Coinbase Research: Crypto Bear Market Coming, Where Are Bitcoin Miners Going?

Original compilation: GaryMa Wu said blockchain

Original compilation: GaryMa Wu said blockchain

key summary

Given the backdrop of falling bitcoin prices and rising energy costs, the economics of bitcoin miners have been challenged in recent months, potentially prompting some miners to shut down machines, liquidate bitcoin reserves, and/or realign their cost structures.

introduce

introduce

With the price of bitcoin falling and energy prices rising, the profit margins associated with bitcoin mining have compressed significantly, likely forcing some miners to shut down. Similar to past cyclical dips in cryptocurrencies, uninformed pundits have begun to come up with ignorant theories that if no miners are able to mine profitably, they will shut down their machines, liquidating their Bitcoin reserves, further increasing the selling pressure. According to this theory, then the transactions in the entire network will not be verified or confirmed, and the network value will be zero. Obviously, this is wrong.

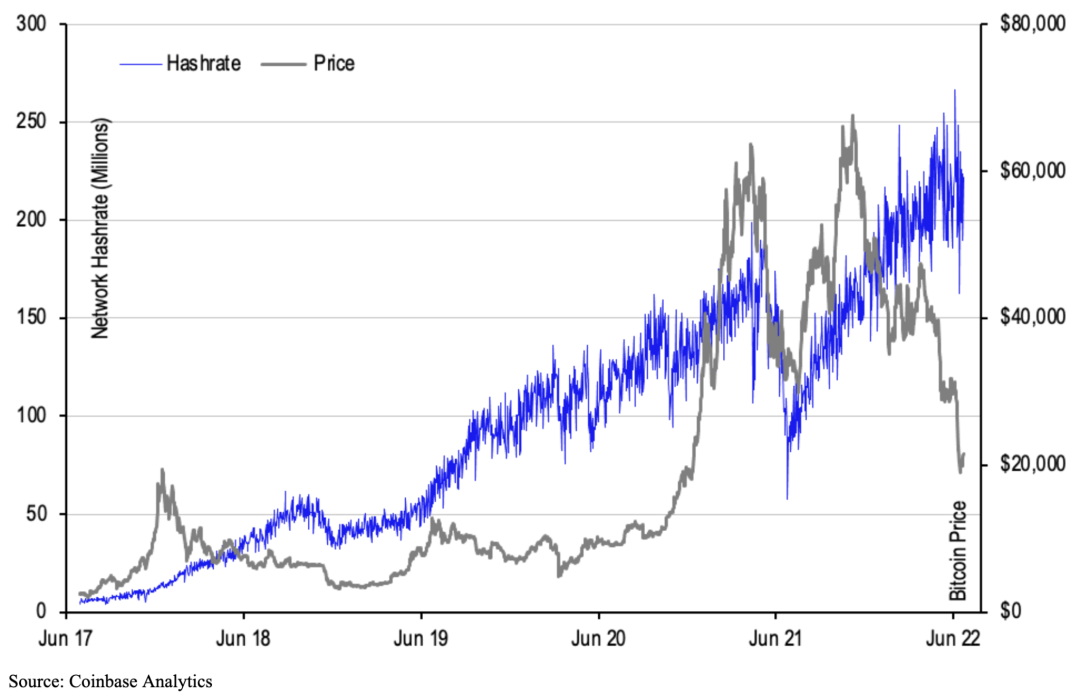

The reality is much more subtle, and in fact, one of Satoshi Nakamoto's core innovations: difficulty adjustment, allowed the Bitcoin network to absorb and recover from such shocks naturally. That is, there is a"balanced"The network computing power of , among which the reduction of mining difficulty has promoted the recovery of mining activities. In this way, mining mirrors the ups and downs of the broader credit cycle. What we are seeing now is that Bitcoin’s current hashrate is hovering near all-time highs despite declining revenue. As we will explore in this report, a period of rapid credit expansion from 2020 to 2021, and the observed rise in the cost of capital in 2022, accelerates the negative impact on Bitcoin miners amid falling prices.

To better understand these mechanisms, it is first necessary to understand the key factors that drive Bitcoin miner profitability, which include:

The technical capabilities of the mining rigs (i.e. newer mining rigs are more efficient and can reduce costs)

The average computing power of the entire network (the lower the network computing power, the lower the difficulty of mining, so the higher the profit)

Electricity cost per kWh (lower energy costs make mining more profitable and vice versa)

The price of bitcoin (the higher the bitcoin price, the more profitable it is to mine and vice versa)

Break-Even Analysis

While calculating the average bitcoin miner's"breakeven"The direction of the cost structure is in the right direction, but the reality is that two of these factors: miner efficiency and energy costs, vary widely across mining operations around the world. Additionally, mining costs may vary depending on a particular operator's labor and capital expenditures, including initial outlays for machinery and construction costs, and the depreciation schedule for said machinery.

For the purposes of this analysis, we focus on marginal production costs, which represent the cost of mining one bitcoin at a location that is already in operation, assuming the machines are already in place and ongoing maintenance costs are minimal. Other factor forms of miner cost analysis include depreciation charges for ASICs and/or hosting facilities (direct production costs), and indirect costs such as wages and SG&A (gross production costs).

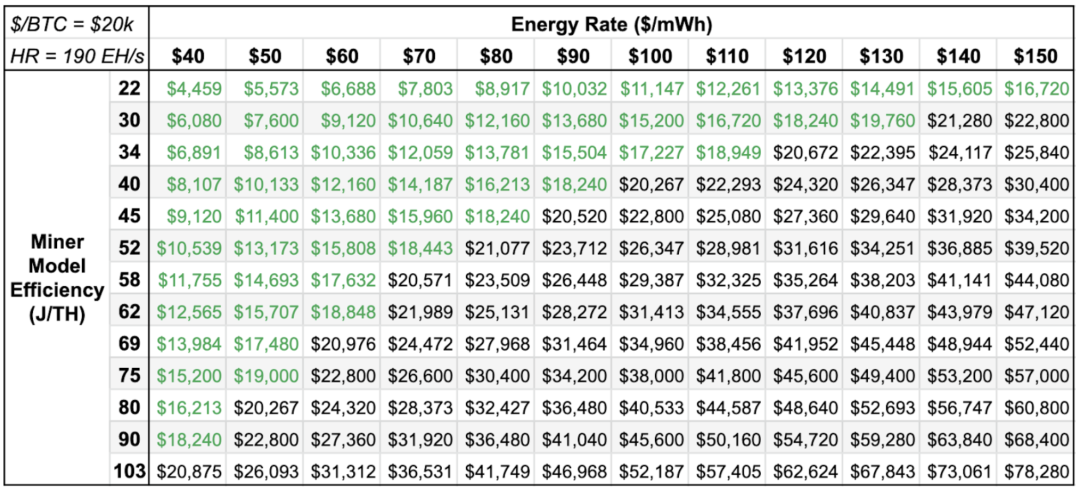

The table below depicts marginal cost scenarios for various miner efficiency models and electricity costs based on static inputs of Bitcoin price and network hashrate (approximately $20,000 and 190 EH/s).

As shown in the table above, the current low bitcoin price and increased network computing power (and thus increased mining difficulty) means that in the current environment, only the latest generation of mining machine models and/or operations with relatively low electricity costs To profitably mine bitcoins.

The Importance of Difficulty Adjustments

Because miners rely on mining rewards (consisting of newly created bitcoins and transaction fees) to pay for their operations, lower bitcoin prices dampen the purchasing power of these outputs, making paying fees more difficult. As a result, the miners with the highest production costs will no longer be profitable and will be forced to stop mining, similar to the production cost dynamics of traditional commodities. However, unlike traditional commodities such as gold, where production costs and operating expenses respond slowly to changes in the price of gold, Bitcoin's production costs are designed to dynamically adjust every two weeks to current market conditions.

Every 2016 blocks (approximately every 14 days, an epoch), the Bitcoin protocol adjusts the difficulty (of mining a new block) to reflect the average computing power for that period (representing the computing power trying to mine the next block). The adjustment is based on a protocol rule that states that Bitcoin block creation times take an average of 10 minutes. If blocks were created on average every 9 minutes instead of every 10 minutes, the mining difficulty would increase. Conversely, if on average a block is created every 11 minutes, the difficulty decreases. Difficulty adjustment is an important part of the Bitcoin protocol, not only ensuring Bitcoin's strict monetary policy, but allowing the network to continuously adapt and absorb shocks related to changes in the aforementioned profitability inputs.

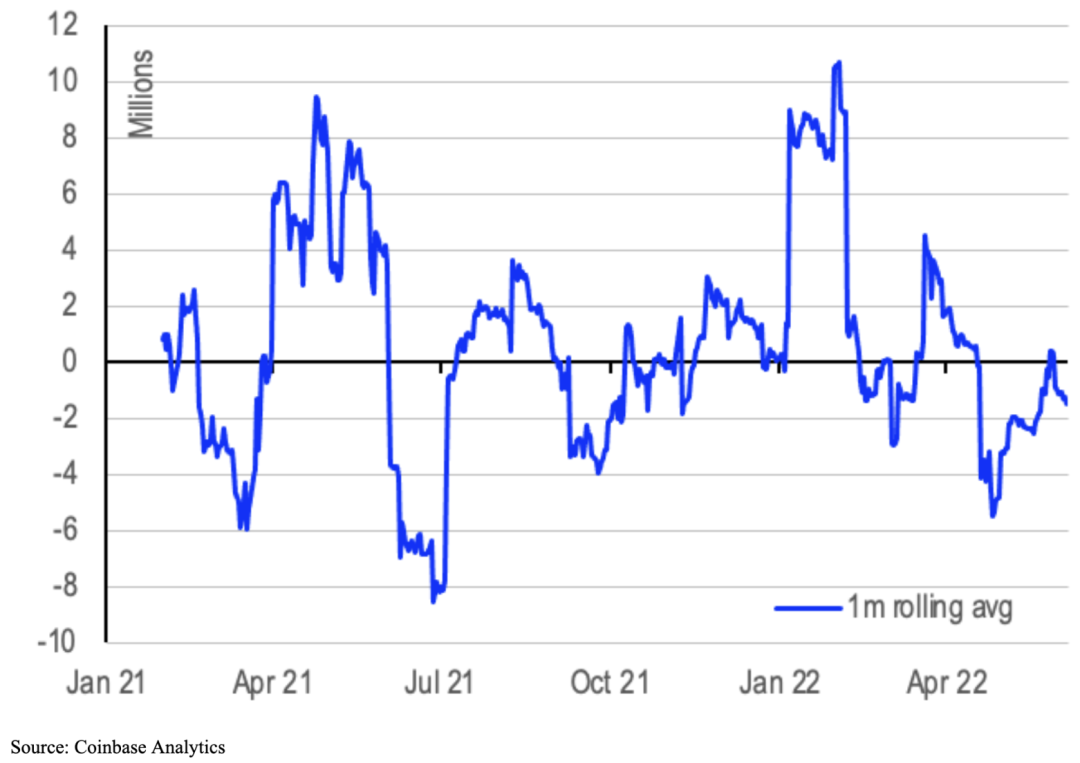

So miners are selling?

Another common concern during the cyclical downturns in bitcoin mining is the extent to which miners dump bitcoin. In fact, no matter where the market is in the cycle, there are some miners with lower margins who may sell some of their Bitcoin-denominated revenue. Margins are compressed across the board at a time of market volatility and falling bitcoin prices, which will naturally force more miners to become net sellers of bitcoin, whether they're just trying to weather the storm or shut down operations indefinitely . However, even if all newly issued bitcoins were immediately sold on the market each day, this would only equate to a daily selling pressure of 900 bitcoins. Furthermore, as a percentage of the average daily Bitcoin trading volume on major exchanges, daily new issuances account for only 1.0-1.5% of total trading volume.

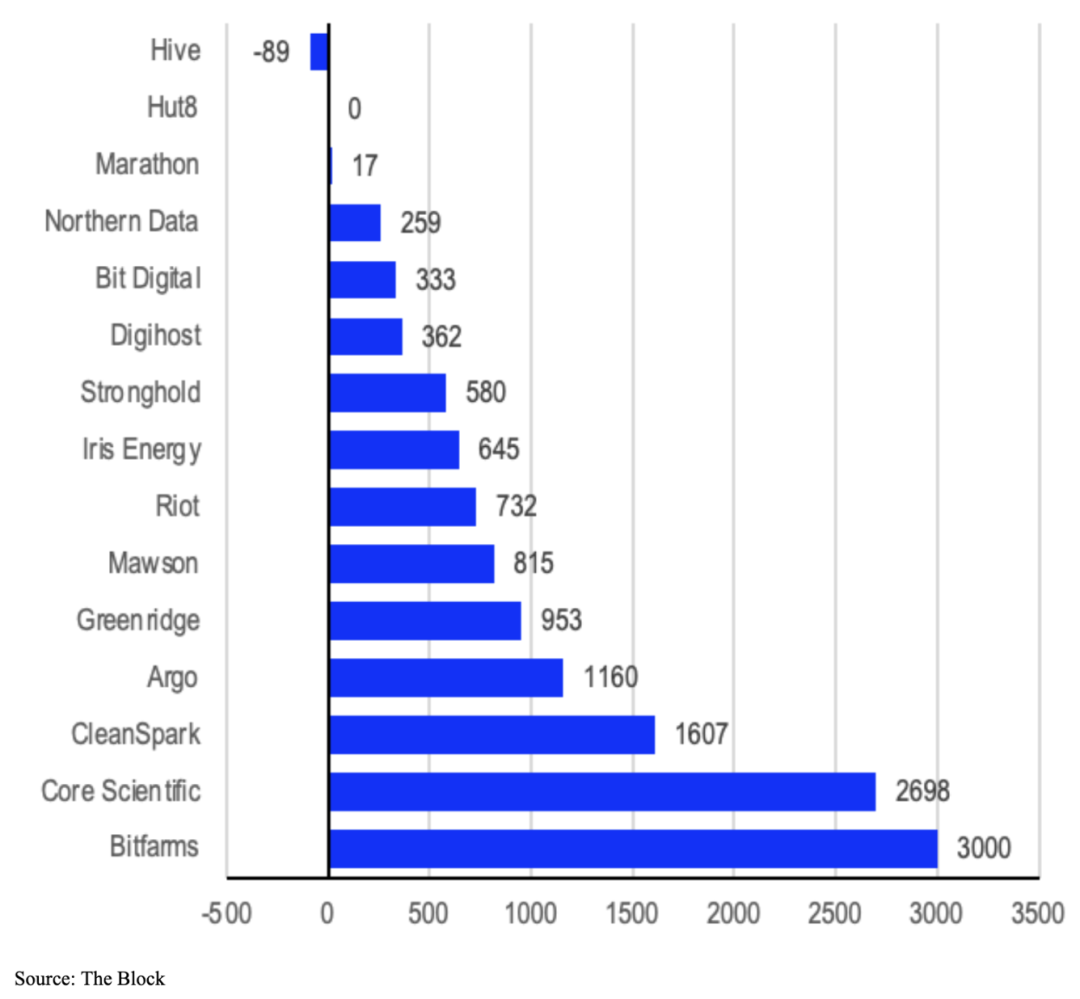

What's more, more selling pressure could come from miners, who may be forced to exit the market entirely or liquidate some of their Bitcoin reserves as they manage to over-leverage their operations too close to margin calls. Evidence of this sell-off can be observed in the disclosures of some large publicly traded mining companies. From January to May of this year, 15 listed mining companies reported that they mined nearly 22,000 BTC, with their holdings increasing from 35,000 BTC to 47,000 BTC during the period. This reflects a net sale of approximately 10,000 bitcoins (according to The Block data). This group includes mining companies that have traditionally implemented Bitcoin clearing strategies such as Iris Energy, Mawson, Greenidge, BIT Digital, and CleanSpark, as well as companies that have recently modified their Bitcoin holding strategies in response to market conditions: Core Scientific, Marathon, Riot , Bitfarms, hu8, Argo, and HIVE, which had previously committed to a 100% holding strategy by the end of 2020 (which worked well during a period of price appreciation and strong funding in 2021), but many were forced to reconsider in 2022 its capital structure.

The figure below shows the number of bitcoins cleared by each mining company from 2022 to the present

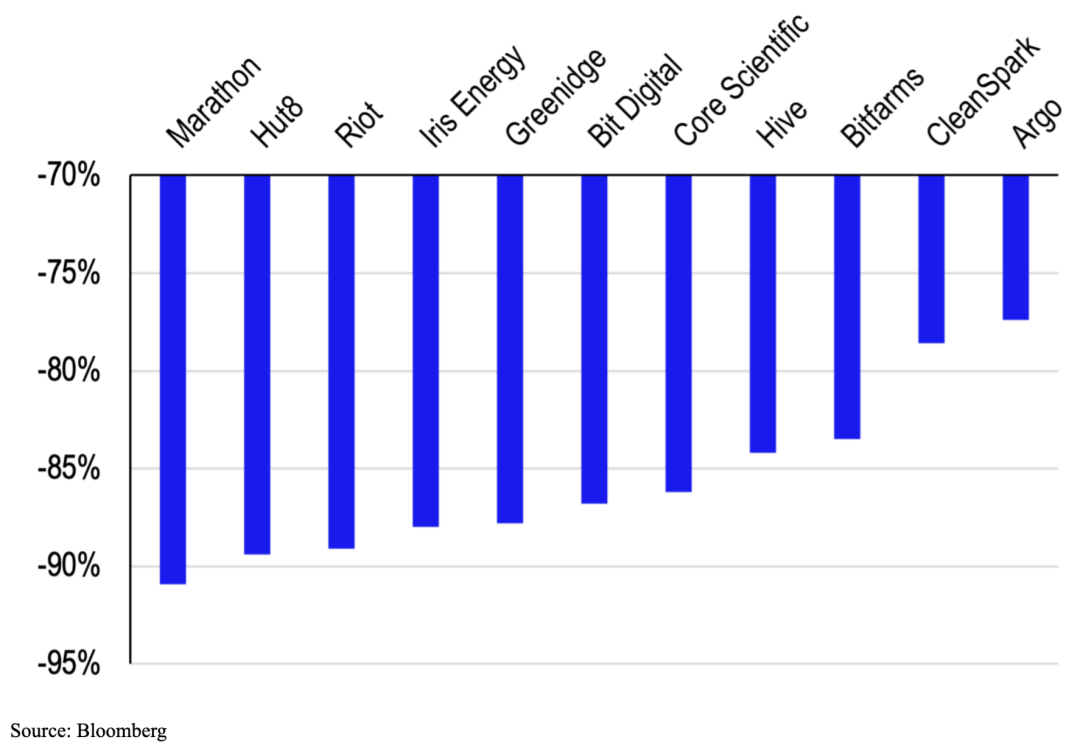

In May, Core Scientific reduced its bitcoin reserves by 20%, raising roughly $80 million, while Argo and Riot began liquidating a portion of their monthly output. In contrast, Marathon trimmed their reserves slightly, while Hut8 and HIVE maintained their full holding strategies. Bitfarms liquidated 3,000 bitcoins (roughly half of their reserves) in June to de-leverage an outstanding $100 million loan it had taken from Galaxy. Collectively, Riot, Core Scientific, Argo and Bitfarms have accounted for more than half of the bitcoin sold by this group of public companies so far this year. Not surprisingly, many of these publicly traded mining companies are down about 75-95% from their 2021 highs.

The following chart shows the stock price decline of various mining companies

The credit cycle in the context of Bitcoin mining

Notably, the Bitcoin mining financing landscape has changed dramatically since previous cyclical downturns, as the number of lenders providing various forms of liquidity to mining operators has grown rapidly, particularly throughout 2021 . In addition to traditional financing methods such as issuing common stock, bonds or convertible notes in private and public markets, bitcoin mining companies have also begun to use their holdings of bitcoin or ASIC mining equipment as collateral, from Genesis Capital, NYDIG, Silvergate, Crypto companies such as Foundry, Galaxy Digital, BlockFi, Securitize, and BlockFills receive loans (notably, Coinbase offers loans through its lending platform, which can be secured by Bitcoin. But so far, no mining rigs or Future mining income is a secured loan). These loans are primarily structured in an overcollateralized manner and are primarily executed by mining operators with aggressive expansion plans in 2021, such as Bitfarms, Marathon Digital, Greenidge and Core Scientific. Additionally, certain mining operators are able to structure debt agreements based on a revenue share (often denominated in Bitcoin).

In addition, some non-encrypted native financial entities will issue loans to Bitcoin mining companies in 2021 to purchase more ASIC mining machines, mainly to expand mining infrastructure and production capacity throughout North America in response to China's computing power migration . For example, venture debt firm Trinity Capital signed a senior secured equipment financing in December 2021 to provide Hut8 with a $30 million loan. In June 2021, WhiteHawk Finance, a private credit investment company, signed a $40 million loan agreement with Stronghold Digital, allowing the mining operator to add new mining machines. Both deals have an annualized interest rate of around 10%, according to The Block.

Based on the financial statements of a group of the largest public or private bitcoin mining companies, it is estimated that these entities raised more than $5.8 billion during 2021 (75% of which was equity financing). In October and December 2021 alone, these companies raised about $2.4 billion, more than 40% of their total funding for the year, according to The Block. Debt financing also saw a huge uptick in late 2021, with convertible notes accounting for the majority of debt financing in Q4 2021, followed by secured loans, senior unsecured notes, and loans secured by Bitcoin holdings or mining rigs. Marathon, one of the largest publicly traded bitcoin mining companies, issued a $747 million convertible bond in November, the largest debt financing executed by a bitcoin mining company to date.

Another way to directionally describe the surge in funding in 2021 is to analyze the dilution of the common shares of publicly traded bitcoin mining companies. Marathon, Riot, Argo, HIVE, Bitfarms, and Hut 8 have all significantly increased their outstanding stock counts in 2021 and are relatively flat in 2020. This dilution also happens to coincide with a shift in strategy by the aforementioned entities, which will hold the vast majority of mined bitcoins at the end of 2020, rather than liquidating them, to ease operating expenses.

The financing environment for the sector has changed significantly since late 2021, given the fall in the price of Bitcoin in recent months and the resulting compression of mining operators' profit margins. Raising capital in the public market has become extremely difficult, and while private lending activity continues until 2022, access to funding has narrowed significantly in the current context. In the past 1-2 years, many mining companies aggressively expanded their operations and expanded their operations by leveraging their balance sheets (consciously or not assuming a flat or higher Bitcoin price), but now they are forced to restructure their operations. In many cases, they liquidated some of their bitcoin reserves to meet regular expenses as well as loan payments or margin calls. These conditions should provide an opportunity for consolidation across the mining industry in the second half of the year as less cautious miners continue to face challenges. A mining panel echoed the sentiment earlier this month at the Consensus conference in Austin, Texas.

Having said that, there is reason to believe that certain miners, especially those taking a more conservative approach, will be able to take advantage of the aforementioned expansion of funding sources appropriately. All else being equal, a more liquid capital market that facilitates increased infrastructure investment to improve the efficiency of mining operations (reducing electricity costs by updating equipment and/or using renewable or stranded energy sources) should Greater flexibility will be given to these participants.

Hedging strategy

Additionally, a stronger bitcoin derivatives market should give miners more options in terms of potential hedging strategies. If miners are worried about falling bitcoin prices, one strategy they employ is to buy put options on the shares of publicly traded mining companies (with strike prices around their cost of production), which has historically been a high beta bet on bitcoin prices . Additionally, to fund these option purchases, miners can concurrently buy (sell) covered call options for a cost-free collar strategy.

Another strategy is writing (selling) Bitcoin futures contracts to hedge spot exposure. As far as strategic hedging is concerned, a recent development is the concept of hashrate derivatives (allowing miners to effectively "go long" the prospect of rising hashrate because they Essentially “shorting” computing power), but these markets are relatively new and less liquid. However, the simplest method of hedging may still be a strategy of continuously exchanging some bitcoins for fiat currencies.

The following figure shows the net flow of Bitcoin by miners

Where are we in the cycle?

While the Bitcoin mining ecosystem has matured significantly since previous cyclical downturns, the purpose of analyzing past mining cycles is to estimate where we are in the current cycle. From 2017 to 2019, we can observe a cyclical progression very similar to today's trajectory. At the end of 2017, the price of Bitcoin began to grow faster than the network hash rate, which led to an influx of new miners and business expansion to take advantage of this mismatch (similar to the expansion observed throughout 2021). Then, as prices peaked in late 2017, the deployment of new equipment continued to cause network hashrate to continue its upward trajectory (similar to the rise in hashrate for most of 2022, despite the Bitcoin price drop).

Finally, the price of Bitcoin fell again in November 2018, when many miners became unprofitable and were forced to shut down their machines (similar to Q2 2022). Around this time, network hashrate peaked (around 54 EH/s) and began to decline as miners shut down and difficulty adjusted downwards. Subsequently, the network computing power bottomed out at around 35 EH/s (in line with the low price of Bitcoin slightly below $4,000), and then began to recover. If we go back to the current cycle, it seems that the network computing power peaked in May at about 237 EH/s, and has dropped to about 200 EH/s in recent weeks.

So while the mining market may still be far from balanced in terms of hashrate, evidence of miner selling and shutdown activity in recent months has started to show up in the form of network hashrate drops and eventual mining difficulties.If these downtrends continue, we believe that the point at which they then begin to flatten may mark the beginning of a bottoming process, based on trends observed during the 2018 crypto winter.

Summarize

Summarize

In these difficult market conditions, the conservative approach of many mining operators is to liquidate some of their Bitcoin holdings as the price falls. As unprofitable miners exit, our pre-computing power will drop, as will the downward adjustment in difficulty, creating a new equilibrium that better supports network activity. We see lower steady-state hashrate as a potential bottom for the cycle, which would be a precursor to new entrants. At the time of writing, the network’s hashrate continues to drop and is currently around 180 EH/s. The recent drop in the difficulty of mining on the network also supports the claim that miners have been shutting down machines in recent weeks. Although subject to change, this indicator is critical for future monitoring.

Original link