DeFi year-end review: TVL fell by 76.1% overall, and the circulation of the four major stablecoins dropped by 7%

Looking back at the development of the blockchain in recent years, although concepts such as MEME coins, NFT, and GameFi have been sought after at different times, so far, DeFi is still the most important use case of the blockchain. The various data in DeFi can reflect the current application situation. This year (January 1, 2022 to December 22, 2022), the various data are summarized as follows:

The TVL of all DeFi projects on the public chain has dropped by 76.1% overall. Although Arbitrum’s TVL has also dropped by 45.5% in the past year, it has risen to fourth place in absolute value.

The sum of the circulating supply of the four major stablecoins USDT, USDC, BUSD, and DAI has dropped from 144.6 billion to 134.5 billion this year, an overall drop of 7%. USDC and BUSD have seized part of the USDT market.

The trading volume of DEX has shown a downward trend since December last year, and Uniswap still accounts for 62% of the trading volume on Ethereum.

The total deposits of the three major lending protocols MakerDAO, Aave, and Compound decreased by 76.1%.

Among cross-chain bridges, Multichain ranks first in terms of liquidity and transaction volume, and Wormhole's TVL drops by up to 94.6%.

first level title

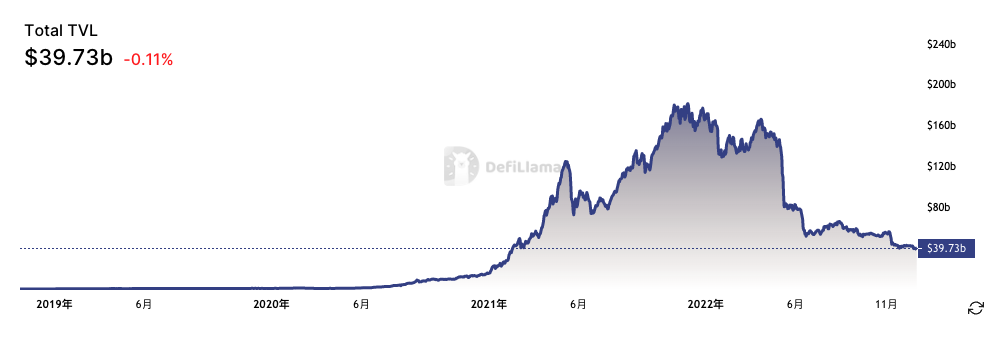

TVL: Total Locked Volume Dropped 76.1% Overall to $39.73 Billion

Total Value Locked TVL is a measure of DeFi adoption. According to data from DeFi Llama, since the beginning of this year, the TVL of all DeFi projects (after excluding indicators that are easily recalculated) has dropped from US$166.58 billion to the current US$39.73 billion, a drop of 76.1%.

If divided according to the public chain, among the three public chains with the highest TVL, the TVL of Ethereum dropped from US$95.4 billion to US$23.41 billion, a drop of 75.5%; the TVL of the BNB chain dropped from US$12.08 billion to US$4.17 billion, a drop of 65.5%; Tron's TVL fell 18.2% from $5.21 billion to $4.26 billion.

Surprisingly, the TVL of Arbitrum, the second layer of Ethereum, is already in fourth place, although its TVL has also dropped from $1.98 billion to $1.08 billion in the past year, a drop of 45.5%.

The biggest drop was undoubtedly Terra (now Terra Classic), which was going to collapse in May. Terra’s TVL rose from US$11.81 billion at the beginning of the year to US$21.02 billion in May, and now it is only US$5.29 million.

first level title

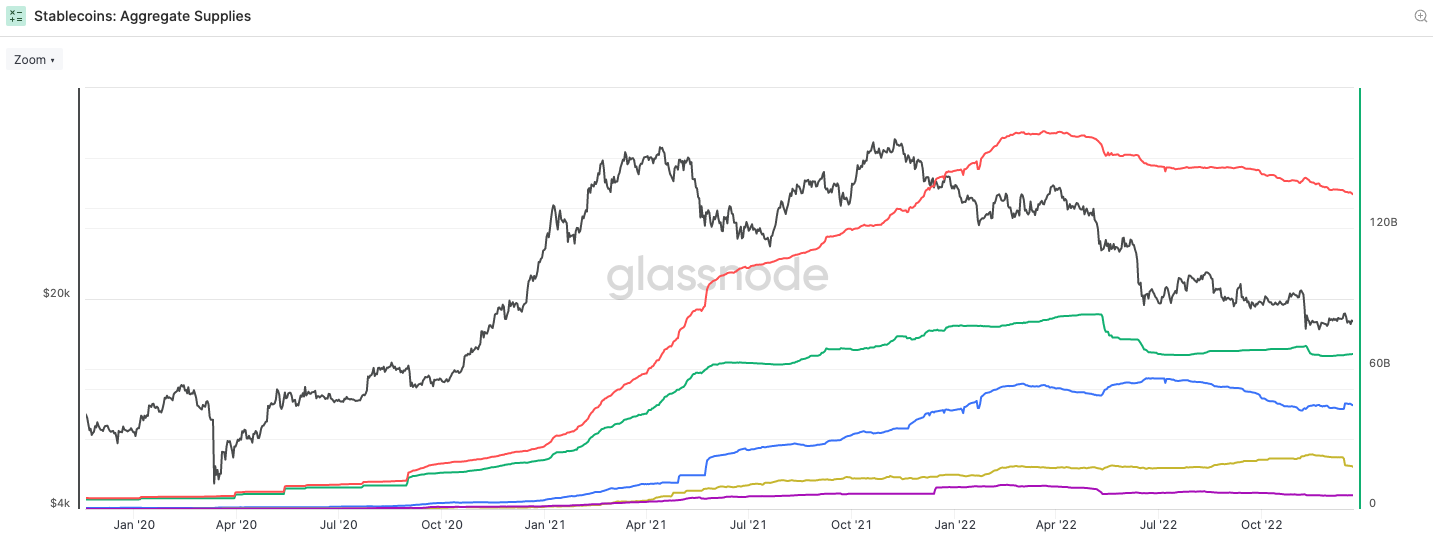

Stablecoins: USDT’s circulating supply has dropped 20.4% from its highs

In the case of the Fed’s interest rate hike and the recession of the encryption market, the issuance of stablecoins has also rarely declined. According to Investing.com, the U.S. 1-year Treasury yield is currently 4.63%, while the largest lending agreement Aave’s USDC deposit APY in the Ethereum market is only 1.16%.

According to data from glassnode, the sum of the circulating supply of the four major stablecoins USDT, USDC, BUSD, and DAI dropped from 144.6 billion to 134.5 billion this year, an overall drop of 7%, but USDC and BUSD still maintained growth.

The circulation of USDT decreased from 78.3 billion to 66.2 billion; USDC increased from 42.3 billion to 44.3 billion, BUSD increased from 14.6 billion to 18 billion, and DAI decreased from 9.2 billion to 5.8 billion. USDC and BUSD have taken away part of USDT's market share, and decentralized stablecoins represented by DAI have been more affected after the collapse of Terra/UST.

The circulation of USDT reached a historical high of 83.2 billion in May this year, which has dropped by 20.4% compared to the high point, and is still on a downward trend.

first level title

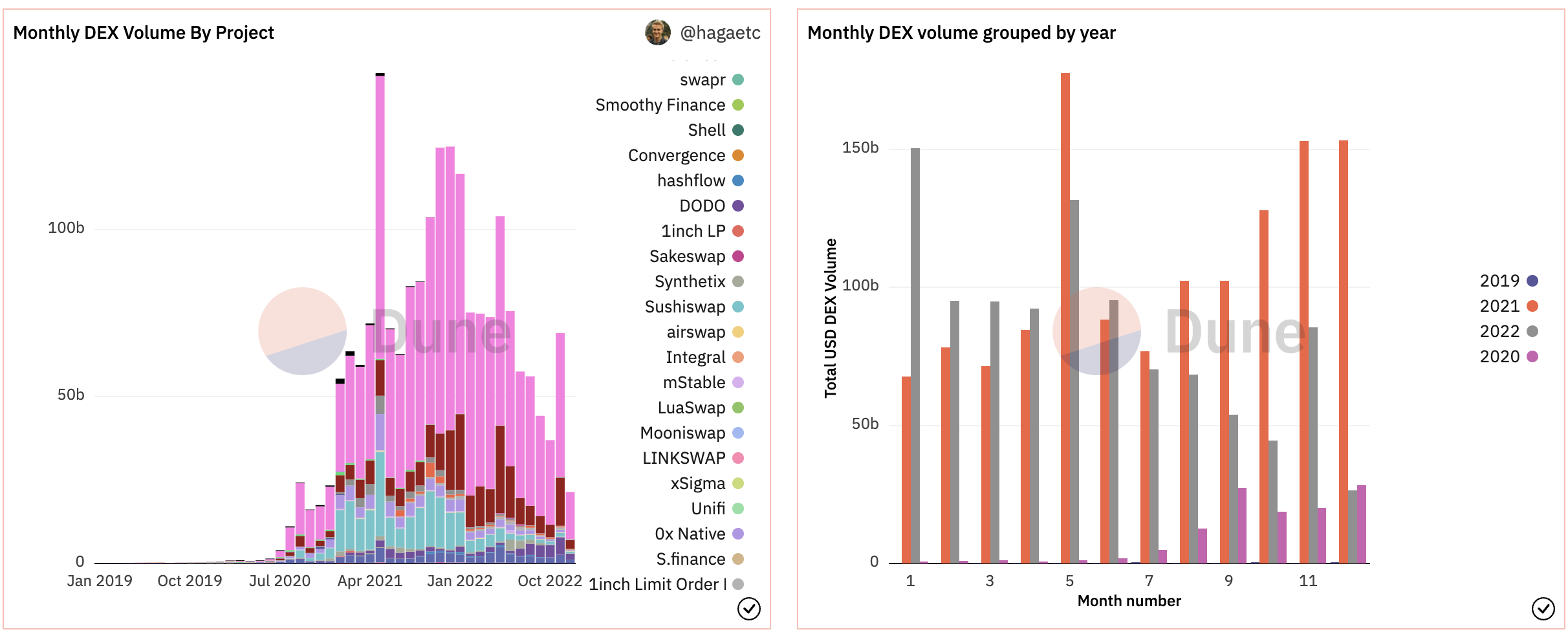

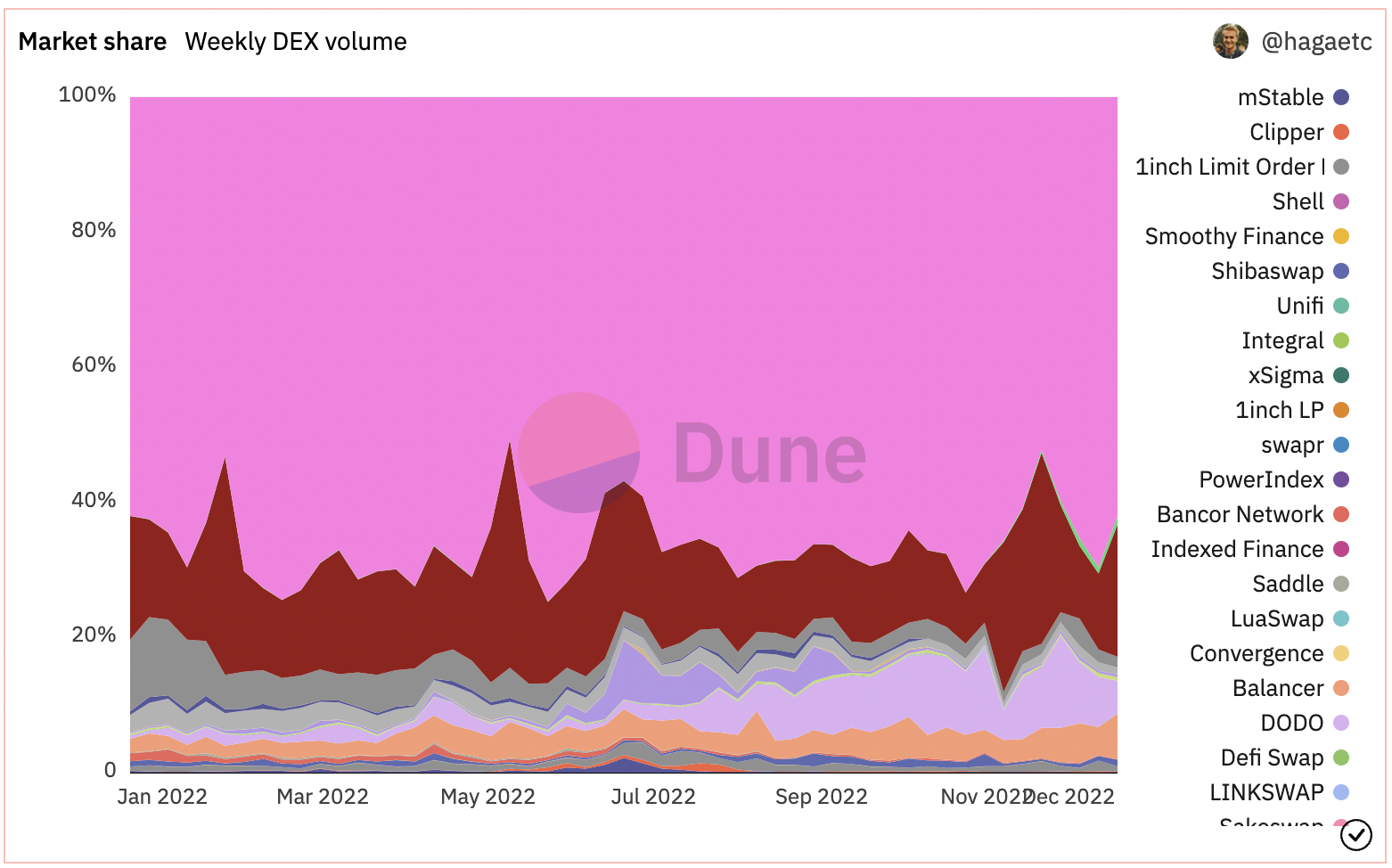

DEX: Trading volume has been on a downward trend since December last year

According to the dashboard of hagaetc, the co-founder of Dune Analytics, the monthly trading volume in DEX will generally increase until December 2022, and then begin to gradually decline after that. Taking the already concluded November as an example, the transaction volume in November this year was 85.6 billion U.S. dollars, a decrease of 44.1% compared with the 153.1 billion U.S. dollars in the same period last year.

In terms of market share, Uniswap continued to maintain a 62% share of trading volume, Curve's share rose from 12.9% to 19.6%, Balancer's rose from 1.9% to 6.8%, DODO rose from 1.2% to 4.9%, and Sushiswap rose from 1.9% to 19.6%. 11.2% down to 1.6%.

first level title

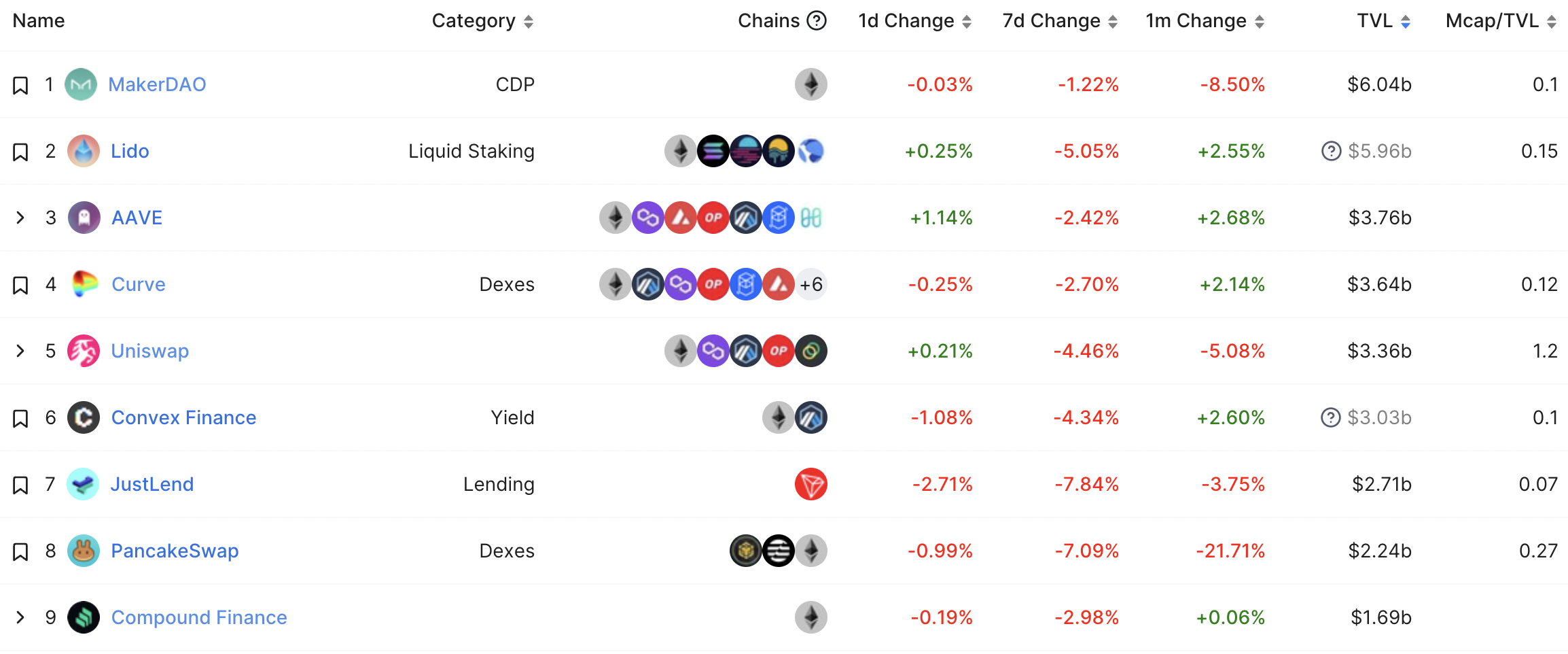

Lending: The total deposits of the three major lending protocols of MakerDAO, Aave, and Compound decreased by 76.1%

The top three lending protocols on Ethereum, MakerDAO, Aave, and Compound, still maintain their positions. But on other chains, the current TVL of Compound has been surpassed by JustLend on Tron, and the TVL of Aave was briefly surpassed by Anchor on Terra.

According to data from DeFi Llama, MakerDAO’s TVL has dropped from $17.5 billion to the current $6.04 billion, a drop of 65.5%; Aave’s TVL has dropped from $14.21 billion to $3.76 billion, a drop of 73.5%; Compound’s TVL has dropped from $8.9 billion To 1.69 billion US dollars, down 81%.

Because MakerDAO is a CDP type, it can only lend DAI issued by itself, and TVL is the total deposit; while deposits in Aave and Compound can be used as loans for others, and TVL is total deposit-total borrowing. Aave’s total deposits fell 78.5% from $26.2 billion to $5.64 billion, while Compound’s total deposits fell 84.2% from $14.9 billion to $2.35 billion. The total deposits of the three major lending agreements MakerDAO, Aave, and Compound dropped from $58.6 billion to $14.03 billion, a drop of 76.1%.

first level title

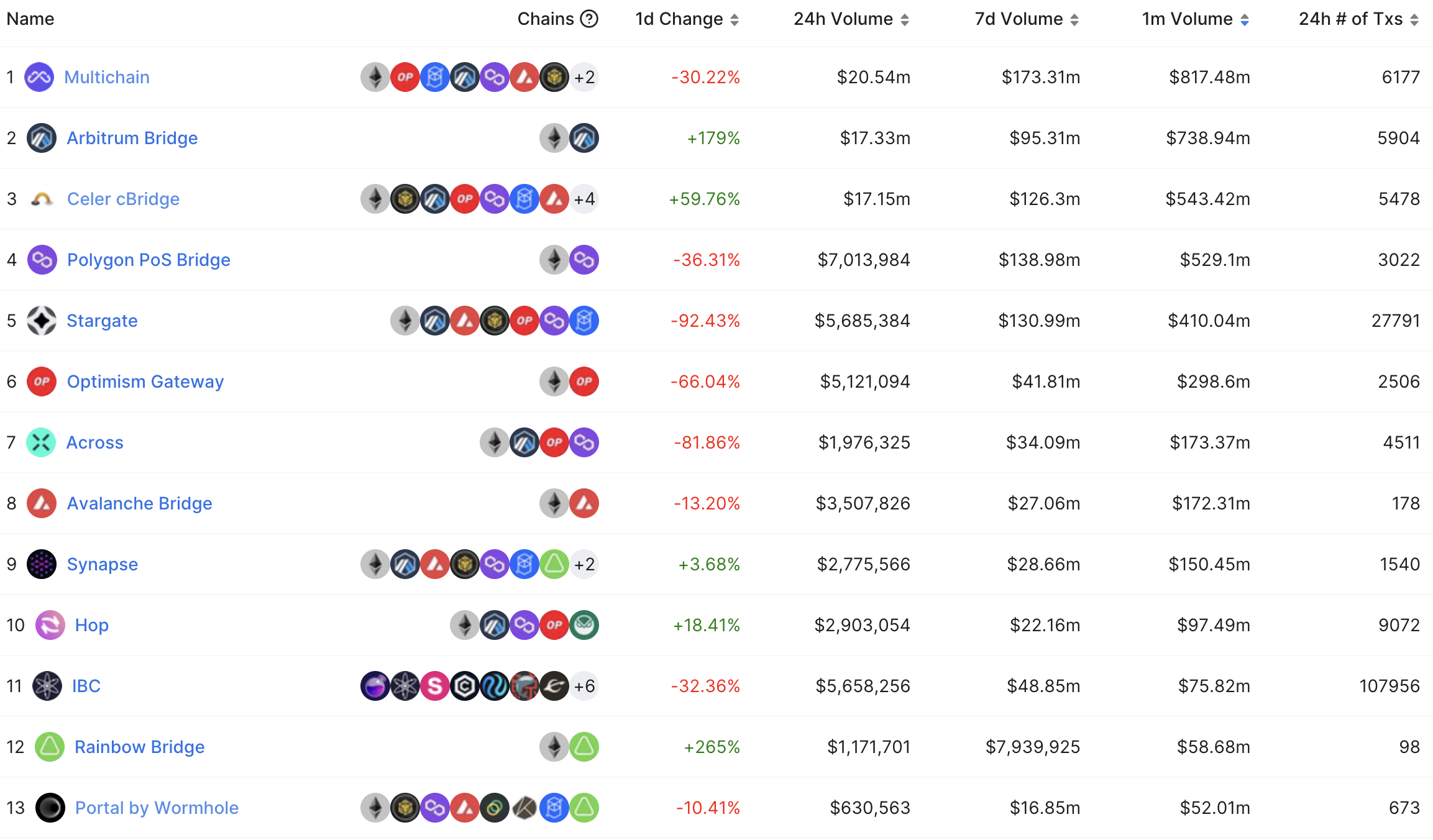

Cross-chain bridge: Multichain ranks first in both liquidity and transaction volume, and Wormhole's TVL drops by up to 94.6%

Cross-chain bridges need to lock a large amount of funds, but usually the transaction volume is not high, the proportion of handling fees is also low, and security accidents are prone to occur, which belongs to a more difficult category of projects. This year alone, the cross-chain bridges that caused hundreds of millions of dollars in losses due to hacking attacks include Wormhole, Ronin Network, BNB Chain, Horizon, and Nomad, the first three of which have been paid by the project side.

According to DeFi Llama data, in the past month, the general-purpose cross-chain bridges with the highest transaction volume and their transaction volumes were: Multichain $817 million, Celer cBridge $543 million, Stargate $410 million, Across $173 million, Synapse $150 million Dollar. In terms of the amount of funds locked, Multichain’s TVL of US$1.6 billion also ranks first among cross-chain bridges.

Like the competition for transaction volume in DEX, Multichain also makes concessions on cross-chain handling fees. For example, for the USDC cross-chain between Layer 2 Optimism and Arbitrum, Multichain only charges 0.19 USDC as a gas fee and waives other fees; For other non-Ethereum EVM chain cross-chain, the fee charged by Multichain is generally 0.02%.

first level title

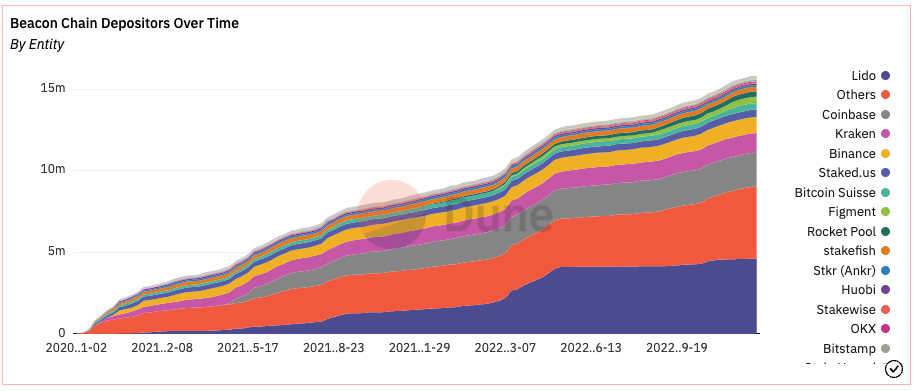

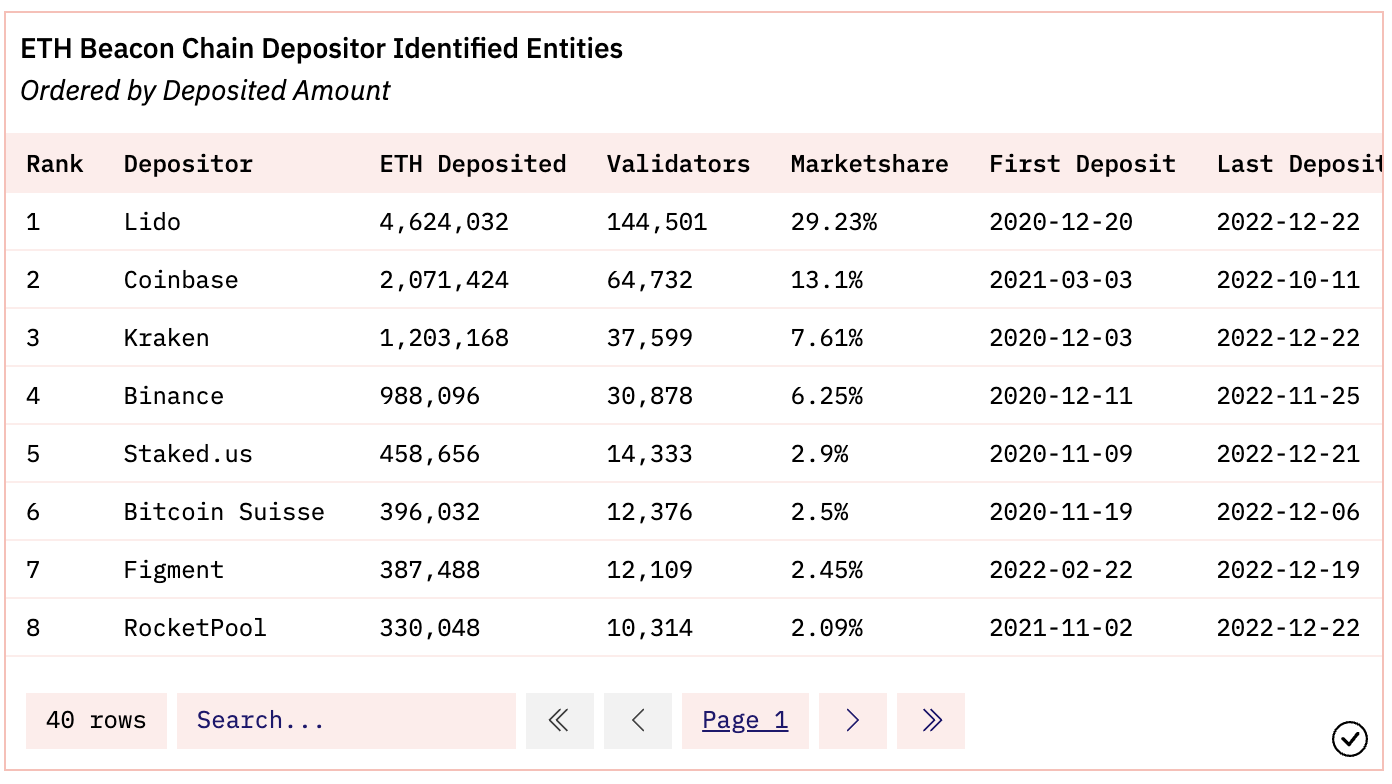

Liquidity staking: ETH staking ratio rose to 13.59%, and Lido accounted for 29.23% of the market

According to the data of Staking Rewards, even if the pledge ratio of Ethereum is only 13.59%, the pledged funds of 20.2 billion US dollars are much higher than other public chains. In the pledge of ETH, according to the data collated by Dune @hildobby, there are currently 15.74 million ETH pledged, an increase of 85.6% compared to the 8.48 million ETH at the beginning of the year.

Not only Lido, Rocket Pool and other projects that focus on liquidity staking are providing ETH staking services, but centralized institutions such as exchanges also provide services by taking advantage of their own users and large amount of funds. The top five staking entities and market share are: Lido 29.23%, Coinbase 13.1%, Kraken 7.61%, Binance 6.25%, and Staked.us 2.9%. Most liquid staking service providers issue liquid staking tokens for users, and these liquid staking tokens have a slight negative premium if the currently pledged ETH cannot be redeemed.

The use of Flashbots MEV-Boost Relay can enable verifiers to increase the income from MEV (maximum extractable value). This advantage has recently made the proportion of blocks produced through Flashbots MEV-Boost Relay as high as 57%, which has aroused concerns about Flashbots. At present, Flashbots Steps are also being taken towards decentralization.