Comprehensively analyze the interaction mode and relationship model of DAO-2-DAO

Original Author: MIDDLE.X

Original Author: MIDDLE.X

secondary title

Related Reading:

In-depth analysis of 7 common voting mechanisms of DAO

In-depth discussion of DAO collaboration methods: how to guide and motivate people to work for DAO?

We have discussed the governance layer, collaboration layer, and organization layer of DAO successively, but all the discussions are limited to the dismantling of single DAO, and the interaction between DAO and DAO has not been involved yet. For a chemical substance, more important than each atom is the chemical bond connecting the atoms. For the human brain, more important than each neuron is the topological structure composed of synapses. Therefore, we believe that It is necessary to discuss the interaction mode between DAO and DAO, so as to get a clear picture of the encrypted business world composed of many DAOs.

NFTConnect:Owned by AmirKarimian

In the past two years, hundreds of DAOs have emerged, with assets under management exceeding $18 billion. Although most DAOs are still operating independently like an island, there have been many different interactions between DAOs and DAOs form. Based on what we have observed, we summarize the current DAO-2-DAO (D2D) interactions into three categories, namely financial interaction, grafting and reorganization, and Metagovernance.

first level title

Financial Interactions: DAO-to-DAO Trusted Contracts

The one-way payment behavior of one DAO to another DAO does not require credible constraints, but the actual transaction is often two-way or even multi-directional. behavior. For example:

Token exchange: two DAOs exchange token assets in their respective treasuries according to the agreed exchange rate

Joint funding: two DAOs pay a third-party fund pool according to the agreed ratio (some scenarios may be to establish a joint venture project, jointly provide liquidity for a certain transaction pool, jointly fund a certain cause, and jointly provide bonuses for a certain activity)

In traditional business, both parties to a transaction often use paper documents to sign a contract and rely on judicial power to ensure the performance of the contract. In some cases, a trusted third party is also introduced to escrow funds. Alipay is the most typical case. But there is a new option in DAO, which is to do it through smart contracts.

A smart contract can be considered as an on-chain script. Once a set condition is met, an action or a set of actions will be executed to change the state of the ledger. By establishing smart contracts, a set of digital contracts can be created and enforced when conditions are met. If the condition is timed out and fails to trigger, the funds escrowed in the contract can also be withdrawn without loss or risk to either party.

Although DAO can write smart contracts at its own cost, using some mature smart contract frameworks can help make contracts between DAOs more convenient. Prime Deals developed by Prime DAO is such a smart contract that focuses on D2D trusted financial interactions frame. There are also some smart contract frameworks whose core application scenarios may not be D2D interactive scenarios, but can also be applied to D2D scenarios in disguise. These frameworks allow non-developers to create specific types of contracts by filling in forms, for example, dedicated to establishing OpenLaw, a smart contract template market, the Gnosis CTF (Conditioned Token FrameWork) framework, which is mainly used to create conditional payments and prediction markets, and Kleros, which is mainly used to create escrow contracts.

Prime Deals is highly applicable to D2D scenarios, especially for the two scenarios of "Token exchange" and "co-investment". Feature extensions supported by Prime Deals include:

An unlimited number of DAOs can participate in the exchange process, turning a two-party financial interaction into a multi-party financial interaction

Multiple types of tokens can be exchanged in one contract

Let the DAO be the appointed representative of a contract

Conditions can be added in real time to account for changes in the negotiation process

In addition to supporting one-time conditional payment, it also supports multiple payments and periodic payments (with the help of Proposal Inverter)

Transactions can be made private and details are not revealed until all participants are ready

While supporting a single shallow condition, it also supports multi-level nesting of conditions to cope with complex collaborations

Prime Deals is built on Ethereum and benefits from the composability of smart contracts. No matter which governance framework you use to build DAO, Gnosis Safe, Daohaus or DAOstack, Prime Deals can be applied. In the future, Prime Deals also plans to realize D2D cross-chain interaction .

We believe that with the further prosperity of DAOs and the development of tool applications, the financial interaction between DAOs and DAOs will become more frequent and convenient in the future, making many DAOs form a safe and high-speed value network.

first level title

Grafting and reorganization: DAO's merger, split and business transfer

Just like in traditional business, companies will merge, split, and business unit transactions, DAO, as the native organizational form of Web3, will also have similar behaviors.

Let’s take a look at two DAO mergers and acquisitions that had a huge impact at the end of last year:

On December 8, 2021, after their respective communities voted, xDAI and Gnosis officially decided to merge, and each STAKE (xDAI governance token) was allowed to be exchanged for 0.032 GNO (Gnosis governance token) within a limited period. After the merger, GNO will be used as the unified governance token, and xDAI Chain will also be renamed Gnosis Chain as planned. Previously, xDAI Chain was a sidechain of Ethereum, which was originally created to reduce Gas fees for the circulation of the stable currency DAI, and xDAI is the shadow asset of DAI on xDAI Chain. Gnosis's main business is a decentralized prediction market, and Gnosis Safe, a multi-signature wallet creation tool, is one of its businesses.

On December 22, 2021, the merger proposal of Rari Capital and Fei Protocol was approved by a high number of votes from the two DAO members, and the total locked value (TVL) after the merger reached 2 billion US dollars. According to the terms of the merger, holders of RGT (Rari Governance Token) will exchange RGT for TRIBE (Fei Governance Token) at a ratio of 1:26.7 within 180 days. Tribe holders who are dissatisfied with the merger decision can "retire in anger". The merged body will be called Tribe DAO. Fei Protocol is an over-collateralized stablecoin protocol. The stablecoin is called Fei. Unlike the DAI created by MakerDAO, Fei Protocol uses the algorithmic reserve of protocol control value (PCV) as collateral. Rari is an open-rate lending protocol where anyone can create permissionless lending pools called fuse pools. The merger will be referred to as two sub-products under Tribe DAO.

We see that both DAO mergers have gone through the following steps:

1. The two DAOs each initiate a merger proposal;

2. Both DAOs approve the merger proposal through a governance vote;

3. According to the exchange rate agreed in the proposal, the governance token of one DAO is required to be exchanged for the governance token of another DAO within a time limit.

The merger and acquisition of DAO is a major decision involving all the value in the treasury. It needs to be fully discussed and widely agreed in the community, and can only be reached after an overwhelming voting victory. Through merging, DAO can bring together multiple ecological resources and community strength, stimulate combined innovation, and at the same time help improve DAO's competitive position and increase its chances of survival. Through the merger of xDAI Chain and Gnosis, the existing ecology has been revitalized, and the merger of Fei and Rari has enabled the newborn Tribe DAO to have a strong independent financial system.

Multiple DAOs can be merged into one DAO, and one DAO can also be split into multiple DAOs. DAOs can transfer their business to each other. In contrast, the latter two processes are relatively simple, and there is no need to replace governance tokens within a time limit.

A typical situation where a DAO evolves into multiple DAOs is the incubation of a DAO. A business unit in a DAO is transformed into a new DAO. At this time, a new DAO treasury needs to be created and part of the funds of the parent DAO should be transferred there, or with the help of The DAO tool upgrades the multi-signature wallet (Pod) of the sub-business to a new DAO, creates governance tokens for it, and formulates governance rules.

Whether it is a DAO merger, split, or business transaction, it is essentially a reorganization and grafting of resources. It is of great significance for resource optimization configuration in DAOverse.

first level title

Metagovernance: DAO to DAO ownership and governance

A DAO can hold the governance token of another DAO, and influence another DAO through governance voting. The industry refers to such a governance process as "MetaGovernance".

We have seen this phenomenon in several governance cases.

In the summer of 2021, Fei protocol (yes, it again) used its INDEX to list itself on Aave. Aave is a lending protocol whose list of supported assets is governed by governance votes. If you want to add an asset type to the list of assets supported by Aave, you need to propose an AIP (Aave Improvement Proposal), which requires at least 80,000 $AAVE tokens (owned or entrusted), with a current price of 20 million US dollars. For Fei Protocol at that time, the threshold was too high. However, some people in the community soon proposed a plan to save the country with a curve, which is to use Index Coop to start leveraged governance.

Index Coop is a DeFi index fund, and its sub-product DeFi Pulse Index holds more than 100,000 $AAVE tokens in its vaults. If you have enough $INDEX (the governance token of Index Coop), you have the opportunity to control the governance rights of these $AAVE tokens. After a month of planning and coordination, Fei Protocol decided to purchase 100,000 $INDEX at a current price of $4 million. With these $INDEX, Fei Protocol initiated and passed the IIP (IndexCoop Improvement Proposal), which agreed to use the $AAVE in the treasury to initiate an AIP to list Fei on Aave, which was finally passed.

In this case, Fei Protocol used 4 million US dollars to leverage 20 million US dollars of voting rights, and achieved its goal, well done!

This kind of leveraged governance also exists in traditional business. For example, if Company A holds 51% of the shares of Company B, and Company B holds 51% of the shares of Company C, then Company A indirectly controls Company C, and the cost of control is only direct half of the control. In encrypted business, the threshold for such indirect control will be lower, because most DAOs, including Aave and Index Coop, often adopt the principle of relative majority in order to improve governance efficiency, and only need to obtain A majority would allow the proposal to pass. For example, Index Coop’s valid voting threshold is 5%, which means that as long as 5% of $INDEX participate in voting, it is considered a valid vote, and if more than 55% of them vote in favor, it is equivalent to voting in favor of all. Therefore, you can achieve leveraged governance with less cost, unless your proposal may encounter strong opposition from the community.

Another classic example of MetaGovernance is Curve War.

Curve is currently the largest stablecoin trading market in the encrypted world. Its governance token is CRV. Curve will reward CRV for liquidity providers, but the rewards for different trading pairs are different. Transactions with greater rewards Pairs will have the opportunity to capture more liquidity, and the distribution of rewards will be based on the proportion of voting support obtained by each trading pair in the governance vote. This mechanism has induced various stablecoin projects to compete for Curve's liquidity. They skew Curve's liquidity rewards in favor of them by controlling more CRV voting power. Players participating in the competition include Olympus, Luna, Abracadabra, Frax, Alchemix, Tribe, Redacted, etc., and it is very lively.

Curve adopts a time-weighted voting scheme. Voters need to lock CRV to obtain veCRV. The longer the lock-up time, the more veCRV they get. The actual voting will be done with veCRV.

As the competition continues, a second-tier governance body such as Convex has emerged to serve this competition by simplifying operations. Convex borrows a large amount of veCRV by issuing cvxCRV, and provides its governance token CVX as interest. You can influence the voting distribution of veCRV in the Convex vault through vlCVX (the voting token obtained by staking CVX).

With more than 80% of veCRX gathered in Convex, Curve War is not over, but continues in the way of Convex War.

There have been a large number of articles explaining and analyzing the causes and consequences of Curve War in detail, so we won't dwell too much on it.

In the two cases of Fei-Index-Aave Leverage Governance and Curve War, we have seen the situation where a DAO influences another DAO through governance voting. However, it is difficult for us to consider the above two cases as positive. In fact, Fei Protocol launched Fei to Aave at a relatively small cost, which may not cause too much damage to Aave, but it is definitely not what Aave wants to see. Due to the operation of Fei Protocol, the $AAVE vote held by Index Coop did not express the interests of Aave, but the interests of Fei Protocol.

The Curve War has been burning so far. While there are lobbying politics among competitors, there are more borrowing (by issuing bond derivatives and paying interest to borrow governance tokens), election bribery (through economic interests, affecting governance token holdings) People's votes) and other financial behaviors are the same as the former case of Aave. The governance behavior is not driven by the self-interest of the agreement, but is kidnapped by the interests of the outside world. More seriously, there has been a behavior similar to Mochi Inu poaching Curve through governance voting for its own benefit, or we can also call it-governance attack!

Mochi uses its governance token MOCHI INU to incentivize the liquidity of its USDM stablecoin in Curve, and uses a large number of Mochi it holds to mint a large amount of USDM out of thin air. Mochi then swaps these USDMs for DAI and buys CVX in large quantities with DAI to further incentivize liquidity. When the liquidity of USDM reached 100 million US dollars, Mochi began to cash out and run away, exhausting the liquidity in the pool, making the USDM peg invalid, and liquidity investors suffered heavy losses.

Although both Curve and Convex have "blocked" Mochi through emergency governance measures, the shocking scam has aroused the community's vigilance against Metagovernance.

However, the effect of Metagovernance is not entirely negative, and in some cases, it can play a positive role. For a long time, token holders have often entrusted governance tokens to active contributors in the community and elected them as representatives to achieve representative democracy. But personal representatives may have problems of one kind or another:

The activity of individual representatives is unstable and highly mobile, and representatives often leave their posts. Voters need to change their delegation settings frequently. If they forget to change, it will cause some votes to go silent for a long time;

Personal representatives do not have an open and stable voting tendency, and token holders do not know which representative they want to entrust their votes to;

Individual representatives may be excellent contributors, but they are not necessarily excellent decision makers. They may have expertise in a certain area, but governance decisions will involve different topics, and their familiar fields cannot be covered;

Whether an individual representative can get a delegation often depends only on their reputation in the community, not on whether they made the right decision in the governance vote.

In actual operation, the method of entrusting individual representatives has little effect on improving the participation rate of governance. For example, nearly 3/4 of $COMP representatives did not participate in voting after receiving the entrustment.

The solution to the above problems is to introduce group representatives: a voting alliance with specific values and voting tendencies, which collects entrustment from token holders and actively participates in governance. We might as well call it a GaaS institution (Governance as a Service). The GaaS organization promises the governance participation rate to the client, and regularly provides the governance report to the client, and publicizes the records and reasons of its previous votes. They try to prove to the client that they are responsible and participate in the interests of the projects they are governing. governance, rather than serving their own interests. In addition, it seems that GaaS institutions should not issue their own governance tokens to prevent governance power from being captured by other interest groups in circulation, which means that GaaS institutions should exist as an independent Pod. Even if a GaaS institution issues a governance token, it should not let its own governance process directly determine the governance vote of the shares held in the treasury, and should still entrust an independent group to manage the vote.

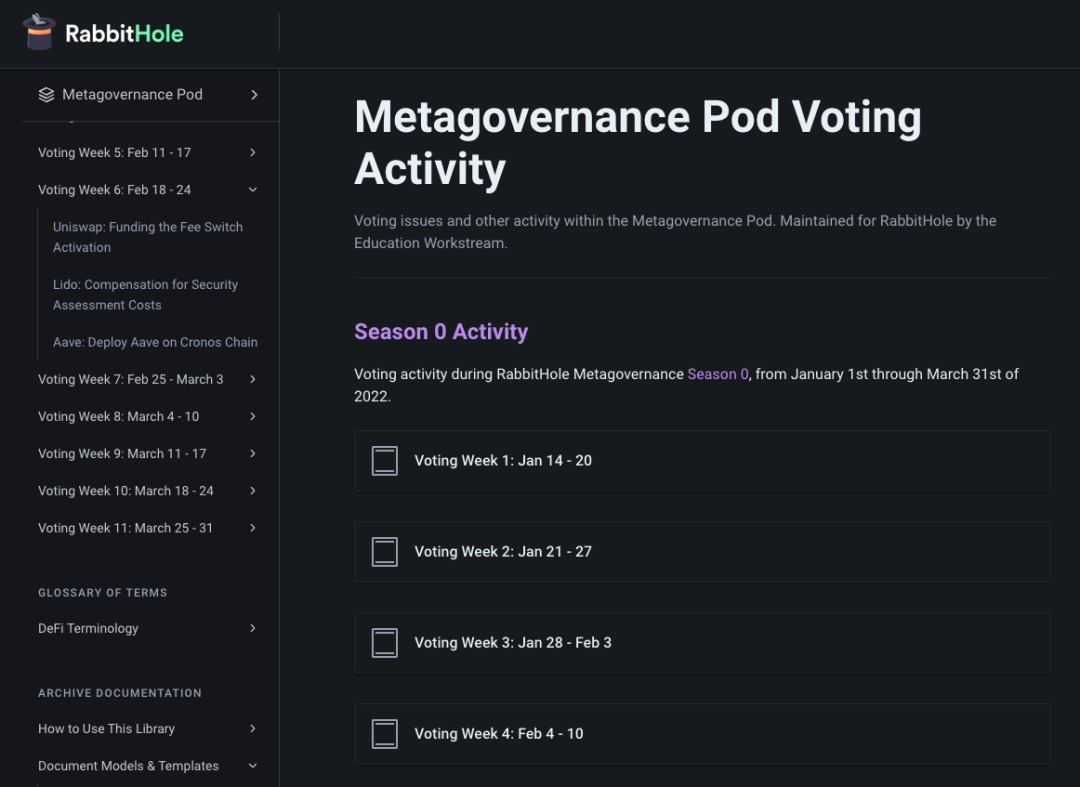

Coincidentally, on January 11, 2022, RabbitHole announced the establishment of the Metagovernance Committee and recruited governance experts. As a Token holder, RabbitHole's Metagovernance Pod has actively participated in the governance of ENS, Uniswap, Aave, Compound Labs, The Graph, PoolTogether, and Mirror, and strives to help these protocols gain active contributors.

RabbitHole Metagovernance Pod voting public interface

https://metagov.rabbithole.gg/

image description

GaaS institutions are a bit like investment management institutions (Investment Stewardships) in traditional finance. These institutions hold customers' stocks on behalf of customers, actively participate in governance, perform supervision duties on company executives, and disclose voting status to customers. For example, Blackrock (BlackRock) and Vanguard (Vanguard Investment), they are the main shareholders of several listed companies, the former has a team of more than 50 people, and is responsible for interacting with the invested companies on governance issues, and the latter only 168,000 proposals were voted on in 2020 alone.

GaaS institutions can also be described as "agreement parties", which can operate in a more organized and stable manner than independent "agreement politicians".

Of course, for DAO, there are still many problems to promote a GaaS-based governance ecology, such as:

How to convince the holders of the DAO governance token to entrust the ticket to the GaaS organization instead of putting it in the DeFi agreement? Is it appropriate to rely on offering higher yields?

How to prevent the integrity of the GaaS organization from being lobbied or bribed by other interest groups?"How to formulate a reasonable revenue model for GaaS organizations so that they don't have to just"?

generate electricity for love

first level title

summary

summary

Above, we have discussed three types of typical D2D interaction scenarios. We have seen that the DAOverse (DAO universe) constructed by numerous DAOs and D2D interactions has similarities with the traditional business world constructed by companies, but presents a A completely different picture.

First of all, the interaction between traditional companies always needs to deal with lengthy and complicated legal files, which is inefficient, while the exchange between DAO can rely on Web3 tools to make everything simple and efficient, and also make the value flow and capital in DAO Faster distribution, after all, is the advantage that the programmability of the blockchain gives the DAO.

Secondly, DAO is a digital organization, and D2D interaction reflects stronger digital characteristics. D2D financial flow information has a high degree of data availability, which makes D2D interaction more automated and reduces human participation. In addition, no matter how complex the value network constructed by D2D is, its topological structure is clearly visible, which facilitates the research of DAO sociology.