to enhance the public disclosure of its reserves and communication to users. As a leader in the ever-growing cryptocurrency industry, Tether has always strived to be one of the most transparent stablecoins. Tether has always been fully backed, and the proof of reserves it provided reaffirms this. Tether will continue to validate its business as it grows in the market. We understand the public interest in this matter and are pleased to make Proofs of Reserves public now and in the future as part of our ongoing commitment to transparency.

9. As an important part of the encryption industry, how does Tether respond to pressure from the regulatory side and legal risks to prevent systemic crises?

Tether is working closely with law enforcement around the world to assist with investigations, including freezing addresses involved in the crime. We are in almost daily contact with law enforcement officials, and we pride ourselves on being able to respond to their requests in a timely manner. When Tether receives an applicable/legal request from a verified law enforcement agency to freeze private wallets, the company will comply with the freeze (we will not freeze wallets of exchanges/service providers). So far, OFAC has not indicated that stablecoin issuers will freeze secondary market addresses posted on OFAC’s SDN list or operated by individuals and entities sanctioned by OFAC. Additionally, we are in almost daily contact with U.S. law enforcement. While no law enforcement or regulatory agency has filed such a case asking for details, we always provide accurate details.

Tether also supports global law enforcement, helping to prevent crime, terrorism, and serious national security threats. Preventing bad actors from misusing financial networks is a critical part of building modern payment systems.

Tether's ability to support law enforcement is not only based on the strong circulation capacity of USD₮. We will freeze the associated USD₮ due to the transfer of funds by criminals, after proper legal procedures and risk assessment.

10. For a long time, as the object of FUD, Tether will experience various doubts every time the market plummets. How should Tether restore users' confidence in the face of these negative reports?

The spread of disinformation is one of the biggest threats facing the cryptocurrency industry right now. Fake news is just as worrisome as scams, hacks or cyberattacks. The spread of false information poses a risk not only to the reputation of the industry, but to every member of the community.

The crypto industry has long been a popular target for skeptics due to many high-profile crises, frauds, and scams. Unfortunately, there are far more bad actors in the cryptocurrency industry than we think.

Skeptics and critics are highly concerned about the crypto industry and it is amazing how many real bad actors, frauds and unsustainable investment schemes they have witnessed, Tether has been the subject of many skeptics, journalists over the years Even a popular target for mainstream media attacks.

Tether continues to receive so much attack from the media despite publishing nearly two years of comprehensive reserve reports and independent certificates of reserve on their website. Why there are so many skeptics and uncensored irresponsible speech in these media organizations, we will not know.

We understand that this may be a rainy day to prepare for the so-called "risk", but it means that these media only believe what they want to believe, and ignore the facts.

In this worldview, it is a foregone conclusion that Tether becomes a "real risk". Like SBF making a moral justification of his actions, despite the facts in plain sight, the ends achieved justify the means.

And the fact that Tether's customers take advantage of the unique utility that the Tether token provides makes it by far the most widely accepted and reputable stablecoin in the world.

Tether is professionally managing its reserves and it is committed to guaranteeing that any customer redemption requests are consistent with the same liquid reserves reported on the Reserves Transparency page. In the CRR report, the top five auditing firms in the world released an independent attestation on Tether’s reserves, which is now available on the website.

Tether is profitable and will remain solvent even in crisis situations. Instead of gambling customers' money, Tether has been accurately managing its reserves and not using a portion of them.

Tether goes to great lengths to explain basic financial industry products and how its asset-liability management works to “savvy journalists” who write “PR articles,” but it’s time for the rumors to stop.