Top 5 Predictions for the Cosmos Ecosystem in 2023

Original source: newworder

Compilation of the original text: The Way of DeFi

Core point of view:

Cosmos: The current version of ICS will be stuck in 2023

Cosmos: Mesh Security Will Lead to Validator Centralization Problems

Celestia: Data Availability Sampling (DAS) Will Revolutionize Blockchain Development

In 2023, key infrastructure will be built to solve the bottleneck of liquidity fragmentation

Unbounded territory AI

Image credit: byUnbounded territory AItool generation

Cosmos: The current version of ICS will be stuck in 2023

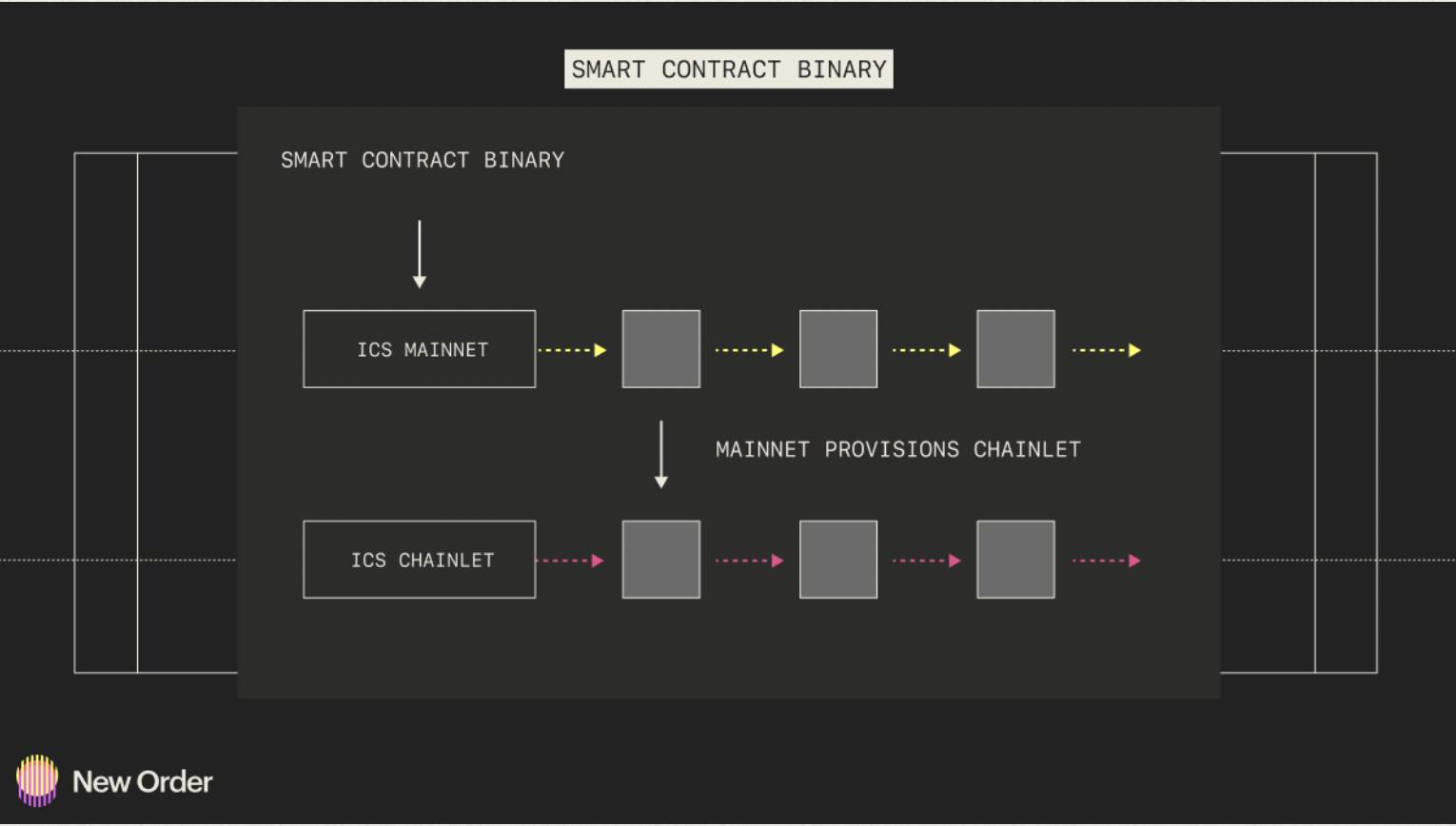

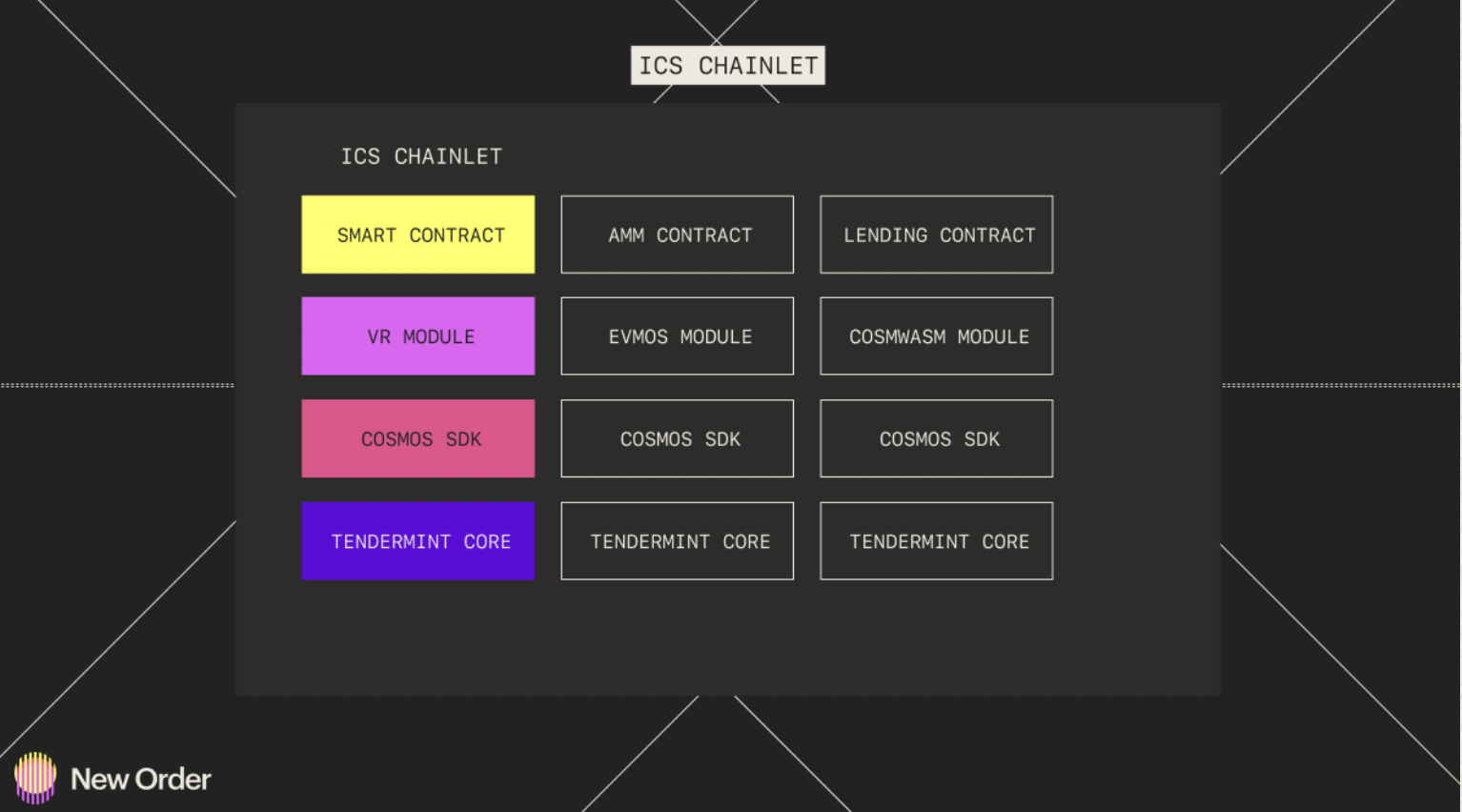

The adoption and implementation of Interchain Security (ICS) won't see market fit in its current state, but will happen with more bespoke and marketable solutions like Saga. This is because, for small teams like indie game studios and projects, just getting a validator set is not enough because they cannot afford Golang developers with CosmosSDK experience (with the popularization of Lisk, the market will Such developers are in increasing demand). With a customizable Lisk solution providing all the building blocks such as agnostic VM selection, validator sets, and easy setup, ICS will see the real adoption it deserves. After all, it's great technology.

The fact that the Cosmos Hub community recently voted against the Atom 2.0 vision further strengthens this argument. Interchain Security (ICS) will definitely see some use in the Hub, and there may be some chains opting in (if they can enforce it through governance). The Cosmos Hub has quite a few hardliners who have been pushing for it to remain as free and inflationary as possible. This could make it difficult for some proposals to pass. With the failure of the Atom 2.0 proposal, we saw how serious this problem was. This is another reason why ICS may not be able to fully develop on the Hub itself. Regardless, the fact that the team still has to do most of the initial work (apart from validator setup) means that the vast majority of applications and protocols won't be able to implement it. Most of these teams don't have the funds to pay over $300,000 per year for blockchain engineers with Golang (CosmosSDK) experience. This means that they will likely choose to provide a customizable out-of-the-box solution without actual development work on the blockchain side. This is why solutions like one-click deployment of Lisk will be very important if we want to see the Interchain ecosystem grow beyond what it is today.

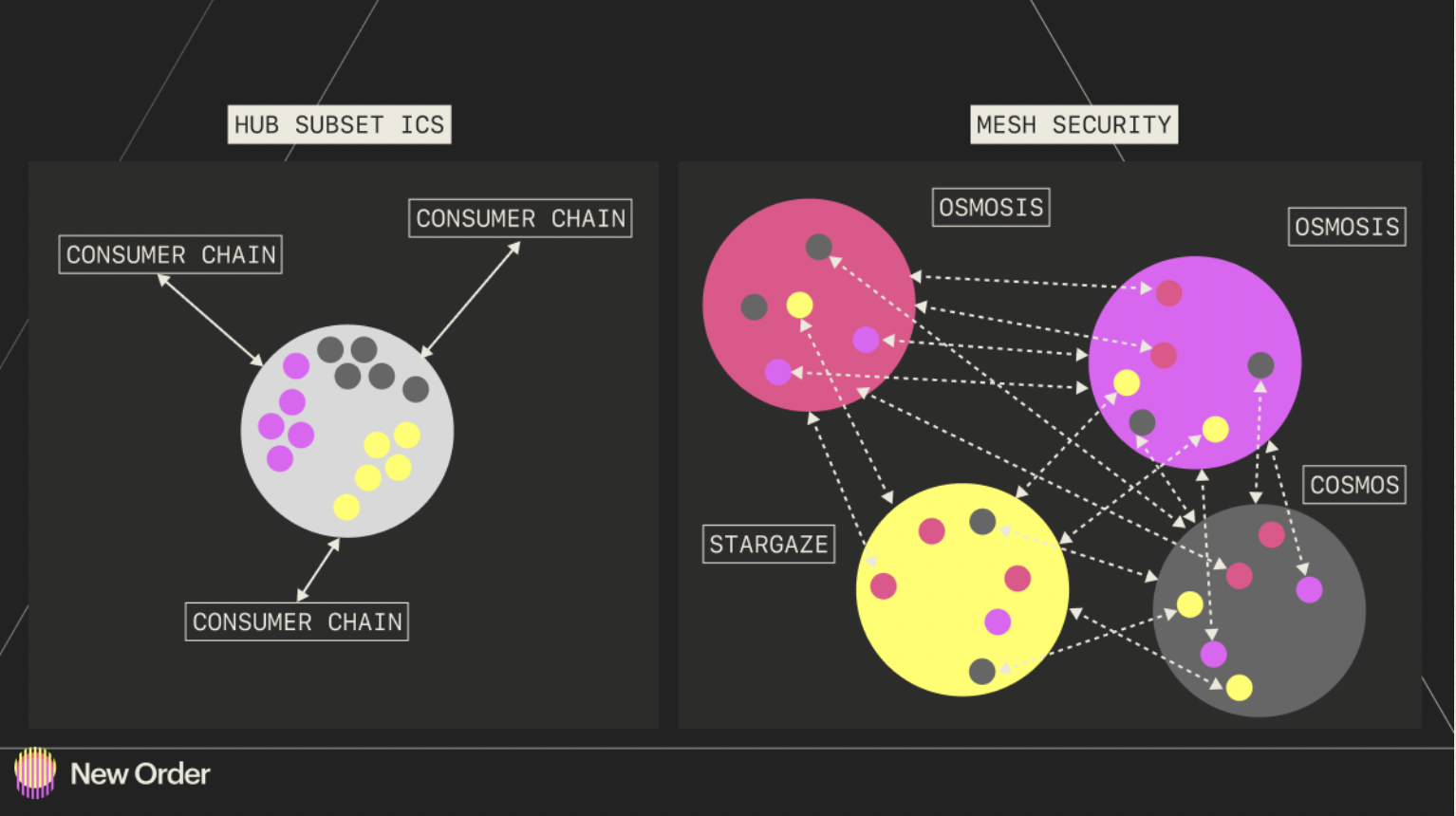

Cosmos: Mesh Security Will Lead to Validator Centralization Problems

Mesh Security will increase the power of certain groups of validators, leading to centralization and collusion. While the NATO example Sunny gave in his talk on mesh security makes sense, it fails to take into account that the "nation-states" of the Interchain community are not particularly nationalistic and tend to favor chains in the Cosmos technology stack . This means that while some of these chains are very popular, some are not so popular, and if Mesh Security becomes the preferred security measure, it will be heavily concentrated in the hands of a specific few validators (some of them already possessed incredible powers).

Rather, we should look at ways to further decentralize among validators so that the power is not held by the few, but by the many. Mesh Security is theoretically an answer to ICS, and it aims to solve some problems that ICS may bring. Let's quickly explain what mesh security is, what its advantages are, and where it may fall short. The main problem with the way ICS is supposed to work with the Cosmos Hub is that by essentially opting in, it makes a subset of validators validate various chains. In this case, you get security not from the Cosmos, but from a subset of validators, which can reduce security and fall prey to malicious behavior with increased centralization. In any case, it would fall short without protecting the entire staked interest of the consumer chain.

Going back to our earlier theory, it clearly states that an ICS Hub should be built for the specific purpose of ICS, not for the Hub to be a hub which most people would disagree with - like the Cosmos Hub. Now for mesh security, you allow delegators on the provider chain (e.g. the Hub) to delegate to validators in the consumer chain's own validator set, which counteracts some of the subset problems. What you get now, however, is increasingly decentralized security spread across several chains, where some staking providers (validators) may become increasingly entangled and expand their power base.

If this is going to happen, there needs to be a clear user experience that clearly shows who is validating what, how much stake they hold, etc. Mesh security has the opportunity to fragment and spread more needs, it also gets entangled, which can have disastrous consequences if not handled properly. However, at this point the dependencies between validators are very large on-chain, as shown in the Juno/Osmosis example below. So from that perspective, mesh security seems like a natural extension of what's already going on. The question is, should we really praise it?

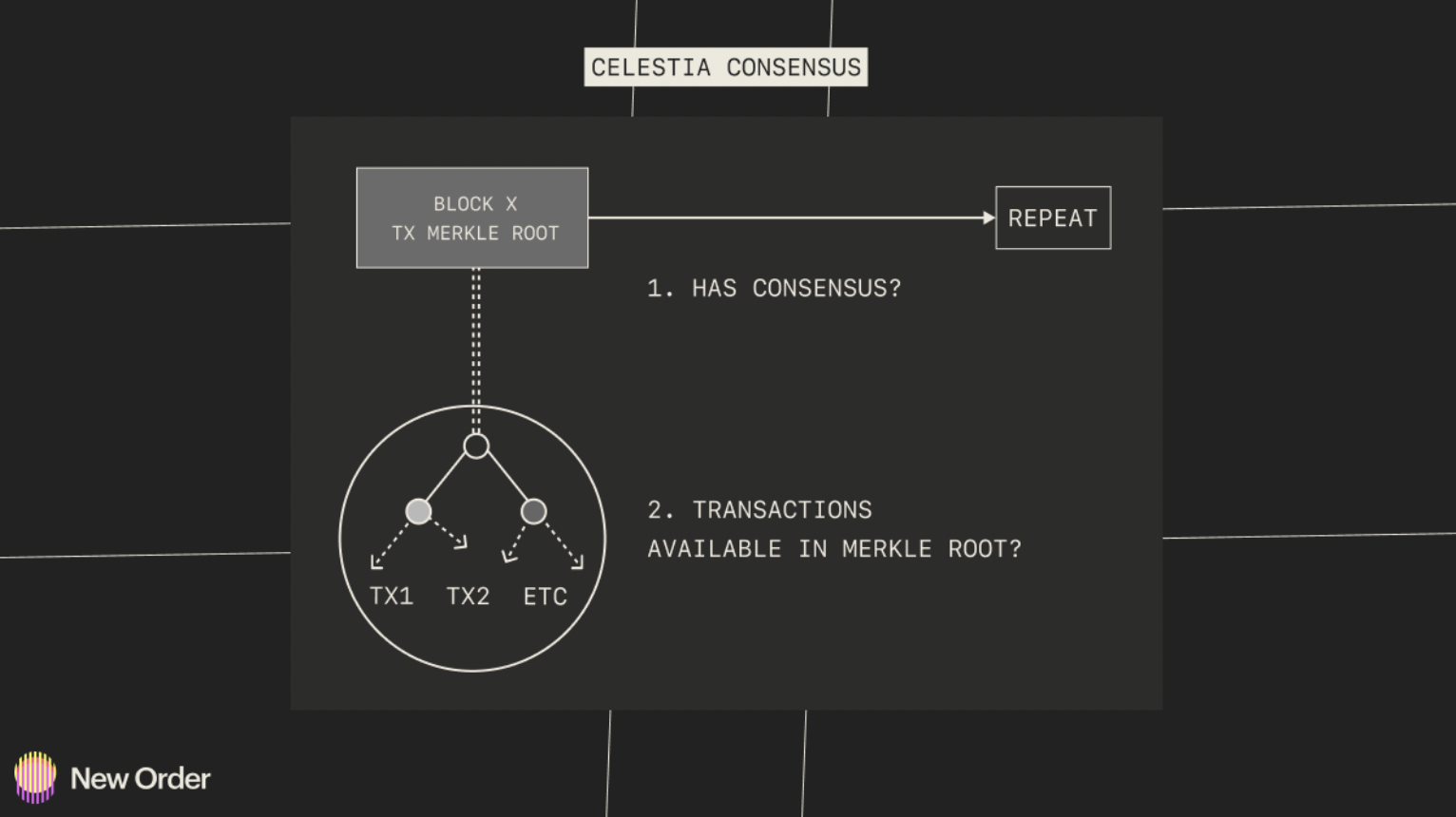

Celestia: Data Availability Sampling (DAS) Will Revolutionize Blockchain Development

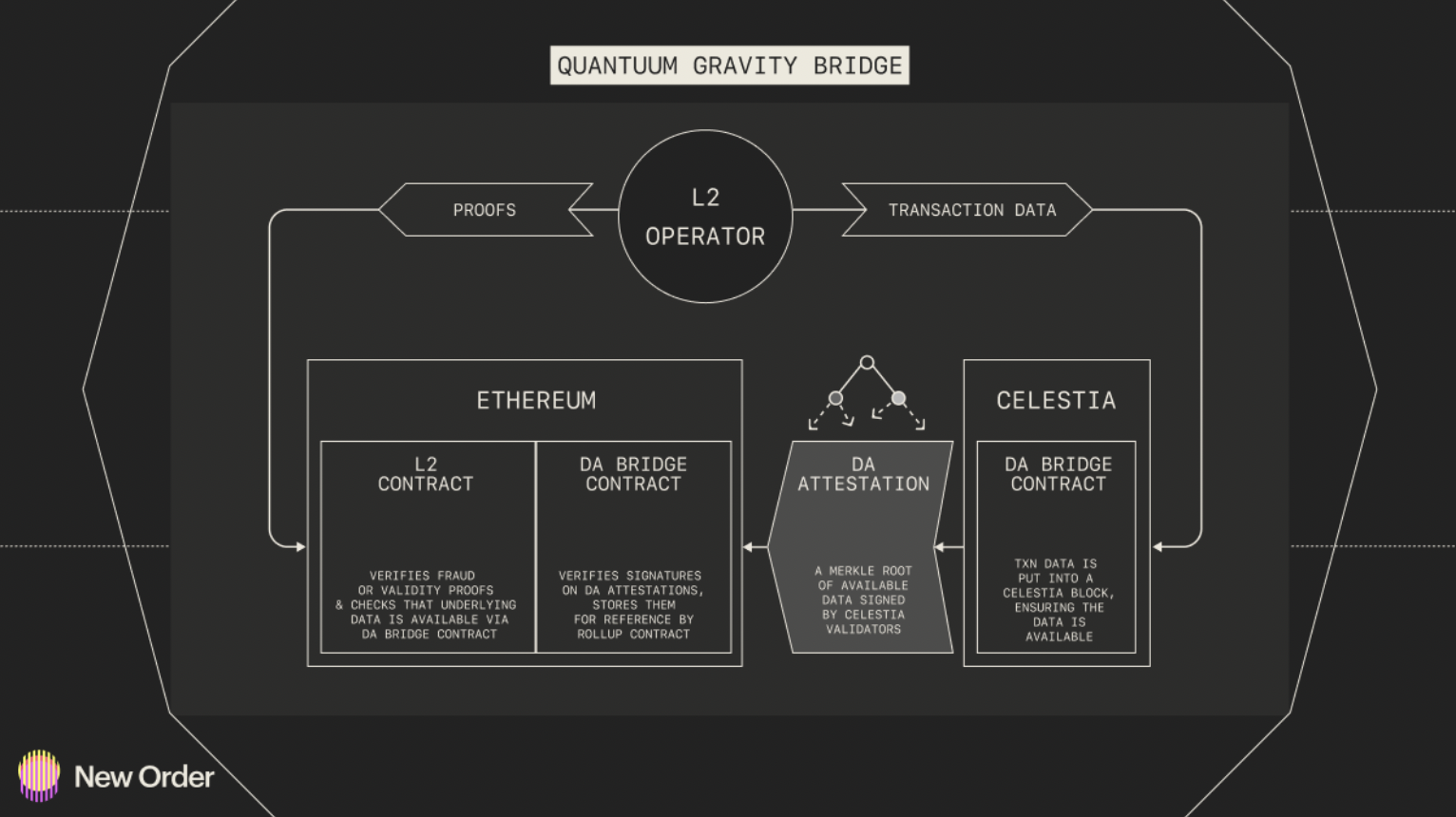

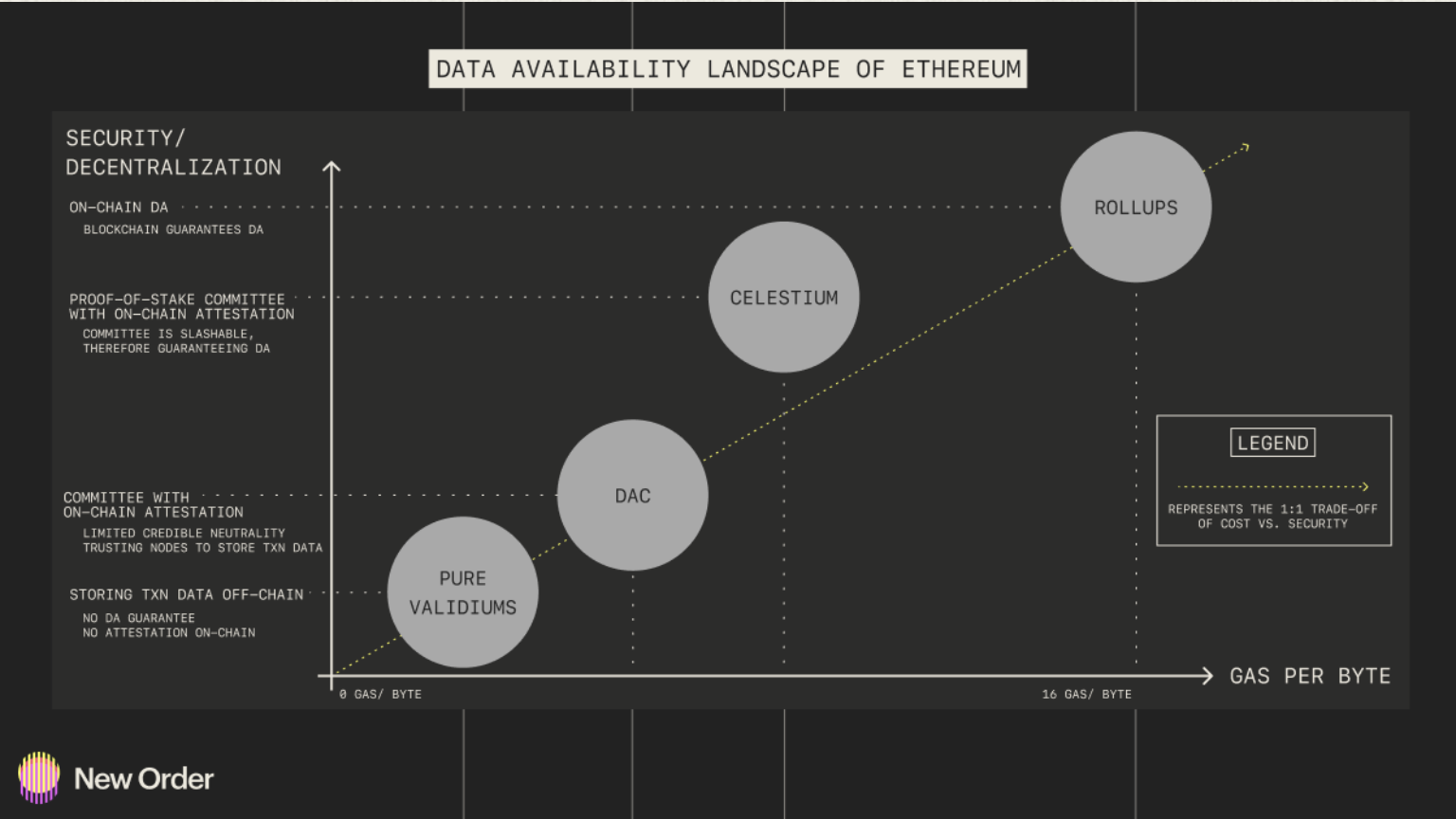

Data Availability Sampling (DAS) will be the biggest innovation in many aspects of building blockchains. DAS enables you to increase decentralization (number of nodes) without losing throughput. For example, block validation in Celestia works quite differently than other current blockchains because blocks can be validated in sub-linear time. This means that throughput increases sublinearly with cost compared to linearly with cost. This is possible because Celestia's light clients do not validate transactions, they only check each block for consensus and block data available to the network.

By optimizing part of the network (in Celestia's case, data availability and consensus) or just one, we can let the other networks and layers focus on what they deem most important. This means that we generally get a more professional and focused blockchain ecosystem with various layers and nodes that excel at their specific tasks. This means that throughput, data availability, etc. will not be a big problem for a longer period of time. By focusing on what makes the layer (rather than the execution) best, we can make the execution more efficient. As others have said before us, execution is now the bottleneck - so how would you improve it? There are multiple layer 2 teams working on this and it will be very interesting to see what happens at the executive layer in the next year or two.

Now for some bold predictions for Celestia - we're expecting a thriving ecosystem on top of Celestia that will put the ecosystem in the top 10 for eco TVL. We would also like to see Celestium gain significant traction within the Ethereum ecosystem before the advent of Danksharding.

After all, Ethereum must enable a modular future that supports decentralization while increasing throughput.

Another thing we would like to point out is that we would also like to see DAS and erasure coding used in Ethereum and Celestia not just data availability sampling for DA. For example, in an excellent paper by Joachim Neu of Stanford UniversitypaperAnother use case is clearly described in the paper describing the use of DAS for information diffusion and provable retrievability for Rollup. It is an efficient protocol for storage and communication using linear erasure codes and homomorphic vector commitments. It also does not require modifications to on-chain contracts, and can even provide some privacy assumptions for storage nodes. It's a fascinating application that only scratches the surface of what these technologies can do.

In 2023, key infrastructure will be built to solve the bottleneck of liquidity fragmentation

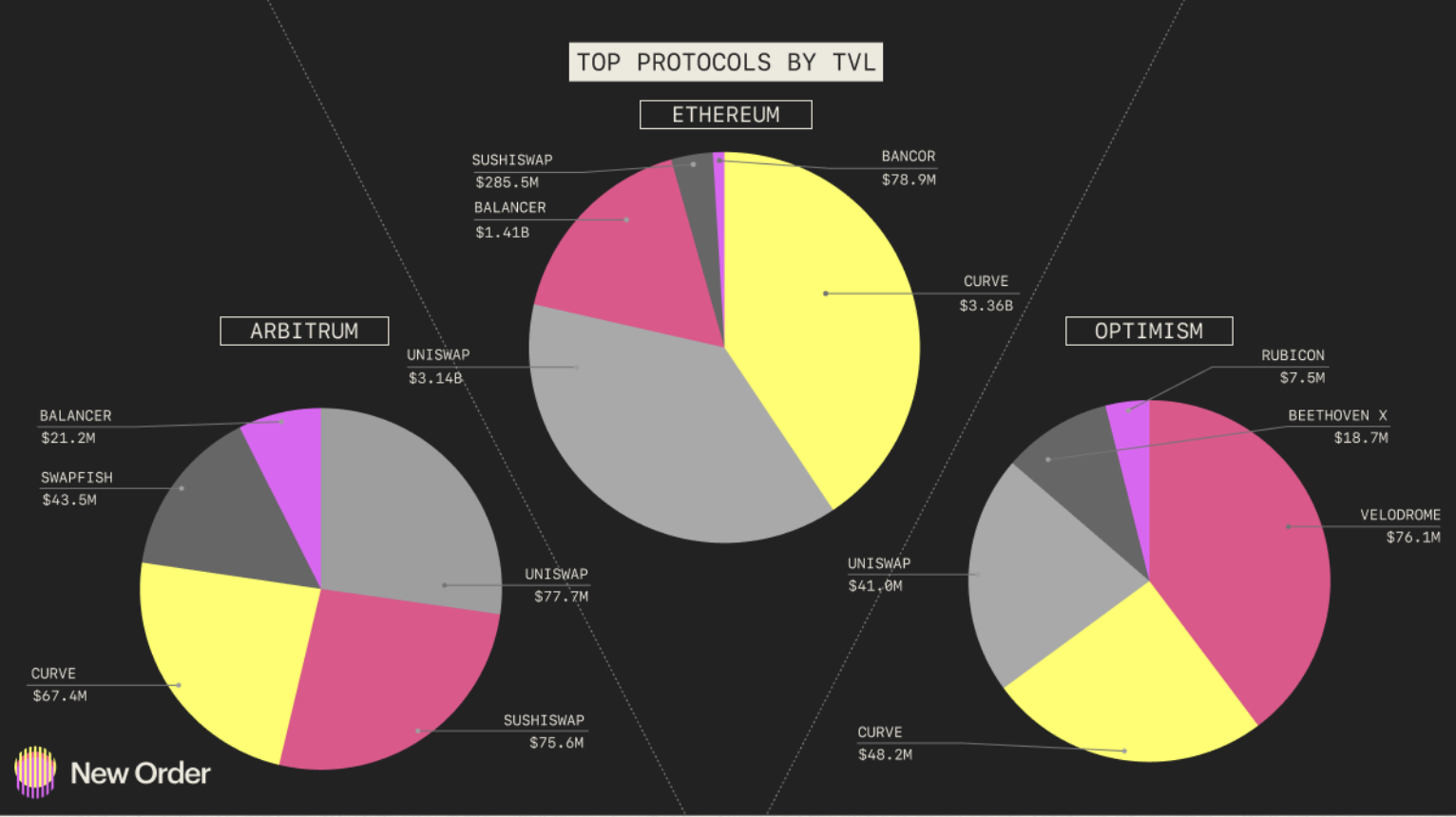

Fragmentation of liquidity (both inter-chain and cross-chain) creates significant price differentials, creating an unfavorable environment for both liquidity providers (LPs) and traders. It is difficult for liquidity providers to correctly predict the favorable trading venues with the highest volume and lowest fees to maximize capital utilization and income. Traders, on the other hand, suffer from high slippage, which seriously deteriorates transaction pricing and user experience.

The introduction of centralized liquidity provision and stableswaps is propelling the market towards professionalization, although a large portion of the nascent token market is unable to find a consistent edge scattered among the various xyk bonding curves. Such token markets rely on trade aggregators to efficiently route their trade orders to the best execution environment while navigating the decentralized liquidity of trading venues.

To analyze the path to integration, we should break down the big problem of fragmentation into layers. These layers include the following: applications, middleware, and infrastructure.

The application is a decentralized exchange, with a bonding curve as the bottom layer of the transaction hierarchy. Examples of such protocols include Curve, Uniswap, SushiSwap, etc.

The middleware layer acts as a chain-specific DEX aggregator and liquidity optimizer. The most prominent examples are 1inch as an aggregator, and centralized/unilateral liquidity provision as an optimizer. This layer introduces chain-specific efficiency optimizations, but does not address the fragmentation of funds within and across chains.

On the other hand, the trading infrastructure includes a liquidity direction engine and a communication protocol that allows efficient cross-chain asset and message transmission. The top-level examples include Layer 0, Polymer, Socket, etc. The infrastructure layer directly solves the fragmentation problem by providing a toolkit for cross-chain liquidity. This allows liquidity providers to allocate capital based on predictive models around capital utilization, slippage, and fees incurred. This infrastructure allows liquidity to be allocated to the most heavily traded environments, thereby maximizing capital utilization for liquidity providers and minimizing price impact for traders.

The consolidation of liquidity is largely considered bounded by bonding curve innovations, where liquidity providers are seeking the highest capital utilization combined with the lowest exposure to impermanent losses. We believe that the main bottleneck is the liquidity infrastructure, which exceeds the limitations of the application and middleware layers. Solutions to repair fragmented liquidity will see unprecedented growth in 2023, driven by advanced infrastructure. Achieving a unified standard for liquidity will be two main approaches:

Asynchronous cross-chain communication: an enhanced cross-chain messaging solution that provides native composability for different execution environments, for example, chain-agnostic IBC;

Shared liquidity layer: liquidity center, which distributes liquidity to various markets on different chains and applications according to predicted quantity demand (such as SLAMM cross-chain liquidity model);

The Most Important Problem to Solve in 2023: Exclusive Order Flow (EOF)

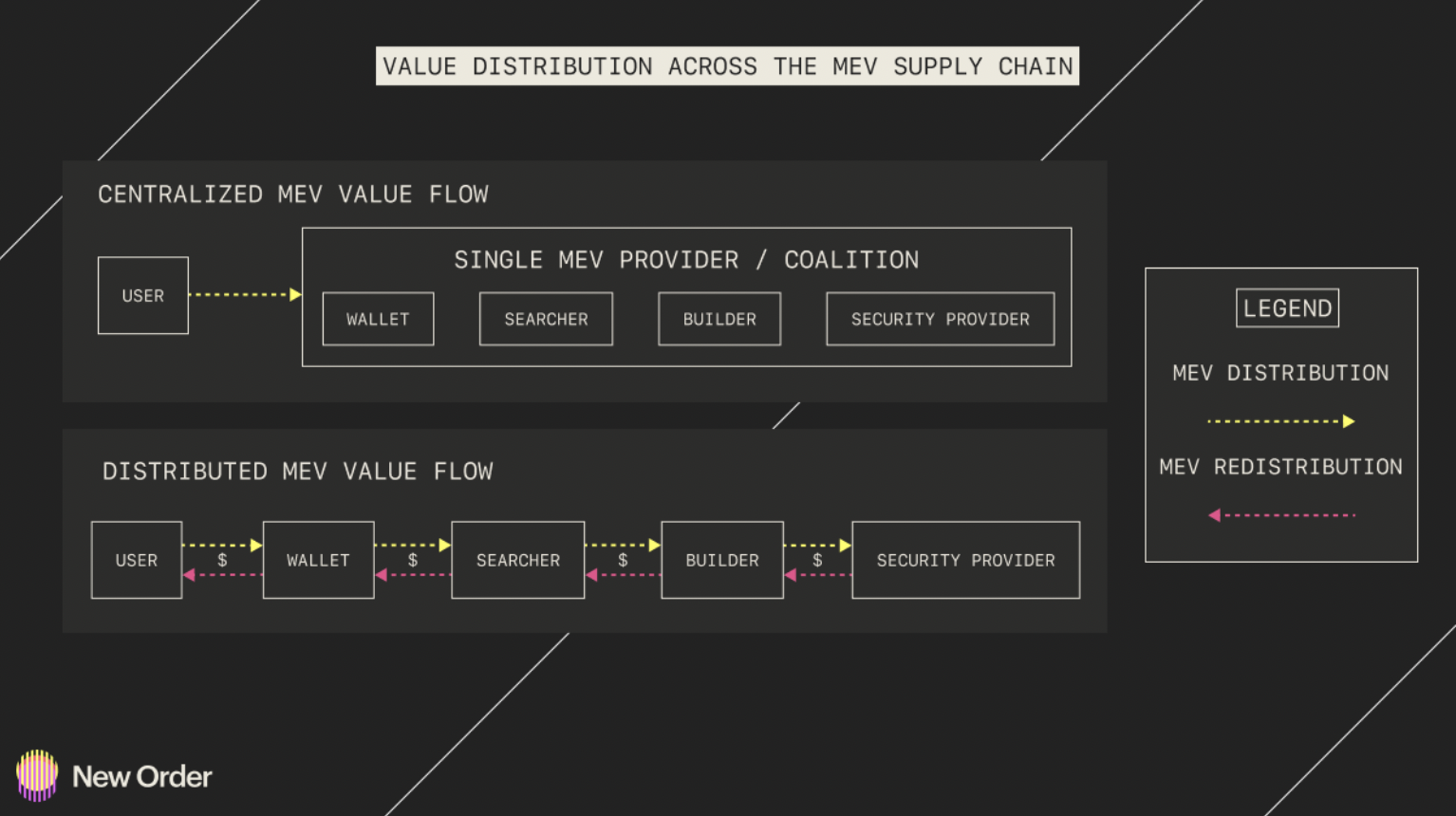

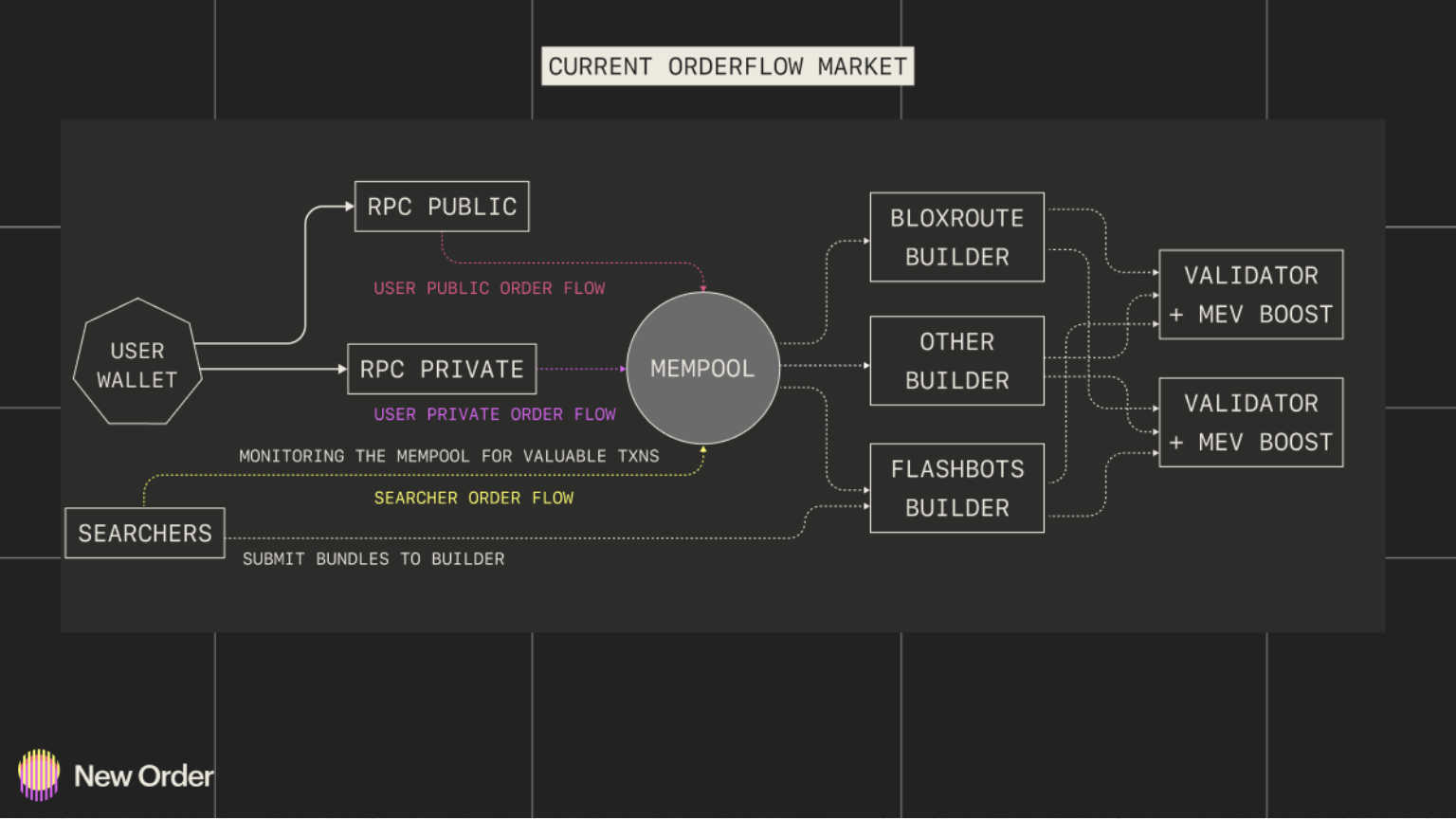

The main goal of block builders is to extract the maximum amount of value from the set of "orders" or orderflow, and they are ultimately motivated to accept as much private orderflow as possible. This is the so-called Exclusive Order Flow (EOF) problem. This is detrimental to the blockchain network as builders who receive order flow exclusivity, i.e. toxic order flow, gain a huge advantage over their peers and create a central point on the network which can lead to market manipulation and Transaction review. Furthermore, this value extracted from the EOF (called MEV), is fully retained by the extractor (block builder/searcher), without redistribution of rewards to other parties (validators/users). This situation could lead to a small group of colluding block builders excluding all other competitors and gaining control of order flow throughout the blockchain stack. While there are many effective solutions to prevent EOF from breaking the network, none of them are fully usable yet. The threat is real when it comes to the long-term prospects of any blockchain network.

The MEV supply chain consists of a series of actors (see diagram above) that play a role in executing transactions. However, these players are often acting dishonestly, extracting profit-seeking value from the $1 billion+ pool of capital up for grabs. Specifically, mercenary value extraction is when the value extraction is not distributed fairly among the parties who helped facilitate the transaction in the first place. This usually happens when there is a collusive agreement between block builders and relayers or proposers, but it can also happen directly between relayers and proposers, as described below. However, the mercenary MEV problem stems from the exclusive order flow of various centralized, colluding players acting only in their own interests.

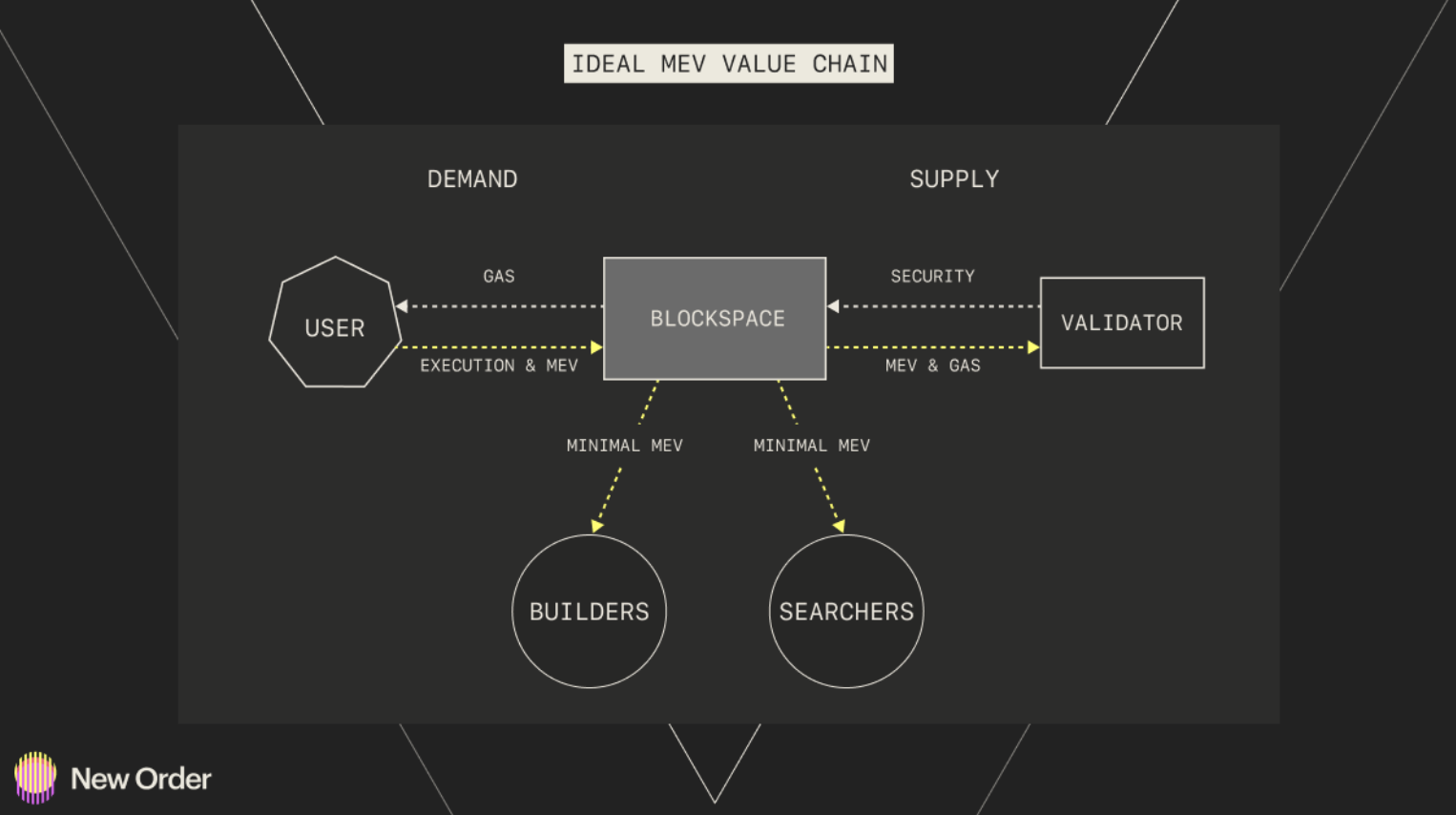

Users and validators are the two most important parties in the entire blockchain, so they should be fairly compensated. Users represent the sole source of block demand and should be rewarded for fair execution and receive MEV rebates based on the amount of block space their transactions use. Similarly, validators are the source of block security; without them, there would be no block supply. They should get the gas fee and most of the MEV paid at the market rate. Therefore, the value extracted from the block space should mainly accumulate to the edge rather than the middle parties (block builders and searchers).

The optimal solution for EOF is to create an optimal blockchain-based financial economy that decentralizes all components of the MEV supply chain and aligns the incentives of participants with extracting and redistributing MEV. As such, the fundamental question is how to prevent malicious actors from exploiting the system for profit while maintaining the most critical network attributes: security, fairness, and efficiency.

People have been trying to solve some aspects of this problem, but none of them have completely solved it. For example, Flashbots and Bloxroute are off-chain searcher-builder marketplaces designed to minimize harmful MEVs. While they offer some benefits, they also increase the risk of centralization, which is a more important concern. Flashbots and Bloxroute's routers and builders create a central point that, if exploited, will have a meaningful impact on all players in the value chain. In addition, it creates opportunities for cartels, as a single entity can play multiple roles throughout the value chain and create an oligopolistic system of competition.

Despite these challenges, there are several projects that use a variety of methods to try to solve the EOF problem. Generally speaking, there are three main ways: transaction fee auction, fair sorting and randomness. Transaction fee auctions enable block builders to bid on transactions, with the highest bidder receiving fees as a reward. Fair Ordering employs a priority-based transaction ordering system that ranks transactions based on certain criteria such as their size, time, or reputation of the sender. Finally, on-chain randomness makes transaction outcomes less predictable, which helps reduce the profitability of front-running and enhances the overall security of the network. The most efficient solution may be a combination of these factors, but it is impossible to determine this until all working solutions are fully operational.

While there have been some positive developments, we need to pay more attention to this issue. Flashbots, the leading block builder in the industry, open-sourced their builder to promote competition, with some success as their market share dropped from 75% to 25%. However, in order to prevent collusion, it is necessary to take more measures. A potential solution is a mechanism to decentralize sorters, validators, and builders to prevent vertical integration. Two projects in particular stand out: Flashbots SUAVE and DFlow.

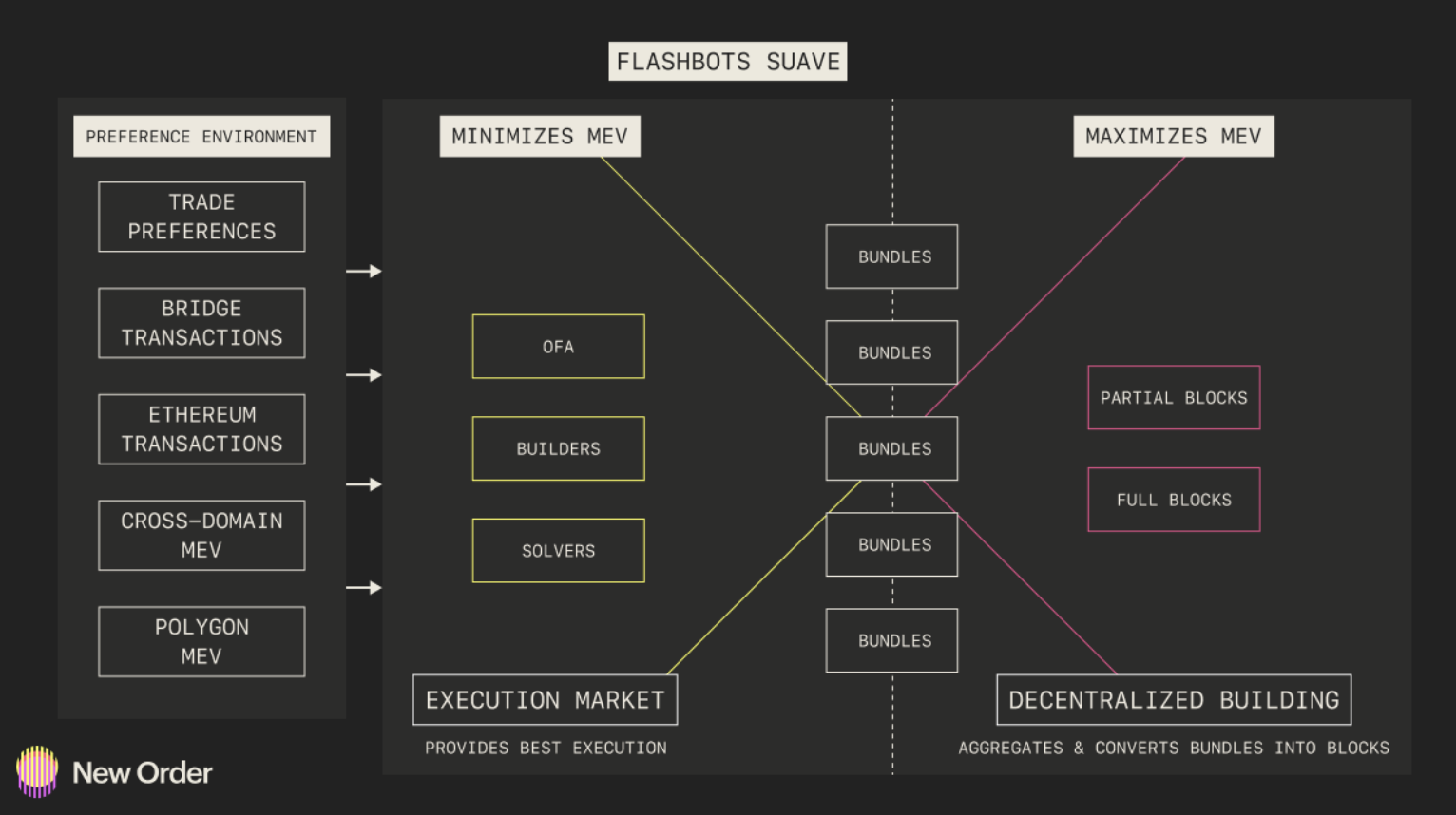

Flashbots SUAVE is a blockchain that acts as a plug-and-play storage pool and decentralized block generator for any blockchain. The team has identified EOF and cross-domain MEVs as major risk factors for MEV supply chain centralization. SUAVE aims to solve this problem by developing three components: a common preference environment (chain and storage pool aggregators), a best execution environment (a network of executors competing to provide the best trade execution), and a decentralized zone Blocks build the network. With SUAVE, a user's transactions are private, accessible to all participating block builders, and users are entitled to any MEV they generate. Furthermore, to counteract the impact of cross-domain MEV, block builders across different chains can be integrated in an open and permissionless manner. The combination of these components aims to solve the entire Exclusive Order Flow (EOF) and centralization problem.

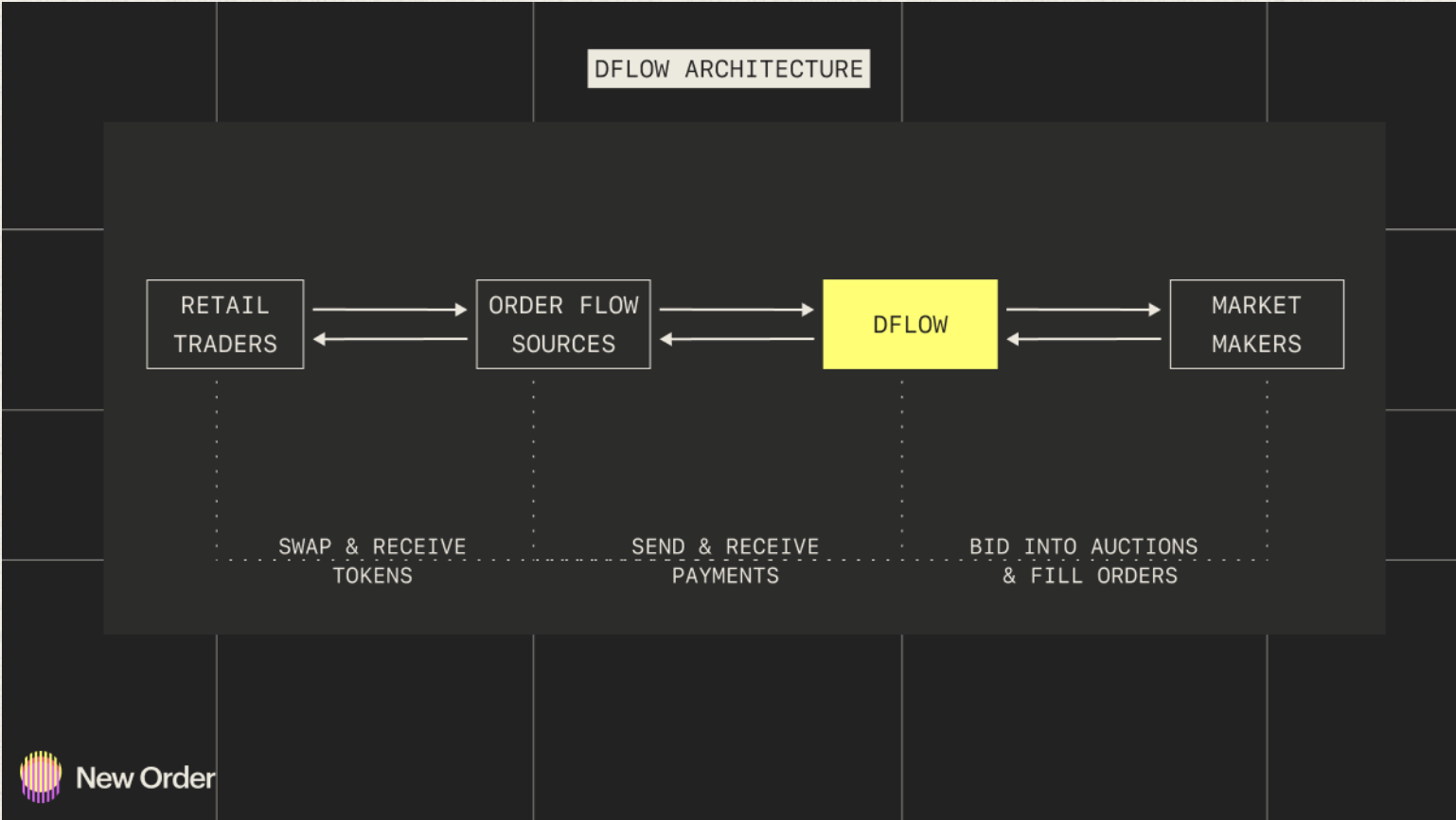

As the name suggests, DFlow is building a decentralized payment for order flow (PFOF) marketplace. Specifically, the project is a Cosmos application-specific blockchain that facilitates decentralized first-price sealed-bid auctions that run in parallel and sequentially. Like SUAVE, DFlow is blockchain-agnostic, meaning any application, no matter which blockchain it is on, can sell its order flow, and DFlow will facilitate PFOF auctions.

Other potential solutions or contributors to the EOF problem include encrypted storage pools (such as Shutter), side pools (such as EIP-4337), and application-specific storage pools via batch auctions (such as the CoW protocol).

Due to the high upfront costs and technical requirements required for the industry to be profitable, a small number of players may end up dominating the block builder market. Vitalik agrees with this idea, emphasizing the need to carefully consider the level of decentralization that is actually achievable in block production. The need for decentralization in key areas of block production will become more apparent through 2023 as the exclusive order flow problem continues to cause centralized actors to collude and control vast amounts of value in the network. Collaboration among a wider range of actors working on various approaches is critical to identifying the most pressing problems and finding effective solutions. Without a robust decentralized value chain, the consequences could be catastrophic.