After the upgrade of Ethereum Shanghai, which tracks will explode?

Original source: BitpushNews

Original source: BitpushNews

On January 5th, the Ethereum core developer meeting was held, and the final scope of the Shanghai upgrade was determined. So, what is the main content of the Shanghai upgrade? Which tracks will get new opportunities after Shanghai's upgrade? After the Shanghai upgrade, what problems will the Cancun upgrade mainly solve, and which tracks will benefit from it? After Ethereum switched to PoS, the miners disappeared, and the MEV sector developed rapidly. What projects are worthy of attention?

After the upgrade of Ethereum Shanghai, the pledge track may usher in an explosion

The Ethereum Foundation held the first all-core developer (ACD) meeting in 2023 on the 5th of this month. The developers agreed to remove the code changes related to the EOF implementation from the Shanghai upgrade to ensure that the timetable for pledged ETH withdrawals is consistent. It will be delayed, and the Shanghai upgrade mainnet is tentatively scheduled to start sometime in March 2023. In addition, Ethereum core developers have also reached a consensus on the final scope of the Shanghai upgrade, the main function of which is to introduce beacon chain withdrawals for stakers. The following article briefly summarizes the upgrade content of Ethereum Shanghai:

The Shanghai Upgrade Execution Layer Specification lists all incorporated EIPs, which can be broken down into three distinct parts: Minor Improvements, EVM Object Format, and Withdrawals:

1. Minor improvements

EIP-3651: Warm COINBASE (Reduce the gas overhead of accessing COINBASE addresses)

EIP-3855: PUSH 0 instruction (add opcode `PUSH 0)

EIP-3860: Limit and meter initcode (limit the size of initcode and introduce gas metering)

2. EVM Object Format (EOF)

Most of the EIPs included in the Shanghai upgrade are part of a single feature: the EVM Object Format (EOF). This work was broken down into 5 different EIPs to help client developers understand each individual modification, but to provide a higher level overview, the developers published a consolidated specification.

EIP-3540: EVM Object Format (EOF) v1 (EVM Object Format Version 1)

EIP-3670: EOF - Code Validation (EOF - Code Validation )

EIP-4200: EOF - Static relative jumps (EOF - Static relative jumps )

EIP-4750: EOF - Functions (EOF- import function )

EIP-5450: EOF - Stack Validation (EOF- Stack Validation )

3. Beacon chain withdrawal

The main part of "Shapella" (collective name of Shanghai/Capella) is the beacon chain withdrawal. This part of the change is described in the consensus layer specification and EIP-4895. Noteworthy details are: 1). There is no prioritization/ordering difference in proposing "Full Funds" vs. "Partial Funds" when processing withdrawals; 2). In order for withdrawals to be processed, validators must use 0 x 01 certificate, which is represented by ETH address; 3). The scan of the validator is bounded by each block.

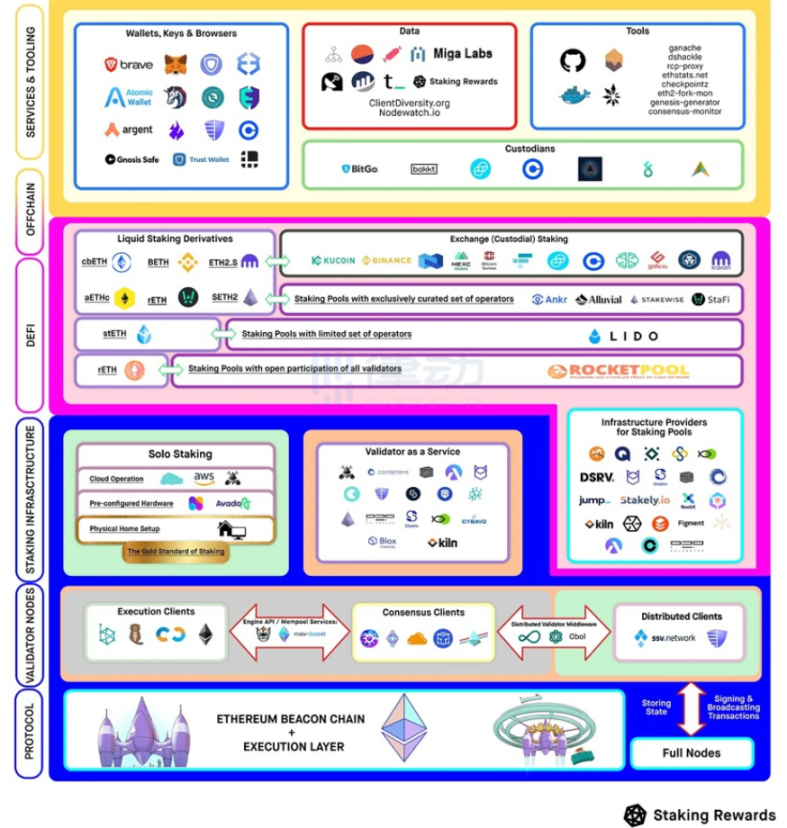

Why the Shanghai upgrade will promote the explosion of the pledge track? Compared with the token pledge ratio of many other big public chains, the pledge ratio of Ethereum is relatively low. The pledge ratio of many public chains is mostly distributed around 60%-80%. There is still a lot of room for improvement in the pledge ratio of Ethereum. However, it should be noted that the high pledge rate of many public chains is mainly attracted by the high annualized rate of return. In the deflation stage, with the continued prosperity and development of the Ethereum ecosystem, the economic incentives of Ethereum staking are highly sustainable and attractive, and it continues to attract more and more institutions to participate. Leading projects worthy of attention on the Ethereum staking track include Lido, Rocket Pool, StakeWise, SSV, and FXS.

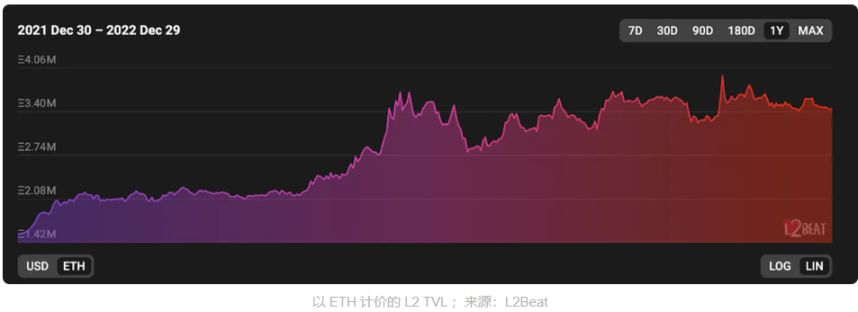

Cancun is upgraded, Layer 2 may usher in a real outbreak

Due to the full content of the Shanghai upgrade, many EIPs (CFI) that were considered for the upgrade failed to enter the Shanghai upgrade. Although some small improvements will help promote the development of Layer 2, the real outbreak may have to wait until the Cancun upgrade (, The next important upgrade after the Shanghai upgrade, and the name of the consensus layer is yet to be determined). In terms of the consensus layer, EIP-4844 has become the first EIP to be written into the specification after the Capella upgrade. The executive layer doesn't (yet) have a specification that would allow for this layout, but the executive layer team agreed to follow a similar path, with EIP-4844 at the center of the next upgrade. So why is it said that the Cancun upgrade will make Layer 2 usher in an explosion?

The largest piece of the unit cost of Layer 2 transactions is "Call Data". Call Data is crucial to the security mechanism of L2. Basically, in case of malicious validator activity on L2s, the entire L2 chain can be rebuilt by using Call Data published on L1s. However, the cost of publishing Call Data on L1 is high, currently accounting for more than 80% of L2 transaction fees. Fundamentally, more space needs to be created for data on L1 to reduce L2 transaction fees. Data sharding (DankSharding) will help build a huge data space on Ethereum L1. That's why the Ethereum core developers and the Rollup team started proposing differently, building an instant data space on L1 and making Rollup immediately price-competitive in the L1 market. EIP-4844 is the result of these efforts and is expected to bring down Rollup fees by orders of magnitude. EIP-4844, also known as proto-danksharding, basically implements most of the logic of the data sharding specification and prepares for Danksharding.

With the implementation of EIP-4844, L2 will be more competitive with other L1, and the future development prospects are relatively large. In addition to greatly reducing L2 transaction fees, EIP-4844 also provides a good soil for the future application of Danksharding, so that data sharding can be easily realized in the future. A specific example is that EIP-4844 can be compatible with future changes in the consensus layer, helping L2 developers get rid of the need to upgrade. It also introduces a multi-dimensional fee market for Ethereum L1, which separates usage and fees for different types of resources, such as EVM applications, block data, witness data, and state size.

At present, the most anticipated projects on Layer 2 mainly include Optimism, Arbitrum, zkSync, StarkNet, etc. Among these four projects, only Optimism has issued project tokens. In addition, Polygon is developing rapidly. Polygon has established Web3 partnerships with Starbucks, Disney, Adidas, PRADA and other brands.

After the miners, the MEV track may become a new outlet for the next round of bull market

After Ethereum transitioned to proof-of-stake through mergers, the role of miners was taken over by validators, and the MEV (Maximum Extractable Value) market underwent an important change. After the conversion of Ethereum to the POS consensus, the participants in the division of MEV on the chain have changed from the original single miner group to the major Layer 2, CEX, Lido, verification node custodians, etc. Multi-party participation also makes the MEV problem of ETH 2.0 more complicated. The MEV track has also become an important track for multi-party competition, and it is expected to become a very important outlet for the next round of bull market.

Maximal extractable value (MEV) is the maximum value a validator can extract in block production that exceeds standard block rewards and gas fees by adding, removing, and changing the order of transactions in a block. But the problem is that there is no mechanism built into the protocol to help validators capture MEV. If left unchecked, this structure will allow specialized companies and larger entities to better capture MEV by setting up multiple validators and strategies to build optimal blocks where other validators will not be able to compete effectively. So Flashbots created a merged alternative called MEV-boost.

MEV-boost allows validators to auction off their block space to the open market and maximize their staking rewards. Within this framework, searchers will continue to look for opportunities to monetize MEV. When it is a validator's turn to propose a block, they query the MEV-Boost relay with the highest paying payload and include it in their proposed block. One of the implications of this is that MEV rewards will change. For example, periods of high volatility tend to result in higher MEV fees, and validators who propose during these periods may be rewarded with higher MEV.

Although there are many solutions for MEV, there are still many problems faced by MEV. Although Danksharding's PBS (Proposer-Builder Separation) can solve the MEV problem under the assumption; but in a few years from now to Danksharding, MEV still needs a transitional solution. Considering that there are many articles related to the pledge track and Layer 2 track, this article focuses on some MEV track projects:

MEV-Boost

Considering Ethereum's merger with Proof of Stake, the Flashbots auction moved to mev-boost, a PoS implementation of Ethereum's Proposer-Block Builder Separation (PBS). MEV-Boost minimizes the downside of MEV by letting validators outsource block building to a competitive market of block builders and accept the most profitable block building through services called relays Influence. MEV-Boost enhances the security and decentralization of Ethereum, enabling verifiers to receive PBS-supporting MEV rewards regardless of the verifier size, making MEV not just a game for the few.

Manifold Finance

Like Flashbots, Manifold Finance built its technical infrastructure to minimize the negative impact of MEV. The foundation of Manifold Finance is their Secure RPC system which allows users to submit secure and private transactions. By sending orders to RPC endpoints like Manifold's SecureRPC or Flashbots, users' trades are routed through an intermediary, which protects users from searcher arbitrageurs in public pools.

BloxRoute

After Flashbots, BloxRoute is becoming the second largest repeater provider. They currently run three different repeaters: BloXroute Max Profit, BloXroute Ethical, and BloXroute Regulated.

Eden Network

Original link