Weekly Editors' Picks Weekly Editors' Picks (0716-0722)

"Weekly Editor's Picks" is a "functional" column of Odaily.On the basis of covering a large amount of real-time information every week, a lot of high-quality in-depth analysis content will also be released, but they may be hidden in the information flow and hot news, and pass you by.

Now, come and read with us:

Now, come and read with us:

Investment and Entrepreneurship

Investment and Entrepreneurship

《Glassnode Research: Pressure on Diamond Hands Increases, Has Bitcoin Bottom Formed?Analysis and interpretation of Glassnode's on-chain data indicators. Conclusions include: capitulation of diamond hands, redistribution of wealth from low to high conviction holders, miner populations, observations that the market has entered a bear market, however a confident bottom has not yet been formed.

Bitfinex: U.S. Inflation Is a Powerful Fuel for Bear Market, Miners Are Selling Bitcoin and Ethereum

The article introduces some basic technical analysis methods and investment thinking theories. Investors should keep in mind: not all asset prices can rebound. It is necessary to find out the reasons for the decline in asset prices, fully understand the project, understand the reasons for wanting to buy, and then find the right time to buy.

Token Economics

Token Economics

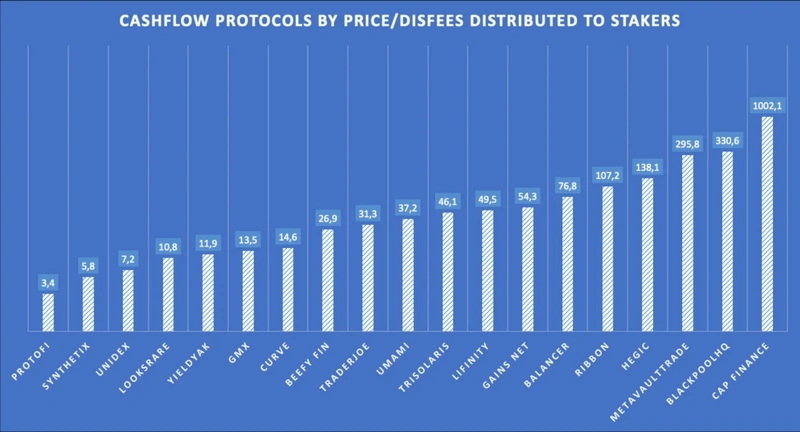

Inventory of 19 cash flow protocols: Which protocol tokens are the most "profitable"?

The first three methods are mainly to increase the share of each token holder in the project and provide continuous purchasing power for the token, while the fourth method provides cash flow for holders so that each holder can choose Whether to reinvest or diversify into other assets. The author agrees with the 4th approach (cash flow protocol), believes that they are the ultimate evolution direction of the token model, and uses the modified P/E ratio of the crypto industry (price / discount fee = fully diluted valuation / annual distribution fee) Indicators to assess whether a particular item is over/undervalued.

Ethereum and scaling

Ethereum and scaling

An article to understand the expansion scheme of the blockchain execution layer, storage layer and consensus layer

It is recommended that readers who have a basic understanding of blockchain technology start reading directly from the "Three Key Features of Blockchain Expansion".

The article introduces five expansion schemes of the blockchain execution layer and their advantages and disadvantages, including improving the hardware requirements of verification nodes to achieve vertical expansion; creating a multi-chain ecology to achieve horizontal expansion; sharding the execution layer to achieve horizontal expansion; through Modularization to achieve horizontal expansion; payment and state channels.

The six schemes for expanding the blockchain storage layer are: vertical expansion of blockchain nodes, data fragmentation on the underlying blockchain, use of modular blockchains to compress data storage on the chain, modularization of blockchain Off-chain data storage, data pruning, statelessness, state expiration, and state rent.The four key goals of expanding the blockchain consensus layer include improving execution and storage capabilities, reducing network bandwidth usage, reducing network latency, and increasing security budgets. Ultimately, while increasing speed, it also improves accuracy, stability, and security. .》《Recently, there have been many articles about the merger of Ethereum, and the following three articles are recommended: "》《IOSG Ventures: The merger is imminent, explaining the latest technical route of Ethereum in detail4D talks about the ideal and reality of Ethereum merger

An article to sort out the latest progress of ETH2.0: the main network merger date is initially determined

》, from the perspectives of technology and industry influence, systematic review and timeline. Highlights include:

As the timeline stretches to the next few years, the overall value of Rollup will increase: Ethereum presents a multi-Rollup development pattern, the cross-Rollup infrastructure is highly complete, and the Rollup ecology is highly prosperous—even surpassing Ethereum itself.

New ecology and cross-chain

New ecology and cross-chain

How does StarkNet's currency issuance change the L2 landscape?

The issuance of StarkNet may accelerate the process of issuing Arbitrum.

In the short term, Optimism is compatible with EVM, backed by the Ethereum ecosystem, supports related development tools, has a low development threshold, and has low difficulty in project transplantation. Compared with StarkNet, it has development advantages; the market share gap between Optimism and StartNet is large, and StarkNet is difficult to catch up in the short term. In the long run, StarkNet's decentralized PoS mechanism will win the competition with Optimism's centralized MEVA mechanism.

OPR projects have an inherent MEVA dilemma. StarkNet’s PoS mechanism can limit MEV and create a higher income ceiling. It has token economic barriers and will win the battle with OPR in the long run.StarkNet will challenge Ethereum's dominance by capturing gas settlement value and intercepting network traffic.Recently, Beep News is playing Layer 2 from house to house. "StarkWare: The strongest Layer 2 technical team, StarkNet depends on technology to break the gameAn overview of the zkSync ecology: infrastructure occupies half of the country

DAO

secondary title

In-depth discussion on the governance crux of the DeFi protocol

In order to eliminate the leverage of governance, it is possible to: defend against borrowing tickets - exchange governance rights with lock-ups, use privacy technology to prevent election bribery, and increase governance participation rate - govern political parties and governance incentives. In terms of setting up the gatekeeping mechanism, voters can formulate a review standard and appoint a risk control team to check the assets and decide whether to release them.

hot spots of the week

secondary titlehot spots of the weekOver the past week, Celsiusclass action lawsuit, accused of selling unregistered securities through a Ponzi scheme,Announcement of restructuring plan, creditors can choose to receive cash compensation at a certain discount (for more details, see theFirst day of bankruptcy hearing), Odaily compiled aboutNine latest real developments in Three Arrows debt(including information on 27 creditors), and translated the interview with Bloomberg: "The full text of the latest interview with the founder of Three Arrows: Multiple details disclosed for the first time》, Affected by the market decline,Legion Strategies fund under Tianqiao Capital,Suspension of redemption, the founder of Tianqiao Capital stated that the Legion Strategies fund has no liquidation risk,Redemptions will resume when the market improvesBenzinga CEOVoyager asks court

Allowing it to cash out $350 million in user cash assets, court documents showOne of the largest creditors of Voyager Digital;In addition, in terms of policies and macro markets, Putin signed aBanning the use of digital assets for payments in Russiathe bill,central african republicSango platform and Sango Bitcoin side chain will be launched,

Sango coinIt will go on sale on July 21, and you can become a citizen with an investment of 60,000 US dollars;In terms of opinions and voices, members of the US Department of Homeland Security saidThe U.S. Government Knows Who Satoshi Nakamoto Is, Zhao Changpeng stated that as a "pure Web3 company",Binance has no plans to offer stock trading, the founder of BitMEX thinksIf the United States restarts the "money printing machine", Bitcoin will bottom out,, V God:At the end of the scaling roadmap, Ethereum will be able to process 100,000 transactions per secondNIO Responds to Rumors of “Issuing Coins”It also stated that no digital currency or NFT has been issued to the public;

Institutions, large companies and top projects,teslaInstitutions, large companies and top projects,teslaCoinbases partners with ENSCircle plans to go public via SPAC in the fourth quarter of this year,, will provide a Web3 username for free,HuaweiCurve to issue over-collateralized stablecoins,Multiple departments are researching and exploring Web3,Curve to issue over-collateralized stablecoinsPolygon to Launch Polygon zkEVM Public Testnet,, is expected to release the main network next year,Thousands of POAP in the address of a large account are suspected to be destroyed by the official

NFT and GameFi fields,, POAP official may issue an announcement;,NFT and GameFi fields,OpenSea Announces Launch of Solana LaunchpadSTEPN launches APE Realm,,passTencent plans to shut down the digital collection business "Magic Core"phantom nuclear responseSaid that the current operation is as usual, and a new version of the App is being prepared.With "Editor's Picks of the Week" series...well, another week of ups and downs.

With "Editor's Picks of the Week" seriesPortal。

See you next time~