StarkWare: The best team for Ethereum expansion, is $8 billion overestimated?

Author: Jessie

Author: Jessie

Original editor: penny

Original Source: Overseas Unicorn Team

If the final narrative of the previous bull market was the public chain, then Layer2, especially zk Rollups, is a well-deserved protagonist in the final curtain call of this round of bull market.

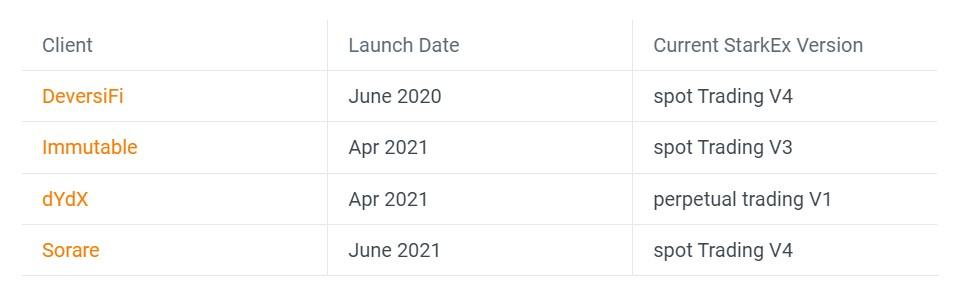

zk rollups is recognized by the industry as the ultimate solution for blockchain expansion, and StarkWare is recognized as one of the best zk rollups teams in the world. The co-founder Eli Ben-Sasson is the world's top cryptography scientist, and Uri Kolodny is He is a serial entrepreneur with mature business literacy, with comprehensive team capabilities and long boards. At present, the company has a valuation of 8 billion US dollars, and has received full support from capitals such as Vitalik, Paradigm, and Sequioa. It is the team with the highest valuation in the expansion field.Unlike the L2 field, which generally charges through operating nodes,StarkWare created a scaling as a service business model by providing the scaling technology solution StarkEx, has served leading customers in the industry dYdX, Sorare, ImmutableX, DeversiFi, etc. It is worth mentioning that the support of StarkEx technology directly contributed to the cooperation between Tiktok and ImmutableX,

In its partnership statement, Tiktok specifically mentioned: "StarkWare is the first carbon-neutral Layer 2 scaling solution."

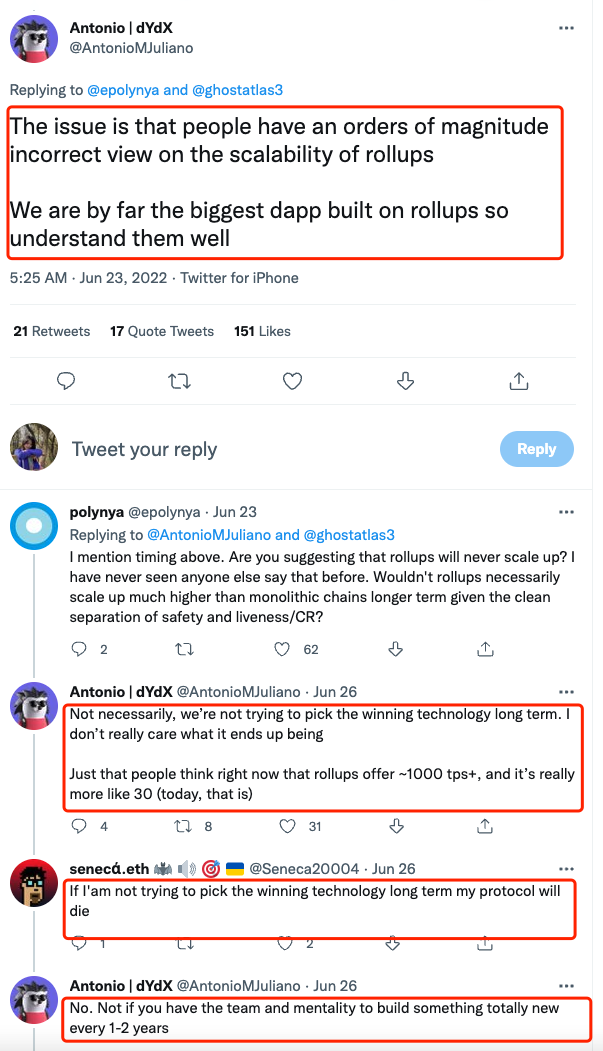

The two-layer network StarkNet is also being developed and tested, and it is expected to delegate nodes to the community for operation and become a fully decentralized version.However, dYdX, which accounts for 90% of StarkWare's revenue source, announced on June 22 that it would leave rollups and migrate to the Cosmos ecosystem to develop an independent application chain. Antonio Juliano, the founder of dYdX, once publicly stated that people are currently too optimistic about rollups:“We are already the largest dapp on rollups and know it very well. Although it may be the winning technology in the end, it is not easy to use at the moment.”

This incident directly affected investors' confidence in Layer2's narrative, and the valuation of Layer2 may be lowered as a whole.We think that in this high-odds track, it should be laid out in the early stage.

The following is the table of contents of this article, and it is recommended to read it in combination with the main points.

The following is the table of contents of this article, and it is recommended to read it in combination with the main points.

01. Optimistic about the logic of StarkWare

02. Background

03. What is Starkware

04. Customers and ecology

05. Market competition

06. Risk

first level title

01.

Optimistic about the logic of StarkWare:

secondary title

Market level:

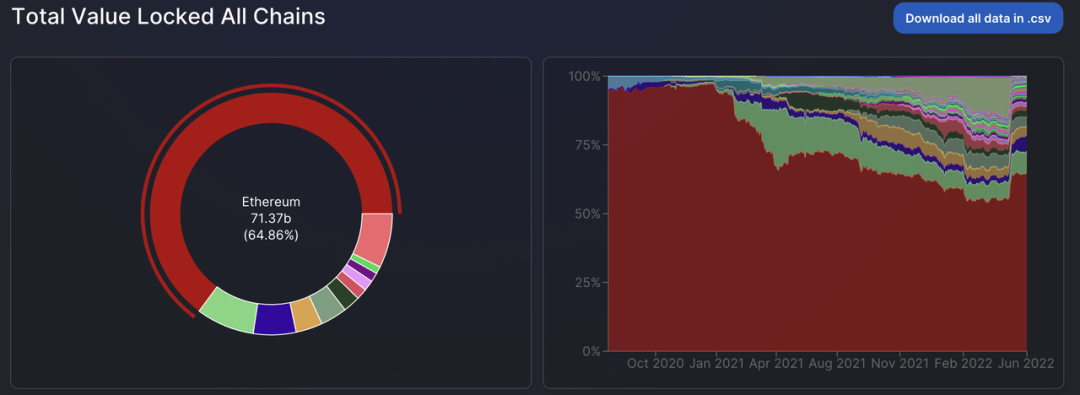

Ethereum is the largest next-generation web3 platform. Currently, Ethereum accounts for 64.86% of the TVL of the entire Layer1 network. We believe that Ethereum will continue to maintain this crushing market share.

In the long run, Layer1 will only serve as a consensus layer and ensure security, while Layer2 will undertake all calculations, similar to a decentralized cloud computing service provider. Assuming that decentralized "cloud computing" will be as important as the public cloud, the market opportunities contained here can reach hundreds of billions of dollars.

secondary title

Competitive level:

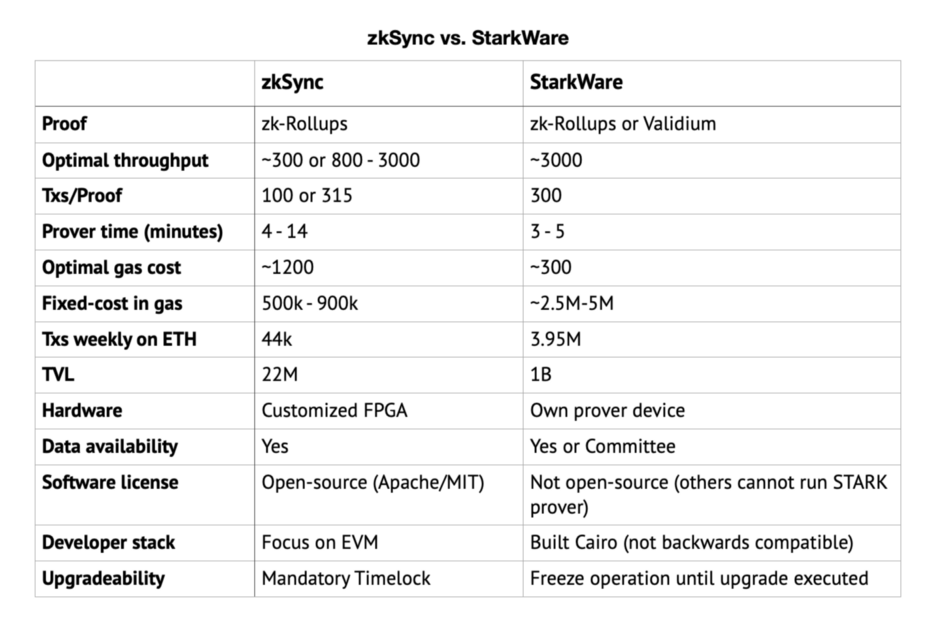

StarkWare adopts the zk rollups technology based on STARK. Compared with optimistic rollups, zk rollups bring better user experience with its faster withdrawal time. Vitalik, the founder of Ethereum, believes that in the long run, zk rollups will become the key to expansion. The biggest winner in the field. The StarkWare team has the best zk rollups technology, and is also the inventor of the most mainstream zero-knowledge proof technology zk SNARK and zk-STARK.

StarkWare's community building is not so strong compared to competitors, but we believe that this is related to StarkWare's phased goals. The STARK technology development cycle is long, and it is not yet fully decentralized. In the early stage, StarkEx products provide customers with Technical services adopt a centralized mode of operation. At present, StarkWare has entered the stage of perfecting the decentralized StarkNet, and the community is also under construction. As the technology matures, anyone can independently deploy contracts on it, and the community will play a greater role and become more prosperous, although the speed may be slower.

secondary title

background

02.

background

secondary title

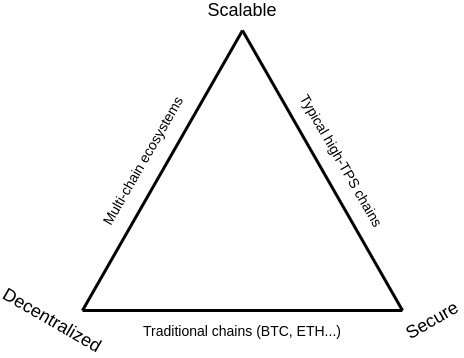

The scaling problem of EthereumEthereum is the next generation web3 platform.

However, the "impossible triangle" problem that has been faced for a long time, that is, the tradeoff in the three dimensions of "decentralization", "security", and "scalability", has caused Ethereum to suffer from unscalable congestion and high gas for a long time fee. During the window period when Ethereum was limited by capacity, a series of public chains known for their "high scalability" ran out. They made a certain degree of compromise in terms of "decentralization" and "security". The GameFi market is booming, and these public chains have eaten up part of the market share of Ethereum.Despite this, Ethereum still occupies 64.86% of the TVL of the entire Layer1 network, compared to the second ranked BSC (7.78%), the third Tron (5.68%), and the fourth Solana (3.56%),

The large-scale application of blockchain is bound to solve the expansion problem of Ethereum, thus a series of solutions around the expansion of Ethereum have been produced. With its high security and scalability, rollups are considered to be the best technical route among all expansion solutions, and they are also the most mainstream Layer 2 solution.

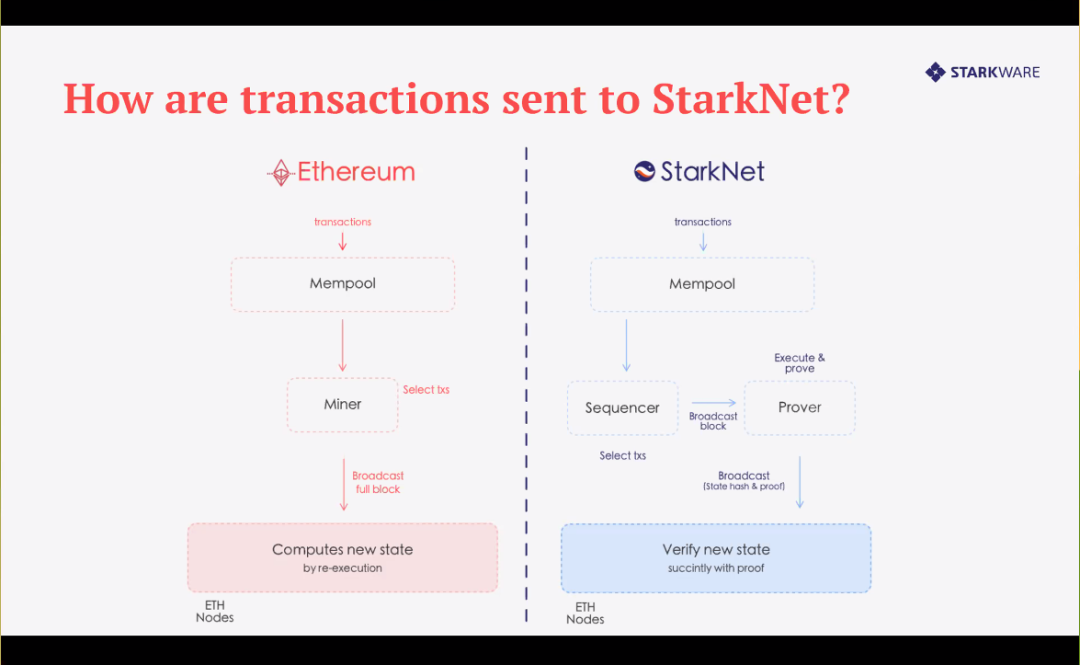

secondary title

The most mainstream technical route Rollup

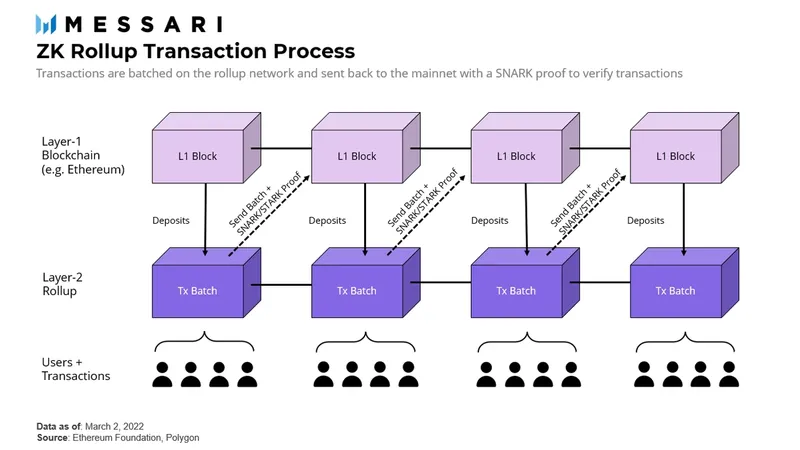

First, what is Rollup?Rollup "rolls" multiple transactions and sends a transaction to Ethereum in batches. The calculation of the transaction is completed off the chain, and then a proof and the data status calldata after the calculation is completed are sent to the main chain,This is a bit like when taking a math test, write the tedious calculation process on the scratch paper, and only write the correct answer on the test paper.

By verifying multiple transactions at one time, the efficiency is greatly improved. At the same time, it inherits the security of Ethereum. Without sacrificing security, tps has increased from the current 15 to hundreds or thousands.As a candidate, you can of course trust the calculation process on your scratch paper, but how can L1 trust the independent L2?How do you know that these new data states are correct?

If anyone can submit any data without any consequences, then they can transfer all assets in the rollup to themselves. In order to solve this problem, two rollups based on different proof mechanisms are produced.

According to different proof mechanisms, Rollups are mainly divided into two categories: Optimistic Rollups and zk Rollups.

Optimistic Rollups: Using fraud proofs, the Rollup contract tracks the entire history of the state root and the hash of each batch. If someone discovers that a batch has an incorrect new state root, he can post a proof to the chain that the batch was miscalculated. After the contract verifies the proof, the batch is resumed. Punish fraudsters and reward whistleblowers.

zk Rollups: Using validity proofs, each batch contains a cryptographic proof called zk-SNARK, which proves that the new state root is the correct result after executing the batch. No matter how computationally intensive, this proof can be quickly verified on-chain.

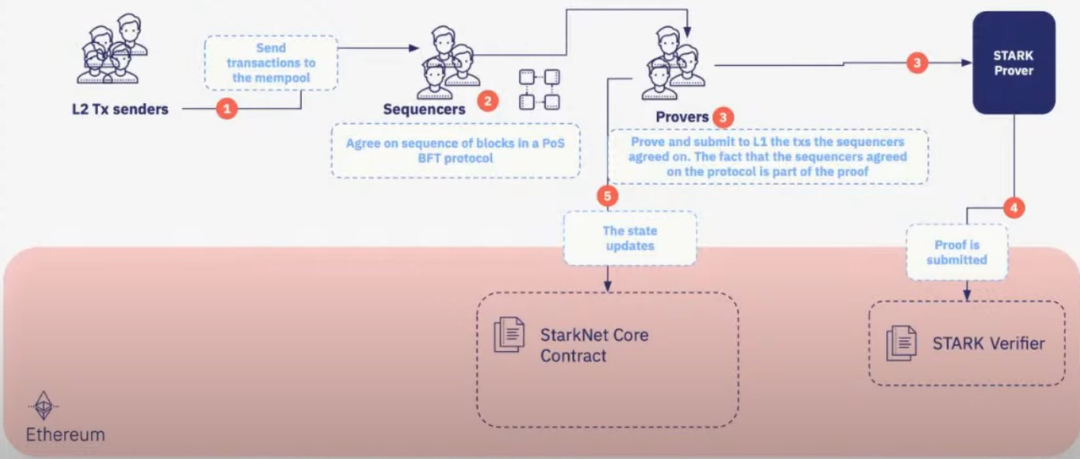

Sequencer:We also explain the three roles that may appear in Rollup:

Prover:Privileged participants in the Rollup system, they receive transactions from users, sort them and batch Merkle roots of transactions (a form of state representation) to Layer1, providing data availability, similar to the role of miners.

Verifier:This small group of nodes is responsible for a lot of work, needing to calculate all transactions and aggregate them into a compact zk proof. They run on special hardware that is mathematically impossible to forge false zk proofs.

Verify the validity of these proofs submitted by the Prover, that is, spot check the data sample to ensure that it provides all the information needed to calculate the honesty. Anyone can run such a node, no specific hardware required.

At present, the Layer 2 sequencer is run by the project itself, so it is often criticized that the sequencer is not decentralized enough. But in the future, it is hoped that these node operations will be decentralized to the community, and the ecological development will be driven by issuing tokens to capture network value.

Although optimistic rollups currently occupy the mainstream of the market, zk rollups still have two prominent structural advantages:Supports the expansion of both on-chain and off-chain data models, especially

The latter provides much higher throughput than any rollup and much lower fees, while optimistic rollups have much higher transaction fees than sidechains or other Layer1

No Fraud Proofs Required, Fast Withdrawals, No DelaysVitalik once made the following judgment in the article An Incomplete Guide to Rollups (January 2021):

"In the short term, optimistic rollups will win because of their EVM compatibility, and zk rollups are more likely to win in some simple payment and transaction use cases. In the medium and long term, with the improvement of zk-SNARK technology, zk rollups will win all use cases."

Next, let's explain zk Rollup in detail, that is, rollup based on zero-knowledge proof. Zero-knowledge proof is a concept in cryptography, that is, a method in which one party (the prover) proves a certain proposition to the other party (the verifier), and it is characterized in that no information is disclosed except that "the proposition is true". Therefore, it can be understood as "proof of zero disclosure". The zk proof consists of a "verifier" and a "prover". The prover creates a proof from the input of the system, and the vefifier confirms that the prover has uploaded the real calculation without recalculating it again.

In the words of StarkWare CEO Uri: "It provides computational integrity without trust, which is the ability to be sure that the calculation is performed correctly even if no one supervises it." (doing the right thing even when no one's watching)

At present, the two most mainstream proof systems for generating zero-knowledge proofs in the market are ZK-SNARK and ZK-STARK. Zk SNARK was first jointly invented by Professor Eli Ben-Sasson of the Israel Institute of Technology, and zk STARK is an improvement made by the same team for zk SNARK technology.

The superiority of ZK STARK based on ZK SNARK is mainly reflected in the following three aspects:Transparency:

The use of zk-SNARK requires mandatory initial trust settings, but there are hidden risks. For example, if the parties involved in the system setup are destroyed, then the destroyers will have the ability to create false proofs and falsify transactions. This is the biggest challenge for SNARK . While zk-STARK does not require external trust settings, it prevents any party from destroying or modifying parameters through random public verification.Scalability:

ZK STARK reduces the arithmetic complexity. In terms of the amount of computation to generate proofs, ZK STARK is 8-10 times faster than ZK SNARK, greatly improving scalability.Security against quantum attacks:

In theory, ZK STARK uses a collision-resistant hash function to improve its ability to resist quantum attacks, but in fact, once quantum computers are used on a large scale, the entire encryption industry based on cryptography will have a huge impact. Therefore, we will not elaborate on this advantage.But SNARKs are being adopted much faster than STARKs.first level title

03.

first level title

StarkWare is one of the best companies in the zk rollups track, co-founded by the aforementioned Professor Eli Ben-Sasson of the Technion-Israel Institute of Technology (co-inventor of zk SNARK & zk STARK), it provides the blockchain industry with STARK-based technical solutions.

secondary title

Products and Business Models

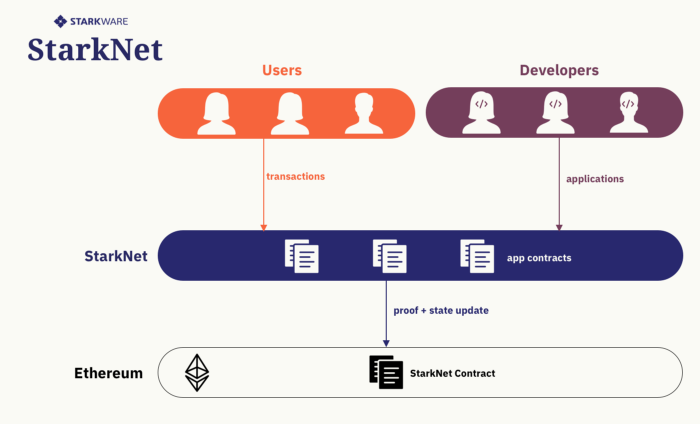

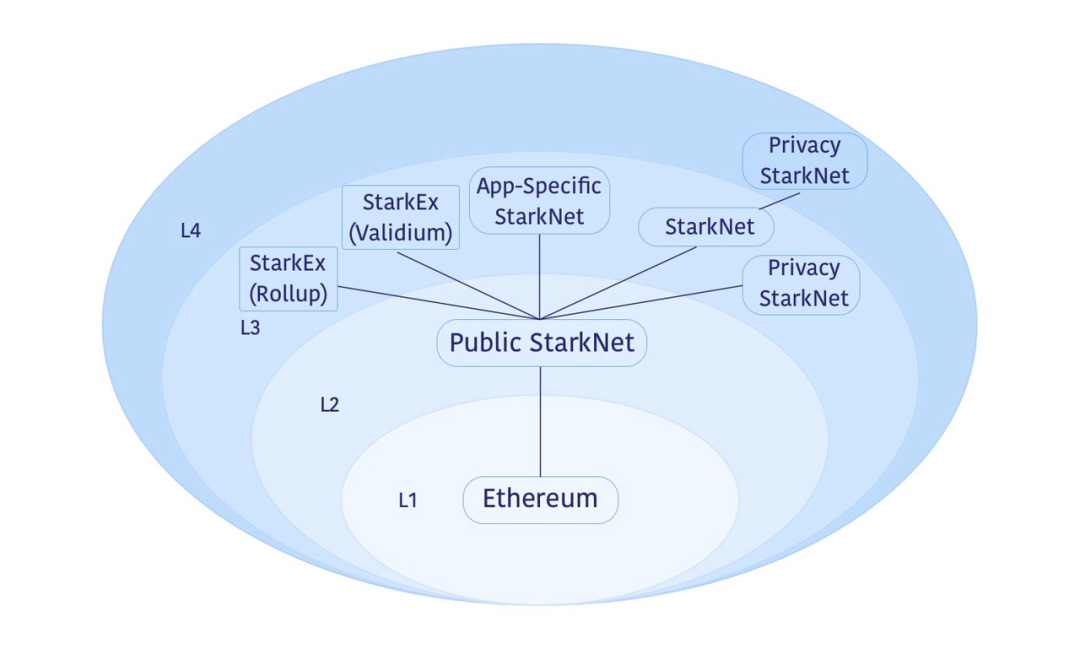

The team is currently developing two products: StarkEx & StarkNet, with two different business models:

Sell customized technology engine service StarkEx, and directly charge service fees to customers with expansion needs, which is essentially a customized 2B service.

Create a decentralized Layer 2 network StarkNet that supports the autonomous deployment of dApps. This part of the business model will be similar to other Layer 2 projects. Users can be charged Layer 2 transaction fees, and the value of MEV can also be obtained through the auction mechanism of the sequencer. Tokens will be issued in the future, the StarkNet project will be incubated with technology and funds, and ecological development will be driven through tokenomics.StarkWare co-founder Eli Sabasson once compared the difference between StarkEx and StarkNet to the difference between a computer and a cloud

, buying StarkEx is like owning your own customized computer, each customer has his own expansion computer, and only that customer can use his own computer. And StarkNet is closer to Ethereum itself, everyone can deploy contracts on the network independently.Since the official launch of StarkWare products in June 2020, the cumulative transaction settlement through STARK technology has reached 100 billion US dollars, and tens of millions of transactions have been processed. The first generation STARK solution batches thousands of transactions in a single dapp and processes them with 1 proof. The current STARK willIt's the equivalent of carpooling with others to increase efficiency.

secondary title

StarkEx: scaling as a service

StarkEx is a Layer2 scaling engine that provides technical services for dApps that can "rollup" hundreds of thousands of transactions into an 80 KB proof - far smaller than the size of a smartphone photo.

Unlike other rollups, which mostly make profits by operating nodes, obtaining top customers through customized expansion services is a feature of Starkware's development path. Perhaps the team believes that healthy cash flow and clear customer feedback are more important in the early stages of development. It is also because the technical route and language adopted by Starkware are difficult for developers to get started at the beginning, so the customized service is more customer-friendly. The codes of expansion solutions for customers such as dYdX and ImmutableX are all written by the StarkWare team.

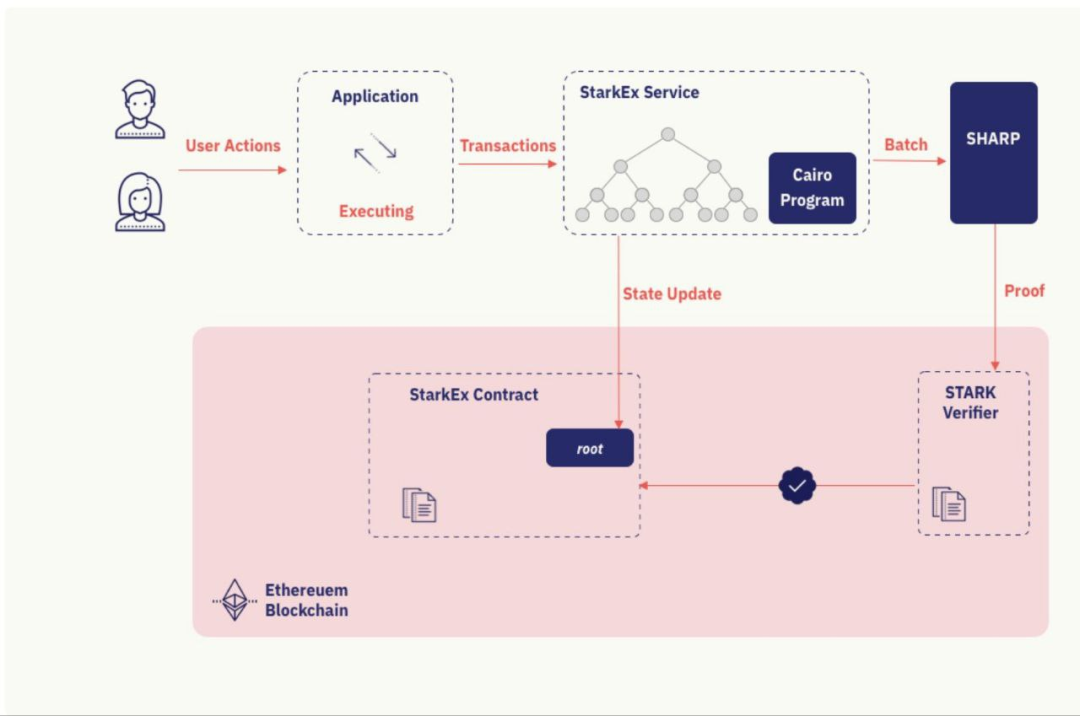

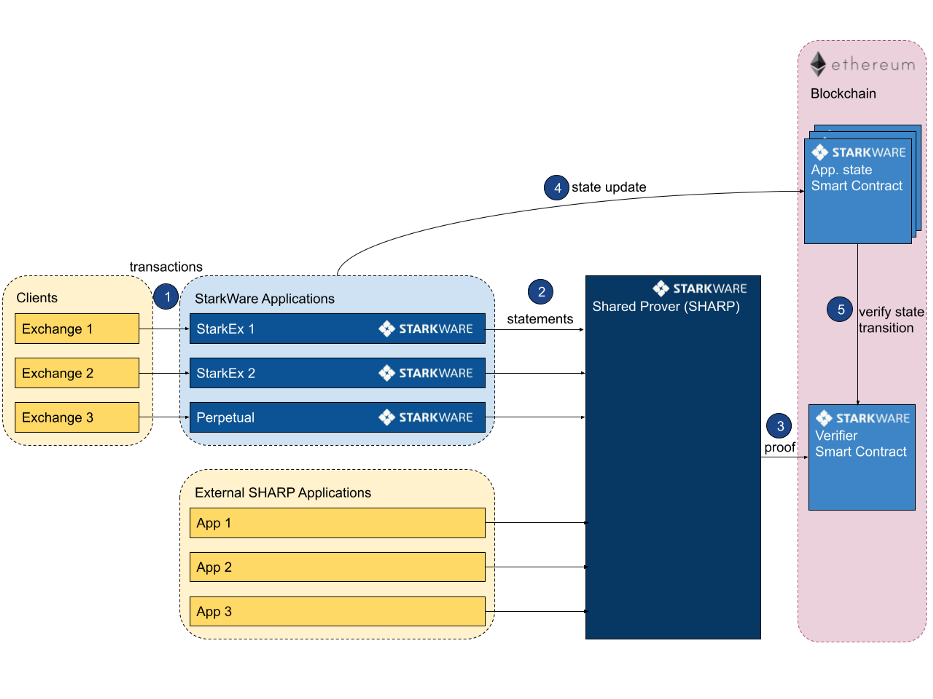

How StarkEx worksThe off-chain components in the leftmost yellow box receive user transactions and define business logic and execution order.

It passes the transaction to the StarkEx service. This component is the centralized front end of the application, usually a web or desktop client.The StarkEx (i.e. Sequencer) in the light blue box is responsible for batch processing and coordination.

It sends operations for each batch (executed in Cairo language, and first converts Solidity bytecode into Cairo language smart contracts, run in Cairo language environment) to SHARP to prove its validity. Once a proof is verified, it publishes a new state on-chain, represented by a Merkle tree.SHARP - Shared prover (customized by StarkWare).

SHARP is a shared proof service for the Cairo language. It receives proof requests from different apps and outputs proofs to prove the validity of Cairo code execution. Currently, it will be deployed on StarkWare's centralized servers.

The StarkEx contract (verifier contract) is a smart contract on Ethereum responsible for status updates, deposits and withdrawals.

Programming LanguageCairo

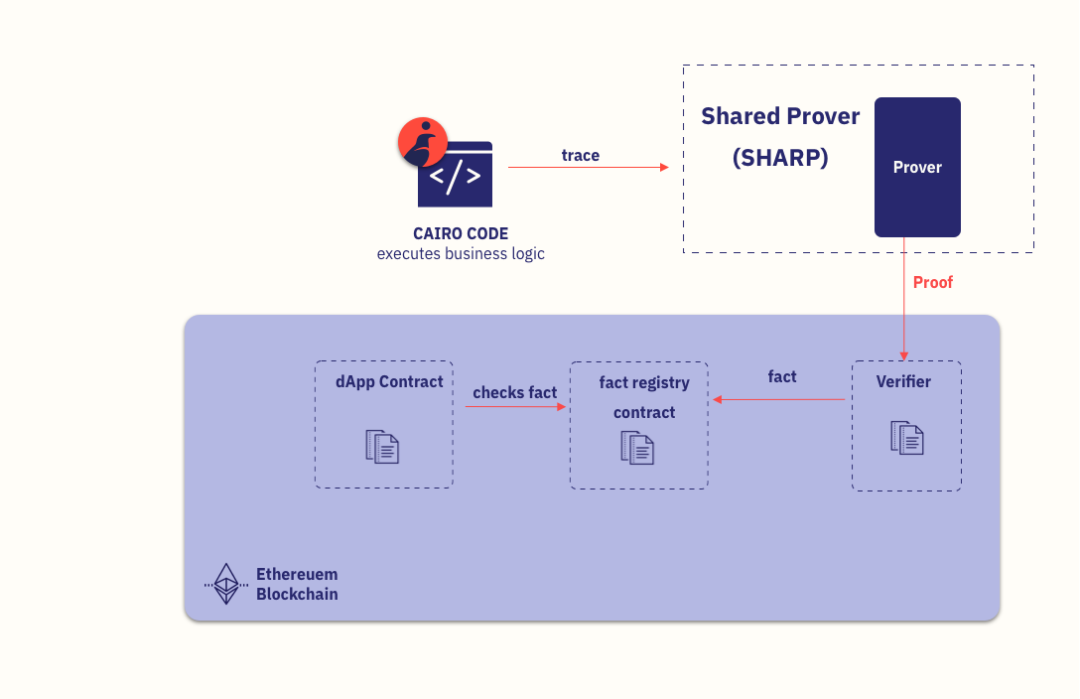

Ethereum's native programming language Solidity is very suitable for those EVM-compatible blockchains, but its common data structures are very expensive to translate into a STARK-compatible format. So the StarkWare team adopted the Cairo language. The execution of a Cairo program will generate a record, which is then sent to the prover (prover), who will generate a STARK proof, proving the validity of the instruction or calculation represented by the Cairo program. This proof is then checked by the verifier.

This language is still relatively new. There are still relatively few developers who can use this language, and it is not compatible with EVM. It is difficult for dApps to move existing contracts on Ethereum.However, Cairo has very prominent advantages: in addition to supporting zero-knowledge proof systems, which also reduces the execution of the program to a few sets of polynomial equations, specifically writing provable programs. These features enable Cairo developers to abstract business logic from smart contracts to the off-chain execution environment, and support writing thoseHuge cost, heavy execution

apps (these apps may even consume more gas than the entire Layer1), while retaining the security and settlement guarantees of Ethereum, which are not restricted by gas and Layer1.- Games built on StarkNet using Cairo can now store all game state on-chain, not just scores, thanks to better support for the STARK data structure in re-execution environments. This opens up a world of possibilities for the next generation of on-chain gaming.

data availability

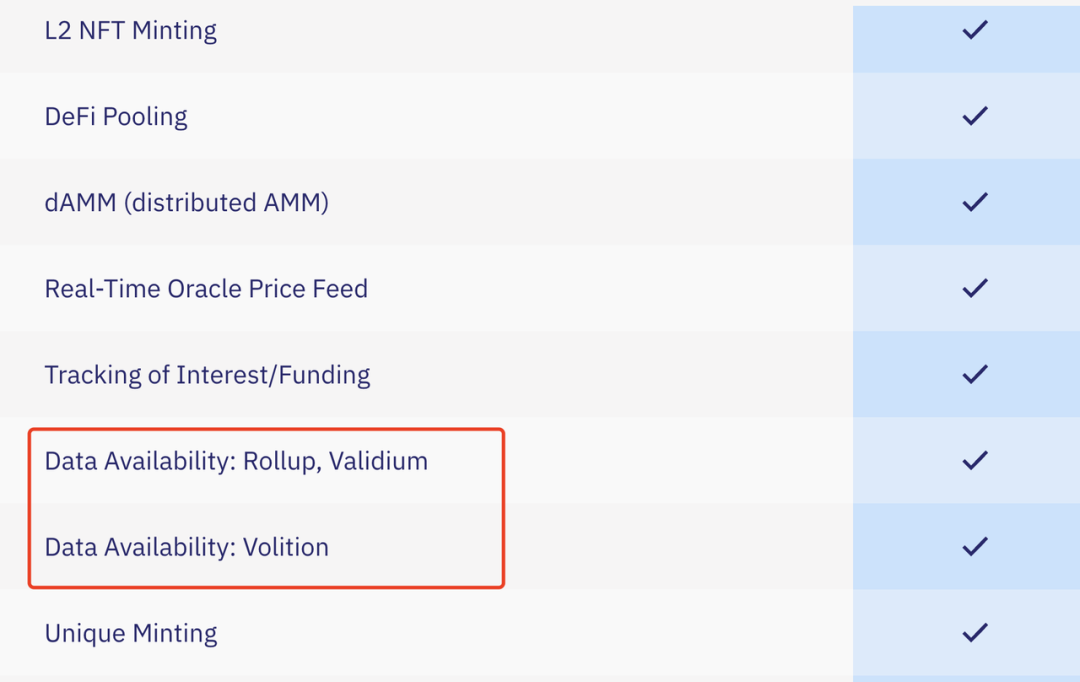

data availabilityStarkWare tends to refer to their solution as Validity Rollups, since zk rollups are not necessarily used in the solution. StarkWare according to the data

The difference between on-chain and off-chain storage supports three data availability schemes, all of which belong to Validity Rollups:

Rollup: data is stored on the chain

Validium: data is stored off-chain

Volition: Allow users to choose to store data on-chain or off-chain for each transaction

In order to eliminate users' trust in StarkEx operators for off-chain storage, StarkWare established a Data Availability Committee (DAC), which is composed of third parties such as ConsenSys and Infura. DAC members are entrusted with keeping a copy of off-chain data and releasing it back into the public domain in case of emergency, which is generally a case where the StakEx operator is not servicing user withdrawal requests.From a data security point of view, zk rollups store data on the chain to protect user funds from confiscation, censorship and hacking;but reduces throughput, zk rollups currently has an upper limit of 2000 transactions per second on Ethereum, while Validium can reach 9000+ transactions per second.From the perspective of transaction costs

, even complex perpetual transaction costs will be 100 times cheaper than completing in Layer1, and in the Validium mode, the cost will be even lower.

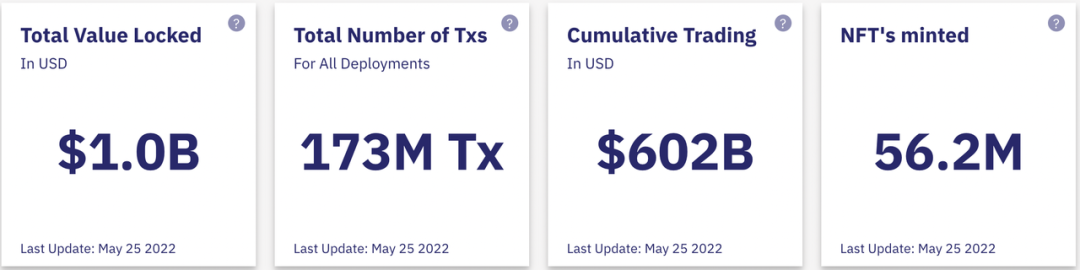

At present, StarkEx's total lock-up volume has reached 1 billion US dollars, 173 million transactions have been processed, the cumulative transaction volume has reached 602 billion US dollars, and the value of Minted NFT has exceeded 56.2 million US dollars. Clients include dYdX, Sorare, ImmutableX, DeversiFi, Celer, and more.

secondary title

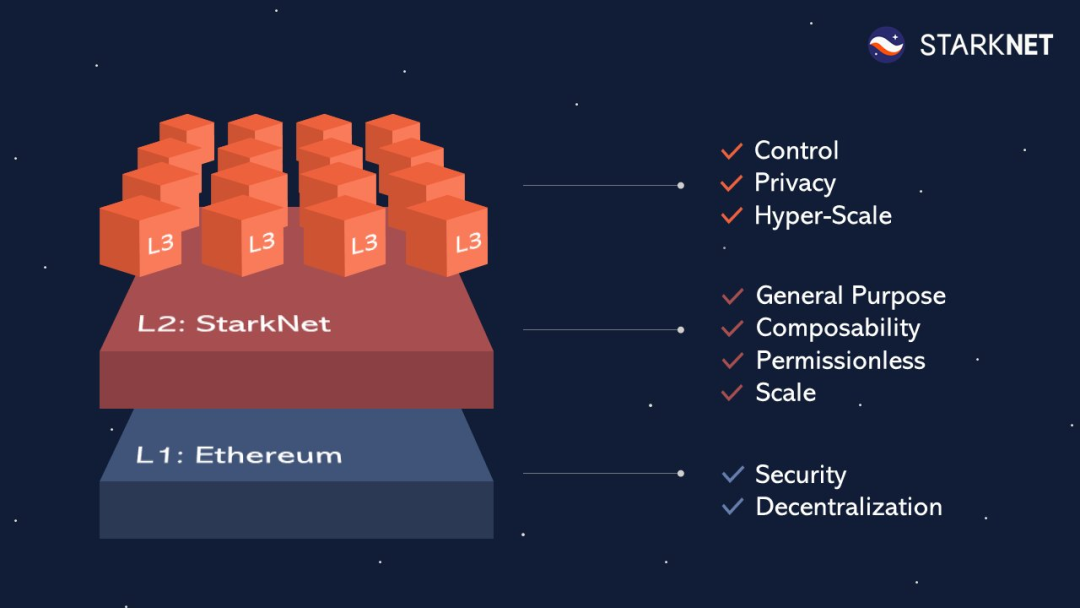

StarkNet: Decentralized Layer 2 Network

StarkNet is a decentralized zk rollup that does not require StarkWare permission. It is a Layer2 network running on Ethereum. Developers can independently deploy contracts on StarkNet through application. It has high scalability while maintaining the composability and security of Ethereum. It is planned to be launched at the end of the year. Centralized version.

StarkNet achieves decentralization on two levels:

StarkWare plans to decentralize sequencers and provers to the community, and everyone can run these nodes, thus achieving decentralization and censorship resistance.The use of STARK proofs ensures that everyone canwith lower hardware

Verifiers are required to verify the complete StarkNet chain, and there is no need to trust any external entities.

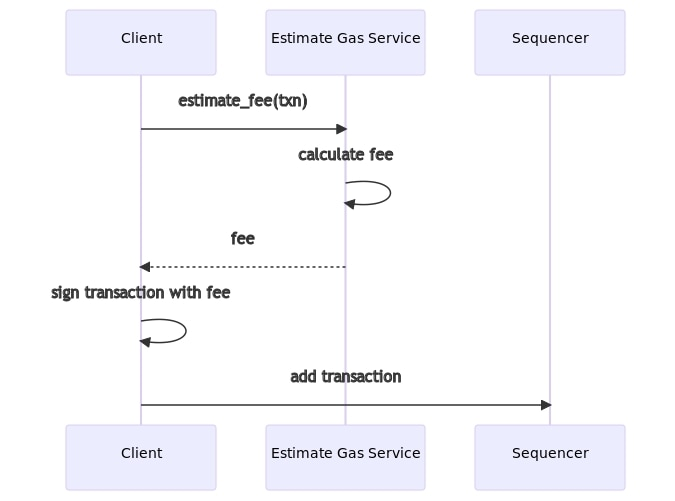

Transaction Costs and Revenues on StarkNet

The fees involved in StarkNet are currently paid in ETH. In general, the cost of a transaction depends on several factors:

1. Data update cost: determined by the amount of data sent to Layer1

a. State difference information

b. Number of messages transferred between L2 → L1

c. Consumed L1 → L2 information

These are sent to Layer1 as calldata.

2. Calculate the cost

a. L1 Proof Verification

b. L2 calculation cost (SHARP)3. Storage cost:

How many read/write operations were performed during the execution of the transaction

4. L2 network transaction transmission costs: transmission of calldata, etc.If we do transactions on L1, all the above costs will be generated in L1. Since the execution of transactions requires expensive maintenance, the costs of 2 and 3 are very high. When using L2 transactions, the calculation and storage are transferred off-chain, and the correct state can be obtained only if the calldata is correct.

Therefore, 2 and 3 do not require expensive maintenance costs, so the price is cheaper.Judging from the fee paid by the user on each transaction:

The cost of 1 and 4 will be shared by users by packaging multiple transactions, and the prices of 2 and 3 are also cheaper, so the fee that users need to pay is much lower than that on Ethereum.From the perspective of StarkNet fees:

In addition to the gas fee for uploading transactions to L1, the fee received from users also includes service fees for computing, storing, and packaging transactions for users, which is also the core source of StarkNet's income.In addition, the sequencer may also have MEV income:

When the network becomes decentralized and the sequencer, prover and other nodes are given to the community, the team will consider introducing a market mechanism, the details of which are currently being studied, such as fee auctions, allowing the sequencer to pick the highest price Fee transactions. Optimism and zkSync have already taken such a practice.

StarkNet is currently not compatible with EVM, and Cairo cannot be used to write contracts and be directly deployed on StarkNet. Starkware's partner Nethermind's Warp team is developing a translation language from Solidity to Cairo: Warp, which helps developers translate Ethereum contracts to StarkNet. There are already several projects under development and deployment.secondary title

team

team

At present, the team has a total of 80 people, and it is the best technical team in the field of cryptography, especially zero-knowledge technology:

Eli Ben-Sasson: Co-Founder & Chief Scientist, Professor of Computer Science at the Israel Institute of Technology. Founding scientist of Zcash, inventor of zkSNARKs.

Uri Kolodny: Co-Founder & CEO, Uri is a serial entrepreneur with rich business experience and good at cooperation.

Michael Riabzev: Co-Founder & Chief Architect. Doctor of Israel Institute of Technology, worked in Intel and IBM.

Michael Riabzev: Co-Founder & Chief Architect. Doctor of Israel Institute of Technology, worked in Intel and IBM.

Oren Katz: Vice President of Engineering. Graduated from Hebrew University majoring in computer science, Tel Aviv MBA, senior engineer with 20 years of experience.secondary title

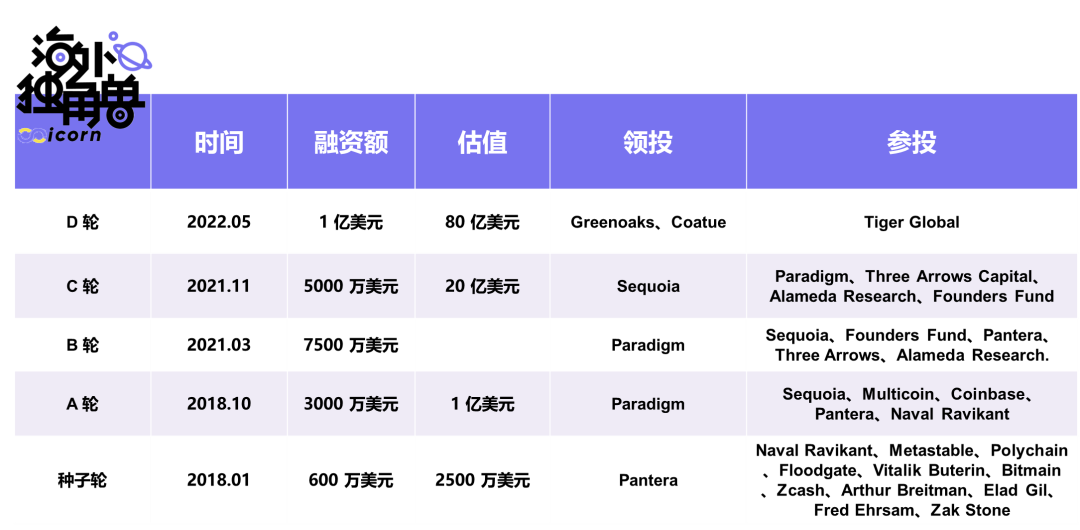

financing

financing

first level title

04.

Customers and ecology

secondary title

StarkEx customers

StarkWare's current income mainly depends on StarkEx's technical services. The main demand of customers is to maintain the security of Ethereum level while reducing gas costs. The official website shows that there are currently 6 customers. Divided into 2 categories:

Decentralized exchanges such as dYdX, DeversiFi

Compared with other L1 or L2, why is StarkEx their best choice?

safety:safety:

As an exchange platform that handles huge amounts of money, there must be no compromise on securityfluidity:

The highest liquidity on Ethereum, which is one of the most important needs of trading platformsPrivacy:

For DeFi users, zk-STARK technology can protect user privacy and avoid the risk of being manipulated by centralized exchangeslow cost:

High-frequency transactions require low gas and smooth transaction speed, especially for NFT players, whose asset transactions require higher gas. The more popular the platform with the larger transaction volume, the higher the gas cost to be consumed, and the more cost-effective it is to use StarkEx

Eli once said: "StarkEx is suitable for very specific business applications, especially those scenarios with a large number of payments, a large number of transactions, a large number of Mint and trading NFT. But if you want to build game-like applications, such as generative art, encrypted cats that can evolve, etc. etc., cannot be achieved through StarkEx."Judging from the composition of revenue last year, dYdX is StarkWare's largest customer, accounting for 90% of StarkWare's total revenue. On the one hand, as the largest decentralized exchange project last year, the choice of dYdX proves that StarkWare has a huge demand to solve, and its team capabilities have also been recognized and favored by leading projects.

dYdX

But on the other hand, the excessive reliance on a single client makes us worry that once dYdX adopts solutions from other teams or builds its own Layer2 platform, it will have a major impact on StarkWare's revenue. This concern was soon fulfilled, and the dYdX V4 version plans to launch an independent blockchain based on the Cosmos SDK.dYdX CEO Antonio Juliano reveals

, in mid-2020, the gas fee of the decentralized exchange dYdX is as high as 90-100% of the revenue, so StarkEx is chosen to expand the engine. At the end of 2020, dYdX launched the zk Rollup version, which processes billions of dollars in transactions every day Reduced to 1/50 of the original, promoting business growth of 500 times.On dYdX, a single client, StarkWare has earned more than $50 million in revenue in the past year.Compared with the cost saved by StarkWare for customers, such income is undoubtedly worth it: according to the annual revenue of 450 million US dollars, before cooperating with StarkWare, the gas fee of dYdX was as high as 405-450 million US dollars, after the cooperation, the gas fee dropped to 3-5% of revenue, approximately $13.5-22.5 million,

This means that StarkWare helped dYdX save at least about $300 million in costs.

However, on June 22, 2022, dYdX announced that the V4 version will develop an independent blockchain based on the Cosmos SDK and the Tendermint PoS consensus protocol, through a fully decentralized off-chain order book and expansion engine, thus gaining a higher level of blockchain than other blockchains. The scalability of the block chain is several orders of magnitude higher.

IOSG once made such a vivid metaphor:

Ethereum Rollup is like an old real estate in the city center. The advantage is that there are prosperous business districts and transportation facilities around it (combinability), and the disadvantage is that the decoration is dilapidated (infrastructure iteration is slow), and the owner is not allowed to decorate (it does not support the application of custom nodes. ). dYdX is a big tenant of this building, and usually has no social interaction (does not rely on composability), so it decided to move to the suburbs to build a small villa. At this time, I happened to meet a good decoration team (Cosmos SDK), who once had a big production in the suburbs (Terra), so they hit it off and left Rollup aside.Antonio Juliano, the founder of dYdX, thinks this way: "When choosing a chain, I think people should not think about what kind of users there are on the chain, but what kind of product experience the chain can achieve." This also means,The StarkEx experience may not be as good as imagined.For order books, throughput is critical. However, the dYdX founder complained that the current rollup tps is more like 30, not 1000+ as people think. There is still a long way to go for the decentralization of Layer2 node operations. StarkWare currently has a very small number of sequencers, and all of them are deployed by itself. This is also a common phenomenon of rollup.

This creates 2 problems:

The risk of centralized institutions doing evil, or the development progress needs to be subject to the rhythm of StarkWare

Token DYDX will not be able to participate in node operations and lock the protocol value of dYdX

ImmutableX

dYdX is the leading native project of Ethereum and an early adopter of Layer2. Its approach to building application chains will also be emulated by other projects and turn to build their own application chains. If this becomes a trend, then perhaps we should lower our expectations for Layer 2 valuation appropriately.But the great success also comes with a huge cost - because ImmutableX will reward players who hold NFT assets, it has to spend $6 million worth of gas. As gas prices continue to rise, they have to take scaling measures for NFT mint and transactions.

Note:

Note:

Starkware reduced the transaction gas of ImmutableX to the cent level. This solution eventually led to the cooperation between ImmutableX and tiktok. In its cooperation statement, Tiktok specifically mentioned: "StarkWare is the first carbon-neutral Layer2 expansion solution."

Note:

Note:

Gods Unchained minting 8 million NFT trading cards consumes approximately 490 million kWh on Ethereum. ImmutableX uses zk rollup compression casting to mint the same number of NFTs using only 1,030 kWh, a 475,000-fold reduction in energy consumption.

Sorare

According to Growjo, Starkware receives $1 million in annual revenue from ImmutableX and expects $3-5 million in annual revenue in 2022.

Sorare is a football platform that brings together fans, players, and clubs. Before cooperating with StarkWare, Sorare also approached many other blockchain projects with higher scalability, but the increase in throughput came at the expense of security and decentralization, the user experience was not good, and withdrawals were delayed .

DeversiFi

Sorare does not want to sacrifice security, they believe that Ethereum has interoperability and network effects unmatched by other blockchains, and it is "neutral" and not controlled by any profit-making organization, it is most suitable for fans to own their own An open platform for games. Sorare saves millions of dollars in gas fees every week by cooperating with StarkWare.

DeversiFi is a professional-grade decentralized exchange. Withdrawal speed has always been one of the key challenges facing the mass adoption of decentralized exchanges. Execution, settlement, withdrawal, and API speeds are an integral part of a profitable trading strategy and cannot be sacrificed.

With the batch settlement supported by STARK, the tps paid by DeversiFi reached 18,000, which can compete with the fastest centralized exchanges and provide fast and reliable withdrawal services (especially beneficial to arbitrageurs). Unlike other decentralized exchanges, trader balances are updated in a timely manner with no risk of rollbacks or trade failures.

According to Growjo data, DeversiFi's annual revenue in 2021 is $4.2 million, and StarkWare's revenue on this customer is about $630,000.

secondary title

StarkNet EcologyMetaMaskIn addition to being a technology engine provider, StarkWare's most important product is the decentralized and scalable layer-2 network StarkNet. At present, the main network has just been launched and is not yet open to the public, but it has invited a series of well-known project parties to develop on StarkNet. Yesterday announced the latest cooperation with ConsenSys to introduce zk rollups

and Infura.One of the most important functions of the $8 billion financing raised by StarkWare is to build an ecosystem, provide financial incubation or technical support for projects developed on StarkNet, and in the future, this will also become part of StarkNet's source of income. At present, StarkWare also operates key nodes such as Sequencer and Prover, and will receive benefits.

But in order to ensure that there is no single point of failure and regulatory pressure on the data, the agreement will be decentralized in the end, and this part of the benefits will be given to the community.Ethereum itself is not a perfect design, and there are many restrictions on developer productivity. Therefore, Solidity, the native language that adapts to the Ethereum standard, also has problems such as inefficient dependent data structures. The Cairo language used by StarkWare gets rid of the historical baggage of Ethereum and promises to achieve what Ethereum cannot do today

1. The proof mechanism of zk itself, that is, to realize the verification and protect the original information through the mechanism of generating zk proof

privacy:privacy:

Large privacy transactions based on the security of EthereumOnchain's information asymmetric strategy game:

For example darkforestAuthentication system:

For example, interact with centralized entities to generate proof protocols (such as DECO) while protecting privacy, and build channels for web2/web3 proof systems (credit system building, identity verification, chain credit system building, and corresponding tool development ), or even replace all practices that involve collecting data to central hosting

2. High scalability with shared L1 securityentertainment:

High-performance games may be produced under high expansion, such as real-time battles, communication and settlement, and the combined gameplay of NFT. The entertainment is much more innovative than that on the main network. At present, the gamefi/NFT ecosystem on Starknet is the richest, with new projects such as physics engine projects, machine learning platforms, and game composability protocols (BRIQ)finance:

Liquidity aggregation, Starkware proposed the idea of aggregating cross-chain liquidity, all liquidity is stored in Layer1, but can be used in Layer2first level title

05.

market competition

https://l2beat.com/

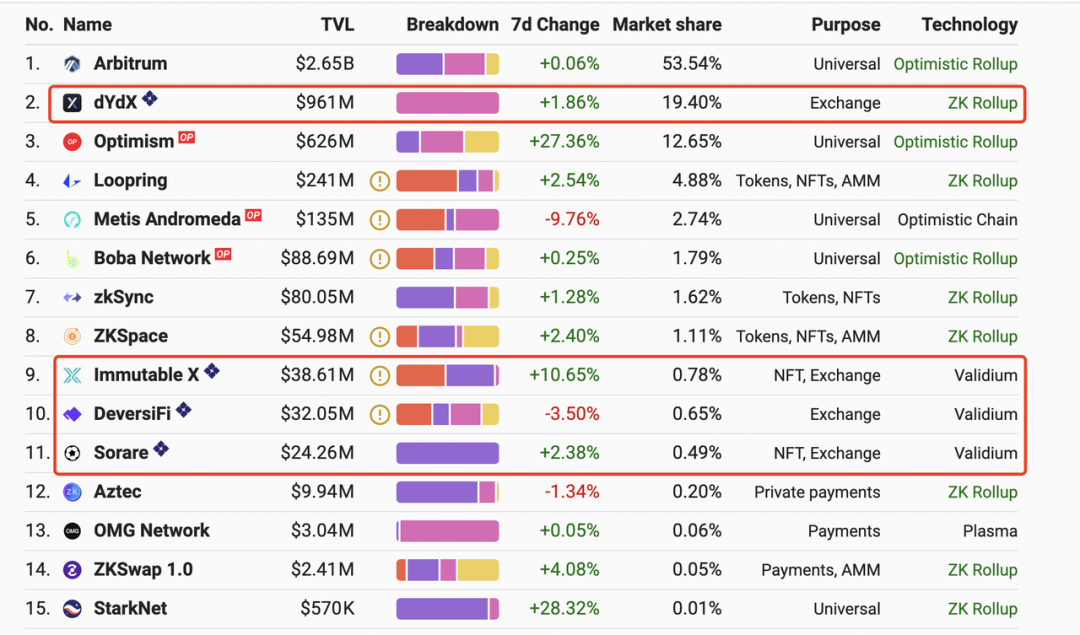

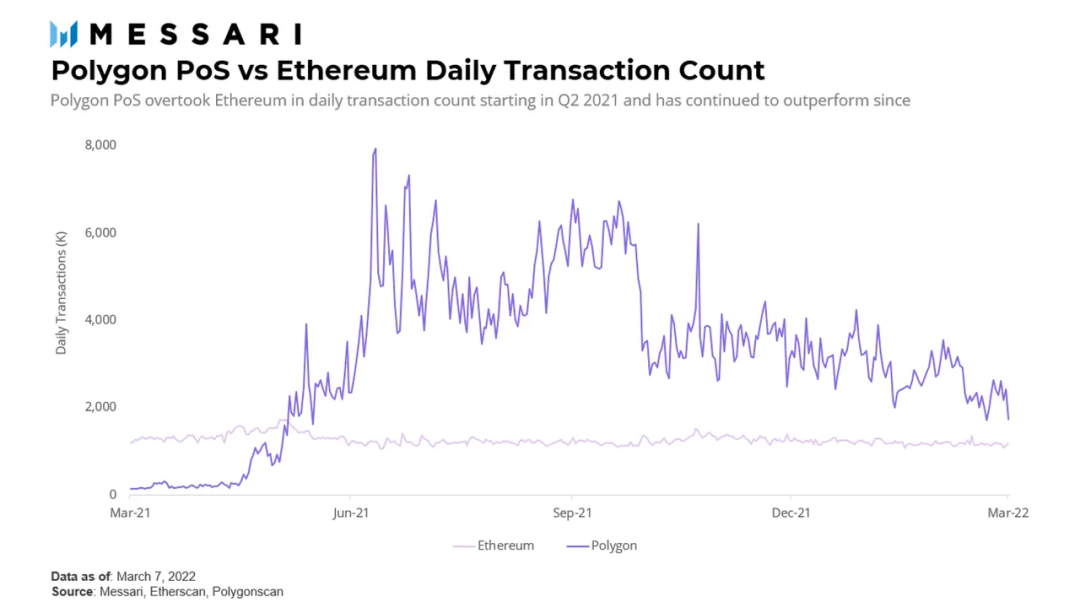

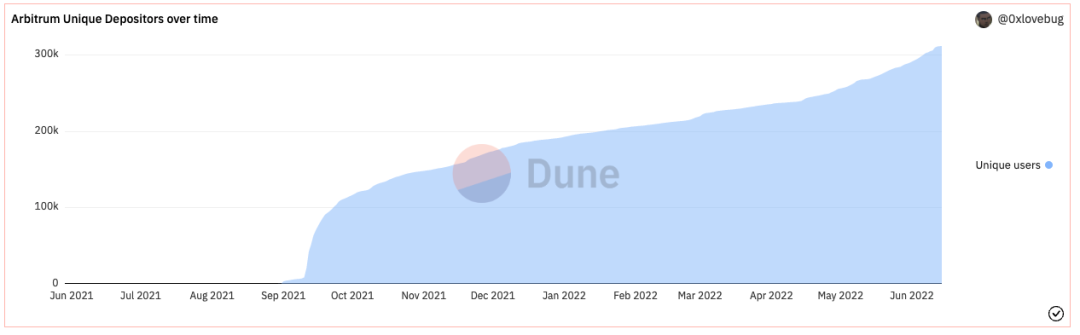

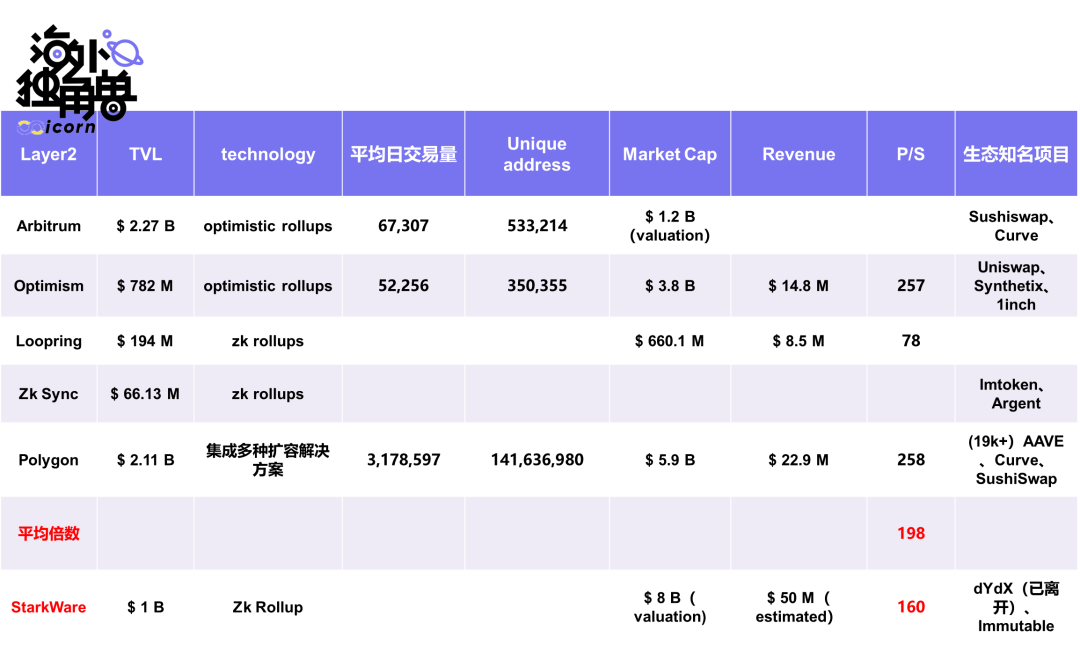

image descriptionThe current Ethereum expansion track is not big, but the competition is already very fierce.The entire Layer 2 track currently has a total lock-up volume of US$4.95 billion, accounting for 7% of the total lock-up volume of Ethereum ($68.07 billion).The total market share of applications supported by Starkware accounts for 21.32% of the entire Layer2In contrast, Arbitrum, as the most mainstream optimistic rollups solution at present, accounts for 53.54% of the total Layer2 market share. It can be seen that the competition in the expansion field is fierce. Polygon's co-founder Mihailo Bjelic once used "let a thousand flowers bloom "To describe the competitive landscape of this industry.

StarkWare has 4 main categories of competitors:

1. An all-in-one solution like Polygon

Polygon was founded in India in 2017 and was originally called Matic Network. The initial expansion route was Plasma. With the decline of Plasma, it began to explore other expansion solutions, renamed Polygon, and became a developer platform that supports multiple expansion solutions.

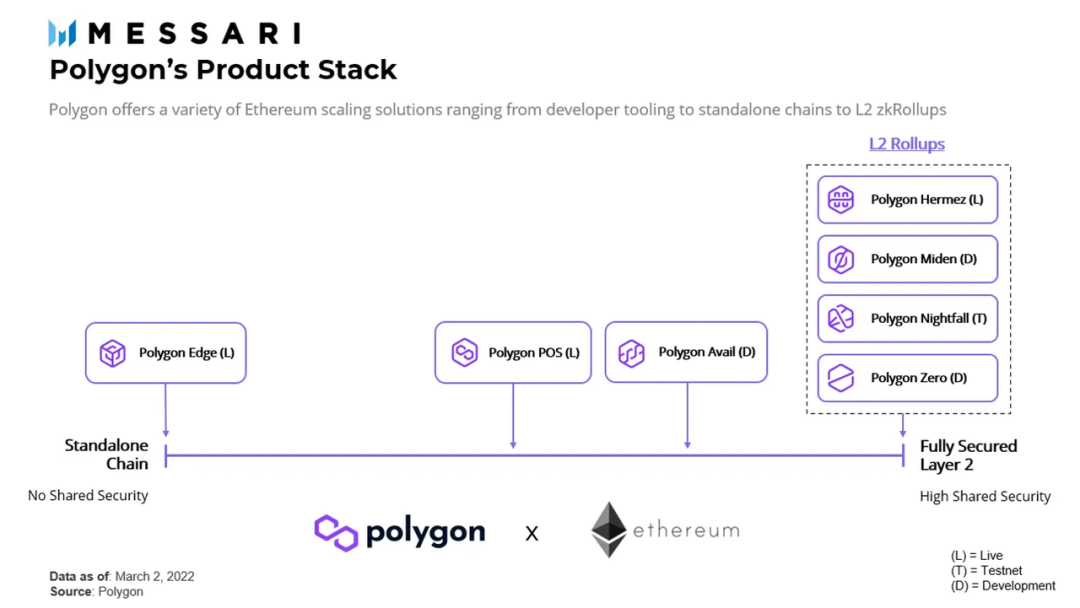

Polygon's product line includes PoS sidechains and 6 zk projects. 3 of them - Hermez, Miden, and Zero are ZK Rollups, the other Nightfall is a hybrid Optimistic-zk rollup, and the remaining 2 Avail and Edge are designed to help build zk and modular infrastructure.Polygon has EVM compatibility and has a good community development atmosphere. Polygon's valuation has reached $20 billion after Polygon's latest round of financing (Sequoia India led the investment of $450 million) in February this year. The Polygon token has a market cap of $5 billion, up from $15.6 billion before the crypto market crash.

There are currently over 19,000 dApps on the platform.If StarkWare's community gets a 2, Polygon's community gets a 10.

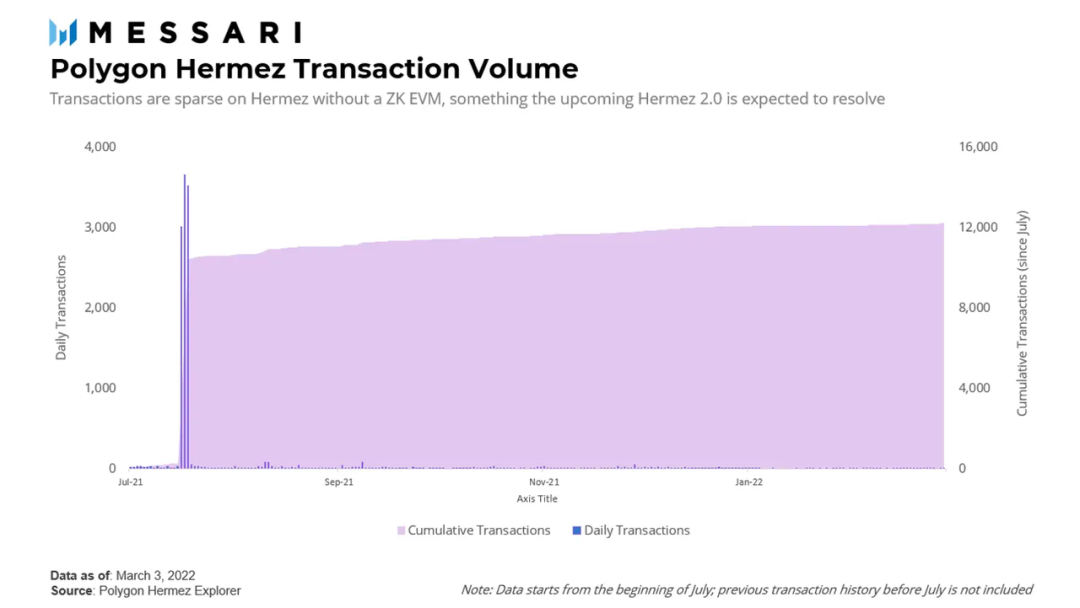

Polygon Hermez is currently the only decentralized Layer2 network that does not require a centralized operator, but it can only be used as a payment layer with limited functions.

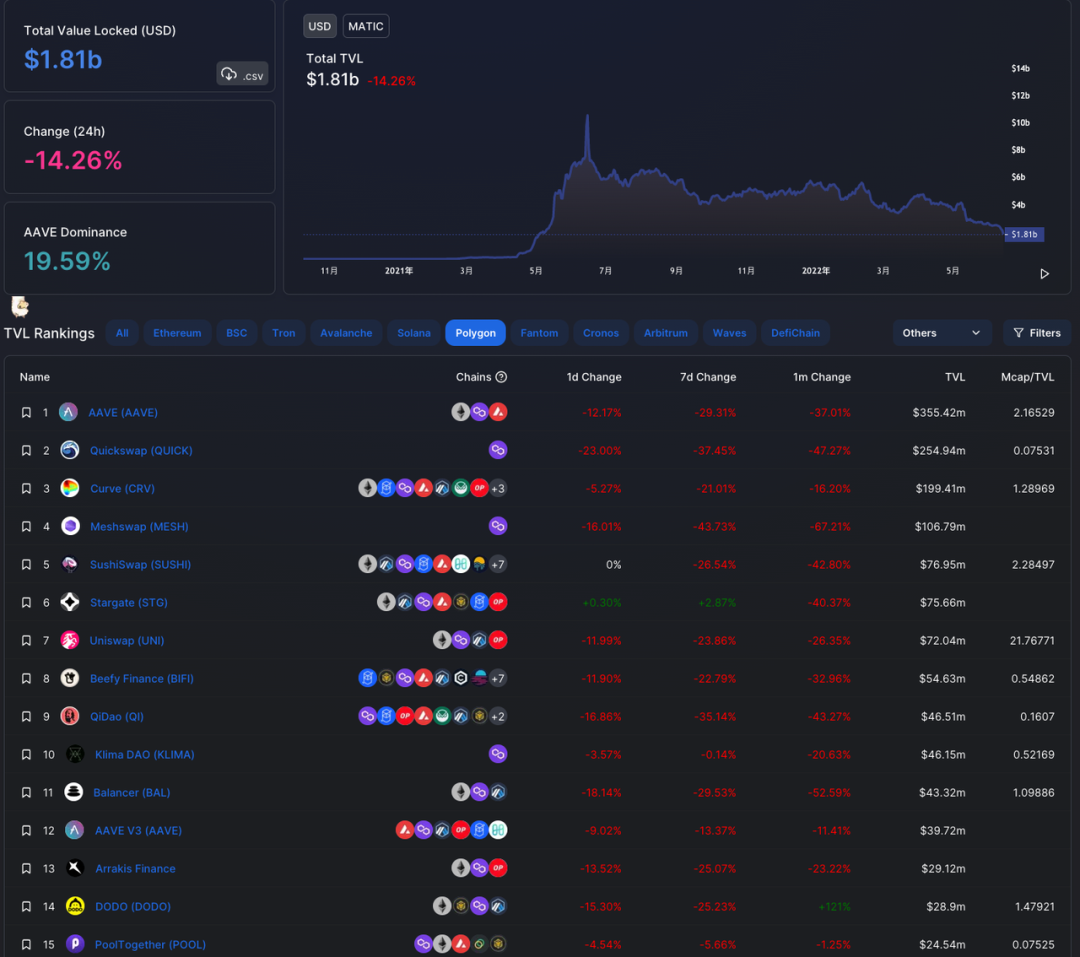

The total lock-up volume of the Polygon ecosystem is currently US$1.81 billion, of which four projects, AAVE, Quickswap, Curve, and Meshswap, have a lock-up volume of more than US$100 million. According to the 249 agreements counted by DeFiLllama, more than half of them are DeFi projects.

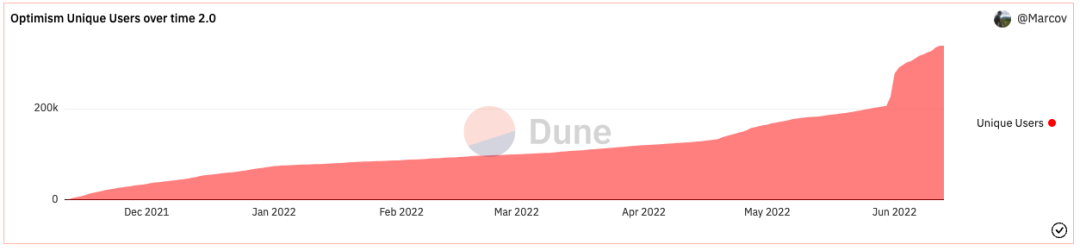

2. Optimisitic rollup represented by Arbitrum and Optimism

Since Optimistic rollups are technically easier to implement than zk rollups, they have gained mainstream application in the market earlier and are more mature. The head players of this track are Arbitrum and Optimism.

Arbitrum was developed by Offchain Labs. The founding team includes Ed Felten, a senior professor of computer science at Princeton University. It is currently valued at $1.2 billion. Investors include Lightspeed, Polychain, Pantera, etc. The total lock-up volume of the ecology currently reaches 1.06 billion US dollars, accounting for 53.54% of the total lock-up volume of Layer 2, and it is Layer 2 with the largest market share. Among them, 5 projects have locked positions of more than 100 million US dollars, including SushiSwap, GMX, Curve, dForce, Stargate, Uniswap, AAVE, etc.Optimism goes beyond simple EVM compatibility to EVM equivalence.By assuming the role of Sequencer, Optimism charges users Layer2 execution fees (99% of which are the cost of publishing batch transactions to Ethereum). According to Messari, its revenue is about 24.5 million US dollars.

Note:

Note:

EVM equivalence: On an EVM-compatible chain, developers will still need to modify their web3 applications to use a different architecture. Additionally, tools built for Ethereum may not necessarily work for other EVM-compatible chains over time. The EVM equivalence of Optimism is almost equivalent to be implemented on the Ethereum mainnet to solve this problem, allowing one-click porting of applications and all tooling work. This approach will help Optimism grow its developer community faster and with fewer bugs than other scaling solutions.

3. Strong opponents in the zk Rollup tracka16zZkSync is one of the strongest opponents in the zk Rollup track, and the development team behind it is Matter Labs, which was established in December 2019. zkSync is also supported by top capital, including: Ethereum Foundation,

, USV, 1kx, etc., its ecology currently has more than 70 projects.

Unlike StarkWare, zkSync uses the zk system based on SNARK technology. zkSync 2.0 supports two modes: zkRollup with on-chain data availability and zkPorter with off-chain data availability, and is compatible with EVM.In addition, there is Scroll, a rising star in the field of zk rollup

, currently valued at 2 billion US dollars, investors include core members of the Ethereum community, with EVM equivalent, more open-source technology, and a better community atmosphere.

first level title

06.

risk

riskFrom the perspective of income composition:

The source of income is too dependent on a single head project (dYdX). We were worried that once important customers choose other solutions or self-built expansion solutions, it will have a severe impact on StarkWare's income. The reality has also fulfilled our hidden worries - dYdX, the largest application on the second-layer network, will launch a custom application chain based on the Cosmos SDK, which may lead to other Ethereum native projects to follow suit. But this will be improved after StarkNet ecological prosperity.From the perspective of product completion:

The StarkNet network is at a very early stage, the fee model is not yet clear, and the decentralized version has not yet been released, so there are still many uncertain technical details. But in the words of Sorare CEO Nicolas Julia: "StarkWare is the only technical team I have seen in the past ten years that releases products and functions according to the roadmap", we believe this is a team with strong contract performance and trustworthinessFrom a community building perspective:

At present, the centralization is more serious. If StarkWare's technology can score 10 points, then only 2 points for community building. There are several factors in this:

StarkWare's past product, StarkEx, provided technical services to customers, rather than open source products. StarkWare has always focused on technology research and development and customer service, and community building is not their priority.

Cairo is a very new language, and there are very few developers who can use this language; and it is not compatible with EVM, it is difficult to directly deploy existing contracts on Ethereum, and the atmosphere of the developer community is relatively deserted

At present, important nodes such as sequencer and prover have not been opened to the community, and are still centrally operated by StarkWareJudging from the implementation of rollup:

The actual experience of rollup is not as good as the "bragged" of major project parties.

False L1 on-chain confirmation: the data is uploaded to Ethereum before it is really on-chain, but the immediate confirmation of rollup is not really on-chain, it is just a temporary soft confirmation through rollup turnover

Exaggerated tps: Antonio, the founder of dYdX, once "spiked" that the current tps of rollups is more like 30, not the claimed 1000+

MEV risk: After the sequencer is distributed to the community, in order to better capture network value, it is likely to adopt bidding models such as MEV, which may make the gas cost of rollup very high and the user experience is not goodFrom the perspective of market competition:

The competition on the zk track is fierce. Both teams that originally adopted the zk route and teams that did not originally adopt the zk route can join this track, and Cosmos, Polkadot, etc. support super apps to build their own appchains, especially the departure of dYdX may promote this trend.From the perspective of industry cycle:

Key person risk:Valuation

07.

Valuation

secondary title

PS multiple angleBy taking the average of the PS multiples of the top Layer2 projects, it is 198 times. Compared with StarkWare's 160 times PS, it is currently very expensive but not the highest. However, StarkEx is partly a technology provider, and its business model is different from other L2 ecosystems. This figure is for reference only.

secondary title

Decentralized Cloud Computing PerspectiveConsidering the revolutionary impact of zk rollups technology on the entire blockchain ecology, it is biased to use a purely financial perspective.According to the current official layout of Ethereum, Ethereum will become the Consensus Layer, the "consensus layer" responsible for security and consensus, and Layer 2 will develop into the Excution Layer, the application layer that handles various transactions and calculations.

first level title

08.

in conclusion

in conclusionWe are optimistic that StarkWare's strongest thesis still comes from its far-reaching expansion technology.To make the experience of the blockchain world as smooth as that of the web2 world, the team's capacity expansion technical ability is the top priority, and it is far from enough to achieve the expansion capacity of the current Layer2 state.At this point, only StarkWare's super-scalable capabilities allow us to see more possibilities.

But it is undeniable that in the foreseeable future, the Layer2 ecology will experience a "public chain war" similar to the previous cycle, and there will be multiple technical solutions and project ecology occupying a certain market share.