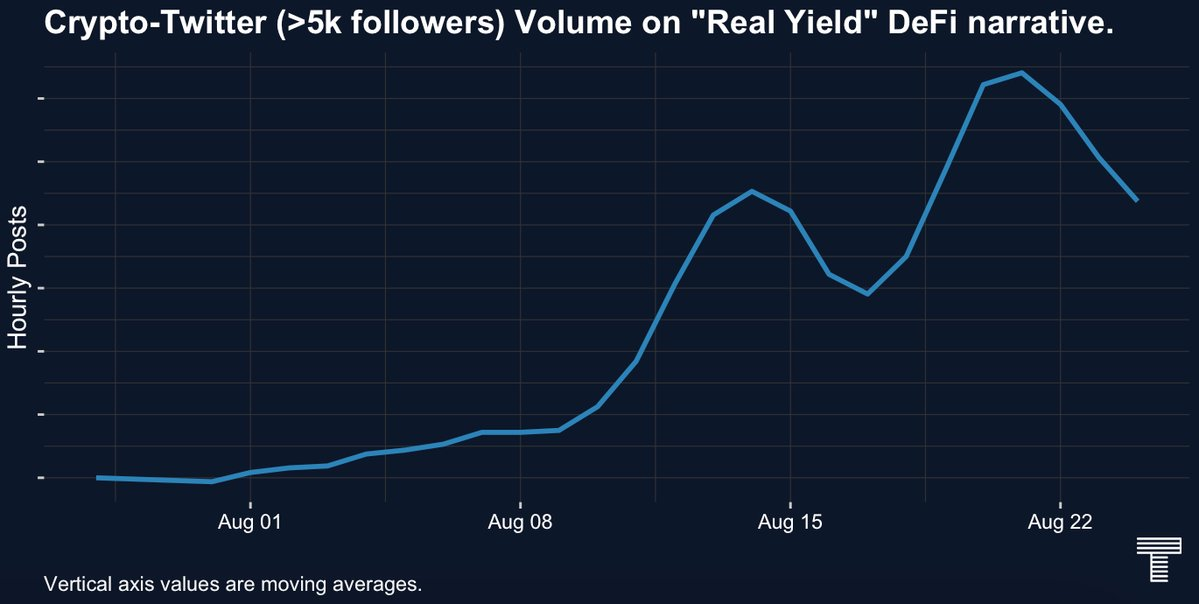

Since August, the discussion of Real Yield among KOLs on Twitter has intensified. The genesis and explosion of this discussion coincides with GMX's stellar performance in a bear market.

Real yield is the same as what it literally expresses, which DeFi protocols can generate real benefits and feed back such benefits to users; from another perspective, the protocol no longer simply uses its own tokens to motivate Liquidity mining, but giving users stable coins or mainstream tokens, such as ETH, USDT, etc.

Terra crashed, Celsius Network and Voyager Digital filed for bankruptcy, and Three Arrows Capital collapsed. These shocks have cast a shadow over the hearts of former DeFi fanatics, and the argument that "DeFi is dead" is endless. Against such a background, the emergence of the Real Yield narrative is very simple and powerful. It is not only the good expectation of DeFi users, but also symbolizes the struggle of DeFi projects against Ponzi schemes, pursuing sustainable project returns and returning them to users.

But any hotly debated narrative requires repeated scrutiny and consideration. This article hopes to examine the rationality of Real Yield calculations from three aspects, and the significance of the emergence of Real Yield from a narrative perspective:

Conceptualization of Real Yield

How Real Yield is calculated

Discussion on the meaning of Real Yield

I. Conceptualization of Real Yield

In the current definition of Real Yield, it mainly focuses on two issues:

1) Is the net revenue of the agreement positive?

2) If the net income is positive, will the protocol distribute it to token holders? More importantly, in what form is the protocol distributed, the additional tokens issued by the protocol, or mainstream tokens such as stable coins and ETH?

The dividing points of the definition are:

1) The net revenue of the Real Yield protocol is positive;

2) The Real Yield protocol distributes the proceeds to token holders in the form of mainstream tokens.

Taking these two standards as a starting point, we will re-evaluate whether the current mainstream DeFi protocols can generate Real Yield, and we will see what is worth exploring.

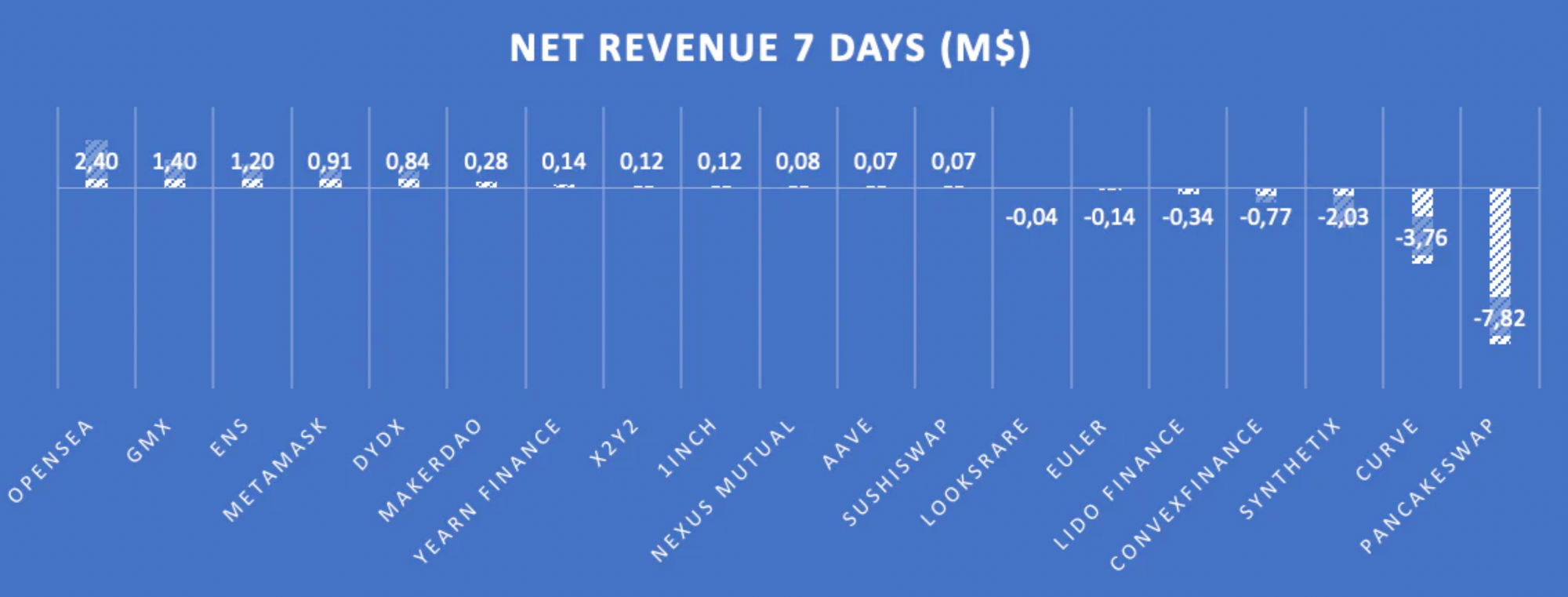

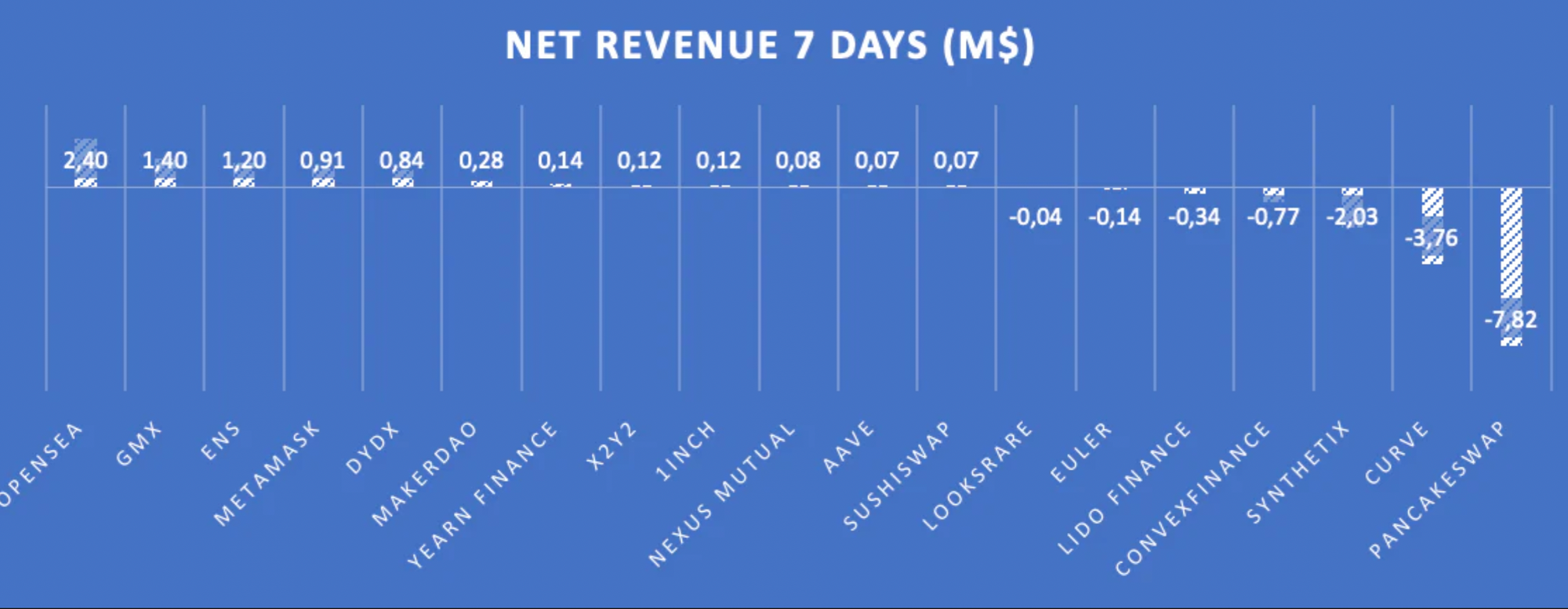

Most protocols fail to achieve positive returns

In a study on Real Yield by defiman, 12 of the 19 agreements have positive net income, but only 4 of the 12 agreements have positive net income. The 19 TOP agreements have a total weekly net income of -$73 million. This is the case in the top-ranked protocols, but for emerging DeFi protocols, it is even more difficult to achieve positive returns.

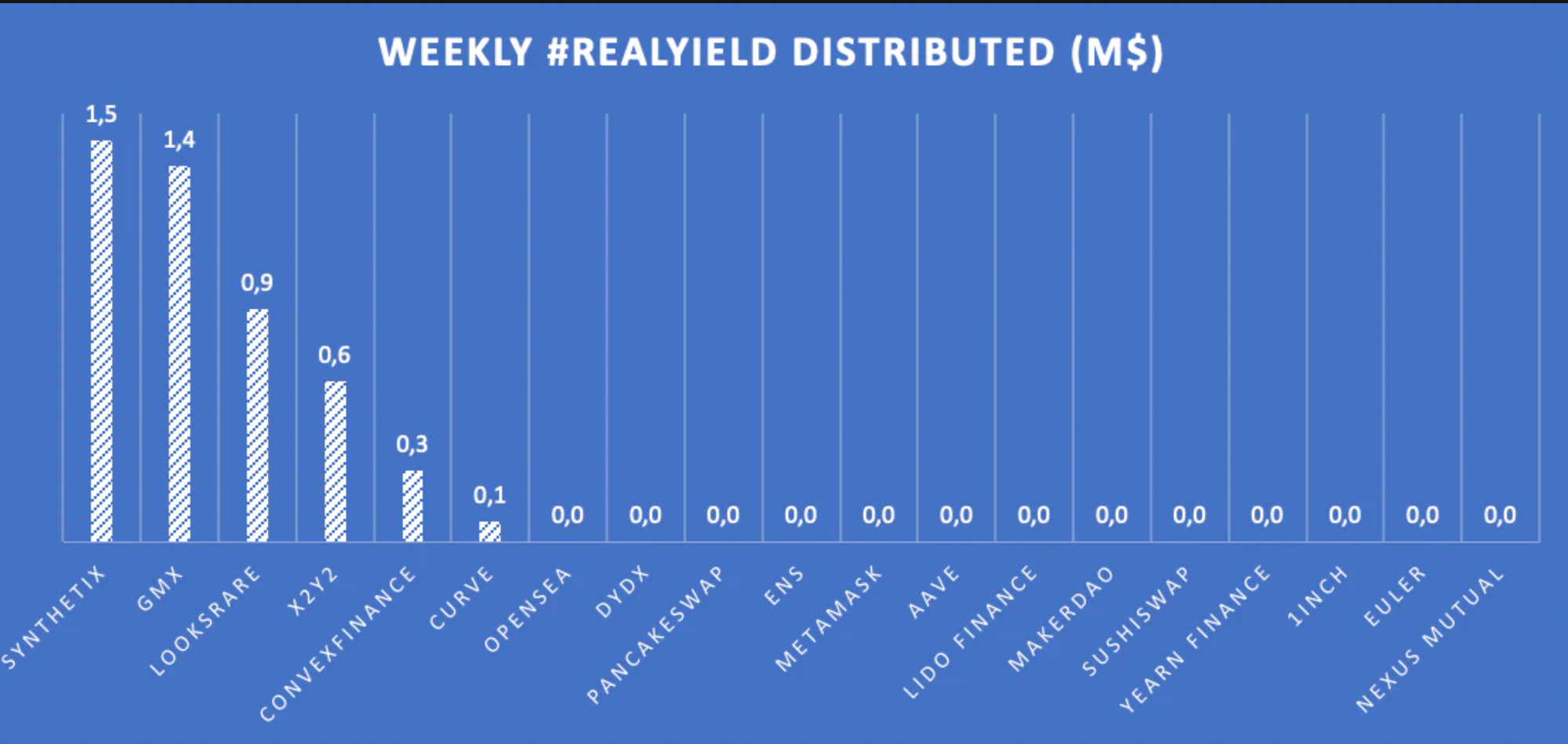

2. It is a minority protocol that distributes the net proceeds to token holders

Also, in this research article, we can see that only 6 of the 19 top protocols actually distribute the main rewards to token holders, the amount distributed by each protocol is shown below, Synthetix and GMX etc. Perpetual Protocol is currently leading the pack, followed by NFT marketplaces like LooksRare and X2Y2.

3. Do you have to use mainstream tokens (or sound money) to distribute

What form of tokens to distribute to users is a point of debate in the concept of Real Yield.

The current situation is: 11 of the 19 TOP protocols are using their own tokens for incentives. 2 of the 8 non-incentivized protocols do not yet have tokens (Opensea and MM).

In a bear market, users pay more attention to the income of real gold and silver, so they prefer to pay in the form of ETH or stable currency, but if we think about it from another angle, if it is in a bull market, users may prefer the native token of the protocol, because native tokens are also Can capture a greater value imagination space.

4. The distribution of real income and the sustainable distribution of real income, the two concepts need to be treated differently

image description

Synthetix rewards SNX stakers with two revenue streams: 51.6% SNX inflation yield and 5.89% sUSD transaction fees

Conceptually, the definition of Real Yield can start from the two issues of income and distribution, but we can also see that there is something worth discussing behind this definition. Similarly, in terms of specific calculations, there are also some ambiguous factors, which we will discuss in the next section in the form of formulas.

II. How Real Yield is calculated

Most definitions of Real Yield can be summarized as Real Yield = Protocol Revenue - Token Cost. For example, the formula used by @defiman is:

Net Revenue = Protocol Revenue - Market value of protocol emissions

Let's analyze the details of this calculation formula one by one:

Why Net Income and Not Net Profit

The reason why most articles choose net income as an indicator to measure agreement revenue is because data such as operating costs are generally difficult to find or capture completely, such as information related to infrastructure and team wages, so using net income as an indicator can understand.

first,

first,The composition of the total income of the agreement is different for different tracks: For example, the income of the DEX protocol in DeFi comes from transaction fees. Due to the fee rate, the income of futures (perpetual) transactions is generally far better than that of spot transactions.

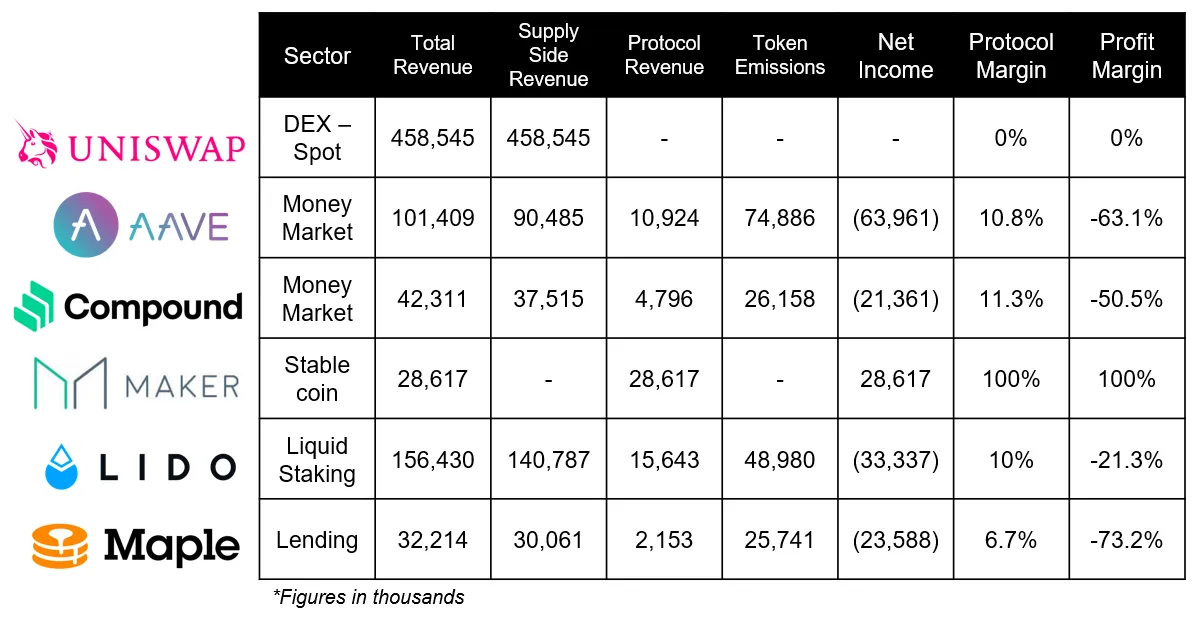

Secondly, in DeFi projects,The total revenue of the agreement is not necessarily an indicator to measure the ultimate of an agreement; In order to reflect the competitive advantage, the spot transaction fee may be lower and lower. For example, in order to expand the trading audience, Uniswap is deployed to the cheaper Polygon, which reduces the total income of the agreement to a certain extent; and in order to compete with Curve, a 0.01% fee TIER for stable currency pairs is introduced. So the protocol margin looks really thin (see the table below),In this way, although the revenue of the agreement is reduced, the number of users may increase. It can be seen that the agreements of different tracks have different trade offs for revenue.

3. How to consider the cost of token release

First of all, the reason why token emission is used as a cost subtraction is because from the perspective of token holders, this is a marketing strategy for protocol drainage. In addition, the additional issuance of tokens will dilute the value of existing tokens in circulation.

Market value of the current token release = current currency price * token circulation (token circulation in the selected time period, March/1 year, etc.)

However, token price fluctuations are difficult to calculate and will affect the magnitude of token fluctuations in both bull and bear market environments

The significance of the token release variable in the above formula: If we want to maximize the net income of the agreement, then the token release cost needs to be minimized. Of course, as long as the sum of token release and operating costs is less than the total revenue of the protocol, it is considered healthy. Because in the current development stage of long-tail DeFi projects, users need token release as an incentive; but in the long run, due to its own reflexive token release, it is not a sustainable means of drainage.

4. The current definition ignores the distribution of fees between token holders and the DAO

First of all, if all projects blindly pursue Real Yield and choose to point these fees to token holders instead of DAO, this will cause some problems in the future.

In the discussion of fees around UNI and DAOs, it can be seen that all DAOs are pushed to define and finalize their token payment policy. How to balance this income distribution within DAO is a game theory game between DAO organizations and token holders.

Likewise, choosing to keep money within the DAO in moderation to retain talent and fund new developments will better serve the community in the long run.

III. Discussion on the meaning of Real Yield

1. RealYield appears background

Although we pointed out that Real Yield is open to question as a measure of DeFi indicators, there are reasons for everything that is in line with the environment at that time.

In 2021, almost all DeFi protocols will aggressively use the token release model to quickly attract liquidity. The direct "involution" and FOMO sentiment of the DeFi protocol created such a phenomenon. The last round of DeFi boom came to an abrupt end in the middle of this year with the collapse of projects such as Terra and Celsuis. With the arrival of the bear market and the mud and sand in the currency circle, the market began to question the actual role of DeFi, and the speculative sentiment retreated. Users and researchers began to delve into whether DeFi projects produced real money or meme coin bubbles.

It can be said that the attack on fake yield has led to the demand and pursuit of real yield.

At the same time, at the end of August, according to Nansen data, the number of transactions on GMX once surpassed Uniswap, becoming the protocol with the most transactions on the Arbitrum network within a week. As one of the projects that generate "Real Yield", GMX has completely ignited the Real yield narrative. KOLs are arguing about who will become the next GMX, and it has even become a new marketing strategy for DeFi projects.

2. Why discuss Real Yield

In a bear market environment, users will pursue more stable and real returns. If a project is fairly regarded as a Real Yield project, such an evaluation can become an important indicator for users to screen reliable projects. In other words, with the development of DeFi, users began to examine the sustainability of APY. The double-digit APY made people discouraged, and they hoped to further explore whether DeFi can bring real value to the cryptocurrency circle.

For the project side, especially the initial stage of the project, although the label of real yield can quickly attract people's attention, it may not be true according to the above definition and analysis method of Real Yield. For example, Polysynth, which is an option strategy, puts a real yield label on its Twitter name. Although the income Polysynth gives is indeed a stable currency, putting its own assets into the strategic vault they manage will face great risks. Investors may Face a loss of up to 60% of your principal.

In addition, even labeling it as Real Yield is not good for long-term development. At this stage, DeFi projects still need to use liquidity mining to do a cold start at the initial stage, so the blind pursuit of real yield means that the funds used for protocol construction will be compressed, such as community construction, project research and development, marketing, etc.

3. Narrative economics

The market does not operate through numbers, but stories, narrative.

There is a theoretical discipline called Narrative economics (narrative economics). The core of the theory is that words and language can easily affect the behavior of people in the market, thereby affecting the market. Markets are volatile and emotional because people who participate in them tend to listen to stories. Interesting narratives can touch people's values, and then connect people's behaviors.

Therefore, it is necessary to track the narrative in the market in time, which is why we discuss Real Yield. Behind it is the interpretation and translation based on numbers, so that such stories can mobilize people's emotions to participate in investment and transactions.

Robert Shiller, author of Narrative Economics, also stated,

“Ultimately, large groups of people who are not well-informed make decisions that cause economic volatility ... and their decisions drive overall economic activity. So there must be attractive narratives that drive these decisions. "

The theory of narrative economics certainly exists, but to become a good researcher and investor, one needs to further interpret the narrative and distinguish between reasonable points and questionable logic.

References:

References:

https://newsletter.banklesshq.com/p/here-are-the-best-real-yields-in

https://newsletter.banklesshq.com/p/which-defi-protocols-are-profitable

disclaimer:https://twitter.com/DodoResearch/status/1587274217082404864?s=20&t=C-6v-1VDaGFj6QprHqJwrA

disclaimer

More information

Copyright Notice

Without the authorization of DODO Research Institute, no one may use without authorization (including but not limited to copy, disseminate, display, mirror, upload, download, reprint, excerpt, etc.) or allow others to use the above intellectual property rights. If the work has been authorized to be used, it shall be used within the scope of authorization, and the source of the author shall be indicated. Otherwise, its legal responsibility will be investigated according to law.

about Us

"DODO Research Institute" led by the dean "Dr.DODO" led a group of DODO researchers to dive into the Web 3.0 world, doing reliable and in-depth research, aiming at decoding the encrypted world, outputting clear opinions, and discovering the future value of the encrypted world. "DODO" is a decentralized trading platform driven by the Proactive Market Maker (PMM) algorithm, which aims to provide efficient on-chain liquidity for Web3 assets, allowing everyone to issue and trade easily.

More information

Official Website: https://dodoex.io/

GitHub: https://github.com/DODOEX

Telegram: t.me/dodoex_official

Discord: https://discord.gg/tyKReUK

Twitter: https://twitter.com/DodoResearch

Notion: https://dodotopia.notion.site/Dr-DODO-is-Researching-6c18bbca8ea0465ab94a61ff5d2d7682

Mirror:https://mirror.xyz/0x70562F91075eea0f87728733b4bbe00F7e779788