In-depth interpretation of the nine modular public chains: characteristics, financing, and status quo

Original title:Original title:

Original Author: Breeze

TL;DR

first level title

1. Compared with Ethereum, which is burdened with heavy historical data, the modular chain represents a more reasonable multi-chain structure trend.

2. The modular chain is currently dominated by DA and the execution layer. The execution layer is easy to deploy, and DA emphasizes the optimization of performance.

first level title

first level title

How are modular chains different?

The modular chain itself is also a blockchain with network nodes. Different from the monomer chain, these nodes only focus on one type of task, such as only focusing on DA, only focusing on transaction execution, or only focusing on network consensus.

Take Celestia, for example, a chain focused on data availability. It encourages nodes to provide DA for other chains/Rollups by rewarding and slashing tokens for node behavior.

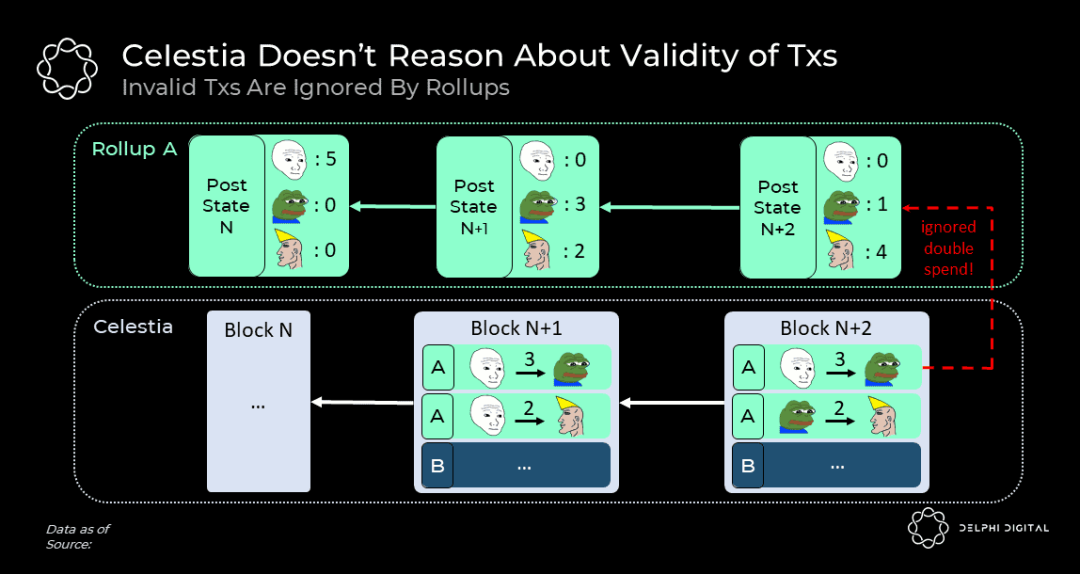

image description

Source: Delphi Digital

The verification and execution of the transaction is handed over to Rollup based on Celestia DA. For invalid transactions, Rollup will ignore them, and Celestia will not "dispose" of these invalid transactions.

It can be seen that the modular chain is like different processes on the assembly line, connecting each other and performing their own duties, so that the overall efficiency is improved.

first level title

Advantages of modular chains

1) Lighter and can be combined with each other

Take Celestia DA-based modular execution layer as an example, they can share Celestia's security. As long as complete data is available, Rollup will compute the same state when running the same validity rules. This means that even if these modular execution layers are attacked, after the fork, these execution layers can still calculate the same final state.These execution layers no longer need to design for their own security, weigh complex underlying consensus and token economic models, and no longer need to rack their brains to persuade nodes to join to maintain network operation and improve decentralization. They can even be designed to be slightly centralized. they

It can be made lighter and easier to deploy quickly.Different modular chains, even modular chains and monomer chains can be combined with each other

, such as DA and execution layer combination, Celestia and Ethereum combination. Of course, in the process of combination, there must be considerations and even trade-offs in terms of security, compatibility, and performance.

2) Governance decoupling, the execution layer can respond quickly, and the consensus layer can achieve robust improvement

If you check the project governance proposals, you will find that a large part of the proposals are related to execution, such as token freezing and burning. Such proposals will not be able to make quick decisions if they solicit broad community votes, and may result in protocol losses in black swan events.

For some low-level governance proposals, out of security considerations, the improvement of the protocol often requires a long period of community coordination, trials, and adjustments to be finalized and finally implemented.

In the scenario of a modular blockchain, the consensus layer, execution layer, DA layer, and settlement layer are already separated from each other, so governance can also be independent. Therefore, the execution layer can respond quickly to the environment, and the governance of the consensus layer does not need to be rushed.

Governance decoupling essentially reflects an important trend in the differentiated development of each modular chain. The core layer close to consensus and state can stick to the fortress of decentralization and security. The execution layer can enhance scalability and maximize performance.

3) Form a "trust-minimized" cluster

Blockchains are connected by bridges. Bridges can be divided into two types according to their security: bridges that require trust and bridges that minimize trust. The two chains connected by a trust-minimized bridge need to meet two conditions: 1) have the same DA as a guarantee; 2) can provide transaction validity/fraud proof.

In the scenario of a modular blockchain, a "trust-minimized bridge" can be formed between Rollups that use Celestia as DA (and their transaction ordering rules are consistent), and it is expected that relatively safe funds and message transmission can be carried out between them.

first level title

9 modular chains

The market is paying more and more attention to the modular public chain. But at present, there are not many related attempts, especially some general-purpose solutions.

If you do not consider the modular structure of the entire ecology such as Cosmos and Polkadot and the Ethereum execution layer Rollup, there are only 9 related solutions collected by Beep News, namely Celestia (including Cevmos, Celestium), Polygon Avail, EigenDA, Fuel, Assembly, zk Porter, StarkEx DAC, Arbitrum Anytrust, Adamantium.

Through observation, it can be found that the current modularization attempts are mainly based on the execution layer and DA.In particular, the modularization of the execution layer will be easier to deploy.

Because the modularization of the execution layer generally does not require too much consideration for decentralization, and the connection between the execution layer and the main chain already has a security solution such as validity proof/fraud proof.The modularity of DA is also relatively easy to deploy. Celestia was originally called LazyLedger (lazy ledger), because it does not need to deal with transaction execution and transaction validity, but only needs to store and provide data.

DAs themselves will also emphasize TPS, that is, how to store more DA.

In terms of modular settlement layers, Cevmos, a dedicated settlement layer launched by Celestia and Evmos for EVM Rollup, is currently the only one.

secondary title

1)Celestia

https://celestia.org/

progress:The representative of the modular chain is a general-purpose modular solution. The first testnet Mamaki was launched in May this year. The incentive testnet will be launched in Q4. The mainnet will go live in 2023 with tokens.

Financing:In March 2021, it received US$1.5 million in seed round financing. Investors include Interchain Foundation, Binance Labs, KR1, etc.

Features:Features:

In order to improve TPS, Celestia introduces the same Data Availability Sampling (DAS) technology as Ethereum Danksharding.

We know that as blockchains are used, on-chain data accumulates. This places ever-increasing hardware requirements on full nodes to download all data and validate all transactions.

Light nodes only need to download and verify block headers. Therefore, light nodes in the network often account for a large proportion, and there is a trend of increasing proportion. But light nodes will bring a problem, that is, when malicious nodes publish blocks and hide invalid transactions, light nodes cannot make judgments.

Data Availability Sampling (DAS) uses erasure coding. The basic principle is to divide the data into segments and add a certain check to make the association between each data segment. In this case, even if the data is lost, as long as the data sampled by all light nodes reaches a certain proportion, the complete data can be calculated, so that the light nodes can obtain DA.

The advantage of this is that the light node itself reduces hardware requirements, and mobile phones and laptops can become light nodes, which is conducive to the decentralization of the network. Second, DAS allows a higher proportion of light nodes in the network. Furthermore, the more light nodes that participate in data sampling, the more secure the network will be, and it will also support the appropriate increase of block space, and the overall effect of capacity expansion will be achieved.

It is undeniable that block space is a real consumable, and there seems to be no good solution to ensure that any one blockchain is always available.

Cevmos:Even the current expansion scheme of Ethereum only reduces the redundancy of storage and verification by packing and compressing transactions, appropriately expanding the block space, and sampling data, thereby improving the utilization of block space, but the available block space Actually less and less. This is also true on any new public chain.

Celestium:secondary title

2)Polygon Avail

https://polygon.technology/solutions/polygon-avail/

progress:Universal modular solution, providing DA. The testnet was launched in June this year. At present, channels such as Twitter show less progress.

introduce:secondary title

3)EigenDA(EigenLayer)

https://www.eigenlayer.xyz/

Features:Features:

EigenDA is a DA scheme proposed by EigenLayer. EigenLayer itself is the restaking layer of Ethereum.

Founder Sreeram Kannan put forward this point of view: the trust between blockchains and DAPPs is separated from each other, and each has to pay high capital costs to maintain ecological trust. For example, the Ethereum Beacon Chain now has more than 13 million ETH pledged. To maintain this pledge volume, Ethereum now provides pledged users with an APR of about 5%.

secondary title

4)Fuel

https://fuel.network/

progress:Fuel is a modular execution layer. In June, a developer network-based demo application, SwaySwap, was launched, which is an AMM.

Financing:In September 2021, it received US$1.5 million in financing, led by CoinFund, with participation from Fenbushi Capital and Origin Capital.

Features:Features:

Fuel is the Optimistic Rollup of Ethereum, which initially expands the capacity of Ethereum through technologies such as UTXO (unspent transaction output). 1.0 is mainly applicable to payment applications.

secondary title

5)Assembly

https://assembly.sc/

progress:A modular smart contract layer on top of IOTA. Currently in pledge period 3. By staking MIOTA through firefly.iota.org, stakers can get 0.000001 Assembly token ASMB every 10 seconds. The wallet must reach more than 1 ASMB to receive the airdrop. 20% of the total ASMB will be allocated to IOTA stakers. The main network of Assembly is expected to go online this year, and the ASMB transfer function will be opened at that time.

Financing:The total funding raised reached $118 million. Investors include Huobi, LD Capital, HashKey Capital, Signum Capital, etc.

Features:Features:

Assembly is based on IOTA. Different from the account model of Ethereum, IOTA is based on the UTXO ledger and supports high concurrency, but UTXO is not compatible with smart contracts like the account model. In addition, IOTA also adopts DAG (Directed Acyclic Graph) data structure, which is also conducive to high concurrency.

In the combination of IOTA+Assembly, IOTA can achieve high performance because of UTXO and DAG. Because UTXO is not compatible with smart contracts, IOTA is very suitable for L1 that only focuses on DA and settlement (equivalent to no DAPP and execution layer competing for block space on L1). Assembly is a smart contract layer built on IOTA to support Rollup's smart contracts.

The structures of IOTA+Assembly and Polkadot+Moonbeam, and Cosmos+Evmos are similar. The modular smart contract layer provides support for smart contracts such as Rollup and parachains.

6)zkPorter

https://zkporter.io/#/

secondary title

Features: zkSync supports both zk-Rollup and zkPorter solutions. The DA of the former is on the chain, and the DA of the latter is placed off the chain. The off-chain DA of zkPorter is maintained by Guardians (zkSync token holders) and has a penalty mechanism. Maintaining DA based on Guardians is a more centralized way.

7)StarkEx DAC

https://starkware.co/starkex/

Features: StarkEx DAC is StarkEx's off-chain DA solution. DA is maintained by the Data Availability Committee (DAC), and the maintenance method of DA is more centralized than zkPorter. StarkEx also has a Volition plan, that is, DA can be placed on-chain or off-chain.

8)Arbitrum Anytrust

secondary title

Progress: Arbitrum launched the Nova chain in August, which is based on Anytrust technology. At present, the Nova chain has been launched on the main network. The official stated that Nova is suitable for high-frequency scenarios such as games and social networking, and is sensitive to transaction fees.

9)Adamantium

Features: Adamantium is also an off-chain DA solution. Little information is available. Just know that it retains the scalability advantages of off-chain DA, but without trusting the Data Availability Committee (DAC), users can choose to host their own off-chain DA. Even if the user is offline, the funds will not be stolen or frozen, and can be automatically moved back to L1.

first level title

Status and Future Prospects

Overall, the modular chain is currently in the early stages of development.

There are many updates on Celestia and Fuel’s twitter, but it is mainly about the popularization of modular advantages, as well as information about team members’ participation in online and offline activities. There is almost no information on cooperation between project parties. It can be seen that the modular project is still mainly in the early stage of evangelism and start-up.

Among the 9 modular chains counted by Beep News, at most 2 are already available on the mainnet, namely the Arbitrum Nova chain based on Arbitrum Anytrust technology and StarkEx's DAC solution. Others such as Celestia, Polygon Avail, Fuel, zkPorter, etc. are still in the testnet stage, and others should still be in the conceptual stage.However, it is very likely that we are about to usher in the highlight moment of the modular chain.

Celestia announced that the main network will be launched in 2023, and the main network of zkSync 2.0 is expected to be launched in late October and early November. With the advancement of the new public chain and the development of Ethereum L2, these important developments are likely to win higher attention for the modular chain.

In addition, we have observed that Ethereum Rollup has made many attempts to modularize DA. They all try to maintain off-chain DA through relatively centralized groups, such as Guardians (token pledgers) and DAC (Data Availability Committee), so as to solve the problem of high cost of on-chain DA mentioned at the beginning of the article. This is also a good solution for Ethereum trading scenarios with high-frequency trading requirements.

Under different scenarios and needs, we need to have different inclinations and trade-offs for decentralization and performance. So in the modular chain ecology, we should also be able to see different options. Even in the future, ecosystems such as BNB Chain and Solana may also attempt modularization.However, before all this happens, the initial modular chains such as Celestia will be the first to face the test of the market, and modular chains may also bring some new problems.

For example, do they introduce new security issues when they are connected to each other and L1? For example, does the modular chain also break the composability of the original Ethereum DAPP? How do these problems need to be solved?