From the perspective of gas fees, in-depth research on the seven use cases of Ethereum

This article comes from GlassnodeThis article comes from

, Original author: Niko Kudriastev & Antonio Manrique de Lara Martín, compiled by Odaily translator Katie Ku.

This article quantifies gas consumption across major tokens, protocols, and transactions, delving into Ethereum's most prominent use case scenarios, revealing the complex and evolving nature of the Ethereum ecosystem.

image description

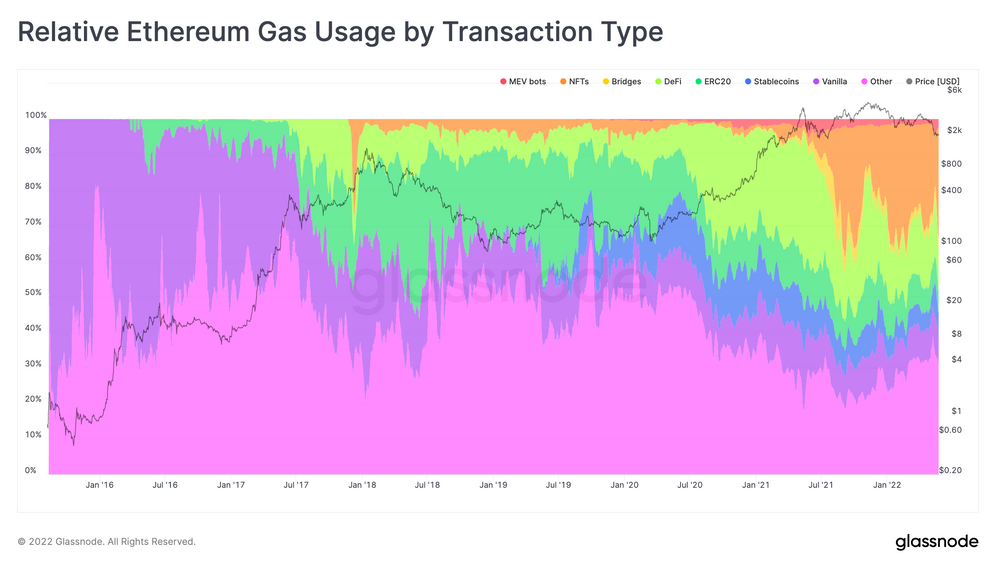

We begin with a graphical overview of the history of Ethereum. Figure 1 shows the relative gas usage of all transactions recorded on the Ethereum blockchain, broken down into 7 main categories, 2 of which (cross-chain bridges and MEV on-chain arbitrage bots) only emerged in the last year.

Vanilla transfer (pure transfer)

image description

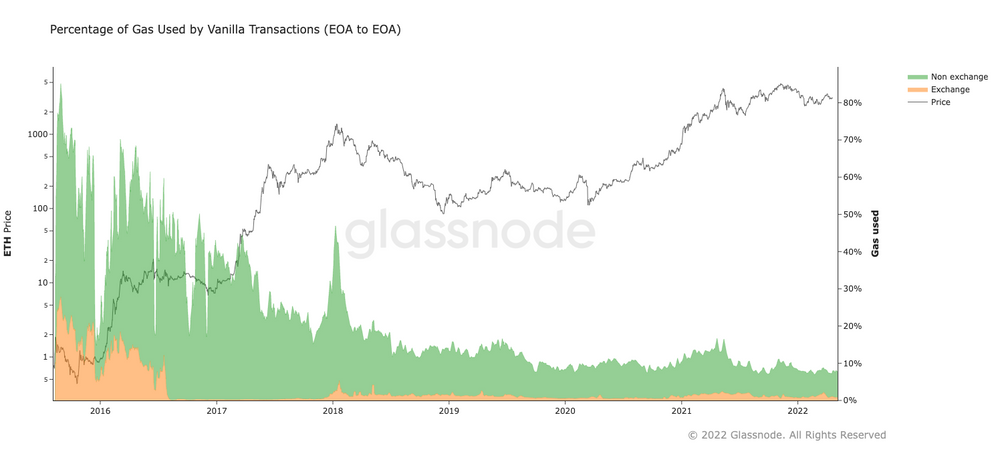

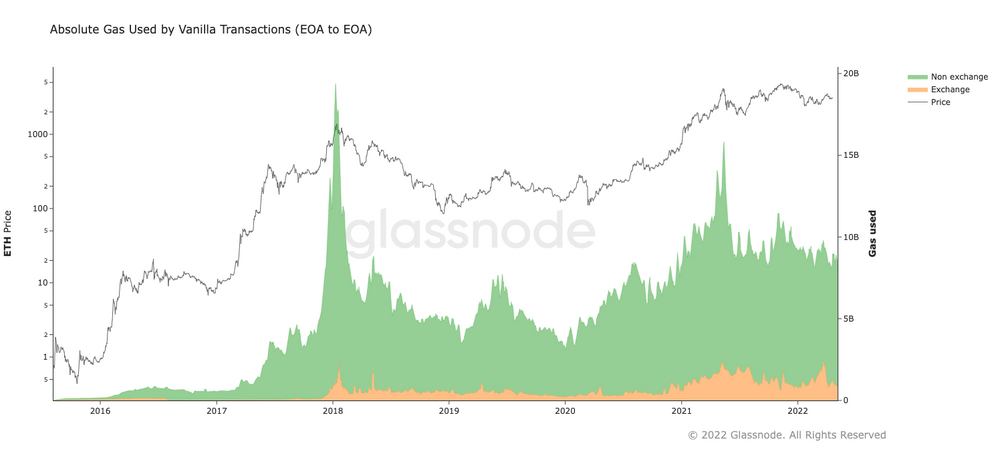

Vanilla transfer (pure ETH transferred between externally owned accounts controlled by private keys, without calling contracts) represents Ethereum being used as a currency. From the perspective of gas consumption, this use case has dropped from 80% in the early days (2015) to 10% in the last two years.

image description

Figure 3: The amount of gas used by vanilla transferstable currency

stable currency

image description

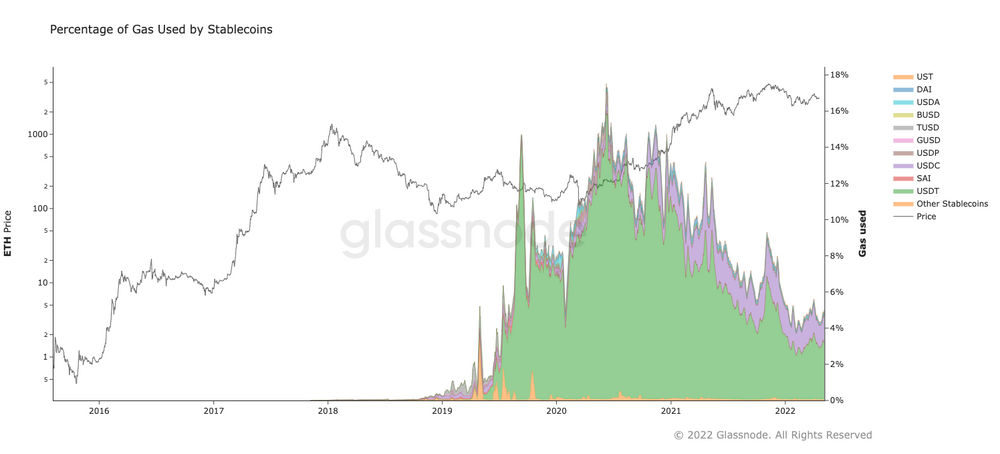

Figure 4: Percentage of gas used by stablecoin transactionsStablecoins were not born in Ethereum, but Ethereum was the underlying chain on which stablecoins initially flourished. Stablecoins quickly became a major source of gas consumption as USDT shifted to lower fees and faster transaction confirmation times.

For most of the past three years, Ethereum has been more of a payment platform for USD stablecoins than ETH.Stablecoins expanded to other chains as Ethereum gas fees became an issue. Currently, more USDT is issued on the Tron platform than on Ethereum. USDC supports 8 different chains. UST supports 10 types.

It is important to pay attention to the competition and cooperation relationship between platforms and protocols in the multi-chain era. Not only are many protocols based on Ethereum, many of them run on multiple chains. You cannot fully understand the Ethereum ecosystem without considering stablecoins. You also cannot fully understand the stablecoin ecosystem without investigating other chains.

ERC-20 tokens

image description

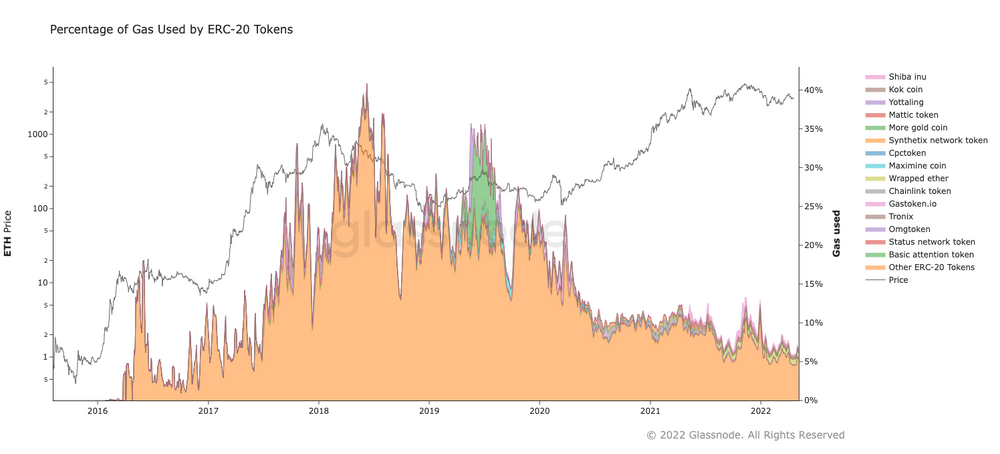

Figure 5: Percentage of gas used by fungible tokens

In the history of blockchain, there have been many projects that have enjoyed "15 minutes of fame", and they are all dominated by a few short-lived and fleeting tokens.

image description

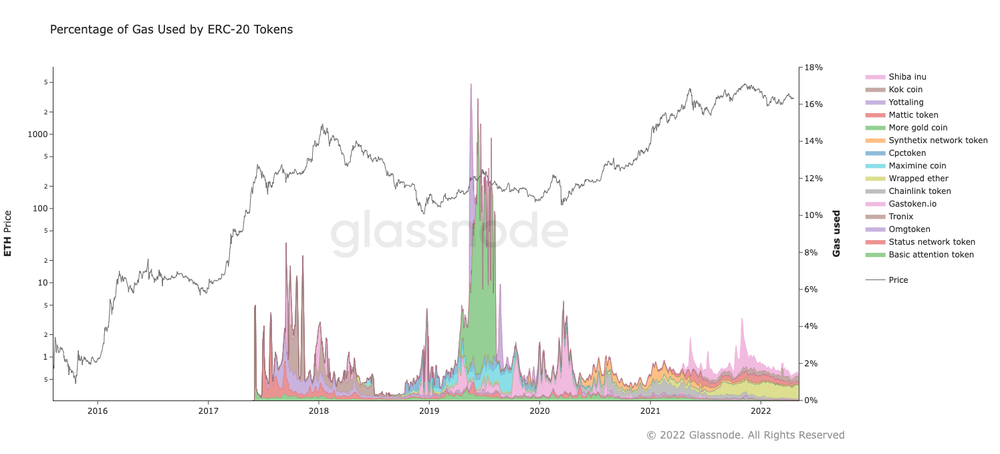

Figure 6: Percentage of gas used by the most popular coins

secondary title

DeFi

image description

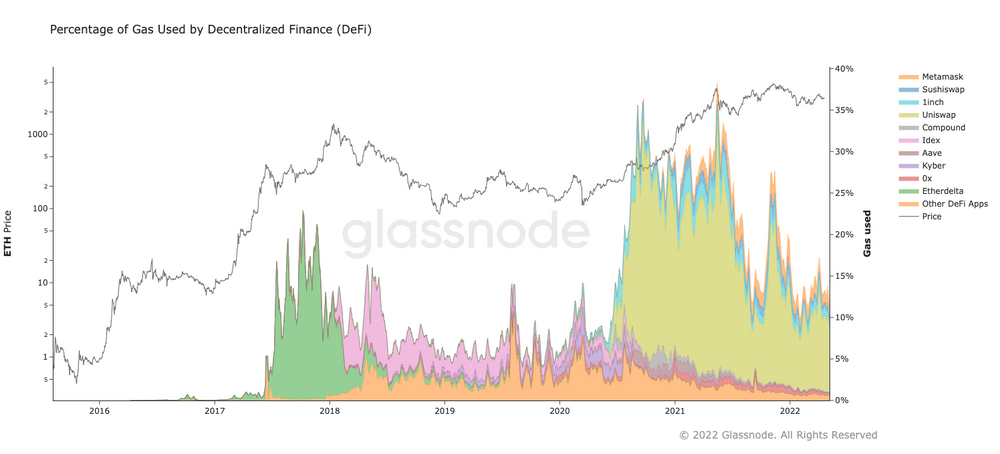

Figure 7: DeFi gas usage percentage

DeFi has many applications — lending, spot and derivatives trading, storage, insurance, and more. Most of the impact we’ve seen so far has come from decentralized asset exchanges. In the past two years, providing liquidity and yield farming have also become quite popular applications, and the DeFi field may need to be further subdivided in the future.

DEXs first gained popularity in 2017 with the emergence of the decentralized exchange EtherDelta, and since then DEXs have been the main area of gas consumption (in DeFi).Cross-chain bridge

Cross-chain bridge

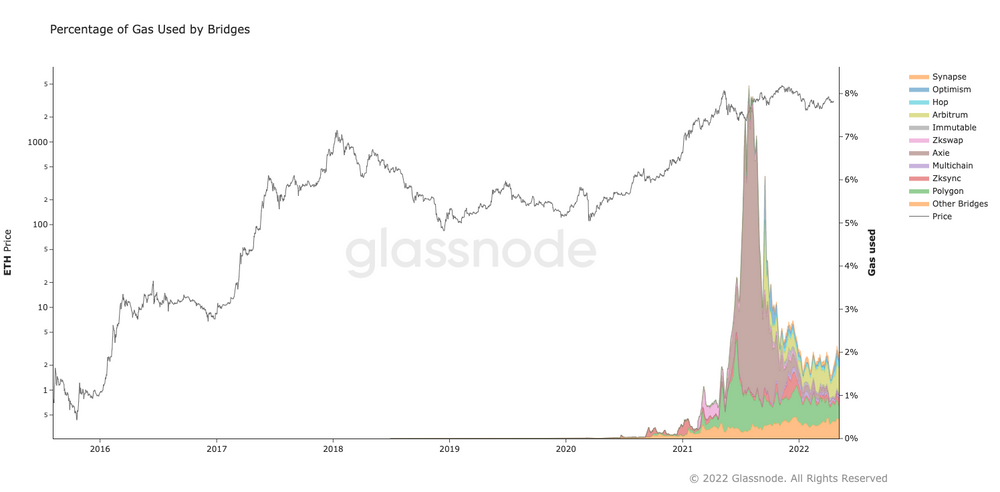

image description

Figure 8: Percentage of gas consumed by cross-chain bridgesCross-chain bridges are one of the latest gas-hungry areas.As transactions on Ethereum become quite expensive and competing chains mature in terms of stability and functionality, we see frequent cross-chain capital flows.Except for a brief gas spike on the Ronin cross-chain bridge when Axie Infinity was most popular (peaking at 8% gas consumption in a few days), the gas consumption of the cross-chain bridge doubled in the last year (from 1% to 2%), and connect Ethereum to L2 solutions (Polygon, Arbitrum, Optimism), and competing chains (Avalanche, Polkadot).

secondary title

NFT

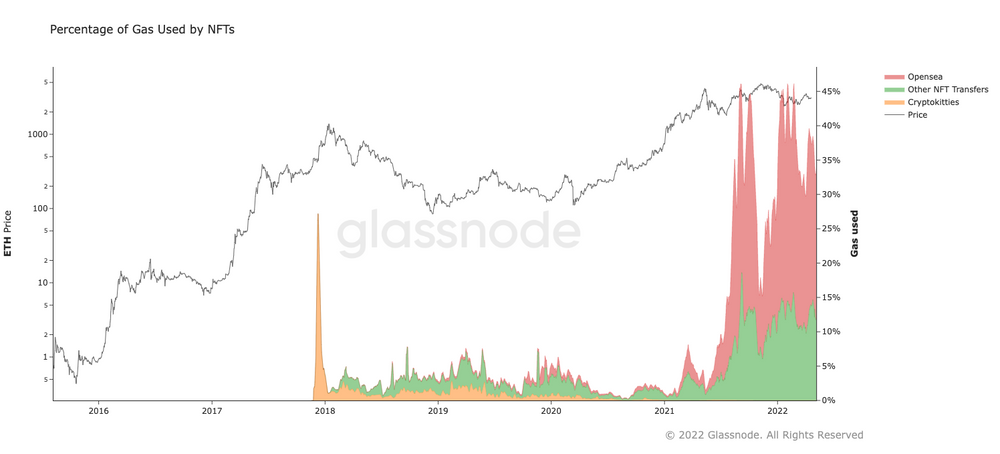

image description

Figure 9: Percentage of gas used by non-fungible token activityBack in 2017, Cryptokitties, the first NFT mainstream application, briefly contributed about one-third of network throughput, driving network fees up significantly. In the same year, OpenSea released a beta version. However, it will not be until the second half of 2021 that the NFT sector will once again become the mainstay of the gas market. Since then, NFTs have become a force to be reckoned with.As of now, roughly one-third of all gas consumed on Ethereum is spent on NFT-related activities.

The introduction of the ERC-1155 standard has brought some efficiency gains, which is another trend to watch.

Arbitrage Bots on the MEV Chain

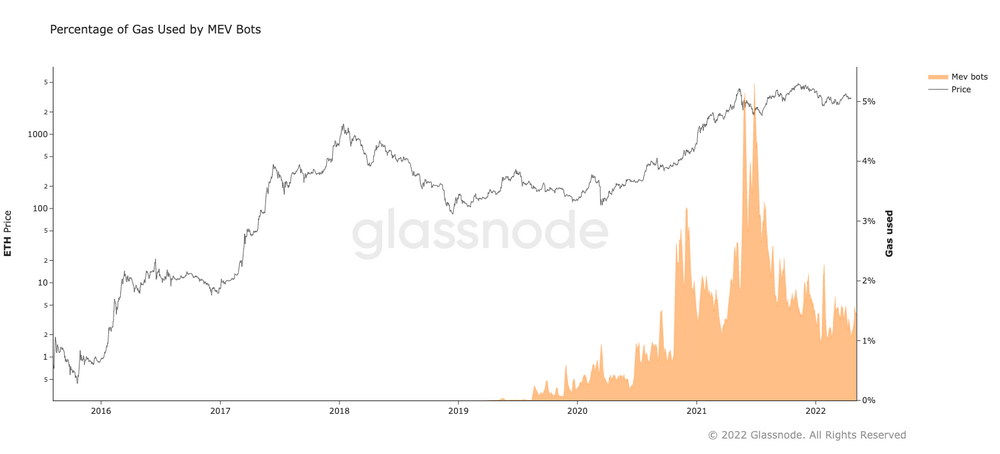

image description

Figure 10: Percentage of gas used by arbitrage bots on the MEV chain

Miner-Extractable Value (MEV), a native product designed by Ethereum, plays an important role in improving the efficiency of the DeFi ecosystem, namely eliminating the price difference between decentralized exchanges through arbitrage, which accounts for more than 95% of MEV activity .

We may be underestimating the real numbers given that MEV players generally don't push the hype. According to the Flashbots team, at least 4% of gas is consumed by MEV transactions. If altchains can reduce the impact of MEV, it will incentivize users to migrate from Ethereum to altchains.

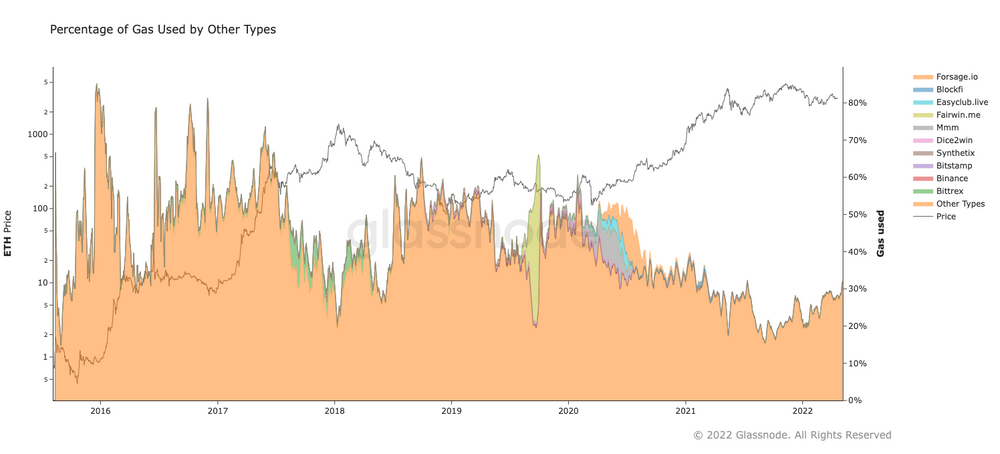

Other gas usage categories

image description

Figure 11: Gas usage for all other transactions

secondary title

Summarize

SummarizeEthereum is still a platform primarily used to transfer value, but what constitutes that value and how that is constituted is constantly changing.

Unlike Bitcoin, Ethereum-related practitioners need the following tools and mindsets:

Sensitive to use cases and adaptable to new development directions;

Diversified assets, broad value definitions, including homogenized and non-homogeneous tokens;

Multi-protocol and multi-chain, extensive transaction definitions, including decentralized financial protocols and cross-chain bridges.There are many uses for Ethereum. From the early native asset payment network, to the fungible token in 2018, to the non-fungible token NFT, many use cases have become the largest "payer" of the platform. We have to admit that Ethereum is very much in line with the original Ethereum vision. Understanding the resulting dynamic ecosystem is not a simple task.

Value flows through the network in countless different forms through many different channels. Further complicating matters is the increasing interconnection of Ethereum with a large number of other L1 and L2 chains. More and more assets, projects, protocols, and entities exist on multiple chains simultaneously and move freely between platforms.