OP Research: Wallet, CEX and DAPP, who is the future traffic entrance of Web3?

Original Author: CloudY, Sihan

first level title

1. The development history of the entrance

Currently, the Web3 industry as a whole is in the early stage of development. Compared with the traditional Web2 industry, traffic capture is still in a relatively primitive stage for the time being, and is usually carried out in a relatively rough way.

With the development of the Web3 industry, we roughly divide the way of obtaining traffic into three major stages according to user needs:

Early:

In the early stage of the encryption industry, the main needs of users are cryptocurrency transactions. Most users in the encryption industry often enter the centralized exchange (CEX) through the web page or mobile phone to use various functions, such as the early Mt. Gox and Bittrex et al. Therefore, at this stage, CEX is the main entrance of traffic, leading to the emergence of a large number of CEX, such as Binance, Huobi, OKEX, KuCoin, MEXC, Gate, etc. In addition to trading cryptocurrencies, since users also have the demand for fiat currency deposits and withdrawals, CEX is often compatible with P2P deposits and withdrawals services to further control traffic entry. But also because CEX holds a large market share, once a problem occurs in CEX, it will have a serious impact on the entire market. The Mentougou incident is a good example.

Middle term:

With the continuous development of the encryption industry, the functions required by individual users are gradually enriched, such as using blockchain wallets to store digital currency or transfer funds, and interact on the chain. Especially after the birth of Ethereum, the launch of smart contracts has brought about the development of the ecology on the chain. For a time, DAPPs sprung up like mushrooms, coupled with the popularization of basic knowledge of the encryption industry and the influx of a large number of new users, the usage rate of wallets also increased, and wallets also assumed the mission of DAPP entrances on various chains. In the subsequent development, the business scope of CEX and wallets was further expanded, and CEX gradually began to gradually develop financial derivative business around transactions, such as adding contracts, options, etc., to compete with wallets. However, due to the single public chain and the lack of infrastructure on the chain, major wallets support fewer chains, and functions such as transfer and cross-chain are not as good as the exchange experience. Especially after the birth of TRON, the extremely low transfer fee has a great advantage over CEX. However, due to the launch of EOS and USDT, the demand for on-chain interaction has increased significantly, the function of the wallet has been further expanded, and the flow part has been tilted from CEX to the wallet, and the on-chain ecology of the encryption industry has gradually taken shape.

now:

first level title

2. About the current situation of Web3 entrance

However, according to NFTgo.io data, on October 28, the total transaction volume of NFT on Ethereum was about 10.68 million US dollars, while the transaction volume of Reddit Collectible Avatars was about 2.5 million US dollars. In other words, Reddit NFT has a transaction volume equivalent to about 25% of the entire Ethereum NFT market. Opensea has about 2.3 million existing cumulative users, and most of the 2.83 million Reddit NFT holders have registered with Reddit Vault. The number of Reddit wallet registrations is almost the same as the number of wallets that have traded NFTs on Ethereum (approximately 3.43 million). A Web2 platform can obtain the same scale of traffic as the entire Web3 NFT industry by issuing an NFT, and the number of users in a short period of time exceeds Web3's largest NFT market Opensea. It can be seen that although Web3 has already had many revolutionary innovations, there is still a lot of room for further development.

When we review the changes in Web2 portals, we find that the sequence of development is: portal website-search engine-PC social platform-mobile social platform. From the large and comprehensive information collection that has been screened, to the self-screened information collection, to the user's own information output, the user's fragmented information output, and finally the user's fragmented view information output. Compared with the current Web3, from the original BTC-based POW public chain investment, to the surge in investment targets in the ICO era, to the listing of IEO and IDO, and finally to conduct research and analysis of high-quality projects by users themselves or based on DAO organizations, and recommend them, There are certain similarities. Information is transformed from centralization, passivity, and complexity to decentralization, initiative, and simplicity.

Based on this phenomenon, we considered the current status, distribution and future development of Web3 portals. Since the current definition of Web3 is not uniform, this article defines Web3 as: Web3 refers to the collection of decentralized applications running on the blockchain. These applications (DAPPs) allow anyone to participate without sacrificing personal data. Therefore, when we talk about the Web3 entrance, we will not limit it to "Crypto", but include all objects that can attract traffic to it, such as traditional Web2 platforms, centralized exchanges, Web2 games, etc.

first level title

3. Web3 entrance comparison

Before classifying Web3 entrances, we need to judge the purpose of users entering Web3, or what Web3 can bring to users:

Change the logic of existing applications: copyright confirmation, privacy ownership, asset ownership, behavior incentives

cryptocurrency investment

NFT investment

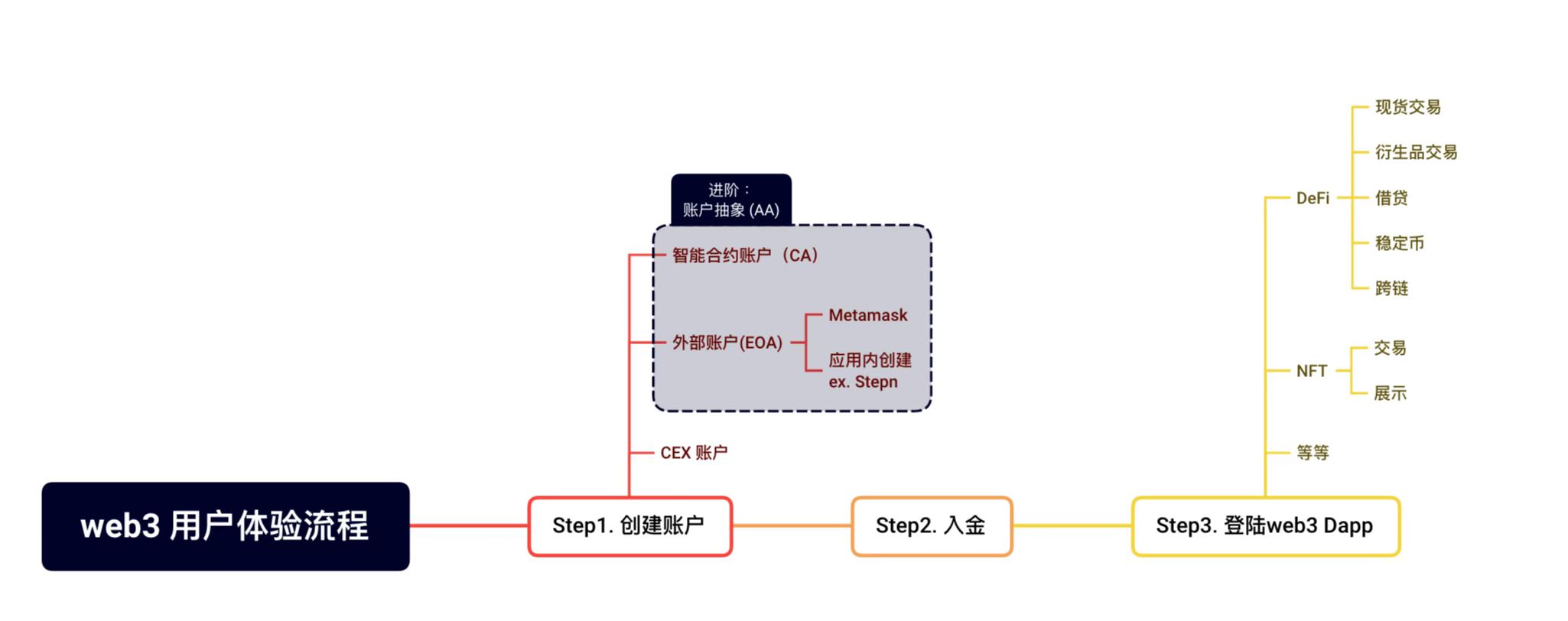

According to the functions of Web3 mentioned above, we have drawn the process of users entering Web3. Based on this process, we have defined two major categories of Web3 entrances:

1. Account system (deposit and withdrawal and fund management):Centralized exchanges, independent deposit and withdrawal projects, deposit and withdrawal aggregators, cryptocurrency ATMs, cryptocurrency bank cards and over-the-counter transactions (OTC); EOA, CA and MPC wallets, account abstraction (AA).

2. Web3 Dapp (Tools, Social and Entertainment):secondary title

account system

1. Money management

Fund management involves storing, sending and receiving crypto assets. Except for the early exchanges, wallets are the main entrance for users in the encryption industry, carrying user identities, assets and even reputation. Security is the first priority of the wallet, and the second priority is convenience. The core of the wallet is actually a public-private key manager, which is based on the private key generated by asymmetric encryption and other technologies, and has the user's absolute control over the wallet, address (public key), and assets. Therefore, how to manage private keys is a key technology for different wallet products. On top of this, how to do more expansion based on the wallet is another battlefield for different wallet products.

Currently, the main types of wallets are divided into custodial wallets and non-custodial wallets. Simply put, it is whether you control your wallet through the private key. Now the main escrow wallet is the exchange account, and the exchange takes care of the assets in the wallet for you. Non-custodial wallets are relatively diversified, including hardware wallets, address wallets (EOA), and smart contract wallets (CA). The EOA wallet is divided into plug-in wallet and mobile wallet according to the usage method. At the same time, there is another extension of EOA wallet, called multi-party secure computing wallet (MPC). And a new wallet concept, account abstraction (AA), upgrades the EOA wallet to have the function of smart contracts.

(1) Escrow wallet

"If you have a private key, you have a wallet" sounds very safe, but in fact, it is precisely because the private key/mnemonic is too important that the preservation of the private key/mnemonic is established as the threshold for users to use the wallet. The user experience of most existing wallets is far below the level of Web2. This is why CEX will become the first choice for most users entering Web3, because CEX allows users to remember the login password. But the flaws are also obvious. Once the exchange goes down, runs away or is hacked, the assets in CEX may also disappear. The Mt.Gox incident is a good example. In 2014, it announced that hackers had stolen 850,000 bitcoins and suspended user withdrawals, and then declared bankruptcy. In addition, since all funds in CEX are controlled by CEX, CEX can realize the transfer of funds by modifying the numbers (for example, the notorious data smashing), and even directly embezzle the funds in custody for value-added.

However, these shortcomings do not affect users to continue to use CEX, because through the exchange's own reputation endorsement, coupled with the ease of use of the exchange, and most users' needs are only secondary market transactions, so the current exchange still has the entire Web3 big Partial traffic. In December 2021, there were 295 million users in the encryption industry, while Binance, the world's largest exchange alone, had 120 million users, but Uniswap, the largest DEX that is also an exchange, only had about 3.9 million users. It can be seen that CEX has great advantages as a Web3 portal. In other words, most users choose to sacrifice security for convenience.

(2) Non-custodial wallet

Contrary to CEX, most wallets give up convenience for security, which leads to high barriers for users to enter Web3. Specifically, the hardware wallet is the safest, because only the hardware wallet and the password can call the assets in it; but correspondingly, it is more complicated. It must be carried with you, and once the hardware wallet is lost, the funds in it will also be lost.

The EOA wallet is relatively safe and convenient. Because the EOA wallet can be used based on web plug-ins or mobile software, users can access it more conveniently, but users still need to keep in mind and keep the private key well, but the EOA wallet provides another private key—mnemonic (12 English words converted from the private key). Once the private key/mnemonic phrase is lost, the wallet will no longer be safe, so while it is safe, it is also a risk. According to CertiK statistics, losses due to private key leaks have been at least 274 million U.S. dollars since 2022, and there are many professional market makers in the industry such as Wintermute.

Although there are new technologies now, based on the EOA wallet, the MPC wallet has been developed, and there is also a more scalable CA wallet to realize the so-called private key-free or low-threshold wallet, but the EOA wallet is still the current mainstream. Among them, Metamask (little fox) is the leader, with more than 80 million users in December 2021, and its monthly active users in March 2022 even exceeded 30 million. Although compared with Binance, it still pales in comparison, but in the current software wallet, the status of Little Fox is already unshakable.

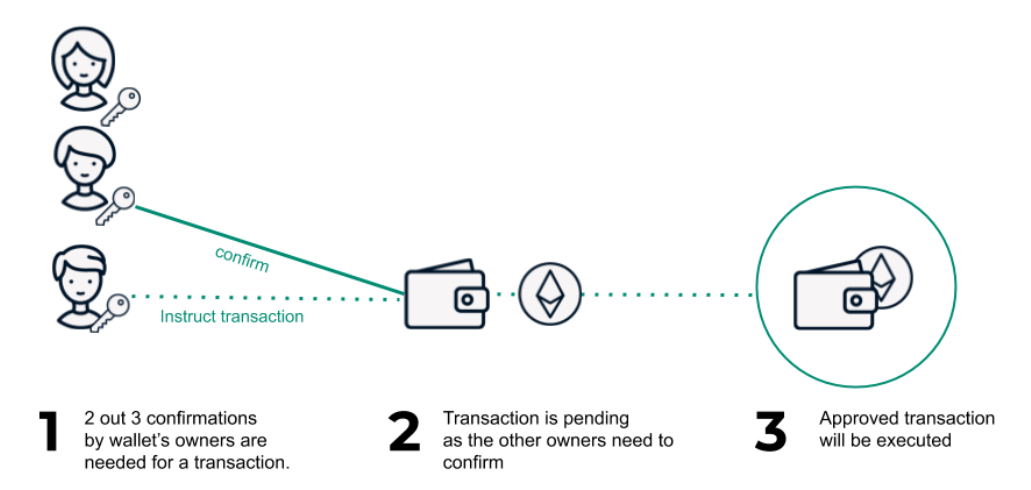

In the MPC wallet, multiple parties will each get part of the private key but not all of it. This is similar to a multi-signature wallet, where multiple parties must all sign to initiate a transaction. The MPC wallet disperses the private key in a chain decentralized manner, which increases the security of the wallet account. In addition, the MPC wallet can also perform the refresh function of key fragments: replace the original key fragments in everyone's hands with new key fragments to solve the problem of key loss. Users only need to match the corresponding email address or biometric verification information to retrieve their wallet assets. Compared with the current traditional wallet with cumbersome security operations, this latest solution undoubtedly increases the convenience of users and lowers the threshold for Web3 entry.

The emergence of account abstraction (AA) is likely to change the situation of the current wallet. Account abstraction combines EOA and smart contracts, and upgrades EOA wallets to smart contract wallets (CA) without changing the underlying structure of ETH, making EOA While greatly reducing the entry threshold, it also gives it unlimited scalability, realizing most of the functions of the current Web2 account. For example, payment of Gas fee, no private key, account social recovery, etc. Specifically, the smart contract wallet means that the wallet itself will be programmable, customizable and even modular, which will make the smart contract wallet have endless imagination. In the wallet with smart contracts, you can customize the security thresholds required for different amount transfers, the classification of operation permissions for different DAPPs, and a series of situations that can be realized by smart contracts, which will be closer to users. Current smart contract wallet examples: Argent (social recovery) Gnosis Safe (multi-signature) A3S (wallet transferability).

2. Deposit and withdrawal

2. Deposit and withdrawal

The key factors of the deposit and withdrawal project include: identity verification, deposit from legal currency to cryptocurrency, and withdrawal from cryptocurrency to legal currency.

Users who usually trade more than a few hundred dollars per month need KYC. KYC requires identification documents (ID card, passport or driver's license), proof of residence and facial recognition, etc. Most compliant exchanges will require users to perform KYC to deposit and withdraw funds, but not all exchanges require this. However, independent deposit and withdrawal projects, deposit and withdrawal aggregators, and encrypted currency ATMs are more decentralized and free. However, centralized exchanges and large OTC platforms support relatively more types of fiat currency, because they have more legal and technical resources.

As far as deposit and withdrawal methods are concerned, they are limited to wire transfers, ACH transfers, debit/credit cards and third-party payments (such as Google or Apple). However, some exchanges, such as FTX, support the exchange of cryptocurrencies within the platform into legal tender, and transfer them to the receiving account through wire transfer. This brings great convenience to users, and at the same time avoids the possibility of receiving black money on OTC or decentralized platforms.

However, there are frictions in the process of exchanging legal currency and cryptocurrency, such as exchange rate fees, distributor bonuses, blockchain network fees, etc. Generally speaking, the fewer levels of distributors, the smaller the friction, so in terms of friction loss, CEX=OTC<independent project<aggregator.

Centralized exchanges are the most commonly used legal currency deposit and withdrawal platforms. They generally have remittance licenses in most countries around the world, support the most types of legal currency and encrypted currency, and have the lowest rates. However, CEXs can provide cryptocurrency payment services to realize another form of withdrawal. For example, Binance Pay of Binance can be used to book hotels, purchase shopping cards, etc. And CEX itself has a large number of secondary trading users, so it is less difficult to convert them into deposit and withdrawal customers.

Independent deposit and withdrawal projects (such as Moonpay, Transak, Wyre) operate like small exchanges, but most of them only provide fiat currency deposit and withdrawal services. Their interactive interface is simple and easy to use, and the user learning cost is low, but these projects will have distribution bonuses.

Deposit and withdrawal aggregators (such as TransitSwap, KyberSwap, and MetaMask’s fiat currency deposit services) as the name implies, aggregate various independent deposit and withdrawal projects and CEX to achieve the optimal exchange rate and charge commissions from them. But the most important thing is that they can introduce functions such as DEX, liquid pledge and NFT market to realize one-stop deposit and withdrawal and Swap/Staking services.

secondary title

Web3 Dapp:

1. Tools

The potential of tool applications as Web3 traffic portals should be the largest among the three sectors. Tool application is not only based on Web2 improvement, but also cross-age innovation. Like DeBox (social payment platform), Monaco (instant social media), and Skiff (collaborative work platform), in essence, add Token economy on the basis of Web2 applications, and realize privacy, transparency, and go Trusted, so they are all dubbed"Web3 xx"The titles of Web3 WeChat, Web3 Weibo, Web3 Google Docs, in other words, they did not provide a motivation for users to abandon the current Web2 and completely turn to Web3, but to motivate users to use it for a short time through Token. Therefore, we will focus on the role of DEX, NFT and copyright trading platforms as Web3 entrances in the following article.

(1)DEX

DEX DAPP plays a vital role in the process of users entering Web3. In the past, users needed to go to CEX when switching between different assets, because the depth of the order book exchange on the chain was far less than that of CEX. When AMM DEX appeared, the role of market maker was removed, and the depth of transactions on the chain was greatly improved, and the birth of liquidity mining further optimized the trading experience of AMM DEX. The existence of DEX allows users imported by other DAPPs to directly convert the obtained tokens into stable coins such as USDT and USDC on the chain to lock in profits.

But the problem with AMM DEX is that there is no market maker. When the depth of an LP pool is insufficient, or when users make large transactions, it will cause huge slippage. Take the cUSDC incident that occurred on September 28 as an example: a user sold 1.5 million U of cUSDC on UniswapV2, but because cUSDC basically had no liquidity, it only sold about 520 U.

(2)NFT Marketplace

NFT (Non-fungible Token), as a new asset form based on the blockchain, is a good traffic entry for Web3. Beeple's Everydays: The First 5000 Days was sold at a sky-high price of $69m, which made people realize the value of digital assets, and also gave birth to a large number of NFT-related projects, such as Sandbox and Decentraland representing the metaverse plate, BAYC and CryptoPunks The PFP plate represented, as well as the NBA Top Shot. Later, some copyright NFTs such as IP copyright, patent copyright, and music copyright appeared to help creators confirm their rights.

NFT is the most easily understood form of encrypted assets for the public. The value of paintings is not only on the canvas, but the art itself, so digital paintings also have their value. Compared with traditional paintings, NFT is more sharable and can well satisfy users' show-off psychology. Therefore, PFP-like NFTs came into being, and CryptoPunks, as a representative of Crypto OG, allows those who own it to automatically obtain the title of Crypto Native. BAYC hopes to create a club that breaks the gap between mainstream culture and Web3. It has also become a symbol of reputation and identity because of the participation of stars or well-known organizations such as Curry, Jay Chou, JJ Lin, and even China's Lining. Different from PFP, Sandbox and Decentraland are recognized by major international companies buying their land at a high price to enter the metaverse. The land can be used as a brand display platform to attract customers for the company. On the contrary, its inherent customers will also understand Web3. with the Metaverse. Similarly, NBA Top Shot also introduces the original NBA audience into Web3 through NFT, and then uses the wealth creation effect to attract more people to enter, achieving a further increase in price and reputation. Similarly, copyright-type NFT imports the audience in the creator's field to Web3 through the addition of creators. While giving creators more sources of income, it is convenient for investors or fans to invest or collect copyrights of works.

As the core place for NFT value-added, NFT Marketplace, such as Opensea, Rarible, SuperRare, just like DEX to most DAPPs, gives users the possibility to make profits on NFT, and guides users to do more interactive behaviors on Web3. Based on it, the derived NFT lending platform, NFT fragmentation platform, and NFT transaction aggregator all serve as tools to assist users to enter Web3.

2. Socialize

Domain names and DeSoc under the concept of DID are typical entrances in Web3 applications. Similar to traditional DNS domain names and social media, they can directly carry and convert user traffic, and use "pretty names" and "information" as tools to acquire users. The global domain name registration market size in 2020 is 374 million, and according to the Messari research report, the number of ENS (Ethereum Domain Name Service) registrations reached a record high of 1.12 million in the third quarter. And when we compare the number of users of Medium and Mirror, we can also find that Medium has 25 million monthly visits, while Mirror has only 2.1 million. It can be seen that, as the entrance of Web3.0, domain names and DeSoc have more than 10 times the potential.

(1) Domain name

Web3 domain names convert complex addresses (such as Vitalik Buterin address: 0xAb5801a7D398351b8bE11C439e05C5B3259aeC9B) into readable characters (Vitalik.eth), which greatly reduces the operating threshold of addresses as interactive objects in the process of recognition and input, and the meaning of readable characters to users Addresses can be given additional value (eg year of birth, name, brand name, etc.). The current domain name is still in the early stages of its ecology, and the address can only be simply replaced with short characters, but we can still see users who change their Twitter name to xx.eth, breaking the identity barrier between Web2 and Web3. "xx.eth" means all the on-chain data associated with this address in the ETH ecosystem, in other words, it records the "lifetime" of this address, and when it is applied to the Web2 world, it is equivalent to putting it in the Web3 world All interactions are brought in, and Web2 users can locate the same "person" based on this name.

With the development of domain names, in addition to .eth, .ether and domain names based on other public chains have appeared, such as .bnb of BSC, .apt of Aptos, .evmos of Evmos, and issued by companies focusing on multi-chain domain names domain names, such as .bit of DAS, .nft, .crypto, .dao of Unstoppable Domains, etc. And Twitterscan is also expanding the relevance of domain names and Twitter. But in terms of practicality and recognition, currently .eth is still unmatched, because the user volume and capital volume of ETH still occupy a dominant position. Other domain names are mostly expected to temporarily attract users through airdrops, and cannot retain users for a long time.

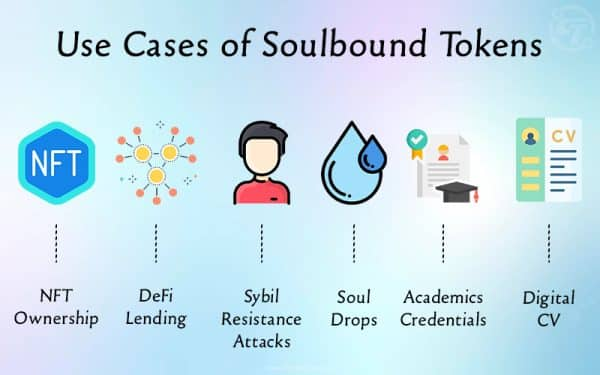

(2)DeSoc

In May 2022, Ethereum founder Vitalik Buterin, economist Glen Weyl, and Flashbots researcher Puja Ohlhaver jointly published the article "Decentralized Society: Finding the Soul of Web3". As a result, the term DeSoc became very popular. The DeSoc in this article was established on the basis of Soulbound Token (SBT). In essence, it wanted to use the non-tradability and DID of SBT to construct a decentralized society with credibility. . At present, the mainstream applications of Web3 are still concentrated in the financial field, such as increasing capital utilization, faster and safer transactions, and more complex derivatives. DeSoc, on the other hand, can change the current over-financialized state of Web3 and take us to a "more transformative, pluralistic, socially distanced, increasing-return future."

Taking the current popular DAPP as an example, Galxe and Quest3 are task platform applications that convert the needs of the project party into a series of tasks and issue corresponding SBT as proof, and users can obtain SBT by completing tasks and wait for the airdrop of the project party later . Some of these tasks only require users to interact on Web2, such as Twitter, Discord, and Telegram, which can absorb a large number of Web2 users into Web3 through the money-making effect.

Another intuitive case should be Binance’s SBT—BAB, which uses BAB to import user traffic that has passed KYC into BSC, and retains users with the help of airdrops for BAB, while developing projects based on BAB, such as Lifeform. cc, which requires users to have BAB to claim the character token LBT of their games.

3. Entertainment

Entertainment Web3 applications are an important part of the industry. Among such APPs or DAPPs, GameFi is the most important category. Compared with other Web3 portals, GameFi has a natural advantage, that is, it can support a large number of users within a certain period of time. Has a huge appeal, including a large number of traditional Web2 users. In today's mainstream GameFi games, there are many mature classic games in the Web2 era that have undergone Web3 chain reform, which means that GameFi is born with excellent ability to break the circle.

GameFi, which became popular last year because of the attention of Axie Infinity, has become one of the most important tracks in the Web3 field. At present, the number of active players on the chain has been maintained at around one million for a long time, and GameFi is concentrated on the three public chains of BSC ETH POLYGON. And the concept of "X to earn" derived from this, taking StepN, a creative outdoor Web3 game invested by Binance, which has become popular this year, as an example, also represents the latest entertainment trend in the Web3 field. In addition, there are still many types of entertainment apps or DAPPs, such as imitation short video apps, dating software, etc. All the above-mentioned new generation Web3 applications are mainly oriented towards user profit, supplemented by game play, and have a strong ability to break the circle. This main type of application means that GameFi in the Web3 era has more mature gameplay and traffic attraction than other portals.

secondary title

Thoughts on Web3 applications:

As mentioned at the beginning of this article, we currently divide the application portals of Web3 into two categories: account system and DAPP. These two types of entrances have their own advantages and disadvantages: for account system entrances, this entry method is more like a face-to-point process. Users first deposit funds through the centralized account system path, create One's own account system, and then radiated from the account system (such as exchanges, wallets, etc.) to peers (Web3 applications such as DAPP), which is a more traditional traffic entry method at present. Due to the maturity of this type of entrance, the deposit system is relatively complete and convenient, and users can have sufficient choice and freedom. The disadvantage is that it is relatively single and one-sided in terms of attracting traffic categories, and it is impossible to target different groups of people. Different policy configurations. For the Web3 DAPP type entrance, this is more like a point-to-surface radiation. The traffic often enters through the point (Web3 DAPP), and then enters the larger Web3 ecology. This method can give full play to the subjective aspects of different types of DAPP. Advantages, attracting their respective target traffic, such as some specific NFT Marketplace and the once popular Axie Infinity, all attract a large amount of traffic outside the circle through the influence of DAPP itself.

first level title

4. Prospects for the future entrance of Web3

Although StepN, the representative project of this year's traffic explosion, has temporarily shelved a series of plans due to the general reasons behind the operation and the general environment, but in the current development stage of the Web3 industry, with the eye-catching ability and the popularity of the industry's explosive applications. From the perspective of traffic aggregation capabilities, it has created conditions for them to create their own independent entrances with huge traffic in a short period of time. After achieving phased success, they are not satisfied with the opening of the game market, but want to use the traffic portals to develop Launchpad, DEX and even more DAPPs have a series of metaverse images around the Stepn ecology. I have to say that this is a very imaginative move. The author believes that this is also the way for many entrepreneurs who are not satisfied with Web3 APPs or DAPPs to rise. StepN’s imitation of the wallet’s development path has at least opened up an idea, that is, it hopes to use its peak traffic to develop the ecology and retain traffic. Such a move makes Web3 entrepreneurs realize that such a path is not limited to wallets. APP Developers of DAPP and even various traffic captures in the future can try this way. Recently, MOOAR, a new NFT trading platform under the parent company Find Satoshi Lab of StepN, will also be launched soon. Although the project failed to fully adopt the original idea as expected, StepN has at least set an example.

We believe that the reason why the traffic of such short-term explosive apps can escape the gravity of exchanges and wallets, and obtain independent traffic is only in stages, that is to say, the industry’s bonus period is limited. This is true for both users and entrepreneurs. We believe that this is only caused by the immature or unbalanced ecological development in the Web3 field. When the industry matures, this phenomenon will gradually disappear, and valuable traffic resources will be concentrated in a few Several leading leading applications. It's like during the period of rapid Internet development, both the application end and the traffic entrance can be flourishing, but in today's mature industry, most services and even functions have converged into a few leading apps, and small and medium-sized applications will either die or be eliminated. Integration is not just the result of capital operation. We believe that the most fundamental reason is that this is in line with human nature. As users, we cannot enter through complicated and complicated entrances for a long time. Traffic will always tend to facilitate and one-stop integrated entrances , this may be the inevitable result of the demand on the product side. Web3 era applications that focus on the concept of decentralization may be able to decentralize the backend, but the frontend still cannot escape the gravity of user habits, and user habits are difficult to decentralize. .

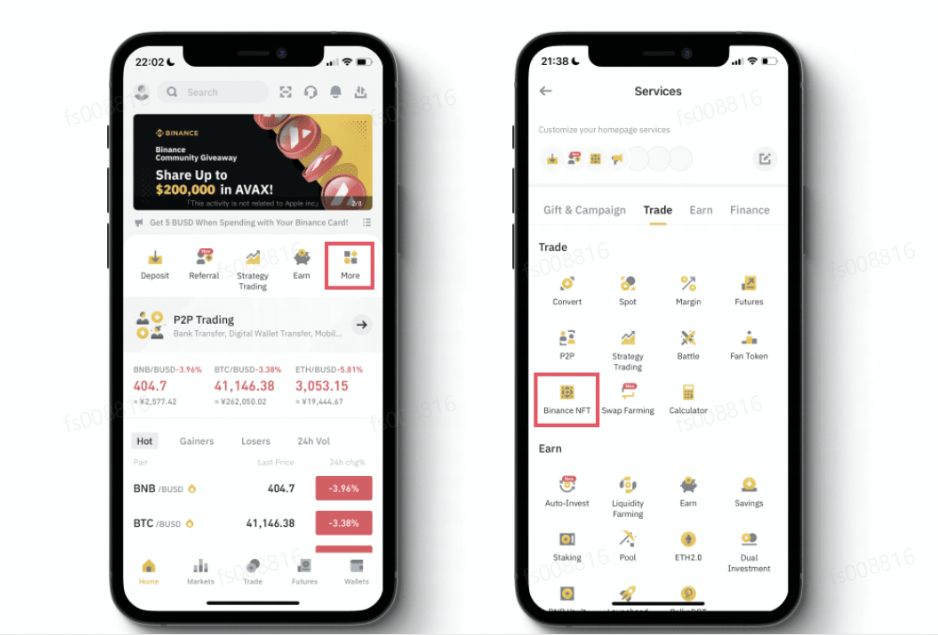

Therefore, we believe that in this situation, the future Web3 traffic portals, whether they choose the account system or the Web3 DAPP method, should still be concentrated in a small number, and should conform to the form of radiation from the surface to the point. Specifically, judging from the current situation, exchanges and wallets are currently the most powerful and most likely to achieve this successful ending. If CEX and wallets can grasp the current golden period of traffic and develop a platform that adapts to user habits And the entrance of the use environment should be able to greatly improve its dominance in terms of traffic. For example, the drop-down applet interface in the main interface of the Binance exchange that integrates various APP and DAPP entrances. In my opinion, this is a very worth learning. try.

We believe that the concentration of traffic entrances on a few leading applications is the most likely industry model in the mature stage of the industry in the future (currently, the entrances of exchanges and wallets are the closest to this point), and this traffic grabbing method does not violate the principles of Web3 Decentralization and respect for individual users, because their backend is still built on top of the entire decentralized approach. Based on the spirit of decentralization, it is worth thinking about whether there are better and better solutions for traffic entry in the future that can optimize this centralized traffic entry method.

In addition, Musk has recently completed the acquisition of Twitter. As the world's largest Web2 social network and a huge portal that carries the entire Internet traffic, it is worth looking forward to the reform of Twitter's Web3 method. Musk may target Twitter. It is worth pondering whether such a huge Web2 and traditional Internet behemoth will carry out Web3 reform, in what way, to what extent, and what kind of far-reaching impact these will have on the traffic entrance. Yes, assuming that Twitter can carry out decentralized reforms or be compatible with a large number of Web3 industry applications, it may break the current pattern of all Web3 traffic distribution. We believe this must be an epoch-making event, let us wait and see.

Reference:

Reddit NFT: Dissecting the Web2 to Web3 Mass Adoption Curve

Total OpenSea traders over time (Ethereum)

The first stop of Web3's entry into the pit, an inventory of the business model of deposit and withdrawal of encrypted currency and fiat currency

MPC-based wallet without private key, the "breakout" of Web3 entrance

Low barrier to entry wallets - necessary tools for mass adoption of Web3 applications

An overview of the Ethereum blockchain account abstraction and its potential use cases

From DNS to ENS, the Web3 Era of Domain Names

Take you to understand the decentralized society (DeSoc)

A&T View: The most comprehensive GameFi upstream and downstream development status and prospects in history (Part 1)

A brief history of NFT: the shining moment of NFT stars spanning six decades