V God: Break the monopoly of ENS domain name and set a normal fee based on demand

This article comes from Vitalik Buterin, compiled by Odaily translator Katie Koo.

This article comes from

, compiled by Odaily translator Katie Koo.ENS domain names are very cheap these days. Registering and maintaining a five-letter domain name costs as little as $5 per year. From the point of view of someone trying to register a single domain name, this sounds reasonable, but globally, the situation is very different: in the earlier days of ENS, someone could register a random five-letter domain name. Word domain name, and prepaid for one hundred years of ownership. Today, domain names for almost all of these words are already taken, waiting for someone to buy them from them for a higher price. OpenSea data shows that around 40% of all domain names are for sale or only on the platform.Is this really the best way to distribute domain names?The ENS DAO receives far less revenue than it could have earned, which limits its ability to improve the ecosystem. The status quo is also not conducive to the fairness of the ecosystem.

The nominally cheap registration price does not actually save costs for users. In fact, reliance on secondary markets makes domains more expensive than premium in-protocol mechanisms.

Can we assign ownership of domain names in a better way? Is there a way to add more revenue to the ENS DAO and better ensure that domains are owned by those who can make the most of them while maintaining the trusted neutrality and accessibility that makes ENS valuable long-term ownership Strong Guarantee?

secondary title

Problem 1: There is a fundamental trade-off between the power of ownership and fairness

Assuming there are N "high-value domain names", after P years, no one can get high-value domain names again.Fortunately, ENS not only charges a one-time fee to register a domain name, but also a recurring annual fee to maintain the domain name.

Not all decentralized DNSs have the foresight to make this happen. Not so with Unstoppable Domains, which prefers short-term consumer appeal (never renewing fees) to long-term sustainability. The regular fees for ENS and traditional DNS are a healthy way to mitigate the excesses of the truly unlimited "one-time-own" model. At the very least, the regular fees mean that no one accidentally locks a domain forever because they forget or are careless. But that may not be enough. It's still possible to spend $500 to lock down an ENS domain for a century, and there are certainly some types of domains that are in high enough demand that they're vastly underpriced.

secondary title

Problem 2: Speculators don’t actually create efficient markets

Because of the "first come, first served" model with low flat fees, many domain names will be bought by speculators, but speculation is natural and a good thing. It's a free market mechanism where speculators really want to maximize their profits, and they're incentivized to resell the domain name in such a way that it gives anyone who can make good use of the domain name, their excess return is just for the Compensation for such services.

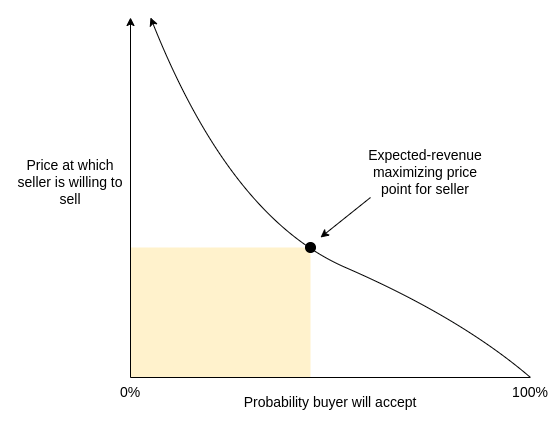

Maximizing a seller’s revenue almost means accepting the possibility of not selling the domain at all, leaving it completely idle. Auctions aimed at maximizing a seller's revenue are least efficient when there is one potential buyer (or at least one buyer whose valuation is significantly higher than the others), and when there are many competing potential buyers At home, this efficiency diminishes rapidly. But for a large number of domain names, the first category is exactly what they are. For example, some people, projects or companies buy domain names with the same name as them. So if a speculator bought such a domain, they would of course set the price high, accepting that there was a high chance that the deal might never be done, in order to maximize their revenue should a deal come up.

Therefore, we cannot say that speculators capture most of the domain name distribution revenue only as compensation for ensuring that the market is efficient. Conversely, speculators can easily make the market worse than a well-designed mechanism in the protocol that encourages domain names to be sold directly for a fair price.

secondary title

Set stricter standards for the stability of domain name ownership

But the risk of being forced to sell something at any time can have enormous economic and psychological costs, and because of this, advocates of the Harberger tax generally focus on the application of ownership by established market participants.

As it turns out, domain names don't do very well to be Hodl'd. Domain owners are often immature, the cost of switching domains is often high, and the negative externalities of switching domains wrong can be substantial. The highest value owner of coinbase.eth may not be Coinbase, or it is possible that scammers snatched up the domain and immediately faked a charity or ICO claiming it was run by Coinbase to get people to send money to this address. For these reasons, Harberger's taxation of domain names is not a good idea.

secondary title

Alternative Solution 1: Demand-Based Normal Pricing

Today, maintaining ownership of an ENS domain name requires payment of the normal fee. This is an easy and very low $5 per year fee for most domain names. But what if we charged based on the actual level of market demand for that domain name?

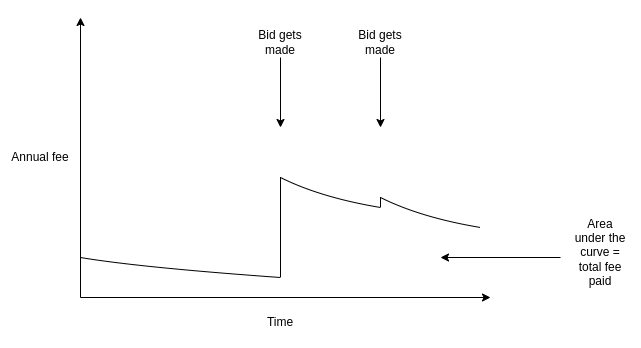

This does not necessarily make the domain immediately available for sale at a specific price. Instead, the initiative in the pricing process will rest with the bidders. Anyone can bid on a particular domain name, and if they keep an open bid long enough (say 4 weeks), the domain's valuation will rise to that level. The annual fee for the domain name will be proportional to the valuation. It can be set at 0.5% of valuation). If there are no bids, the fee may drop at a constant rate.

This property is important because it means that "breaking" the domain holder is risky and expensive, and may even end up benefiting the victim. If you own a domain name and a powerful person wants to harass or censor you, they may try to bid a lot for the domain name in order to greatly increase your annual fee. But if they do, you can sell them directly and charge a huge amount.

This already provides more stability to ENS domain prices and is more friendly to novice buyers than the aforementioned Harberger tax. Domain owners don't need to always worry about whether they're setting their price too low. Instead, they can pay the annual fee directly, and if someone bids, they can take 4 weeks to make a decision, either sell the domain name, or continue to hold it and accept the higher fee. But even that may not provide enough stability. To go further, we need to make compromises within compromises.

secondary title

Alternative Solution 2: Normal Pricing Caps Based on Demand

We could modify the scheme above to provide stronger safeguards for domain name holders. We can try to provide the following properties:

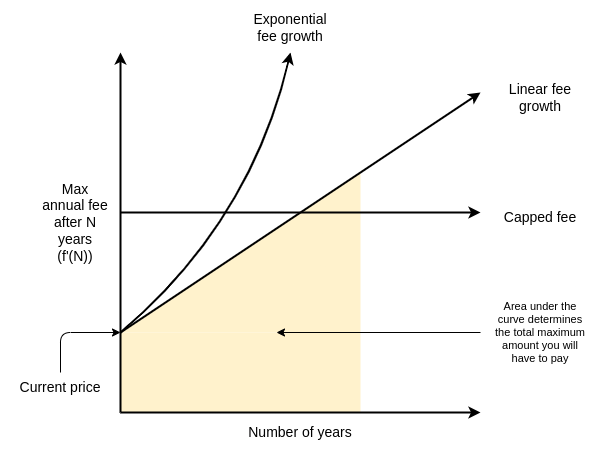

Strong Time-Limited Title Guarantee: For any fixed number of years, there is always the possibility to work out a fixed amount that you can pay up front, unconditionally guaranteeing ownership for at least that number of years.

As shown in the picture:

Please note that the amounts in the table are only theoretical maximums required to guarantee holding a domain name for a certain number of years. In reality, almost no domain name ever gets a high bid, so almost all domain holders end up paying much less than the maximum price.

Demand from outside bids clearly provides some signals about the value of the domain name (and thus the extent to which the owner excludes other buyers by maintaining control of the domain name). So I think some attractive parameter choices should be found for demand-based fees.

A superlinear f(N) value with a maximum annual fee that increases over time is a good idea. First, paying more for long-term security is a common feature across the economy. Fixed-rate mortgages typically have higher interest rates than variable-rate mortgages. You can earn higher interest by offering long-term locked-in deposits. This is compensation the bank pays you for providing long-term security to the bank. Likewise, longer-dated government bonds typically yield higher yields. Second, the annual fee should be able to eventually adjust to the market value of the domain name, we just don't want that to happen too quickly.

secondary title

Two scenarios that are likely to be successfully implemented

Democratic legitimacy: come up with a compromise, a truly adequate compromise that satisfies more people and may even result in higher returns for some existing domain name holders (not just potential domain name holders).

A possible compromise would be for ENS DAO to hand over single-letter domains individually to projects that run some other type of trusted neutral marketplace for their subdomains, as long as they hand over at least 50% of their revenue to ENS DAO.

Summarize

secondary title

Summarize