The second half of the competition between DeFi and CeFi: Uniswap incarnates as an aggregation platform, challenging CEX giants

"Our first task is to withdraw some of the funds from the centralized exchange giants." Recently, Uniswap Labs Chief Operating Officer Mary-Catherine Lader expressed his ambition.

Although Uniswap is the leader in encrypted asset decentralized trading applications (DEX), its trading volume is still far behind the centralized exchange (CEX) giants. On September 26, Uniswap’s 24-hour trading volume was US$591 million. At the same time, Binance and FTX’s transaction data for the same indicators were US$15.27 billion and US$1.464 billion, respectively.

Challenging CEX giants, why Uniswap? Lader revealed that Uniswap will soon launch a one-stop NFT aggregation trading platform, which will help business growth; in addition, the Uniswap Foundation has funded the new product "Uniswap Diamond", which attracts professional users.

Uniswap keeps moving, but it is not easy to catch up with CEX. On the one hand, the NFT market, which it regards as an entry point of the aggregation platform, has been deserted for many days, the trading volume continues to slump, and the market base is difficult to bring scale to Uniswap; on the other hand, for the professional group of encrypted transactions, Uniswap lacks financial derivatives In the trading business, institutional users cannot hedge risks in its products, which makes it difficult to attract the migration of professional traders.

first level title

Integrate NFT trading business

There is no doubt that Uniswap is the largest decentralized trading application in the DeFi field. According to data from DeFiLlama, on September 26, the 24-hour trading volume of Uniswap was US$591 million, ranking first among all DEXs, nearly US$280 million more than the second-ranked RadioShack.

But its ambitions don't stop there.

image description

24-hour trading volume ranking of DEX on the whole network

Although it firmly sits at the top of the DEX market, the trading volume of Uniswap is still only a fraction compared to the CEX giants. According to data from CoinmarketCap at the same time, the 24-hour trading volume of Binance was as high as 15.27 billion U.S. dollars, and the second-ranked FTX 24-hour trading volume was 1.464 billion U.S. dollars.

In the deep waters of the bear market, the trading volume on the purely decentralized chain has been much lower than before. Uniswap began to think about its future and moved towards a comprehensive trading platform, which became one of its choices.

As the developer behind Uniswap, Uniswap Labs Chief Operating Officer Lader revealed that the team is focusing on several new products, and the product that has been intensively developed recently is the NFT trading business.

In June of this year, Uniswap Labs acquired the NFT aggregator Genie, which has already sent a signal to enter the NFT trading market. Today, Lader made this trend clear again. He revealed that Uniswap will soon launch an NFT trading product, which allows users to buy and sell NFT from many different markets in one stop.

first level title

Launch of Uniswap Diamond for Professional Traders

In order to challenge the CEX giants, Uniswap also realizes the importance of attracting professional traders and institutional users, who are the contributors to the huge trading volume of the encryption market.

Previously, the Uniswap community unveiled a grant program (UGP) aimed at funding projects that benefit the growth of the ecosystem. On September 21, the Uniswap Foundation announced the whereabouts of the first wave of grants. Of that total, about $1.6 million in grants totaling $1.8 million was used to fund a new protocol called “Uniswap Diamond.”

Public information shows that the developer of Uniswap Diamond is GFX Labs, which was founded in 2021 by two professional encryption traders and developers. Of the 14 approved Uniswap governance proposals, 6 were proposed by GFX Labs.

According to reports, Uniswap Diamond will enhance the experience of professional traders and liquidity providers, simplify the development process and on-chain data analysis work, and become the core infrastructure for developers and data analysts in the ecosystem. It will include APIs and SDKs for historical and real-time on-chain data, which will be a game-changer for developers, analysts and end users building on Uniswap, making it easy to integrate real-time and historical Uniswap v3 data into integrations, applications program and analysis.

In addition, Diamond products include a professional version of the trading page, mainly for professional traders and liquidity providers. Its functions are similar to Coinbase Pro, and its experience is closer to traditional trading platforms. It provides trading markets, limit orders, and liquidity tools, aiming to increase Uniswap's market share among professional users.

first level title

There are still challenges in catching up with CEX giants in the short term

During the bear market of encrypted assets, a series of actions of Uniswap showed its attitude of challenging CEX giants. However, in the short term, whether it is NFT trading business or services for professional traders, the status of CEX is difficult to shake.

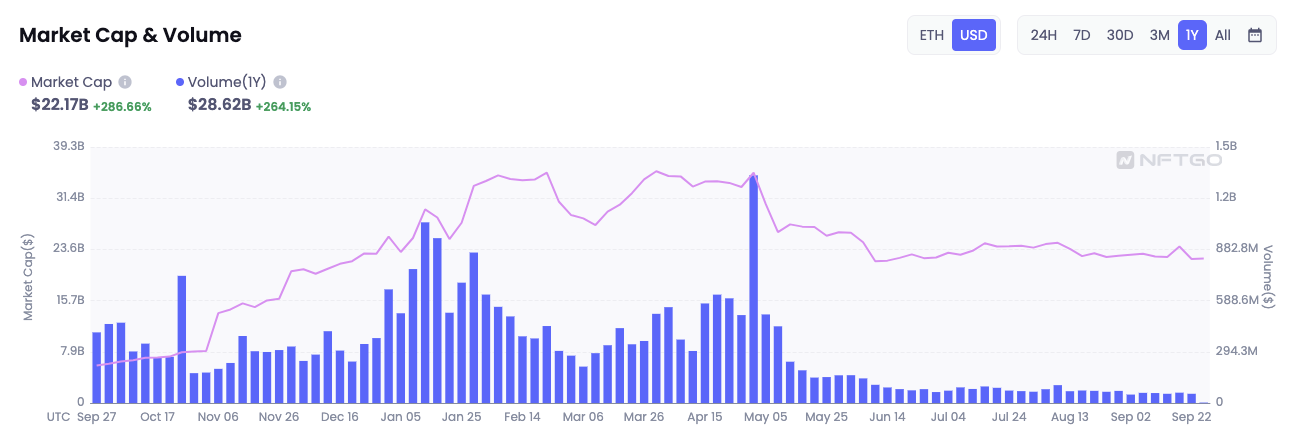

image description

The recent NFT transaction volume is very sluggish

In such an environment, the frequency of new NFT projects is reduced, and users lack sufficient motivation to participate in NFT investment. Due to the poor liquidity of this market, the trading frequency of NFT is not high, and the trading volume has remained sluggish recently. Some people in the industry believe that the decline in the value of NFT and the decrease in transaction volume are typical manifestations of a bubble burst. The market is pessimistic. It is difficult to bring large-scale data growth to the new NFT trading business on Uniswap.

In terms of attracting professional traders and institutions, Uniswap also has shortcomings. On the one hand, professional traders pay more attention to the safety of funds, and the frequent security incidents in DeFi are likely to make them stop outside Uniswap. In addition, whether the trading depth and trading functions of Uniswap Diamond can meet the needs of professional institutions still needs to be considered. Their full migration to Uniswap may require a relatively long verification process.

Industry insiders believe that there is another important reason why it is difficult for Uniswap to surpass platforms such as Binance, that is, it currently does not have financial derivatives business such as futures contracts and options contracts for encrypted assets to hedge risks.

Contract trading has always been regarded as a high-profit place by centralized trading platforms, and has almost become the standard configuration of CEX. On the one hand, futures contracts can be traded with leverage, which can expand user positions and increase trading volume; on the other hand, using contract products, traders can short assets in a bear market to hedge risks or capture profits.

Judging from the historical laws of the market, in a bear market cycle, investors' demand for spot transactions is significantly reduced, while the impact on contract business is relatively limited. Therefore, it is difficult for Uniswap, which does not provide financial derivatives transactions, to match the CEX giants in terms of transaction volume.

Uniswap still faces many challenges if it wants to erode market share from CEX in the short term. However, if you look at the beginning of the story, Uniswap was not well-known in the encryption industry until 2020, and it has snatched a large number of users and transaction volume from CEX in just two years, which is already a good result for it. And Uniswap's practice of iterating the DeFi core "automatic market maker" (AMM) model in V3 products is the most powerful guarantee for it to be able to tell the story of "aggregated trading application".

Binance CEO Changpeng Zhao once predicted that in the next five to ten years, decentralized exchanges will eventually surpass their centralized peers. If the prophecy comes true, Uniswap is still the one most likely to stand at the head. From an automatic market maker trading application that was originally "small and beautiful" to harvest traffic, to a comprehensive trading platform, Uniswap may be able to create a bright spot in the next market peak.