2022 GameFi Track 4D Summary Report

foreword

foreword

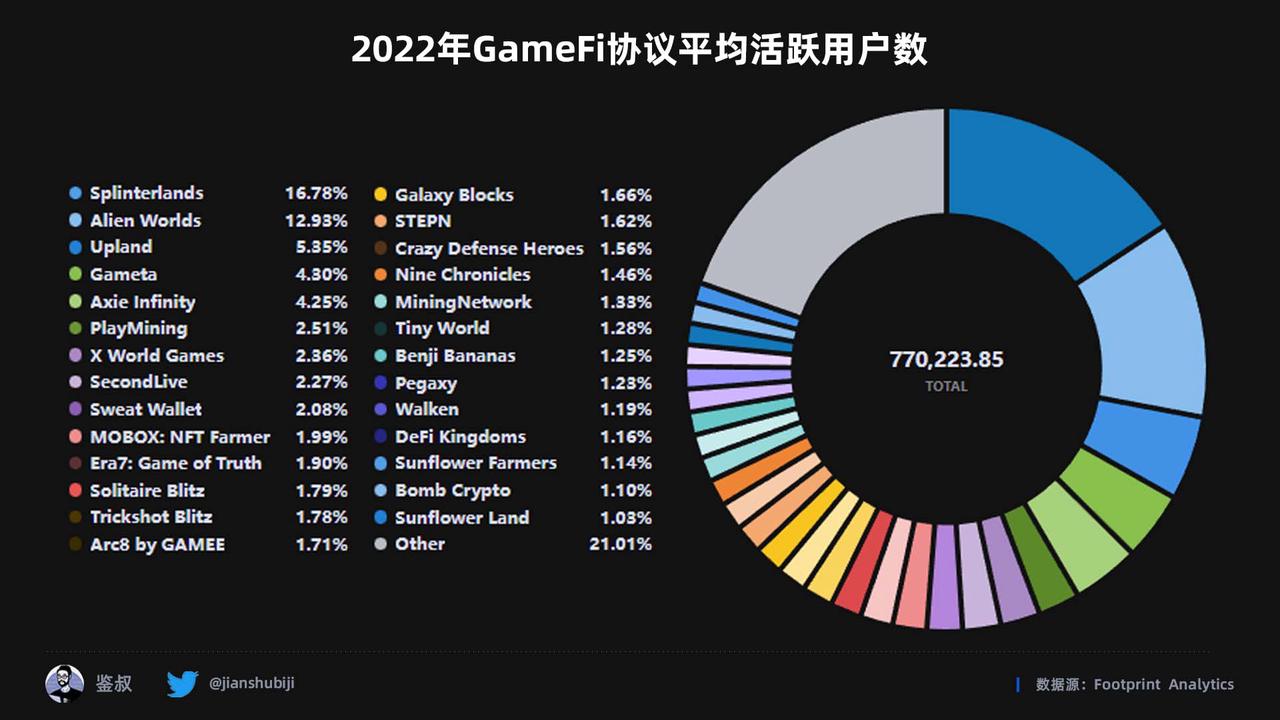

GameFi will achieve great development in 2021. The representative events are Axie Infinity’s wave of gold mining all over the world, especially in Southeast Asia, Facebook’s renaming as Meta and its announcement of entering the Metaverse field. After entering 2022, although GameFi was negatively affected by the overall decline in the market value of cryptocurrencies represented by Bitcoin, it still burst out with huge potential in the first half of 2022, and the Move to Earn project represented by StepN emerged, causing extensive attention. Of course, the young GameFi track does not have enough strength to go against the trend. As Terra, the largest algorithmic stablecoin protocol ever, started the death spiral, Bitcoin fell below the May-July 2021 formation in May 2022. The strong support has completely destroyed the hope of the return of the bull market, and the Web 3 industry, including GameFi, has also ushered in its own gloomy moment.Trading View

Bitcoin Price Chart - Weekly K Data Source:Data Kanban。

In-depth exploration of GameFi, an emerging track, the "2022 GameFi Track Summary Report" carefully polished by the Jianshu team will be divided into two parts: data and project. Combining market data, chain data and specific project analysis, try our best Describe for readers the development of the GameFi track in 2022, the comparison with 2021, and possible future development trends. Additionally, most of the chart data used in this report has been established on Footprint

Data Kanban

In the project chapter, we will sort out the popular GameFi projects with more than 50k Twitter fans in 2022 according to the game type. From the birth of Axie Infinity to the near release of StepN, the GameFi track, as the participation model closest to Web2, has the potential to solve the common pain points of traditional games on the one hand, and the possibility to attract Web2 users to evolve on the other hand. It also allows people to see the vigorous vitality of the Web3 field in the future.

Forecast: The project report will be launched after the Spring Festival in 2023. Please pay attention to Jianshu’s Twitter updates.

secondary title

Basic conclusion of the data article

Throughout 2022, although the GameFi track has bright moments, it underperforms the market and Bitcoin most of the time.

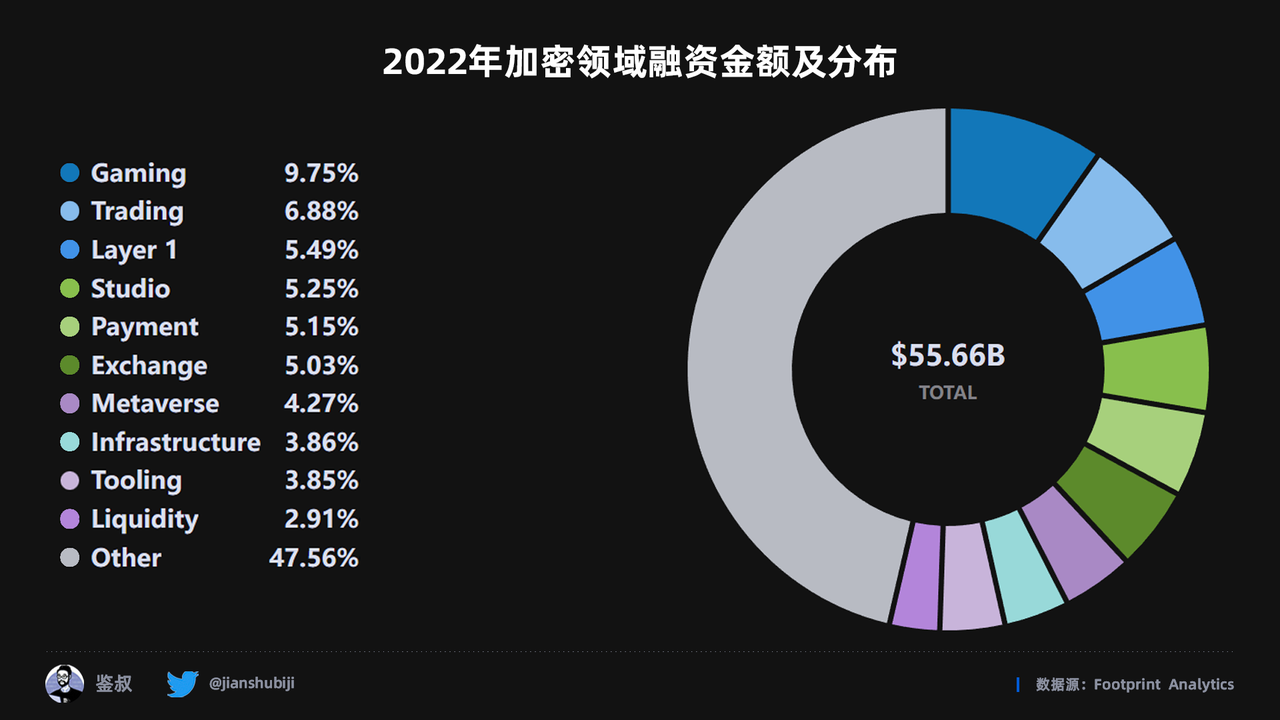

In 2022, the GameFi track financing amount will increase significantly year-on-year in 2021, but in the second half of the year, the market attitude of some investment institutions has changed from positive to wait-and-see.

first level title

overall market performance

secondary title

text

image descriptionFootprint

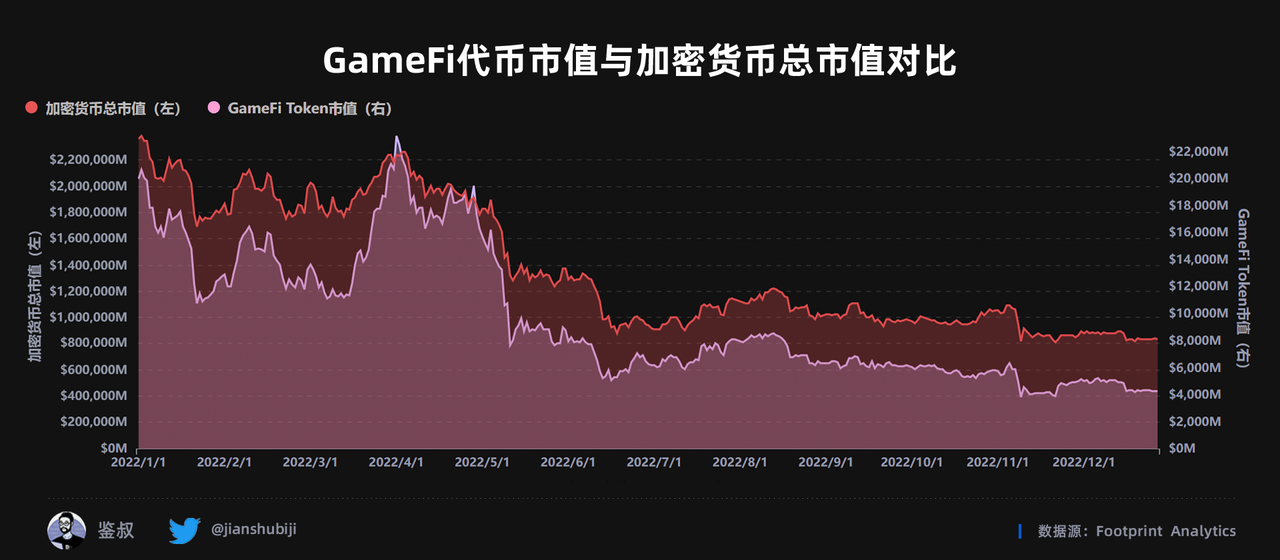

GameFi Token Market Cap vs Total Cryptocurrency Market Cap Data Source:Footprint

image description"Throughout 2022, the market value of GameFi tokens will maintain a trend of advancing and retreating with the total market value of cryptocurrencies. Among them, except for March-April triggered by StepN "Play to Earn

text

image descriptionFootprint

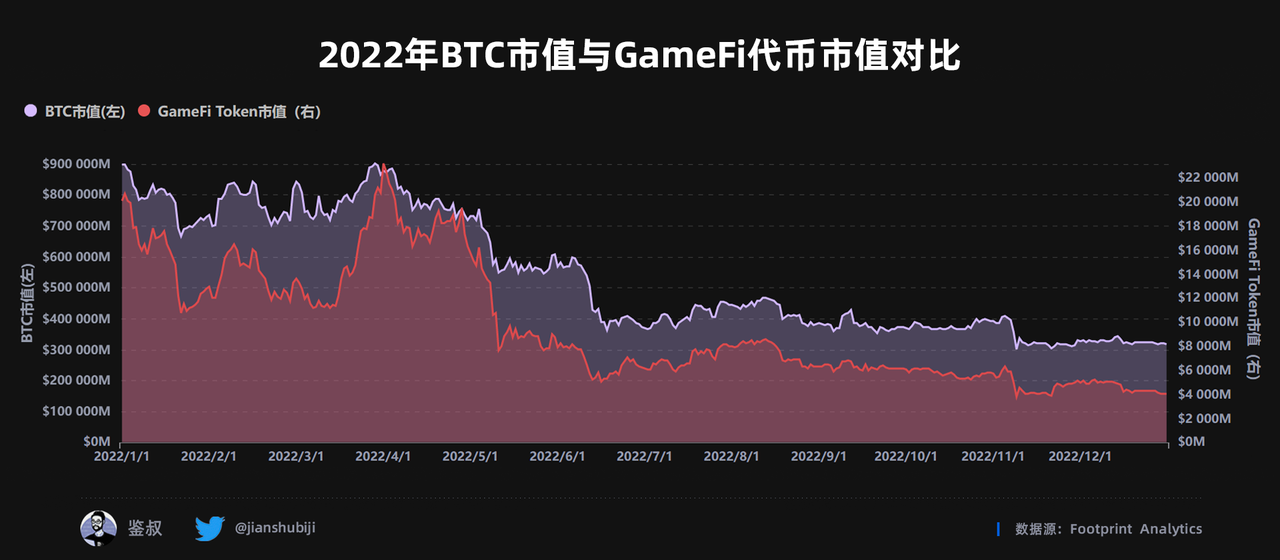

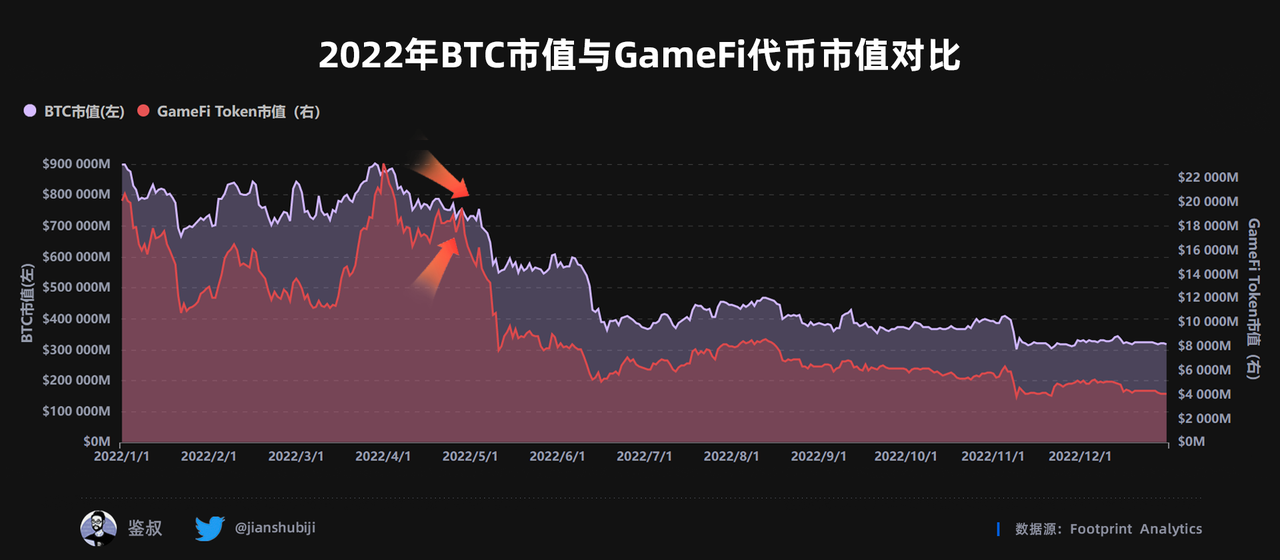

2022 BTC Market Cap vs. GameFi Token Market Cap Data Source:Footprint

image descriptionFootprintData source for the change in the ratio of BTC market value/GameFi token market value in 2022:

), based on January 1, the market value of Bitcoin on that day was about 43 times the market value of GameFi tokens, and until December 31, the gap had become 75 times, and GameFi underperformed Bitcoin by 74.4 percentage points.

text

image descriptionFootprint

2022 BTC Market Cap and GameFi Token Market Cap Change Data Source:Trading View

BTC Price Chart - Weekly K Data Source:

image descriptionTrading View

text

GameFi market capitalization year-on-year changeFootprint

2021 vs. 2022 GameFi Token Market Cap Comparison Data Source:

secondary title

text

image descriptionFootprint

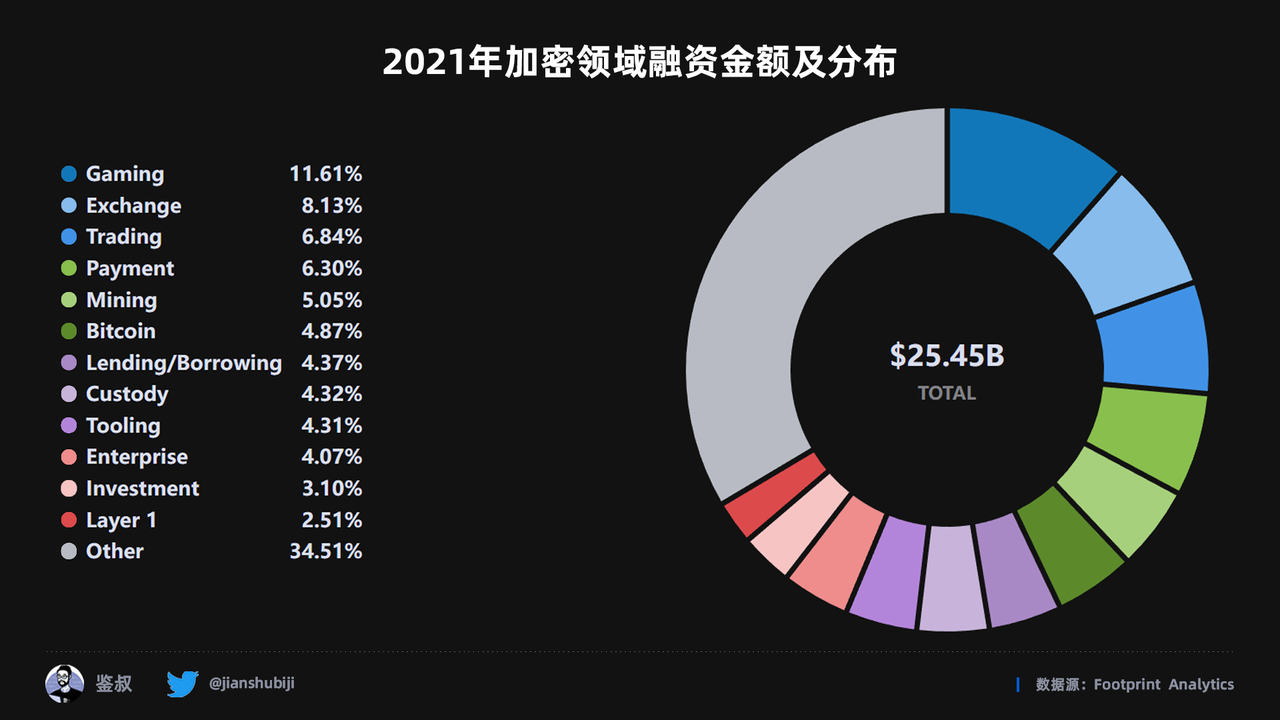

Data source of financing amount and distribution in the encryption field in 2021:Footprint

Data source of financing amount and distribution in the encryption field in 2022:

first level title

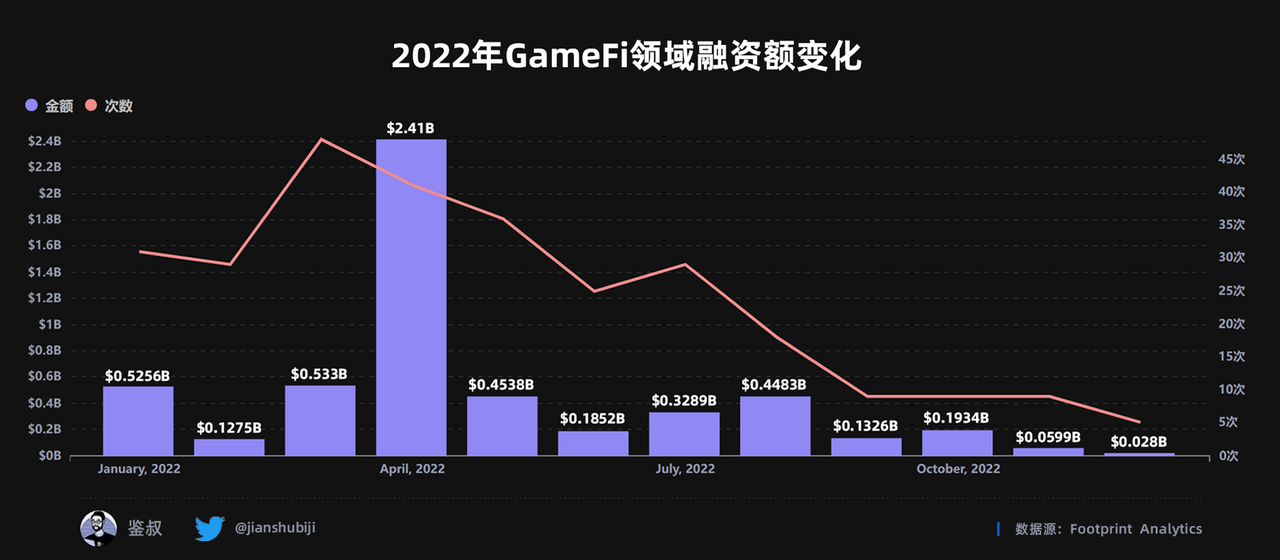

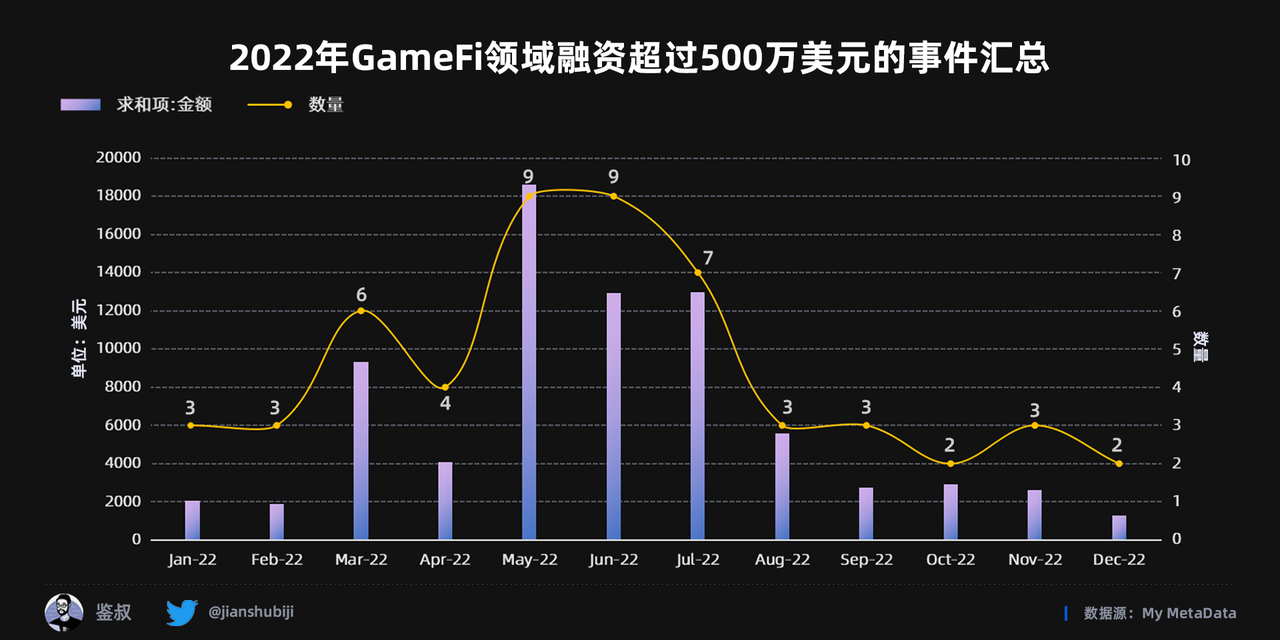

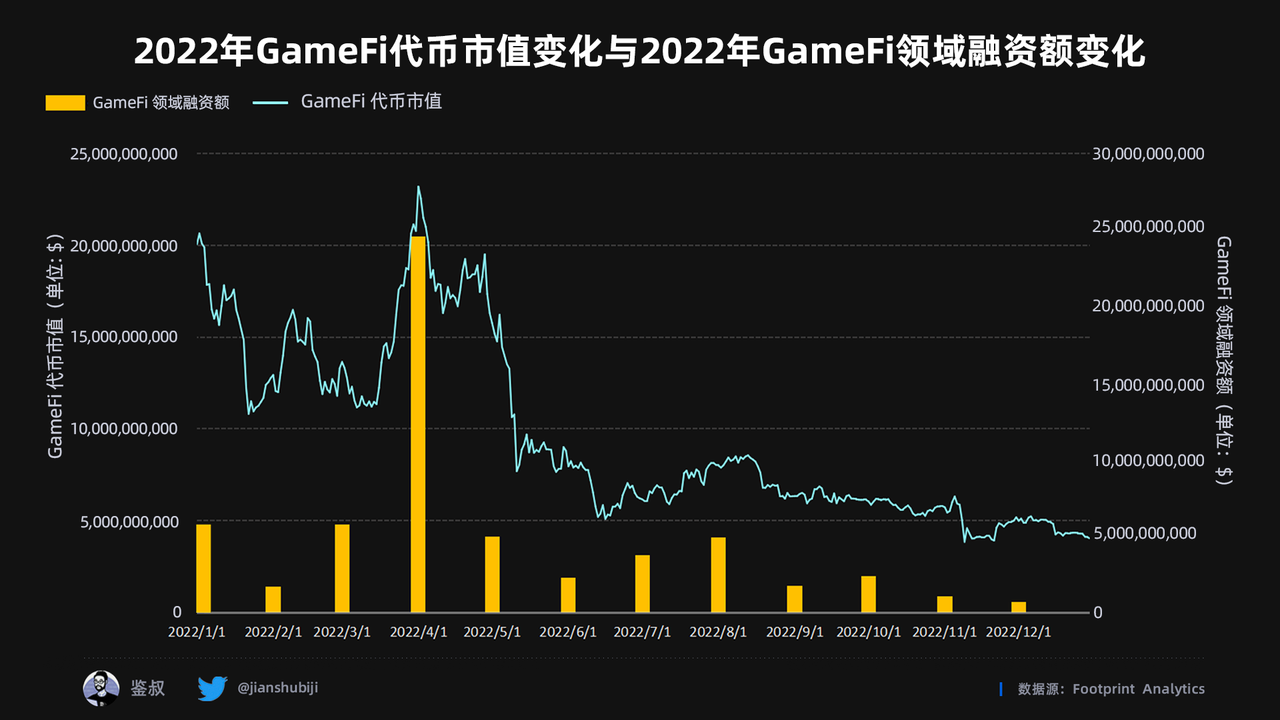

GameFi's full-year 2022 financing situationFootprint

Data sources for changes in the amount of financing in the GameFi field in 2022:

Dismantling the financing data, the GameFi field financing in the whole year of 2022 exceeded 5.4 billion US dollars, but nearly half of it was completed in April, which may be related to the blockchain game fever triggered by StepN. With the decline in the market value of GMT, financing in the GameFi field also declined rapidly after reaching its peak in April. Although there was a slight rebound in July and August, it began to gradually decline again. Especially after entering November, the financing amount in November and December was only 59 million US dollars and 23.3 million US dollars respectively, and the total financing amount was less than half of that in October. But this period of time is not without benefits. Binance, the world's largest cryptocurrency exchange, launched a new IEO project on November 24th - Hooked Protocol, which is a Web3 gamified social learning platform and belongs to "X to Earn" Track, this IEO will last until December 1st. This is also the first time that Binance has started IEO again after 9 months, and the last IEO project was the famous 100-fold project StepN. The benefits of Binance’s personal exit are not insignificant, but the financing volume in November and December has not improved. It can be seen that the poor market in the past few months has greatly affected the confidence of investment institutions.My MetaData

first level title

GameFi Fundamentals Performance

secondary title

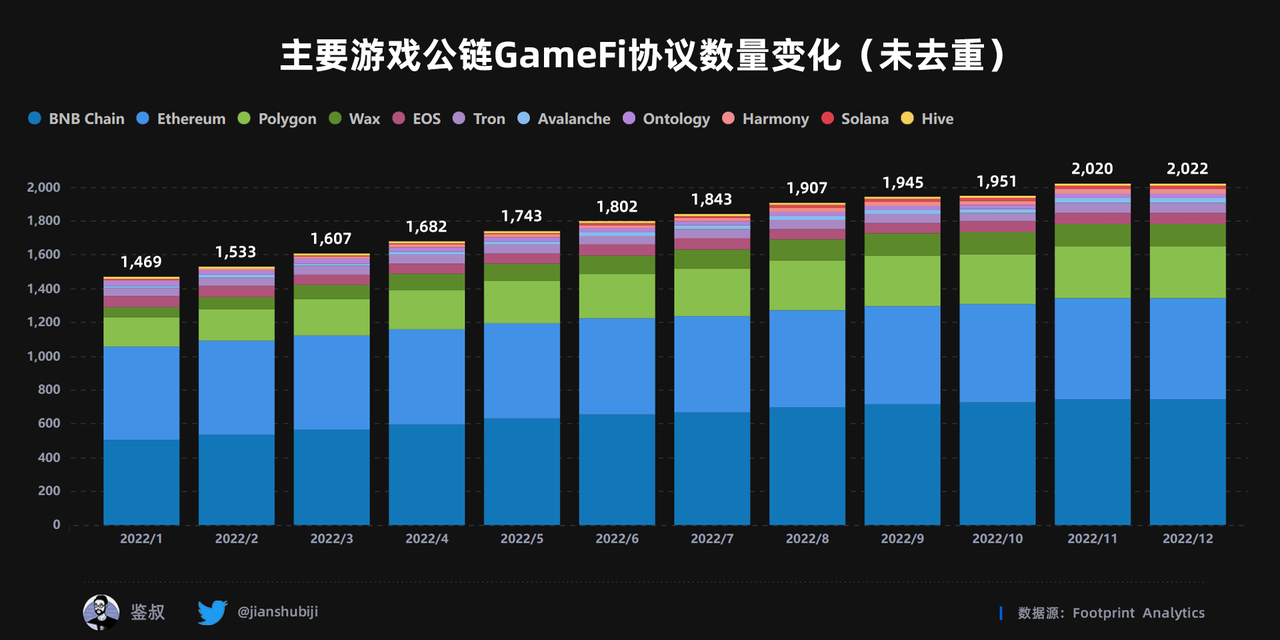

GameFi game volume changesFootprint

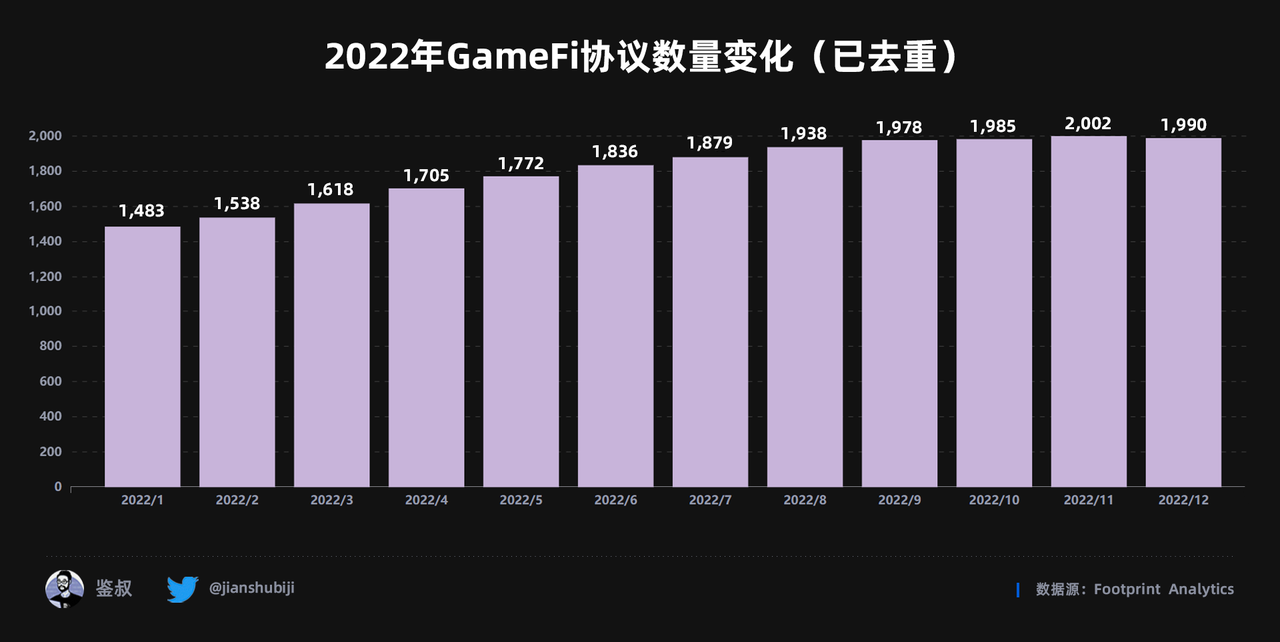

Changes in the number of GameFi agreements in 2022 (deduplicated) Source:

image descriptionFootprint

image descriptionFootprint

image descriptionFootprint

The number and distribution of GameFi agreements in Q3 in 2022 Data sources:Footprint

image description

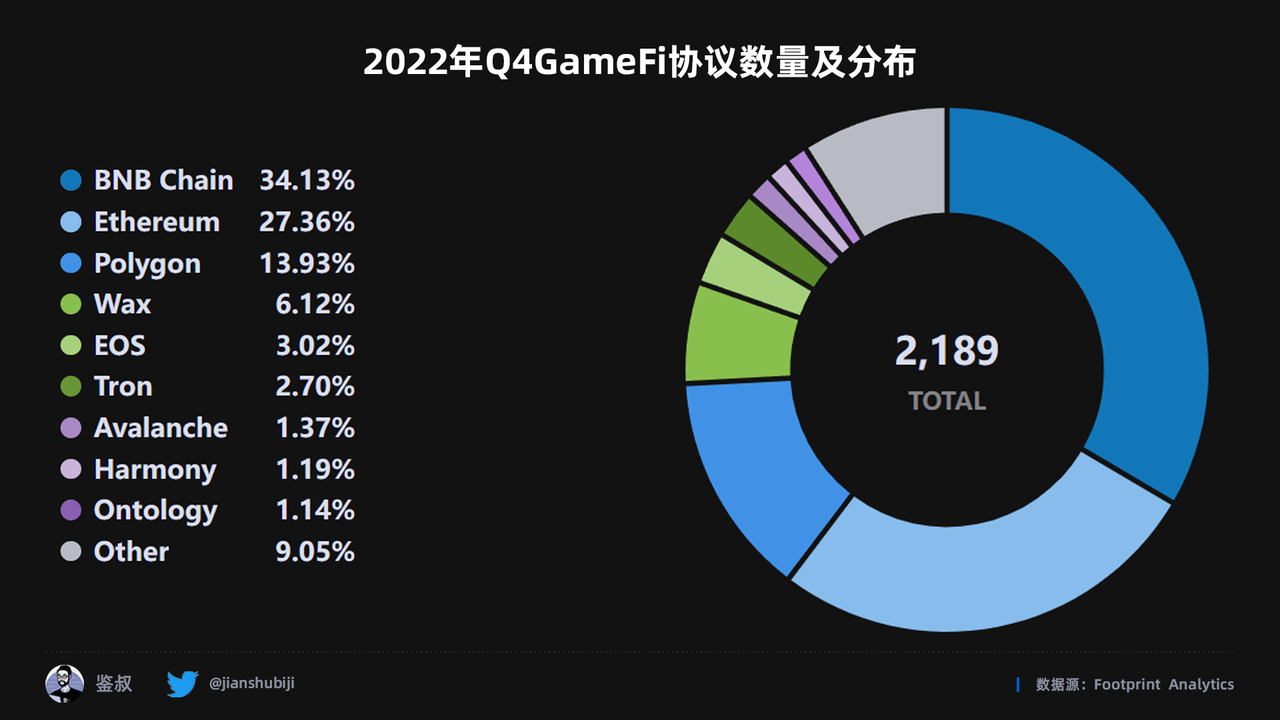

Data source for the number and distribution of GameFi agreements in Q4 in 2022:

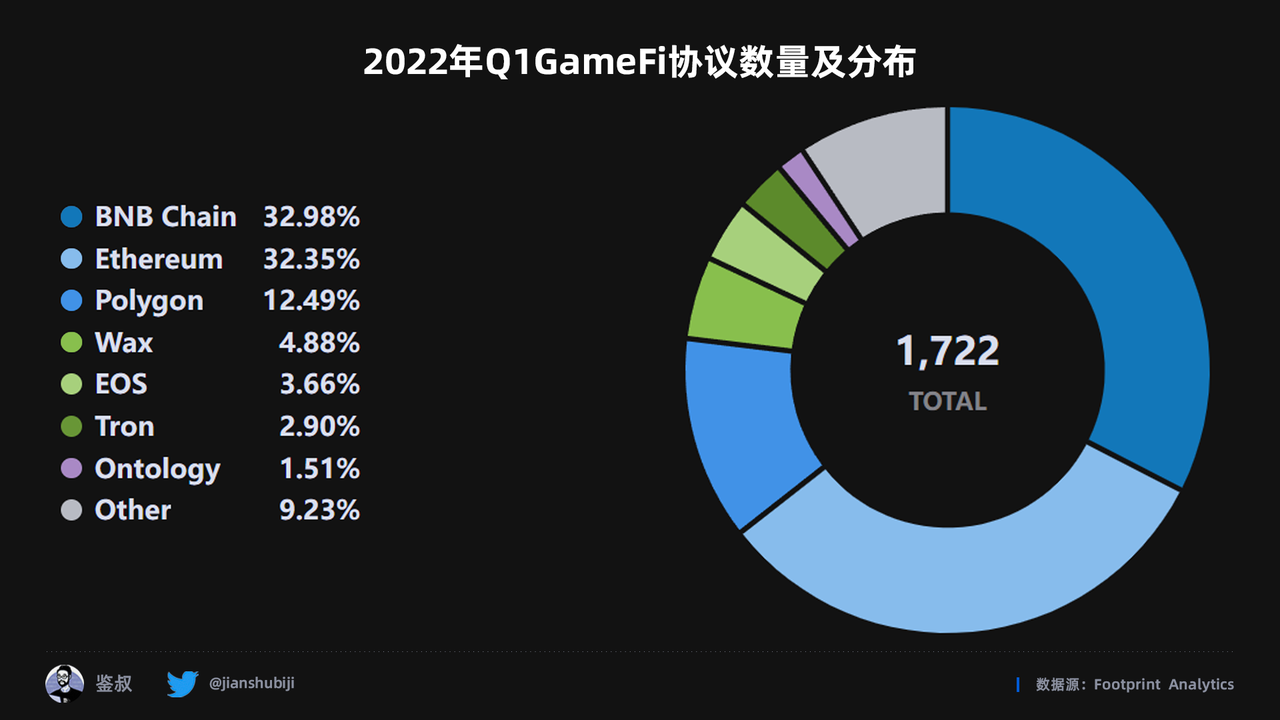

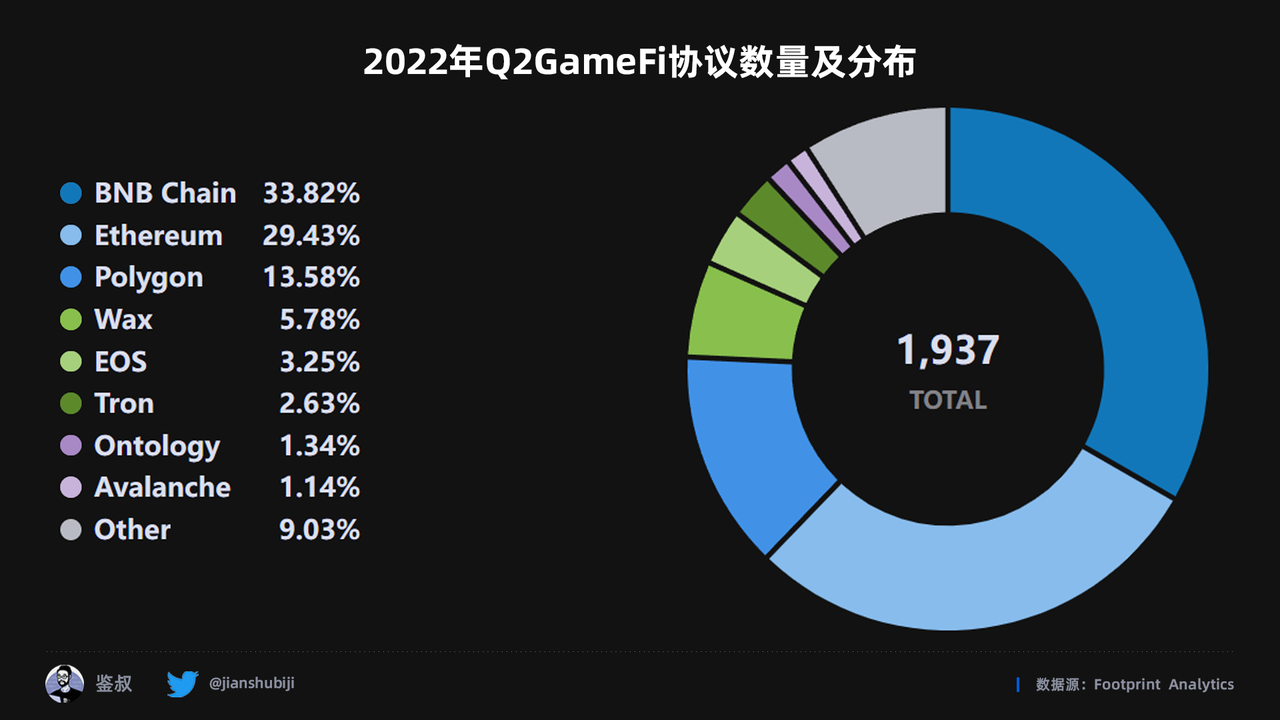

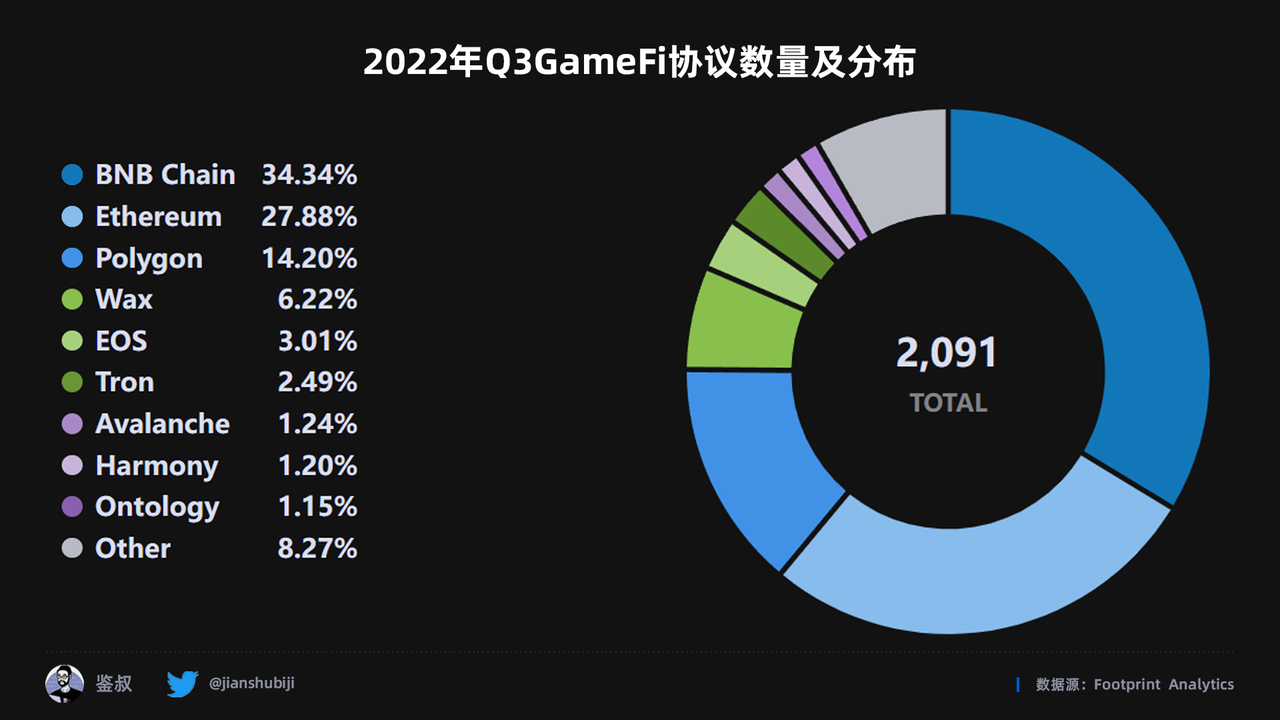

Special note: The number of games in Q1, Q2, Q3, and Q4 has not been deduplicated, so the data in Q3 and Q4 will be higher than the change (deduplication) in the number of GameFi games in 2022. The reason is that some games are deployed on multiple chains. For example, The Sandbox exists on both Ethereum and Polygon. Deduplication will cause data distortion in the dimension of the chain, so it is not deduplicated.

In addition, Q1 to Q2 in 2022 ushered in a blowout period of game growth, perhaps because the StepN with "Move to Earn" as the main mode in Q2 pushed GameFi to the peak of this round of bull market, stimulating a large number of games to catch up with the wind And the project party that is anxious to release the game. The direct consequence is that due to the single game mode and uninnovative planning, the GameFi track has been more affected and the decline has been greater after the rapid bearishness of the encryption market. After a large number of players who could not meet their profit expectations left, many games were forced to stop operating, and the entire emerging track began to calm down. Therefore, in the Q4 stage, the overall growth rate on the chain is not optimistic.

secondary title

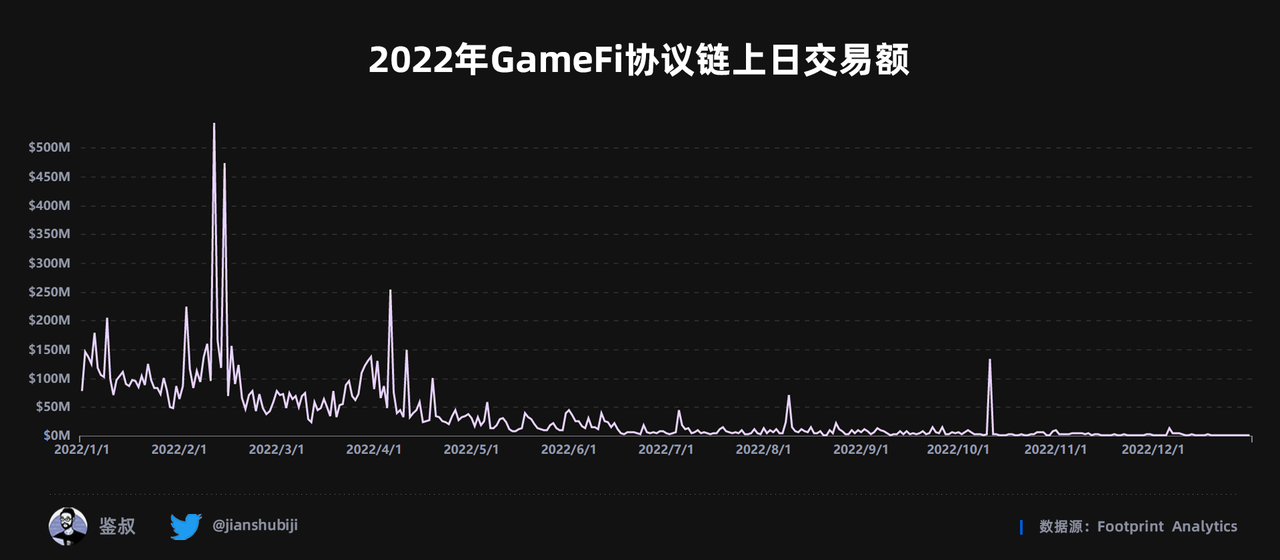

image descriptionFootprint

image descriptionFootprint

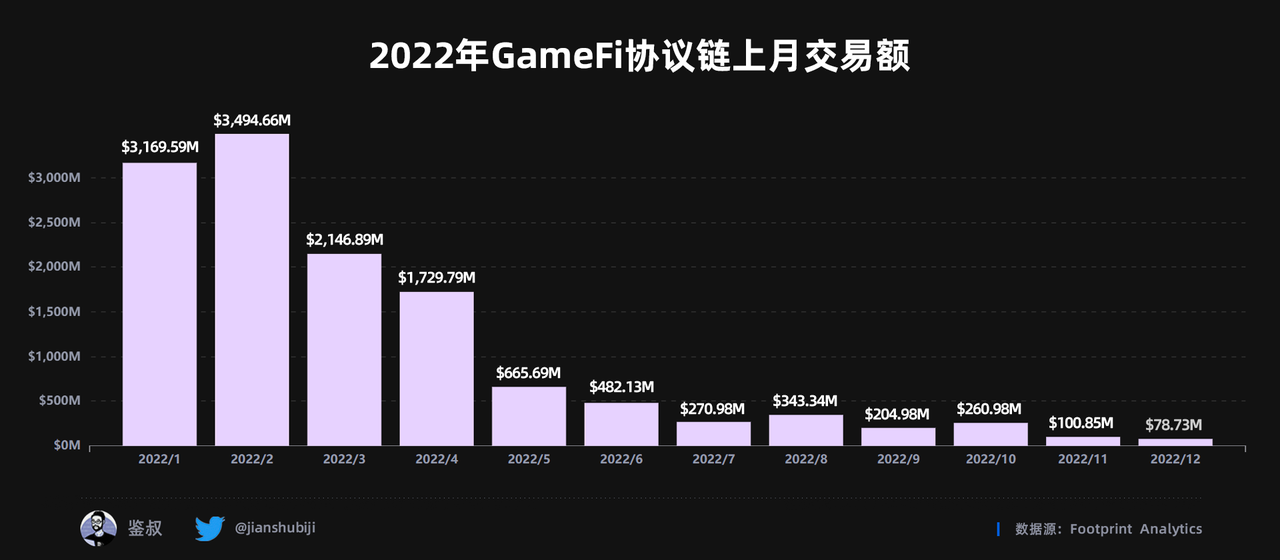

Data source of the monthly transaction volume on the GameFi protocol chain in 2022:Footprint

image description

Special Note: Due to the complexity of the data on the chain, there are cases where the smart contracts of some agreements are not fully included in the data source, and the NFTs of some agreements are traded on third-party secondary platforms and are therefore not included in the statistics. Therefore, the relevant on-chain data used in this article The transaction volume/volume data are incomplete statistics and are only used to analyze general trends.

Observe the daily on-chain transaction volume of the GameFi protocol in 2022, which is correlated with the market value of GameFi tokens and the amount of financing in the GameFi field. When transactions on the chain are active, GameFi's market value and financing amount are often at a high level. It can be seen that in April, August and October of 2022, the daily transaction volume on the GameFi protocol chain has suddenly increased. Correspondingly, the market value of GameFi tokens has also experienced a slight increase in these three months. Rebound; financing amount started to rise after bottoming out in June, and reached the highest level in the second half of the year in August.Delphi Digital

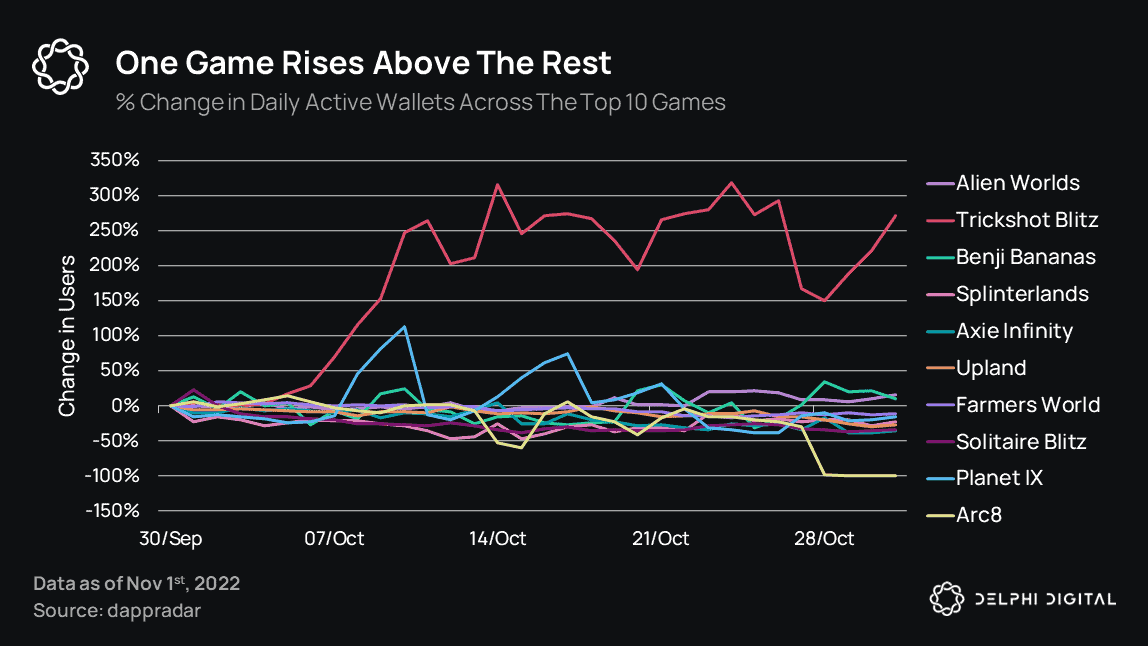

image description

Data source of changes in the number of TOP chain game users in October:

Among the daily on-chain transaction volume of the GameFi Protocol in 2022, a high point in October is quite eye-catching, and its huge transaction volume is in stark contrast to the previous few months. A closer look at the reason may be related to Planet IX and Trickshot Blitz (TB).

TB is a free-to-play mobile game where players play pool against each other. It features players being rewarded with RLY tokens that are instantly convertible into fiat currency. TB updated the reward mechanism in October. From October 6th to 15th, it doubled the new token rewards for old users. At the same time, it reduced the user's withdrawal fee and increased the maximum single withdrawal amount.

secondary title

text

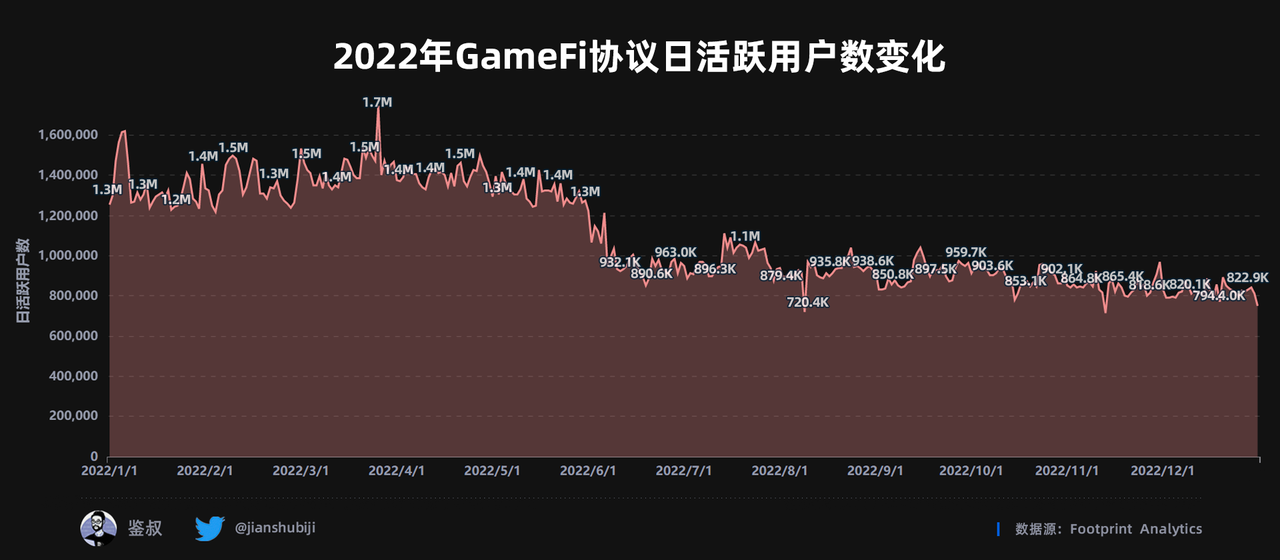

Changes in the number of GameFi active users on the chainFootprint

2022 GameFi protocol daily active user change data source:

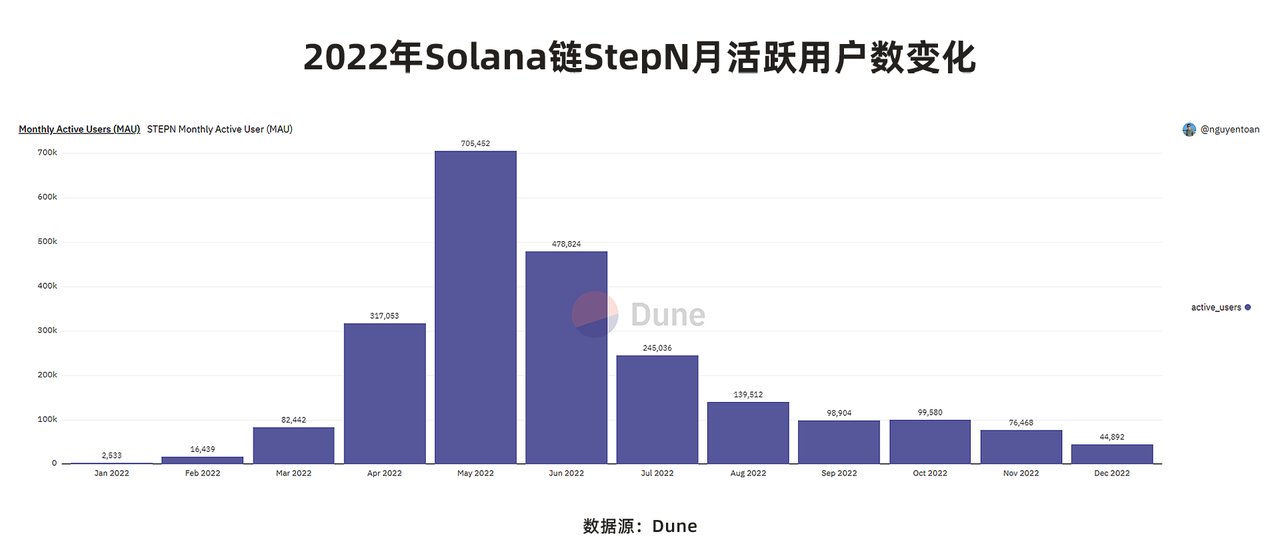

image descriptionDune

Data source for the number of monthly active users of Solana Chain StepN in 2022:Footprint

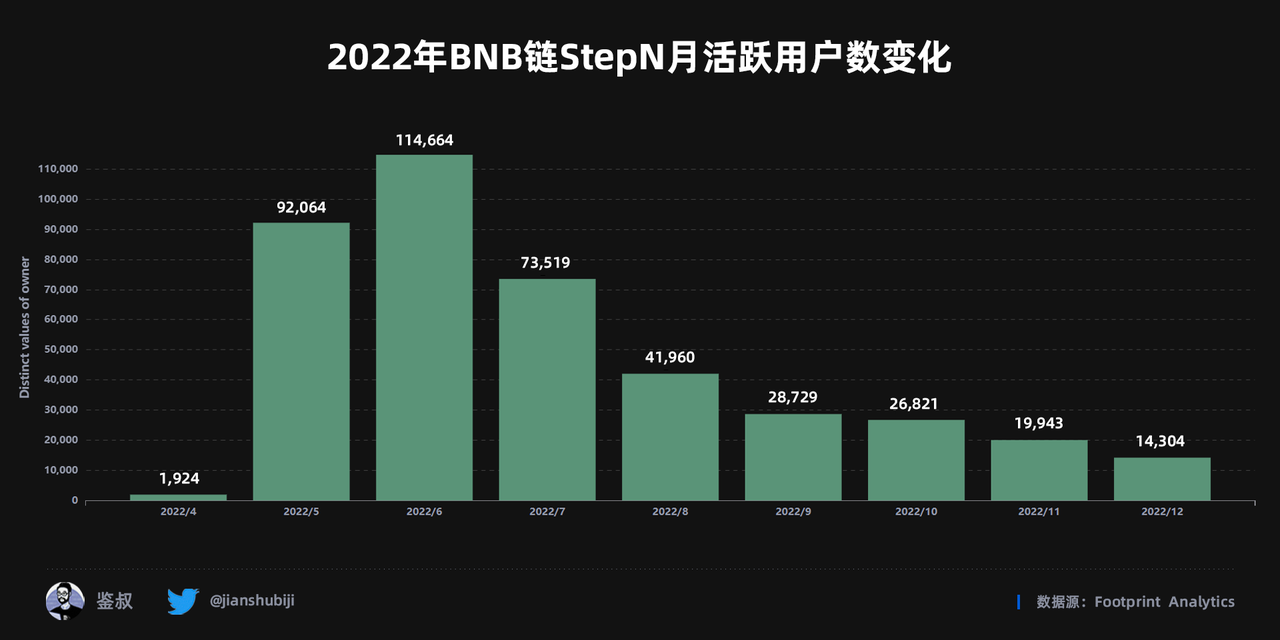

Data source of BNB Chain StepN monthly active users change in 2022:

text

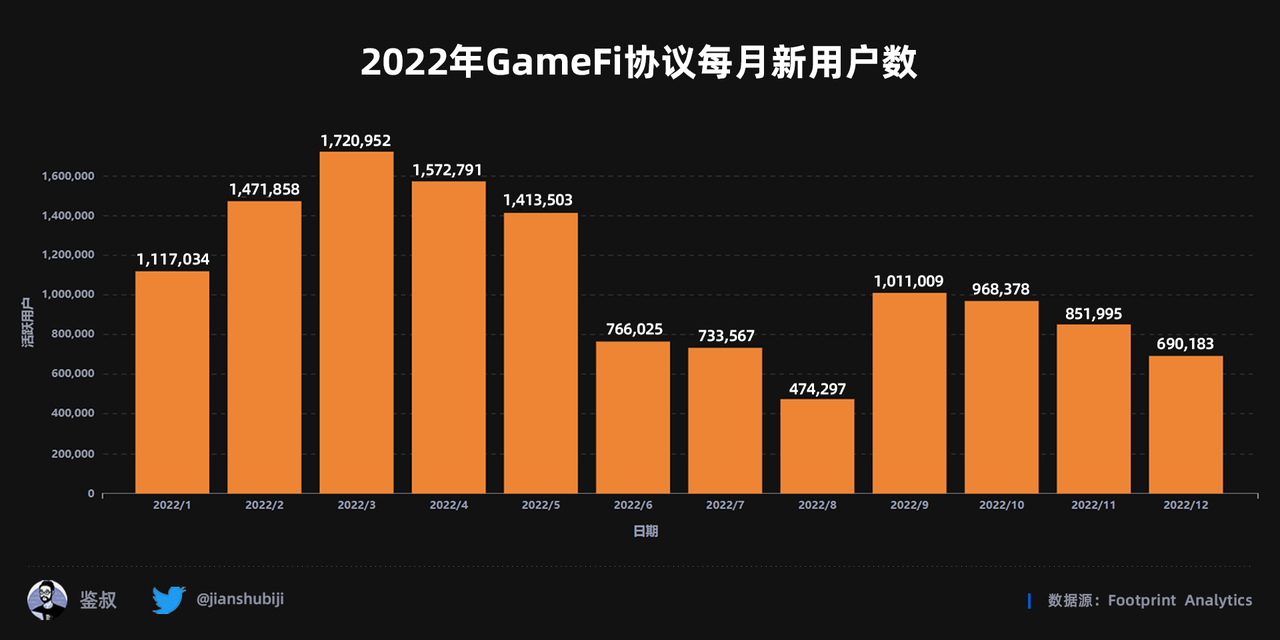

Changes in the number of new users on the chainFootprint

image description

Compared with the sluggishness of other dimensional indicators, the monthly growth of new users of the GameFi protocol in 2022 performed well, and there was no situation where there was a large amount of data at the beginning of the year and very little at the end of the year. Although the data in June, July, and August were relatively bleak, the data in September showed positive growth, and the number of new users reached 995,000, sweeping away the haze of the previous few months. During this period, several game projects have made big moves. For example, the 3D female-oriented dress-up NFT game Power of Women based on Solana topped the list of games in the US region of Google Play; The Sandbox launched only for Polygon The exclusive SAND pledge plan open to landowners on the network, etc.

image descriptionDappraddar

first level title

secondary title

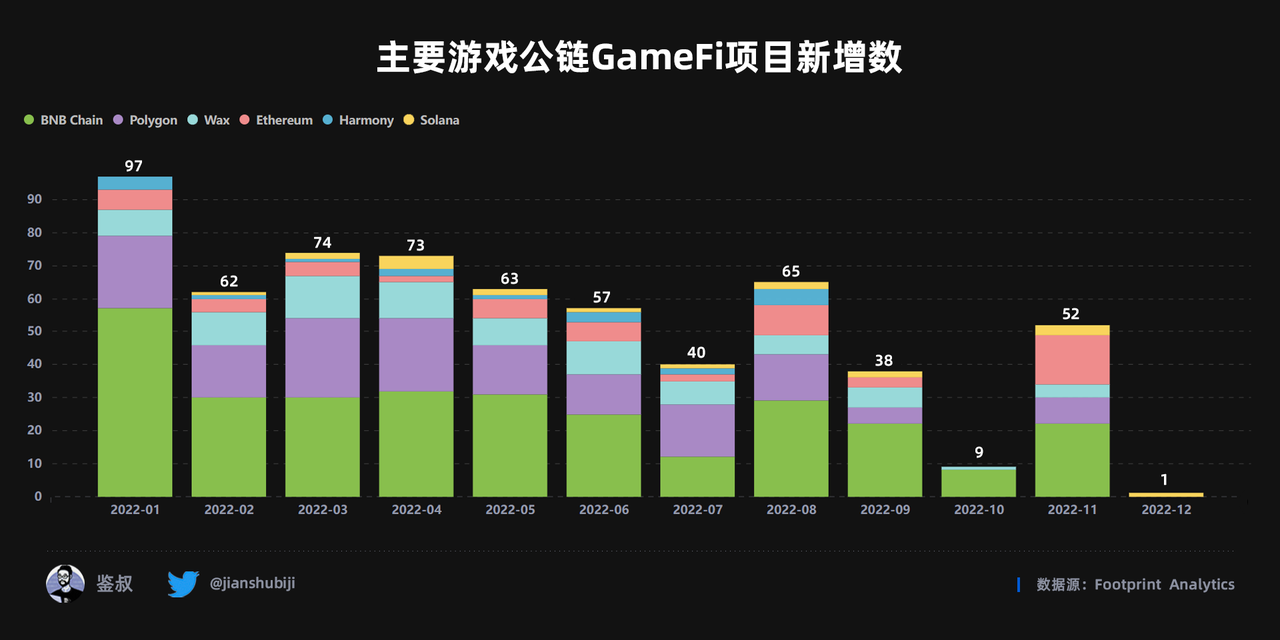

Main game public chain GameFi project dataFootprint

image description

Note: The number data of the GameFi protocol of the main game public chain has not been deduplicated, so the data will be higher than the change (deduplication) of the number of GameFi games in 2022. The reason is that some games are deployed on multiple chains. For example, The Sandbox exists on both Ethereum and Polygon. Deduplication will cause data distortion in the dimension of the chain, so it is not deduplicated.

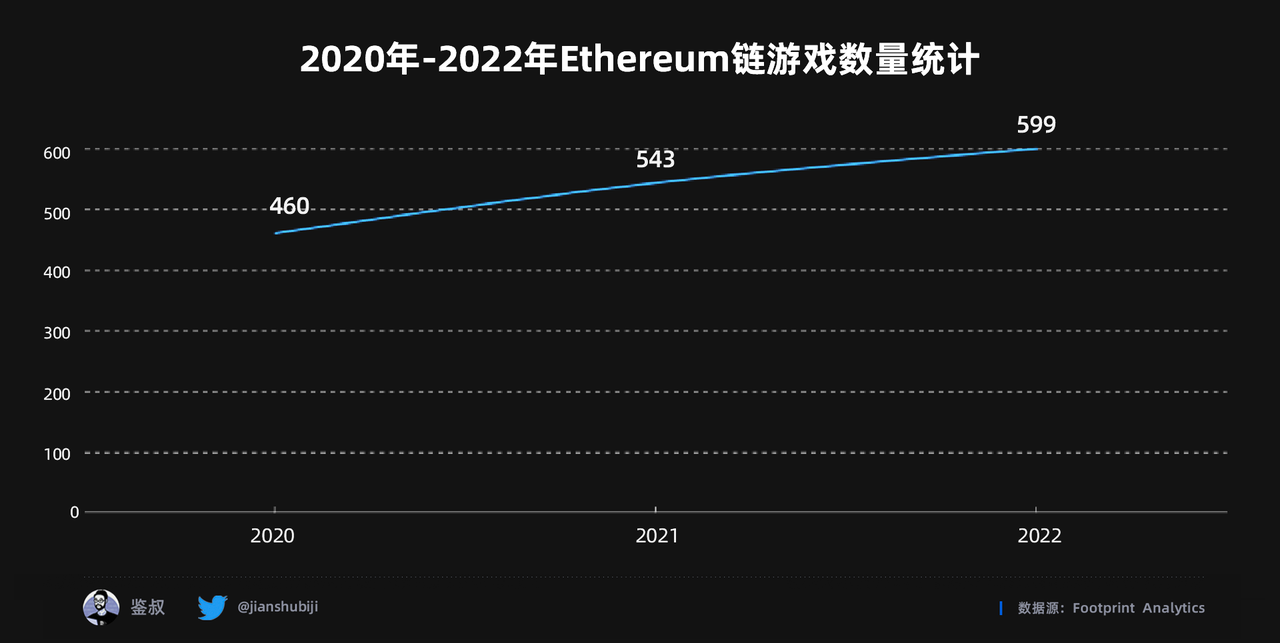

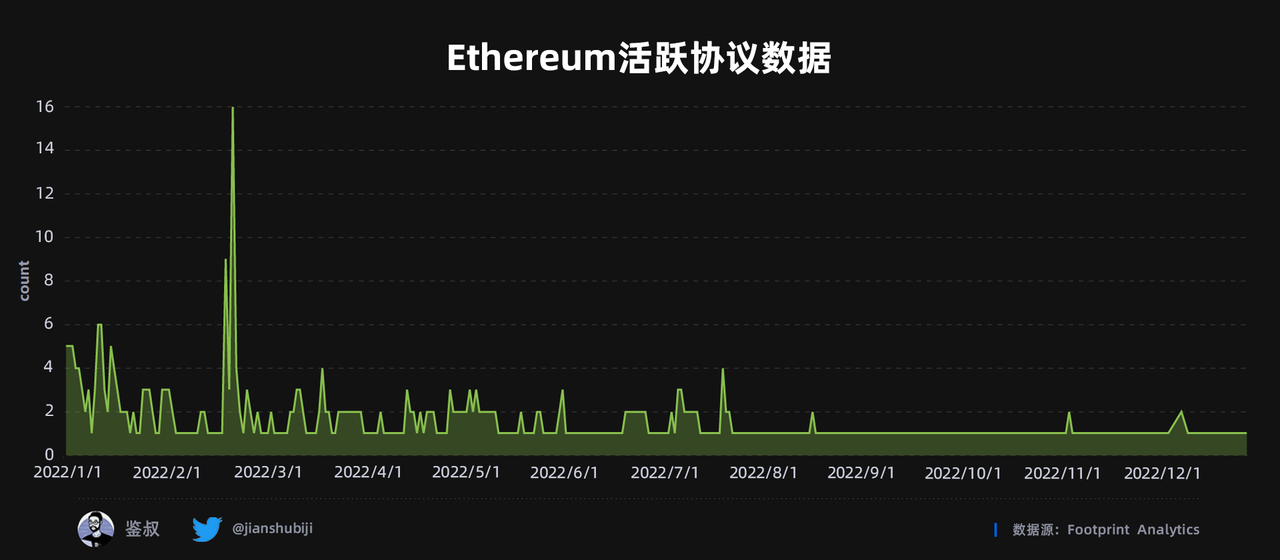

Pay attention to the agreement on the TOP game public chain chain. The large transaction volume on the chain, strong ecological support, and long-term ecological prosperity make Ethereum, Polygon and BNB Chain firmly in the leadership position of the game ecology. BNB Chain has 747 blockchain games, an increase of about 47.04% from the beginning of the year. Polygon has 305 blockchain games, an increase of approximately 74.28% from the beginning of the year. There are currently 599 games on Ethereum, an increase of approximately 10.3% from the beginning of the year. It is worth mentioning that nearly 77% of the games on the Ethereum chain were launched before 2021. Obviously, Ethereum started early on the Gamefi track, but it is no longer the preferred public chain for gamers to deploy.Statistics on the number of Ethereum chain games from 2020 to 2022

text

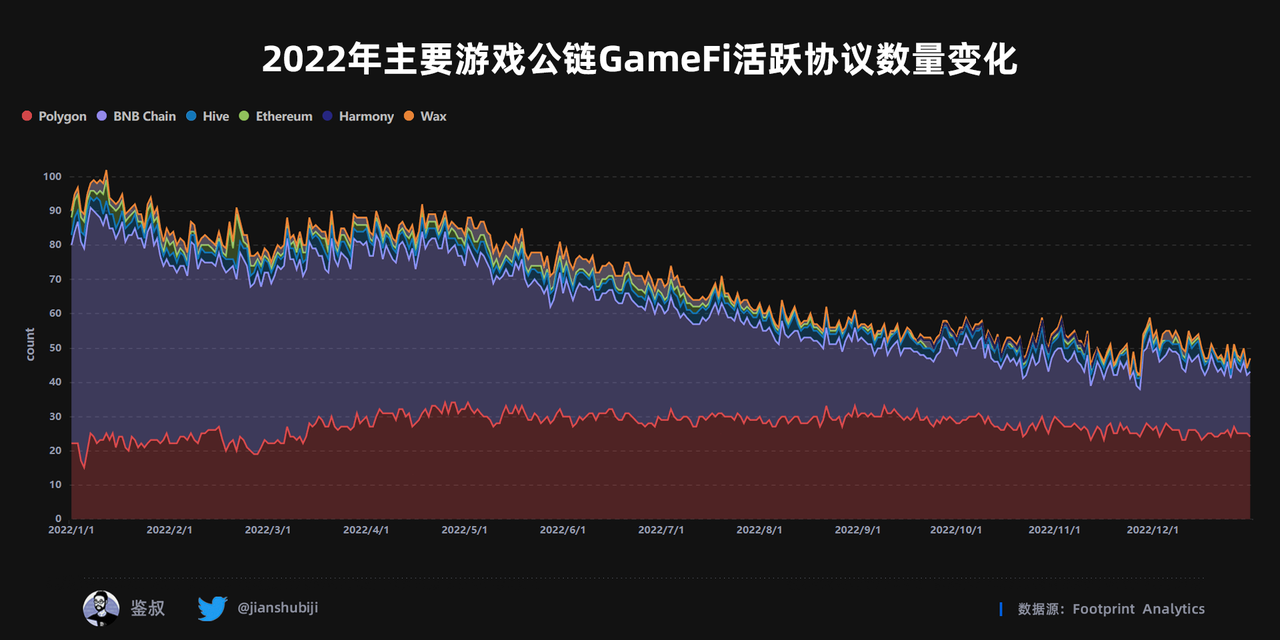

The active number of main game public chain GameFi projectsFootprint

Data sources for changes in the number of active agreements on the main game public chain GameFi in 2022:

image descriptionFootprint

image descriptionFootprint

Polygon active protocol data sources:Footprint

image description

Ethereum active protocol data data source:

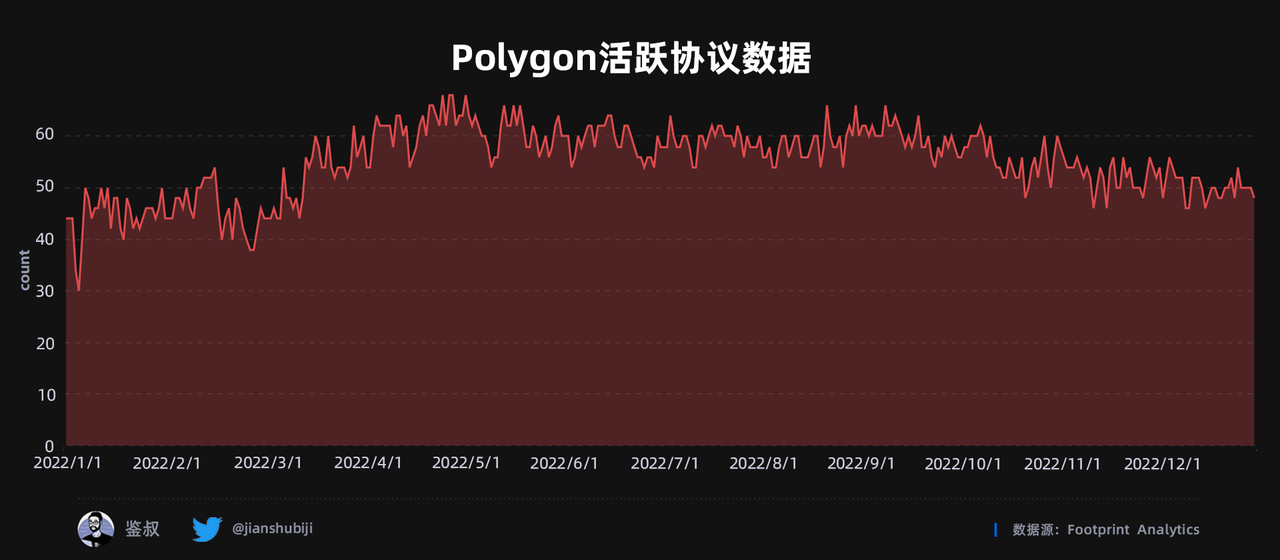

In contrast, the fluctuation of the number of active agreements of Polygon is relatively stable, and the downturn period appeared in the period from January to February at the beginning of the year. From April to May, the number of active projects increased steadily. Overall, Polygon is more stable in terms of game layout.

text

The number of newly added GameFi projects on the main game public chainFootprint

image description

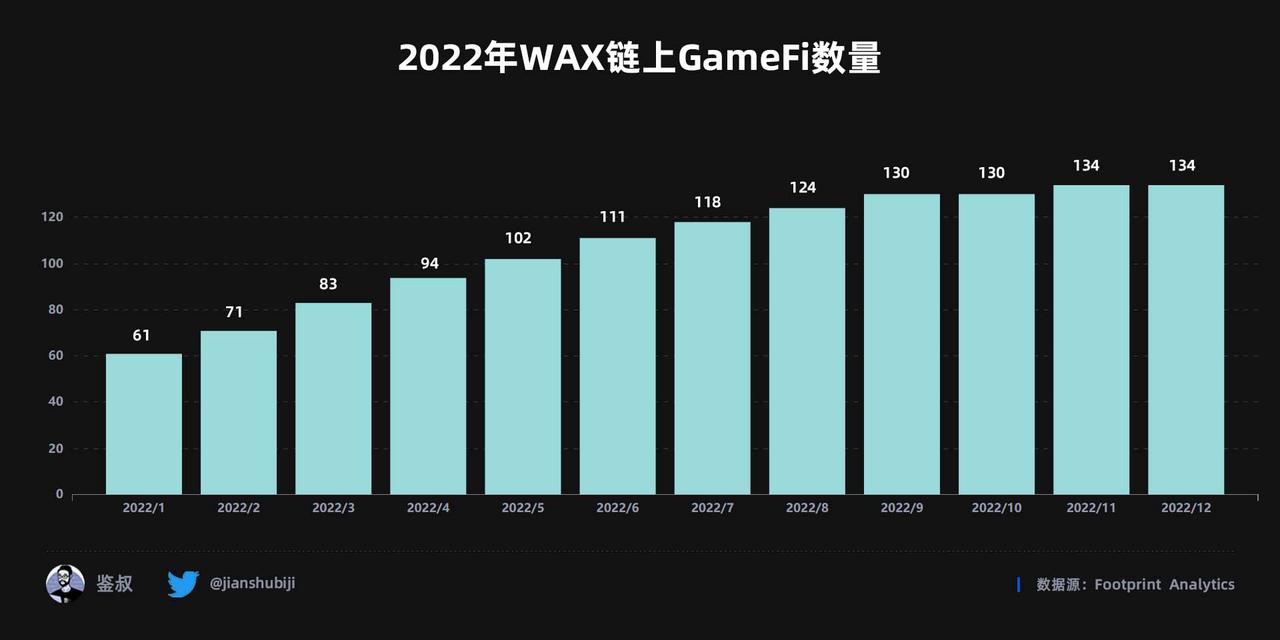

Specific to each public chain, in 2022, BNB Chain and Polygon will show a rivalry in terms of the strength of the layout of the game track, but after September, the pace of Polygon will slow down greatly. On the contrary, BNB Chain will be launched in October when Polygon is dormant. 8 new games were released. Backed by the support of Binance, games on the BNB Chain will still have considerable momentum of development. In the early part of 2022, WAX, the leader of the game public chain, also has a very impressive performance. The number of new games from January to August ranks in the Top 3 of the public chain, and it comes to the second place in September. Although by Q4 in 2022, the average number of new games per month will be less than 2. In summary, game developers still prefer Polygon, BNB Chain, and WAX.

The special month may come from November. New projects on the Ethereum chain are prominent. After all, Ethereum is the public chain with the most comprehensive ecology, which may still be the main reason why it is favored by game project parties.

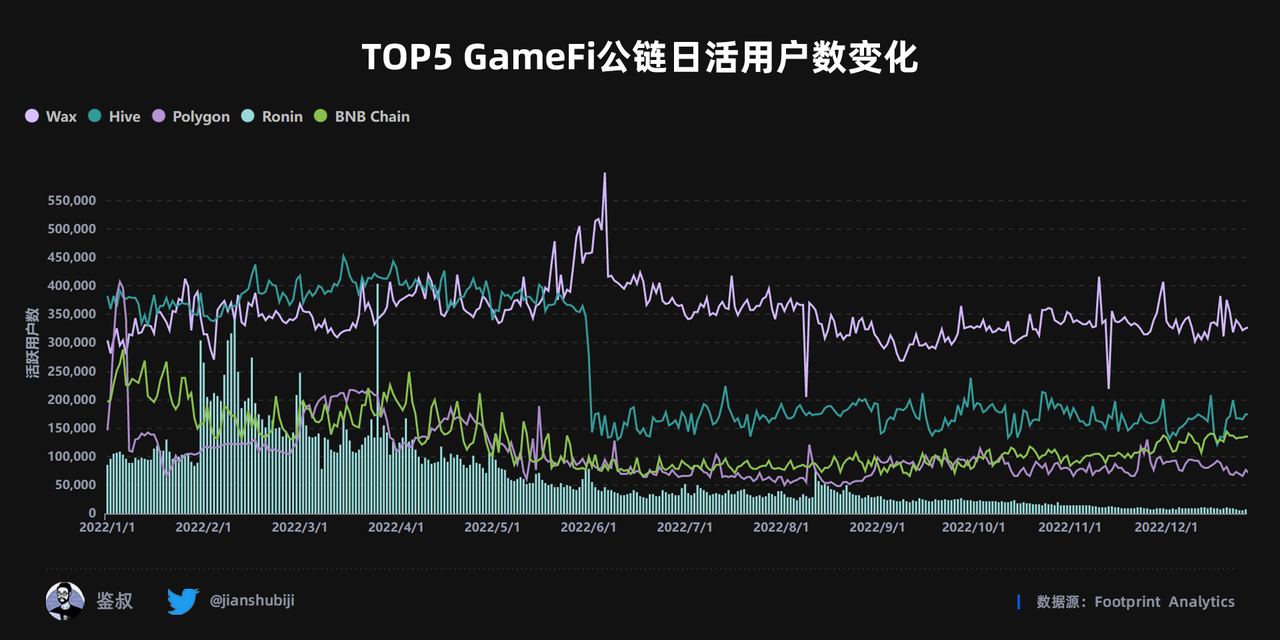

Main game public chain GameFi user data

*The top five public chains with the number of GameFi users among the main game public chainsFootprint

image description

Data sources for changes in the number of daily active users of the TOP 5 GameFi public chain:

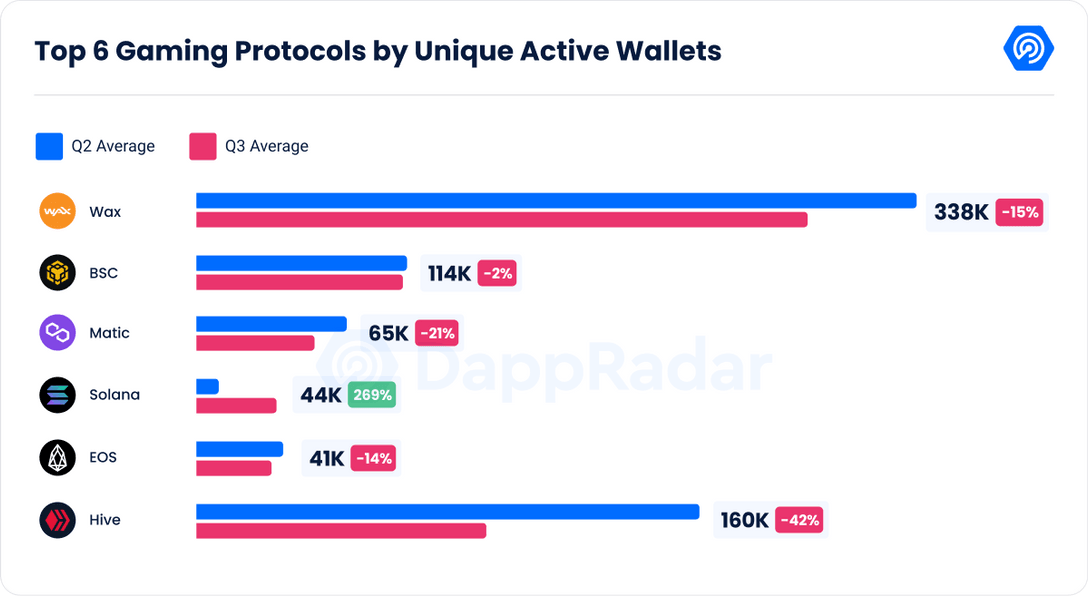

The number of users is the cornerstone of the healthy operation of the entire GameFi ecosystem. Contrary to public opinion, the number of GameFi users is not concentrated on the traditional strong public chain.

Polygon and BNB Chain also ushered in a wave of user peaks in March and April, but unfortunately the duration was not long, but the strong public chain ecology can also stabilize the number of users in the range of 100,000 to 200,000.

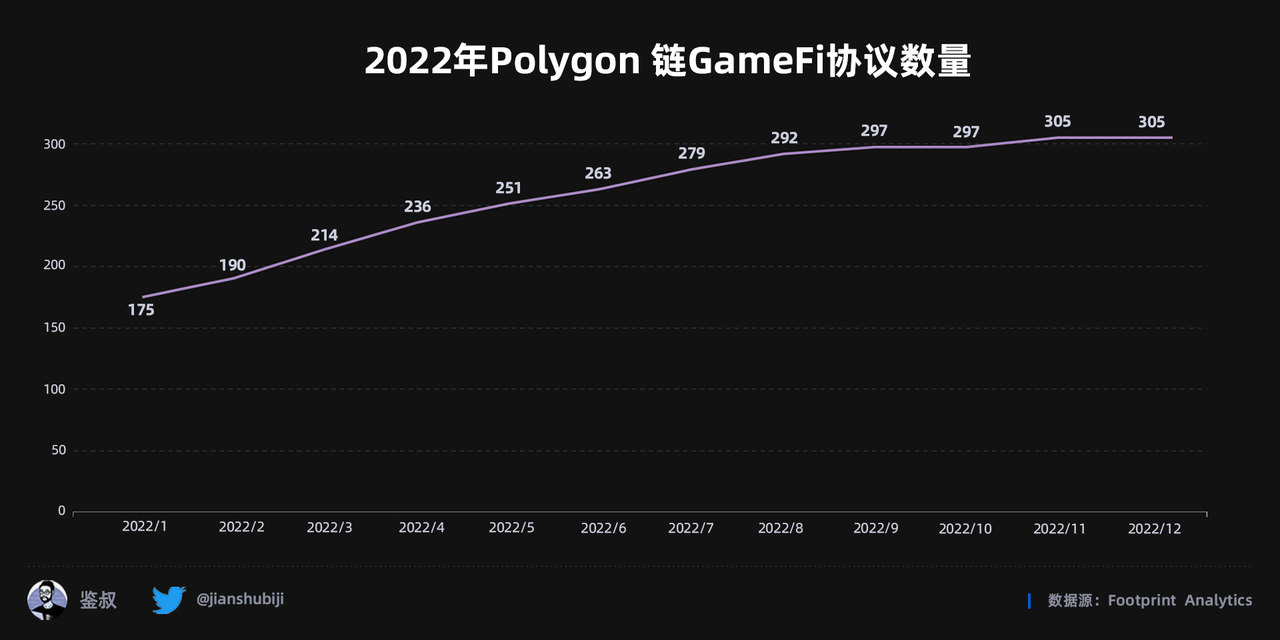

secondary title

text

text

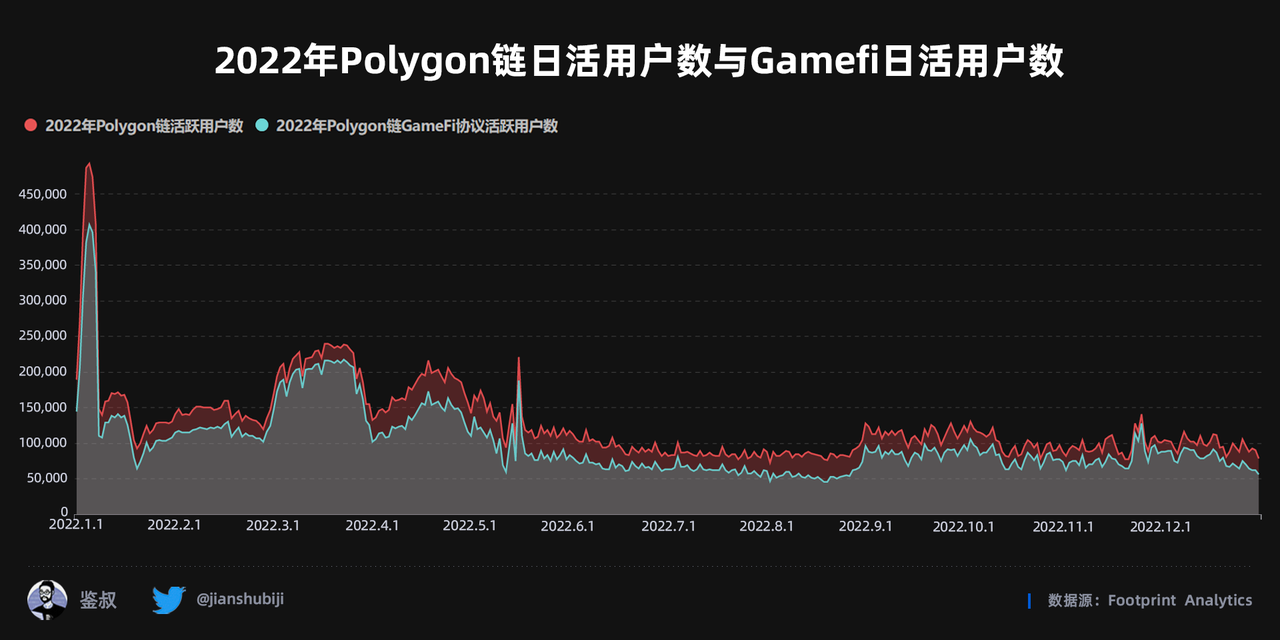

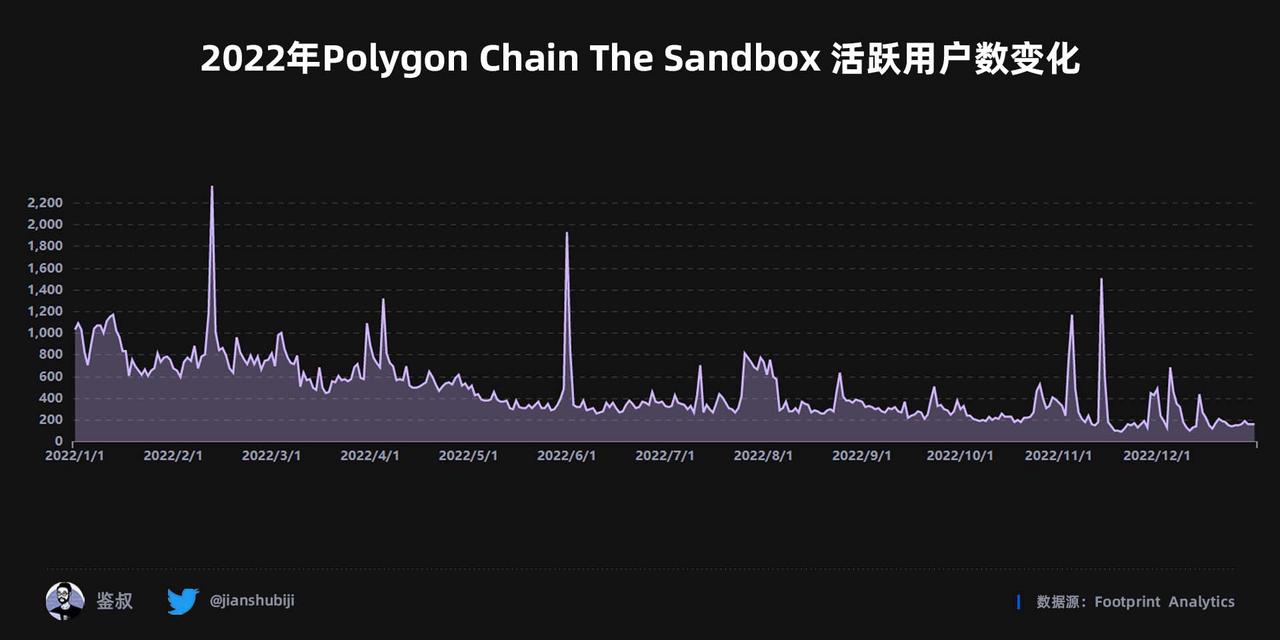

Polygon

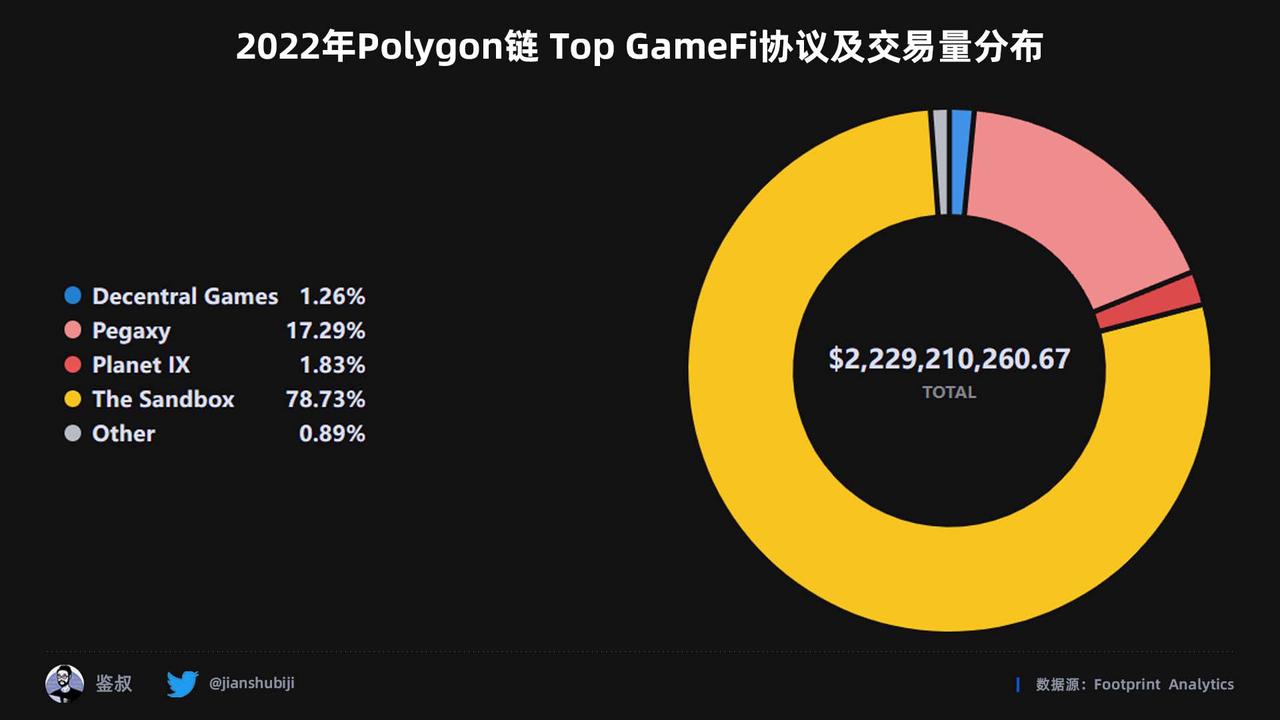

textFootprint

2022 Polygon Chain GameFi protocol volume data source:Footprint

image description

Data source of daily active users of Polygon chain and daily active users of Gamefi in 2022:

As of December 2022, Polygon has 305 blockchain games, an increase of approximately 74.28% from the beginning of the year. In addition, in the past three months, the number of monthly active users related to Polygon games accounted for more than 65% of the number of users on the chain, and a relatively mature ecological prosperity can already be seen on Polygon.

Excellent GameFi performance on Polygon thanks to:First-mover advantage, being able to quickly and stably undertake Ethereum ecological spillover projects.Using a high-throughput blockchain, according to its

development documentation

Team Ecological Exploration: The Polygon development team established Polygon Studios to incubate the GameFi protocol last year, with partners including Animoca Brands, The Sandbox, Decentraland, etc.

Relying on top Web 2 projects: Undertaking the transition from traditional games to blockchain games, the choice of decision-making may bring Polygon a larger user base.Footprint

image description

2022 Polygon chain Top GameFi protocol and transaction volume distribution data source:

The February 12 high was spurred by news that The Sandbox had introduced SAND staking on Polygon, with weekly 500,000 mSAND rewards being distributed to staking participants starting four weeks before the announcement.

image descriptionFootprint

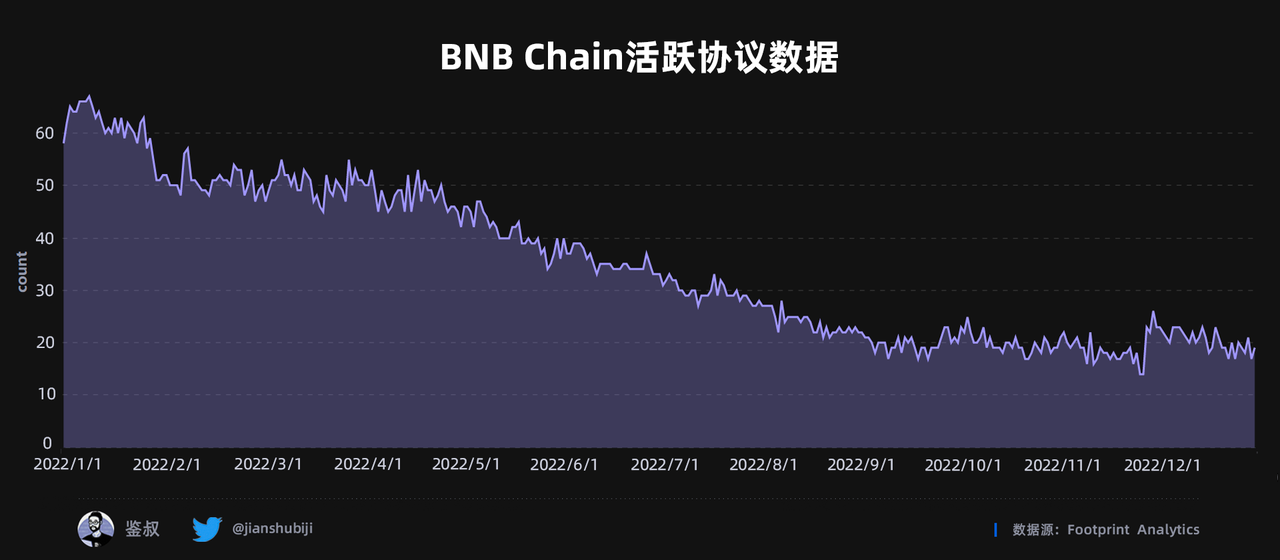

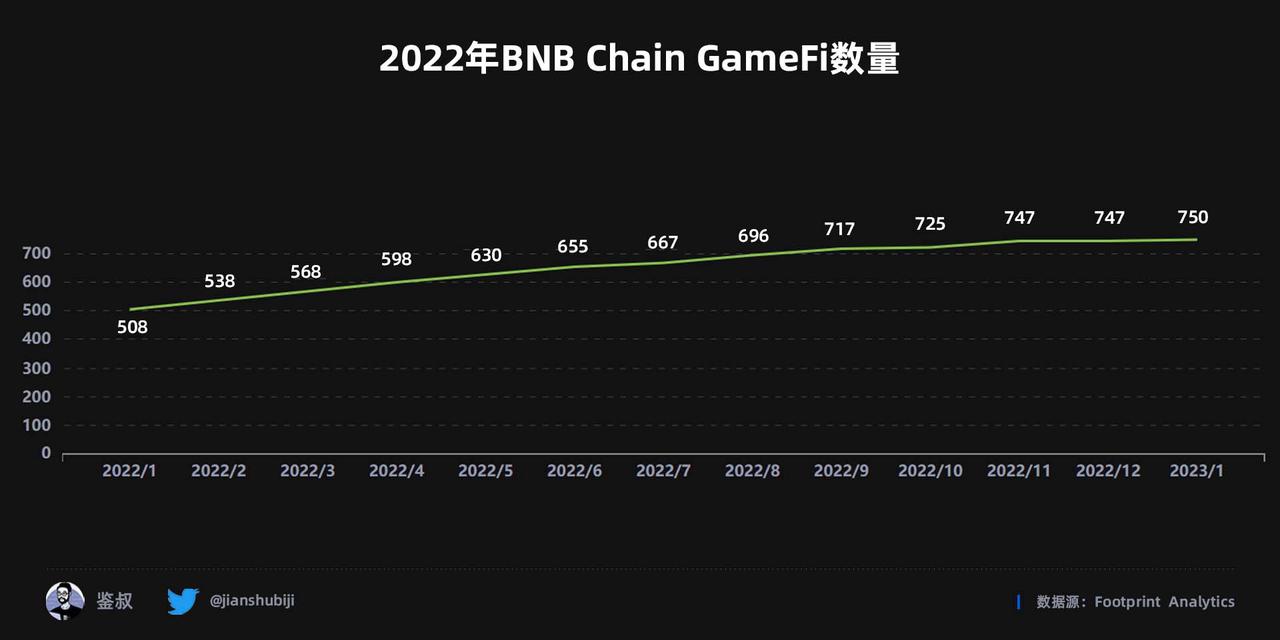

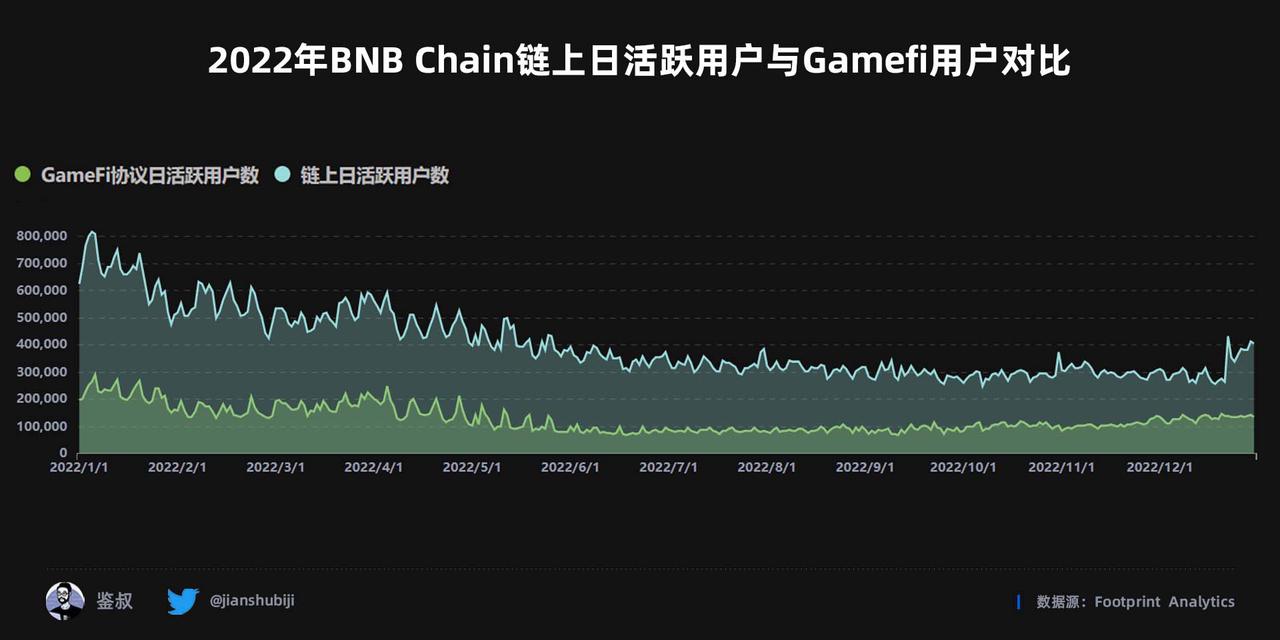

BNB Chain

image descriptionFootprint

2022 BNB Chain GameFi volume data source:Footprint

BNB Chain has 747 blockchain games as of December 2022, an increase of approximately 47.04% from the beginning of the year. From June to July, the ratio of game-related daily active users to the total active users of BNB Chain dropped below 25%, compared to 33.21% at the beginning of the year. However, BNB Chain has three major advantages in the layout of GameFi, and the future trend is still optimistic:

according towhite paperaccording to

white paper

BNB Chain has strong financial resources in the ecology. In October 2022, Binance Labs launched the MVB Accelerator Program to help innovative projects expand on the BNB Chain, and in December announced a partnership with GameFi.org, a one-stop Web 3 gaming platform.

Binance’s strong liquidity and its own huge Web 3.0 user base are suitable for the Move to Earn game that exploded at the beginning of the year. Therefore, BNB Chain successfully allowed the StepN team to deploy the hottest protocol at that time on its chain.Footprint

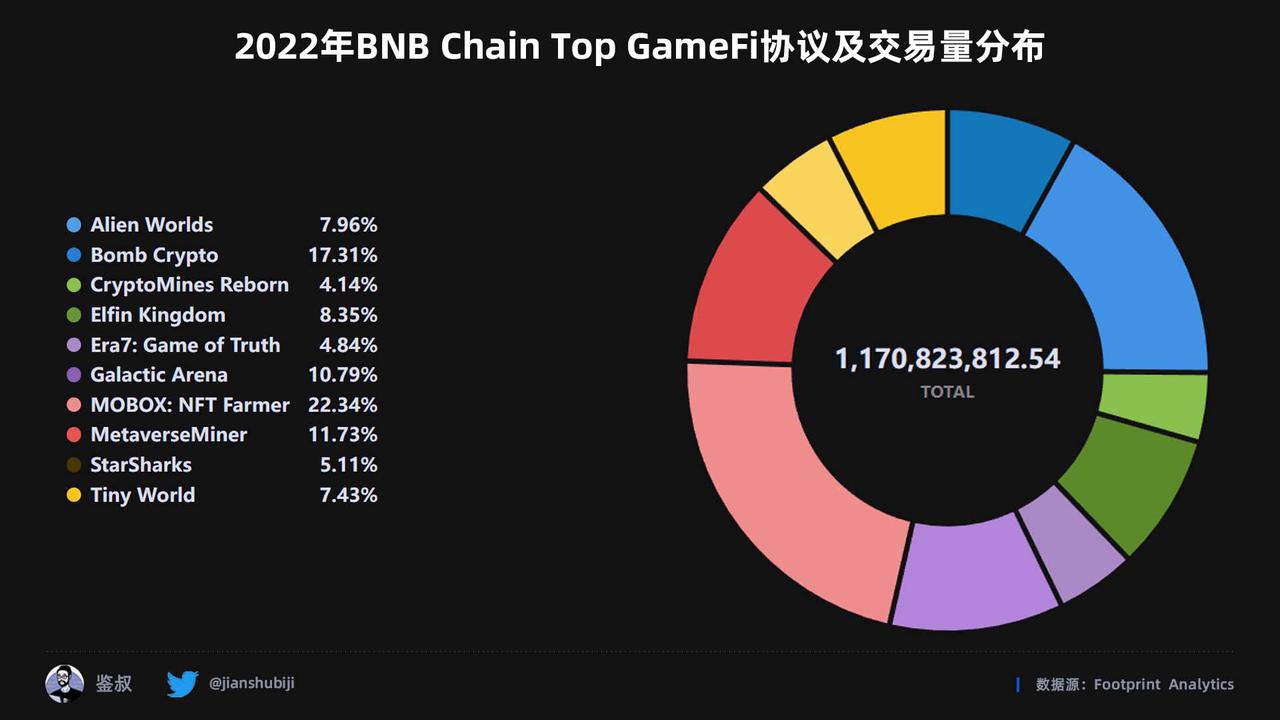

Data source of BNB Chain Top GameFi protocol and transaction volume distribution in 2022:

image descriptionFootprint

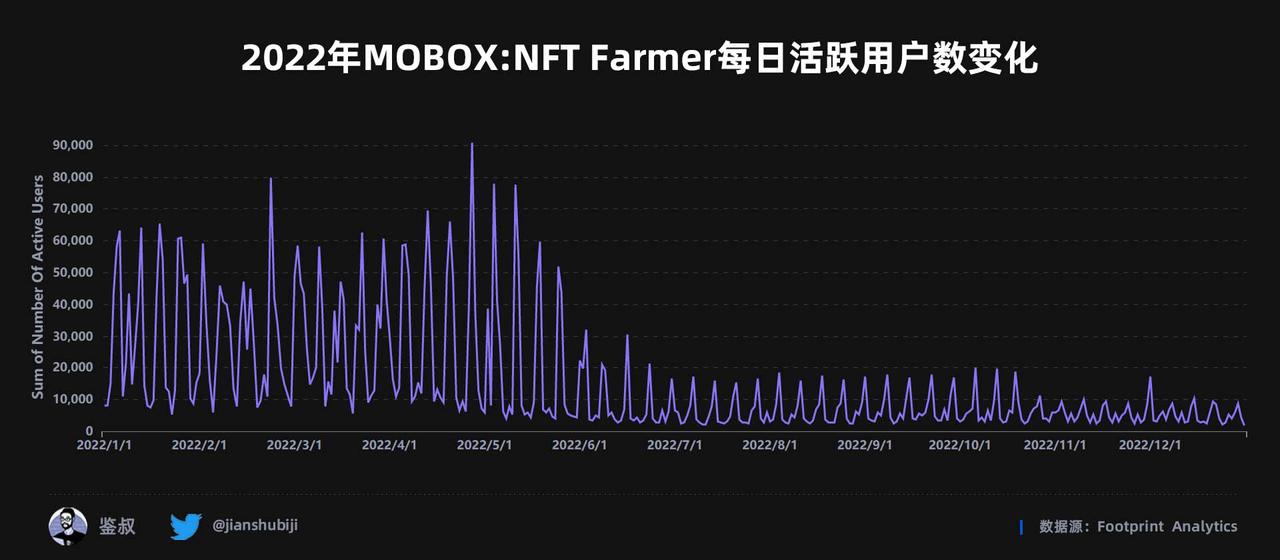

2022 MOBOX: NFT Farmer Daily Active User Change Data Source:

Game public chain part

Hive

image descriptionFootprint

Data source for the number of GameFi on the Hive chain in 2022:Footprint

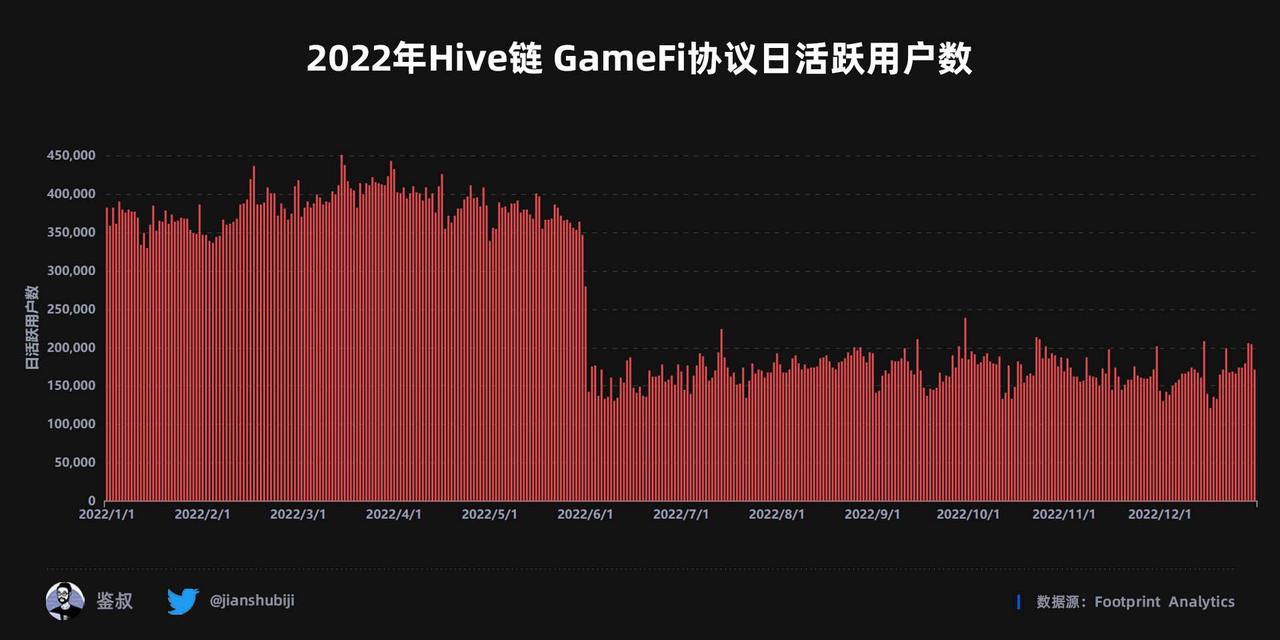

The data source of the number of daily active users of the Hive chain GameFi protocol in 2022:white paperThe Hive chain has 12 blockchain games as of December 2022, and the number has not increased. From the perspective of daily active users, before the first half of 2022, the daily average of the Hive chain can be maintained at more than 350,000, but it has shrunk sharply after June 2, with the daily average falling below 150,000, a single-day drop of 49.10% . However, daily active users have remained stable since then. According to its

white paper

Description, the characteristics of the Hive chain are also obvious "fast, stable, and economical":

High scalability: Mechanisms such as side chain expansion scheme and multi-signature, while further improving the security of the public chain, meet the network requirements of Dapp products in the ecosystem, lower the ecological threshold, and improve user experience.

Zero gas fee: Each user is provided with the rights of 20 free transfers per day. If users have more frequent transfer needs, they can also freeze GSC to get more free transfers. Even if the transfer is completed by burning GSC, every The pen only needs to burn 0.002 GSC, compared to BTC and Ethereum, the transfer cost is almost 0.Footprint

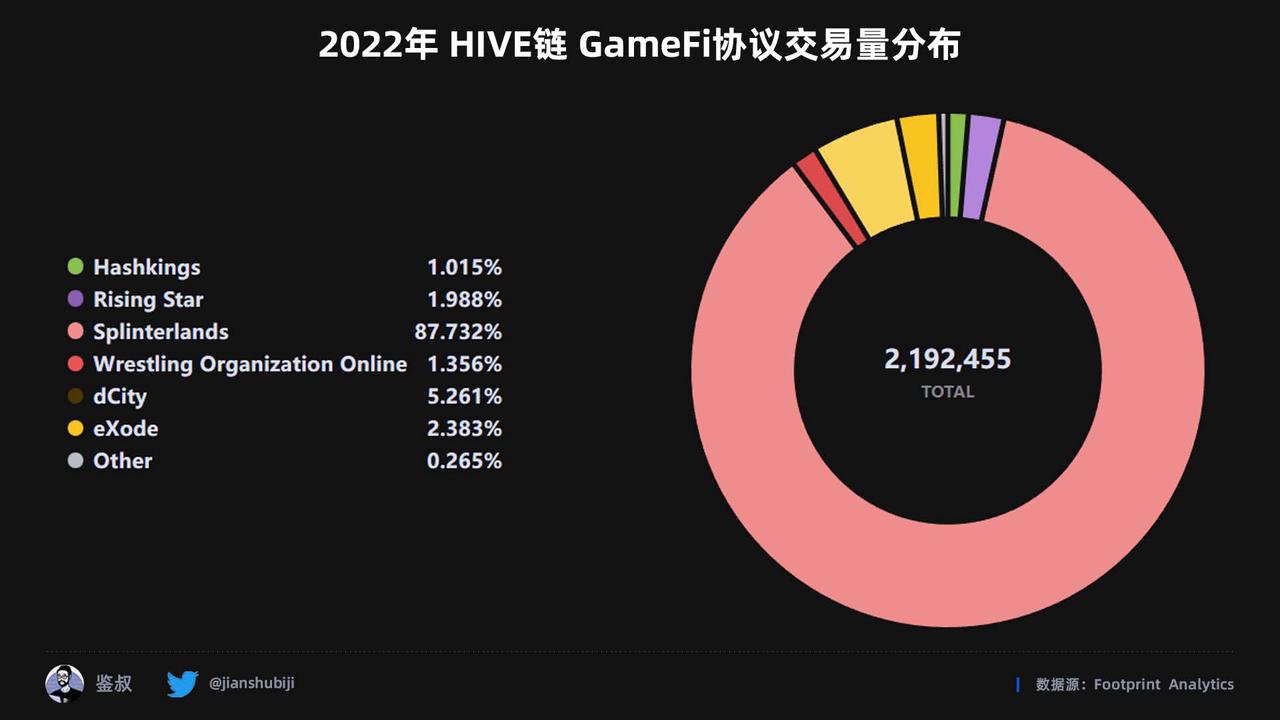

2022 HIVE chain GameFi protocol transaction volume distribution data source:

For a long time, Hive has relied on the game of Splinterlands to support the entire public chain UAW, and it has firmly taken the top spot in the Hive chain.Footprint

image description

Note: The data in this figure does not match the change in the number of daily active users of the GameFi protocol in 2022. The difference lies in the removal of two protocols, Neopets Meta and Farmers World. calculate.

Splinterlands is also considered an "undervalued" project. As a multiplayer digital collection trading card game, it has survived a round of bull and bear since its launch in 2018. The number of active users can still be ranked Top 1. On January 17, the transaction volume of the game was as high as 417,000, reaching the peak of the annual daily transaction volume, while the peak of the number of daily active users appeared laggingly in March, and its UAW reached 434,000.DappRadar

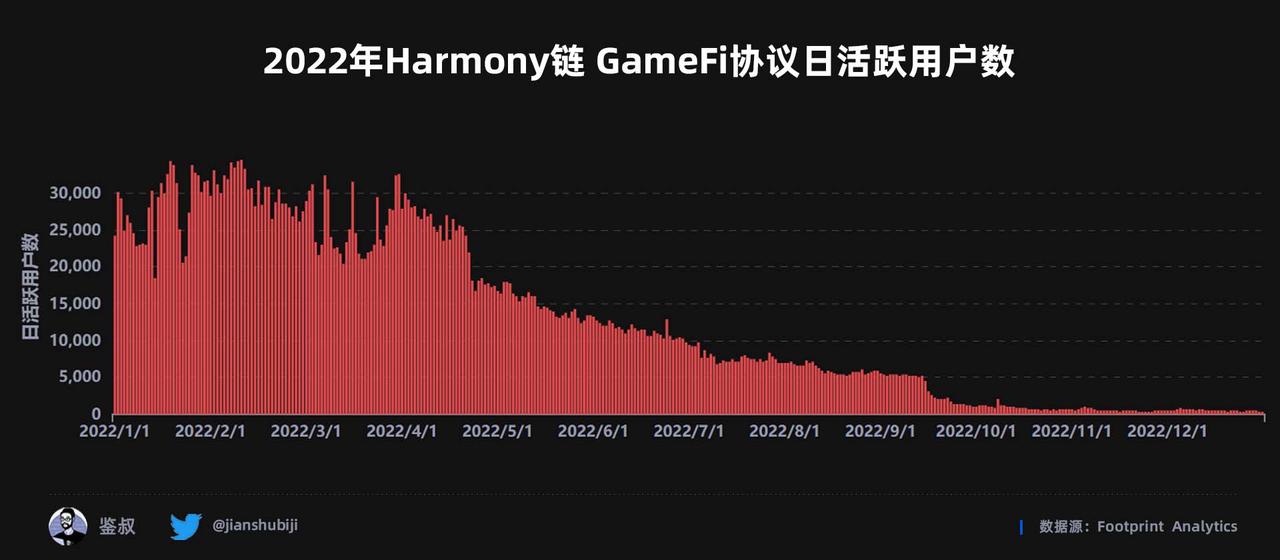

Harmony

Splinterlands historical data data sources:Footprint

Data source for the number of GameFi on Harmony chain in 2022:Footprint

The Harmony chain has 26 blockchain games by December 2022, an increase of about 160% from the beginning of the year. Judging from the daily active users of the GameFi protocol, Harmony’s daily active users fluctuated greatly from January to April, with a single-day drop of nearly 43.75%, but it is still at a relatively high volume.

According to the officialwhite paperAccording to the official

white paper

, Harmony's technical support:

interoperability. With the RaptorQ fountain code, Harmony can use an adaptive information dispersal algorithm to quickly propagate chunks within a shard or across the network. Harmony also uses Kademlia routing to enable cross-shard transactions that grow logarithmically with the number of shards.

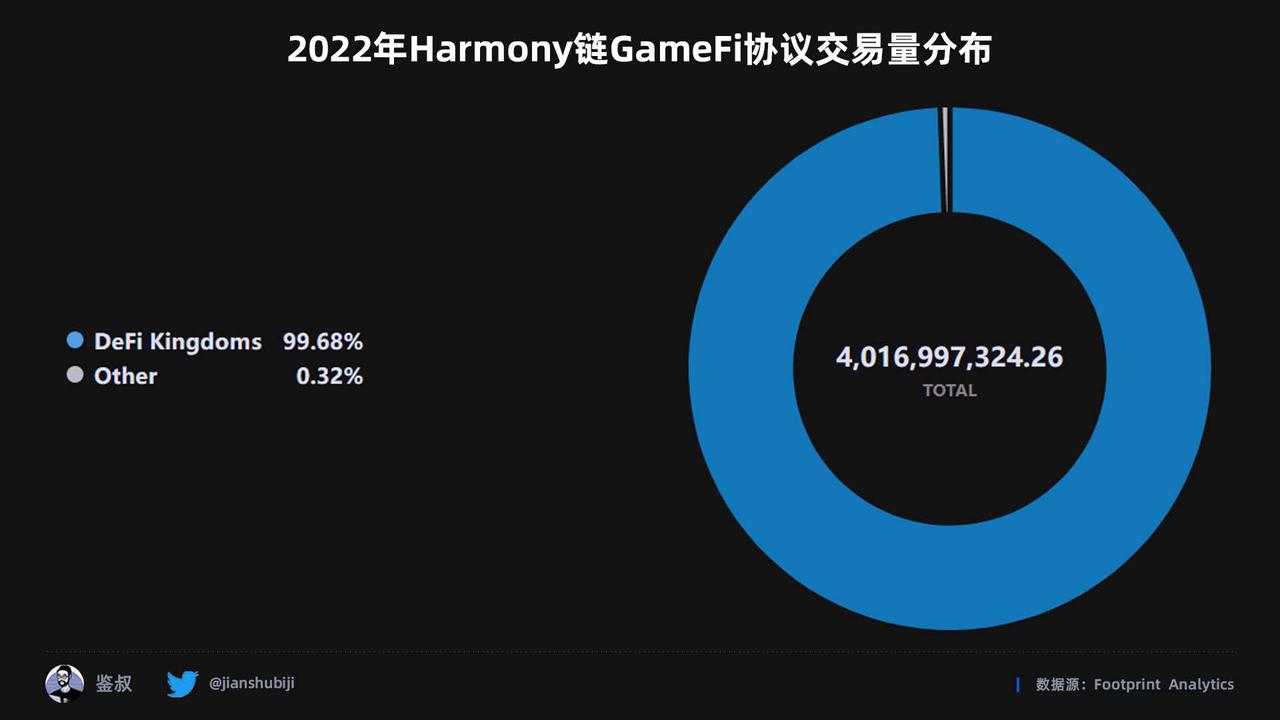

Foreign Cooperation. Expand your reach with Gitcoin Hackathons and Ethereum Events.Footprint

Data source of transaction volume distribution of Harmony chain GameFi protocol in 2022:

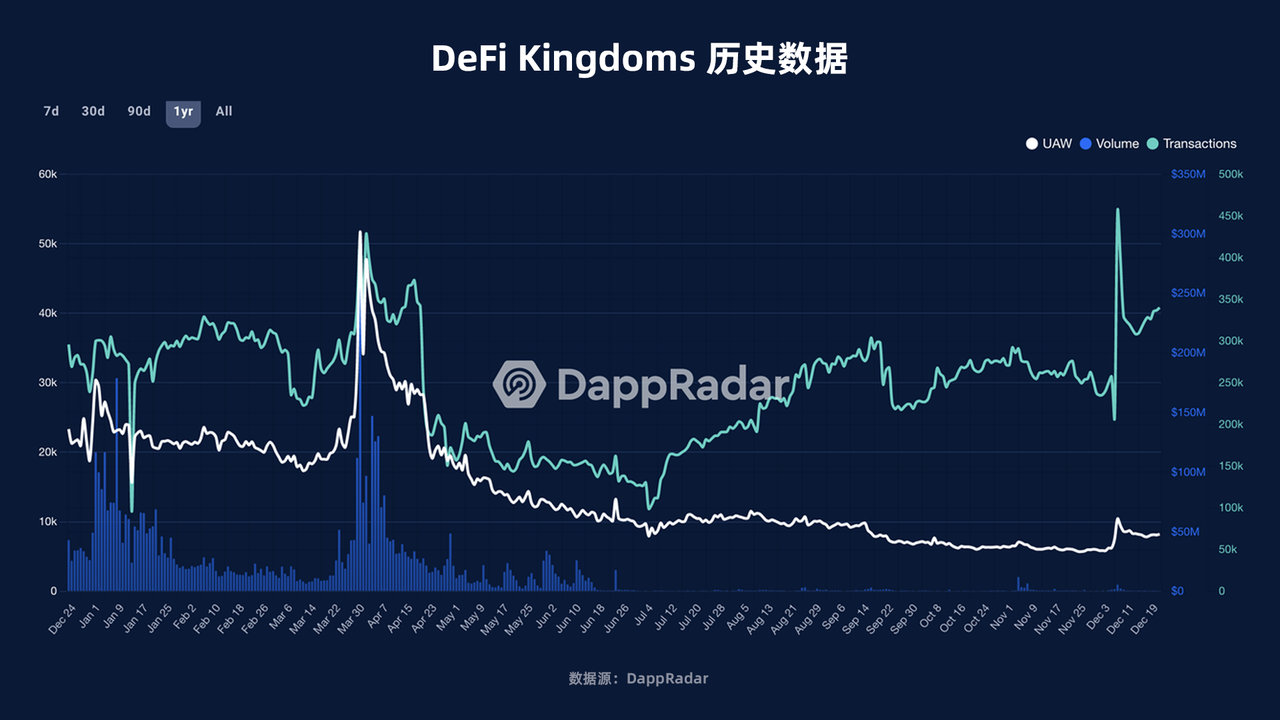

At present, the Harmony ecosystem is dominated by DeFi applications, and the DeFi mining game DeFi Kingdoms is the most prominent in the GameFi layout. Its UAW peaked at 5.1w at the end of March. On December 8, the game officially announced the launch of the Klaytn mainnet, a public chain owned by the Korean Internet giant Kakao, and will use Klaytn’s native DEX to mint a new utility token, JADE, for use in related functions in the game. Come a wave of peaks, reaching 457,100.DappRadar

Ronin

DeFi Kingdoms historical data data sources:

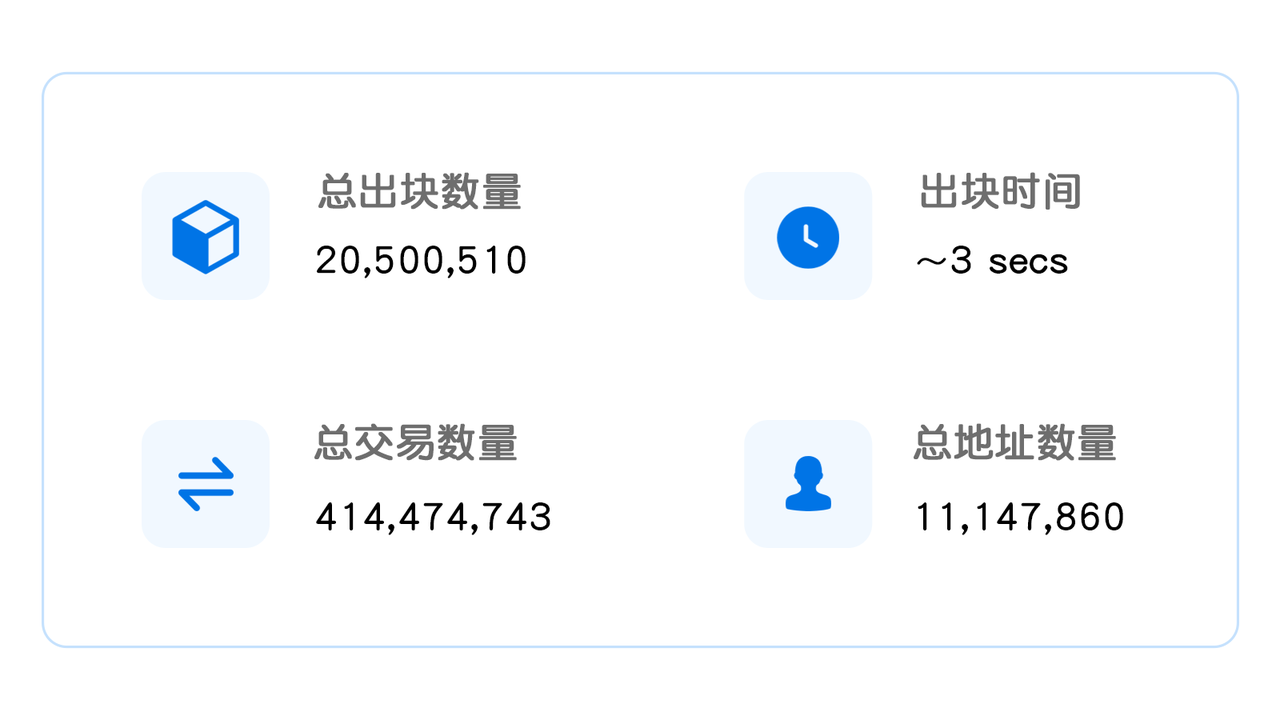

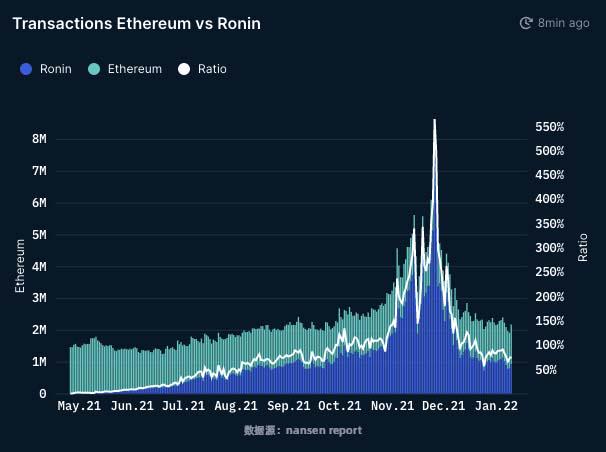

image descriptionThe Ronin Block Explorer

Ronin performance information data sources:nansen report

image description

Gas costs are low. According to the latest gas adjustment, in order to combat spam and enhance security, the minimum gas fee per transaction will be increased to 20 Gwei, but the gas fee will still not burden users.

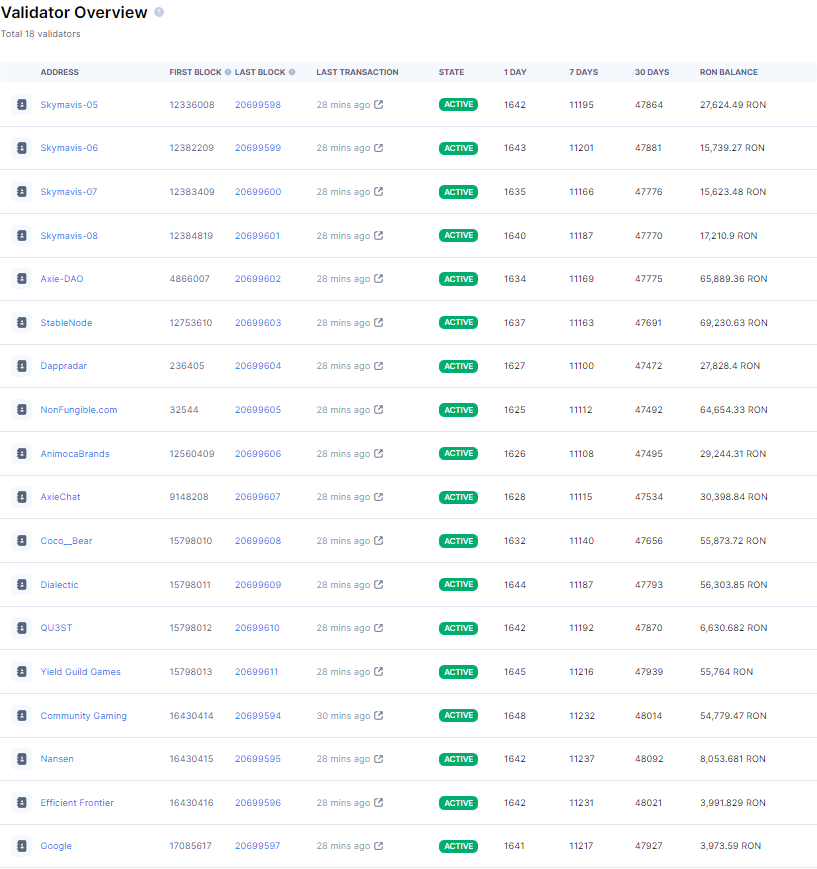

image descriptionThe Ronin Block Explorer

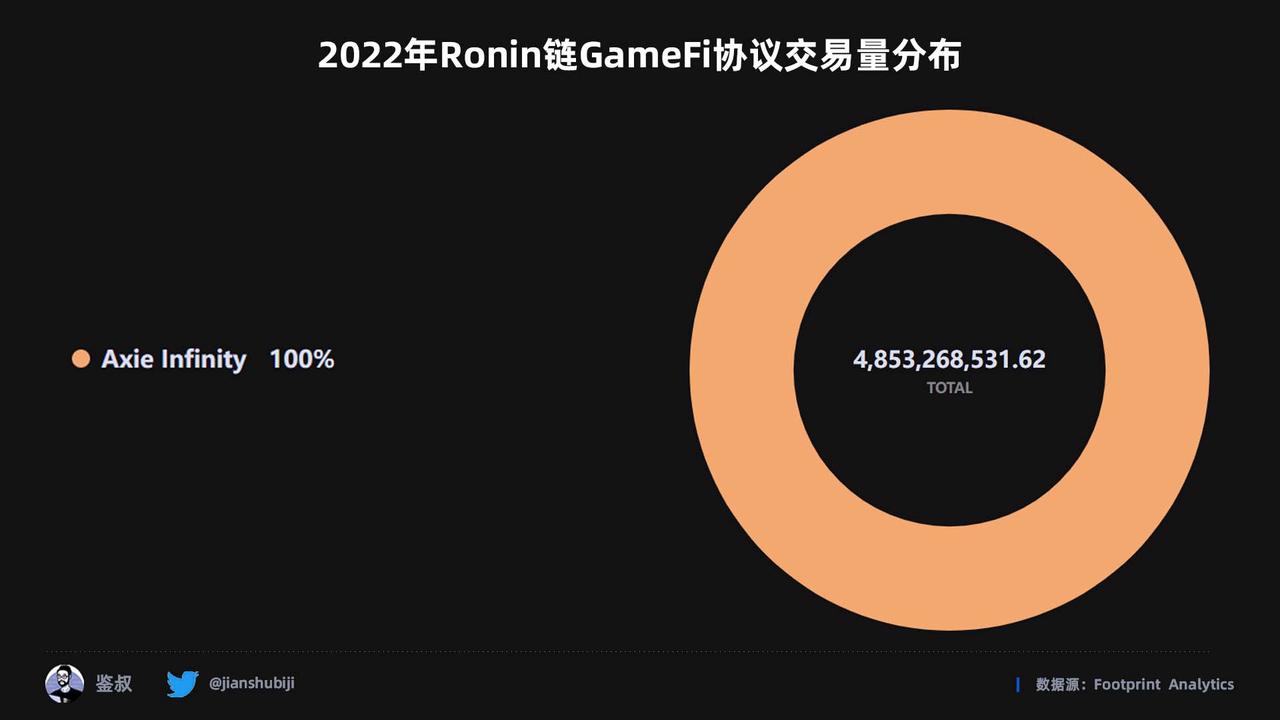

Ronin node validator data source:Footprint

2022 Ronin Chain GameFi protocol transaction volume distribution data source:

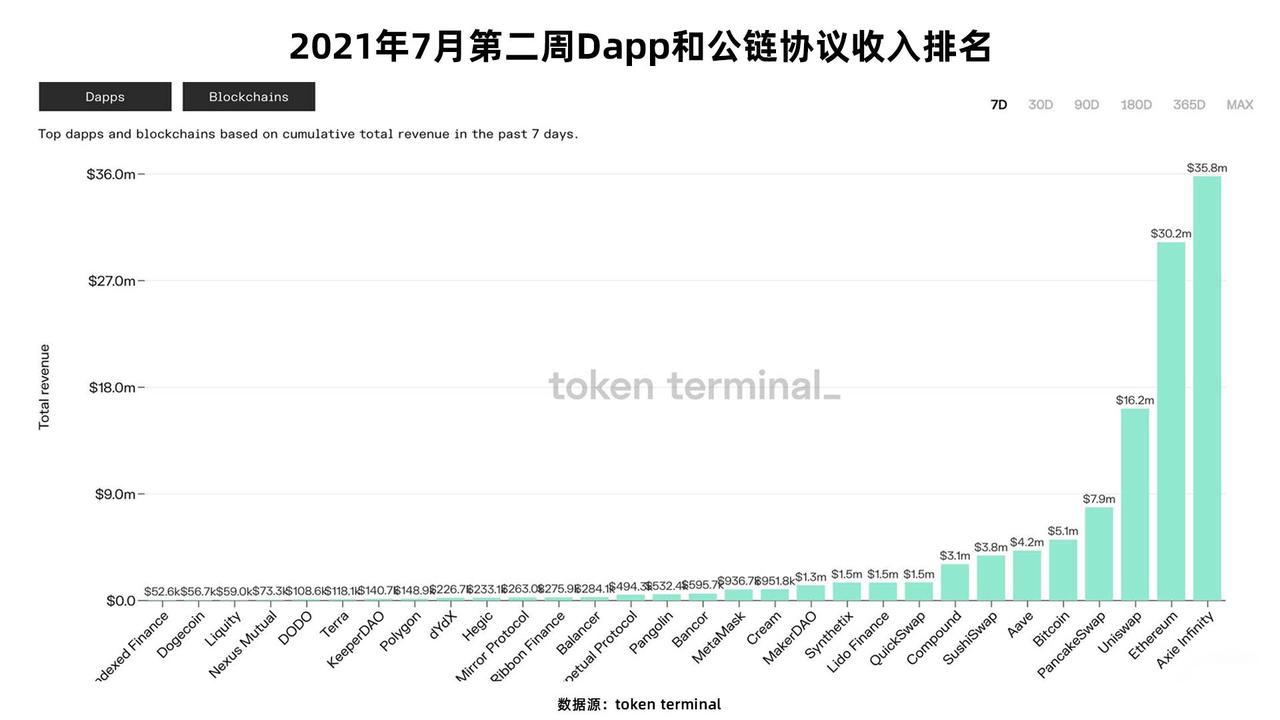

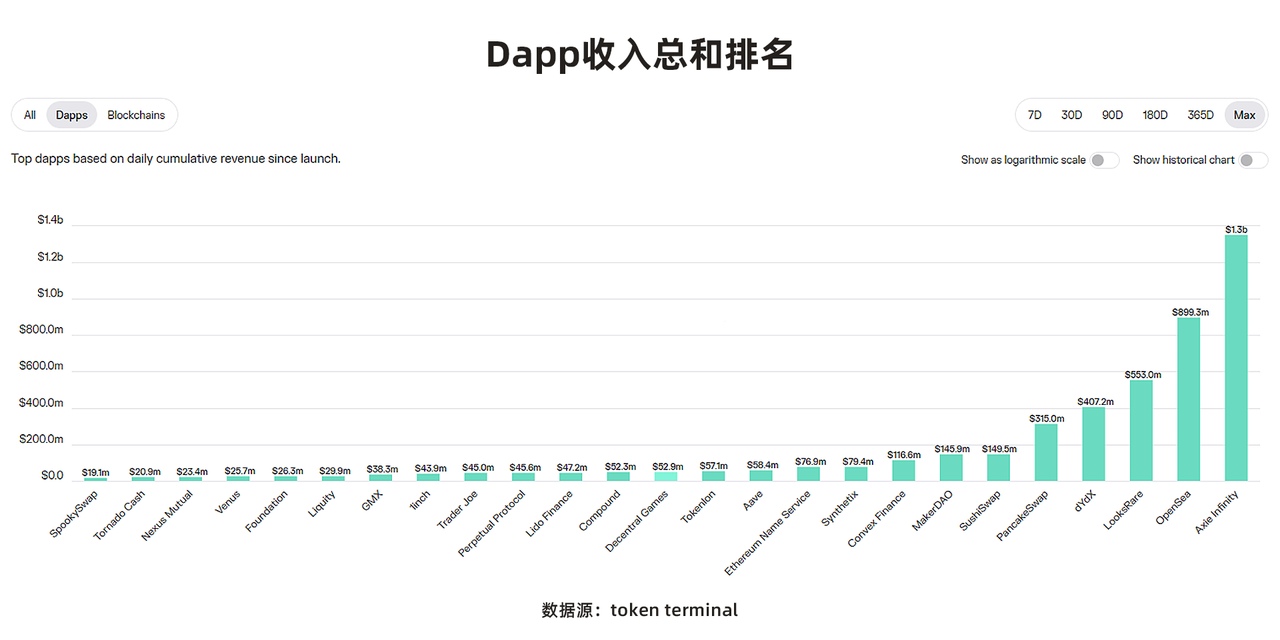

image descriptiontoken terminal

Source of Dapp and public chain protocol revenue ranking chart in the second week of July 2021:token terminal

Source of Dapp protocol revenue sum ranking chart:

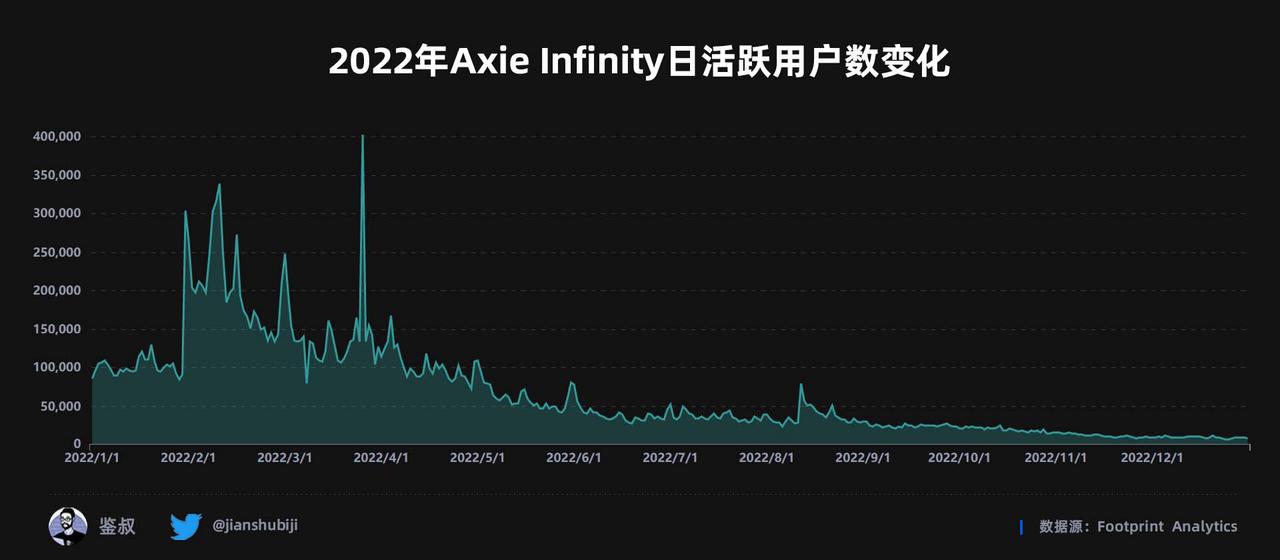

The peak of Axie Infinity’s daily active users was 40.3w, which occurred on March 26. On that day, Ronin announced a series of updates to increase the utility of RON, ensure that Ronin can continue to expand transactions, and boost user confidence. However, by December 2022, the daily active number will drop to a minimum of 6,504, a drop of 98.38% from the highest point.Footprint

Axie Infinity daily active users change data source in 2022:

WAX

image descriptionFootprint

2022 number of GameFi on WAX Chain data sources:Footprint

image descriptionWAX Chain GameFi Protocol Daily Active Users in 2022 Source:According to the white paper

Described, its advantages are:wax.bloks

image description

data source:

In terms of basic resources, WAX was born out of OPSkins, the world's largest digital market operator and the world's largest Steam virtual item trading market. The consistent investment in NFT and props not only ensures the game experience and profitability, but also achieves the ultimate goal of improving the game ecological environment.

In terms of the economic model, its core element is the cross-chain interaction design with Ethereum’s blockchain, which enriches the ecology on the chain and promotes the value cycle with Ethereum.Footprint

image description

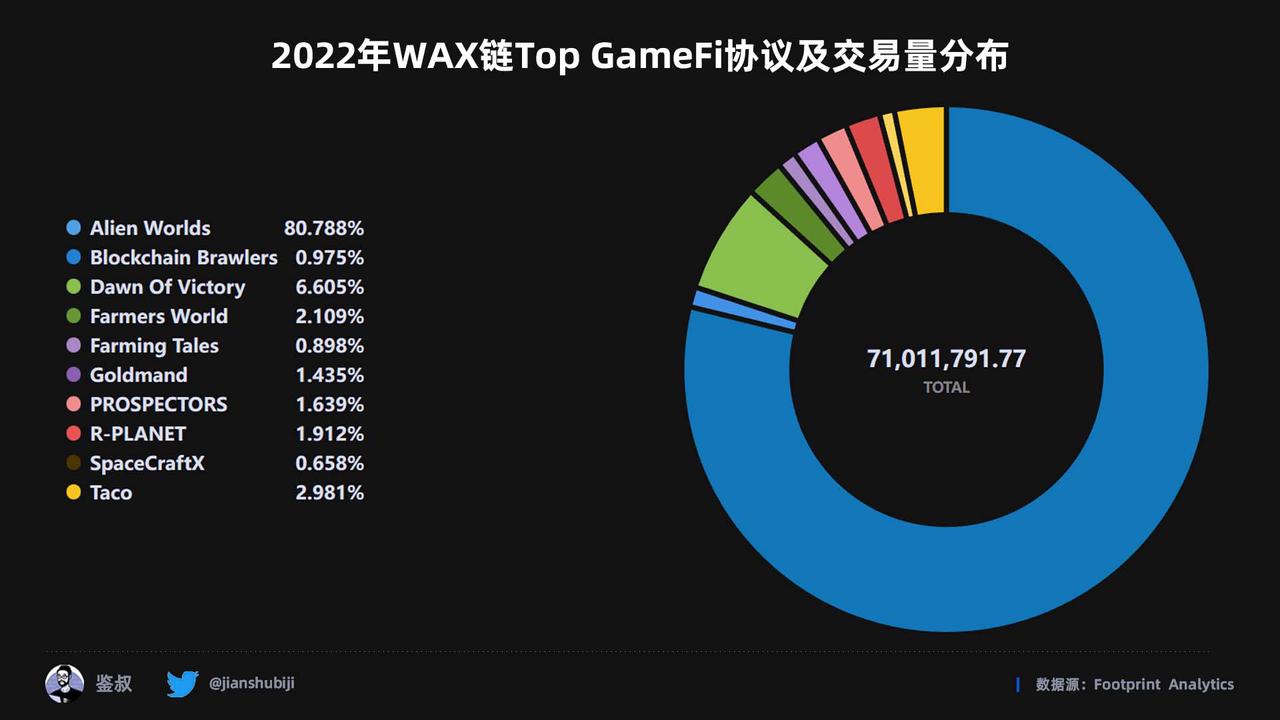

In terms of market share, as the well-deserved leader of WAX, Alien Worlds accounted for 80.78%, and Dawn of Victory ranked second with 6.605%.

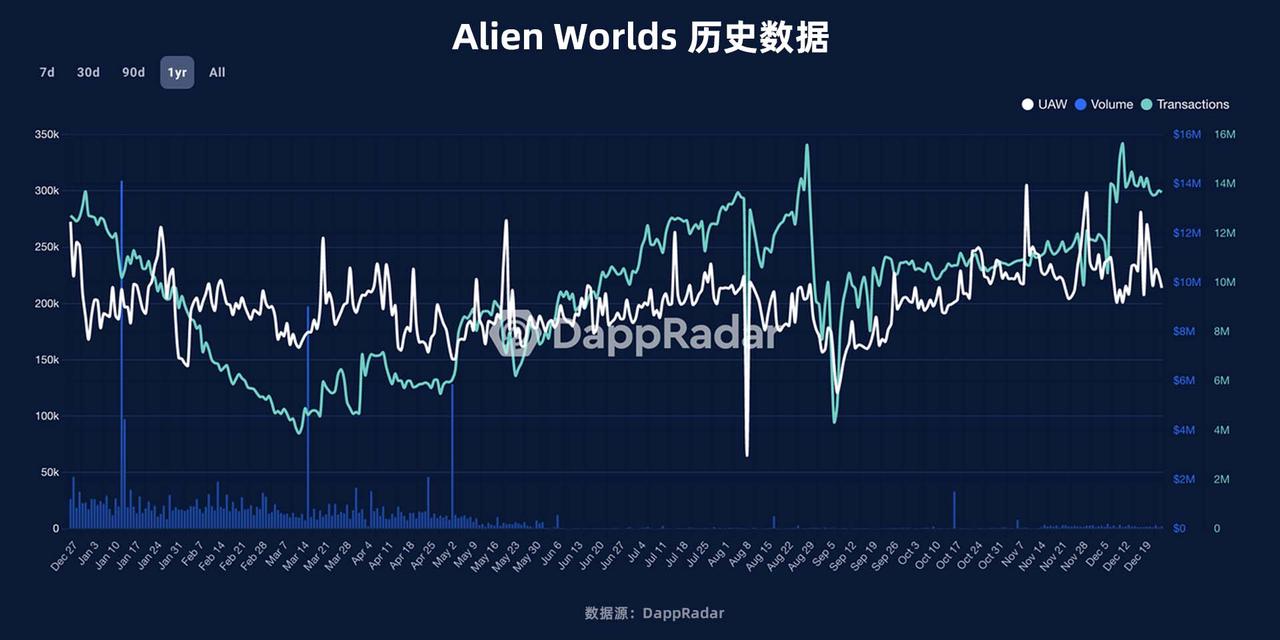

Mainly focus on Alien Worlds, as a space exploration game that integrates the concept of DeFi + NFT + DAO + Metaverse. Although there was an obvious bottom in mid-August and mid-September, the overall volume is relatively high. Especially for UAW, apart from the sharp drop in the number of users to 60,000 on August 10, the highest number of users reached 304,000 on November 10, which is still bright in the bear market. Since then, UAW has remained at more than 200,000.DappRadar

image description

In the dimension of game public chains, Hive, Harmony, Ronin, and WAX have obvious advantages. Among them, WAX and Hive are far ahead in terms of user volume, while Harmony and Ronin have advantages in terms of transaction volume. Even compared with traditional public chains, these four chains The performance of the data does not fall behind, which may reveal the future development direction of GameFi and even the Web3 field-different subdivided tracks will develop and grow in suitable chains according to different characteristics, and the days when a single chain tries to gain a leading position in all aspects will continue. gone forever. Of course, this does not mean that the current state of relative isolation between chains is worth promoting. We have also noticed that more and more GameFi protocols choose to deploy on multiple chains. According to the statistics of Coinmarketcap and Footprint, as of July 2022, the number of GameFi protocols deployed on 2 chains and 3 chains will increase by 62.5% and 40% compared with the whole year of 2021, and the growth rate is very impressive. In addition, the increase in cross-chain demand has also brought about a new problem in the Web3 industry - the security of cross-chain bridges, which will be elaborated in the project chapter.

TOP 5 GameFi Token

first level titleFootprint

image description

Data source of TOP 5 GameFi Token market capitalization changes in 2022:

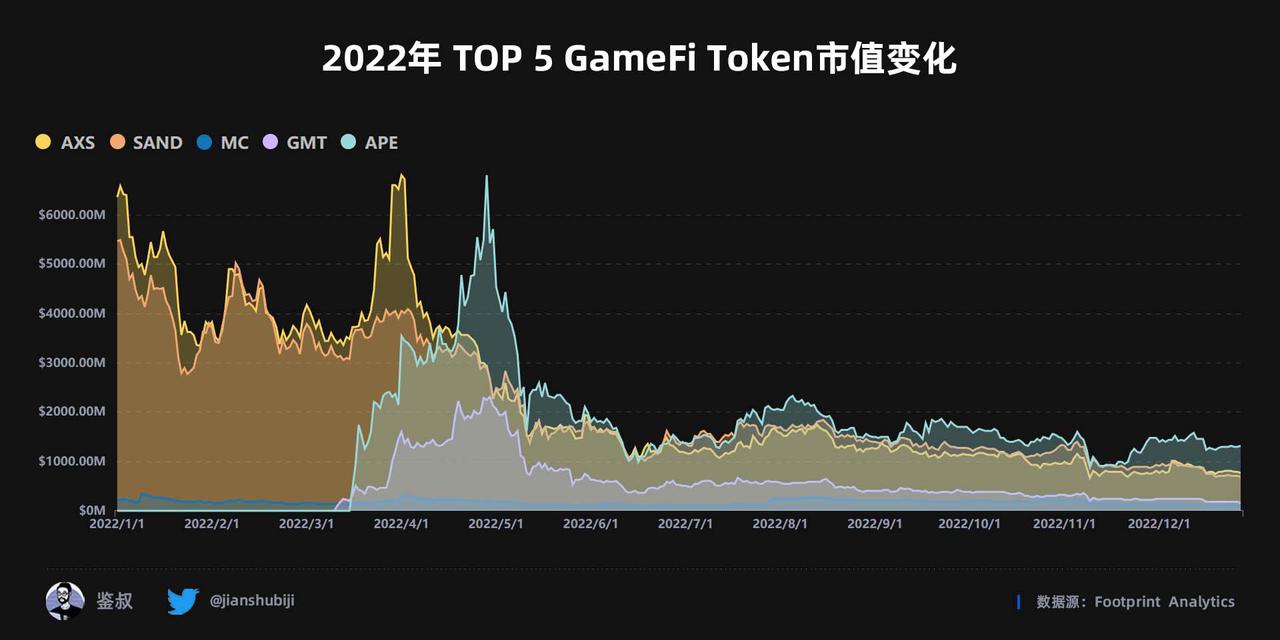

Ranked by market capitalization, the top 5 GameFi tokens in 2022 will be generated in Axie ($AXS), Sandbox ($SAND), game guild Merit Circle ($MC), StepN ($GMT) and ApeCoin ($APE).

In the first quarter, Axie Infinity and Sandbox still dominated the top two in the industry, even with slight fluctuations:

In January, Sandbox’s Token market value shrank by 49.5% year-on-year, and Axie Infinity experienced a 44.06% dive; after a slight rise, both of them ushered in a cliff-like decline simultaneously, of which Sandbox’s decline from February to March reached 39.04% again . Sandbox completed the first round of LAND sale in February, reaching a peak of $5.02 billion and never breaking through again. The glorious moment of Axie's market value appeared at $6.807 billion on April 1, but due to the hacking incident in which Ronin was stolen up to $600 million, Axie then ushered in its darkest moment.

In the second quarter, ApeCoin and $GMT, which debuted in March, started a blockbuster journey:

From the third to the fourth quarter, ApeCoin has occupied the first place for a long time, and the advantage of $GMT is very small:

summary:

In the third and fourth quarters, most of the GameFi Tokens entered a quiet period, but the market value of $APE has relatively significantly increased. The reason may be that its pledge system launched on December 5 has brought new market hotspots. In contrast, $GMT's market capitalization fell below $150 million at the end of December, and the gap between $MC and $MC has narrowed.

Finally, explore the category of Token. Among the TOP 5 GameFi tokens, Sandbox and ApeCoin are more inclined to the concept of Metaverse; Merit Circle is a game guild; $GMT is more inclined to the concept of "Move to Earn", which is somewhat different from "Play to Earn"; only $AXS It belongs to GameFi in a narrow sense. It can be said that the GameFi pattern presents a diversified development trend.