Nansen: How to discover and track NFT whales?

Original source: Nansen

1. Introduction

Original source: Nansen

1. Introduction

NFT traders should have one goal: to find out how to find and track NFT whales. The fundamentally transparent, open, and auditable nature of blockchain technology has spawned a new instance of social copy trading: whale watching. Popular in traditional finance, social trading involves retail investors observing and copying the trading behavior of "investment experts" or peers. Copying other investors' homework doesn't require any skills; investors like to copy the investment strategies of big influencers on social media to improve the returns of their own investment portfolios. Due to the opacity of traditional finance, it is not feasible to copy the work of experts.

In the world of cryptocurrencies, the ability to track and replicate "whales" is available to all. Whales to watch: A recent report detailed that less than 20% of wallet addresses control more than 80% of NFTs on Ethereum. These large players operate with information asymmetries, often with greater intelligence than the average market player, allowing them to consistently outperform the market. Investors who know how to spot these whales can guide their trades and make smarter investment decisions.

NF is a unique encrypted asset that represents the ownership of digital assets stored on the blockchain. This article explores how investors can find these NFT whales, track their movements, and make better investment decisions — ultimately improving their returns, while learning from more experienced and better-capitalized investors.

2. What is an NFT giant whale

"Giant whale" is used by traditional investors and crypto investors to describe large investors with deep capital. "Giant whales" can directly affect the market and may cause violent price fluctuations. NFT "Giant Whales" are collectors with large numbers of crypto-related assets (NFTs).

Retail investors seeking to maximize returns should utilize all the tools at their disposal, as markets are inherently adversarial; information is a weapon that can give one investor an advantage over another. Data on the chain is a very useful resource, and retail investors can copy the transactions of the "giant whale" after finding the "giant whale". Because the data on the chain is real-time, by tracking the activities of "giant whales", investors can get Mint minted before the price rises.

Nansen represents one of the best sources of market whale information, providing on-chain analysis of data from millions of wallets. Investors can browse various data and observe the visualized on-chain data feedback in real time, making it an excellent platform for finding NFT whales. Nansen is an essential tool for maintaining market leadership and outperforming the majority.

Nansen’s NFT Paradise Leaderboard

Nansen's NFT Paradise is a powerful data page with macro NFT market dynamics, including real-time updates of floor prices from OpenSea. Investors can see NFT trends and popular NFT collectibles without having to scroll through unnecessary clutter on Twitter or Discord.

image description

Ranked by time frame, investors can choose to follow up-and-comers or established whales with proven track records.

When users filter by time, the data page will exclude lucky users who have only traded once, leaving wallet addresses with at least 10 NFT transactions in 3 NFT collections. Broadly speaking, this is a more general tool that is best used for precise targeting. As an example, the current leaderboard #10 is "Pranksy," the Bored Ape Bored Ape Club giant whale who at one point owned more than 1,251 Apes NFTs but has since sold them for a profit.

image description

We can further use the Nansen Wallet Profiler wallet analyzer, everyone can see which NFTs Pranksy has realized benefits on, and understand which NFTs are worth holding and which are most suitable for liquidation.

How to track NFT whales?

Once investors have identified the NFT whales, either through the profit leaderboard under NFT heaven or through the NFT god pattern, to find the top holders of a particular collection of NFTs, they can then take advantage of the Nansen Wallet Profiler wallet address analyzer.

This provides insight into all activity of any given on-chain address. The basic content includes, for example, digital asset holdings and which contracts this address has interacted with. Most relevant for NFT whale tracking is the NFT section, which shows all NFT collectibles currently owned by this address, how many are owned, and realized gains.

Investors can see which collectibles a percentage of realized gains came from and what percentage of collectibles have been sold. Undoubtedly one of the best sources for micro on-chain metrics analyzers. Finally, there is transaction data for tracking addresses, including buys, sells, and minting.

Specific case - moin3au.eth

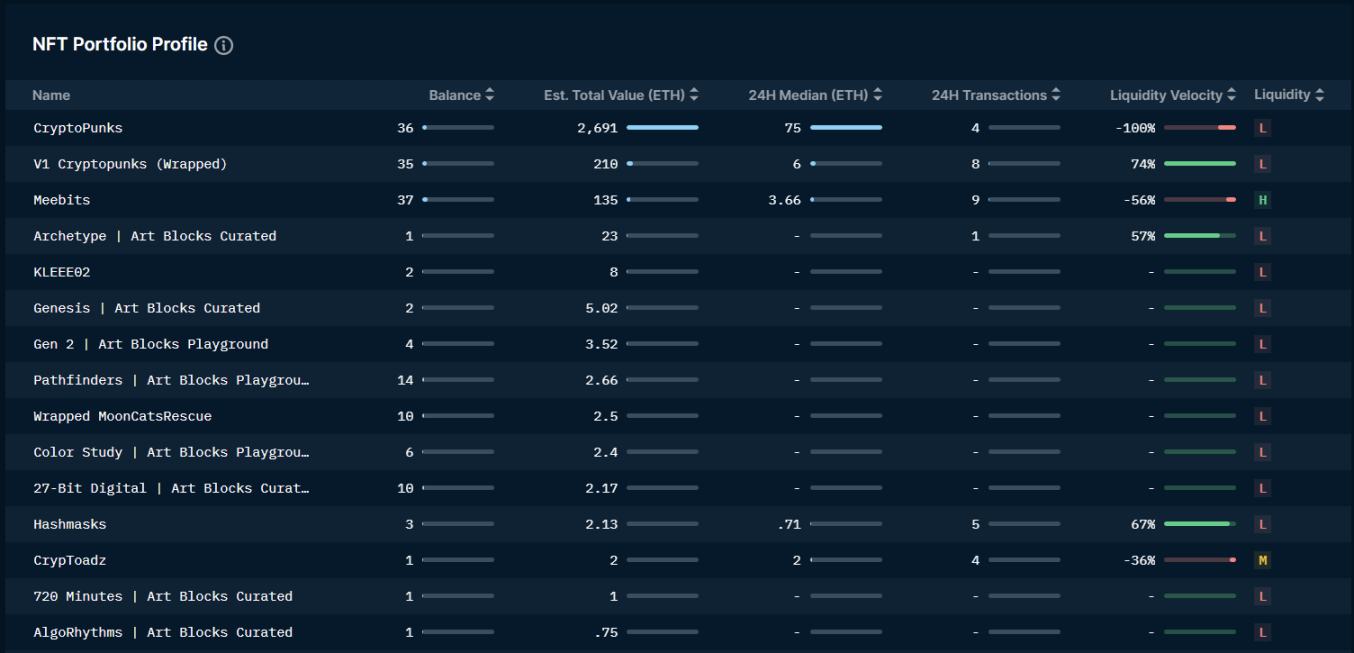

Moin3au.eth is the most profitable NFT wallet address by profit, and most of their earnings are traded through the famous cypherpunk CrpytoPunks NFT, turning 500 ETH into 1500 ETH. The address purchased 356 items and has sold 60% of its total collection to date. Meebits NFT is another highly profitable collection from moin3au.eth, and Nansen’s Wallet Profiler provides a comprehensive breakdown of this wallet’s activity.

moin3au.eth's Wallet

Displaying the NFTs that moin3au.eth decides to profit and the NFT collectibles in the wallet, this dashboard allows investors to replicate best practices.

image description

Specific Case - Shaw

image description

Shaw's Wallets Transaction History

in conclusion

image description

in conclusion