Outlier Ventures: Discuss in detail the advantages and disadvantages of the ve token model and ideas for improvement

![]() Original compilation: aididiaojp.eth, Foresight News

Original compilation: aididiaojp.eth, Foresight News

Original compilation: aididiaojp.eth, Foresight News

What is voting escrow?

Voting escrow is proposed by Curve Finance. Token holders lock their governance tokens for a predetermined period of time and receive voting escrow tokens in return. For example, CRV token holders can lock CRV for a period of time And get veCRV. Token holders can choose a lockup period ranging from 1 week to 4 years. The longer you lock your tokens, the more voting power you get as a reward. During the lockup period, locked tokens lose liquidity and cannot be sold. Locked tokens are released linearly during the lockup period until the escrow tokens are reduced to 0 at the end of the lockup period. To extend their lockup period indefinitely, users can periodically relock released tokens with maximum rewards and governance rights.

In addition to locking tokens and voting on proposals, veToken holders can also receive additional benefits, such as on Curve:

Choose a staking pool with a high CRV release (up to 2.5x).

Get a portion of the protocol fee paid by 3crv (proportional to a percentage of all veCRV).

Weekly votes determine the direction of CRV release (generating profitable income).

Vote on governance proposals.

Basically, stakers lock up their tokens for up to 4 years in return for corresponding voting weight, protocol fees, and other benefits.

How does this benefit the protocol?

For the protocol, the benefit is that the participants who have locked their tokens for the longest time are usually the most loyal supporters of the protocol, and they will pay attention to the long-term development of the protocol. These token holders are willing to convert their capital into illiquid positions in order to gain governance rights over the protocol to improve governance, which means they are more willing to make informed and long-term development decisions.

The reduction in circulating supply also makes the ve token a self-fulfilling superior token design. When a protocol moves to a ve token design, and starts distributing protocol rewards or accepting incentive votes, it usually attracts market attention, resulting in a reduction in supply and an increase in the price of locked tokens. Liquidity is thus reduced, theoretically making price increases more aggressive. Rising token prices combined with more focus on the protocol can help build communities and differentiate them from competitors.

Disadvantages of the ve token model:

There are certainly advantages to the voting escrow model, which is designed to reward long-term holders with a majority of governance rights and passive income from protocol rewards. Locking tokens reduces sell pressure on protocol tokens and creates a loyal base of supporters. While the ve token design is a step in the right direction, the influx of liquid derivatives and meta-governance protocols built on top of them is troubling. A significant risk is that over time voting power becomes more concentrated and passive income is taken away from those long-term locked-in loyal participants.

ve and the "meta-governance monster"

The following will use the Curve ecosystem as an example, but the weakness of the voting escrow design and the "meta governance monster" theoretically appear in all ve tokens.

Due to the hyper-inflationary nature of the CRV token design, the voting escrow model is an integral part of the Curve ecosystem. Directing CRV release to a specific metric to facilitate deep liquidity in these staking pools is a genius concept that allows the protocol to incentivize veCRV holders to vote.

In order to capture as many governance tokens as possible and lock them permanently, meta-governance protocols such as Convex build the protocol on top of the underlying ve protocol. This keeps the supply of governance tokens low and reduces sell pressure, but leaves most of the governance power of the underlying veDAO held by the meta-governance protocol. As is the case with Convex, it has a much shorter lockup period on its own protocol governance token, vlCVX. This means that long-term incentives are gone, as vlCVX holders with all governance rights now only have 16 weeks to choose from.

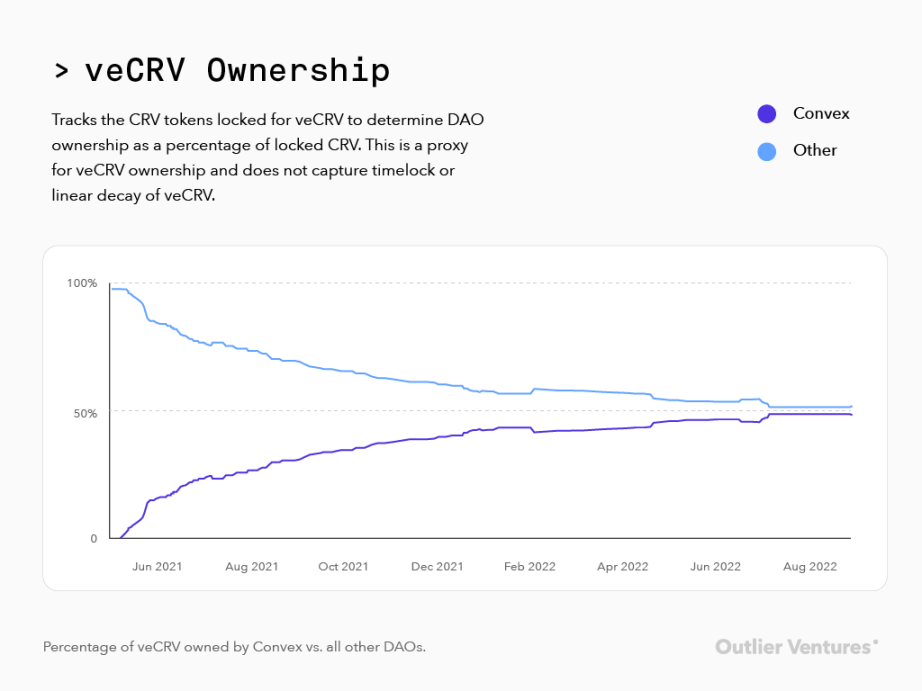

Figure 1: Percentage of veCRV owned by Convex vs. all other DAOs (as of 10/17/22).

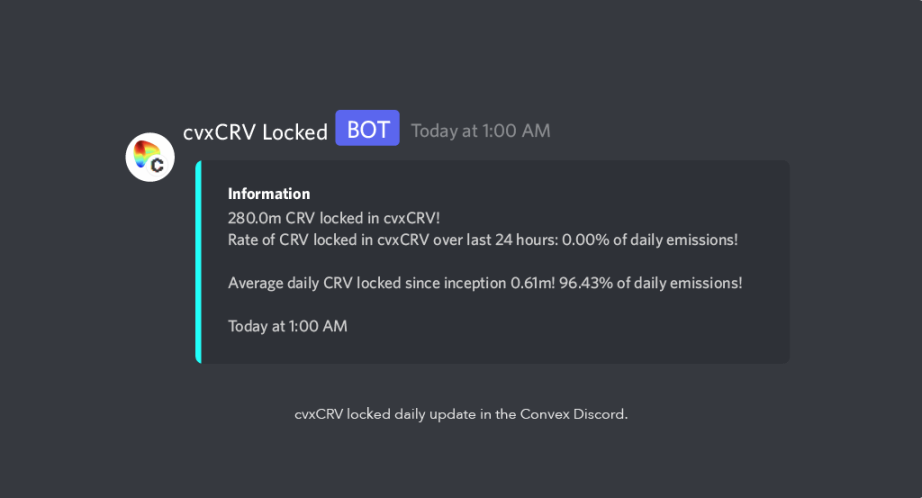

Figure 2: CVxCRV locked daily updates (as of 10/17/22) in Convex Discord.

Figure 1 shows that since the inception of Convex, the amount of CRV that has been accumulated and permanently locked has reached 50% of all locked veCRV and is still rising rapidly. According to the cvxCRV locking bot record in the Convex Discord, an average of 86.71% of new CRV releases per day have been locked into the Convex protocol since its inception.

Permanently deposit CRV into Convex in exchange for cvxCRV, and you can get rewards similar to directly using Curve to lock CRV for 4 years. Convex allows holders to speculate on prices, receive the same rewards (excluding bribery rewards), and have liquid positions. The only risk that exists here is the cvxCRV/CRV peg, vlCVX holders may trade governance rights for liquid positions.

This resulted in the majority of governance being taken away from individual veCRV staking pools that had been locked for up to 4 years, and into the hands of vote-locked CVX (vlCVX) holders who had been locked for up to 16 weeks, ultimately resulting in the same The result was the opposite.

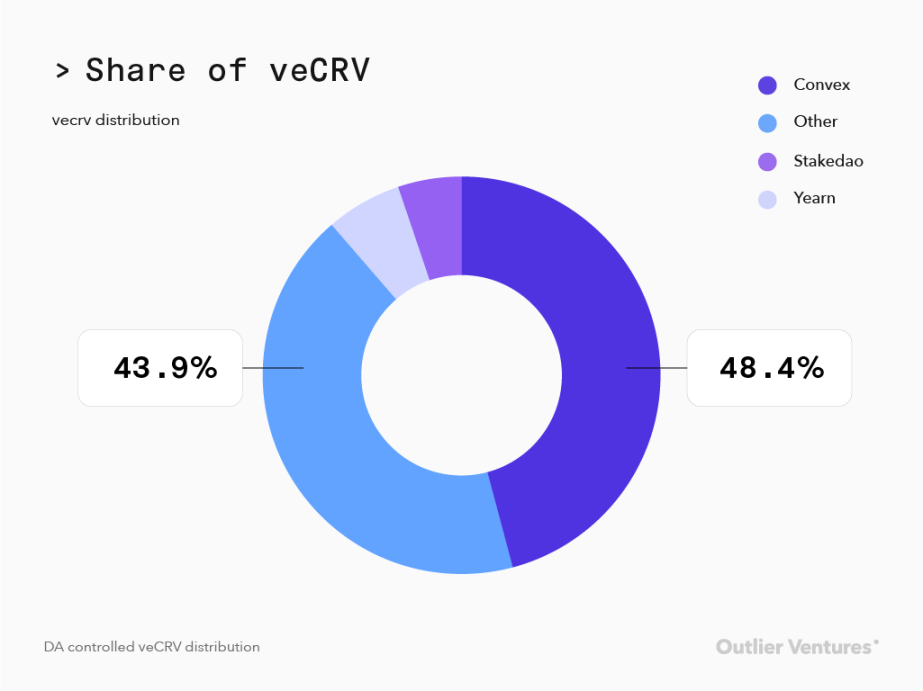

Figure 3: DAO Controlled veCRV Distribution (as of 10/17/22)

As DAOs like Convex accumulate all CRV, their voting weight increases; if the ratio of veCRV controlled by 1 vlCVX grants buyers more governance rights than purchasing that CRV and locking it, this in turn can make Agreement to purchase CVX rather than CRV is more cost-effective. This proportion of governance power also goes to those DAOs who are currently bribing veCRV and vlCVX holders to vote. Once-diluted ve holders miss out on bribe revenue, because every time someone locks another CRV to Convex, their voting power is reduced.

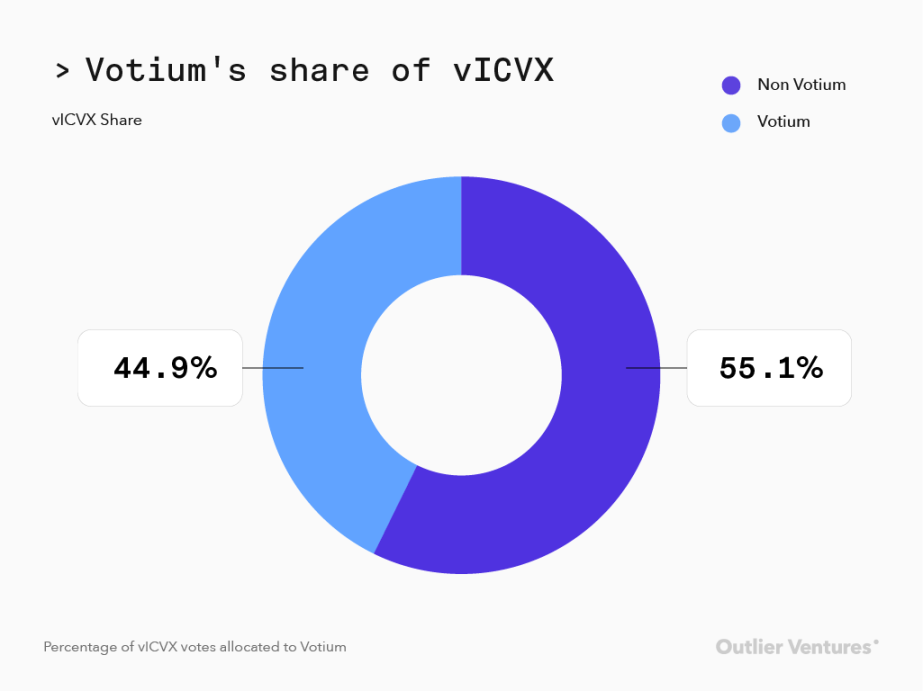

Although they have more and more veCRV governance rights, vlCVX holders are not overly concerned about the direction of CRV release. As shown in Figure 4, 55.0% has been delegated to the Votium protocol built on top of Convex, which aims to maximize voting incentives by distributing voting incentives in a way that earns the most revenue, rather than choosing to allocate directly to specific staking pools.

Figure 4: Percentage of vlCVX votes allocated to Votium (as of 10/17/22)

Complicating matters is that we now have liquid wrappers of meta-governance tokens like vlCVX, and Pirex shows that nearly 1.5 million CVX have accumulated since June (as shown in Figure 5), suggesting that a 16-week lockup is essential for those who want to Too long for someone who wants passive income and wants a liquid position.

Figure 5: Amount of CVX deposited into Pirex + TVL of Pirex (as of 10/17/22)

The net result is that ves are less loyal to long-term holders, not more built on top of the protocol, thereby capturing value through shorter lockups.

This results in the dilution of voting power at an increasing rate for those who initially contributed to the development of the project, unless they continue to lock up emissions equivalent to the percentage of tokens they originally owned. These people can exit the 16-week lock-up period at any time, or hold liquidity-wrapped derivative positions. This allows liquid meta-governance token holders to sell tokens when the price rises and drives down the expected price of community members who are locked and unable to exit positions. As prices fall and transaction volume dries up, distributed rewards can also be significantly reduced, making reward returns less attractive for some staking pools,

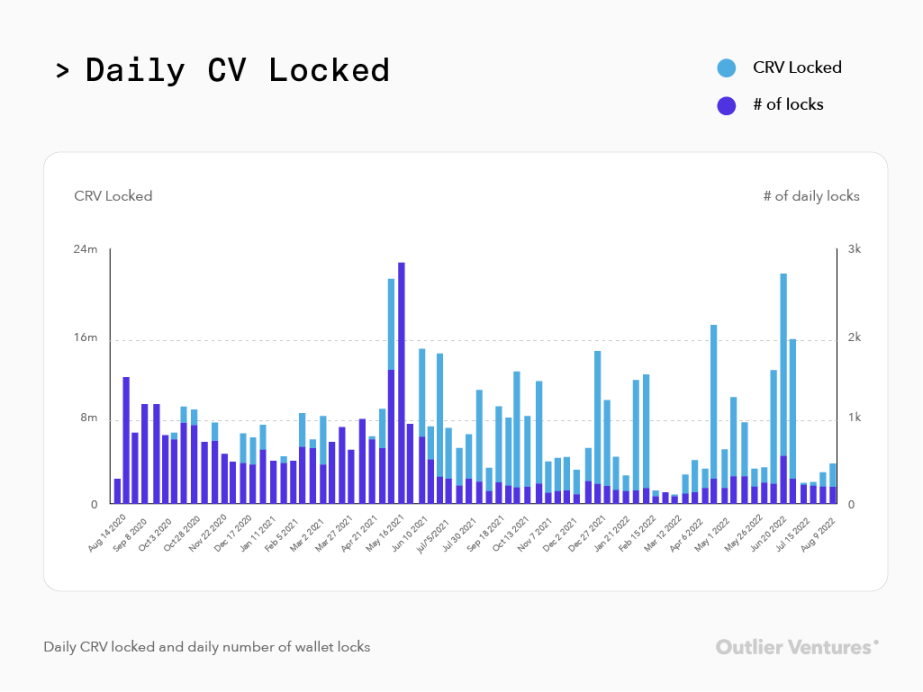

Nobody knows if a protocol will still exist 4 years from now, let alone a temporarily dominant infrastructure. Requiring a 4-year lock-up to maximize yield makes ve tokens very unattractive for investors. As shown in Figure 6 below, Convex daily locks have decreased significantly since mid-2021, which coincides with its launch.

Figure 6: Daily CRV Locked and Wallet Daily Locked Volume (as of 10/17/22)

As times got tough and we entered the toughest part of the cycle, staking pools just wanted a way out. The voting participation rate of token holders is decreasing, they are not interested in re-locking because they just want to redeem as much capital as possible, and new investors are not interested in buying and locking. Governance participation by community members is also low in the communities most in need of leadership.

The need for meta-governance

Voting Escrow Tokens are designed with the goal of maximizing the incentives for long-term staking and building a loyal community to help manage the long-term development of the protocol. As we saw above, allowing them to lock but not allowing them to leave may not be as successful as initially thought. All of this is centered around incentives, and the result is that governance power is extracted from early base protocol staking pools and given to those who prioritize rewards over long-term governance. Protocols like Convex don't make any infrastructure changes to how protocols like Curve operate, their entire business model is to accumulate governance power for themselves and rent it out to the highest bidder.

The original ve model is obsolete

While this idea is primarily focused on the Curve and Convex ecosystems, it is more important for protocols that do not share Curve's release schedule, measure votes, and quality products to consider whether the current version of the vote escrow design is right for them. Implementing voting escrow tokenomics on a protocol that is trying to move away from past token design mistakes can pose even greater risks.

As we look at the growth period from 2020 to 2021, voting escrow should work well for long-term incentives. However, when a bear market comes, every staking pool is at risk of redemption. As liquidity dries up, so does trading volume and protocol revenue, causing staking pools to earn far less than they would have earned in better markets. The loss of governance rights and rewards leads to a loss of confidence for those committed to governance projects, and governance participation will suffer when it is most needed.

Original link