A detailed explanation of the status quo and future of decentralized stablecoins (Part 2)

Original author:SCapital

Related Reading:

A detailed explanation of the status quo and future of decentralized stablecoins (Part 1)

introduction:secondary title

Synthetix’ USD

A detailed explanation of the status quo and future of decentralized stablecoins (Part 1)

Synthetic assets

The previous article focused on generating three decentralized stablecoins around the encrypted asset ETH as the core collateral over pledged. The protocols that will be introduced in this article are more complex than those in the previous article. Although the basic mechanism is roughly the same, the types of collateral extend to interest-bearing assets, protocol native tokens, and long-tail assets. At the same time, stablecoins are endowed with more functions and have more subdivided usage scenarios.

Dynamic Shared Debt Pooling

Synthetix is a decentralized synthetic asset issuance protocol built on Ethereum and L2 Optimism. These synthetic assets are collateralized by Synthetix tokens (SNX), which are locked in contracts to issue synthetic assets (Synths).

“InfiniteLiquidity” & 0 Slippage

secondary title

Synthetic assets are a kind of financial derivative products that allow users to obtain the same income as holding the financial assets without holding the actual assets. For example, sETH, which is synthetic ETH, users do not need to actually hold ETH, but they can also obtain benefits from the appreciation of ETH.

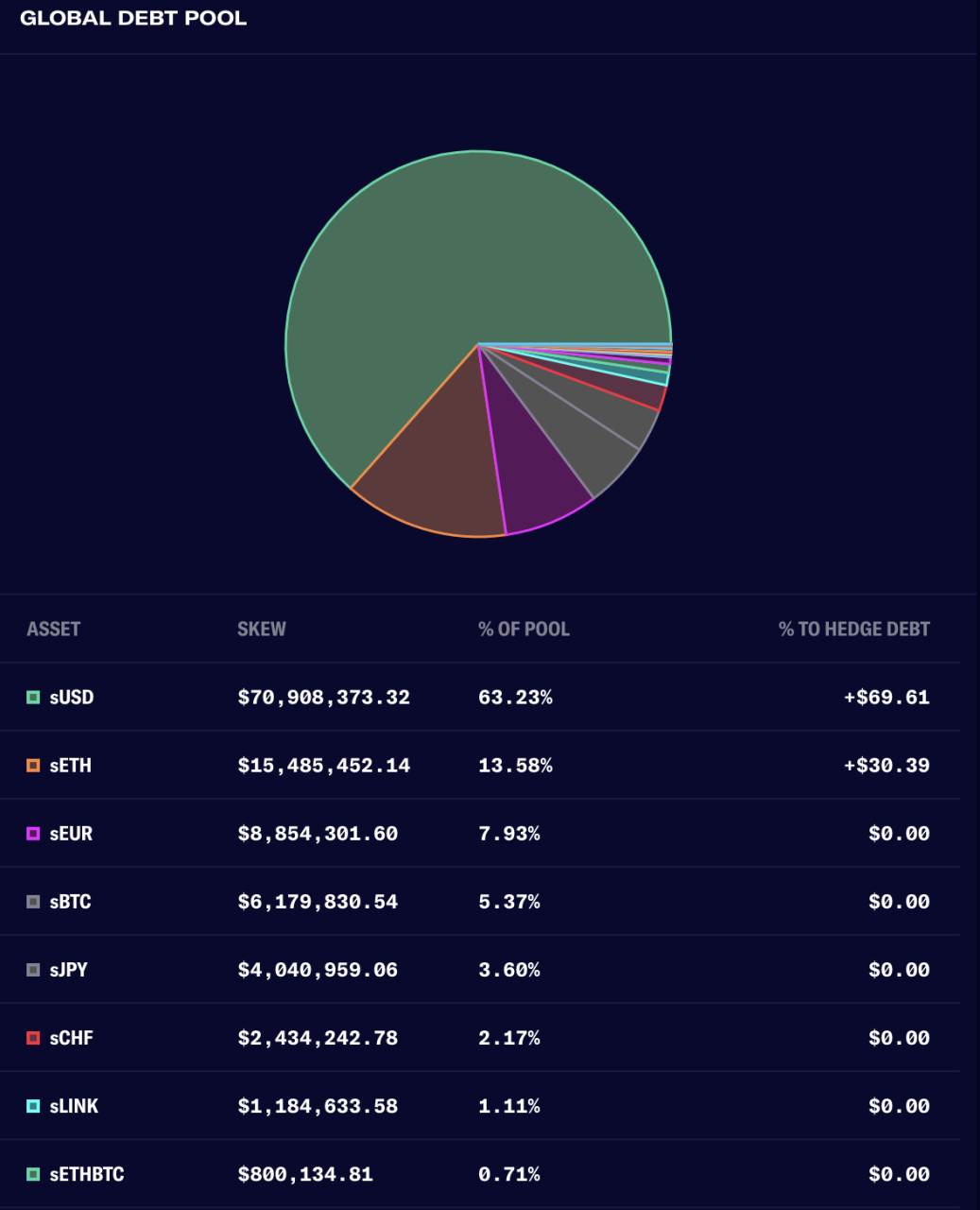

The core feature of Synthetix's design is the dynamic shared debt pool. This collective collateral model allows users to directly use smart contracts to perform Swap between Synths, avoiding the need for counterparties. Compared with the traditional AMM mechanism, it effectively solves the liquidity and slippage problems of DEX. Compared with other DeFi lending agreements, the biggest difference is that the dynamic shared debt pool is collective debt, not personal debt.

Basic Mechanism

secondary title

Since the transaction between Synths is a debt conversion, the total available liquidity that can be traded is the total amount of the debt pool, and the transaction price is directly quoted according to the oracle price. No matter how large the order is, it will not affect the quotation. The quotation is the actual transaction price, and there is no spread or price impact. And as long as there is a sufficient amount of sUSD, you can exchange any amount of Synths, avoiding liquidity problems, which also explains why Synthetix calls itself "unlimited liquidity" and 0 slippage

Benefit of holding SNX

Synthetix currently supports synthetic fiat currencies, cryptocurrencies (long and short), foreign exchange and commodities, etc. According to the user's contribution, the system will pay the transaction fees generated in the Synthetix.Exchange in proportion to the token holders who participate in the lock-up of SNX to issue synthetic assets, thereby encouraging users to hold lock-up SNX. Therefore, the value of SNX comes from the right to use the Synthetix platform and the synthetic asset transaction fees generated by it.

secondary title

SNX can only mint sUSD. If you want to trade other assets, you need to purchase sETH and sBTC through sUSD in the synthetic asset pool. If you are short, open an inverse position, such as iBTC, iETH, etc. Synthetix is also currently experimenting with ETH as an alternative form of collateral, meaning traders can borrow sUSD or sETH with ETH and start trading immediately without the need for SNX. Staking Ethereum requires a collateralization ratio of 130% and creates ETH-denominated debt. Since users do not directly participate in the system's "debt pool" in the form of loans. So in this model, Ethereum holders don't take any risk for the debt pool, but they also don't get any fees or rewards, and they also need to bear the interest costs incurred during the borrowing process.

Key players in the Synthetix system

secondary title

SNX holders are encouraged to hold SNX and mint Synths in a variety of ways.

First, transaction rewards. Transaction rewards are generated every time someone exchanges one Synth for another (i.e. trades on Synthetix.Exchange). The transaction fee generated by each transaction will be stored in the fee pool. SNX stakers can claim SNX in the fee pool proportionally every week as transaction rewards. This fee is between 10-100 bps (0.1%-1%, usually 0.3%) and is displayed when trading on Synthetix.Exchange. However, it should be noted that if the pledge rate is lower than 400% during this period, the reward cannot be claimed.

Second, add token rewards. The protocol's inflation policy incentivizes SNX stakers. From March 2019 to August 2023, the total supply of SNX will increase from 100,000,000 to 260,263,816, with a weekly inflation decay rate of 1.25% starting in December 2019. Beginning September 2023, permanently set the inflation rate at 2.5% annual growth. These newly added SNX will be allocated to qualified SNX pledgers on a weekly basis (not lower than the target pledge rate).

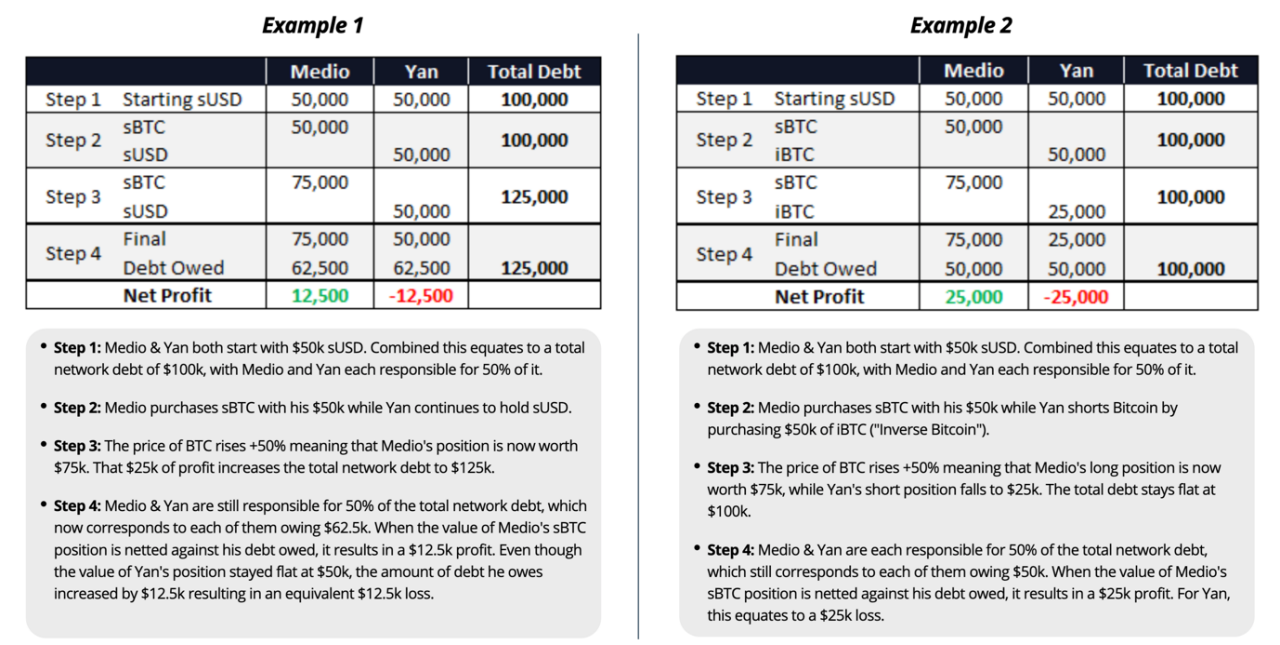

Example 1

secondary title

Pledgors, debtors and counterparties

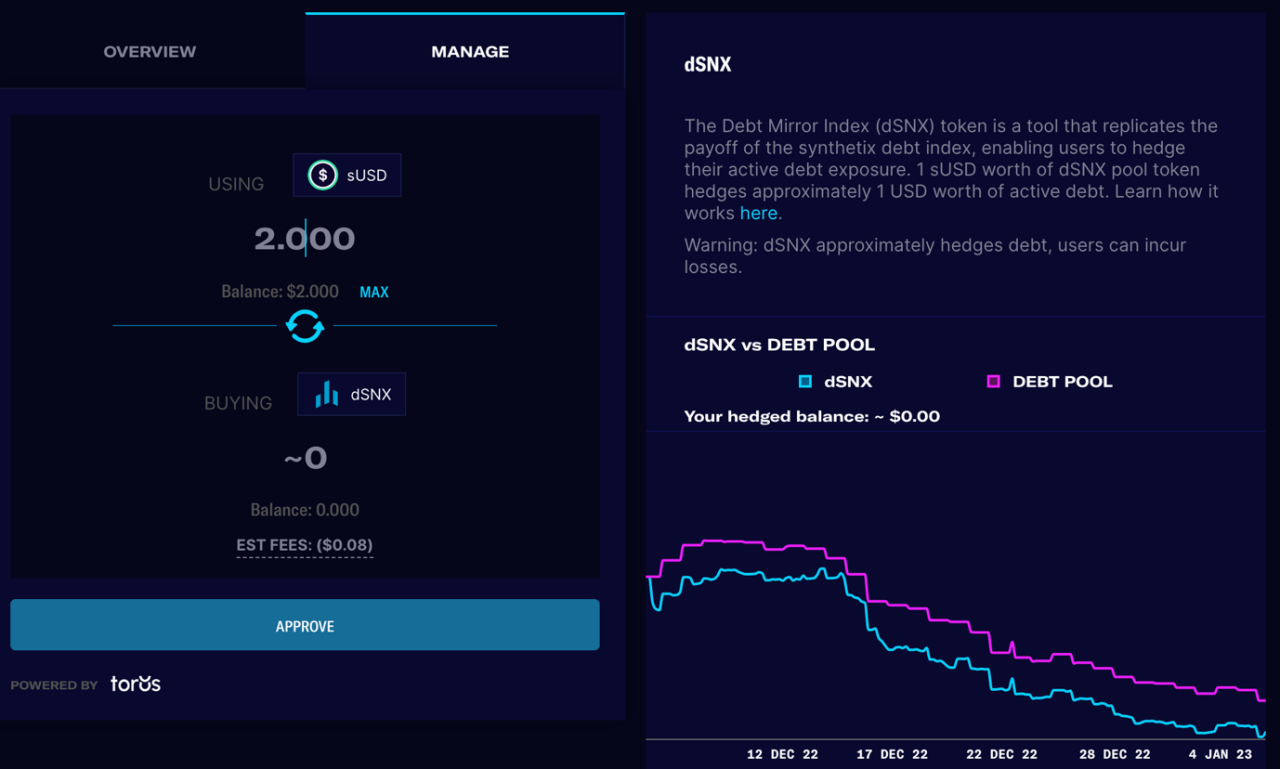

Hedging Strategy

SNX stakers incur "debt" when they create Synths. Depending on the exchange rate and supply of Synths in the network, this debt can increase or decrease independently of its original minted value. For example, if 100% of the Synths in the system are synthetic Bitcoin (sBTC), when the sBTC price halved, the debt in the system would be halved, and each staker's debt would be halved. This means that, in another scenario, when only half of the Synths in the system are sBTC, and the price of BTC doubles, the total debt of the system (and the debt of each staker) will increase by a quarter .

What needs to be explained here is that the sUSD obtained by users through Staking SNX is not a personal debt, but a collective debt, which is the biggest difference between Synthetix and other lending agreements. In other words, the sUSD minted by the user through over-staking will be included in the overall debt in the pool in proportion. Although the user does not perform any operations, the final debt that needs to be repaid will increase or decrease according to the behavior of the counterparty in the pool. In order to better understand this mechanism, we use an example given by the official website to analyze.

Synth Stability Mechanism

Step 1: Both Medio and Yan have an initial investment amount of $50,000, and the combined total debt of the network equals $100,000. Among them, Medio and Yan each took 50% of it. Step 2: Medio buys sBTC with his $50,000, while Yan continues to hold sUSD. Step 3: The price of BTC increases by 50%, which means that the value of Medio's position becomes $75,000, of which the profit of $25,000 brings the total debt of the network to $125,000. Step 4: Medio and Yan are still each responsible for 50% of the network's total debt, or $62,500 each. When the value of Medio’s sBTC minus his debt, there is a profit of $12,500; even though Yan’s position is worth $50,000, his debt has increased by $12,500, or a loss of $12,500.

Although Yan did not perform any operations on the above-mentioned actions, because Medio’s operation brought the total debt of the network to 125,000 US dollars, which increased Yan’s debt risk exposure, he assumed a loss of 12,500 US dollars in vain.

From the above example, we can see that as a pledger, there may be a risk of "others make money and I lose money". Generally speaking, the pledger needs to manage and hedge positions according to the debt pool.

secondary title

Challenges

There are three ways to keep a Synth hooked:

Arbitrage: SNX stakers created debt by minting Synths, so if the peg drops, they can now profit by buying sUSD back below par and burning to reduce debt, as the Synthetix system always values 1 sUSD at 1. If the pegged exchange rate rises, users can go to the Curve sUSD pool for arbitrage in exchange for other stablecoins (USDC, USDT, DAI).

SNX Auction: Synthetix is currently experimenting with a new mechanism using Gnosis' dFusion protocol to auction off discounted SNX in exchange for ETH, which is then used to buy Synths priced below the peg.

Outlook

Compared with other lending protocols, Synthetix's high pledge rate makes users' minting costs very high. The reason is that the protocol uses the native token SNX as collateral. If the pledge rate is too low, it is prone to a death spiral in times of crisis.

ibTKNs-Collateralized Stablecoin

Abracadabra.Money(MIM)

The Synthetix protocol mechanism is too complicated and obviously not suitable for novices. SNX pledgers need to manage their positions in a timely manner according to the debt pool, otherwise they will face the risk of increased debt. For Synths traders, they are essentially trading debt, and the benefits and risks are relatively uncontrollable.

There is huge room for growth in the encrypted derivatives track. With the integration of more DEXs in the future, expanding to more assets (foreign exchange, stocks, fiat currencies, commodities), projects built on existing protocols will become more mature (Kwenta, Lyra, Polynomial, Popcorn), I believe that Synthetix will have more usage scenarios and narrative space. Purely from the user's point of view, the biggest advantage is that you don't need to invest in underlying assets through multiple channels, you only need to buy other synthetic assets and coins by minting sUSD, which will save time and have zero slippage in transactions.

Basic Mechanism

first level title

Stability Mechanism

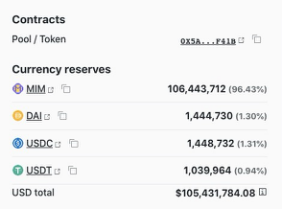

Abracadabra.Money is a lending platform built on multiple chains. The lending mechanism is similar to MakerDao, but the difference is that the protocol mainly uses interest-bearing tokens as collateral to borrow a decentralized stablecoin (Magic Internet Money - MIM) linked to the US dollar. It is worth mentioning that since the protocol supports multiple assets in multiple chains as collateral, it means that the collateral behind the minted MIM is mostly long-tail assets with poor liquidity.

Therefore, the aggressive expansion of MIM's multi-chain and multi-asset can be described as a double-edged sword. In the case of abundant liquidity in the bull market, the agreement has achieved unprecedented success. However, in the scenario where the liquidity in the bear market is exhausted, more currencies are supported as collateral, and logically speaking, it is more likely that the shortfall caused by liquidation will cause the price of the currency to break the anchor.

secondary title

The beauty of minting MIM is the ability to release previously illiquid assets, especially previously idle interest-bearing assets, including a range of tokens such as yvUSDC or aDAI. Most importantly, even when MIM is borrowed, the user's underlying collateral still generates yield.

MIM's stabilization mechanism mainly relies on arbitrage, which can occur in the following ways.

Liquidation

A user holding MIM debt may notice that MIM is trading for less than $1 on some markets, and decide to buy some MIM at this discounted price to pay off some of their debt. This act of buying MIM will have the effect of increasing prices.

A user holding a Vault (active collateral) may notice that MIM is trading above $1 in a certain market and decide to open a position selling the borrowed MIM to use elsewhere. This behavior of selling MIM will have the effect of price reduction.

Users who hold other cryptocurrencies may see that MIM is trading differently in the two aforementioned markets and decide to buy MIM in one market where the price is below $1 and another market where the price is $1 or more Sell online to realize arbitrage.

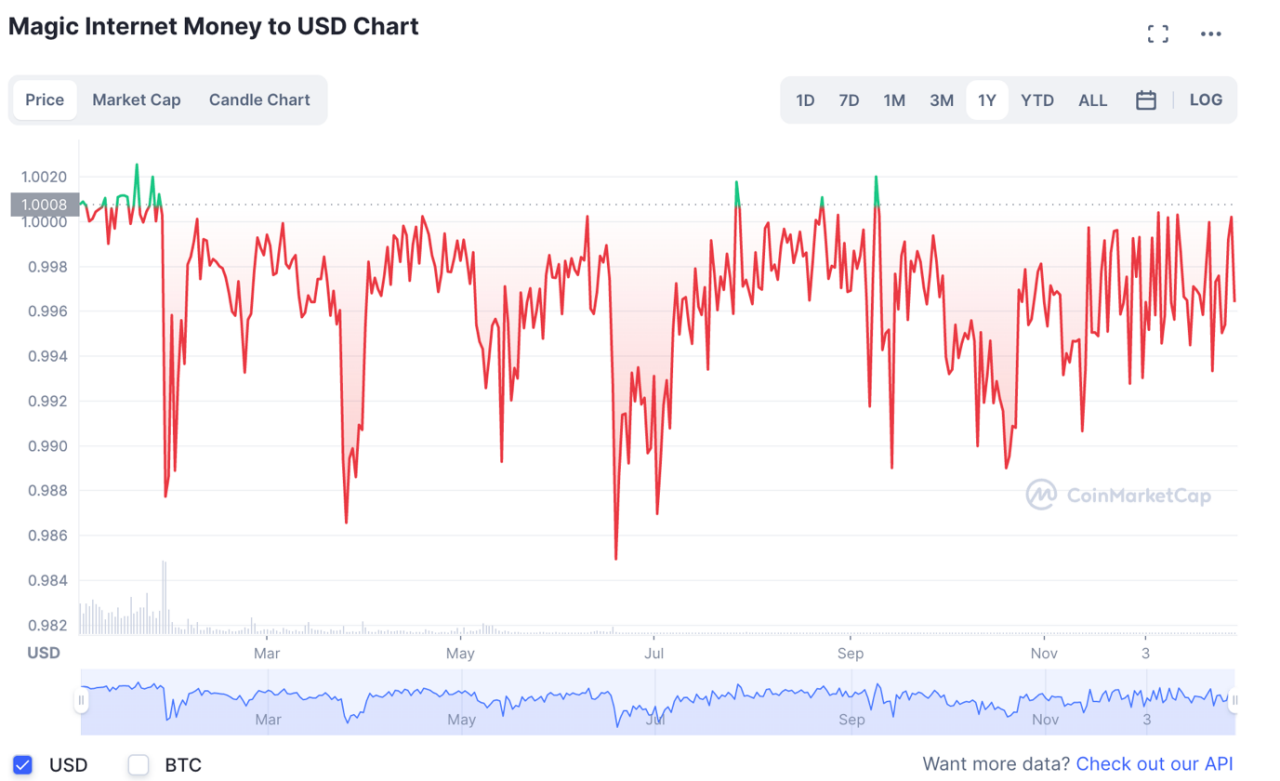

We can see that MIM does not have an effective hard peg mechanism to maintain the currency price. Only relying on arbitrage will cause MIM to have greater volatility in the secondary market than other decentralized stablecoins such as DAI.

The MIM token is a non-algorithmic, collateral-backed stablecoin. This means that each MIM should be backed by more than $1 in collateral. The value of collateral will fluctuate as the market changes, so, like most other DeFi lending protocols, Abracadabra uses liquidations to ensure that MIMs remain overcollateralized.

Alchemix Finance

The liquidation process occurs when a position's collateral value does not adequately cover the position's debit amount. Each vault will have a different liquidation threshold, which is defined by the maximum collateral ratio. Then once a Collateralized Debt Position (CDP) reaches that liquidation threshold, it becomes eligible for liquidation and anyone can use some of the collateral to pay off the position.

However, the biggest problem with Abracadabra is that most of the collateral is long-tail assets. If a large-scale liquidation occurs, the liquidity in the pool will be dried up instantly. MIM will eventually decouple one dollar. The liquidity crisis of FTX is a good proof of this point. .

Although after this incident, MIM quickly returned to around one dollar, and the risk of FTX was released, but the collateral liquidity has always been the pain point of the protocol.

Basic Mechanism

first level title

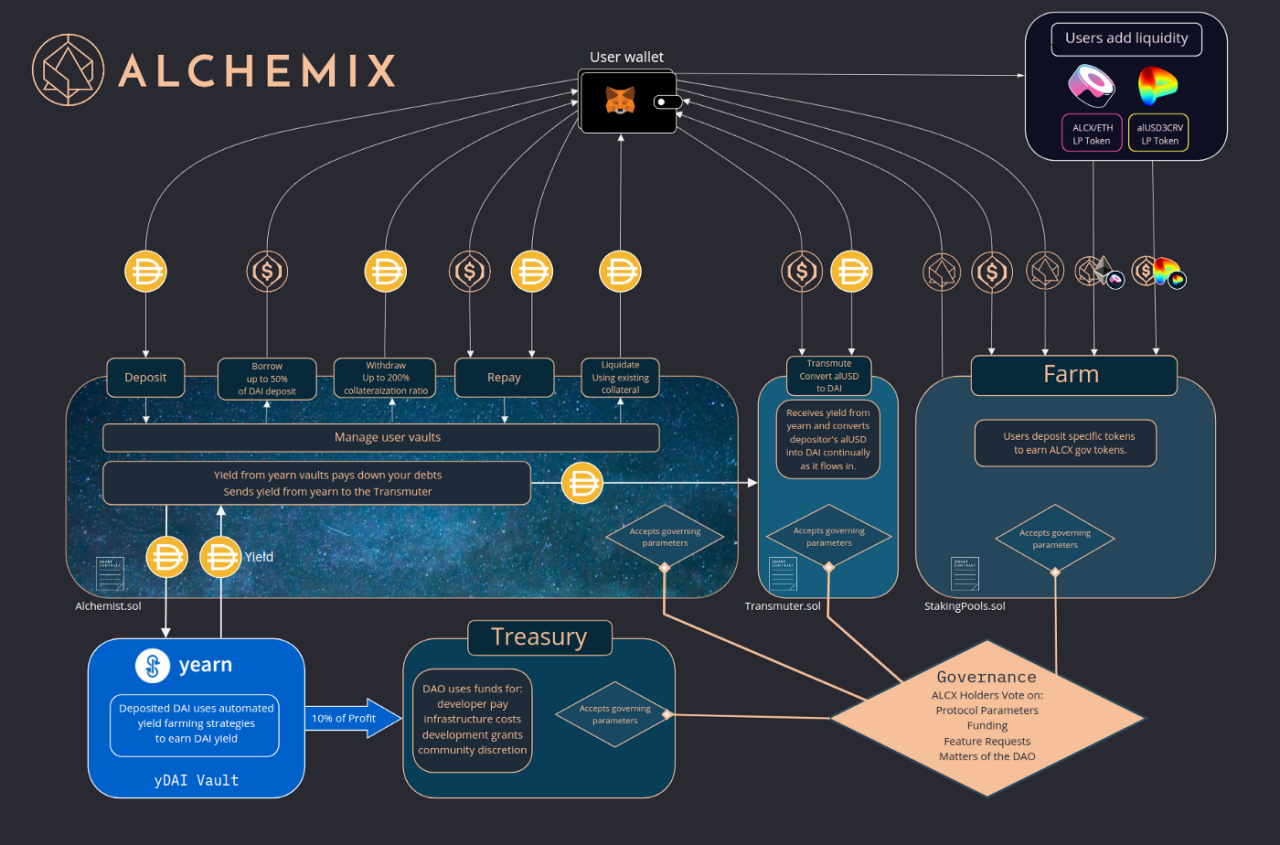

Alchemix Finance is similar to Abracadabra. It also mints the protocol’s native decentralized stablecoin alUSD by depositing interest-bearing assets, which essentially unlocks the credit value of interest-bearing assets. Mortgage interest-earning assets help users obtain future deposit income in advance by creating synthetic asset token alUSD, and use the income to gradually repay the principal over time.

The essence of these two projects is to make use of the special asset class of interest-bearing assets. However, these two agreements are different in terms of positioning. Alchemix does not call itself a "stable currency agreement", but "the Future Yield Tokenization Protocol" (The Future Yield Tokenization Protocol), and "self-compensation "Self-Repaying Loans", while Abracadabra is more focused on creating a stable currency.

So in essence, Alchemix allows users to use 100% of the principal to carry out Yield Farming on other DeFi protocols, and at the same time, they can lend part of the money for other investments to increase leverage for their own income. The difference from other stablecoin protocols is that Alchemix is very flexible. The debt (alUSD) in the contract has no minimum lock-up time and expiration time, and will not be liquidated. The debt can be repaid with alUSD or DAI at any time to exit the position.

secondary title

fully automatic repayment bond

For example, users can deposit DAI into yearn to continue to generate interest, generate yvDAI, and then deposit yvDAI into Alchemist. Using yvDAI as a collateral asset from Alchemix can lend up to 50% of the asset's equivalent alUSD into circulation. The loan will have an absolute minimum 200% collateralization rate. This means that users can borrow up to 1 alUSD for every 2 DAI they deposit.

Stability Mechanism

The cash flow generated by yvDAI's interest in Yearn covers the loan exposure and redeems the principal. Each time a harvest is made, the user's account will be credited with a proportional share of the harvest, thereby reducing the user's debt. If DAI has been deposited, but alUSD has not been borrowed, Harvest will increase the alUSD borrowing limit.

At any time, users can repay any part or all of their debt to unlock their collateral. alUSD debt can be repaid in alUSD or DAI, USDC and USDT. Repaying debt with alUSD is also a price recovery mechanism, because when the price of alUSD falls below $1, users can buy from DEX to repay debt at a discounted price.

Not only that, but users can also cash out some or all of their collateral. The contract will use the DAI in yvDAI to repay the alUSD debt, and the collateral can be directly used to repay the debt.

Essentially, Alchemist provides users with a flexible line of credit (similar to a line of credit in a traditional commercial bank) for future earnings. Users can enter and exit at any time without committing to a long-term lock-in. Users' collateral is never liquidated, as their debt only goes down.

secondary title

Within the protocol itself, there are multiple governance-minimized hook mechanisms

Conversion from alUSD to DAI:

The income obtained by the Yearn vault will be collected regularly and deposited into the Transmutation Pool. Every time the income is sent to the Transmutation Pool, it will be distributed proportionally to all alUSD staked in it. When users claim their DAI in the Transmutation Pool, an equivalent amount of alUSD will be burned.

SCapitalRewards for providing alUSD-3 CRV liquidity: