What kind of NFT has the policy risk of being regarded as a security?

This article comes from MediumThis article comes from

, the original author: Grant Griffith, compiled by Odaily translator Katie Gu.

As the SEC is investigating whether some of Yuga Labs' NFTs and ApeCoin have violated regulations, the issue of whether NFTs are securities has begun to attract attention (ApeCoin fell 10% after the news came out).

One of the biggest risks of investing in NFTs is the risk of being hacked and "returned to zero." If another significant risk were to be brought up, it would be regulation — the risk that some NFTs today could be considered unregistered securities by the SEC. If the SEC launches an investigation and determines that various NFT projects are involved in the sale of unregistered securities, the consequences for these projects will be severe and will have ripple effects throughout the industry.It is hoped that project parties and investors can more clearly understand the potential policy risks of NFT.

secondary title

What is the SEC's definition of a security?

The SEC (United States Securities and Exchange Commission) defined "securities" very broadly in the Securities Act of 1933, including stocks, bonds, and other forms of profit-sharing agreements. It also includes "investment contracts," which for our purposes are a potential way to acquire NFTs and other digital assets.Whether NFT is a security is ultimately based on facts, and the characteristics and characteristics of each item need to be analyzed.

For example, some NFTs, like many sold by Beeple, are no different from physical paintings sold on the street by independent artists. The sale of purely artwork, whether in digital or physical form, is not a security if the relationship between buyer and seller ends after the sale. However, when we start looking at roadmaps and NFT projects, things start to get complicated. As the NFT industry grows, so do the expectations of those investing in new projects. This evolution is exciting, but it also brings risks."All persons selling securities in the United States must register their offering with the SEC, or obtain an exemption from registration." The regulation provides various "safe harbours" for issuers. An issuer that meets any of the above safe harbor provisions is considered a private offering and therefore does not need to register with the SEC.

secondary title

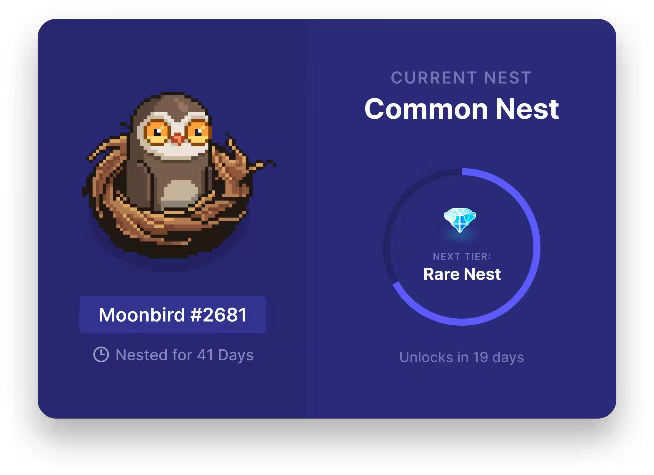

Case Study - Moonbirds

In addition to some NFTs under Yuga Labs that are already under investigation by the SEC, many projects are also approaching "crossing the border" and may be considered unregistered securities. Let's take Moonbirds as an example.

Moonbirds is an Avatar (PFP) NFT collection. It starts mint at 2.5 ETH on April 16, 2022. In just one week, the project’s floor price peaked at around 40 ETH, with hundreds of millions of dollars in sales on the secondary market.

The $58 million raised by Moonbirds mint is recognized as PROOF company revenue and will be used for working capital, making Moonbirds one of the top PFP collections in the world. Founder Kevin Rose acknowledged that mint is a financing that will be used to create a product and bring value to the Moonbirds community. For example, the team has introduced a staking mechanism called "nesting" for Moonbirds.

The Howey test summarizes the legal standard currently used in the United States to determine whether something is a security. According to the Howey test, a thing is a security if it meets all of the following criteria. Moonbirds do appear to fit the definition of a security when viewed strictly against the Howey test definition.

It's an investment of money - yes. Moonbirds mint has raised nearly $60 million.

In a normal business - probably. Thousands of investors are involved in mint, and the success of the project depends on the actions of the founders.

With the expectation of profit, and mainly from the efforts of others - it's hard to deny after hearing Kevin Rose's vision and structure for the project. He made it clear that the funds raised from mint will be used to create a product and provide value to the Moonbirds community. The future direction of the project is clearly in the hands of the founders, and investors are promised returns. Such relationships are dangerous and are only one step away from meeting securities requirements.

The above is a rough analysis of Moonbirds. Whether the NFT of this project is an unregistered security under the current law has to be determined by the SEC. However, assessing risk from a regulatory perspective, it does raise various red flags.If a project has a free mint, then no funds are invested. If the same project doesn't provide a future roadmap or promise, it's less clear whether to expect to profit from someone else's efforts. We've seen various projects like goblintown.wtf follow a similar pattern - free mint, no roadmap, no Discord, no utility.

secondary title

What does it mean for NFT collectors if NFTs are considered securities?

If a project's NFT is considered an unregistered security and otherwise does not qualify for a registration exemption, the consequences are severe.

The SEC can take enforcement action, and every investor who buys an NFT can potentially sue for an unregistered sale of securities. The founders who originally sold the NFT will be held accountable, and they will hold investors accountable for any loss of funds.This will also have wider ramifications. For example, NFT marketplaces like OpenSea risk being considered an "exchange" by federal law if they allow the trading of any NFTs that are considered securities.If that happens, OpenSea will be forced to register with the SEC as a national securities exchange.

See Block.one in 2019 and BlockFi in 2022 for real examples of what penalties can be imposed on companies offering unregistered securities.

secondary title

Future regulatory framework uncertain

Although this article focuses on the Howey test, the way the SEC ultimately judges Moonbirds or other NFT projects may be completely different.

To add clarity, a legal "safe harbor" was proposed last year that would give cryptocurrency projects three years to create a decentralized blockchain network before evaluating whether it complies with securities laws or whether a token qualifies as a federal "securities." definition. This safe harbor will provide some breathing room for projects navigating uncertain legal territory, and hopefully encourage innovation in the process. While the proposal is not directly applicable to most NFT projects today, it does demonstrate that the regulatory framework governing digital assets is rapidly evolving. However, it remains to be seen whether future changes will be more adaptive than our changes today.