Glassnode Research: Pressure on Diamond Hands Increases, Has Bitcoin Bottom Formed?

Original source: Glassnode

Bitcoin prices continued to consolidate in the $20,000 range this week as the market digested extreme downside volatility in June.

With the market down more than 75% from its all-time high, even the strongest and longest-term Bitcoin holders are feeling the pinch. Long-term holders and miners are in focus this week as markets try to find a bottom amidst ongoing macroeconomic uncertainty.

In this edition of our weekly report, we will seek to extract and identify the key features that have historically described the underlying formation of Bitcoin bear markets. This is a period of forced selling, when sellers are exhausted and downward pressure is starting to wane. We'll explore it from a number of perspectives, including:

Even the strongest hands can be shaken off last, causing seller fatigue.

Redistribution of wealth from low to high belief holders.

Demand recovery for large and small entities.

The capitulation of the miner community, which appears to be in progress.

redistribution of wealth

The current bear market has many similarities to late 2018 in terms of market structure, which we can spot in the retracement of all-time high indicators. Here's how the current 2022 bear market compares to the 2018 bear market.

• December 2017-March 2019: The aftermath of the decline in currency prices after peaking in 2017 lasted for nearly 15 months, and finally retreated 85% from the previous high school in history. The $6,000 area can be seen as a breakout from base levels before an eventual capitulation, wiping out another 50% of the Bitcoin price in the span of 1 month.

• November 2021-July 2022: The current bear market has retraced 75% from the previous high, and the bottom line of $29,000 is a similar breakout base level. During the capitulation in mid-June, the price fell to $17,600 in just two weeks, a 40% drop.

One of the main consequences of a prolonged bear market is the redistribution of wealth among the remaining stakeholders. We can analyze the gradual change of hands of wealth according to the UTXO of the Realized Price Distribution (URPD) indicator

As highlighted in the Week 23 Chain Report, past bear markets have had two distinct phases:

The stage after the historical high: short-term investors and speculators (low belief) gradually accept the reality of the bear market, and gradually withdraw from the market in the trend of price depreciation. Additionally, some players attempted to trade against the macro trend, resulting in multiple temporary relief rallies (dead cat rallies).

Bottom discovery stage: Diminishing profitability and prolonged financial pain lead to a decline in new demand, creating favorable conditions for eventual capitulation.

First, we will observe the market from December 2017 to March 2019. Notice how the price acted like a magnet, first attracting buyers into the $6,000 area, and finally, these buyers capitulated and sold again, pushing the price into the $3,000 to $4,000 range. This describes a two-part cycle of capitulation and eventual bottom formation.

In the current 2022 market, after the all-time high in November 2021, we have a similar structure so far. We can see a similar pattern of redistribution happening around the $30,000 floor, initially established May-July 2021. Over the course of May-June of this year, we could see prices trading down to the $20,000 region, which became an important trigger point for investor capitulation and new buyers, and thus a node for Bitcoin to change hands.

The Surrender of the Diamond Hands

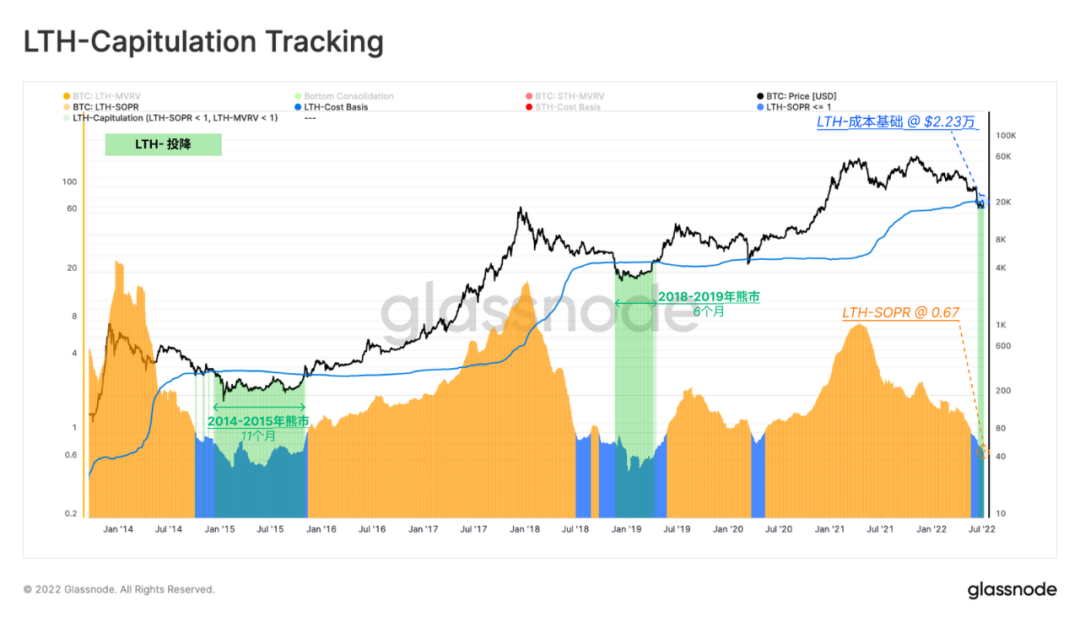

Miners and long-term holders (LTH) are already under pressure as the $30,000 price level breaks down. To demonstrate the continued yielding of long-term holders in the 2021-22 cycle, we can monitor their profitability in two dimensions; their actual losses (sells) and unrealized losses (Bitcoin held below cost basis) .

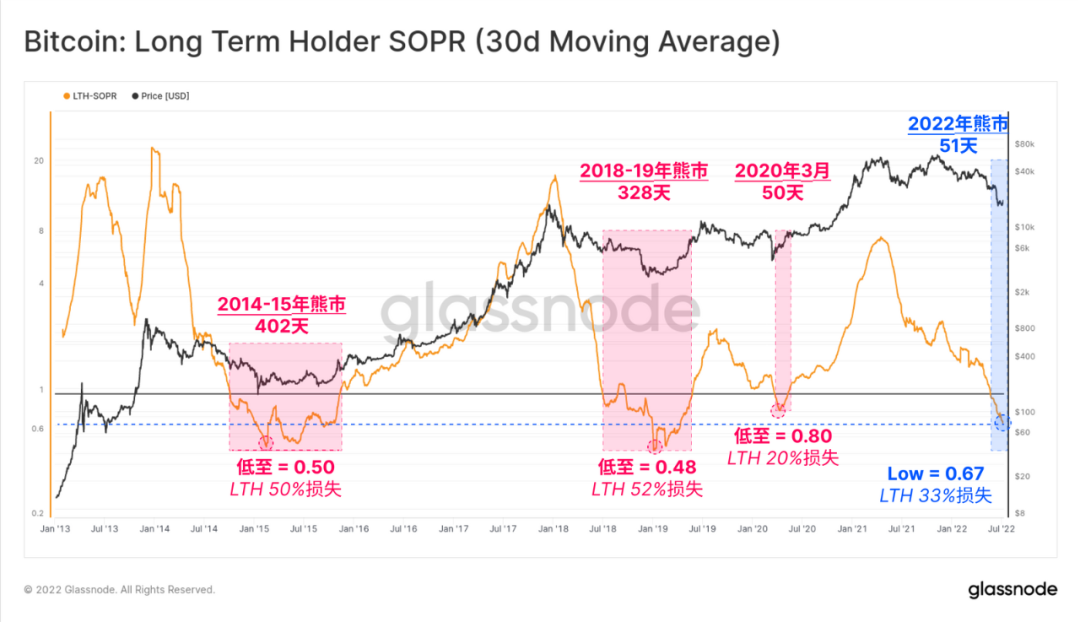

Long-Term Holder Sell Output Profit Ratio (LTH-SOPR) is an indicator that shows the profit margin earned by long-term holders, (eg: a value of 2.0 means that long-term holders sell at 2 times their cost basis price to sell Bitcoin). Therefore, when the value of LTH-SOPR is less than 1, these players sell bitcoin at a price below their cost basis and realize losses.

The current value of LTH-SOPR is 0.67, indicating that, on average, long-term holders lose 33% when they sell their Bitcoin.

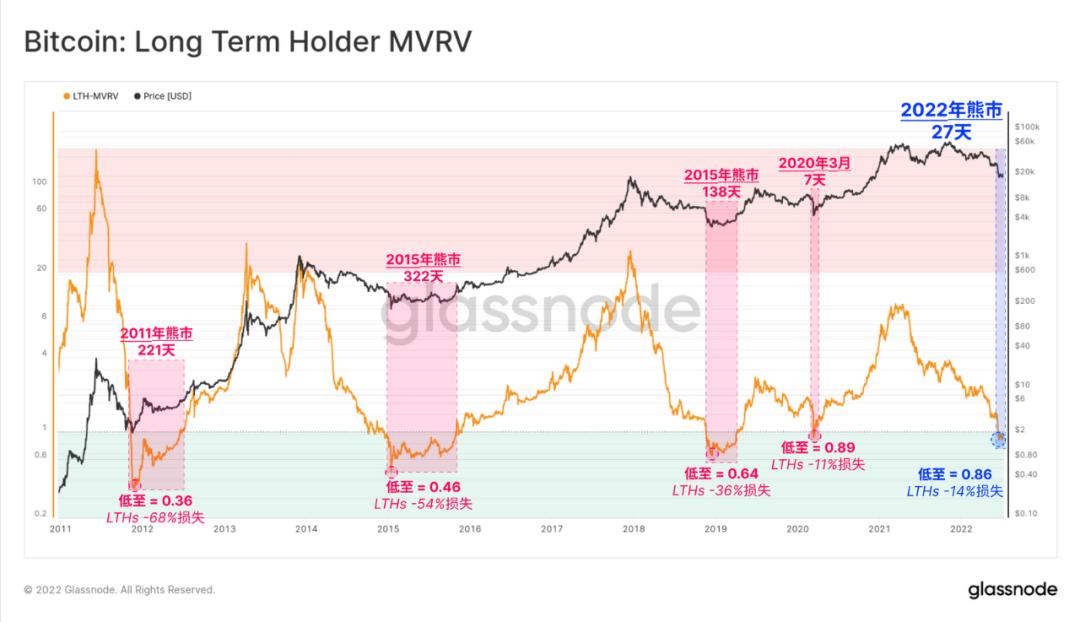

The long-term holder cost basis metric estimates the average price long-term holders pay for their Bitcoin. Therefore, we can consider this group to be at a loss overall as market valuations fall below the cost basis of long-term holders. Likewise, LTHs are currently in a state of floating losses on average, with a total unrealized loss of -14% on their holdings.

The chart below combines these concepts, showing the intervals (green) that satisfy both conditions. These moments are when long-term holders not only hold bitcoins that are in a state of floating losses, but also sell them at a loss, realizing losses. Taken together, this suggests that the likelihood of long-term holders capitulating is increasing.

The current value of LTH-SOPR is 0.67, and the LTH-cost basis is $22,300, which means that LTH realizes an average -33% loss on every bitcoin sold, even though the spot price is only 6% below its cost basis %. This means that long-term holders who bought bitcoin at higher prices are the main sellers right now, while those who still hold bitcoin for the 2017-20 cycle (or earlier) are waiting.

transfer of loss

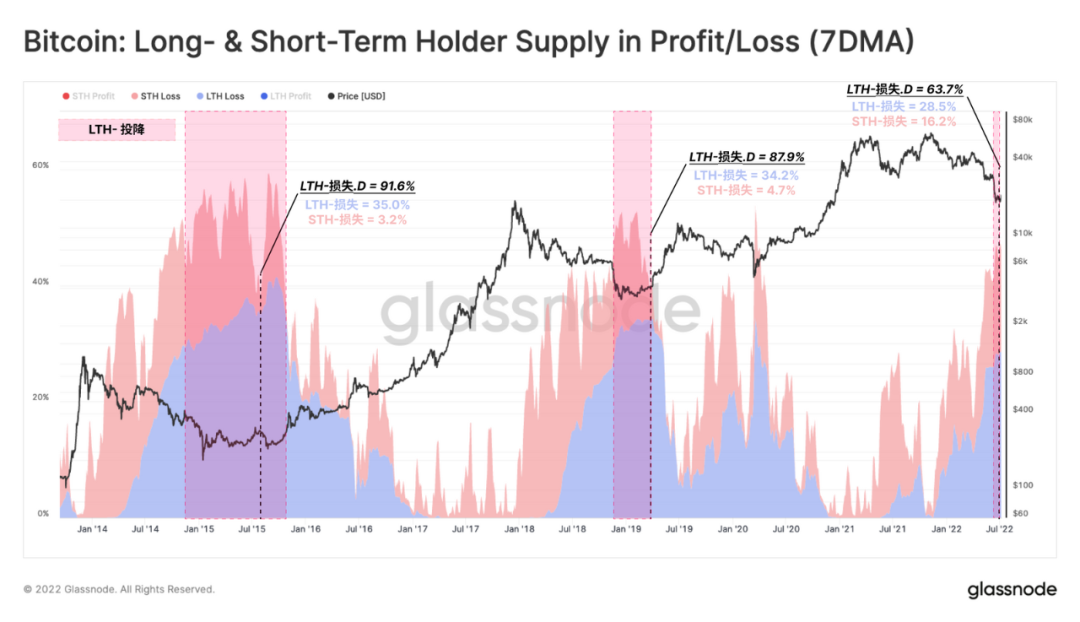

One consequence of the capitulation event was the immediate redistribution of Bitcoin to new buyers, who were initially classified as short-term holders. However, the dominance of long-term holders in supply tends to increase over time as round-the-clock speculators are driven out of the market.

Bottoms are often formed with long-term holders taking on an increasing proportion of unrealized losses. In other words, in order for the bear market to reach an eventual bottom, the lost Bitcoin share should be transferred primarily to those investors who are least price sensitive, and who have the strongest convictions.

This is the result of two mechanisms:

Entities with weak conviction exit (short-term holders).

Gradually transfer bitcoins to committed entities that are relatively price insensitive (long-term holders).

In previous bear markets, the proportion of supply held by long-term holders reached more than 34%, and it was a loss. At the same time, the percentage held by short-term holders has dropped to only 3% to 4% of the supply. Currently, short-term holders still hold 16.2% of the lost supply, suggesting that Bitcoin that has just been resold is now in the hands of higher-conviction holders and needs to go through a process to mature.

This suggests that while many signals of a bottom formation are in place, the market still needs some persistence and pain to build a resilient bottom. Bitcoin investors are not out of the woods yet.

Restoration of needs, no matter how big or small

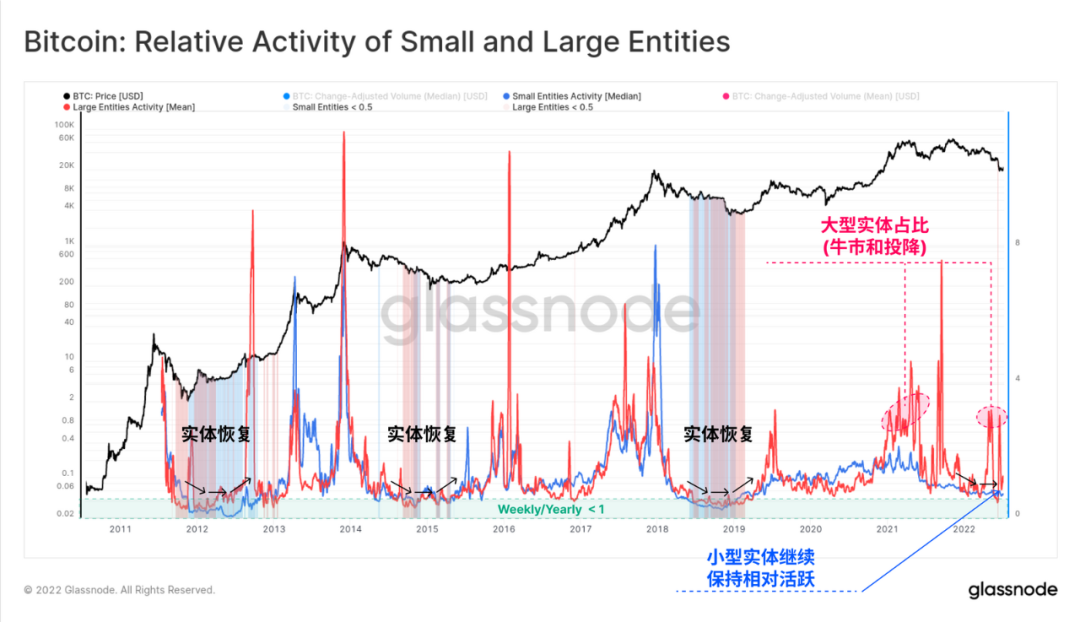

A common component of previous bear market cycles has been the expulsion of Bitcoin tourists. One observation is that the balance growth of Xiami and Giant Whale stands out. Building on this, we introduce a new metric (originally coined by CryptoVizArt) designed to track the relative on-chain activity of small and large entities.

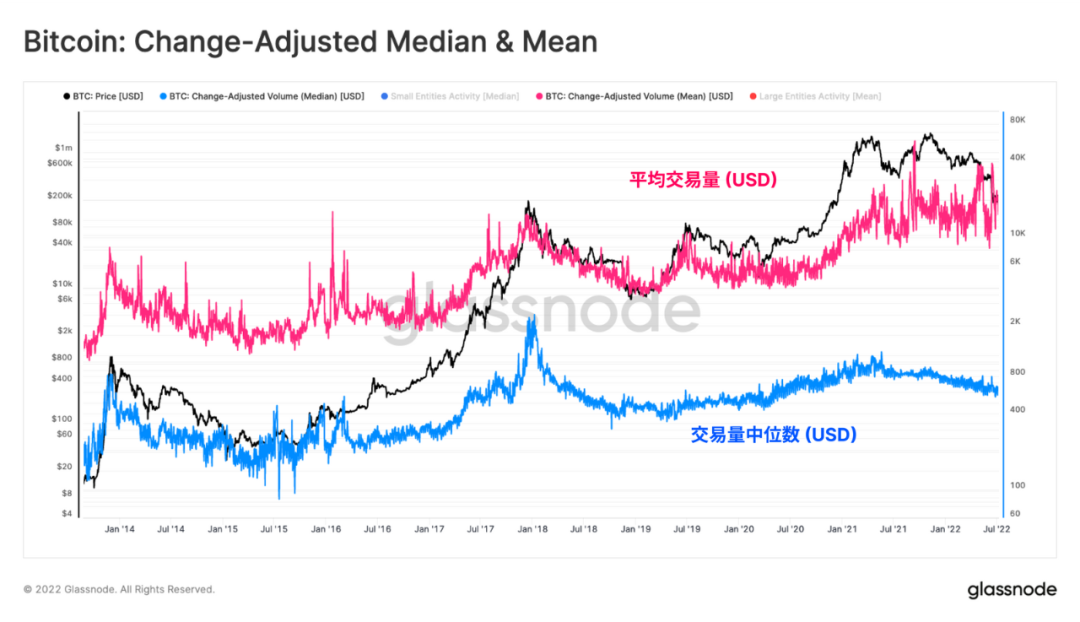

Considering Bitcoin’s historical transaction data, the average daily transfer volume is usually larger than the median. This is mainly due to the large number of small value transactions and a small number of large value transactions.

We can see that there has always been a gap between the 🔴average and 🔵median of USD volume throughout Bitcoin’s history. Therefore, the distribution of transaction value on Bitcoin chain shows positive skewness.

Skewness is the degree of asymmetry observed in a distribution. Positive skewness occurs when the mean is greater than the median. This shows that there are more transactions of small value than transactions of large value.

We can use this observation to develop a macro framework to assess relative levels of activity, and demand from small and large entities. The oscillator below is constructed from the ratio between the median (small body 🔵) and mean (large body 🔴) USD volume for the 7-day moving average and the 365-day moving average.

When small entities 🔵 outnumber large entities 🔴, it usually indicates an influx of small deals and is often associated with bull market excitement and greater speculation.

When the indicator is increasing, it can be considered a signal of increased demand for that entity group.

When the indicator is decreasing, it can be considered a signal of decreasing demand from the group of entities.

What can be seen in the current market cycle is that the red curve has been above the blue curve. This suggests that activity by large entities (probably institutions) has been significantly higher than retail investors, both throughout the bull market cycle and in the recent capitulation event.

Additionally, we can see that smaller entities are still quite active relative to past bear markets, but we have yet to see a bottoming and recovery. This is a point that needs to be watched continuously to see whether the demand of these two entity groups expands. The key takeaway from this indicator is that while activity is in a bottom formation zone, it has not yet returned to recovery mode.

miners surrender

Finally, we will turn our attention to miner groups, who tend to be an influential source of selling pressure late in bear markets. This is a result of fluctuations in their revenue cycles, and bear markets are no exception.

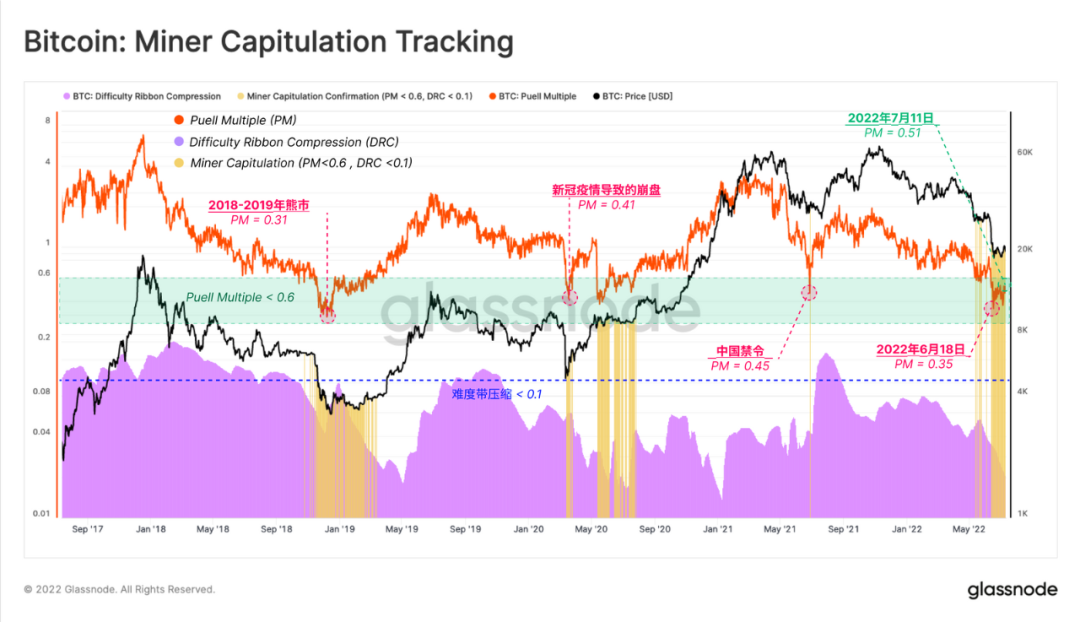

To track whether miner capitulation occurs, we can refer to a two-part model that looks for the confluence between implied income pressure (Puell Multiple) and observable total hash rate decline (difficulty band compression).

The Puell Multiple tracks total miner revenue in USD, relative to a 1-year average. We can find that the current income of Bitcoin miners has only reached 49% of the historical 12-month average. This means miners' income pressure may be a factor.

The compression of the difficulty band indicates that miners are indeed going offline, resulting in a statistically significant decrease in the difficulty of the mining protocol. This is a clear observation that miners are shutting down ASIC rigs due to income pressure.

Miner Capitulation Risk This indicator identifies periods of lows in the two indicators above, which are often associated with extreme bear market lows and a high risk of miner capitulation events.

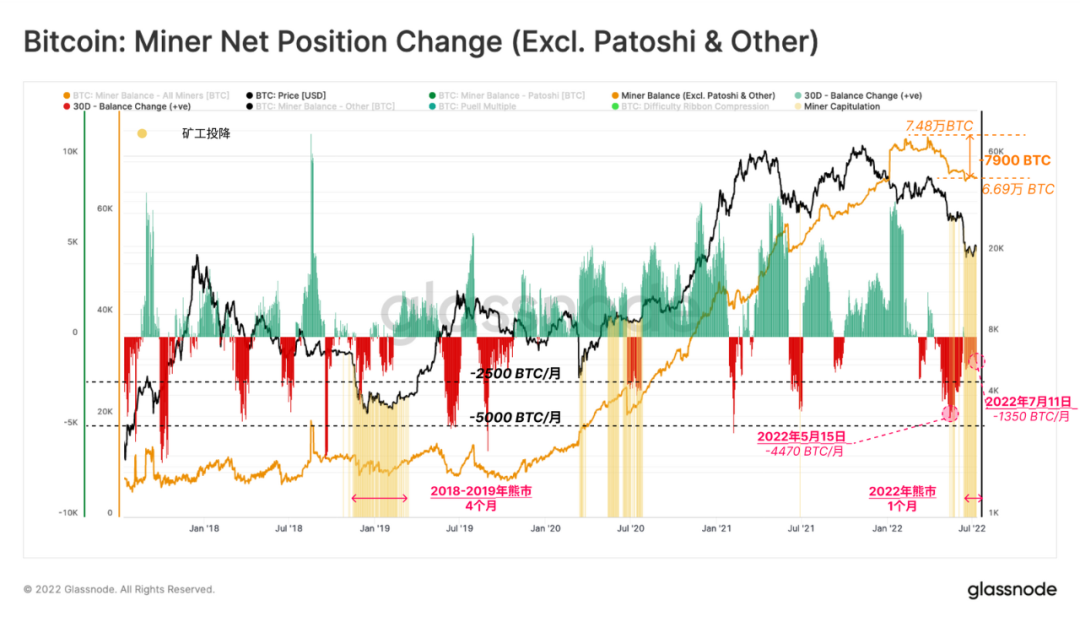

There is indeed a risk of miner capitulation, and we can confirm that the total miner balance has recently decreased at a rate of 4470 bitcoins per month. Mainly started after the collapse of the LUNA-UST project.

Miners’ income pressure led them to sell a total of 7,900 bitcoins in two months. That said, miners have recently slowed their payouts and are currently selling at a rate of 1,350 per month.

In the bear market of 2018-2019, miners surrendered for about 4 months, and it has only lasted for 1 month now. Altogether, miners currently hold about 66,900 bitcoins, so unless the price of the currency rises sharply, they are still at risk of further selling in the next quarter.

in conclusion

The current market structure has many of the hallmarks of a late bear market, with the groups with the highest conviction, namely long-term holders and miners, facing significant capitulation pressure.

The loss-making supply has now reached 44.7%, most of which is borne by the long-term holder group. However, this is still a less severe level compared to previous bear market cycles. We have also introduced a new metric that tracks activity levels of both small and large entities as a tool to map market recovery. This supports the observation that the market has entered a bear market, however a confident bottom has not yet been formed and there is still work to be done.

In general, widespread capitulation and extreme financial stress certainly exist. However, there may be time pain (duration) and perhaps further downside risks to fully test investors' resolve and allow the market to build a resilient bottom.