Sort out the projects co-invested by top crypto VCs: What are the potential empty bids?

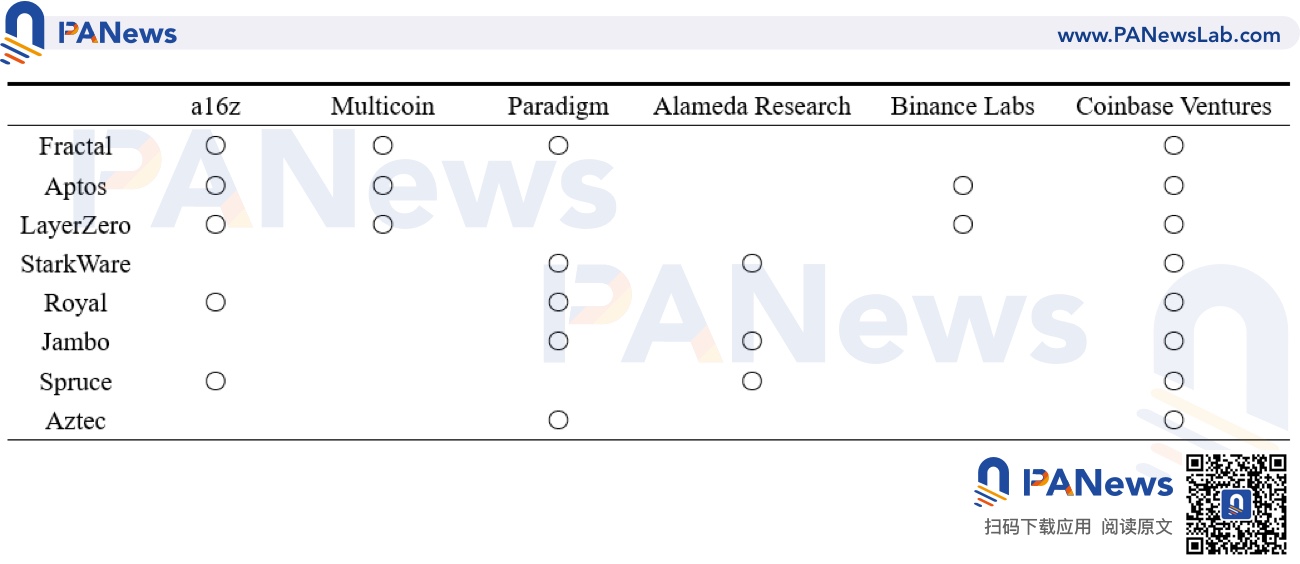

Although the crypto bear market has brought about a long and cold winter, it also brings opportunities to buy "high-quality targets" at a relatively low price, and it also helps ordinary users ambush projects that have potential but have not yet issued tokens. The encryption world is like a dark jungle, how to screen potential empty bids is the primary problem faced by users. In this article, PANews starts from the investment landscape of 6 leading VCs in the encryption circle, including a16z, Multicoin, Paradigm, Alameda Research, Binance Labs and Coinbase Ventures, and sorts out projects that are jointly invested and have not yet issued tokens, and provide users with options for empty bids. refer to.

secondary title

Fractal: Game NFT trading platform

FractalIt is a trading platform dedicated to game NFT deployed in the Solana ecosystem to support the free exchange of in-game assets in a safe and open market. Fractal was founded by Justin Khan, the co-founder of Twitch, and completed a $35 million seed round of financing in April. Paradigm and Multicoin Capital led the investment, and a16z, Coinbase Ventures, Solana Labs, Animoca Brands and others participated in the investment.

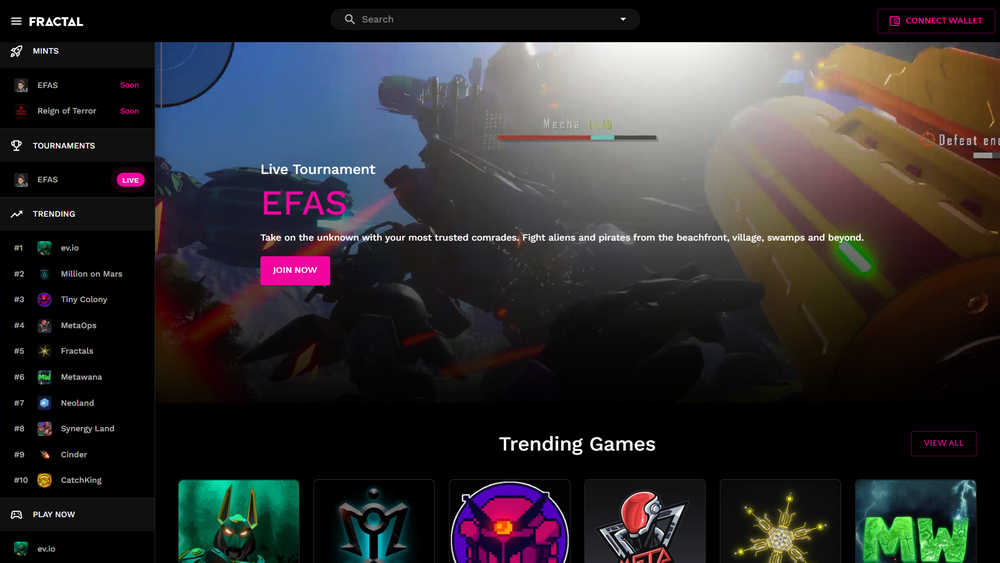

In order to support users to experience the game seamlessly, Fractal has launched the Fractal Wallet, which allows the use of existing Google accounts for easy registration and login. Fractal divides games into 4 categories, namely Mints, Tournaments (tournaments), Trending and Play Now. Among them, Mints displays the game items that are being or will be opened for casting. Users can click on the items in different categories to see them. Information about the project, such as NFT transaction data, project introduction, social media links, etc.

In addition to the traditional "Paly to Earn", the platform has also set up tournament activities, that is, players can compete for bonuses by participating in games in the tournament. The current tournament game is the space sandbox chain game Earth From Another Sun (EFAS), which is in In June, it received US$4.5 million in financing from institutions such as Solana Ventures, Alameda Research, and Lightspeed. This round of bonus is US$10,000. As of August 2, the games that can be played on the Fractal platform are shooting gamesev.io, tank battle gamesPanzerdogs。

secondary title

Aptos: A new public chain built by the former technical team of Facebook

AptosIt is a new public chain focusing on security, scalability, and upgradeability. It was founded in 2021 by the original team members of Meta (formerly Facebook) who were in charge of the Diem project. The programming language used was originally developed for Diem. Move language. Compared with Solidity, one of the most commonly used development languages, Move stands out in terms of security.

Under the halo of the team members' "famous background", Aptos is favored by many top VCs in the industry, including a16z, Multicoin Capital, Binance Labs, Coinbase Ventures, FTX Ventures, Tiger Global, PayPal Ventures, etc.

On August 1, Aptos released the highlights and updates of Incentive Testnet 2. A total of 225 nodes participated in the test, distributed in 110 cities in 44 countries around the world. In addition, Aptos will issue token rewards to participants in the Incentivized Testnet 2 who meet certain conditions. In addition, the Aptos Incentive Testnet 3 will open registration on August 19th and end on September 9th, after which the mainnet will be released in the fall.

In order to promote the development and construction of the entire ecosystem, in addition to the hackathon (which has already been held once), Aptos also launched an ecosystem funding plan. The funding categories include:

developer tools, SDKs, libraries, documentation, guides and tutorials;

Tools and frameworks for development, governance, DeFi, NFT;

Core protocol contributions: Token standards, libraries, protocol upgrades, etc.;

open source and public goods;

education plan;

Applications (such as DeFi, DAO, Gaming, etc.).

It is understood that Aptos has about 100 projects built on the network, involving DeFi, NFT, Gaming and other fields, such as the construction of the first DEX Liquidswap in the ecosystemPontemNetwork, providing liquid pledge servicesZaptos, Aiming to solve the DAO payment problemPaymagic, build wallet Martian Wallet and NFT market CuriosityMartian DAO, decentralized asset management and investment agreementSolrise Finance,walletFewcha WalletAptos ecologyAptos ecologysecondary title

LayerZero: Interoperability Protocol Has Cross-Chain Bridge Application Stargate Finance

LayerZeroIt is a full-chain interoperability protocol to solve the problem of information exchange between different blockchain networks, that is, the current functions on a single chain can also be realized in the form of cross-chain, such as cross-chain lending, cross-chain pledge, etc. LayerZero was developed by the Canadian team LayerZero Labs. It completed a US$135 million A+ round of financing at the end of March. Investment institutions include a16z, Coinbase Ventures, Multicoin Capital, FTX Ventures, Tiger Global, Sequoia Capital, etc. In September 2021, Multicoin Capital and Binance Labs co-led LayerZero’s $6 million Series A round.

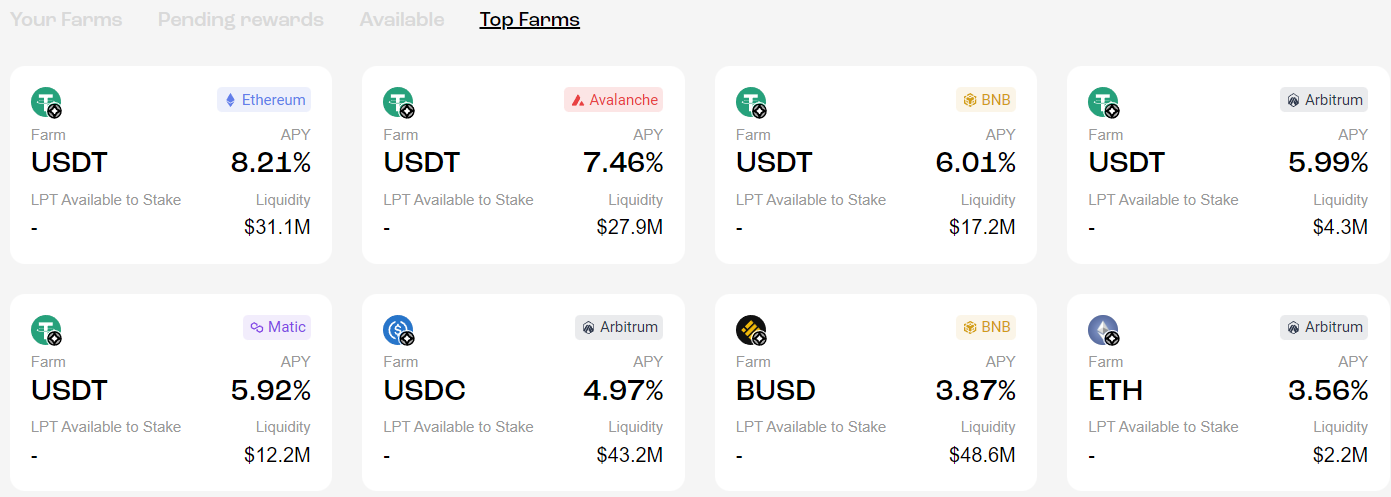

As a cross-chain underlying protocol, LayerZero has launched the first cross-chain bridge applicationStargate Finance, the latter had a lock-up amount of more than 2 billion US dollars a week after its launch. As of August 2, its TVL was about 480 million US dollars. Through Stargate Finance, users can transfer or exchange cross-chain assets (non-encapsulated assets), provide stablecoins (USDC, USDT, BUSD) and ETH unilateral liquidity, and pledge native STG to obtain veSTG (for governance voting). PANews also introduced in detail beforeAdvantages of cross-chain bridge Stargate Finance。

secondary title

StarkWare: Ethereum Layer 2 Expansion Solution

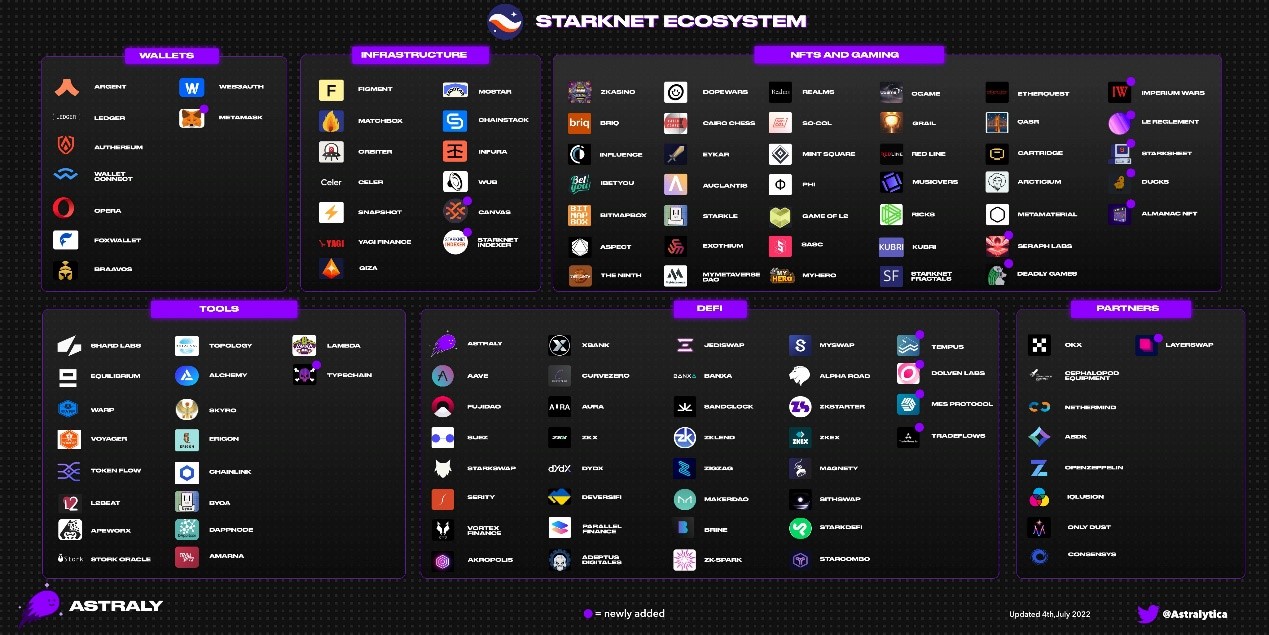

StarkWareIt is one of the "big four" Ethereum second-layer expansion solutions (Arbitrum, Optimism, zkSync), focusing on building ZK-Rollup-based solutions. Currently, it has released two products, StarkEx and StarkNet, among which the protocol built on StarkEx includes dYdX , ImmutableX, Sorare, etc. Compared with StarkEx, StarkNet is more versatile and is a license-free, composable network.

Like zkSync, StarkWare's ecological construction is still in the early stage. Currently, users can interact with projects on the StarkNet testnet to experience its ecology, such as walletsArgent, Decentralized ExchangeStarkSwap, asset management agreementMagnetywait. StarkWare completed its $100 million Series D financing in May, led by Greenoaks and Coatue. Previous investors in the financing round included Paradigm, Alameda Research, Coinbase Ventures, IOSG, Sequoia Capital, etc. On July 13th, StarkWare announced that it will issue tokens in September, and PANews also introduced in detailStarkNet Token Economic Model。

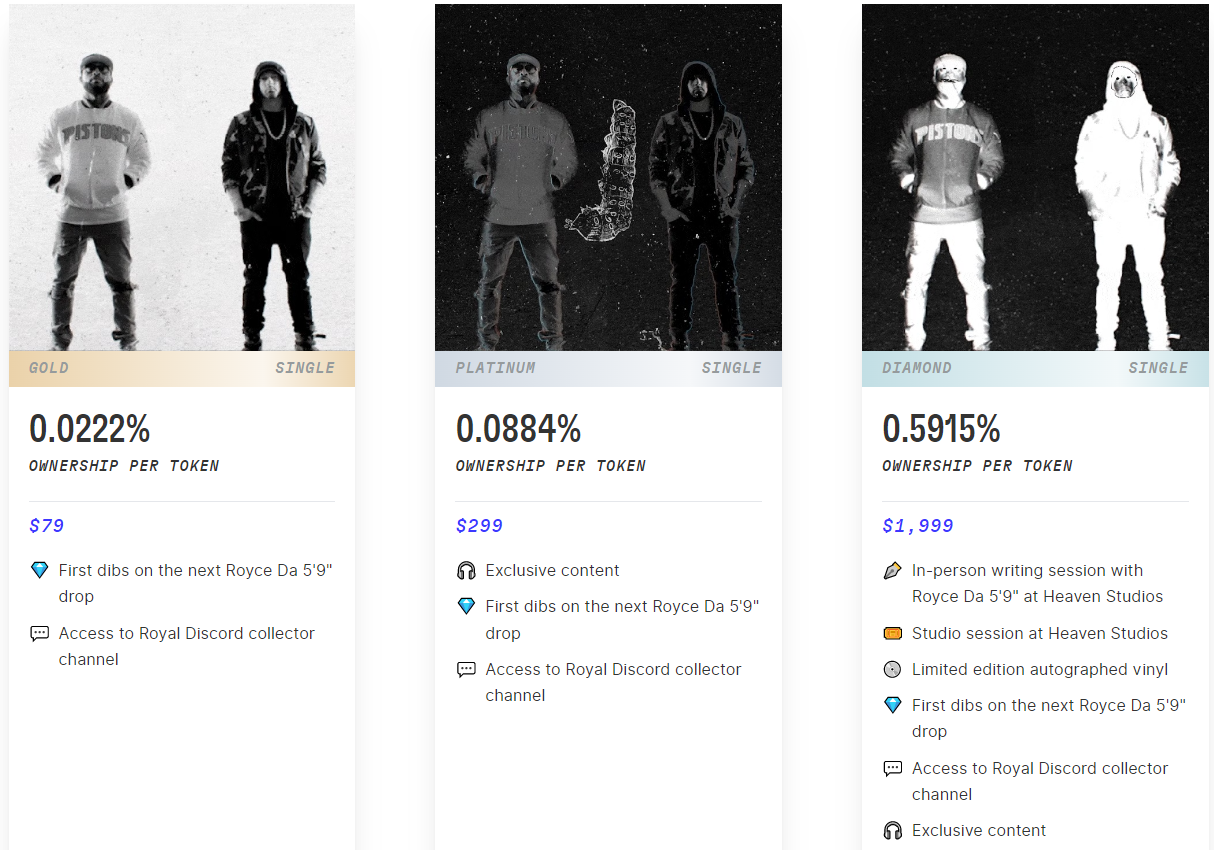

Royal: Music Tokenization Platform

RoyalIt is a music tokenization platform launched by artists 3LAU and JD Ross. Artists use this platform to sell the ownership of songs to fans in the form of NFT. NFTs with different copyright weights contain different rights and values. By purchasing this type of NFT, fans can share the income from royalties with creators. Of course, users can also sell NFT on the OpenSea market, and buyers will get the ensuing royalties and additional benefits.

Royal realizes economic sharing between fans and creators by tokenizing song royalties, aiming to break the traditional centralized platform control mode. In November 2021, Royal completed financing of US$5,500, and investment institutions include a16z, Paradigm, Coinbase Ventures, etc.

Jambo: Web3 Application in Africa

JamboIt is a Web3 application development company located in the African continent. It aims to attract users to enter the Web3 world through the Paly to Earn chain game as a traffic entrance, and lay the foundation for further experience of Web3 products, such as DeFi services. In addition, Jambo is also promoting the JamboAcademy campaign, which aims to help African users enter Web3 through training and education.

It is understood that Jambo is committed to becoming an integrated multi-functional one-stop application and becoming an important Web3 user acquisition portal on the African continent to bridge the gap between Africa and applications from all over the world seeking to enter the African market. In addition to completing a $30 million Series A round of financing led by Paradigm in May, Jambo also completed a $7.5 million seed round of financing in February with participation from Coinbase Ventures, Alameda Research, and Tiger Global.

Spruce: Digital Identity Authentication for Decentralized Identity (DID)

SpruceIt is a digital identity authentication company focusing on decentralized identity (DID), which aims to allow users to have their own identity and realize identity interoperability. Spruce has launched two products, one is the centralized identity toolkit SpruceID, which provides signature, sharing and verification of trusted information, and the other is self-storage Kepler, which allows users to have control over data in terms of storage, sharing and access right.

In September 2021, Spruce won the bid for a project jointly initiated by the Ethereum Foundation (EF) and the Ethereum Name Service (ENS), allowing users to log in to third-party applications through their Ethereum accounts and use their wallets to control their digital identities. Spruce completed US$34 million in Series A financing in April, led by a16z, and will raise US$7.5 million in November 2021. Investors include Alameda Research, Coinbase Ventures, A. Capital Ventures, etc.

Aztec: Privacy Layer 2 Solution

Aztec NetworkIt is an Ethereum layer-2 solution that focuses on the privacy field, and guarantees both scalability and privacy through the zero-knowledge proof technology zkSNARK. Aztec Network completed a US$17 million Series A financing led by Paradigm in December 2021. Other investment institutions (including other financing rounds) include Coinbase Ventures, IOSG Ventures, Vitalik, etc.

Aztec Network officially launched the main network of Aztec Connect, a bridge that provides privacy protection for DeFi transactions, on July 7. Aztec Connect will allow anyone to pass the bridge contract (the interface that connects Ethereum smart contracts to Aztec’s underlying Rollup technology) or allow developers to People integrate their applications with Connect's software development kit (SDK) to add privacy to Ethereum applications. At present, the Aztec Network ecology is only onlinezk.MoneyApplication, users can use zk.Money to encrypt transfer data.