The aftermath of the FTX crash is over, where will Solana go in the future?

first level title

Why Solana?

After the FTX crash, Solana was immediately placed at the center of the storm, which dates back to the summer of DeFi in 2020. At that time, Solana was still unknown, and it was just one of many public chains trying to crack the "impossible triangle". However, SBF (Sam Bankman-Fried), the co-founder and CEO of FTX and the founder of Alameda Research, discovered Solana. In addition to participating in Solana's multiple rounds of financing, he also chose to build a decentralized exchange Serum on Solana (this is Solana's The first decentralized exchange), followed by investing in multiple Solana-based applications, such as offline map Maps.me, prime broker Oxygen, Bonfida that fully utilizes Solana's potential, and multiple functions of AMM/mining/IDO Raydium et al.

image description

image description

Image credit: CoinMarketCap

In a way, FTX, Alameda, and Solana interpenetrate to a degree second only to the symbiotic relationship between Terra and LUNA. Therefore, when FTX exploded, it was like telling the world that the funder behind Solana had collapsed. It was only natural for everyone to turn their attention to Solana, and it was not difficult to imagine the ending of the wall being overwhelmed by everyone.

In particular, Serum, as one of the cornerstones of Solana’s DeFi infrastructure, brought embarrassment and doubts after the collapse of FTX no longer brought high speed and low cost, and quickly became invalid and disintegrated. On November 13, Solana developers urgently forked the FTX-developed DEX Serum due to concerns that Serum might have been compromised in the FTX hack. The forked version of OpenBook quickly went live on the Solana mainnet, with a daily transaction volume exceeding $1 million, while Serum’s transaction volume and liquidity have dropped to close to zero.

image description

image description

Image credit: DefiLlama

On the one hand, the DeFi ecosystem is in a hurry, and on the other hand, the NFT ecosystem is under the impact of selling. According to Forbes, the FTX thunderstorm is destroying the Solana NFT ecosystem and triggering a wave of selling. According to public data, the NFT market Magic Eden on the Solana chain The NFT trading volume of NFT, OpenSea, and Solanart has more than tripled from more than 80,000 per day a week ago, and once exceeded 250,000, indicating that holders are rapidly selling NFT.

first level title

What is Solana?

To answer the above questions, we must first figure out what Solana is and where Solana’s value lies.

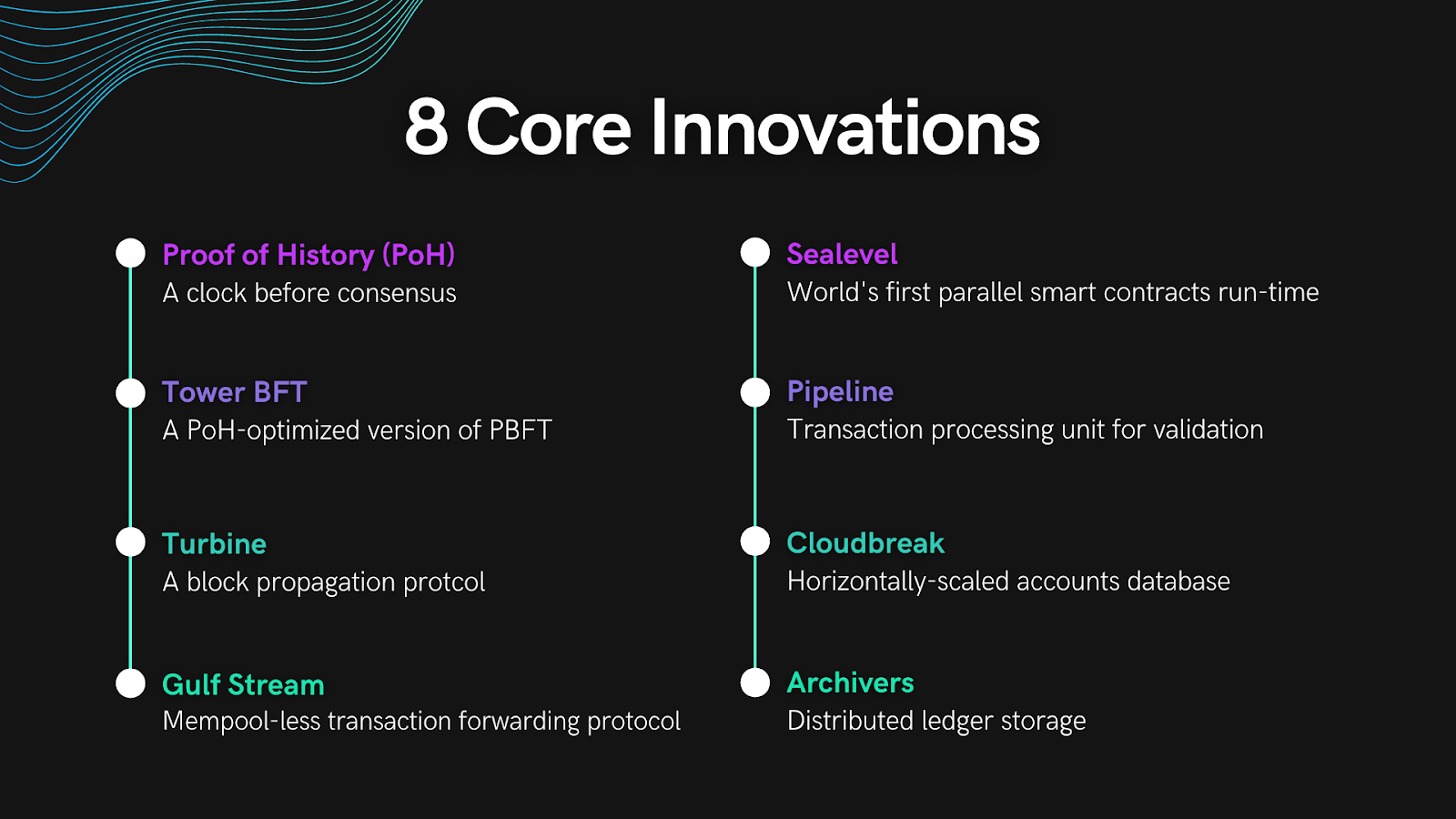

Solana is a public blockchain co-founded by Anatoly Yakovenko and two former Qualcomm colleagues, Greg Fitzgerald and Stephen Akridge. The solid technical background of the three founders has given investors and the market greater confidence. The original intention of the creation comes from the technical response to the "impossible triangle" of the blockchain. Solana tries to use a new blockchain architecture based on Proof of History (PoH) to improve scalability. It positions itself as the world's fastest High-performance public chain. On Solana, PoH is used to encode the untrusted passage of time into the ledger — an append-only data structure, according to its whitepaper. When used with consensus algorithms such as Proof-of-Work (PoW) or Proof-of-Stake PoS, PoH reduces messaging overhead in Byzantine Fault Tolerant replicated state machines, enabling sub-second finality times. Solana also proposes two algorithms that exploit the time-keeping properties of PoH ledgers — a PoS algorithm that can recover from partitions of any size and an efficient Proof of Streaming Replication (PoRep). The combination of PoRep and PoH provides defense against ledger falsification in terms of time (ordering) and storage. In theory, Solana can achieve 710,000 TPS per second on a standard 1 Gbps network.

image description

image description

Image credit: The Tie

Solona supports the creation of smart contracts, Dapps, DeFi platforms, and NFT markets based on it. To a certain extent, Solana has indeed realized Anatoly's original intention, creating a high-performance platform with low handling fees and high TPS that can accommodate many projects running on it. blockchain network. Solana can achieve ultra-large-scale expansion without sharding, and applications can be freely combined on a complete layer-1 network. Correspondingly, Ethereum has long been overwhelmed by the long-term application of resource-intensive PoW governance system before the merger. Solana, which has been prepared for a long time, provides a public chain that can be quickly migrated at low cost without rewriting the contract by virtue of the Ethereum bridge-Wormhole protocol, which provides a foundation for a large number of high-quality projects and active users to migrate to Solana.

In addition, Solana also has "predictability", that is, a no-burden programming model: developers write code, they know that it will always work, and the cost of executing code in the future will be lower than it is now. This provides enough confidence for developers and project parties that they can develop and maintain for a long time with peace of mind.

To sum up, the advantages of Solana have formed a good complement to the shortcomings of Ethereum, providing an attractive and stable option for developers and project parties in the market. Based on this, Solana has begun to vigorously build its ecology.

As a blockchain infrastructure, Solana has gained approval for many applications. Taking the Solana ecological project Francium as an example, Francium once pointed out "three reasons for developing DeFi on Solana":

The bottom layer of the public chain has the advantages of low transaction costs, long-term scalability, higher network value, and decentralization;

Stateless execution of transactions enables large-scale parallel programming;

The ecology has developed rapidly and has begun to take shape, providing the basis for building composable Lego bricks.

Solana is not satisfied with this. It has established a long-term effective ecological support plan (Grants), and continues to hold hackathons with high bonuses and Breakpoint conferences to promote community exchanges. Solana has established several ecological funds and The Creator Fund encourages project development with real funds. The constant influx of new projects, highly active users and developers, and abundant financial support have formed Solana's prosperous ecology.

first level title

Where is Solana headed?

The direct impact of the FTX incident on Solana has gradually bottomed out. According to Solana’s official website, the Solana network did not experience any significant performance or uptime issues during the FTX incident. At the same time, the Solana Foundation also clarified the SOL token unlocking event that recently caused panic in the community. It believes that this is a normal event that occurs every two or three days. At the end of each epoch, token holders can submit Request to release pledge. The current large number of unlocks actually come from 250 addresses. About 29 million SOLs were canceled and unstaked at the end of Epoch 370. It was originally expected that a total of 63 million SOLs were unstaked at the end of Epoch 370, but the 28.5 million SOLs originally entrusted by the Solana Foundation were cancelled. The staking action has been delayed and its unstaking will take effect in the near future.

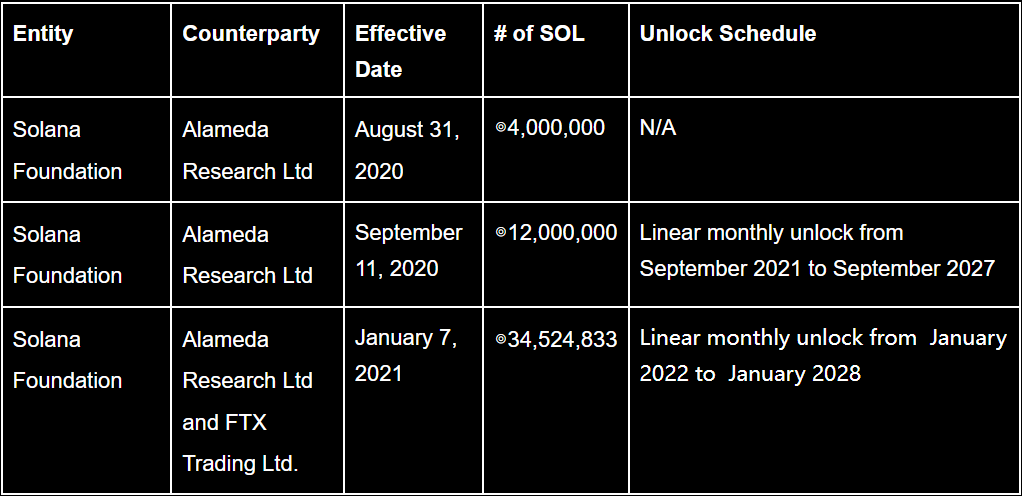

Despite the bad news, another boot has landed as well, as soBTC issued by FTX or Alameda on Solana are confirmed to be non-redeemable, according to a Sollet interface announcement. Solana Compass also stated that 48,636,772 SOL tokens controlled by Alameda have been held by liquidators and have been difficult to sell for nearly a decade.

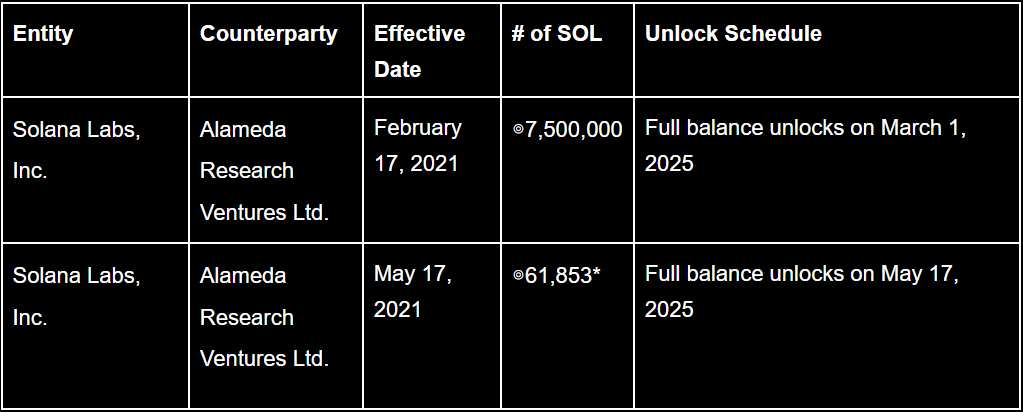

Solana Foundation Balance Sheet Exposure to FTX/Alameda

According to Solana’s official website, the Solana Foundation has approximately $1 million in cash or cash equivalents on FTX.com, which at the time had stopped processing withdrawals. This represents less than 1% of Solana Foundation's cash or cash equivalents, and therefore, the impact on Solana Foundation's operations is negligible.

Solana Foundation does not have SOL hosted on FTX.com

Solana Foundation's Asset Exposure to FTX/Alameda

image description

image description

Caption: Summary of Solana Labs, Inc.'s sale of SOL to FTX/Alameda

According to Solana’s official website, the total exposure value of Sollet-based assets circulating on Solana is about $40 million, and the status of the underlying assets is currently unknown.

image description

image description

image description

image description

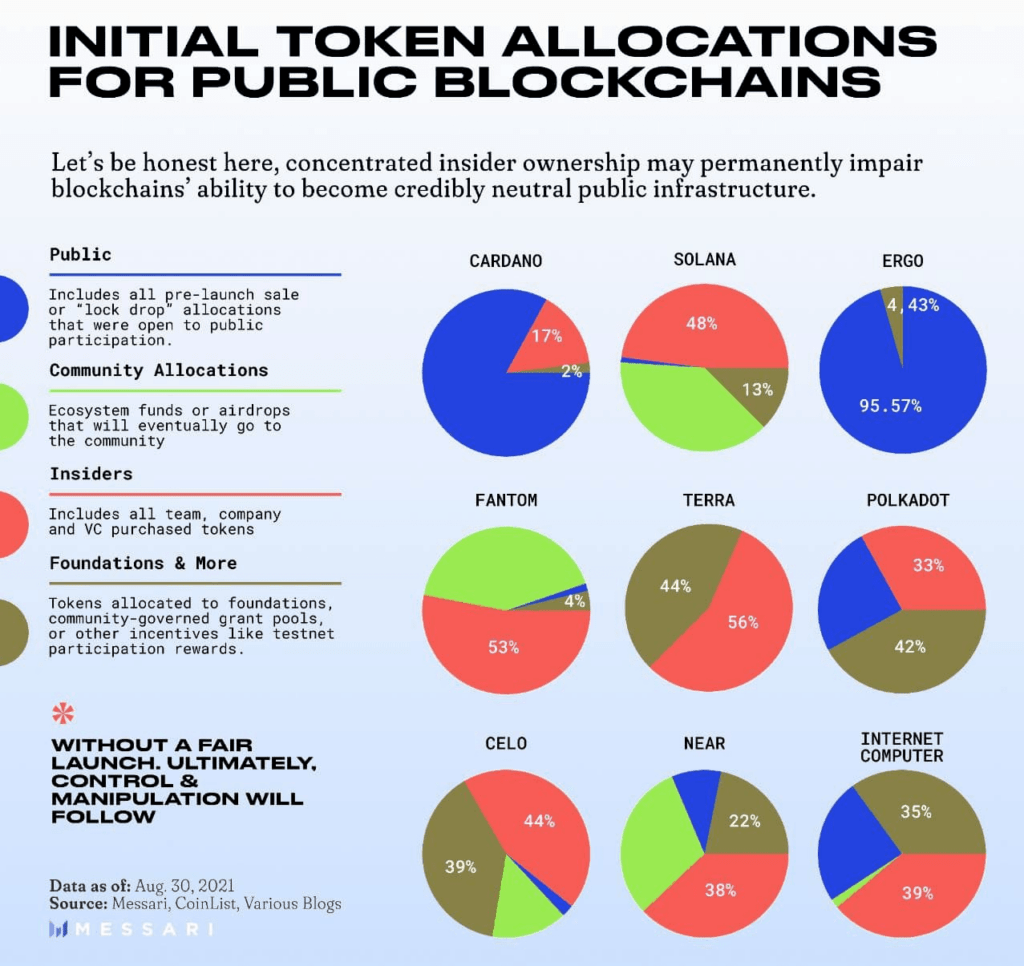

Image credit: Merssari

Discussions about Solana on social platforms are also rampant, but there seems to be a general consensus that the future of Solana lies in its ecosystem (if there is a future). Fortunately, such beliefs not only exist within Solana and SOL holders, but also exist in the hearts of many project parties and developers in the Solana ecosystem. Especially for NFT projects, Solana is currently the largest blockchain after Ethereum, with sales exceeding $1.7 million, more than 8 times that of the third-ranked Cardano. Solana provides a global expansion tool to meet the development needs of projects of different scales. It is a small and beautiful, but also large and comprehensive infrastructure development platform, and all tools are open source and free, and participants can create NFT for free artwork and build community. If Solana falls, it is undoubtedly something that NFT project developers do not want to see.

image description

image description

Image credit: Dune@Dsaber

In its report released in October, Solana made technical changes to some of the existing problems. The purpose of these changes is to solve the current network stability problems, increase revenue without increasing transaction fees, and expand the user base wait:

Implementing QUIC on mainnet beta: QUIC is a protocol built by Google designed for fast asynchronous communication. This is an improvement over the existing UDP-based protocol that the Solana network previously used to pass transactions between RPC nodes and the current block leader. UDP lacks flow control and acknowledgment of receipt, so it fails to provide a meaningful way to prevent or mitigate abuse. To address this, Solana's transactional ingestion protocol is being reimplemented on top of QUIC, which enables session and traffic control, and is currently running on testnet and mainnet beta. However, the mainnet beta still supports UDP and QUIC. QUIC is planned to be the default transaction ingestion and forwarding protocol on the mainnet testnet, and once QUIC is adopted, more options will be available for optimizing data ingestion and preventing abuse.

Increased transaction size: Transactions on the Solana network are currently limited to a maximum of 1,232 bytes. This limitation limits the ability of programs to be combined with each other. With the implementation of QUIC, the possibility of increasing transaction size is within reach.

Stake-weighted Quality-of-Service (QoS): This was built in parallel to QUIC and enabled before QUIC was adopted on the mainnet testnet. Currently, block producers accept transactions without regard to their origin. Solana is a proof-of-stake network, and stake-weighted QoS extends the utility of stake-weighting to transaction quality. In this model, nodes with 0.5% of the stake will have the right to transmit at least 0.5% of the packets to the leader. Transactions submitted by validators with a stake in the network will always be accepted by block producers, regardless of the amount of traffic from non-staked nodes.

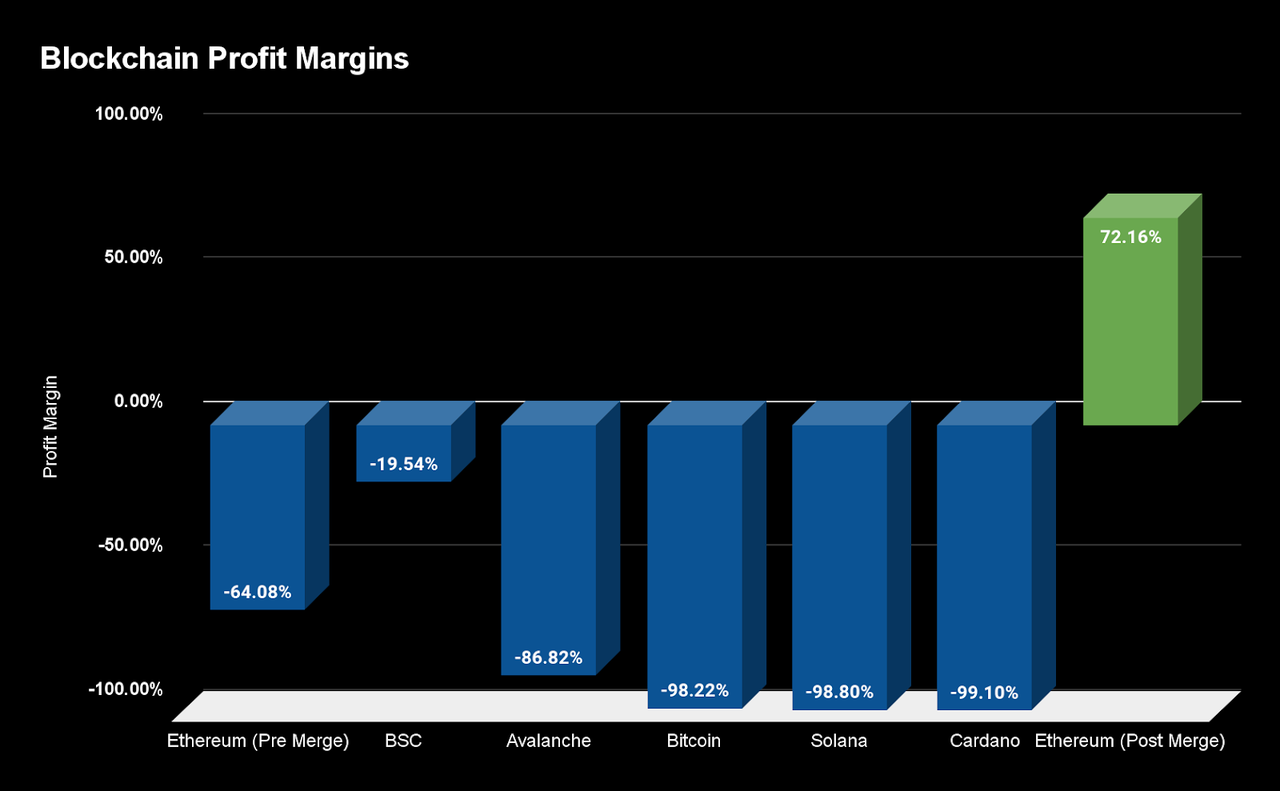

Fee Market: The fee market has been partially introduced and is expected to be further implemented after QUIC is fully adopted. The first part of the fee market implementation is to support priority fees. Previously, the network processed transactions on a first-come, first-served basis, which did not give users any way to express the urgency of transaction execution. Priority Fees changes this by giving users the discretion to charge additional fees when executing transactions and including them in blocks. Priority fees are calculated based on the amount of computing resources the transaction is expected to require. For example, a simple token transfer requires a lower total priority fee than an NFT Mint expressing the same level of urgency. Priority fees have been running on mainnet beta since July 2022. Future versions will add additional functionality to the fee market. These include a new RPC method that will help users and applications determine the minimum additional fee that might be required to be included in the next block, higher fees for competing accounts, and improvements to block scheduling. These pending improvements are expected to create a more efficient fee market for all Solana participants.

In terms of ecology, there are currently more than 500 ecological projects built on Solana, and Solana has formed an ecology covering eight main areas: DeFi, NFT, games, tools, wallets, dApp applications, development, and subdivided areas covered Including DEX, derivatives, transaction analysis visualization, lending, synthetic assets, stable coins, etc. With the support of these huge market segments, Solana still has the confidence to impact the most important infrastructure of Web3.

epilogue

epilogue

References:

References:

https://newsletter.banklesshq.com/p/the-first-profitable-blockchain

https://mirror.xyz/cryptozyh.eth/Yf 7 OdypO 83 Iw 2 uH 1 hCK 5 QNRndVXmujnWLZBo 800 naGc

https://solana.com/solana-whitepaper.pdf

https://research.thetie.io/solana-ecosystem/#Solanas_ 8 _Core_Innovations

http://www.yuanli 24.com/news/7801

https://www.youtube.com/watch? v=Df 9 K 7 LdabGc

https://zombit.info/solana-ftx-impact-price-plummet-tvl-fall/

https://solana.com/news/solana-facts-ftx-bankruptcy

https://coinmarketcap.com/currencies/solana/

https://www.8 btc.com/article/6783622

https://new.qq.com/omn/20211110/20211110 A 0 AFKL0 0.html

Disclaimer: There are risks in the market, and investment needs to be cautious. Readers are requested to strictly abide by local laws and regulations when considering any opinions, viewpoints or conclusions in this article. The above content does not constitute any investment advice.

Disclaimer: There are risks in the market, and investment needs to be cautious. Readers are requested to strictly abide by local laws and regulations when considering any opinions, viewpoints or conclusions in this article. The above content does not constitute any investment advice.