Bloomberg: In Q4 2022, the amount of financing for crypto startups will drop to the lowest level in nearly two years

This article comes fromBloombergBloomberg

Odaily Translator | Nian Yin Si Tang

, original author: Hannah Miller

Odaily Translator | Nian Yin Si Tang

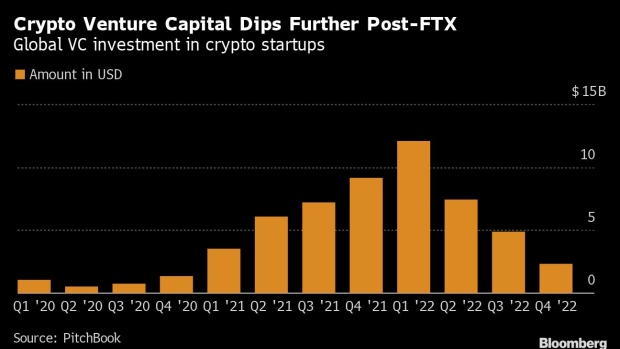

Crypto startups are facing a tough time attracting private financiers following the collapse of cryptocurrency exchange FTX. In the fourth quarter of 2022, venture capital funding in the industry fell to its lowest level in nearly two years, according to research firm PitchBook.

Overall, VCs invested $2.3 billion in crypto startups during the quarter, down 75% from a year earlier, according to PitchBook. Venture capitalists had already begun to slow investment activity, but the FTX crash in November prompted them to retreat further, said Robert Le, a crypto analyst at the research firm.

“Investors are trying to see what happens next and are in no rush to deploy capital,” Le said in an interview.

This pullback contrasts with the enthusiasm for the crypto industry in early 2022. Last January, FTX raised $400 million at a $32 billion valuation, while VCs including Andreessen Horowitz (a16z), Haun Ventures, and Electric Capital raised billions of dollars to back cryptocurrency companies. Enthusiasm for the industry led to a record $26.7 billion in investments in blockchain startups last year, most of it in the first quarter, according to PitchBook. This represents a slight increase compared to 2021.

FTX’s debacle was certainly the last straw for some VCs. Alex Thorn, head of company-wide research at crypto financial services provider Galaxy Digital, said setbacks, such as the bankruptcy of crypto lender Celsius Network last July, have given them pause. The debacle of the TerraUSD stablecoin and the closure of the now-disgraced crypto hedge fund Three Arrows Capital both drove down the price of the digital asset, further spooking investors.

Multifunctional VCs that dabbled in cryptocurrency when the market was hot may be more hesitant about the industry now, especially if they were hit by one of the industry’s major crashes, Thorn said. While such firms could turn to other tech sectors for investment, smaller funds could be at risk if they focus solely on cryptocurrencies.

"It's hard to imagine how some of this will persist," Thorn noted.

FTX has no formal board of directors and its investors have been criticized for not conducting proper due diligence, which is also changing the crypto venture capital landscape. FTX and its sister company Alameda Research were active venture investors before their collapse. PitchBook's Le said that FTX has a reputation in the industry for making deals quickly and for being generous, while asking few questions of the founders during this fast process, which often crowds out other venture investors.

“I don’t know how constrained they are on price,” Le said, “It’s better for other crypto investors because now you can go back to the right valuation and the right due diligence process.”

Venture capitalists who are still interested in cryptocurrencies are spending more time doing due diligence, said David Pakman, managing partner of crypto venture capital firm CoinFund. They demanded stronger investor protections and fought for board seats. Valuations have also become more realistic, he added.