How did the Hong Kong encrypted ETF perform in January? What market signals are reflected?

On December 16 last year, two encrypted asset exchange-traded funds (ETFs) were approved to be listed and traded on the Hong Kong Stock Exchange, marking an important step for the Hong Kong government to become a new center for encryption in Asia. In a blink of an eye, a month has passed, how is the performance of the Hong Kong encryption ETF?

The two ETFs launched last year, both launched by CSOP Asset Management Co., Ltd., mainly track the futures prices of Bitcoin and Ethereum on the Chicago Mercantile Exchange (CME), so they are called futures ETFs, and the codes are 3066 and 3068 respectively. On January 13, Samsung Asset Management also launched an ETF that also tracks CME Bitcoin futures on the Hong Kong Stock Exchange, code: 03135. Therefore, there are currently three cryptocurrency futures ETFs in Hong Kong.

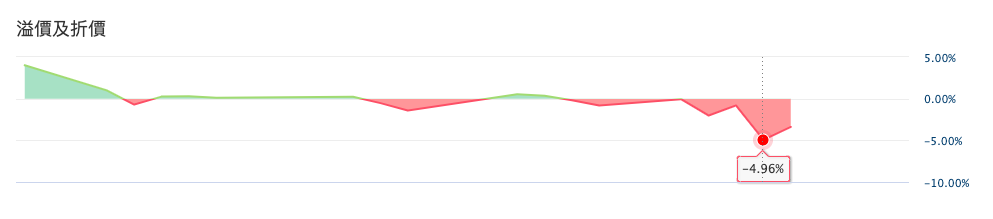

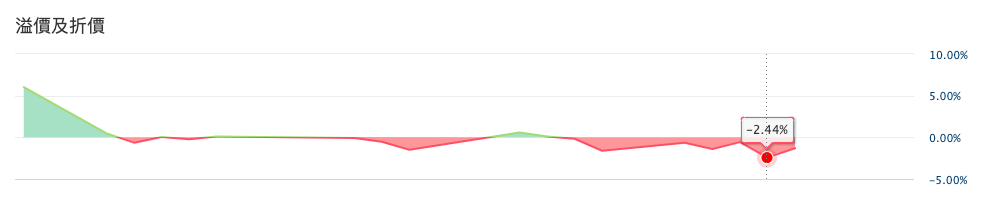

Odaily observed that the two ETFs of CSOP had higher premiums (the transaction price was higher than the net asset value) on the day of listing, which were 6.01% (Ethereum ETF) and 4.02% (Bitcoin ETF); Affected by the encryption market, the price fell for a short time, and basically remained at the same level as the net asset value.

After the end of this year, the encryption market rebounded. Bitcoin and Ethereum spot prices rose by 27.6% and 30.2% respectively. The market prices of the two futures ETFs also rose accordingly, which were 29.2% and 32.9% respectively, and the increase exceeded the spot performance. (Note: The market is bullish, and the futures price is higher than the spot price, which is called futures contango.) The trading volume of the two ETFs has also increased, but neither has exceeded the previous value of last year: the previous value of the daily trading volume of the Bitcoin futures ETF is 2.1 million (December 30), the highest daily trading volume in 2023 is 1.822 million; the previous value of the daily trading volume of Ethereum Futures ETF is 1.661 million (December 20), and the highest daily trading volume in 2023 is 990,000

image description

image description

(Ethereum ETF)

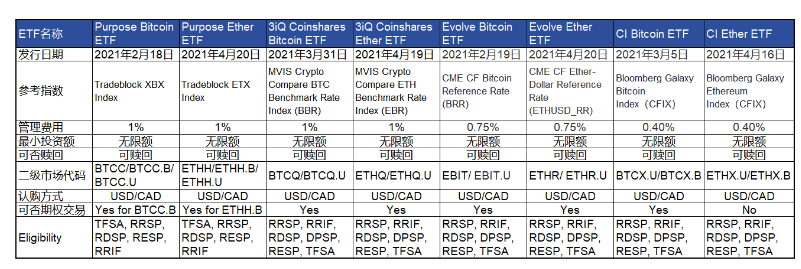

Compared with other cryptocurrency ETFs, it can be found that this trend has no commonality: the net value discount rate of Grayscale Bitcoin Trust (GBTC) dropped from 45.1% at the beginning of the year to 38.8%; the net value discount rate of Ethereum Trust (ETHE) dropped from 59.3% at the beginning of the year. % dropped to 51%; while the two Canadian cryptocurrency ETFs (BTCC, BTCQ) both had a premium, especially the positive premium of BTCQ once rose by more than 10%.

In addition, Hong Kong's ETFs are not very competitive in the international market. It has been a month since they were issued, but their asset size has not increased on a large scale. On the one hand, it is limited by the overall poor performance of the encryption market, but on the other hand, it is also related to its own mechanism design.

image description

(List of other crypto ETFs in Canada)

However, the newly launched Samsung ETF seems to have learned a lesson and took the initiative to reduce the management fee to 0.95%; and Samsung's global brand influence is also greater. From this point of view, the Samsung Bitcoin ETF may come from behind, and its asset management scale will surpass that of CSOP. Samsung also stated that if conditions permit, it will consider launching a spot-based Bitcoin ETF in Hong Kong in the future.

At present, the Hong Kong government is still actively exploring more encryption practices. For example, the Hong Kong Securities Regulatory Commission has proposed to approve some "high liquidity" cryptocurrencies for retail transactions. Odaily will also continue to pay attention to the new trends in encryption in Hong Kong.