This article compares the four LP automation management protocols of Uniswap V3

Original author:

Original author:@0x1Charles

Since the launch of Uniswap V3 in 2021, the trading volume has been ranked first in the entire ecological DEX. Its most important and currently the most innovative function in the industry is centralized liquidity management. LPs can customize the liquidity range instead of the global liquidity of V2 , to achieve better depth and lower slippage for trading pairs in a narrower price range, attracting more trading volume, so that LP can earn more fee income, and improve the efficiency of LP's capital utilization.

However, V3 LP also faces some problems: the impermanent loss caused by the price fluctuation of the transaction, and the liquidity range needs to be adjusted frequently; in order to make the management of LP more flexible and active, and improve the level of passive income of LP, the LP automatic management protocol layer thus produce.

The main functions of the LP automation management agreement include:Automatically adjust the liquidity range, rebalance, fee reinvestment.

1. Arrakis Finance

Arrakis (formerly G-UNI)It is a Uni V3 LP automated management protocol launched by Gelato Network, an automated execution tool for Ethereum smart contracts, in June 2021. Users and project parties can directly provide liquidity in Arrakis Vaults and obtain ERC-20 LP tokens. Arrakis will transfer the liquidity Inject Uniswap V3, and use strategies to manage LP on top of it to optimize LP income.

TVL bear market contrarian growth rate of 300%

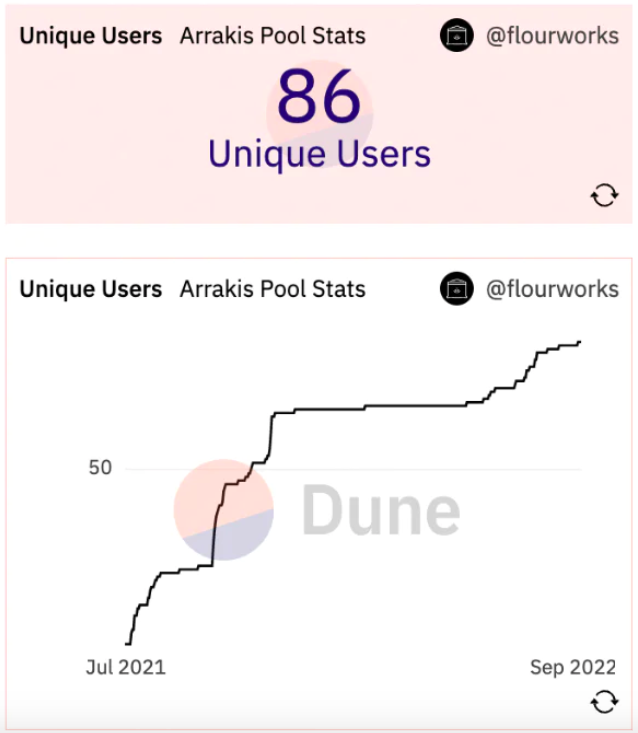

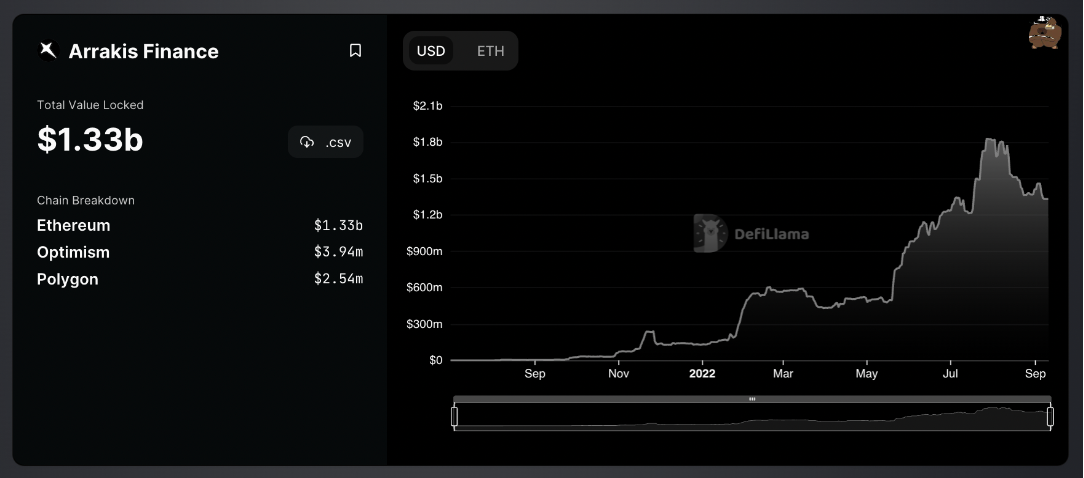

Arrakis currently supports three major networks (Ethereum, Polygon, Optimism),Total TVL 1.33B, according to Defillama data,Ranked 12th among all DeFi dApps and 2nd in the Yield dApp category after Convex;Arrakis TVL achieved a 3x growth (600M to 1.8B) against the trend during June-August 2022; as a liquidity management protocol, the size and growth of TVL are its most important indicators, and Arrakis can be described as the most important indicator in a bear market The performance is extremely impressive, and it was realized without native token incentives; the number of independent addresses has also been increasing, currently 86.

Manage the two largest pools of TVL on Uni V3

Arrakis' current TVL accounts for 24.5% of Uniswap V3 TVL (Ethereum),It is currently the largest LP of Uni V3.

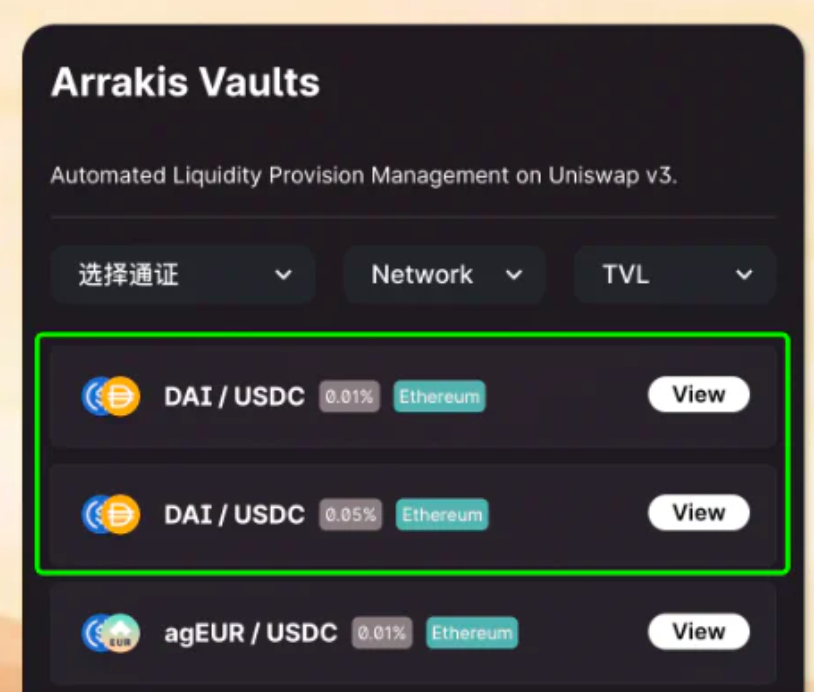

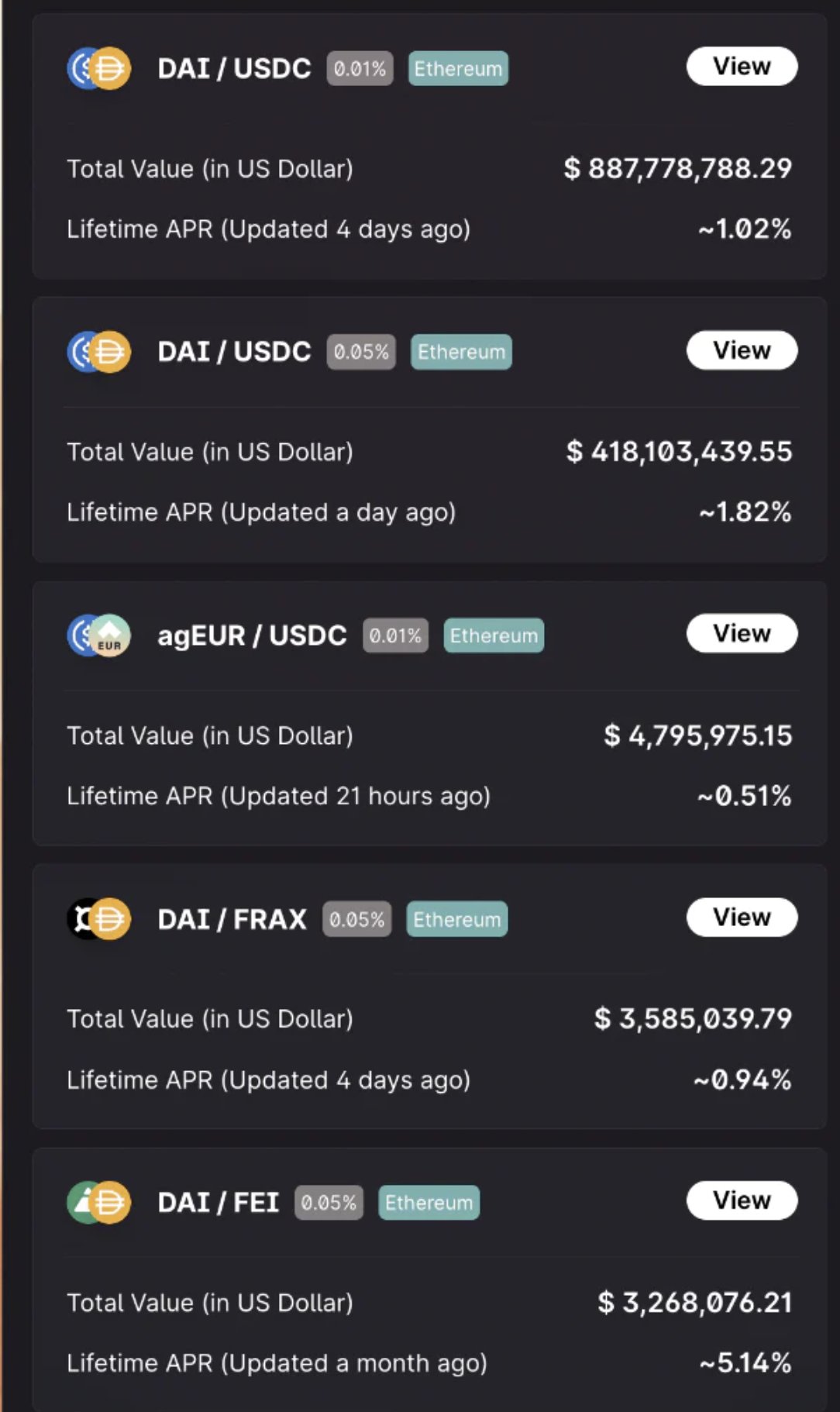

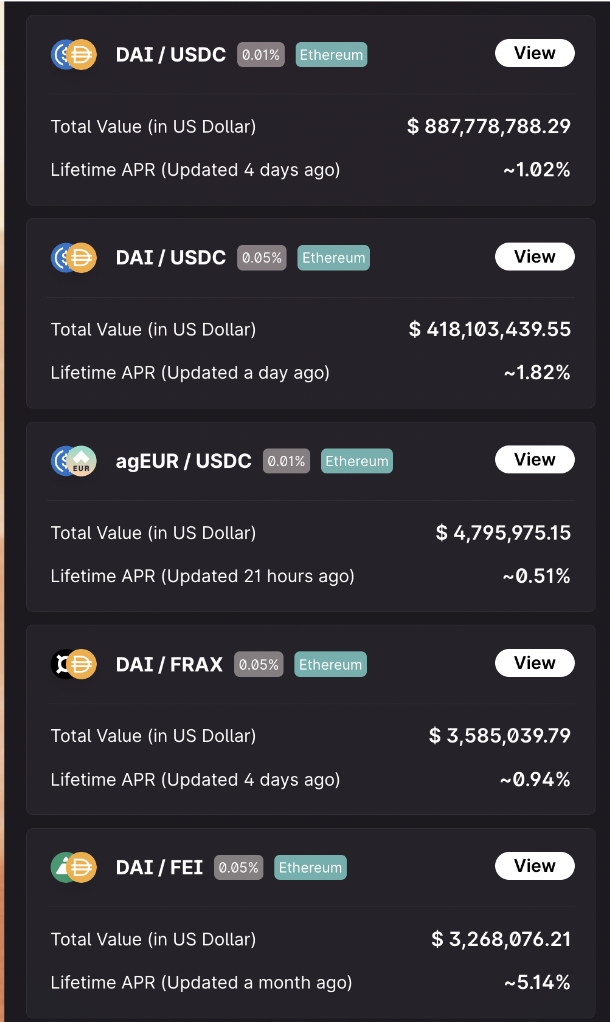

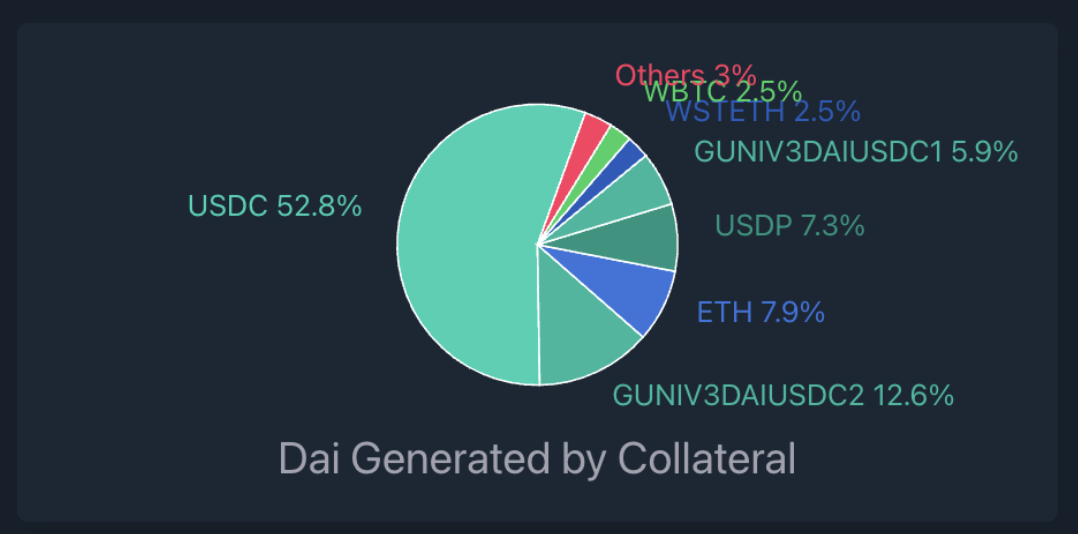

It is worth noting that the two pools with the largest TVL in Uniswap V3: DAI/USDC (0.01%) and DAI/USDC (0.05%) are also the two largest pools in Arrakis, and these two pools account for 99.5% of the total. 98.6%, which meansThe liquidity of DAI on Uni V3 is basically provided by Arrakis, Arrakis actually manages the two largest pools in TVL on Uni V3,DAI market makers are using Arrakis entirely for liquidity management.

99% of TVL comes from the stable coin pool

The top 5 Arrakis liquidity pool TVL are all stable currency pairs, with a total amount of funds of more than 1.3 billion US dollars, accounting for 99%+ of the total TVL of the agreement, indicating that the currentMostly stablecoin market makers are using Arrakis.

Ecological cooperation

Ecological cooperation

token economy

token economy

Arrakis expects to issue the native token SPICE in 2023, which will refer to Curve's veCRV economic model, stake SPICE to get xSPICE, and obtain pledge income and voting governance rights; market value expectations can refer to CRV, and the TVL ceiling is limited by the size of Uniswap.

product upgrade

According to the official introduction, Arrakis will introduce more tokenized products in the future:

a. Automatically hedged delta-neutral LP positions

b. Centralizing complex long positions on AMMs

c. Cross-AMM positions

d. LP positions combined with lending/options

e. Cross-chain liquidity strategy

future direction

At present, the main sources of demand for Arrakis business are other agreements, institutions and large investors; in the future, it is foreseeable that Arrakis business will expand in two directions:

(1) Based on the native token SPICE, more Uni V3 LPs such as institutions and large investors are encouraged to use Arrakis;

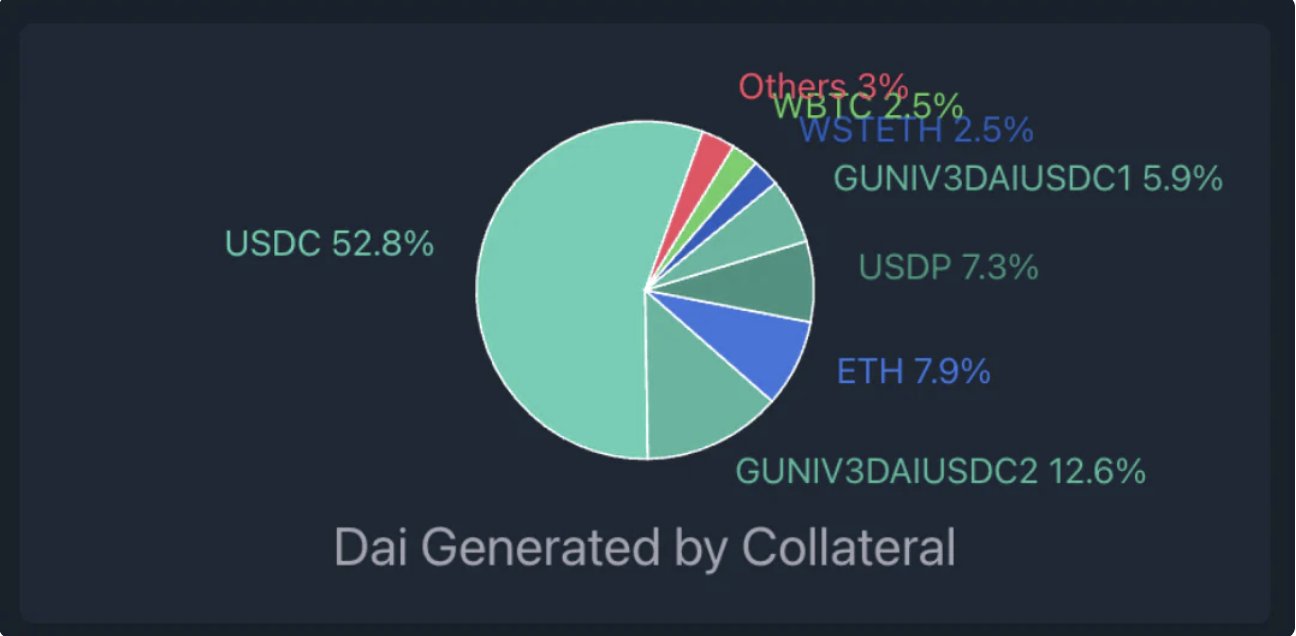

(2) As a liquidity middle layer, lend liquidity to other protocols to expand the usage scenarios of LP. For example, in MakerDAO, Arrakis’ LP can be used as collateral to mint DAI, as shown in the figureThe LP of GUNIV3-DAIUSDC2 has become the second largest source of collateral for DAI minting, accounting for 12.6%.

2. Gamma (ex Visor Finance)

Previously, the most well-known Uniswap ecological project was Visor Finance; however, Visor was attacked by hackers continuously, not only $1.6 billion in funds was stolen, but also a bug in vVISR's unlimited casting was discovered.

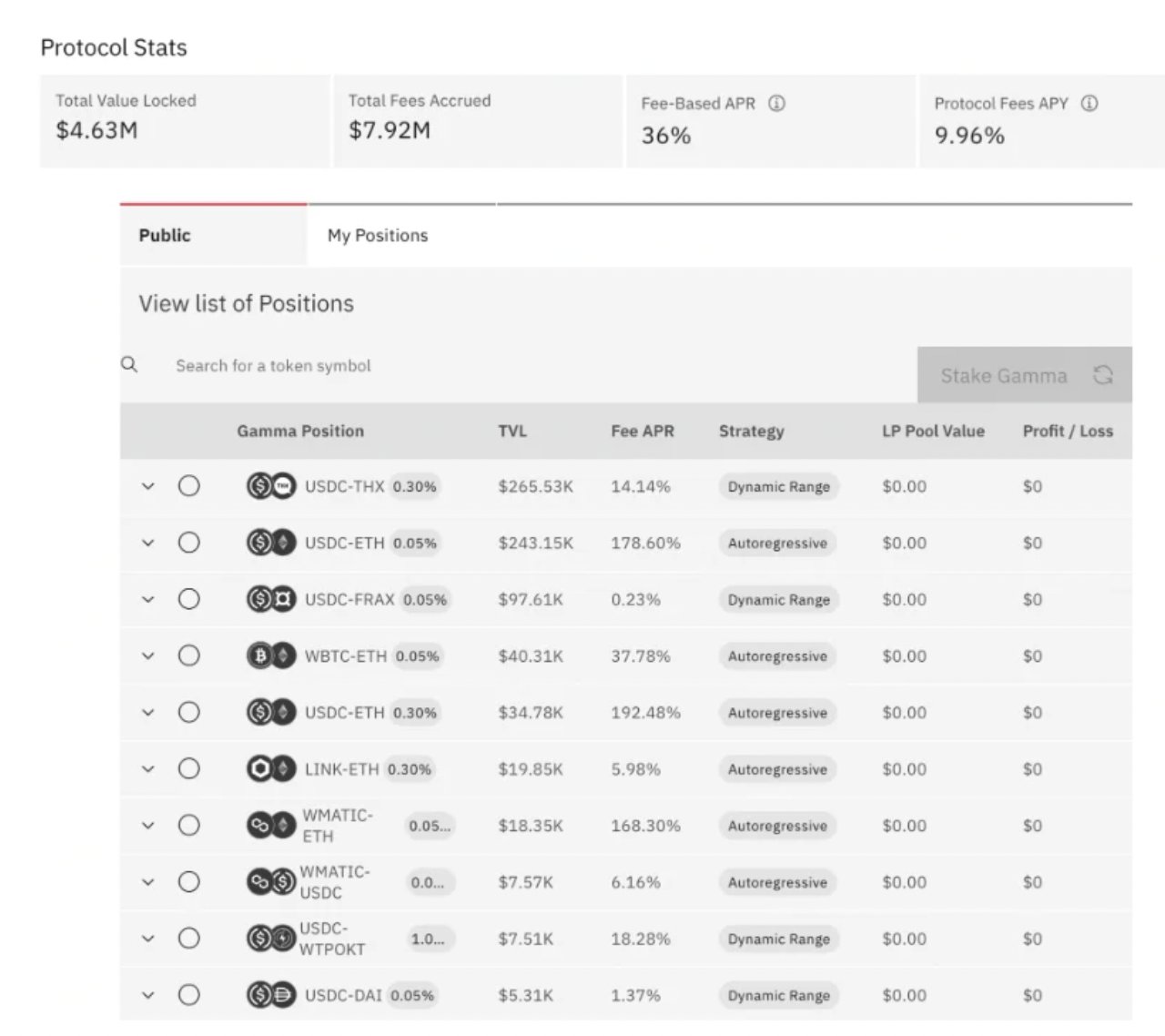

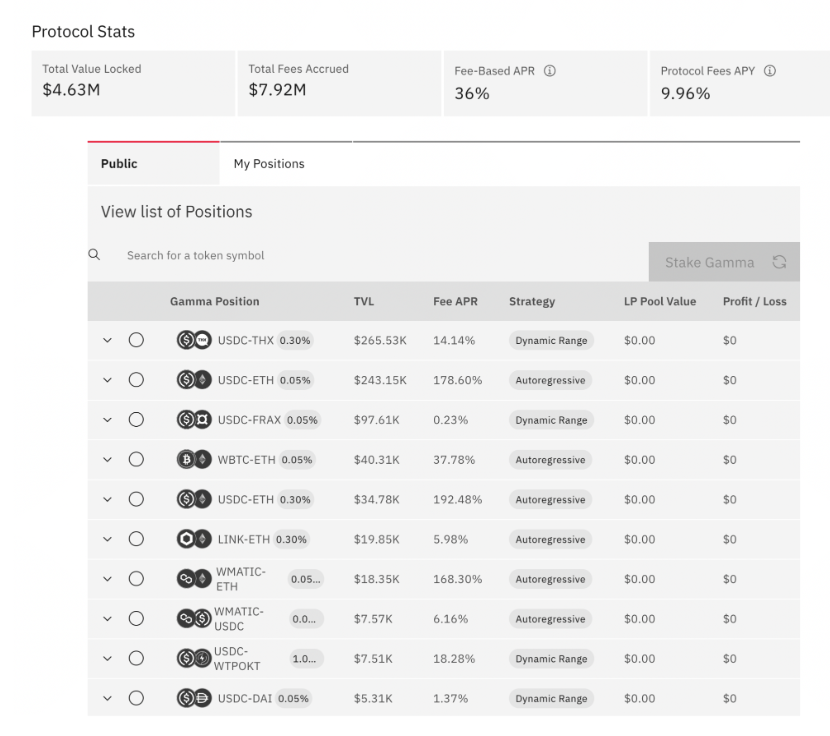

Later the protocol was restarted and renamedGamma, the current TVL is 4.63M; first of all, due to the theft of Visor, the market will definitely have concerns about the safety of Gamma, and the consensus will be damaged; secondly, there are only 23 pools to choose from on Gamma.

Because the Gamma protocol adopts the practice of incentivizing liquidity with native tokens, the main trading pairs have a relatively high APR, and the APR of ETH/USDC has reached an astonishing 178.6%.

Although the APR is extremely high, the TVL of the Gamma protocol has dropped from more than US$7 million in early June to more than US$4 million at present; and since December last year, the TVL has always shown a downward trend.

3. Charm.fi

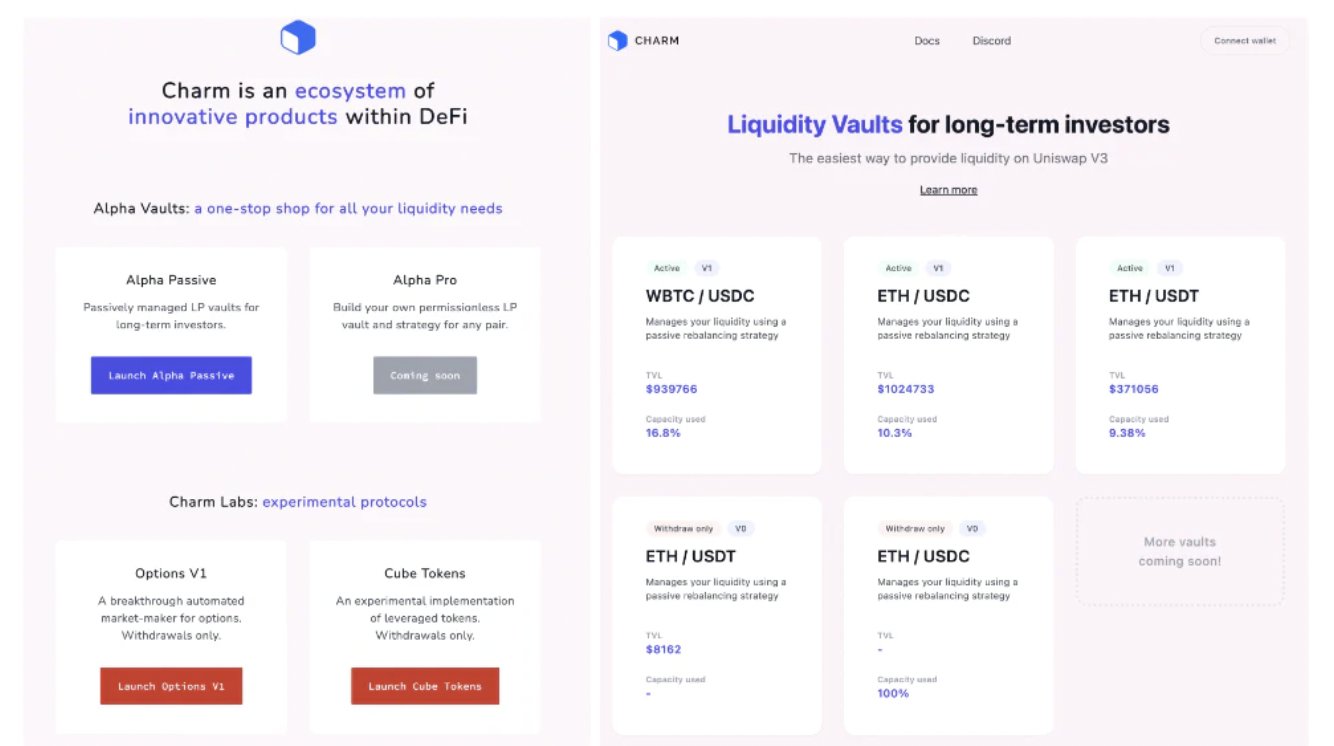

I have done options and Cube Token products before, but they were not very successful. Recently, these two products have been shut down, and the focus has shifted to Uniswap V3 liquidity management.

There are only 3 pools currently available (WBTC/USDC, ETH/USDC, ETH/USDT), the strategy range is relatively large, the product is relatively early, and there is a lot of room for improvement; the current TVL is 2.39 million US dollars, which is the liquidity for Uni V3 The introduction is still relatively weak.

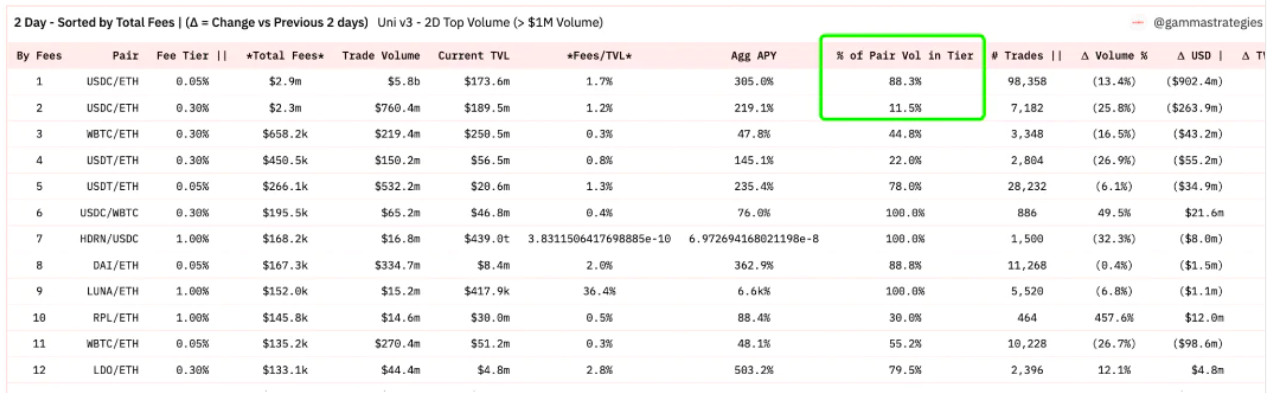

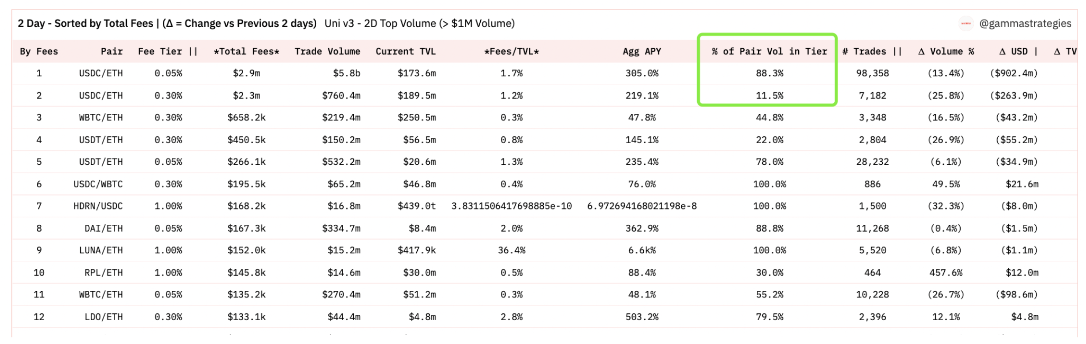

From the disclosed data,Charm.fiCompared with Uni V3, the utilization rate of funds is lower. For example, for the ETH/USDC trading pair, the utilization rate of Charm.fi is 10.3%, while that of Uni V3 is 11.5% and 88.3%.

4. Kamino Finance (Solana)

Kamino is the first V3 LP liquidity management protocol in the Solana ecosystem. Of course, this V3 is not Uni V3, but Orca's centralized liquidity protocol Whirlpools (like Uni V3 on Solana).

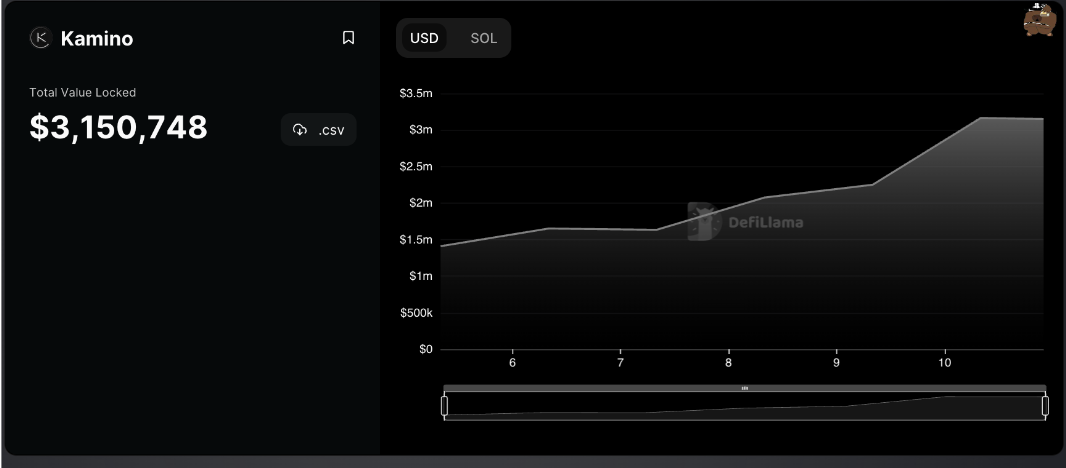

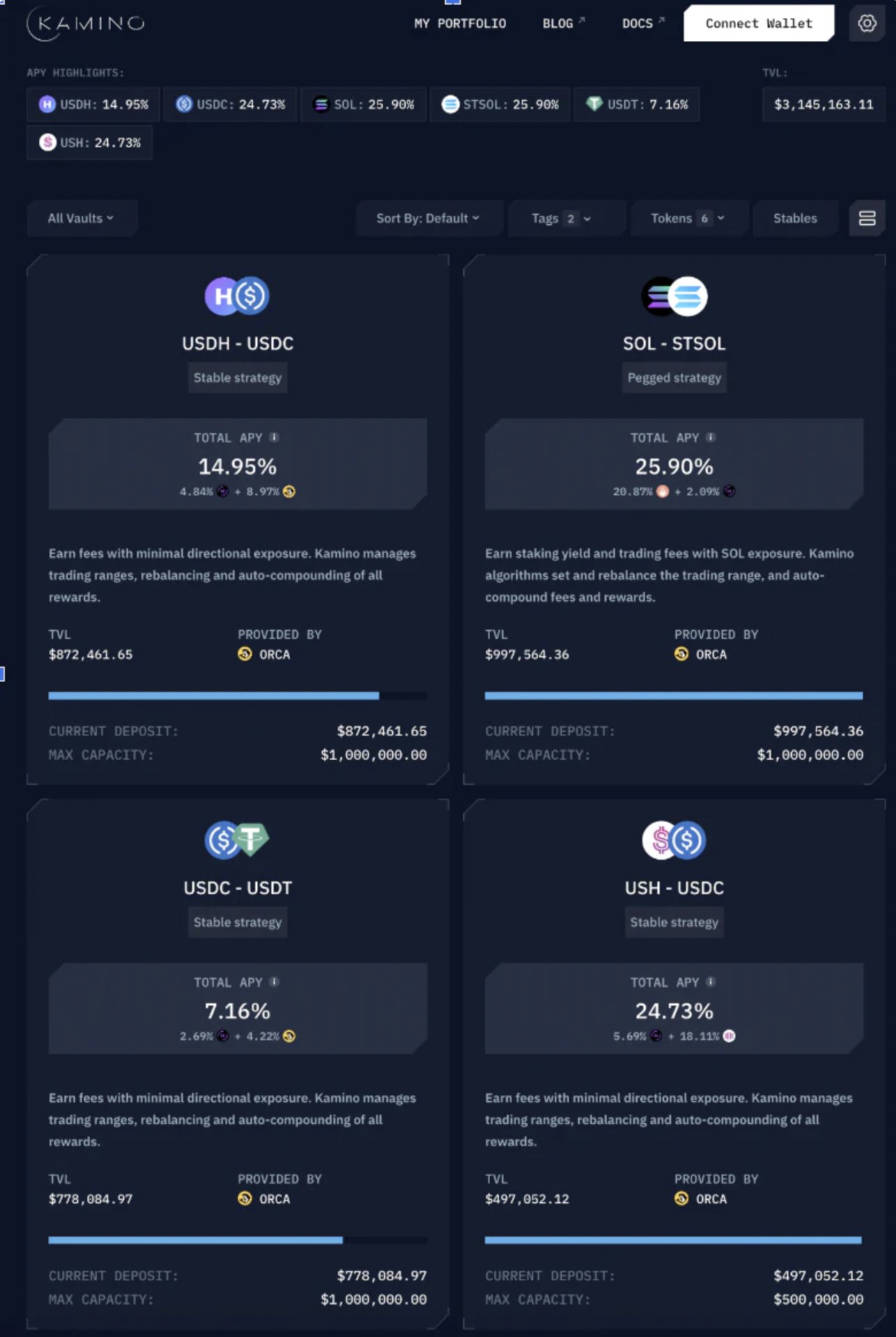

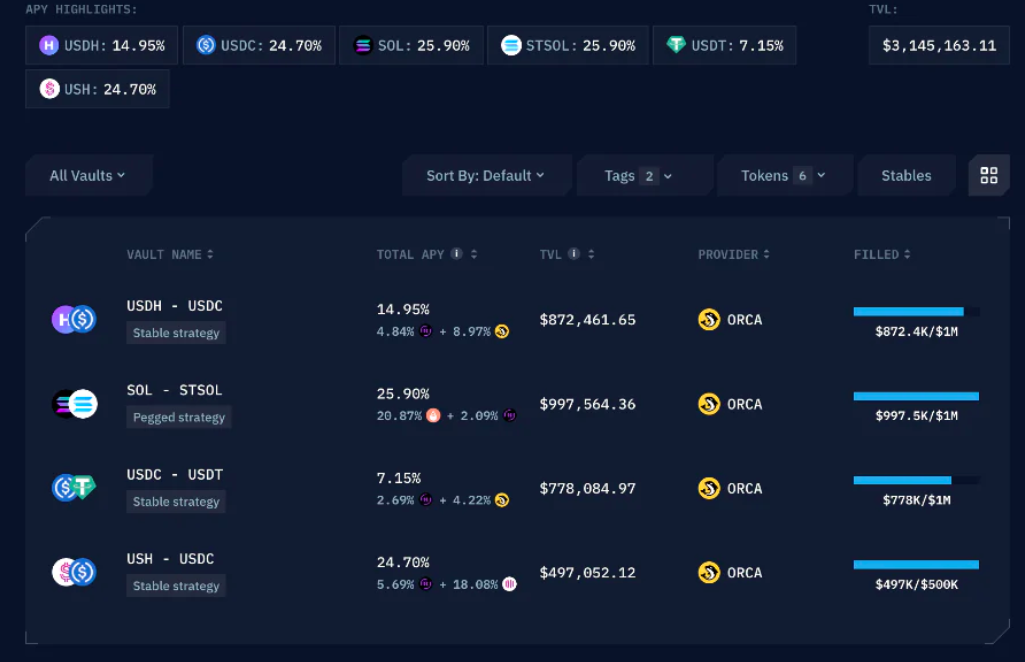

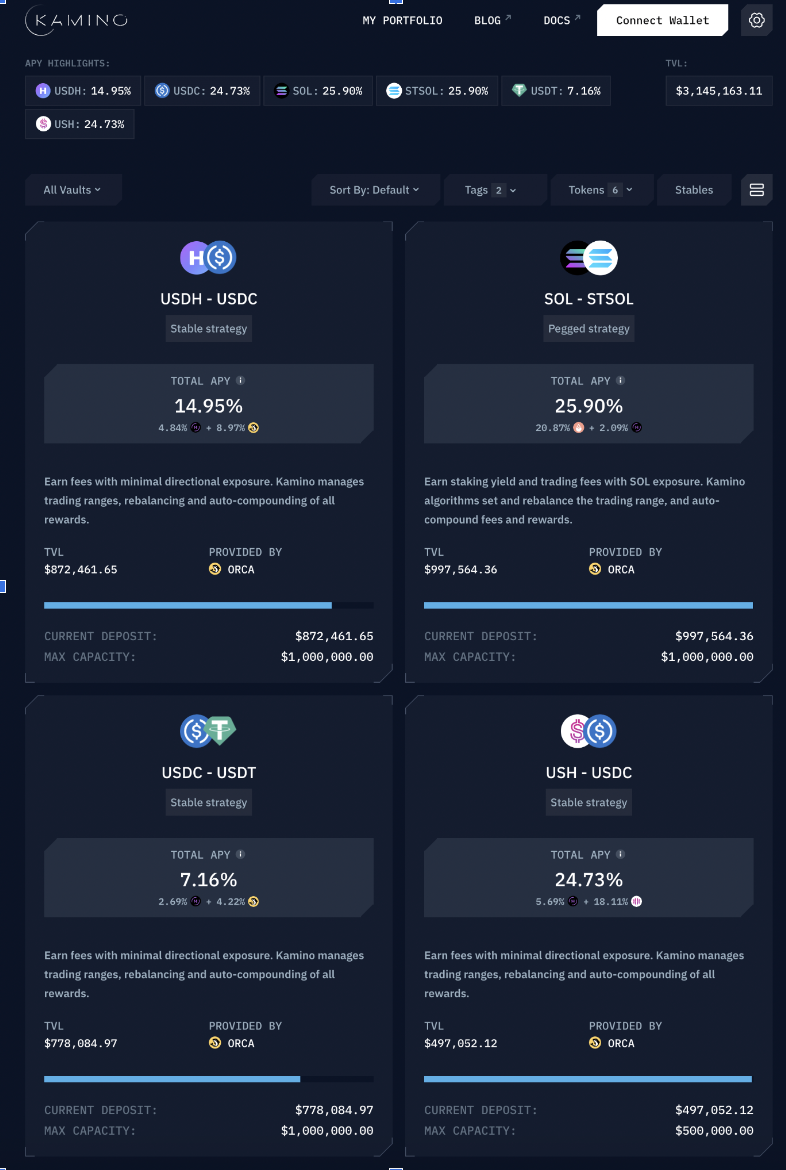

Incubated by the liquidity protocol Hubble, Kamino has received a TVL of 3 million US dollars just after its launch in September. It has performed brilliantly and surpassed Charm.fi.

Kamino’s functional considerations are also relatively comprehensive, including automatic adjustment of price range, rebalance, automatic reinvestment of fees & rewards, leverage utilization and composability of tokenized LP, and quantitative model for optimizing returns.

Kamino currently only has 4 vaults, all of which are provided by Orca. In addition to optimizing fee income for LP, it also provides token rewards from other partnerswrite at the end

write at the end

1) With the strong support of DAI market makers, Arrakis obtained 25% of Uniswap's TVL, which initially verified the feasibility of LP liquidity management. However, except for DAI, other liquidity introductions are currently relatively weak. The further growth in the future is doubtful; in addition, there is a lack of effective data on fee agreement income, and the agreement organic income model has yet to be verified;

2) In comparison, the other two protocols of Ethereum are still in their early stages and need to be investigated;

3) Kamino currently occupies a relatively leading ecological position in Solana. If there is Orca or other CLMM agreements and more market makers' long-term support in the future, there is room for growth;

Original link