三箭创始人最新采访全文:多个细节首次披露

本文来自 Bloomberg,原文作者:Joanna Ossinger, Muyao Shen, and Yueqi Yang

Odaily 星球日报译者 | Moni

在躲藏了五周后,三箭资本创始人 Su Zhu 和 Kyle Davies 在一个未公开的地点接受了彭博社采访。

他们谈论了许多内幕消息,并对这段加密之旅感到懊悔。他们坦言三箭资本的风险管理出现了系统性失败,由于错误押注导致信贷流动性受到巨大影响。不过,两人拒绝透露他们在哪里,但电话中的一名律师表示,他们的最终目的地是阿拉伯联合酋长国。

35 岁的 Su Zhu 和 Kyle Davies 在高中时就已经是好朋友。他们曾联手把三箭资本打造成一个加密交易庞然大物。可是,由于糟糕的投机和杠杆交易,三箭资本最终引发了多米诺式爆雷——随着三箭资本的倒闭,一系列连锁反应出现:债权人破产、加密市场抛售,给比特币和其他代币者持有者带来巨额损失。

在前往迪拜的途中,两人称这是一场“令人遗憾的崩溃”。

当过度杠杆遇上加密寒冬

最近,英属维尔京群岛一家法院下令清算加密货币对冲基金三箭资本,称他们被拖欠超过 28 亿美元的无担保债权。法庭文件显示,这一数字预计还将大幅上升。迄今为止,监督破产的清算人已经控制了价值至少 4000 万美元的资产。

Su Zhu 和 Kyle Davies 长期以来一直是最知名的加密货币多头,然而在杠杆的推动下,他们一步步将三箭资本置于“雷爆中心”。随着加密货币崩盘,三箭资本陷入困境。Su Zhu 说道:“我们将自己定位于一种最终不会发生崩盘的市场中,” Kyle Davies 补充称:“我们固执地相信加密市场会一直向好,我们在三箭资本中拥有我们所有的、几乎所有的资产。然后,在美好的时光里,我们做到了最好,但在糟糕的时期,我们输得最多。”

同时,Su Zhu和 Kyle Davies 认为市场中并非只有他们有问题,糟糕的行情、相互关联的单向押注和宽松的借贷策略导致诸如 Celsius Network、Voyager Digital 和 BlockFi 等公司的破产。

Su Zhu 说道:“不仅是我们,Celsius 这类公司都有问题,这并不奇怪,我们有自己的资本,有自己的资产负债表,但我们也从这些贷方那里吸收存款,然后我们为它们创造收益。因此,如果我们从事吸收存款然后产生收益的业务,那么你知道,这意味着我们最终会进行类似的交易。”

显然,Su Zhu 和 Kyle Davies 在推卸责任,要知道,他们之前曾大力鼓吹加密资产。

就在本周,有消息称 Su Zhu 在三箭资本倒闭之前还前为一艘价值 5000 万美元的游艇支付了首付款,不过这个消息引发了 Su Zhu 的不满并称这是诽谤。Su Zhu 解释说:“这艘船是一年多前买的,委托建造并在欧洲使用,而且这艘游艇有完整的资金来源。”Su Zhu 否认他享受奢侈生活方式的说法,并指出自己每天骑自行车上下班,他的家人“在新加坡只有两套房”。

“我们从来没有在任何俱乐部花过很多钱。你知道,我们从未见过我开着法拉利和兰博基尼,我觉得这种对我们的抹黑只是来自经典剧本,你知道,当这种事情发生时,当爆雷时,这些都是人们喜欢看的新闻头条。”

Luna 引发的“惨案”

Su Zhu 和 Kyle Davies 承认,在 Luna 和现已失效的算法稳定币 UST 的交易上让他们遭遇重大损失,他们坦言对 LUNA 的崩盘速度感到惊讶。Su Zhu 解释说:

“我们没有意识到的是,Luna 能够在几天内几乎归零,这将引发整个行业的信贷紧缩,也将对我们所有流动性不足的头寸造成巨大压力,回想起来,三箭资本可能与 Terra 的创始人 Do Kwon 太接近了。”

“当 Do Kwon 搬到新加坡时,我们开始直接了解他。而且我们只是觉得该项目会做一些非常大的事情,并且已经做得不错了。”Su Zhu 坦言自己对 LUNA 出现误判,“LUNA 最初的表现太好了,你知道的,太大了,太快了。这对我们来说非常像一个长期资本管理的机会,其他人也有这类交易,我们都认为是好的,LUNA 增长得太快了。”

“其中一项交易”涉及 stETH——旨在释放 staked ETH 的流动性,并被广泛用于 DeFi 中。一旦期待已久的以太坊区块链升级生效,每个 stETH 都可以兑换成一个 ETH,但 Terra 崩溃引发的动荡导致其市值跌破正常水平,其他投资者为了风控也在抛售。

Su Zhu 进一步说道:“Luna 刚刚出事,非常像一种传染病,人们会说,好吧,有没有人也使用长期质押的 ETH,而不是随着市场下跌而被清算 ETH?整个行业都在寻找这些有效的头寸,但最终这些人都被猎杀了。”

尽管如此,三箭资本在市场危机刚刚出现的时候仍能继续从大型数字资产贷方和富有的投资者那里借款——直到他们自爆。

在 Luna 破产后,Su Zhu 表示贷方对三箭资本的财务状况“感到满意”,甚至允许他们继续交易,“好像一切都没有错”——正如法院文件现在所显示的那样,其中许多贷款只需要非常少量的抵押品。

“所以我只是认为,在那段时间里,我们继续照常营业。但是,当比特币从 30,000 美元跌到 20,000 美元时,对我们来说非常痛苦,那也是钉在我们棺材上的最后一颗钉子。如果我们更多地参与游戏,我们就会看到信贷市场本身就是一个循环,你知道,我们可能无法在我们需要的时候获得额外的信贷。”

被 GBTC “锁死”

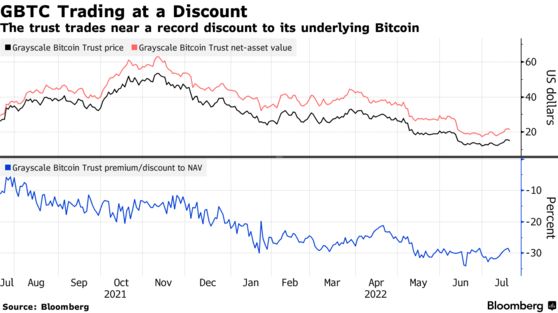

灰度比特币信托基金(GBTC)是一个封闭式基金,允许那些不能或不想直接持有比特币的人购买投资于他们的基金的股票。有一段时间,GBTC 是少数受美国监管的加密产品之一,因此它拥有自己的市场,也非常受欢迎,以至于其交易价格一直高于其在二级市场上持有的比特币的价值。

另一方面,灰度允许像三箭资本这样的大投资者通过将比特币交给他们来直接购买股票,然后这些 GBTC 持有者可以将其持有的股份出售给二级市场。这种溢价意味着任何销售都可以为大投资者带来可观的利润。在 2020 年底提交给监管机构的最后一份文件显示,三箭资本是 GBTC 的最大持有者,当时持有的头寸价值 10 亿美元。

不过,该策略有一个障碍:直接从灰度购买的股票有六个月的锁仓期。从 2021 年初开始,这种限制就成了一个问题,随着 GBTC 的价格从溢价滑落到折价——一股价值低于支持它的比特币——这款产品不得不面临来自其他同类产品更激烈的竞争。几个月过去后,GBTC 的折价幅度越来越大,所谓的 GBTC 套利交易也不再奏效(尤其是伤害了那些利用杠杆来试图提高回报的投资者),三箭资本也因此受到影响。

在 Su Zhu 和 Kyle Davies的讲述中,投资 GBTC 的部分原因是他们的从众心理:“当时的利润非常大,我们设法在正确的窗口期做到了,然后像其他人一样,我们开始亏钱,而且还变成了负数。我们的信任就打折了,而且,打折的幅度比任何人想象的都要大得多。”

无风险回报?不存在的!

永远不存在没有风险的投资。

在回答“三箭资本出了什么问题”时,Su Zhu 表示,多年牛市让他对市场产生了过度自信,这种牛市不仅注入了他和 Kyle Davies 的思维里,而且注入了几乎加密行业里的每个信贷基础设施服务提供商。

Su Zhu 说道:“你总是需要对自己进入的领域有所了解——选择投资时,要分辨这家到底有没有风险,对我们来说,如果你访问我们的网站,我们总是有大量关于加密风险的免责声明,我们从来没有将自己标榜为无风险的。”

他说,当加密市场在 5 月首次开始下滑时,“我们满足了所有追加保证金要求,所以我们觉得,人们应该明白这其中存在风险。当我们做得好时,贷方受益匪浅,他们可以说,看,我每年能从三箭资本的借贷业务中赚取 2 亿美元,获得 10 倍收益。但现在,情况则完全相反。”

目前,Su Zhu 和 Kyle Davies 正在前往迪拜,Su Zhu 希望一步步来,通过其私人资产进行清算。Su Zhu 透露,加密行业里甚至有人对他们发出死亡威胁,因此现在希望到人身安全并保持低调,“这对每个人都有利”。

Su Zhu 最后说道:“鉴于我们计划将业务转移到迪拜,现在必须尽快去那里评估是否能够按原计划将公司搬到那里,或者未来是否还会有其他想法,但目前的情况非常不稳定,主要重点是帮助债权人进行偿付。”