Where are the opportunities for the future? Listen to what 20 crypto investment institutions have to say

Original Authors: Jiang Mengchu, Chen Siyu, Dave Chan

The main controversy of social networking is: everyone agrees that social networking is a necessary demand, and it also has a very high upper limit. However, many organizations believe that the existing SocialFi project is still in the early stage of development, the model is not yet clear and no sustainable paradigm has been formed. It is difficult to acquire users from traditional giants if we only rely on the token economy and the packaging transformation of Web2 social networking.

Summary

It has become the consensus of all investors and practitioners that the encryption market has entered a bear market. And winter is the time to prepare for spring planting. What kind of fruit will be borne in the future, of course you have to ask the person who sowed it. Huobi Research interviewed more than 20 representative global excellent investment institutions, hoping to use their development status, investment philosophy and layout direction as samples to understand investment institutions' judgments on the status quo and trends of the industry, and to discover potential tracks .

During the interviews, we learned that most investment institutions tend to watch more and act less. They pay more attention to infrastructure projects, among which ZK, new public chain and middleware are the most concerned. In terms of application projects, DeFi, Game, and social networking rank the top three. Among them, DeFi is the most promising direction for institutions, and games and social networking are very controversial.

The focus areas and logic of institutions are as follows:

ZK is one of the potential core driving forces of the next cycle and has long-term value. It occupies the two core-level narratives of Ethereum expansion and privacy computing. ZK accelerated network and mining are the focus of institutions' layout, because it has a stable game structure.

Institutions pay more attention to the new public chain strategically, rather than seeing definite opportunities. They are very concerned about the two innovations in the recent batch of new public chains, Move programming language and parallel processing technology, and believe that their value may exceed a certain public chain itself.

The degree of attention of middleware is second only to zk and the new public chain. More attention has been paid to decentralized identities, data protocols, and wallets.

Institutions tend to continue to pay attention to DeFi, but generally maintain a wait-and-see attitude. For existing DeFi protocols, only those with stable cash flow and not relying on subsidies can explode again. For emerging DeFi protocols, institutions are currently paying more attention to protocols with relatively mature businesses in the traditional field but fewer competitors on the chain. From the perspective of categories, most of them belong to the direction of derivatives.

The main controversy of social networking is: everyone agrees that social networking is a necessary demand, and it also has a very high upper limit. However, many organizations believe that the existing SocialFi project is still in the early stage of development, the model is not yet clear and no sustainable paradigm has been formed. It is difficult to acquire users from traditional giants if we only rely on the token economy and the packaging transformation of Web2 social networking.

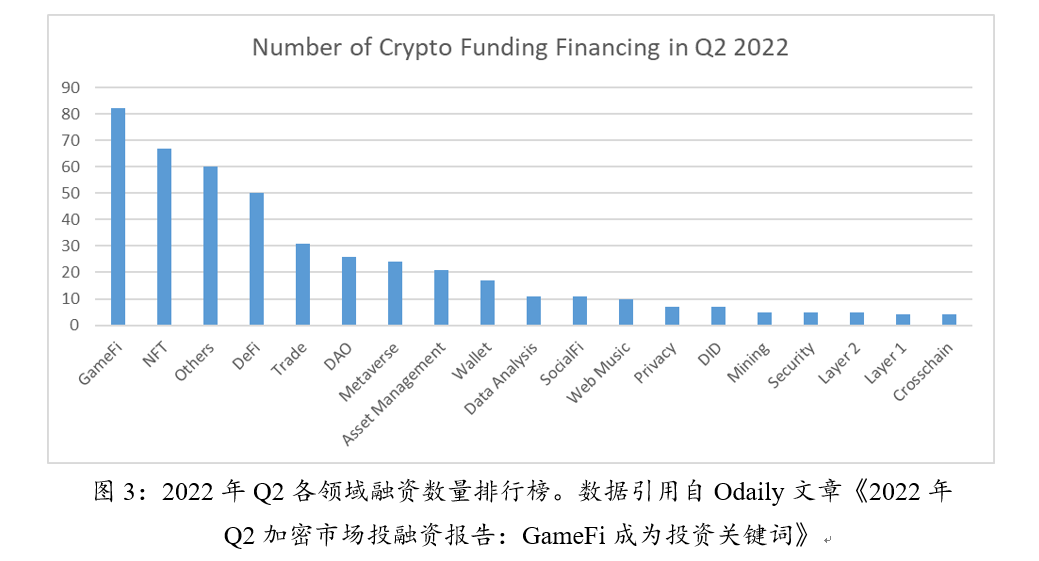

Let's review what areas investment institutions have focused on before. As shown in the figure below, in Q2, the most concerned areas of global crypto investment institutions are GameFi and NFT. Games, game-related infrastructure and technology solutions received a total of 82 financings, ranking first in terms of volume, accounting for 16% of the total number of financings. The amount of financing in the GameFi field is also far ahead, as high as 2.996 billion US dollars, accounting for 23.5% of the total financing in the industry. A total of 67 financings have been obtained in the NFT field, ranking second in terms of quantity. DeFi ranked fourth with 50 financings. The infrastructure field represented by L1, L2, mining, privacy, identity, etc. has become a "long tail field", and the number of investments they have obtained is about 10.

We believe that the industries with more potential in the future are infrastructure, including ZK, new public chains, and middleware. On the application side, there is greater uncertainty, and DeFi has a relatively high winning rate, and the potential direction is in the field of derivatives. Since the preconditions required for socializing are not yet complete, there is still some time before the outbreak. Games have growth opportunities, and games with better economic models have even greater opportunities.

1. Current status of investment business

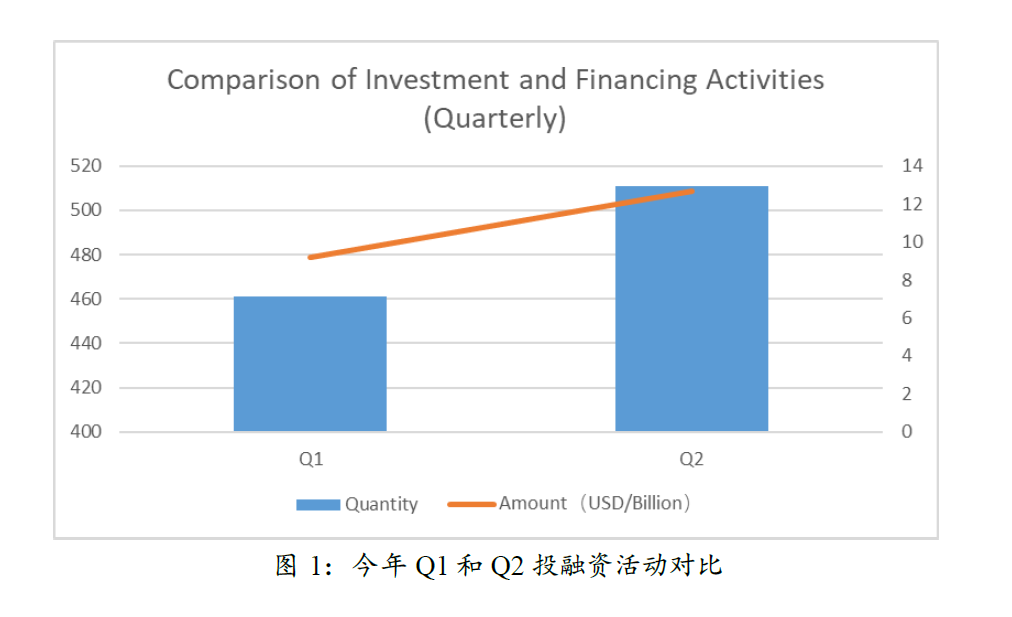

First of all, we observe the status quo of investment business in the global encryption market. According to public information statistics reported by Odaily and PANews, a total of 511 investment and financing events (excluding fundraising and mergers and acquisitions) occurred in the global encryption market in the second quarter of 2022, with a total disclosed amount of US$12.71 billion. Among all financing events, the number of transactions with a financing size of more than US$100 million reached 28.

Compare with the first quarter of this year. A total of 461 investment and financing events occurred in the global encryption market in Q1 this year, with a total disclosed amount of US$9.2 billion. Although the environment of the encrypted secondary market worsened in Q2, investment and financing activities showed signs of recovery. The number of investment and financing activities increased by 11% month-on-month, and the amount increased by 38% month-on-month.

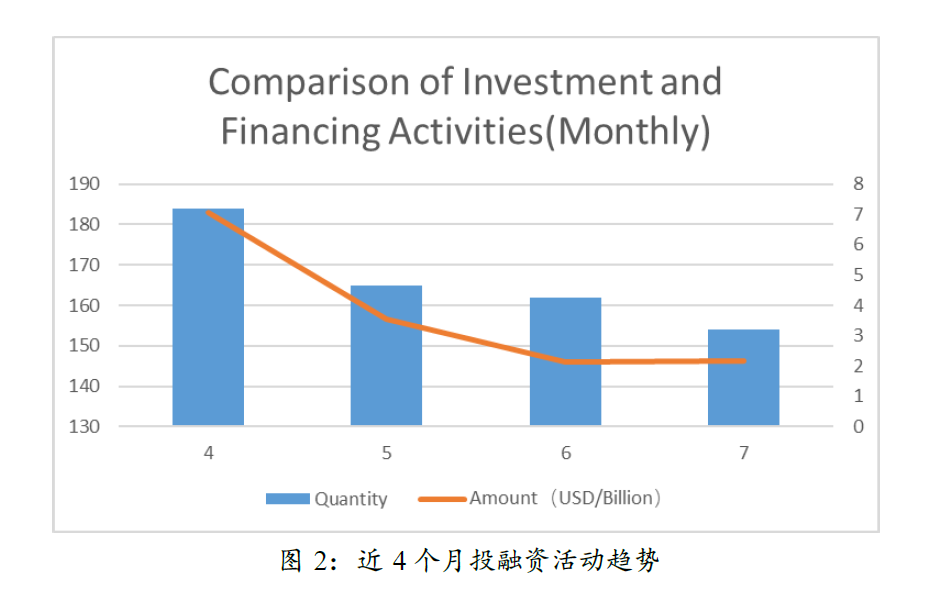

However, if we look at it in terms of months, we feel a bit of coolness. From April to July, the number and amount of investment and financing activities decreased monotonically. The total amount of investment and financing dropped by nearly 70% in the four months, and the volume dropped by 16%. The desolate state of the investment and financing market is basically consistent with the psychological state of the investors we interviewed.

The reason for the divergence between the quarter and the month may be that the secondary market rebounded from January to March, which drove the investment and financing market, and financing news was mostly disclosed in April. The collapse of Terra and 3AC severely hit market confidence and led investors to be more cautious. Therefore, the number and amount of investment and financing decreased from May to July.

Let's review what areas investment institutions have focused on before. As shown in the figure below, in Q2, the most concerned areas of global crypto investment institutions are GameFi and NFT. Games, game-related infrastructure and technology solutions received a total of 82 financings, ranking first in terms of volume, accounting for 16% of the total number of financings. The amount of financing in the GameFi field is also far ahead, as high as 2.996 billion US dollars, accounting for 23.5% of the total financing in the industry. A total of 67 financings have been obtained in the NFT field, ranking second in terms of quantity. DeFi ranked fourth with 50 financings. The infrastructure field represented by L1, L2, mining, privacy, identity, etc. has become a "long tail field", and the number of investments they have obtained is about 10.

2. Track potential ranking and investment logic

Huobi Research has interviewed more than 20 investment institutions in this survey of investment institutions, including crypto native top investment institutions, crypto departments of traditional investment institutions, investment departments of crypto group companies (such as exchanges, wallets, asset management, etc.), investment Incubating companies, and investment institutions focusing on specific tracks. We hope to obtain a more comprehensive and real understanding through a diverse sample of interviews. In this interview, we mainly communicated with various investment institutions about their analysis of the status quo and prospects of each track, investment logic and investment strategies, etc. I hope it can provide some guidance for readers to deeply understand the cryptocurrency industry.

2. Track potential ranking and investment logic

secondary title

The areas of focus of each institution can be divided into two categories, infrastructure and application. On the whole, everyone pays more attention to infrastructure projects. Infra has the highest frequency of mentions, and the two main lines are ZK and the new public chain. Fields such as middleware, data, oracles, and DID also obviously have infrastructure components. In terms of application projects, DeFi, GameFi, and social networking rank the top three. Although DeFi has been deserted for a while, it is still the most optimistic direction for institutions. In contrast, Game and social media are very controversial. Some organizations are supportive, while others are obviously not optimistic. Let's analyze one by one to see why institutions pay attention to these areas.

Second, prepare for the new narrative of Web3. The grandest narrative in the current Internet field is Web3, and many traditional Internet giants such as Amazon, Google, Meta, ByteDance, Baidu, etc. are actively exploring and deploying. One theory is that Web3 is a new generation of Internet ecosystem based on blockchain technology. Of course, the users served by this Internet system cannot be just a few million people, but one billion. However, the current blockchain infrastructure is far from sufficient to serve such a large number of users, so it must be continuously upgraded and transformed.

The survey results show that various institutions pay more attention to infrastructure than applications. Some institutions did not explicitly mention the word "Infra", but their focus still falls on areas such as ZK and new public chains. For the convenience of discussion, this article classifies zero-knowledge proof, new public chain, middleware, DID, data, modularization and other fields into infrastructure.

Why focus on infrastructure

There are two main reasons for paying more attention to infrastructure: the first is to comply with the industry development cycle, and the second is to prepare for the new narrative of Web3.

First, conform to the cycle of industry development. The cycle mentioned here is not a general bull-bear cycle, but a sector rotation cycle between infrastructure and applications.

IOSG Ventures uses the law of "Newton's pendulum" to summarize this phenomenon. They believe that if the emerging technology field wants to spread the application, it first needs the underlying infrastructure as technical support. When the infrastructure development reaches a certain level, its performance can support the germination of some early applications (for example, there is no earliest DeFi without Ethereum smart contracts. application). The growth and prosperity of applications requires stronger infrastructure and more complex technology middleware or the improvement of application infrastructure in subdivided fields, which reversely impacts and promotes further iterations of infrastructure (for example: more complex DeFi II Layer protocols need stronger performance support to promote the development of Rollup in reverse. The current crypto GameFi and SocialFi are also in the early stage and require dedicated infrastructure for their respective subdivisions). According to this rule, there will be a phenomenon of fat protocols and thin applications first, that is, the protocol will first capture the value of tokens on a large scale. In investment practice, after five years of investment in the protocol layer and Infra infrastructure, IOSG has invested in platforms such as Cosmos/DoT Near Avalabs in Layer 1, invested in Starkware and Arbitrum in Layer 2, and invested in a large number of native developers in middleware protocol. When Infra was approaching stability and maturity, IOSG turned to the investment strategy of fat applications, and began to capture DeFi and game social unicorns (including metamask and 1inch/Project Galaxy and /Cyberconnect/Bigtime Studio and illuvium, etc.).

Bixin Ventures believes that currently there are not many innovative products coming out of the application layer, and some hotly-hyped concepts have not yet landed, and there is no time for investment. This is a good time to invest in infrastructure, hoping that they will be the first to start in the next bull market. Compared with betting on application projects, this is the winning rate[1]higher layout. Moreover, the odds of infrastructure projects are also very high, and they can also undertake larger funds. Matrix Partners proposed the "8020 Law" as a practical work guide. In a bear market, use 80% of your energy to research Infra, and 20% to research application projects, and in a bull market, adjust this ratio upside down.

Second, prepare for the new narrative of Web3. The grandest narrative in the current Internet field is Web3, and many traditional Internet giants such as Amazon, Google, Meta, ByteDance, Baidu, etc. are actively exploring and deploying. One theory is that Web3 is a new generation of Internet ecosystem based on blockchain technology. Of course, the users served by this Internet system cannot be just a few million people, but one billion. However, the current blockchain infrastructure is far from sufficient to serve such a large number of users, so it must be continuously upgraded and transformed.

text

The views and judgment logic of various institutions on several key areas in infrastructure are discussed below.

Let's make two horizontal comparisons first to see the status of ZK in the minds of institutions.

Zero-knowledge proofs (ZK) are the area of the most attention from various institutions in the technical infrastructure. It mainly includes ZK Rollup and its accelerated network.

The position of ZK

Let's make two horizontal comparisons first to see the status of ZK in the minds of institutions.

First, ZK Rollup will play a greater role in the expansion of Ethereum, and its capabilities have not been fully utilized at present. Needless to say, improving performance, ZK can also solve the problem of lightweight blockchain. Because all nodes have to store a large amount of data, it is difficult for ordinary operators to carry it, which increases the degree of centralization. ZK Rollup needs to upload a smaller amount of data to the chain, which helps to alleviate the storage pressure on nodes. The more prosperous the ecosystem on the chain, the greater the demand for lightweight, and the greater room for ZK Rollup to develop. Of course, the original transaction data still needs to be stored, which is where the data availability layer in the modular public chain comes in handy.

Second, in the competitive landscape of the public chain, institutions are slightly more optimistic about ZK than the new public chain. The reason is that ZK, or the Layer 2 it endorses, represents the expansion direction of Ethereum, and institutions are relatively more optimistic about Ethereum at this stage. JDAC Capital believes that Ethereum will become a settlement agreement in the future, and the objects using this agreement may expand, and even the traditional Internet can also use the public chain for settlement. The asset attributes of Ethereum are high, and the network value consensus is high, so settlements on Ethereum will have a higher degree of trust, and the value of assets will be more recognized.

Logic of Layout ZK

The reason for being optimistic about ZK is that in addition to its comparative advantages, it is necessary to look deeply at its own value. Zonff Partners clearly stated that ZK is one of the four potential core driving forces in the next cycle and has long-term value. It occupies two core levels of narrative, Ethereum scaling and private computing. Maybe what ZK Proof is to cryptography and blockchain, will have the positioning of machine learning to artificial intelligence. Especially in the field of Ethereum expansion, it already has the structure of the upstream and downstream of the track, such as developers, computing equipment providers, node services, application requirements, user requirements, etc. On the one hand, a track with a stable structure is more suitable for the capital layout of institutional types; on the other hand, the development expectations are stable, and it does not completely depend on the macro or a hot event. Positive feedback is easier to generate during the entry process of projects or entrepreneurs.

First, ZK Rollup will play a greater role in the expansion of Ethereum, and its capabilities have not been fully utilized at present. Needless to say, improving performance, ZK can also solve the problem of lightweight blockchain. Because all nodes have to store a large amount of data, it is difficult for ordinary operators to carry it, which increases the degree of centralization. ZK Rollup needs to upload a smaller amount of data to the chain, which helps to alleviate the storage pressure on nodes. The more prosperous the ecosystem on the chain, the greater the demand for lightweight, and the greater room for ZK Rollup to develop. Of course, the original transaction data still needs to be stored, which is where the data availability layer in the modular public chain comes in handy.

Institutions pay more attention to ZK Mining's position in the entire industrial structure.

Based on the above logic, many institutions believe that ZK Rollup is the best solution in Layer2. And because the Ethereum Foundation itself also takes a fancy to ZK technology, and has not seen the same advanced solution so far, so it is necessary to lay out its bottom layer.

ZK's key layout direction

Zonff Partners, JDAC Capital, and Hashkey Capital all clearly mentioned that they are focusing on ZK accelerated network and mining. ZK Rollup requires a large amount of calculations when generating proofs, so it needs to be accelerated by hardware and has real requirements. Considering the status of ZK in the entire ecology mentioned above, ZK mining is still a long-term demand.

Institutions pay more attention to ZK Mining's position in the entire industrial structure.

Second, ZK will expand the demand for the DA layer. As mentioned above, although ZK Rollup needs to upload less data to the chain, it still needs to upload the original data. The DA layer is responsible for storing these raw transaction data and ensuring their availability. From this perspective, it can be said that it is an upstream industry of ZK, and the prosperity of ZK will also drive the prosperity of the DA layer. The author's previous article "How the Data Availability Layer can shape the future of blockchain" once made a simple calculation. If Rollup achieves greater development, a "Rollup-centric" situation will appear. With the price of ETH rising again, DA Layer is expected to reach $2 billion in annual revenue.

However, it is difficult for the ZK hardware industry to obtain the market scale like Bitcoin mining. The first is to see whether the ZK underlying protocol is open to the proof of decentralization, that is, mining, and it can be done in a centralized way. The second point is more important. ZK mining is limited by the scale of the ZK project, that is, how much capital can be carried on ZK in the future. If there is a big breakthrough in this point in the future, the ceiling of ZK Mining can also be very high.

The impact of the rise of ZK on other tracks

Finally, take a look at how the rise of ZK interacts with other tracks.

First of all, ZK will enhance the competitiveness of Ethereum. JDAC believes that the level of technical solutions and community building of Ethereum is unmatched by other L1s, and it is difficult for other L1s to break its dominance when using EVM. Once ZK matures, it will further strengthen the position of Ethereum. Let’s not draw conclusions here, but we can make such a guess that the development of ZK will greatly enhance the competitiveness of Ethereum, and the Iron Throne of the public chain will not be so easy to change hands. When the market was good last year, Ethereum’s Layer 2 was not adopted on a large scale, and the handling fees of other new public chains were already negligible, and Ethereum still accounted for more than 60% of TVL. So if Ethereum narrows the performance gap with other public chains and maintains a high degree of decentralization, we have reason to believe that its status will be further strengthened.

Second, ZK will expand the demand for the DA layer. As mentioned above, although ZK Rollup needs to upload less data to the chain, it still needs to upload the original data. The DA layer is responsible for storing these raw transaction data and ensuring their availability. From this perspective, it can be said that it is an upstream industry of ZK, and the prosperity of ZK will also drive the prosperity of the DA layer. The author's previous article "How the Data Availability Layer can shape the future of blockchain" once made a simple calculation. If Rollup achieves greater development, a "Rollup-centric" situation will appear. With the price of ETH rising again, DA Layer is expected to reach $2 billion in annual revenue.

text

Fourth, the development of ZK may give birth to new application projects. ZK Rollup needs to upload a small amount of data, which means that the application can design more complex business logic. There may be some different application projects, such as DeFi projects with more complex business logic, and the killer application of Layer 2 is likely to appear in ZK Rollup. However, this requires a prerequisite, that is, the maturity of the general ZKEVM.

The logic of laying out the new public chain

The new public chain has also received a lot of attention, but investment institutions have much less discussion about it than zero-knowledge proofs. Many of them are focused on strategic configuration, rather than seeing definite opportunities.

The logic of laying out the new public chain

Highlights of the new public chain

When judging and selecting projects, several venture capital institutions have proposed to look at performance correctly. First of all, the performance itself is not important, but the comparison of performance is important. Every new generation of public chains has to mention performance improvement, and their comparison object is Ethereum. However, Ethereum itself is also improving performance. When Layer 2 is more adopted, users may find it difficult to detect the performance gap between public chains, or the gap is not enough to attract users. Second, actual performance is more important than lab performance. The 160,000 TPS claimed by Aptos is laboratory data, and the correlation between transactions needs to be detected in order to better utilize the concurrent capabilities. The actual performance remains to be seen. Solana claims 65,000 TPS, but it went down 4 times on a large scale, and its performance is not stable enough.

Highlights of the new public chain

Although there is no particularly exciting project, HashKey and NGC Ventures are very concerned about two innovations that have appeared in a recent batch of new public chains.The first is the Move programming language used by popular public chain projects Aptos and Sui. The second is parallel processing technology. Their value may not be limited to a certain public chain itself, but will have a greater impact on the industry.

Decentralized identities (DIDs) are Internet addresses that users can own and control, and are an infrastructure for many Web3 applications. In the current blockchain network, users already have ownership of assets, but the user's identity in virtual life has not yet been established. Just as assets in a decentralized world can flow freely across the boundaries of applications, users themselves should also have this ability, which requires a user identity that can represent the user. With identity, social applications, other Web3 non-financial applications, and some new DeFi businesses can be launched. For example, when users use social applications, they can prove who they are by using a certain DeFi protocol, participating in the governance of DAO, or playing a certain game, so as to find more like-minded friends. However, investment institutions are also concerned about whether the agreement can generate sustainable income. This point has not been seen yet, and most DID protocols obtain income through staking and liquidity mining, which is unhealthy. In the long run, if you have a certain user group, you can make profits through service fees. There will be a long construction cycle in the middle, and the project team must adhere to long-termism.

Parallel processing is another big bright spot, and it may be the underlying improvement trend. Currently, Ethereum transactions are processed serially, and all transactions need to be processed by the single-core CPU of the EVM. The idea of parallelizing transactions is not to use linear processing, but to use a more parallel method. For example, Aptos uses a 16-core CPU to open multiple threads to process unrelated transactions at the same time to improve TPS. Fragmentation technology is actually a typical example of parallel processing, but it is more about parallel design at the architecture level. The parallel processing mentioned here refers to the parallelization of processes or threads during program processing, which is closer to the bottom layer of the system. Parallelization may become the standard configuration of public chains in the future, and all public chains have this feature more or less. This transformation is similar to the adoption of the POS consensus mechanism in public chains after 18–19 years, and the general abandonment of the POW mechanism.

2.1.3 Middleware

The degree of attention of middleware is second only to ZK and the new public chain. Middleware generally refers to software that provides common services and functionality to applications. Data management, application services, messaging, authentication, and API management are often handled by middleware. Its role is to connect infrastructure and applications. For the convenience of discussion, this article first classifies it into the infrastructure category.

Because middleware has the attributes of infrastructure, if more applications adopt it, it will attract other applications to follow, and then form an unwritten standard. Therefore, its network effect is very strong, and it is prone to a winner-take-all situation. Investment institutions will naturally not let go of such a field. They focus more on decentralized identities, data protocols, and wallets.

Decentralized identities (DIDs) are Internet addresses that users can own and control, and are an infrastructure for many Web3 applications. In the current blockchain network, users already have ownership of assets, but the user's identity in virtual life has not yet been established. Just as assets in a decentralized world can flow freely across the boundaries of applications, users themselves should also have this ability, which requires a user identity that can represent the user. With identity, social applications, other Web3 non-financial applications, and some new DeFi businesses can be launched. For example, when users use social applications, they can prove who they are by using a certain DeFi protocol, participating in the governance of DAO, or playing a certain game, so as to find more like-minded friends. However, investment institutions are also concerned about whether the agreement can generate sustainable income. This point has not been seen yet, and most DID protocols obtain income through staking and liquidity mining, which is unhealthy. In the long run, if you have a certain user group, you can make profits through service fees. There will be a long construction cycle in the middle, and the project team must adhere to long-termism.

text

For middleware like wallets, expanding the audience is a key issue. Most outsiders have never used an encrypted wallet, and wallets are even an obstacle for them to enter the encrypted world. And StepN has made a good demonstration. It integrates the Web3 wallet into the product itself. When registering an account, it guides users outside the circle to create a wallet, giving users a seamless wallet experience for the first time. This is also a new idea for the wallet itself, through deep integration with consumer-oriented dapps to achieve non-inductive acquisition of incremental users.

2.2 DeFi

As a pioneer in the application layer, DeFi has naturally aroused quite a lot of discussion. However, apart from the AMM algorithm, DeFi does not have more mechanism innovations, and the nesting doll-style innovations cannot stir up too much splash in the market. Therefore, like the public chain, institutions tend to continue to pay attention to DeFi, but generally maintain a wait-and-see attitude.

Since the birth of AMM, the current DeFi market has developed relatively mature. Not only are the tracks diverse, but the ecological projects are also relatively complete. Some large and comprehensive infrastructures have formed obvious head effects, such as DEX, lending, etc. Institutions such as Nothing Research and Matrix have some basic judgments on the overall trend of DeFi in the future:

Blockchain has been closely connected with finance since its inception. With the introduction of smart contracts, DeFi has gradually demonstrated strong financial innovation vitality and attracted a large number of funds. At the same time, DeFi, by virtue of its own combination and no need for access, has well solved the pain points of users such as high access threshold, centralization risk and high capital volume in traditional finance. For transactions, there is no private misappropriation of assets, and anyone can also perform corresponding operations based on the liquidity and positions on the chain. Smart contracts provide automated rules for how specific financial instruments and protocols should behave, executed and governed by code, without favoring any one investor. After frequent thunderstorms by CeFi institutions, the advantages of DeFi are particularly prominent.

development path

Since the birth of AMM, the current DeFi market has developed relatively mature. Not only are the tracks diverse, but the ecological projects are also relatively complete. Some large and comprehensive infrastructures have formed obvious head effects, such as DEX, lending, etc. Institutions such as Nothing Research and Matrix have some basic judgments on the overall trend of DeFi in the future:

secondary title

2. For the new DeFi protocol, the current DeFi tracks are relatively saturated. Before disruptive innovations appear in the general environment, it is difficult to find a new continent for development. Therefore, institutions are currently focusing on DeFi protocols with relatively mature businesses in the traditional field but fewer competitors on the chain. From the perspective of category, most of them belong to the direction of derivatives. The current model of some derivatives agreements is not bad, but the market has not yet been educated. In addition to allowing users to learn by themselves in the big rising market, it is also necessary to rely on the protocol's own operating capabilities to acquire incremental users.

The logic of social layout

The social track has always been a hot topic worthy of attention, but the views and judgments of various organizations on the track are quite different.

The logic of social layout

On the one hand, various institutions have basically reached a consensus on the discussion of the meaning of social existence, that is, social interaction is the basic need of human beings, and it is also a necessary behavior for the interaction and exchange of values that occur in production and other social activities. Web3 social networking is the future trend, and the upper limit of development is very high. Cobo Ventures believes that in the social platform of the Web 3.0 era, people will have absolute control over their social data.SocialFi products are based on the underlying infrastructure of Web 3.0, starting from people's needs for decentralized social and financial, and integrating the two needs into a product category. It can break platform monopoly, eliminate single-point risks, and create new business models and product categories in the wave of the global digital economic system.

On the other hand, the differences between institutions mainly fall on the short-term and medium-term expectations. Huobi Incubator thinksExisting SocialFi projects are still in the early stages of development, no sustainable paradigm has been formed, and the future model is still unclear. More importantly, if SocialFi only relies on the token economy and the packaging transformation of Web2 social networking, it is destined to be difficult to open the user gap of traditional social giants, and it is necessary to dig more into the original user characteristics and user needs of Web3.The focus of each project has gradually changed, starting to pay more attention to Web3 users themselves, and improving the underlying information transmission and relationship establishment based on their respective Web3 identities.

development path

After many interviews, we have summarized the development path of the social track. The protocol that uses blockchain technology and tokenomics to empower social has the following directions:

First, blockchain + social, improving the disadvantages of Web2 social

The core idea of some social projects is to subvert the monopoly of traditional social giants, and to use the characteristics of the blockchain to make changes, which are mainly reflected in the following aspects:

1. Data autonomy. In traditional social platforms, users are only data participants or users, and the blockchain can realize data uploading, allowing users to control the data themselves;

2. Data Sharing. There are isolated islands of information in the Web2 world, and the data between various platforms are not interoperable;

3. Data Privacy. Unlike traditional Web2 where users passively bear the risk of privacy leaks, although the information in the blockchain is publicly accessible, users can also use encryption technology to protect the privacy of data such as addresses on the chain and control the degree of disclosure.

In terms of economic system, it is logical for blockchain social projects to reward users by issuing platform tokens. After the introduction of the token economy, the interest relationship between users and the platform will change accordingly, and the binding relationship with the platform will also be deeper. If users participate and pay more in the platform, they will not only be rewarded in the number of tokens, The value of a single token will also increase accordingly. At the same time, in order to provide more economic incentives, some "X2Earn" or content creation and mining models have also brought new ideas to social networking, leading to a short-lived SocialFi boom.

The token economy can help blockchain social projects to give certain support in the early cold start, but how to make more users generate real social needs on the platform and carry out production and creation cannot be achieved simply by relying on the token economy solve.

The bigger difficulties faced in SocialFi are:

1. The user base is small. In view of the relatively small number of Web3 social user groups, the effect of only using tokens to realize Web2 traffic conversion is not ideal;

2. Token economic backlash. The interest relationship represented by the token itself is of a time nature. Rewards issued in cash are timely, but the value of tokens will continue to change over time. When the value of tokens drops, the incentives that users can obtain are also shrinking, which will exacerbate the deterioration of the fundamentals of the project;

3. Blurred portraits of users on the chain. Since most SocialFi projects focus more on "Fi", that is, the financial nature of the project, a large number of trading speculators have attracted a large number of trading speculators, and they will leave quickly once they are unprofitable. As a result, the platform has insufficient understanding of social users on the chain and cannot capture the real need;

4. Inadequate infrastructure. The current underlying infrastructure cannot support complex and data-intensive SocialFi applications.

Second, the exploration of Web3 social

The focus of each project has gradually changed, starting to pay more attention to Web3 users themselves, and improving the underlying information transmission and relationship establishment based on their respective Web3 identities.

2. Identity Aggregation. There is no threshold for data analysis, and any project can use identity data to develop products on this basis. However, if users can actively aggregate information on multiple chains, multiple addresses, and even off-chain, so as to carry out a more accurate and three-dimensional image portrayal, it will be the source of continuous development of the project.

The premise of steady and long-term progress is a solid infrastructure. More and more projects are exploring the creation of Web3 identities to describe user groups with real social needs. The establishment of an identity graph includes two aspects:

1. Data analysis. Traditional social products need to establish user habits from scratch; however, data on the Web3 chain is a public resource, and anyone can use existing data (such as transaction data, NFTs that commend identity or personal taste) to portray user images and establish identifiable identities ;

2. Identity Aggregation. There is no threshold for data analysis, and any project can use identity data to develop products on this basis. However, if users can actively aggregate information on multiple chains, multiple addresses, and even off-chain, so as to carry out a more accurate and three-dimensional image portrayal, it will be the source of continuous development of the project.

2. Directed messaging. For example, send a message with a specified address or a type of address. The main scenarios are: NFT off-site transactions, hacker negotiations, and project airdrops.

There are two cases of information transmission:

1. Non-directed information transfer. Mainly rely on the form of social media to attract the attention and communication of others by publishing content (text, pictures, videos);

2. Directed messaging. For example, send a message with a specified address or a type of address. The main scenarios are: NFT off-site transactions, hacker negotiations, and project airdrops.

relationship building

secondary title

In general, social networking has slowly figured out the path of sustainable development after the early exploration and the frenzy of SocialFi. In the future, with the continuous completion of infrastructure such as social data and network relationships, the real needs of social networking will be gradually discovered, and Web3 social networking will be just around the corner.

4. The game can be used as the traffic entrance of L1 and the test field of L2. GameFi is regarded as the track with the most active transactions and the closest to physical applications so far. In 2021, GameFi began to pay attention to the role of the public chain, and the TPS of Ethereum could not meet the requirements of instant computing in the game scene, and some high-performance public chains began to seek new opportunities; for L2, there is currently a lack of attention A cash cow with fast delivery and high activity, and the game just fits with it, and the two may be able to achieve each other in the future.

From the perspective of demand, games are very similar to social networking, and both belong to common application tracks in life; the difference is that the wave of games led by Axie in 2021 has proved that games can not only get out of their own Alpha, but also rely on tokens to create Gold and money-making effects can earn enough premiums on the second level. However, the good times don’t last long. With the gradual cooling of top projects, there are more and more arguments about emptying GameFi, and GameFi is often on the cusp. Judging from this survey, GameFi is also full of controversy.

Layout game logic

On the discussion of why the game should be chained, most organizations can find a consensus. Animoca Brands and Huobi Ventures have discussed this in detail, and we summarize it as follows:

1. Blockchain + games can realize the return of player ownership, which can make the game better establish a decentralized trust mechanism and asset transferability, making the game more sustainable.

2. The game is easy to generate various trading scenarios. Gold mining and free markets in traditional online games and client games have long existed. Both on-site and off-site markets have developed mature adjustment mechanisms and design logic. There is also a need for item circulation and gold coin circulation in games. It's just that the secondary trading market is not very common in traditional games, mainly because the company prohibits it, and the user experience in this area is actually not good. Blockchain technology has changed this, and it will benefit both game companies and users. Now the company mainly earns money from selling skins, and the secondary market of games also has a huge space. Game companies can obtain continuous income by collecting transaction taxes. Players have more freedom and can create and experience more gameplay, which will increase their stickiness to the game, increase the value of the game, and be more willing to pay for the game.

3. The multiple purposes of the unique assets in the game (trading, speculation, collection) have a relatively high fit with NFT. Some in-game items are unique, and these items also have differences in rarity and function. NFTization is a matter of course.

4. The game can be used as the traffic entrance of L1 and the test field of L2. GameFi is regarded as the track with the most active transactions and the closest to physical applications so far. In 2021, GameFi began to pay attention to the role of the public chain, and the TPS of Ethereum could not meet the requirements of instant computing in the game scene, and some high-performance public chains began to seek new opportunities; for L2, there is currently a lack of attention A cash cow with fast delivery and high activity, and the game just fits with it, and the two may be able to achieve each other in the future.

Overall, GameFi Tier 1 investments are riskier from an investment standpoint. In the traditional Web2 game field, before any game is developed and launched, the manufacturer will do a lot of market research and testing. The cost of manpower, material resources, and financial resources is unbearable for the crypto industry, especially in terms of time. Because this industry is too cyclical, opportunities to make money are often linked to the overall market conditions. If GameFi wants to take into account the playability of the game, it must require a strong and professional team, and the development cycle will naturally be extended. Therefore, this contradiction often means an increase in investment risks and bargaining chips.

There are two ways to solve this problem. The first is to make the game fun and keep it fun. The second is to make the economic structure healthier, allowing players to have a relatively stable game relationship due to the outcome of the game or the division of labor in the game. It cannot rely on growth to solve all problems and let new players take over. At least one of these two methods needs to work, so that game-based assets can have a foundation of long-term value, and its value consensus and transaction logic become possible.

GameFi development path

According to Maslow's hierarchy of needs theory, human beings generally first satisfy the basic physiological needs and safety needs, and then pursue higher-level needs, such as social relations, respect, and self-actualization. From this point of view, the game belongs to a higher level of demand, and it is at a very early stage of development in the blockchain world. Specifically, the history of Ethereum is only 10 years old, and the explosion of applications began with DeFi Summer in 2020, followed by GameFi represented by Axie one year later. The boom of the bull market has made the development of GameFi a bit ahead of schedule. The primary market needs new narratives, and the secondary market needs new gameplay. The market conditions have forced the rapid rise of GameFi. As the market gradually cools down, we are able to re-examine the game track. Although there are shortcomings, in terms of long-term value, games are still regarded as the starting point for killer applications built on infrastructure, and there are still many opportunities bred in it.

1. Looking at opportunities from the game team

First, the traditional game manufacturers of Web2. It is not uncommon for traditional Web2 companies to seek transformation and actively embrace Web3 news, and the game field is no exception. Generally speaking, this kind of game manufacturers who have been cultivating for many years have rich game development experience and resources. They have their own systems in various channels such as game release, online operation, project revenue, and advertising. A game product is not a problem. Therefore, this kind of game manufacturers entering the GameFi track may not only develop one game, but a series of game matrices, using the existing user base to gradually realize user conversion, and then inject more incremental users into the ecology. What is certain is that although the user increment brought about by this conversion is the most effective, the development and operation process is relatively slow, requiring game manufacturers to make long-term plans.

Second, crypto native game manufacturers. Correspondingly, there will also be some teams in the native encryption industry who choose to develop blockchain games. However, game development has a considerable degree of participation threshold. Even if the team can introduce talents from major Web2 game manufacturers, after losing the operations and channels of the original major manufacturers, it will be difficult for them to replicate past success in terms of gameplay. As a result, some game teams began to change their thinking, trying to find a way to break through the token economic model. A good economic model must be full of games, so that players can benefit from others while paying, instead of blindly picking up the wool of the project party. Foresight Ventures proposed that for GameFi, the economic model is 1 and the gameplay is 0. It is impossible for original manufacturers to compete with traditional games in terms of gameplay, and a good economic model is the first priority.

2. Looking at opportunities from game modes

Whether it is the P2E model represented by Axie or the expanded meaning of the X2E model represented by StepN, GameFi can actually be regarded as a pan-DeFi product. Because the main innovation of such projects is focused on tokenomics, not on gameplay. The P2E and X2E models are essentially liquidity mining with a few more steps. They are new token distribution mechanisms and do not have core competitiveness. What's more, as mentioned above, the current token economics model is not so healthy. In the future, the value source of GameFi must be the playability of the game and more model innovations on crypto native. SevenX believes that there are 3 types of games that are most likely to take the lead in breaking through: the first is simple games, which use a low threshold to expand the number of players; Long-term retention; the third is that the economic model is more optimized, allowing some players to make stable money in the game, and realize the endogenous cycle of the game ecosystem.

Overall, GameFi Tier 1 investments are riskier from an investment standpoint. In the traditional Web2 game field, before any game is developed and launched, the manufacturer will do a lot of market research and testing. The cost of manpower, material resources, and financial resources is unbearable for the crypto industry, especially in terms of time. Because this industry is too cyclical, opportunities to make money are often linked to the overall market conditions. If GameFi wants to take into account the playability of the game, it must require a strong and professional team, and the development cycle will naturally be extended. Therefore, this contradiction often means an increase in investment risks and bargaining chips.

first level title

In addition, from the perspective of the game itself, any game has a lifespan. The type of a game is determined from the very beginning, and it is relatively difficult to update and iterate. Investing in GameFi is more like a one-shot deal. Therefore, before the game solves the above problems, various institutions are more cautious in taking action on game projects, tending to watch more and act less.

ZK Mining is a good opportunity with high winning rate and odds. Analogous to Bitcoin mining, the concentration of ZK mining will not be very high, and the return will be relatively stable. Its market has a lot of room for imagination. Although the current technical route (GPU/FGPA/ASIC) is uncertain, the residual value of the first two is high and the fault tolerance rate is high. The ZK Rollup platform has two relatively leading projects StarkNet and zkSync, but the competitive landscape of the industry has not yet been fully determined. There are also huge opportunities here. From the perspective of technical strength and financing situation, the two leading projects are still the most optimistic. However, StarkWare's current valuation is relatively high, which may be risky.

After analyzing so many fields, we can't help but think about what kind of projects will explode in the next round of bull market, and in which fields will they be born. And what kind of strategy should be adopted to seize these opportunities. We make a little prediction and do not constitute investment advice.

Infrastructure prediction and strategy

Judging from the cycle of plate rotation, the next protagonist of the encryption market is likely to be (in fact, it is already) infrastructure.

ZK Mining is a good opportunity with high winning rate and odds. Analogous to Bitcoin mining, the concentration of ZK mining will not be very high, and the return will be relatively stable. Its market has a lot of room for imagination. Although the current technical route (GPU/FGPA/ASIC) is uncertain, the residual value of the first two is high and the fault tolerance rate is high. The ZK Rollup platform has two relatively leading projects StarkNet and zkSync, but the competitive landscape of the industry has not yet been fully determined. There are also huge opportunities here. From the perspective of technical strength and financing situation, the two leading projects are still the most optimistic. However, StarkWare's current valuation is relatively high, which may be risky.

The odds of the game are very high, and the winning rate is higher than that of social networking. It is a track that can accommodate many small and medium-sized projects. As more major manufacturers enter the market, more incremental users will enter the market, bringing about the overall growth of the track. So gaming is an area where the next bull market is likely to break out. Fun is not necessarily the most important attribute of chain games. The P2E narrative will definitely make a comeback, especially in the rising stage of the market. Games with better economic models may achieve greater success. To have a relatively long-term development, an economic model with a stable game structure is essential.

Middleware is similar to the new public chain, and it is also an industry with a low winning rate and a high odds. It needs to pay more attention to upstream and downstream cooperation. For middleware, the advantages of leading projects will be more sustainable, so we need to keep paying attention. Before the industry competition pattern is clear, it can be configured in an indexed way, and it is not appropriate to bet on a certain project alone.

Applied predictions and strategies

DeFi still has huge growth opportunities in the next bull market. DeFi is also an area with high odds but low winning rates. At present, due to the sluggish market, DeFi will temporarily enter a dormant period. Some blue-chip projects may go through the bull-bear market, and their second growth curve needs to superimpose mechanism innovation or business scope expansion on the basis of public chain performance improvement. The focus of DeFi innovation may be concentrated on Layer 2 or derivatives on the new public chain. In the field of derivatives, the proportion of perpetual contract trading volume is still far lower than that of CEX, and there is still room for development here. As the market continues to pick up and rise, the demand and narrative for unsecured/undercollateralized lending and algorithmic stablecoins are long-standing, and they may have opportunities for growth. However, after the collapse of UST and 3AC, these two fields need to evolve. The growth potential of DeFi is huge, and the industry concentration is high, so we should focus on leading projects.

The social odds are extremely high, but the winning rate is very low. Its development needs to be based on on-chain identity and performance improvement of the public chain, as well as more application scenarios. So it's probably a late start area. It is difficult to have a breakthrough advantage by copying the existing model, and it is impossible to compete with traditional social giants. Blockchain-based social networking is not useless, and there may be opportunities in these areas. First, meet the original needs on the chain, such as accurate information transmission and community building. Second, use the token economy to solve the real needs of actual social networking, such as trust issues in social networking.

The odds of the game are very high, and the winning rate is higher than that of social networking. It is a track that can accommodate many small and medium-sized projects. As more major manufacturers enter the market, more incremental users will enter the market, bringing about the overall growth of the track. So gaming is an area where the next bull market is likely to break out. Fun is not necessarily the most important attribute of chain games. The P2E narrative will definitely make a comeback, especially in the rising stage of the market. Games with better economic models may achieve greater success. To have a relatively long-term development, an economic model with a stable game structure is essential.

Thanks to the more than 20 investment institutions that cooperated with the research for their suggestions and inspirations for this article. The following is the list of institutions (in alphabetical order, institutions that do not want to disclose their names are not listed):

[1]Original link