On the first day of APE staking, the biggest profit is the arbitrageur

For holders of BAYC and its derivative series of NFT and APE tokens, APE pledge is the most noteworthy event in the near future, and it is also of reference for the subsequent development of the NFT industry.

In the early hours of this morning, the APE staking smart contract, which has undergone numerous tests and reviews, was officially deployed on the mainnet, which also means that the APE staking function is officially launched. Users can now open APE deposits through ApeStake.io, and the staking rewards will be available on December 12. receive.

secondary title

Detailed explanation of Ape pledge mechanism

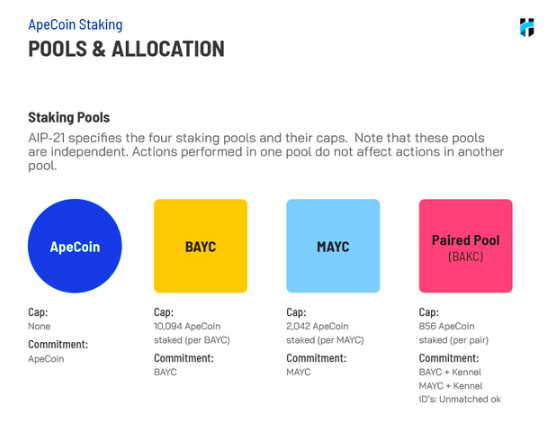

The APE staking system has 4 token pools, and the staking rules and rewards of each token pool are different:

The first pool is "ApeCoin Pool". The pool does not require users to hold NFTs, and any APE token holder can deposit as many APE tokens into the pool as possible.

The second pool is the "BAYC Pool". The pool requires users to hold a Bored Ape to participate. In the BAYC pool, users can deposit up to 10,094 APE tokens for each Bored APE they hold.

The third pool is the "MAYC pool". The pool requires users to hold a Mutant Ape to participate. In the MAYC pool, users can deposit up to 2,042 APE for each Mutant Ape they hold.

The fourth and final pool is "BAKC + BAYC or MAYC". This pool is different from BAYC and MAYC pools, because users not only need to own a Bored Ape or Mutant Ape, but also need to own a Bored Ape Kennel Club Dog. Users who meet the conditions can buy for each Bored Ape/Mutant Ape they hold Deposit up to 856 APE with BAKC Dog.

In terms of reward distribution, 175 million APE (accounting for 17.5% of the total Token distribution) will be allocated to four pools within 3 years, 100 million APE in the first year, 50 million APE in the second year, and 0.25 in the third year 100 million APEs.

In terms of reward distribution, 175 million APE (accounting for 17.5% of the total Token distribution) will be allocated to four pools within 3 years, 100 million APE in the first year, 50 million APE in the second year, and 0.25 in the third year 100 million APEs.

Specifically, the distribution of rewards for the four token pools will be determined based on the NFT price in Q4 of the previous year. Among them, the "ApeCoin pool" will allocate 30% of the total reward pool of the year, and the remaining three will fluctuate with the subsequent NFT price. The higher the NFT price, the higher the APE distribution ratio corresponding to the pledge pool.

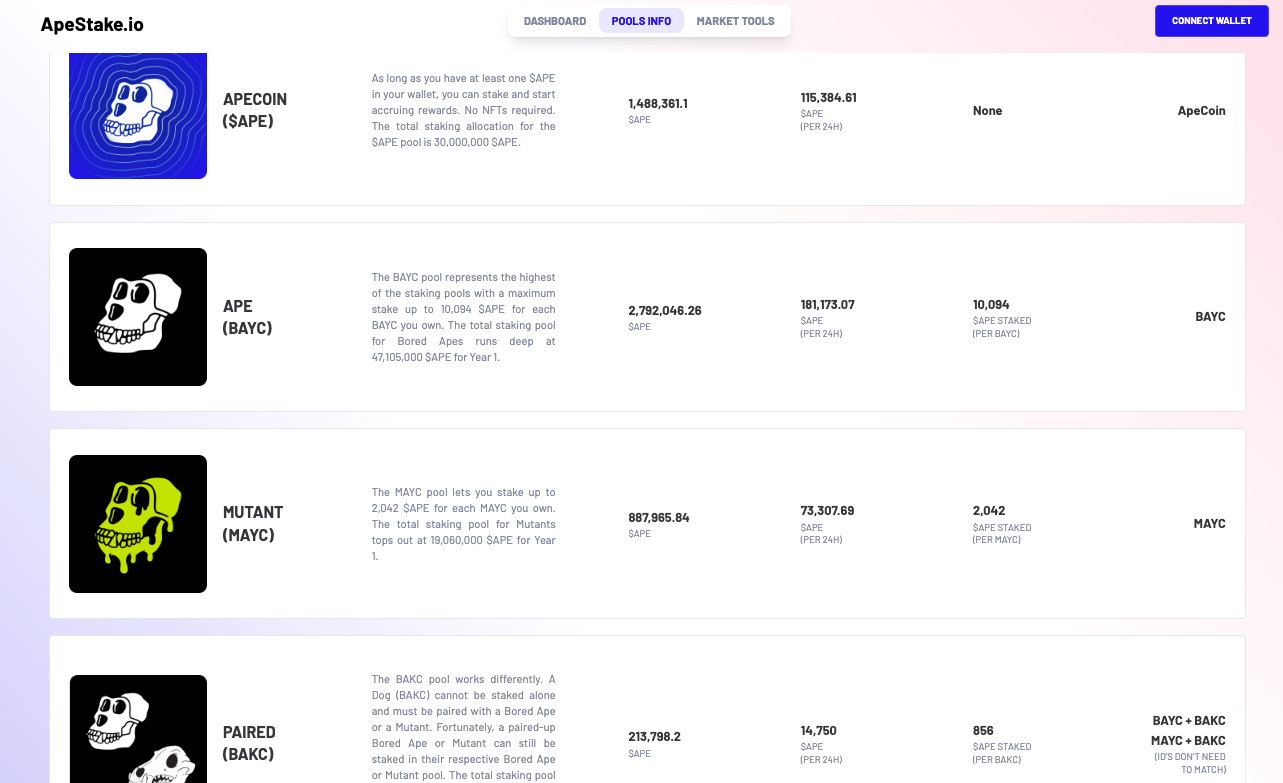

Up to now, a total of 5,377,915 APEs have been pledged, and the data of the four pledge pools are:

ApeCoin Pool: A total of 1,488,361.1 pieces are pledged, accounting for 27.6%

BAYC pool: A total of 2,792,046.26 pieces are pledged, accounting for 51.9%

MAYC Pool: A total of 887,965.84 pieces are pledged, accounting for 16.5%

secondary title

Hidden BUG triggers arbitrage mechanism?

Before the APE staking function was launched, a big V had already reminded users participating in the staking to remove their BAYC and its derivative series NFT from all NFT markets, otherwise if someone bought the NFT you listed, Then you will also lose your pledged APE tokens at the same time.

Obviously, this friendly reminder was not widely disseminated, which led to the triggering of the arbitrage mechanism within a few hours of the launch of the APE staking function.

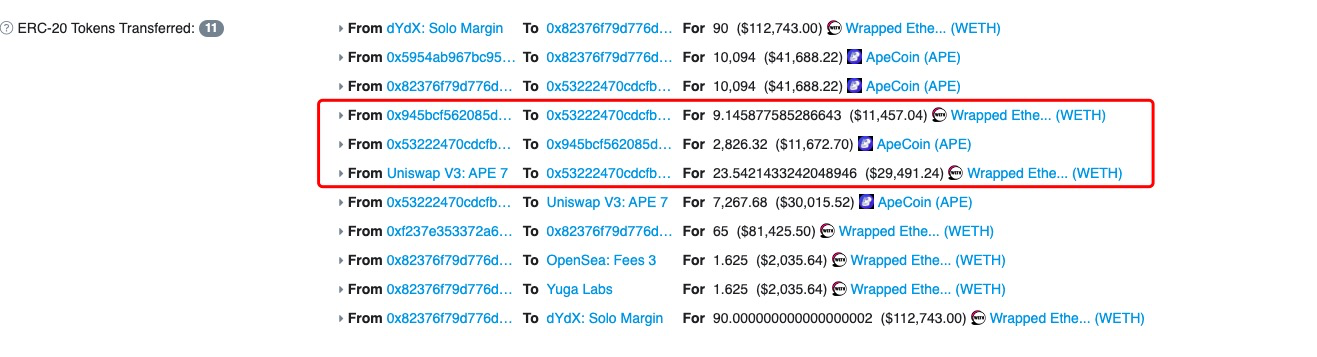

According to Paidun’s monitoring, some arbitrageurs borrowed 82 ETH from dYdX in the form of flash loans to purchase BAYC #6762, thereby obtaining 64 00 APE pledged by it. The arbitrageur sold APE for 20 ETH, and then sold BAYC #6762 at a price of 68 ETH, making a net profit of about 6 ETH.

Soon, this arbitrage model was successfully replicated. A set of profiteers also borrowed 90 ETH from the dYdX platform in the form of a flash loan, purchased BAYC #1633, and obtained 10,000 APE pledged under the NFT at the same time; the arbitrageur then converted the obtained APE into approximately 9.1 ETH and 23.54 ETH, a total of 32.68 ETH, and then sold BAYC #1633 at a price of 65 ETH, netting about 7 ETH.

Arbitrageurs discovered the bug and made profits, but APE staking users suffered losses. The significance of the ApeCoin DAO staking plan is to motivate ecological participants. Obviously, there is still room for improvement in the mechanism.